What general points are important to know about creating a reserve for repairs?

As indicated by the provisions of paragraph 2 of Art. 324 of the Tax Code of the Russian Federation, the reserve for the repair of fixed assets should be calculated in two ways:

- for the purpose of carrying out standard, inexpensive OS repair work;

- for the future implementation of complex and expensive repair work.

The creation and application of reserves for each of the above areas is carried out in its own way.

IMPORTANT! At the same time, when deciding on the formation of a reserve, in its accounting policy the company should determine the limit, if exceeded, repairs will be classified as expensive.

In order to correctly form a reserve for the repair of fixed assets, the company should have reliable and complete information:

- about the initial cost of fixed assets as of the beginning of the year;

- the amounts spent on repair work over the previous three years, as well as plans for carrying out such work in the future (at an estimated price);

- expensive repair work (separate information: what work was carried out previously, for what amount, what work is planned for the foreseeable future, etc.).

In addition, the company may be interested in aspects of creating other reserves. In particular, see the article “Provision for doubtful debts: procedure for creation and calculation of deductions.”

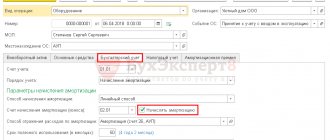

Preparation of repair and modernization documents

When carrying out repairs of fixed assets, the following documents are drawn up:

| Dear visitors! The site offers standard solutions to problems, but each case is individual and has its own nuances. |

| If you want to find out how to solve your particular problem, call toll-free ext. 504 (consultation free) |

- order of the manager, which determines in relation to which objects work should be carried out;

- defective statement, which indicates the nature of the malfunctions and defects requiring repair work;

- estimate documentation;

- contract agreement if third parties are involved;

- act of acceptance and delivery of repaired fixed assets form OS-3.

| Best-selling book “Accounting from scratch” for dummies (understand how to do accounting in 72 hours) > 8,000 books purchased |

St. Petersburg, Leningrad region call: +7 (812) 317-60-16

From other regions of the Russian Federation call: 8 (800) 550-34-98

What are the main stages of calculating the reserve for OS repairs?

As the norms of the Tax Code of the Russian Federation indicate, when creating the reserve in question, the company should focus on two main indicators: the standard of deductions and the total cost of fixed assets (clause 2 of Article 324 of the Tax Code of the Russian Federation).

In this context, the cost of fixed assets is understood as the total accounting value of all fixed assets that the company uses in production, as of the beginning of the year in which the reserve in question is created. At the same time, you should not include in the calculation the cost of leased operating systems and operating systems that the company uses free of charge.

IMPORTANT! Accounting specialists should not forget that in this situation, the initial cost is taken for calculation, and not the residual value.

In general, the algorithm for calculating contributions to the reserve under consideration can be presented in the form of successive steps:

- calculate the deduction limit;

- calculate the total cost of fixed assets that was relevant in the company at the beginning of the tax period;

- by calculation, determine the standard of deductions based on the results of the previous action;

- calculate the total amount of the reserve in question.

How to calculate the maximum amount of contributions to the reserve and the standard?

In order for a company to find out the upper limit of possible contributions to the reserve, it is necessary to perform the following steps.

First, you need to prepare an estimate for “standard” (inexpensive) repairs, based on the order of repair work in the billing tax period (indicator A).

It is important for the company to remember that the costs of repair work may include the following (clause 1 of Article 324 of the Tax Code of the Russian Federation):

- amounts spent on the purchase of materials for repairs (spare parts for equipment);

- salaries of specialists who directly carry out such repairs;

- other expenses that the company incurs due to carrying out repairs on its own;

- other expenses of the company in the interests of third-party companies performing repairs for the company.

Secondly, the company must clearly understand the scale of funds spent on standard (inexpensive) repairs over the past period of 3 years. To do this, you need to divide the total costs for repairs by 3 (indicator B).

Next, you should compare indicators A and B. The indicator that is smaller is the maximum amount of contributions to the reserve in question.

The next step is to calculate the standard of deductions related to the specific total cost of the company's fixed assets.

