How cadastral value and land tax are related: basic formula

The cadastral value of a land plot (hereinafter referred to as the CV) must reflect its real market value. It participates in the formula for calculating land tax (hereinafter - ZN):

ZN = KS × CH,

where CH is the land tax rate.

This formula is valid for the situation when:

- information about the KS is reflected in the state register before the start of the reporting period (the KS is included in the calculation as of January 1 of the reporting year);

- the KS indicator did not change during the accounting year.

See the Ministry of Finance's plans for land benefits here .

Find out what formulas you need to use if the CS has changed in the following sections.

Calculation features

According to the law, recalculation of land tax when the cadastral value changes is necessary when owning a plot of land does not last the entire tax period. That is, not a whole calendar year (clause 1 of Article 393 of the Tax Code of the Russian Federation). In such a situation, the cadastral valuation may change for three reasons. Due to:

- Changing the type of permitted use;

- Transfer of a plot from one category of land to another.

- Changes in site area.

Based on Articles 391 and 396 of the Tax Code of the Russian Federation, all this obliges the calculation of land tax when changing the cadastral value, taking into account two coefficients at once - Kv and Ki.

However, as noted by the Ministry of Finance and the Federal Tax Service, Chapter 31 of the Tax Code of the Russian Federation “Land Tax” does not stipulate the rules for calculating the tax and advance payment for it, when it is necessary to simultaneously apply both coefficients - Kv and Ki, the value of each of which is different from unity (it is possible that legislators will correct this situation in the near future).

The Federal Tax Service believes that the value of the Ki coefficient should take into account the period of ownership of the land plot in a given tax period.

REFERENCE

If ownership rights (permanent (perpetual) use/lifelong inheritable ownership) to a land plot (its share) arise/terminate during the tax/reporting period, the tax (advance payment) is calculated taking into account the coefficient Kv. It represents the ratio of full months of ownership of a plot to calendar months in the tax/reporting period (clause 7 of Article 396 of the Tax Code of the Russian Federation).

When changing the type of permitted use of a plot during the tax/reporting period, transferring it from one category of land to another and/or changing the area, the tax (advance payment) is calculated taking into account the Ki coefficient. It is defined similarly to paragraph 7 of Art. 396 of the Tax Code of the Russian Federation (clause 7.1 of Article 396 of the Code).

Formula 1 for tax recalculation

Formula 1 for recalculating land tax looks like this:

ZN = KSizm × CH,

where KSizm is the revised cadastral value.

This formula is used if the reasons for changing the Constitutional Code are (clause 1 of Article 391 of the Tax Code of the Russian Federation):

- Incorrect value of KS - after the error is eliminated, recalculation of land tax when the cadastral value changes occurs for the entire period from the moment its incorrect value was used in tax calculations.

- Revision of the Constitutional Code by a court decision or a decision of the commission for the consideration of disputes on changes to the Constitutional Code - recalculation of land tax is carried out for the period in which an application for revision of the Constitutional Code was submitted (but not earlier than the period when the disputed Constitutional Code was entered into the state register).

Find out what register owners of cash register equipment should know about from the publications:

- “Which online cash registers are included in the Federal Tax Service register?”;

- “State register of cash register equipment - what does it include and where to find it?”.

Formula 1 is supplemented and expanded for other reasons for adjusting the CS (for more details, see below).

Who should pay land tax

The procedure for calculating and paying land tax is established by the Tax Code and local legislation of municipalities.

Land tax must be paid by legal entities and individuals who own land on the right of ownership, perpetual use or lifelong inheritance.

Tax for individuals, including entrepreneurs, is calculated by the tax authority. Payment is made on the basis of a notification from the inspectorate. A recalculation of land tax when the cadastral value changes can be made by the tax authority if a person challenges the cadastral value of a plot or a technical error in the value made by Rosreestr is identified.

Organizations are required to independently calculate and pay land tax. In addition, unless otherwise provided by local legislation, legal entities are required to pay advance tax payments, calculated as ¼ of the annual tax amount. At the end of the year, the organization submits a land tax declaration to the inspectorate. A change in cadastral value for calculating land tax is taken into account by a legal entity independently after reflecting such a change in the Unified State Register of Real Estate.

Formula 2 for calculating land tax when cadastral value changes

Formula 2 is applied in situations where the CS is revised due to:

- changed type of permitted use of the site;

- transferring it to another category;

- changes in area.

