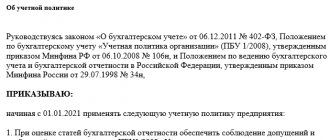

Russian legislation determines that maintaining accounting records is an obligation for all economic entities operating in the Russian Federation. This provision is enshrined in acts at the federal level (in particular, No. 402-FZ), therefore the company’s management must ensure a complete, continuous, and reliable reflection of all transactions in primary documents and consolidated registers.

The regulatory documents define BU objects:

- assets in the form of fixed assets and labor, intellectual property, goods, cash, financial investments, accounts receivable and other property;

- obligations and costs that arise for the entity;

- facts of economic life that arise during activity;

- sources of business financing;

- income from all sources.

Who is responsible for meeting the requirements?

In accordance with current regulations, the head of the company is responsible for compliance with the requirements. Creating conditions for conducting accounting in accordance with the law is his prerogative and responsibility. It is necessary to ensure the ability to effectively organize accounting and perform basic tasks, which include:

generation of information about the activities of a business entity, its financial position, financial results, cash flows - they must be complete, reliable, systematized and documented;

provision of information to all regulatory organizations to the extent of their powers, in accordance with the legislation of the Russian Federation;

preventing negative consequences (by analyzing information, forecasting), minimizing risks;

identification of on-farm reserves in order to obtain maximum profit, rational use of financial, material and labor resources.

The organization of accounting and storage of documents is entrusted to the manager by law. The head of the organization is obliged to entrust accounting to:

- for the chief accountant,

- to another official of this organization authorized by the head,

— enter into an agreement for the provision of accounting services with a third-party company or entrepreneur

The manager does not have the right to conduct accounting independently, with the exception of certain cases.

The manager has the right to maintain accounting records independently in cases where the economic entity:

- has the right to apply simplified methods of accounting, including simplified accounting (financial) reporting,

- is a medium-sized business entity, with the exception of organizations subject to mandatory audit, housing cooperatives, microfinance organizations and other organizations (specified in paragraph 5 of Article 6 of Law No. 402-FZ).

The person charged with accounting responsibilities must have certain professional qualifications. Requirements for the qualifications of an accountant are established by clause 4 of article 7 of law No. 402-FZ.

In Russia, the professional standard “Accountant” has been adopted, which was approved by Order of the Ministry of Labor dated December 22, 2014 No. 1061n.

If the manager delegates accounting to another person (including the financial director, chief accountant), he must indicate these functions:

- in the employment contract and job description, if this is an employee of the company,

- in an agreement with a third party or organization (list responsibilities as much as possible and delineate areas of responsibility).

Law No. 402-FZ defines a list of entities that can conduct accounting in a simplified form and those that may not conduct accounting at all according to the rules of the Russian Federation (RAS).

In a simplified form, they can keep records:

- small businesses, except those subject to mandatory audit;

- non-profit organizations (NPOs), except for funds for which audit is mandatory;

- other organizations specified in clause 4 of article 6 of law No. 402-FZ.

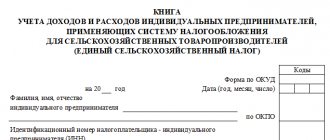

Accounting according to RAS rules may not be carried out by:

- individual entrepreneurs on UTII

- branches and representative offices of foreign organizations, if they maintain tax records according to the rules of the Tax Code of the Russian Federation

- other persons specified in clause 2 of article 6 of law No. 402-FZ

Let us note that divisions of foreign organizations in the Russian Federation, as a rule, keep records according to RAS, since this is precisely what is indicated in their Regulations submitted for registration in the Russian Federation. In many cases, this choice is justified because tax rules often refer to the norms defined for Russian accounting. If a branch or representative office has not officially declared that it keeps records in accordance with RAS, then it must maintain accounting according to the rules of the parent organization (IFRS, GAAP, national standards) while simultaneously forming tax registers and tax reporting under the Tax Code of the Russian Federation.

As a general rule, the person entrusted with accounting is responsible to the manager for

- accounting policy;

- the correctness of the methodology and management of accounting;

- maintaining tax records;

- generation of complete, reliable reporting and timely transmission to the appropriate authorities.

If the organization conducts cash transactions and there is no cashier position, the manager can assign these responsibilities to another employee. In this case, it is recommended to conclude an agreement with him on full individual financial responsibility, as well as make appropriate additions to the employment contract and job description.

The manager is obliged to organize an internal control system in the company. An important tool for internal control is the definition of document flow and authority policies.

Accounting requirements are mandatory for all employees of the organization.

List of basic accounting requirements

The system of normative documentation regulating the scope of accounting is determined by the Law on Accounting and the Tax Code of the Russian Federation. The accounting system distinguishes between federal and industry standards, which all economic entities in the Russian Federation are required to comply with.

The basic requirements for accounting contain the following rules:

- accounting is maintained continuously until the liquidation of the organization;

- accounting is maintained through double entry on accounting accounts, the list of which is approved by the Ministry of Finance of the Russian Federation (Chart of Accounts - Order of the Ministry of Finance of the Russian Federation No. 94n dated October 31, 2000, except for credit organizations);

- Each fact is documented in a primary accounting document, which must contain mandatory details. The list of mandatory details is specified in paragraph 2 of Article 9 of Law No. 402-FZ;

- primary documents can be prepared both in paper form and electronically (subject to special rules)

- data in primary accounting documents is registered in chronological order and transferred to accounting registers;

- Registration of imaginary and feigned accounting objects is not allowed (clause 2 of Article 10 of Law No. 402-FZ);

- accounting objects are subject to monetary measurement in the currency of the Russian Federation;

- maintaining documentation in Russian and in rubles (the national currency of the Russian Federation)

If settlements are carried out in foreign currency or assets and liabilities are expressed in foreign currency, then they are converted into rubles at the exchange rate of the Central Bank of the Russian Federation on the corresponding date.

