Salaries for December 2021 were paid in December. How to generate and reflect the payment in the 6-NDFL calculation? How to reflect wages in sections 1 and 2 of the 6-NDFL calculation? Let's explain with an example. If you paid your salary based on the results of December in January 2021, then another article will help you, “Examples of filling out 6-NDFL when the salary for December was issued in January 2020.”

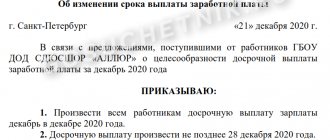

Deadlines for paying December salaries in 2019

How to fill out 6-NDFL based on the results of 2021? This depends on whether you paid your salary in December 2021 or January 2021. If you set the deadline for paying salaries at the end of the month from the 1st to the 8th, you need to pay the salary for December on the eve of the holidays (Part 8 of Article 136 of the Labor Code). If the deadline is from the 9th to the 15th, there is no need to issue wages in advance.

For more information about this, see “ Payment dates for December salaries according to the Labor Code of the Russian Federation .”

Payroll in 1C ZUP 3

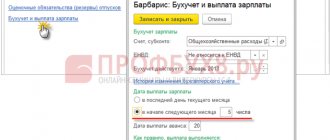

If a decision is made to pay wages for December 31.12.2020, then in 1C ZUP 3 it is necessary to indicate this exact date for the document Statement...

If 12/31/2020 is declared a holiday in the organization and payment is made on 12/30/2020, then the Gazette... sets the date 12/30/2020.

If the salary payment will be made on December 30 or 31, 2020, then read the article - A safe option for paying an advance for January. Registration of two advances in 1C ZUP 3

Salary paid 12/31/2019

The salary paid on December 31, 2019, and the personal income tax on it, should be reflected only in section. 1 6-personal income tax for 2021

In Sect. You will show these 2 amounts already in 6-NDFL for the 1st quarter of 2020. After all, the deadline for paying personal income tax in this case is 01/09/2020 - the first working day after payment of income. The fact that you transferred the tax on December 31, 2019 does not matter (Letter of the Federal Tax Service dated November 1, 2017 N GD-4-11/).

Sec. Fill out 2 6-NDFL for the 1st quarter of 2021 as follows:

- line 100 – 12/31/2019

- line 110 – 12/31/2019

- line 120 – 01/09/2020

When does the employer pay the December salary?

Data on income paid to employees and the tax withheld from it is disclosed by the employer in a report on Form 6-NDFL. The form consists of a title page and two sections. The calculation is submitted to the regulatory authority quarterly. From the first quarter of 2021, the form and filling out rules are regulated by Federal Tax Service Order No. ED-7-11 / [email protected] dated 10/15/2020.

Organizations practice several options for paying wages for the last month:

- in December, which is technically an advance;

- 31st;

- in January next year.

Depending on the day the funds are transferred and the deadline for paying the tax, sections 1 and 2 of the form will be filled out differently. Regardless of the date of actual payment of wages, the date of accrual of income is December 31, 2020. The date of deduction of the calculated tax is the day of payment of funds, the deadline for transfer is the next business day.

ConsultantPlus experts discussed how to correctly fill out 6-NDFL according to the new rules that will come into force in 2021. Use these instructions for free.

to read.

Conclusion

In section 1 of the 6-NDFL calculation for 2021, include:

- in line 020 – the amount of accrued wages for December 2019;

- in line 040 - the amount of personal income tax calculated from it;

- in line 070 – the amount of personal income tax withheld.

In section 2 of the 6-NDFL calculation for 2021, show your salary for December if it was paid no later than December 30. If the salary was paid on December 31, then the personal income tax payment deadline is postponed to January 9, 2020. In this case, the payment must be shown in section 2 of the calculation for the first quarter of 2021.

Transfer of personal income tax to the budget

If the salary was paid on December 31, 2020, then personal income tax must be transferred from it no later than the next working day. Taking into account weekends and holidays this is 01/11/2020.

If the salary was paid on December 30, 2020, then ZUP 3 will consider December 31, 2020 as the next working day, since it is not marked as a day off the Production calendar However, leaving the payment of personal income tax until December 31, 2020 can be dangerous, since it is unknown how banks will work on this day. The safest option is to transfer personal income tax to the budget immediately when paying wages on December 30, 2020.

If personal income tax is transferred to the budget on the day of salary payment on December 30th or 31st, then in the Sheet... is transferred along with the salary checkbox should be left selected by default and personal income tax will be considered transferred exactly on the day the salary is paid.

