Things are getting harder for people, and the government is coming up with new taxes? Soon an additional tax for car owners will be introduced into the Tax Code - an environmental one. Now owners of used cars will pay more because their vehicles do not meet global environmental standards.

People buy used cars out of desperation. If there was more money, car showrooms would not be able to withstand the flow of customers. When buying a car, people do not pay attention to the environmental class of the engine. They are more concerned about its cost, availability of spare parts and fuel consumption per 100 kilometers.

Now, when purchasing, you will have to take into account the harm caused to nature. To pay less, it’s better to forget about 10-year-old cars. Transport that meets world standards will put a dent in the wallets of Russians. Such machines use innovative technologies that greatly increase the final cost.

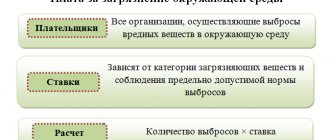

Who will pay tax in 2021?

Anyone who meets the following criteria will have to pay:

- work in Russia

- performing work that has a negative impact on the environment, that is, generating waste. Enterprises classified as category 4, that is, those with minimal impact, as well as those enterprises and persons that generate solid household (municipal) waste in the process and as a result of their activities will be exempt from paying environmental tax.

The new tax for the generation of MSW will be paid by regional operators working with waste (with MSW).

Enterprises and individuals who, according to the new rules, must pay tax, will be specially registered in the region where the enterprise is registered.

A fixed tax rate on the production of substances that are clearly dangerous and have a negative impact on nature is already known.

- So for the production of ammonia the tax will be 138.8 rubles. for 1 t

- hydrogen sulfide – 686.2 rubles. for 1 t

- methane – 108 rub. for 1 t

- nitric oxide - 138.8 rub. for 1 t

- mercury and lead – 18 thousand rubles. for 1 ton of manufactured products

However, there are also substances that are very expensive in terms of environmental fees. So, for 1 ton of benzopyrene emissions, if such a fact is established, the enterprise will have to pay almost 5.5 million rubles, and for a ton of aniline - almost 6 million rubles.

If an enterprise is located in a region with enhanced environmental protection, it will pay tax with an increasing coefficient.

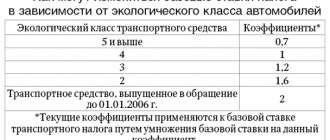

Calculation of modern transport tax

The tax collected from motorists is the responsibility of the municipal government. On a nationwide scale, the size of the transport fee is calculated according to the following principle:

- 2.5 rubles per horsepower - with engine power not exceeding 100 hp;

- 3.5 rubles – from engines up to 150 hp;

- 5 rubles – for cars up to 200 hp;

- 7.5 rubles – for vehicles up to 250 hp;

- The remaining cars cost 15 rubles.

The indicated values change according to government regulations in the region. Due to this, depending on the place of vehicle registration, the tax amount for equivalent cars differs by 3 times. If there are no local installations, the federal prices indicated in the list are applied.

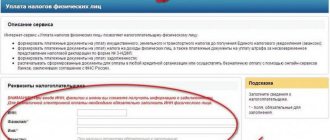

The Federal Tax Service calculates the tax for individuals and sends them appropriate notifications. This happens once a year. Some citizens calculate the tax themselves, using a special calculator on the Tax Service website.

There is no doubt that the introduction of an environmental tax will hit car enthusiasts. They are forced to buy new cars, which cost much more than used ones. All that remains is to save money or pay a long-term loan to the state in the form of an increased fee for a personal car.

How is the tax base planned?

The mechanism for determining the base is the main difference between the tax being developed and the tax levies levied today.

It will be calculated based on the results of environmental monitoring separately for each existing permanent source of waste, and separately for all substances released into the environment, in accordance with its pre-identified hazard class.

What should be taken into account:

- the volume of pollutants that falls within the designated standards

- the volume of pollutants within the limits established in the given region for air emissions and discharges. This category also includes the volume of microorganisms entering the OS.

- emissions exceeding established standards

Further increase in environmental tax

It is envisaged that in the future tax rates will be tied to inflation and multiplied by the corresponding coefficient of changes in consumer prices for goods and services.

Environmental tax in 2021, what needs to be improved

For now, the new tax needs to be finalized. According to experts, it will be necessary to further develop channels through which funds will flow to recycling enterprises.

But the existing system is also ineffective, at least that’s what the Ministry of Finance claims. For example, today collection of debt on unpaid environmental fees is possible today only through the courts. And if there are non-payments of mandatory environmental fees, only administrative penalties can be imposed on enterprises violating the law.

When the environmental tax comes into effect, debts will be collected without alternative, just like insurance premiums. And the presence of debts will be regarded as a crime.

The developers of tax innovations argue that the introduction of the tax will not greatly increase the burden on taxpayers, but budget revenues will increase significantly due to the fact that the quality of administration will increase, that is, the speed of debt collection and bringing defaulters to justice, even criminal liability.

Tax collections will, again, according to those officials who are developing the reform, be much more than what is paid today for environmental pollution. This will provide additional profits also because payments to environmental programs from all budgets, including federal and regional, will be reduced.

Experts are still making mixed predictions. Thus, Anatoly Simonov, head of the association of small business accountants, doubts that such a tax will benefit business, since, in his opinion, the volume of reporting will increase significantly.

