Configuration:

1c accounting

Configuration version:

3.0.43.253

Publication date:

26.07.2016

Views:

114378

Accounting for materials in the 1C: Accounting 8.3 program begins with setting up item accounting accounts. This will be more convenient and faster. First, go to the directory Directories - Nomenclature .

In the directory, we create a group Materials , although if you created a database using the add button, then you should already have standard groups of items and accounting accounts, but we still check their presence and settings. If the group has been created, go to Item Accounting .

To carry out current control, we will enable the ability to display item accounting accounts in documents. Go to the Don't show .

Select the Show accounting accounts in documents , write it down and close it.

We return to Item Accounts and create (if not present) an account setup for Materials; in my case, it was already created.

Useful: Creating a free Tax calendar for LLCs and individual entrepreneurs (UTII, USN, OSNO, Patent)

You might be interested: the program has the ability to capitalize materials through an expense report !

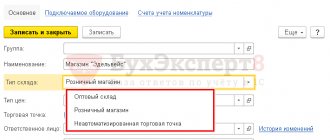

Select Item type, Nomenclature and accounting accounts . The Organization, Warehouse and Warehouse Type fields are not required to be filled in; if no values are selected, then the setting will work for all organizations and warehouses.

We create some Material from the nomenclature directory. Be sure to select the group and type of item . So that the program would pick up that this nomenclature item is a material.

Setting up Material Accounts is complete. Now you can move on to typical operations.

Receipt of Materials to the warehouse.

Go to the section Purchases - Receipts (acts, invoices) .

Select Receipt - Goods (invoice) . The document is generated in the same way as a regular receipt of goods, the main difference is that the receipt goes to other accounting accounts.

We fill out the document. And immediately notice that after you added our Material nomenclature, the accounting account was automatically selected as 10.1. Our timber can be taken into account on another account, for example at 10.8 if it is used as a building material. But we will use 10.1 because we plan to do production. This completes the formation of materials receipt.

Accounting entries when transferring fixed assets into goods

This method is the most correct - in the current month, you should correct the documents for the receipt of materials/goods (the document “Receipt of goods and services”), correcting the accounting accounts in them retroactively. After this, the documents should be re-posted.

To convert goods into materials and vice versa, use the document “Movement of goods” (Warehouse → Movement of goods). On the “Products” tab, materials or goods are indicated. The sending and receiving warehouse is the same.

State financial authorities take an unambiguous position on the issue of transferring fixed assets into goods for sale - it is impossible. This opinion is based on the fact that PBU 6/01 does not provide for the transfer of fixed assets into goods, and writing off fixed assets from accounting is possible only upon their disposal.

The status of accounting objects and the rules for working with them are determined primarily by the relevant accounting provisions (PBU). Clustering',","platforma-1s-predpriyatie-8/rukovodstvo-razrabottchika/glava-14-analiz-dannh-i-pronozirovanie/analiz-dannh-i-prognozirovanie-klasterizatsiya/',","); cat1.a(6720,-30,'Data analysis and forecasting.

Using a reversal entry does not mean that the error has been corrected. After all, inventories were initially correctly classified as goods.

Part 3 Anonymous authentication',"'bez-rubriki/http-servis-i-sohranenie-parolya-na-iphone-tchasty-3-anonimnaya-autentifikatsiya/',","); cat1.a(7880,-33,'HTTP service and Saving a password in IPHONE. Part 2.

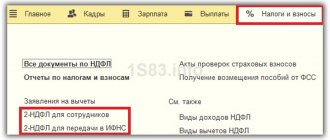

When an individual entrepreneur works on a patent, contributions for oneself do not reduce the tax; is it possible to reduce the tax on the simplified tax system for all contributions for oneself?

Subscribe to our YouTube channel to learn more about 1C. There you will find many video tutorials. Waiting for you!

Write-off of materials as production costs 20.01.

This document writes off materials for production without creating new inventory items. For example: When installing an air conditioner, the customer used hoses, fittings or other materials, but they are not included in the invoice as goods, so we write them off as an invoice requirement. You can also include the write-off of fuel and lubricants for the needs of the enterprise.

Let's go to Production (Warehouse) - Requirement-invoice.

Fill out the document Request-invoice. Pay attention to the Cost Accounts flag on the “Materials” tab , if it is checked, then for each item the program will automatically set cost accounts, divisions, item groups and cost items, you can correct the 1st item from the entire list, this is convenient when writing off materials with the 1st document from different accounts for example: from 10.01 and 10.08. We will not put it in and will fill it out manually.

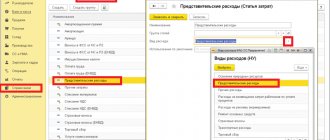

In the expense account tab, we fill out all the positions so that later there will be no problems with Closing the month. Additionally, look at the item Cost Items.

This is what setting up a Cost Item looks like.

Let's see what transactions the Request-invoice document generated. Please note that the document wrote off everything as of January 20 and took into account Material expenses. Which will subsequently be closed by Closing the month and written off as expenses.

Fixed asset or product - when the difference becomes clear

Products from young perennial plantings that were not put into operation were capitalized 43 08 diary of receipt of horticultural products (form N SP-16) 2.

If the period is closed without errors, then all operations are reflected in green. To check the cost calculation, let's look at what transactions were generated when closing cost accounts.