If the transfer is made later than the date of payment of the salary, then to ensure the reliability of the registration of the date of transfer (it is shown only in the report Register of Tax Accounting for Personal Income Tax ), you can uncheck the Tax is transferred along with the salary in the document Statement... and reflect the fact of transfer in the document Transfer of personal income tax to the budget (Taxes and contributions - All documents of transfer to the personal income tax budget - Transfer of personal income tax to the budget).

The date of actual transfer of personal income tax is taken into account only when filling out the report Tax Accounting Register for Personal Income Tax (Taxes and Contributions - Reports on Taxes and Contributions - Tax Accounting Register for Personal Income Tax) and does not affect the completion of 6-NDFL and 2-NDFL . If it is not critical that in this report the date of transfer will not exactly correspond to the actual date of transfer, then you can not enter the document Transfer of personal income tax to the budget and leave the checkbox in the document Statement... so that it reflects the fact of transfer of personal income tax.

If you haven't subscribed yet:

Activate demo access for free →

or

Subscribe to Rubricator →

After subscribing, you will have access to all materials on 1C:ZUP, recordings of supporting broadcasts, and you will be able to ask any questions about 1C.

Did the article help?

Get another secret bonus and full access to the BukhExpert8 help system for 14 days free of charge

Specific examples of reflecting December salaries in 6-NDFL

Example. There are five people in the organization. They are not entitled to the standard deduction. Every month, the accountant accrues income of 150,000 rubles for all employees. Personal income tax – 19,500 rubles. Salaries for December 2019 were paid on December 30.

The accountant included the December 2021 salary in section 1.

Section 2 can be completed in two ways. They differ in the date of receipt of income in line 100.

Method 1. Date of receipt of income - salary payment day

However, in separate clarifications, representatives of the Federal Tax Service indicate that the date of personal income tax withholding cannot precede the date of income, therefore in line 100 it is not December 31, but the day of salary payment

Method 2. Date of receipt of income - last day of the month

According to the Tax Code, the date of receipt of salary income is always the last day of the month. According to the Labor Code of the Russian Federation, the organization is obliged in this case to accrue and pay wages in advance, therefore line 110 indicates an earlier date than line 100

Both methods of filling out section 2 as part of the annual 6-NDFL are acceptable, and the Federal Tax Service is obliged to accept the calculation. However, with the second method, the tax withholding date is earlier than the date the income was received, so the inspection may require clarification.

Example . There are five people in the organization. They are not entitled to the standard deduction. Every month, the accountant accrues income of 150,000 rubles for all employees. Personal income tax – 19,500 rubles. Salaries for December 2019 were paid on December 31.

Section 1 must be completed as in the previous example. In section 2 for 2021, do not show wages paid on December 31st. This income must be included in section 2 of the calculation for the first quarter of 2021.

6-NDFL and wages for December: the Federal Tax Service allowed errors in the 1st quarter

How to reflect your December salary in 6-NDFL depends on when you paid it: in December 2021 or January 2021. Let's consider each of the situations. We will not thoroughly explain the rules for filling out the calculation; you can read about them in numerous materials in our section “Calculation of 6-NDFL”. We will speak briefly and to the point.

Let's start with the fact that in both cases, salary calculation (line 020) and personal income tax (line 040) must be reflected in the calculation for 2021. But then there will be differences.

6-NDFL, if the salary for December was issued in January (for example, 01/11/2021)

When calculating for 2021, regarding the December personal income tax, do not fill in:

- Line 070 - it reflects only personal income tax withheld as of the reporting date, i.e. as of 12/31/2020.

NOTE! After withholding personal income tax in January, there is no need to submit an update for 2021 (letter of the Federal Tax Service dated July 1, 2016 No. BS-4-11 / [email protected] ). This is the difference between 6-NDFL and 2-NDFL, for which an adjustment is required.

- Line 080 - here reflects the tax that will not be withheld.

NOTE! For this amount, you need to send the tax authorities 2-NDFL certificates with sign 2.

- Section 2 - in 2021 it is filled out according to the deadline for paying personal income tax, and it falls already in 2021.

As of reporting for the 1st quarter of 2021, a new form 6-NDFL is in effect, and in it information about personal income tax payable is reflected in a new way:

- not in the second section, but in the first;

- not according to the deadline for paying personal income tax, but according to the withholding period (see letter from the Federal Tax Service dated 04/01/2021 No. BS-4-11/ [email protected] );

- in a more concise form: only the total amount of personal income tax withheld for three months with details of the timing of transfer and the amount of tax (the dates of actual receipt of income and personal income tax withholding, as well as the amount of income no longer need to be given).