To do this, accounting specialists at the enterprise should find the quotient of dividing the maximum amount of deductions by the total cost of the fixed assets. The result will be a certain percentage, which acts as the maximum allowable for the company.

IMPORTANT! The company should establish in its accounting policy the standard of deductions in such an amount that it does not exceed the maximum allowable, calculated according to the above algorithm.

Example

The company independently carried out ongoing repair work to replace worn equipment parts in the amount of RUB 150,000. , of which the purchase of materials amounted to 95,600 rubles. , workers' salary is 35,000 rubles. , depreciation of mechanisms - 8900 rubles. The company does not have a repair shop. The accountant records the repair work with the following records:

Written off as production costs:

Salary of shop workers

Depreciation of fixed assets involved in repairs

If the repair is carried out by a contractor, then the work is carried out on the basis of a concluded contract, the acceptance is formalized by the relevant act, the accountant makes the following entries:

Upon presentation of the certificate of repair work performed, costs are included in the cost price

VAT on completed work

Payment for repairs was made to the contractor

VAT is accepted for deduction

Determining the final amount of contributions to the reserve

At the final stage, the company needs, based on the data calculated by previous steps, to determine the final amount of contributions to the reserve.

As indicated by the provisions of tax legislation, the amounts allocated to the reserve for the repair of fixed assets are included in the company's tax expenses for income tax.

IMPORTANT! At the same time, deductions to the reserve are applied to expenses in equal parts on the end date of each reporting period (clause 2 of Article 324 of the Tax Code of the Russian Federation).

Consequently, if a company reports to controllers for a quarter, half a year, or 9 months, then each time (each reporting period) ¼ of the total annual reserve is included in the reserve.

If the company provides monthly calculations to the tax authorities, then each month it must take into account 1/12 of the total annual value of such a reserve as amounts increasing the reserve.

IMPORTANT! Despite the fact that the Tax Code of the Russian Federation does not directly explain which expenses a company can include amounts that increase the reserve, by virtue of clause 1 of Art. 260 of the Tax Code of the Russian Federation, the company has the right to attribute repair costs to other expenses. Therefore, the company has the right to include the reserve amounts in other expenses, which will reduce the total income tax.

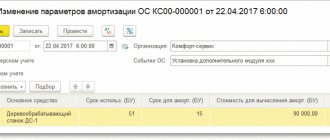

What is important to remember when determining the amount of reserve for expensive repairs?

In practice, there are often situations when a company’s operating system requires not standard routine repairs, but complex and expensive ones.

The company can use the amounts intended for such repairs to increase the limit of contributions to the reserve in question. This is stated in paragraph 2 of Art. 324 Tax Code of the Russian Federation.

To do this, the company needs:

- have at your disposal a schedule of planned expensive repairs and estimates for them;

- make savings for such repairs over more than one tax period (in this case, the possibility of such savings must be specified in the accounting policy);

- not have any costly repairs of the operating system in the three previous tax years.

It is important for a company to understand that the repair reserve should be increased only before the tax period, in which the company plans to begin carrying out expensive repair work.

Moreover, due to the literal interpretation of paragraph 2 of Art. 324 of the Tax Code of the Russian Federation, expenses can include deductions (accumulations) for upcoming expensive repairs in the full amount of the period in which such accumulations were made.

Example

The company calculates the standard based on the following data:

– cost of the operating system at the beginning of 2021 – 1,600,000 rubles. ;

– cost of repairs carried out for the three previous years: in 2015 – 500,000 rubles. , in 2021 – 430,000 rubles. , in 2021 – 510,000 rubles. ;

– the maximum cost of planned repairs for 2021 is 560,000 rubles. ;

– for 2 years (2018 - 2019) repairs of non-standard equipment are planned in the amount of 300,000 rubles.

– the average cost of previously carried out repairs is 480,000 rubles. (500,000 + 430,000 + 510,000) ;

– since the planned cost of repairs for 2021 exceeds the average, the average value for previous periods will be used as the basis for calculation;

– for the repair of non-standard equipment, the repair amount for 2021 will be 150,000 rubles. (300,000 / 2) ;

– the standard for contributions to the reserve was 39% ((480,000 + 150,000) / 1,600,000 x 100%).