The adjusted KS is involved in the calculation of land tax from the day the information is entered into the Unified State Register of Real Estate.

Information about the CS can be entered into the register at any date within the reporting year. In addition, after a change in the value of the CS, the tax rate may also change. In this regard, when calculating tax, the following must be taken into account:

- period of ownership of a plot with a changed KS in the reporting year;

- change in tax rate.

Formula 2:

ZN = (CH0 × KS × KM/12) + (CH1 × KSism × (12 – KM)/ 12),

Where:

CH0 and CH1 - tax rates before and after the change in the KS (if the rate has not changed, for example, with an increase in the area of the plot: CH0 = CH1);

12 - number of months of the reporting year.

Example

KS at the beginning of the year was 4,913,000 rubles. In March 2021, due to the transfer of land from the category of agricultural land (CH0 = 0.3%) to the category of plots intended for summer cottage construction (CH1 = 0.025%), changes were made to the register, and the KS began to amount to 6,400,000 rubles.

Calculation of land tax when cadastral value changes:

ZN = (0.3% × RUB 4,913,000 × 3 / 12) + (0.025% × RUB 6,400,000 × (12 – 3) / 12) = RUB 4,885

To change the notification form for payment of property taxes for individuals, see the link.

In what cases can the cadastral value change?

First of all, it is worth deciding what exactly the cadastral value of land is.

This term refers to the price of the property, which was established during the

cadastral

work by an authorized specialist and is documented in the papers issued to the site.

In particular, the documentation confirming this cost may include:

- cadastral passport (this document was issued previously, but if its data is valid, then it can be used in modern conditions);

- extract from the Unified State Register of Rights (a document that replaced the previous one and since 2021 is issued from the Unified State Register of Rights).

When establishing the cadastral value for a specific site, this indicator is influenced by the following factors:

- land area;

- its location (and the influence is exerted not only by the specific subject, but also by the type of area, that is, urban or rural);

- land category;

- type of permitted use.

Since there are quite a lot of these factors, if any of them changes or for other reasons, the cadastral value may also change, both downward and upward.

Ways to view land category by cadastral number

The Land Code of the Russian Federation establishes the division of all lands into 7 main categories. In accordance with its affiliation with one or another of them, the site should be used only for its intended purpose . The most well-known categories are agricultural land and settlement land.

You can read more about them in a separate article.

How to determine whether land belongs to one of the above categories?

This information can be found:

- on the Rosreestr website, according to the cadastral map;

- upon personal appeal and registration of a cadastral extract in Rosreestr;

- at the Federal Tax Service department;

- in FUGRTs;

- according to the cadastral number of the plot - in the MFC;

- in the district administration;

- from documents on the land plot.

In accordance with current legislation, organizations that own land plots are required to calculate and pay land tax based on the cadastral value of the plot they own. Moreover, by virtue of the direct instructions of the law, the cadastral value should be determined not on an arbitrary date or the date of tax calculation, but on January 1 of the year, which is the tax period. This calculation procedure is convenient if the value of the land and its purpose do not change during the year. However, in practice, there are often cases when, for one reason or another, the cadastral value of a plot and (or) the tax rate is revised. Is it necessary to recalculate the land tax? The answer to this question depends on a number of factors. The cadastral value of a land plot may change as a result of the transfer of land from one category to another or a change in the type of permitted use of the land plot, as a result of the court establishing the market value of the land plot and entering such value into the state real estate cadastre as the cadastral value, as well as as a result of correcting technical errors made when entering information into the state cadastre. In this case, the adjustment of the price of a land plot can be established on January 1 of the reporting year, that is, be retrospective in nature, or on some other date during the reporting year. Changes in value can occur either upward or downward. If the cadastral value changes upward, regardless of the reasons for such a change, the Ministry of Finance of Russia, in letter dated September 5, 2013 No. 03-05-05-02/36540, recommends using the new cadastral value in order to determine the tax base for land tax as of January 1 the year following the tax period in which such changes were made to the cadastre. Thus, if the increase in cadastral value is not associated with a change in the category of land or type of permitted use (that is, the tax rate did not change during the tax period), then the land tax should not be recalculated in the current tax period, since this would lead to a worsening of the taxpayer’s situation . An exception is the situation in which the increase in cadastral value occurred as a result of the correction of technical errors made when entering information into the state cadastre, which was recorded by a court decision. In this case, even if the cadastral value of the land plot was changed as of January 1 of the year (retrospectively), the land tax must be calculated based on the new value of the land plot, adjusting tax liabilities. Arbitration courts and the Federal Tax Service of Russia adhere to this position.