That is, in this case, in section 1 of the calculation for the 1st quarter of 2021, you need to indicate:

ConsultantPlus experts have already provided comments on the procedure for filling out the new Form 6-NDFL from 2021 and have prepared a completed sample. You can view the materials by getting trial access to K+. It's free.

6-NDFL, if the salary for December was issued on December 31, 2020 (new rules!)

In calculations for 2021, show personal income tax withholding on line 070. In section 2, according to the 2021 rules, there is no need to show salary payments, since the deadline for paying personal income tax to the budget falls on the first working day of 2021 (01/11/2021). And this is where the difficulty arises.

According to the new procedure for filling out 6-NDFL, section 1 of the report for the 1st quarter of 2021 should reflect the amounts of personal income tax that were withheld for the last three months of the reporting period (that is, for January-March), regardless of the period of their transfer to the budget, determined by the Tax Code RF. Because of this, personal income tax withheld in December 2020, which was transferred to the budget in January, should not be included in the calculation for the 1st quarter.

However, due to the inconsistency between the old and new filling out procedures, the Federal Tax Service will not consider it an error if you nevertheless show the December personal income tax in the 1st section of the calculation for the 1st quarter - with the transfer deadline no later than 01/11/2021 (see fragment below). After all, this does not lead to an underestimation or overestimation of the amount of tax to be transferred. If you have already done this, you do not need to submit an update for the 1st quarter (see letter from the Federal Tax Service dated 04/01/2021 No. BS-4-11 / [email protected] ).

Let us note on our own that in fact this is the most optimal way out of the situation. If the old rules are followed for the annual report, and new rules for the first quarter, there will be no place for this personal income tax in the reports at all. That is, he will simply get lost. Adding this tax to the calculation for the year is also against the rules and requires clarification. Therefore, it is better to allow for inaccuracy in the current period. Moreover, the Federal Tax Service does not object.

Important! In reports for the following periods of 2021, personal income tax withheld on the last day of the quarter should be reflected in a new way - by the date of withholding, and not by the date of transfer. For example, if you issue a salary on June 30, show the withheld tax in section 1 of the half-year calculation, despite the fact that the payment deadline, July 1, is already the third quarter. The date 07/01/2021 must be entered in the deadline 021.

6-NDFL, if the salary for December was issued before 12/31/2020

In general, if a salary is paid earlier, it is incorrect to withhold personal income tax from it. In this case, it is considered an advance for December, and tax is subject to withholding when paying an advance for January (see, for example, letter of the Ministry of Finance dated October 3, 2017 No. 03-04-06/64400).

At the same time, officials promised not to impose fines for such premature transfer of personal income tax.

Therefore, if you withheld tax when paying, for example, December 30, fill out section 2 in the calculation for 2020: You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Reflection of recalculation in 2-NDFL

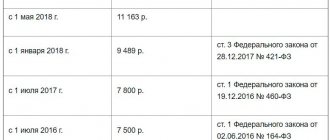

2-NDFL certificates should be sent to the tax office before March 2, 2020. From 2021, the deadlines for submitting 2-NDFL and 6-NDFL are the same. So again there are two options:

- 2-NDFL certificates for 2021 have not been submitted.

In this case, it is necessary to fill them in with correct data on December wages, taking into account recalculation. If by the time the certificate is drawn up, all problems associated with the erroneous calculation have been resolved (for example, the overly withheld tax has been returned to the taxpayer), then the certificate lines “Calculated Tax,” “Tax Withheld,” and “Tax Remitted” will be equal.

If at the time of drawing up the certificate any debts still remain, it is necessary to fill out the certificate with the data that was current at the date of its preparation. Later, when the issue is resolved, it is necessary to submit a corrective form 2-NDFL.

- 2-NDFL certificates for 2021 have already been submitted.

It is necessary to submit clarifying certificates for 2021. Certificates for 2020 will not be affected by the recalculation.

The conclusions expressed in the article are also contained in the Letter of the Federal Tax Service of Russia dated July 21, 2017 No. BS-4-11/14329.

What kind of payment is this from a legal point of view?

Many employers paid the final salary for December 2021 in December, for example, in the period from December 26 to December 30, 2016. In this case, on the day the salary is paid, the calendar month has not yet ended, so it is impossible to regard such a payment as a salary for December in the full sense of the word. Funds paid before the end of the month are essentially an advance.

Let’s assume that the salary for December was issued on December 30, 2016. On this day, the employer is not yet obliged to calculate and withhold personal income tax, since the salary becomes income only on the last day of the month for which it is accrued - December 31. This follows from paragraph 2 of Article 223 of the Tax Code of the Russian Federation. Despite the fact that December 31 is a Saturday, personal income tax cannot be calculated or withheld before this date (letter of the Federal Tax Service of Russia dated May 16, 2016 No. BS-3-11/2169).