The Ministry of Finance reports that in 2021, 14.2 billion rubles were collected for adverse impacts on the environment. When calculations are made for 2018, it is assumed that the total amount of payments will be 11.6 billion rubles. And with tax in 2021 and subsequent years - 10.3 billion rubles.

Today, many enterprises pay an environmental fee because they cannot dispose of their production waste on their own. Most often, this is technologically impossible, since the disposal procedure itself is very expensive, and the production enterprise cannot be held responsible for products already put on the market.

Also, most enterprises today are charged a fee for emissions (and discharges) that harm the environment, as well as a fee for waste disposal. Sometimes the sums have to be paid are quite impressive, so businessmen themselves asked for systematization of payments.

Replacing fees with taxes will increase payment discipline, since there is a higher responsibility for non-payment of taxes. And those fees that must be paid today already have obvious signs of a tax.

It is assumed that the tax base will be determined by the taxpayer independently, and environmental control at production will help him in this.

The explanatory note to the new tax document states that today enterprises do not have significant incentives to make payments. Accordingly, they are often simply not paid. If the fees become a tax, this will significantly increase collection rates.

Who is exempt from paying environmental fees and reporting?

- Manufacturers of packaging who sell it for packaging products to other manufacturers. For example, a factory that sold paper bags to a confectionery shop.

- Manufacturers and importers of packaging, which is subsequently used for their own needs. For example, a factory that produces or imports boxes to transport parts from one workshop to another.

- Exporters of goods and packaging.

- Companies that independently recycle their goods and packaging in volumes no less than those stipulated for the reporting year are only exempt from paying the environmental fee, but are not exempt from submitting reports on the environmental fee!

What are the pros and cons of the new legislative document?

Discussions on the possibility of transferring the environmental fee into the category of taxes have been going on for two years, and since the end of 2021 it has been agreed upon in two ministries, but there are serious disagreements with the Ministry of Natural Resources. The document talks about dividing payments into two categories and including them in the relevant registers. However, in its current version, it does not stipulate financing for the activities of recycling companies. That is, the new tax provides for the receipt of money, but it is not clear how specialized enterprises will be able to receive it - such a mechanism has not yet been created.

A big advantage of the new bill is its complete transparency and greater predictability, since the introduction of taxes and control over them is the prerogative of parliament.

The downside of the document, as mentioned above, is stricter control with an increased fiscal burden.

Help from Eco-safety specialists

Specialists offer professional services for calculating the amount of environmental fees and drawing up the necessary documents for submission to the Rosprirodnadzor authorities.

Professional ecologists will also tell you how you can reduce the amount of environmental fees or profitably and quickly switch to independent waste disposal. Our company’s specialists are present during inspections of government supervisory authorities, comment and explain calculations in prepared reports, and participate in resolving disputes.

History of environmental fees and taxes in Russia

The fact that environmental problems are singled out as a separate tax shows that this problem has recently become extremely significant. The state performs its ecological function not only in modern society, but also at all stages of the development of civilization, taking into account, of course, different levels of tasks. Previously, this function was called “environmental”.

The first legislative acts on the wise use of natural resources in Russia were adopted in 1917 - 1922, and continued to develop in subsequent years. In 1957-1962, the law “On Nature Protection” was adopted in all union republics,

and after that, for 20 years, the codification of legislation on the subsoil, water, and land was carried out.

In 1985, special bodies were created to specifically deal with environmental protection and rational use of natural resources.

Today, it is time to create an optimal model of environmental management.

Today, economic methods for solving this problem are not well developed. Since the procedure for financing those enterprises that are engaged in the reproduction of resources is still uncontrolled, and there is not even a proper economic assessment. It is mandatory to set low prices for natural raw materials and products of their direct processing, which previously led and continues to lead today to their irrational, too wasteful use. Most enterprises do not bear economic responsibility even for significant contamination of the operating system.

The industries and enterprises that are expected to pay taxes include, for example, all mining, chemical and metallurgical enterprises, the entire agro-industrial complex, food production, and landfills for storing and storing solid waste.

Penalties

The tax period, as for other types of taxes, will be the calendar year.

Late payments will be subject to late fees. If today the penalty is 1/300 of the refinancing rate for debts up to a month, and increases to 1/150 of the delay in payments by more than 1 month.

Fines will also have to be paid if false or incorrect calculations are provided. Once the new tax provision is adopted, the penalty will be 20% of the difference between the amount paid and the previously calculated amount.

It is assumed that the tax will be paid through advance payments within one year. Then small and medium-sized businesses will only have to provide annual calculations.

If a small or medium-sized business, as well as an individual entrepreneur or individual, will be engaged only in office activities. They will not pay tax, but will pay the standard fee for the removal of solid waste. The fee will increase significantly and will be calculated based on the cost of removing one cubic meter. What the exact bet sizes will be has not yet been determined. In case of violation of tax laws, it is planned to apply penalties with increasing coefficients on the tax rate. They can reach 100. Thus, taxpayers must develop and draw up a program for the environmental efficiency of the enterprise. If during the audit it turns out that the program points were not fulfilled within six months, the tax coefficient for the enterprise increases 100 times.

To reduce the amount of future tax, enterprises will be able to take effective measures to reduce environmental pollution. What is new in the legislation on environmental tax is a significant fine in case of failure to register with regulatory authorities. Today the fine for such a violation ranges from 30 to 100 thousand rubles.

After the tax amendments come into force, the minimum fine will be 40 thousand rubles.