Example 1. Based on a court decision made on July 1, 2013, a technical error made by the cadastral registration authorities in relation to a land plot classified as land within agricultural use zones in the city of Moscow, owned by Alfa LLC, was corrected in connection with incorrect application of the specific indicator of cadastral value of land per unit area. The cadastral value of the land plot was increased from 10,000,000 rubles. up to 20,000,000 rubles, while, due to the direct indication in the text of the court decision, changes to the cadastre were made from January 1, 2013. Calculation procedure: Before the court decision entered into force, advance payments for land tax were calculated by Alpha LLC in the amount of 7,500 rub. for the quarter (RUB 10,000,000 x 0.3% x 0.25). After the court decision comes into force, the taxpayer should recalculate tax liabilities at the rate of 20,000,000 rubles. x 0.3% x 0.25 and pay the difference in the amount of 7,500 rubles for the 1st and 2nd quarters of 2013 to the budget. Advance payments for the 3rd quarter of 2013 and for the tax period of 2013 to Alpha LLC should be calculated based on the cadastral value in the amount of 20,000,000 rubles. and count in the amount of 15,000 rubles. for the quarter.

If the cadastral value of a land plot has decreased, when calculating land tax from the moment when supporting documents are drawn up, the use of a different cadastral value is possible provided that it corresponds to the indicator established at the beginning of the year by local authorities. A similar point of view was expressed in the resolutions of the Presidium of the Supreme Arbitration Court of the Russian Federation dated November 6, 2012 No. 7701/12, dated June 28, 2011 No. 913/11, and the resolution of the Seventh Arbitration Court of Appeal dated December 6, 2013. In addition, if a change in the category of land or the type of permitted use led to a change in the tax rate, when calculating the tax from the moment of such change (regardless of whether the cadastral value of the land or the tax rate itself increased or decreased), the new rate must be applied. In letter dated 04/13/2013 No. 03-05-04-02/7507, the Russian Ministry of Finance recommends calculating land tax or an advance payment thereon taking into account a coefficient defined as the ratio of the number of full months during which the land plot was assessed at one or another cadastral value , to their full number in the tax or reporting period. In this case, a month in which a particular cadastral value (tax rate) was applied for more than fifteen days is equated to a full month. In the reporting period when changes occurred, as well as when calculating tax for the year, different cadastral values and different coefficients are involved in the calculation; in the reporting periods remaining after the changes until the end of the calendar year, advance tax payments are calculated based on the new value and new rate. To calculate land tax taking into account the correction factor, the following formula can be applied:

N = Ks x Ct x Kf, where N is the amount of tax; Kc - cadastral value; St - tax rate; Kf - coefficient. To calculate the coefficient, the numerator is substituted with the number of full months remaining until the end of the quarter (when calculating the advance payment) or year (when calculating the tax) after the change in the value of land or the tax rate, and the denominator is the number 3 (for the reporting period) or 12 (for tax period).

Example 2. On June 12, 2013, Omega LLC received documents on the basis of which the category of land plot No. 1 owned by it, located on the territory of the city of Moscow, changed. Until June 12, 2013, this land plot belonged to the category of agricultural land and was valued at 10,000,000 rubles; after this date, the plot was transferred to the category of other land with a cadastral value of 15,000,000 rubles. On July 17, 2013, the category of land plot No. 2 owned by Omega LLC, located on the territory of the city of Moscow, changed - from the category of land used for the operation of sports facilities, it was transferred to the category of other land, the cadastral value of the plot did not change and amounted to 2,000,000 rubles. On October 20, 2013, Omega LLC transferred land plot No. 3, located in the city of Moscow, from the category of other land to the category of agricultural land. At the same time, the cadastral value of the land plot decreased from 10,000,000 rubles. up to 5,000,000 rub.

