Question No. 1

Sometimes, when sending an employee on a business trip, atypical situations occur.

What regulations should be followed when resolving issues that arise in these cases? According to Art. 167 of the Labor Code of the Russian Federation, when sending an employee on a business trip, he is guaranteed:

- maintaining your job (position) and average earnings. For all cases of determining the amount of average wages (average earnings) provided for by the Labor Code of the Russian Federation, a uniform procedure for its calculation is established by Regulation No. 922[1] (Article 139 of the Labor Code of the Russian Federation);

— reimbursement of expenses related to business travel. For example, the procedure and amount of reimbursement of expenses associated with business trips on the territory of the Russian Federation for employees of federal government institutions are established by Resolution No. 729[2].

The rules defined in Art. 167 of the Labor Code of the Russian Federation, are applied taking into account the specifics of the procedure for remuneration during the period the employee is on a business trip, established by Regulation No. 749[3].

Allowable travel expenses

What documents can be used to confirm the entertainment expenses incurred?

This can be confirmed by documents that justify one or another type of travel expenses: travel expenses, accommodation, per diem.

The legislation does not define a specific list of supporting documents that an organization can use to justify travel expenses for employees.

Opinion of the Ministry of Finance of Russia and the Federal Tax Service of Russia: documents confirming an employee’s travel expenses for travel and rental premises may be:

– advance report approved by the head of the organization;

– travel certificate;

– documents evidencing the employee’s travel expenses (including documents evidencing expenses for the purchase of an electronic travel ticket), rental of living quarters, etc. (attached to the advance report). At the same time, the presence of documents such as an official assignment and an order to send an employee on a business trip is not necessary to confirm expenses for profit tax purposes. Confirmation: letters of the Ministry of Finance of Russia No. 03-03-06/1/764 dated November 19, 2009, No. 03-03-05/169 dated September 14, 2009, Federal Tax Service of Russia No. MN-22-3/890 dated November 25 2009

Due to the fact that a travel certificate is issued only for business trips within Russia and to the CIS countries, when sending an employee on a business trip to other countries, copies of the pages of the international passport with marks on crossing the border must be available (clause , Regulations, approved by Government Decree RF No. 749 of October 13, 2008).

Important! For one-day business trips, a travel certificate may also be missing.

To justify expenses in the form of daily allowances, documents are required that are drawn up when sending an employee on a business trip (in particular, a travel certificate for a long business trip in Russia and the CIS countries). Additionally, you do not need to present various checks and receipts. Confirmation: letters of the Ministry of Finance of Russia No. 03-03-06/1/741 dated November 11, 2011 , No. 03-03-06/1/206 dated April 1, 2010 , No. 03-03-06/1/770 dated November 24, 2009

What form should I use to prepare an advance report when an employee returns from a business trip?

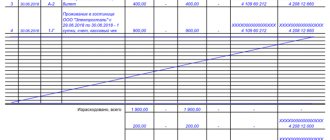

The advance report is the primary document with the help of which an employee (including those sent on a business trip) confirms the expenses incurred by him on issued accountable funds (Part 1, Article 9 of Federal Law No. 402-FZ of December 6, 2011, p. 26 Regulations, approved by Decree of the Government of the Russian Federation No. 749 of October 13, 2008).

An advance report must be drawn up in the form approved in the organization’s accounting policies for accounting purposes. The organization has the right to draw up this document according to the unified form No. AO-1, approved. Resolution of the State Statistics Committee of Russia No. 55 of August 1, 2001. You can also develop an advance report form yourself (including using a standard form as a basis).

In any case, the primary documents used by the organization must contain all the mandatory details listed in Part 2 of Art. 9 of Federal Law No. 402-FZ of December 6, 2011

However, let's get back to business trips. The Labor Code provides a strict list of articles under which a posted worker can claim compensation.

These are travel expenses, rental accommodation and daily allowance. Payment for meals is not made separately. It is assumed that these expenses are included in the daily allowance. In addition to these expenses, the company, by internal regulatory document, can approve a list of additional costs that are compensated to employees. This could be, for example, communication services, the Internet, taxis. One way or another, the principle of economic feasibility must be observed, that is, a person on a business trip must make such expenses only to carry out an official assignment.