In total, the annual reserve will be 624,000 rubles. (1,600,000 x 39%), i.e., the cost write-off per month will be 52,000 rubles. (624,000 / 12), per quarter - 156,000 rubles. (624,000 / 4).

How is the reserve used and can the unused portion be carried forward to the future?

If the company has created a reserve for the repair of fixed assets , then subsequently the amount actually spent on the repair of the operating system is written off against such a reserve (clause 2 of Article 324 of the Tax Code of the Russian Federation).

At the same time, companies should clearly understand that repair costs must be written off against the reserve of the year in which such work was actually performed for the company. That is, when the documents closing the repair work were signed. This is especially true in situations where the start and end of OS repairs occur in different tax periods.

At the end of each period, the company should conduct an inventory, during which company specialists compare the actual amounts spent during the year on repairs with the amount of the previously created reserve.

For information on inventory, see the article “How to conduct an inventory before annual reporting.”

If the repairs for the company cost more than the previously created reserve, then the difference should be taken into account as other expenses due to the instructions in paragraph 2 of Art. 324 and paragraph 1 of Art. 260 Tax Code of the Russian Federation. If, on the contrary, upon completion of the repair there are excess (unused) funds remaining, then such excess must be included in non-operating income.

PAY ATTENTION! Carrying over the unclaimed portion of the reserve for standard (inexpensive) repairs to the next year is not allowed.

This provision also applies to situations where no repairs were carried out at all. In such a situation, the entire reserve is reflected in income on the last calendar day of the year in which the reserve was formed.

As for the reserve for complex and expensive repairs, the legislator does not require that the amounts allocated to increase such a reserve be restored. They accumulate from year to year until repairs are started/implemented. But only if the company states in its accounting policy that it has adopted the practice of making deductions towards the reserve for complex and expensive repairs over more than one tax period.

In the year when expensive repairs are carried out, the company will also have to identify the balance and attribute the excess to expenses and the excess to income.

Accounting

Repairs can be carried out in two ways:

- contract method;

- in an economic way.

In the first case, repair work is carried out with the help of third-party contractors, with whom a contract is concluded; after completion of the work, the contractor draws up estimates for the work performed.

In the second case, repair work is carried out on its own.

The costs of repairing fixed assets are charged to production cost accounts, that is, they are included in the cost of production using the following entries: D20 (23, 25, 26, 44) K10 (60, 70, 69).

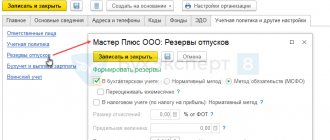

If the costs amount to a significant amount, then the organization can carry out repair work at the expense of a pre-formed reserve. This reserve is formed by gradually including certain amounts in the cost of production over a long period of time, while postings D 20 (23, 25, 26) K96 are made, where account 96 is called “Reserve for future expenses”, on which a reserve is formed for the loan. The amount of monthly deductions for the formation of the reserve is determined as 1/12 of the annual cost of repairs according to the estimate.

During the repair process, all costs are written off to the account of this reserve using the following entries: D96 K10 (70, 60, 69...).

If at the end of the year there are funds left on the credit of account 96 (that is, the amount required for repairs was less than the formed reserve), then the remaining funds are written off to account 91 by posting D96 K91/1, thus account 96 is closed.

If the amount of the reserve is not enough to carry out repair work, then the missing funds are either received using an additional entry to increase the reserve fund D20 K96, or this amount is written off as expenses by posting D20 K10, 60, 70.

Postings for accounting for expenses for repairs of fixed assets:

Results

Forming a reserve for the repair of fixed assets requires the company to correctly record information about the cost of all fixed assets, about completed and upcoming repair work (more specifically, about their estimated cost).

At the same time, the rules for creating and accounting for tax purposes of contributions to the reserve for standard repairs and for expensive repairs are slightly different. In particular, the unused reserve for ordinary repairs must be restored, and if the reserve for expensive repairs has not been fully used, then it can be transferred to future periods. However, in a year when the company carried out expensive repairs, the remainder of the reserve should be included in income, and excessively spent funds should be included in expenses. You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.