The date of receipt of income in the form of wages under an employment contract is the last day of the month for which it was accrued (clause 2 of Article 223 of the Tax Code of the Russian Federation). Not earlier than this day, you can calculate personal income tax on your entire salary, including the previously issued advance. The advance amount is not recognized as income for personal income tax purposes.

About the report form

Employers fill out the 6-NDFL calculation quarterly. The form and rules for filling it out were approved by order of the Federal Tax Service dated October 14, 2015 No. ММВ-7-11/ [email protected] (as amended on January 17, 2018). Employers must prepare and submit a report to the Federal Tax Service for 2021 within the new deadline - no later than March 2, 2021 (due to the day off coinciding with 03/01/2020, the deadline was moved to Monday).

The procedure for reporting information has not changed in 2021, but filling out 6-NDFL for December wages still raises many questions. Let's figure out how to show the payment of December remuneration for labor in the calculation.

From general to specific: from general principles of filling to specific cases

The form reflects generalized information on all individuals for whom the tax agent is the source of payment of income for the reporting period.

General principles when filling out the form:

- Both sections are filled out on a cumulative basis (for the 1st quarter, half a year, 9 months and a year), however, the second section accumulates information only for the last three months of such a reporting period.

- Position 100 - date of receipt of income (Article 223 of the Tax Code of the Russian Federation):

- salary payments (including salary) are considered received on the last day of the month of their accrual;

- other cash income (including vacation pay, financial assistance, bonuses, sick leave payments) - on the day of their payment (including payment from the cash register, transfer to a current account);

- income in kind – at the time of issue;

- payments upon termination of an employment contract - the employee’s last day of work.

- Position 110 - withholding of tax on individuals is carried out directly upon the actual payment of income.

- Position 120 - deadline for transferring tax to individuals (clauses 4 and 6 of Article 226 of the Tax Code of the Russian Federation): no later than the day following the day of payment of income (with the exception of sick leave and vacation pay: for them this is the last day of the month of payment).

- Positions 070 and 080 - the amount of tax withheld/not withheld by the tax agent: information is entered regarding the total amount of tax on personal income, withheld/not withheld by the tax agent in the reporting period in accordance with paragraphs. 4, 5 tbsp. 226 of the Tax Code of the Russian Federation (letter of the Federal Tax Service dated May 24, 2016 No. BS-4-11/9194).

More details on the procedure for entering information for specific positions can be found in the article “Procedure for filling out line 070 of form 6-NDFL” .

- For the 1st section:

- income taxed for individuals at different rates is entered in separate blocks for each such rate (positions from 010 to 050), but cumulatively for all individuals.

- For the 2nd section:

- Grouping of information into blocks is carried out separately (positions from 100 to 140) for each of the following characteristics:

- by date of receipt of income,

- on the timing of transfer of tax on individuals to the budget.

How to fill out the calculation is not necessary: risk of error

A fairly common situation is when the employer transferred the final salary for December to the employees in December, but the accountant, confused by numerous explanations from the Federal Tax Service, does not know how to correctly fill out the annual 6-NDFL. It turns out that early salary is an advance? Should it be highlighted separately in section 2 of the 6-NDFL calculation for the 4th quarter of 2021? Let us pay attention to one of the explanations that may be misleading.

Let’s assume that on December 26, 2021, the organization transferred employees’ salaries for December in the amount of 380,000 rubles. On the same day, personal income tax was withheld in the amount of 49,400 rubles (380,000 x 13%). The withheld amount was transferred to the budget the next day - December 27, 2021.

To find out how to correctly reflect the December salary in the annual 6-NDFL, the accountant turned to the letter of the Federal Tax Service dated March 24. 2021 No. BS-4-11/5106. It recommends withholding personal income tax on the day of actual payment of wages (December 26), and transferring the withheld amount to the budget the next day (December 27). In addition, tax authorities advise reflecting these same dates in the 6-NDFL calculation. However, we do not recommend following such recommendations and filling out section 2 of the 6-NDFL calculation for 2021 in this way.

And that's why:

- the 6-NDFL calculation for the 4th quarter of 2021, filled out in this way, will not pass format and logical control and will return with the error “the date of tax withholding should not precede the date of actual payment”;

- withholding personal income tax from wages until the end of the month contradicts later recommendations of the Russian Ministry of Finance in a letter dated June 21. 2016 No. 03-04-06/36092.