So, what expenses should be reimbursed to an employee sent on a business trip?

You need to compensate for expenses associated with a business trip. In particular, these include: – travel expenses; – expenses for renting housing; – daily allowance; – other expenses that the employee incurred with the consent of the employer.

The specific amounts, as well as the procedure for reimbursement of travel expenses, must be fixed in the collective agreement (another local regulatory act, for example, the Regulations on Business Travel).

Confirmation: Art. 168 of the Labor Code of the Russian Federation .

Labor legislation does not establish the obligation to pay expenses associated with business trips to all employees in the same amount. The amount of compensation is determined based on the financial capabilities of the organization. The employing organization has the right, by its local regulations, to provide for a differentiated amount of these expenses for employees occupying different positions (for example, different amounts of expenses for the head of the organization and his deputies, heads of structural divisions, and other employees).

Confirmation: letter of the Ministry of Labor of Russia No. 14-2-291 dated February 14, 2013 , paragraph 3 of Rostrud letter No. 164-6-1 dated March 4, 2013.

To determine the amount of advance payment to an employee for the entire duration of a business trip, it is necessary to take into account its duration, which can be established on the basis of travel documents. For example, an organization can calculate the amount of daily allowance based on a travel certificate.

Confirmation: clause 11 of the Regulations , approved. By Decree of the Government of the Russian Federation No. 749 of October 13, 2008, letter of the Ministry of Finance of Russia No. 03-03-06/1/741 of November 11, 2011.

However, in any case, the specific amount of the advance payment for a business trip (taking into account the specified features) is determined in a general manner by the head of the organization (clause 4.4 of the Regulations on the procedure for conducting cash transactions).

Question No. 2

In accordance with Art.

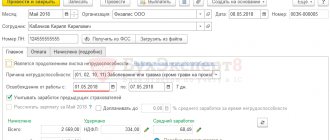

136 of the Labor Code of the Russian Federation, wages are paid at least every half month. The specific date for payment of wages is established by internal labor regulations, a collective agreement or an employment contract no later than 15 calendar days from the end of the period for which it was accrued. When should an employee be paid his average salary when sent on a business trip?

The Ministry of Labor in Letter dated June 27, 2019 No. 14-1/OOG-4422 explains the following:

- in order to prevent the occurrence of labor disputes to the employer in accordance with Art. 8 of the Labor Code of the Russian Federation, it is necessary to stipulate in a local regulatory act (for example, regulations on business trips) the timing of payment of average earnings during a business trip.

— the timing of payment of average earnings during a business trip should be similar to the timing of payment of wages provided for in Art. 136 Labor Code of the Russian Federation.

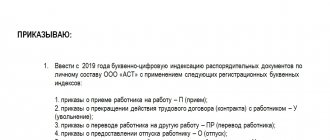

How to extend a business trip

There are times when the period of performance of official duties must be continued. This must be done only with the consent of the employee himself. It happens like this:

- an order is issued to extend the business trip by the head of the enterprise (organization);

- The employee is initially notified in writing or orally.

The new issued order must include information about the number of days required to complete the work. Upon return, the order to change the timing of the business trip, a sample of which is drawn up by the employer, must be signed by the person.

If the business trip time changes up or down, the employer, in accordance with the Labor Code, issues an order.

The extension of a business trip is formalized by order to the extent necessary to resolve official matters.

Is employee consent required?

All questions regarding changes in deadlines for completing official assignments must be agreed upon with the employee. Only after its confirmation are the departure dates postponed, a new order is created or changes are made to an existing one.

There are a number of categories of workers for whom travel days can be issued only with their consent:

- Parents whose children are under 5 years old.

- Workers under an apprenticeship contract.

- Women with children under 3 years old.

- People with disabilities.

- Parents who are raising a disabled child.

- Candidates for positions in legislative bodies.

Pregnant women are prohibited from traveling on business trips.