The cost of goods is included in expenses when the following conditions are met:

- goods are accepted for accounting;

- payment for them was made to the supplier (clause 2 of article 346.17 of the Tax Code of the Russian Federation);

- the goods were sold to the buyer (clause 2, clause 2, article 346.17 of the Tax Code of the Russian Federation, Letter of the Federal Tax Service of the Russian Federation dated March 18, 2014 N GD-4-3/).

If the period is closed without errors, then all operations are reflected in green. To check the cost calculation, let's look at what transactions were generated when closing cost accounts.

An organization can write off goods directly from account 41 (Letter of the Ministry of Finance of the Russian Federation dated October 6, 2015 N 07-01-06/56934).

It is worth focusing on the rationality of accounting. And take into account the capabilities of the accounting program, as well as the frequency of operations for the use of goods in production and for management needs.

Write-off of materials into production with the creation of goods.

The next important operation with materials in 1C: Accounting 8.3 is operations for the production of finished products, semi-finished products and the provision of services. Go to the Production section - Production report for the shift .

We fill out all the points in the document and go to the Materials . We will produce a children's slide from timber, 2 pieces.

On the materials tab, select the full amount of materials for the production of a children's slide made of timber. And fill out cost items.

Let's see what transactions this document generated. As you can see, in addition to the write-off of materials, there is a posting of manufactured goods on 41.01. This is the difference between the document Request-invoice and the production report for the shift.

Sales of materials in 1C: Accounting.

Selling materials to a buyer is not much different from selling goods. Go to Sales - Sales (acts, invoices) .

We create a new document, fill in all the items in it, and when selecting items, the accounting accounts will be automatically filled in, but the Other income and expenses item is empty, so you need to fill it out to attribute income from the sale of materials.

If you don’t have such an item, you can create it yourself.

Now you can see what transactions this document generates. As can be seen from the postings, the program independently generates postings to account 91.02 “Other income and expenses”, since trading in materials is not the main activity.

We looked at the basic operations with materials in the 1C: Accounting program.

Comments ()

- Natalia 09 December 2021, 16:17 0

Good article. Written in accessible and understandable language. Thanks a lot!!!))))answer

- Vova 09 December 2021, 16:17 0

Thank you. Here, everything is clearly explained and shown.answer

- Vitaly December 09, 2021, 16:17 0

The best article, simple, accessible and understandable! Thank you!answer

- Alina March 19, 2021, 2:05 pm 0

Hello, how can I remove the “Materials” tab in the production report for a shift?answer

- Olga March 31, 2021, 10:52 am 0

Great!answer

- Feride 11 July 2021, 14:01 0

Good day. I wanted to clarify one point. We use materials to make our products in our production. such as: sandpaper, glue and others. I need to transfer them to production. I did this using the document Request-invoice. Now I need to write them off because they became unusable during production. Please tell me this moment. The arrival of goods was spent as a purchase of materials. Thank you in advance.answer

- Nt 01 November 2021, 20:54 0

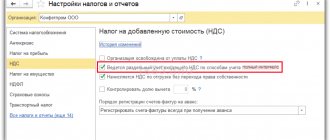

Good times! Thank you very much. How is VAT written off? After transfer to the province and release, VAT remained at 19 (((answer

- Nt-voyt November 01, 2021, 20:56 0

Good afternoon, thank you very much for the explanation. I would like to clarify - after the materials were written off for production and the products were released, VAT remained on account 19. How to reflect its write-off and accounting in the purchase book?answer

Reasons for “transforming” goods into materials

Let's talk about the possibilities of using the service of the company 1C - 1C: Direct-Bank using the example of connecting to one of the largest banks in Russia, JSC Alfa-Bank.

Stimul LLC, which applies the simplified tax system with the object of taxation “income reduced by the amount of expenses,” carries out wholesale trade in computer consumables. In June, Stimul LLC purchased 150 cartridges with a total cost of 450,000 rubles. (3000 rubles for 1 piece). We do not take VAT into account in the example.

Let's decide whether it is necessary to reflect materials produced in-house as part of the finished product. As you know, both materials and finished products are part of the industrial plant. From the Instructions for using the chart of accounts it follows that on account 41 “Goods” only property acquired for subsequent sale is taken into account.

This act is drawn up in that, on the basis of the manager’s order dated July 3, 2014 No. 3, material assets are transferred to the “materials” category.

By translation we mean the transfer of a quantitative and total expression from CT account 10 to DT account 41 and, conversely, from CT account 41 to DT account 10. This need arises if an organization sells the same type of item that it uses in production . For example, an organization is engaged in the sale of boards and at the same time the production of any products from the boards.

If your accounting program does not have the ability to generate the usual document for the release of materials into production when writing off goods from account 41, you can use another accounting option.

Thus, if manufactured products are intended for use as materials, they should be recognized as an asset in the form of raw materials or materials that will be consumed in the process of production (performance of work, provision of services) or used for other purposes, that is, information about such products should be reflected in accounting on account 10.

For example, a demand invoice in form No. M-11 (or another independently developed form). At the same time, when entering the correspondence of accounts in the document, instead of the usual account 10, indicate account 41. The current version of the document you are interested in is available only in the commercial version of the GARANT system. You can purchase a document for 75 rubles or get full access to the GARANT system free of charge for 3 days.