KOSGU-2018: all changes in one table

The procedure for applying the classification of operations of the general government sector (KOSGU) is being improved. Since 2021, changes have occurred in accordance with the order of the Ministry of Finance dated December 27, 2017 No. 255n.

In particular, Article 120 “Property Income” of the KOSGU is detailed in subarticles 121 – 129.

Article 130 “Income from the provision of paid services” of KOSGU is detailed in subarticles 131 – 136.

In addition, the changes affected Article 140 “Fines, penalties, penalties” of KOSGU. Subarticles 141 – 145 have been added.

The Ministry of Finance discussed what else changed in 2018 compared to 2017 in a presentation, which can be found here.

In addition, a special table with changes has been prepared to make it easier for accountants to navigate the innovations.

Comparative table of KOSGU codes for 2021 (as amended by Order of the Ministry of Finance dated December 27, 2017 No. 255n), to those used in 2017

| 2017 | 2018 | ||

| 100 | Income | 100 | Income |

| 110 | Tax revenues | 110 | Tax revenues |

| 120 | Property income | 120 | Property income |

| 121 | Operating lease income | ||

| 122 | Income from finance lease | ||

| 123 | Payments for the use of natural resources | ||

| 124 | Interest on deposits, cash balances | ||

| 125 | Interest on loans provided | ||

| 126 | Interest on other financial instruments | ||

| 127 | Dividends from investment objects | ||

| 128 | Income from the granting of non-exclusive rights to the results of intellectual activity and means of individualization | ||

| 129 | Other income from property | ||

| 130 | Income from the provision of paid services (work) | 130 | Income from the provision of paid services (work), compensation of costs |

| 131 | Income from the provision of paid services (work) | ||

| 132 | Income from the provision of services (work) under the compulsory health insurance program | ||

| 133 | Fee for providing information from government sources (registers) | ||

| 134 | Income from reimbursement of expenses | ||

| 135 | Income from contingent rental payments | ||

| 136 | Budget revenues from the return of accounts receivable from previous years | ||

| 140 | Amounts of forced seizure | 140 | Fines, penalties, penalties, damages |

| 141 | Income from penalties for violation of procurement legislation and violation of the terms of contracts (agreements) | ||

| 142 | Income from penalties on debt obligations | ||

| 143 | Insurance claims | ||

| 144 | Compensation for property damage (except for insurance compensation) | ||

| 145 | Other income from forced seizure amounts | ||

| 150 | Free receipts from budgets | 150 | Free receipts from budgets |

| 151 | Receipts from other budgets of the budget system of the Russian Federation | 151 | Receipts from other budgets of the budget system of the Russian Federation |

| 152 | Receipts from supranational organizations and foreign governments | 152 | Receipts from supranational organizations and foreign governments |

| 153 | Receipts from international financial organizations | 153 | Receipts from international financial organizations |

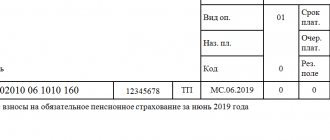

| 160 | Insurance contributions for compulsory social insurance | 160 | Insurance contributions for compulsory social insurance |

| 170 | Income from asset transactions | 170 | Income from asset transactions |

| 171 | Income from revaluation of assets and liabilities | 171 | Income from revaluation of assets and liabilities |

| 172 | Income from asset transactions | 172 | Income from asset transactions |

| 173 | Extraordinary gains from asset transactions | 173 | Extraordinary gains from asset transactions |

| 174 | Lost income | 174 | Lost income |

| — | 175 | Exchange differences based on the results of recalculation of accounting (financial) statements of foreign institutions | |

| — | 176 | Income from valuation of assets and liabilities | |

| 180 | Other income | 180 | Other income |

| 181 | Unexplained receipts | ||

| 182 | Income from free use rights | ||

| 183 | Income from subsidies for other purposes | ||

| 184 | Income from subsidies for capital investments | ||

| 189 | Other income | ||

| 200 | Expenses | 200 | Expenses |

| 210 | Remuneration and accruals for wage payments | 210 | Remuneration and accruals for wage payments |

| 211 | Wage | 211 | Wage |

| 212 | Other payments | 212 | Other payments |

| 213 | Charges for wage payments | 213 | Charges for wage payments |

| 220 | Payment for work and services | 220 | Payment for work and services |

| 221 | Communication services | 221 | Communication services |

| 222 | Transport services | 222 | Transport services |

| 223 | Public utilities | 223 | Public utilities |

| 224 | Rent for use of property | 224 | Rent for use of property |

| 225 | Works and services for property maintenance | 225 | Works and services for property maintenance |

| 226 | Other works, services | 226 | Other works, services |

| 230 | Service of state (municipal) debt | 230 | Service of state (municipal) debt |