To avoid disagreements, when applying for a job, it is agreed upon whether the employee will be able to perform official duties away from home.

If controversial issues arise, citizens can go to court.

Question No. 3

How to pay an employee if he went on a business trip after the end of his working day, but during the same day?

Is it possible to pay for days actually worked? The duration of the business trip is determined by the employer, taking into account the volume, complexity and other features of the official assignment.

The actual duration of an employee’s stay on a business trip is determined by travel documents presented by the employee upon returning from a business trip, and in their absence, on the basis of documents for the rental of residential premises or other documents confirming the conclusion of an agreement for the provision of hotel services at the place of business trip. Or the employee submits a memo and (or) other document about the actual duration of the employee’s stay on a business trip, containing confirmation of the party receiving the employee (organization or official) about the date of arrival (departure) of the employee to the place of business trip (from the place of business trip).

In accordance with clause 9 of Regulation No. 749, the average salary is maintained for all days of work according to the schedule established in the sending organization:

— during the period the employee is on a business trip;

— for days on the road, including during forced stops along the way.

In this case, it is necessary to take into account the following (clause 4 of Regulation No. 749):

— the day of departure on a business trip is the date of departure of a train, plane, bus or other vehicle from the place of permanent work of the business traveler;

— the day of arrival from a business trip is considered the date of arrival of the above vehicle at the place of permanent work;

- when a vehicle is sent before 24.00 inclusive, the current day is considered the day of departure on a business trip, and from 00.00 and later - the next day.

According to the norms of the legislation of the Russian Federation, the average salary of an employee is paid for all working days provided for by the work schedule of the sending organization.

Therefore, in cases where the Labor Code of the Russian Federation provides for the retention of average earnings for an employee, average earnings should be calculated rather than paying current wages.

For example, the Letter of Rostrud dated 02/05/2007 No. 275-6-0 contains an explanation according to which, even if in some cases the “current” salary may be higher than the average earnings calculated in the prescribed manner for payment to an employee sent on a business trip, wages for days on a business trip will contradict the provisions of the Labor Code of the Russian Federation.

Thus, if an employee went on a business trip on the day specified in the order to start the business trip, and this day is marked as a business trip in the time sheet, the designated day is subject to payment in the amount of average earnings, determined in the prescribed manner.

The issue of an employee’s attendance at work on the day of departure on a business trip and on the day of arrival from a business trip is resolved by agreement with the employer in accordance with clause 4 of Regulation No. 749.

Duration of business trip

Any dispatch of an employee to carry out an official assignment within the country or abroad, in accordance with the laws of Russia, must be properly formalized and agreed upon with the employee himself. Back in Soviet times, the law approved a limit on the travel period, which was no more than 40 days, and for certain specialties (builders, installers) a long-term business trip lasting up to a year was stipulated.

Today, the Labor Code does not limit the number of travel days . Even before it begins, the deadlines are adjusted by the employer depending on the volume of work and its complexity (PP 749).

The beginning of the business trip period should be considered the day of departure, and the date of arrival is regarded as its end. If transport is delayed en route, the business trip will be extended by this time. This period also includes holidays and weekends, which are paid at a double rate.

If the amount of payment is not increased by the employer, then an additional day off must be issued for the employee .

There are employers who determine the duration of the trip based on travel documents. If you use your own transport, the employee must provide a memo.

If tickets are not available, you can use documents from the hotel or rental agreement. When registering for a trip abroad, the documents are translated into Russian.

Maximum term

The duration of the business trip is determined by the employer in consultation with the employee. To determine the period, take into account:

- The degree of complexity of the tasks performed.

- Specifics of tasks.

- Travel distance.

- Scope of proposed work.

The maximum duration of a business trip under the Labor Code of the Russian Federation is unlimited . Depends on the feasibility, difficulty and distance of the trip.

The business trip period also cannot last indefinitely. If an employee has fulfilled all the instructions of management, but continues to work at the enterprise where he was sent, then we can say that he has been transferred to that organization (Article 72 of the Labor Code of the Russian Federation).