- mandatory inventory taking;

- balances on bank accounts and settlements with the budget must be agreed upon with the relevant organizations and identical (clause 74 of Order of the Ministry of Finance of the Russian Federation No. 34n dated July 29, 1998);

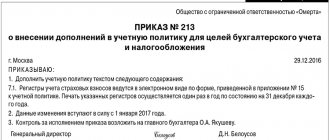

- compliance with accounting policies throughout the organization’s activities

- compliance with the principles of accounting, including completeness and timeliness, prudence, priority of content over form, correspondence of synthetic and analytical accounting data, rationality;

- separation of accounting for short-term and long-term assets and liabilities. The term criterion is one calendar year;

- separate accounting of own property and property of third parties;

- preparation and presentation of annual (financial) accounting and, in some cases, interim reporting. The reporting year is the calendar year. Reporting is prepared in the currency of the Russian Federation;

- Accounting (financial) statements are considered prepared if they are signed by the manager on paper.

- Accounting (financial) statements are not a commercial secret.

- Legal regulation of consolidated financial statements is carried out in accordance with No. 402-FZ and the Law “On Consolidated Financial Statements” No. 208-FZ dated July 27, 2010.

Definition and meaning of basic accounting principles

The property isolation of an enterprise includes the reflection of assets, liabilities on property and obligations that relate to other organizations. For example, the property may not belong to the owner, but is used strictly according to an agreement concluded by the owner himself, so all data will be displayed behind the balance sheet. There are also enterprises that are independent economic entities, where they carry out their activities with acceptable property separation. Thanks to the basic principles of accounting, it is possible to determine its essence and develop the accounting policies of the organization. Accounting policies must operate in accordance with regulations and development strategies. Such information is necessary for the rational management of the enterprise, as well as for external users.

The principle of operating an enterprise on a permanent basis means constant and continuous work, which means that in the future period, it will not cease its activities. This principle has full correspondence with the Bernoulli curve, and is explained by the fact that if accounting once appears, then its actions and the need for it will be eternal. Practice shows:

- the owner or manager cannot be the same during the existence of the enterprise, so the price cannot change until the owner changes. Such conditions prevent the occurrence of inflation;

- reports cannot change if owner changes

Did not you find what you were looking for?

Just write and we will help

Important!

One of the basic principles of accounting is the principle of monetary measurement.

Choosing the right unit and the right method for measuring the value of an item affects the final result of the enterprise’s economic activity. This principle is not reflected in the regulatory document, as it is undoubted. The principle of monetary measurement serves as the boundary of economic work, therefore it is expressed in monetary form, as well as in the general assessment of a particular item, which depends on GDP. In the market sphere, the value of an item and its valuation are its immediate probable price. In the event of competition on the open market, with such conditions, the item has the potential to become alienated. All parties to the contract must act according to the law, have the correct information to make reasonable decisions, and at the same time, the price of the contract should not reflect:

- price changes at the request of the party, in any form;

- all participants in the transaction must have the necessary information in full, since each of them will act for the purpose of economic gain;

- make payments exclusively in cash

Assets that are not in circulation acquire historical valuation. In the absence of inflationary processes, the object should be reflected at the same cost during operation, but there are, of course, many ways that will allow you to determine the residual and modern price. The current price changes upward from the original price during economic instability, and this in turn negatively affects financial statements. Thus, historical cost should be accrued as the sum of actual costs for the period they were entered into accounting, but for such objects there is a liquid value.

Each enterprise, regardless of the choice of assessment, must comply with certain restrictions:

- accounting of each object, type of property and liabilities;

- observe the principle of continuity of operation of the enterprise;

- independence of cost information from the moment of acquisition of costs. This, in turn, will allow us to get rid of deliberate distortion in favor of user interests;

- The principle of prudence in accounting does not exclude preparedness for potential losses and will help to make a profit. This principle is based on the creation of reserves for doubtful debts or the estimated value of certain types of property with a small value. For example, the cost of investments in securities in accounting occurs at the lowest market valuation, and all expenses and obligations for them are at the higher one;

- the cost of one property should not be more than the purchase price, the valuation of the goods of its manufacture cannot be higher in price, the current costs that arose during production;

Based on these priorities, each organization uses accounting policy standards in all accounting periods. This method allows you to compare financial indicators, and this is primarily important for every business activity. But the use of this method does not take place when there have been changes to existing regulatory documents on accounting or during the reorganization of the enterprise.

Definition

The accrual principle is a principle that allows you to clearly separate the periods at the time of receipt of funds, regardless of the form of payment, and the right to receive them, as well as the fulfillment of obligations for this operation.

Using the accrual principle, you can keep accounts of income and expenses of the future period, as well as timely determine the reflection of business transactions and correctly calculate the cash balance.

For example

The organization received a profit that has nothing to do with it - it could be rent, then this cash will be considered as deferred income. After the first reporting month, only a third of the amount can be considered income in a given period. The tenant works on the same principle.

The principle of periodicity is considered as the main one, since its essence lies in the timely provision of periodic reports on the financial condition of the organization and general economic work to shareholders. According to the law, the report must be submitted within the established deadlines, intermediate deadlines - once a quarter, which means once every three months. This principle will increase responsibility for the use of property.

Correct and reasonable management of the assets of an enterprise must be carried out in compliance with these principles. Modern economics involves the use of only two principles - the economic unit and the monetary ratio.