| 231 | Domestic debt servicing | 231 | Domestic debt servicing |

| 232 | External debt servicing | 232 | External debt servicing |

| 240 | Free transfers to organizations | 240 | Free transfers to organizations |

| 241 | Free transfers to state and municipal organizations | 241 | Free transfers to state and municipal organizations |

| 242 | Free transfers to organizations, with the exception of state and municipal organizations | 242 | Free transfers to organizations, with the exception of state and municipal organizations |

| 250 | Free transfers to budgets | 250 | Free transfers to budgets |

| 251 | Transfers to other budgets of the budget system of the Russian Federation | 251 | Transfers to other budgets of the budget system of the Russian Federation |

| 252 | Transfers to supranational organizations and foreign governments | 252 | Transfers to supranational organizations and foreign governments |

| 253 | Transfers to international organizations | 253 | Transfers to international organizations |

| 260 | Social Security | 260 | Social Security |

| 261 | Pensions, benefits and payments for pension, social and medical insurance of the population | 261 | Pensions, benefits and payments for pension, social and medical insurance of the population |

| 262 | Social assistance benefits for the population | 262 | Social assistance benefits for the population |

| 263 | Pensions, benefits paid by public sector organizations | 263 | Pensions, benefits paid by public sector organizations |

| 270 | Expenses on transactions with assets | 270 | Expenses on transactions with assets |

| 271 | Expenses for depreciation of fixed assets and intangible assets | 271 | Expenses for depreciation of fixed assets and intangible assets |

| 272 | Consumption of inventories | 272 | Consumption of inventories |

| 273 | Extraordinary expenses for asset transactions | 273 | Extraordinary expenses for asset transactions |

| — | 274 | Asset impairment losses | |

| 290 | other expenses | 290 | other expenses |

| 291 | Taxes, duties and fees | ||

| 292 | Fines for violation of legislation on taxes and fees, legislation on insurance premiums | ||

| 293 | Fines for violation of procurement legislation and violation of the terms of contracts (agreements) | ||

| 294 | Penalties for debt obligations | ||

| 295 | Other economic sanctions | ||

| 296 | Other expenses | ||

| 300 | Receipt of non-financial assets | 300 | Receipt of non-financial assets |

| 310 | Increase in the value of fixed assets | 310 | Increase in the value of fixed assets |

| 320 | Increase in the value of intangible assets | 320 | Increase in the value of intangible assets |

| 330 | Increase in value of non-produced assets | 330 | Increase in value of non-produced assets |

| 340 | Increase in the cost of inventories | 340 | Increase in the cost of inventories |

| — | 350 | Increase in the value of the right to use an asset | |

| 400 | Disposal of non-financial assets | 400 | Disposal of non-financial assets |

| 410 | Decrease in the value of fixed assets | 410 | Decrease in the value of fixed assets |

| — | 411 | Depreciation of fixed assets | |

| — | 412 | Impairment of fixed assets | |

| 420 | Decrease in the value of intangible assets | 420 | Decrease in the value of intangible assets |

| — | 421 | Amortization of intangible assets | |

| — | 422 | Impairment of intangible assets | |

| 430 | Decrease in value of non-produced assets | 430 | Decrease in value of non-produced assets |

| — | 432 | Impairment of non-produced assets | |

| 440 | Reducing the cost of inventories | 440 | Reducing the cost of inventories |

| — | 450 | Decrease in the value of the right to use an asset | |

| 500 | Receipt of financial assets | 500 | Receipt of financial assets |

| 510 | Receipts to budget accounts | 510 | Receipt to accounts |

| 520 | Increase in the value of securities, except shares and other forms of participation in capital | 520 | Increase in the value of securities, except shares and other forms of participation in capital |

| 530 | Increase in the value of shares and other forms of participation in capital | 530 | Increase in the value of shares and other forms of participation in capital |

| 540 | Increase in debt on budget loans | 540 | Increase in debt on budget loans |

| 550 | Increase in the value of other financial assets | 550 | Increase in the value of other financial assets |

| — | 560 | Increase in other receivables | |

| 600 | Disposal of financial assets | 600 | Disposal of financial assets |

| 610 | Disposal from budget accounts | 610 | Disposal from accounts |

| 620 | Decrease in the value of securities, except for shares and other forms of participation in capital | 620 | Decrease in the value of securities, except for shares and other forms of participation in capital |

| 630 | Decrease in the value of shares and other forms of participation in capital | 630 | Decrease in the value of shares and other forms of participation in capital |

| 640 | Reducing debt on budget loans and credits | 640 | Reducing debt on budget loans and credits |

| 650 | Decrease in the value of other financial assets | 650 | Decrease in the value of other financial assets |

| — | 660 | Decrease in other receivables | |

| 700 | Increase in liabilities | 700 | Increase in liabilities |

| 710 | Increase in domestic state (municipal) debt | 710 | Increase in domestic state (municipal) debt |

| 720 | Increase in external public debt | 720 | Increase in external public debt |

| — | 730 | Increase in other accounts payable | |

| 800 | Reducing liabilities | 800 | Reducing liabilities |

| 810 | Reducing domestic state (municipal) debt | 810 | Reducing domestic state (municipal) debt |

| 820 | Reducing external public debt | 820 | Reducing external public debt |

| — | 830 | Reduction of other accounts payable | |

Let us remind you that we previously published a table with changes to KOSGU that are coming in 2021.