Question No. 4

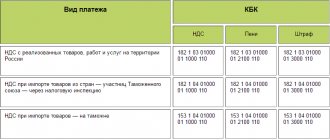

How much should I pay for an employee to go on a business trip on a day off?

If the day of departure (arrival) on a business trip (from a business trip) is a day off or a non-working holiday, then payment for work on this day is made based on the employee’s official salary, and not on the basis of average earnings.

According to clause 5 of Regulation No. 749, remuneration for an employee if he is involved in work on weekends or non-working holidays is made in accordance with the Labor Code of the Russian Federation. Therefore, to determine the amount of remuneration on specified days during a business trip, employers should be guided by Art. 153 of the Labor Code of the Russian Federation, which states that wages are paid at least double the amount.

The specific procedure for calculating it depends on the employee remuneration system used, in particular:

- employees receiving a salary (official salary) - in the amount of at least a single daily or hourly rate (part of the salary (official salary) for a day or hour of work) in excess of the salary (official salary), if work on a day off or a non-working holiday was carried out on within the monthly working hours;

- in the amount of no less than double the daily or hourly rate (part of the salary (official salary) for a day or hour of work) in excess of the salary (official salary), if the work was performed in excess of the monthly working time standard.

In addition, specific amounts of remuneration for work on a day off or a non-working holiday can be established by a collective agreement, a local regulatory act adopted taking into account the opinion of the representative body of employees, or an employment contract.

Increased payment is made to all employees for hours actually worked on a weekend or non-working holiday.

If part of the working day (shift) falls on a weekend or non-working holiday, the hours actually worked on the weekend or non-working holiday (from 00.00 to 24.00) are paid at an increased rate.

Similar explanations are given in letters of the Ministry of Labor of the Russian Federation dated July 9, 2019 No. 14-2/B-527, Rostrud dated October 16, 2019 No. PG/26391-6-1, dated October 16, 2019 No. TZ/5985-6-1.

At the same time, at the request of an employee who worked on a holiday, he may be given another day of rest. In this case, work on such a day is paid in a single amount, and a day of rest is not subject to payment.

How to make changes to the duration of a booked business trip

In life, it is impossible to predict how events will unfold.

It happens that having sent an employee on a business trip, the need to achieve its goal simply disappears, or the employee completed the assigned task ahead of schedule.

The manager needs to recall the employee from a business trip.

It is logical that for this purpose an appropriate order is created, adjusting the timing of the business trip with justification of the reasons for their change.

Moreover, neither in the Labor Code, nor in Regulation No. 749, the legislator does not focus attention on this point and does not provide certain requirements for the preparation of documentation, unified forms.

Therefore, the employer has the right to issue a written order in any form or developed for such situations in the organization.

You can inform the posted worker that the period of his stay on official assignment has been changed by all available means: in a telephone conversation, sending a scanned copy of the order by e-mail, and others.

Upon return, the employee must personally familiarize himself with the original order.

Advance issued for travel expenses when the timing of a business trip changes

According to Art. 168 of the Labor Code of the Russian Federation, the employer pays all material costs associated with the business trip.

Clause 10 of Regulation No. 749 provides for the issuance of an advance to pay for travel to the place of business trip and return home, for the rental of living quarters, and daily expenses associated with being away from a permanent place of residence.

It is clear that when returning from a trip ahead of schedule, there must be money left over for a longer period of stay and daily expenses, which, together with the submission of an advance report, must be deposited into the company's cash desk or returned to the current account.

At the request of the employee, the excess funds paid can be recovered from his salary.

If an employee completed a production task on time, but due to his personal affairs was delayed in the city (country) and returned later than the established deadline, he will not be compensated for these days in the amount of accommodation and daily expenses, and payment for travel on the return trip will also become unreasonable.

In the event that a business trip takes longer than planned, due to an unforeseen stop along the way or the additional time required to complete the task, the person must be compensated for additional expenses.

Moreover, in case of extension of the business trip, an advance payment for daily expenses and accommodation during the estimated period can be sent by postal order or transferred to the employee’s bank account.