The Russian Ministry of Finance has determined approaches to classifying expenses for the implementation of national projects

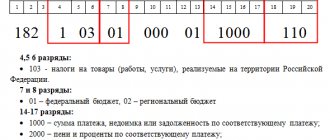

In October of this year, by letter No. 02-05-11/71918 dated October 05, 2018, the Ministry of Finance of the Russian Federation sent methodological recommendations on the formation of budget classification codes when reflecting budget allocations (expenses) for the implementation of regional projects aimed at implementing federal (national) projects. This document has long been awaited by financiers of the constituent entities of the Russian Federation and municipalities, as it is directly related to the formation of regional and local budgets. According to the recommendations, each national project is assigned a certain letter value, which is indicated in the fourth digit of the code of the target item of federal budget expenditures. A total of 13 national projects have been identified, including, essentially equivalent to them, an infrastructure development plan. National projects include federal projects. The fifth digit of the code of the target item of federal budget expenditures determines the number of the federal project that is part of the national one. Letter codes of national and federal project numbers are indicated in the appendices to the methodological recommendations.

To implement regional projects aimed at achieving the goals of federal projects, the financial authorities of the constituent entities (municipalities) of the Russian Federation allocate the corresponding expenses as part of a separate main activity in the target expenditure item: in the 4th-5th category of the target expenditure item the code of the federal project is indicated.

Federal projects are detailed based on the results of implementing the tasks of the federal project. Each result of a federal project is assigned a code for the direction of expenditure: 6-10 digits of the code for the target expenditure item.

If there are no interbudgetary transfers at the level of a constituent entity of the Russian Federation for the implementation of regional projects aimed at achieving the results of federal projects, the financial authority of the subject has the right to use the appropriate codes for the direction of expenditures of the results of federal projects to classify the results of a regional project. If necessary, detailing the fifth or fourth and fifth digits of expense direction codes is allowed.

In the case of provision of interbudgetary transfers from the federal budget for the implementation of federal projects, expenditures of the budgets of subjects (local budgets) are reflected in the areas of expenditures 50,000 - 59,990, corresponding to the areas of expenditures of the federal budget. Financial authorities are allowed to change the fifth digit of the expense direction code, containing the values 50000 - 59990, for greater detail.

For example, at the regional level, to achieve the goal of “Equipping medical institutions with mobile medical complexes to provide medical care to residents of settlements with a population of up to 100 people” of the federal project “Development of the primary health care system”, a regional project was initiated. The federal project “Development of the primary health care system” is part of the national project “Healthcare”. Funds for financial support for the implementation of a regional project aimed at achieving the goals of the federal project are provided from the federal budget.

In accordance with the comparative table of target expenditure items and codes of types of income carried out as part of the implementation of federal projects, used in the preparation and execution of budgets of the budget system of the Russian Federation, starting with budgets for 2021 and the planning period of 2021 and 2021, the code of the target expenditure item of the regional budget has the value XX X N1 51910, where: XX X – regional program (subprogram); N1 – letter designation of the national project and number of the federal project (Appendices 1, 2 to letter No. 02-05-11/71918 dated 10/05/2018); 51910 – expense direction code.

In order to detail budget allocations, the financial authority of the subject has the right to classify the code for the direction of expenses as follows: 51911 - Equipping medical institutions with mobile medical complexes to provide medical care to residents of settlements with a population of up to 100 people in municipal district 1.

51912 — Equipping medical institutions with mobile medical complexes to provide medical care to residents of settlements with a population of up to 100 people,

municipal district 2, etc.

On the official website of the Ministry of Finance of Russia in the section “Methodological Cabinet”, in the heading “Budget Classification of the Russian Federation” there is a list of codes for areas of expenditures to achieve federal projects and a comparative table of target items of expenditure and codes for types of income carried out as part of the implementation of federal projects.

Corresponding changes will also be made to the order of the Ministry of Finance of the Russian Federation dated June 8, 2018 No. 132n “On the procedure for the formation and application of budget classification codes, their structure and principles of purpose. In addition to Order No. 132n, when drawing up budgets for 2021 and for the planning period 2021 and 2021, one should be guided by the Procedure for applying the classification of operations of the general government sector, approved by Order of the Ministry of Finance of the Russian Federation dated November 29, 2017 No. 209n.

For all questions regarding the implementation of budget reform, you can contact the specialists of the BFT Company: E-mail tel./fax