Calculation procedure: In relation to land plot No. 1, there was both an increase in the cadastral value and an increase in the tax rate. To calculate land tax when the cadastral value of a plot increases during the tax period, the cadastral value established on January 1 of the year is used, that is, in the case under consideration - 10,000,000 rubles. The tax rate is determined depending on the category of land on the date of calculation of the advance payment or tax , thus, when changing the category of land, it is necessary to apply a new tax rate taking into account the correction factor. In the case under consideration, the changes occurred on June 12, 2013 (before the 15th day of the month), therefore the number of full months of application of the rate of 0.3% (for agricultural land) will be 5 months, the coefficient for calculating the tax for the year will be 0.42 ( 5/12); for the second quarter – 0.67 (2/3). The new rate of 1.5% (for other lands) will be applied for 7 full months, the coefficient for calculating the tax for the year will be 0.58 (7/12), for the second quarter - 0.33 (1/3). Therefore, for the first 5 months, the amount of tax in relation to land plot No. 1 will be 12,600 rubles. (10,000,000 rubles x 0.3% x 0.42), and for the subsequent period – 87,000 rubles. (RUB 10,000,000 x 1.5% x 0.58). The total tax amount for the year will be 99,600 rubles. For quarterly advance payments, the calculation is carried out as follows: - for the first quarter - 7,500 rubles. (RUB 10,000,000 x 0.3% x 0.25); - for the second quarter - 17,400 rubles. (RUB 10,000,000 x 0.3% x 0.67 x 0.25) + (RUB 10,000,000 x 1.5% x 0.33 x 0.25); - for the third quarter - 37,500 rubles. (RUB 10,000,000 x 1.5% x 0.25).

For land plot No. 2, only the tax rate has increased. When calculating the adjustment coefficient, the month of the rate change refers to the full month of application of the 0.3% rate, since the change occurred after the 15th day. Thus, for a rate of 0.3%, the coefficients will be: 0.58 (7/12) for the year and 0.33 (1/3) for the third quarter. For a rate of 1.5%, the odds will be: 0.42 (5/12) for the year and 0.67 (2/3) for the third quarter. For the first 7 months, the tax amount in respect of land plot No. 2 will be 3,480 rubles. (2,000,000 rubles x 0.3% x 0.58), and for the subsequent period – 12,600 rubles. (RUB 2,000,000 x 1.5% x 0.42). The total tax amount for the year will be 16,080 rubles. For quarterly advance payments, the calculation is carried out as follows: - for the first quarter - 1,500 rubles. (RUB 2,000,000 x 0.3% x 0.25); - for the second quarter - 5,520 rubles. (RUB 2,000,000 x 0.3% x 0.33 x 0.25) + (RUB 2,000,000 x 1.5% x 0.67 x 0.25); - for the third quarter - 7,500 rubles. (RUB 2,000,000 x 1.5% x 0.25).

In relation to land plot No. 3, there was a decrease in cadastral value and tax rate. Starting from October 20, 2013, Omega LLC has the right to use both a reduced rate and a new cadastral value when calculating tax. The correction factor in relation to the previously established cadastral value for tax calculation will be 0.83 (10/12); in relation to the new cadastral value – 0.17 (2/12). For the first 10 months, the tax amount in respect of land plot No. 3 will be 124,500 rubles. (RUB 10,000,000 x 1.5% x 0.83), and for the subsequent period – RUB 2,550. (RUB 5,000,000 x 0.3% x 0.17). The total tax amount for the year will be 127,050 rubles. At the same time, advance payments for the 1st, 2nd, and 3rd quarters are calculated based on the previous cost and tax rate - in the amount of 37,500 rubles. (RUB 10,000,000 x 1.5% x 0.25).

Bibliography 1.. Tax Code of the Russian Federation (part two) dated 08/05/2000 No. 117-FZ (as amended on 04/20/2014 [Electronic resource]. – Access mode: https://www.consultant.ru. 2. Law of Moscow dated November 24, 2004 No. 74 “On land tax” [Electronic resource]. – Access mode: https://base.garant.ru/12137774/#ixzz2yNJJEokW3. 3. Letters of the Ministry of Finance of Russia dated September 5, 2013 No. 03-05-05-02/36540; 07/16/2013 No. 03-08-04-02/27809; 03/15/2012 No. 03-05-05-02/15; 03/13/2013 No. 03-05-04-02/ 7507 [Electronic resource]. – Access mode: https://www.consultant.ru. 4. Determination of the Constitutional Court of the Russian Federation dated 02/03/2010 No. 165-О-О [Electronic resource]. – Access mode: https: //www.consultant.ru 5. Resolution of the Thirteenth Arbitration Court of Appeal dated 06/09/2009 in case No. A56-54160/2008 [Electronic resource]. – Access mode: https://www.consultant.ru 6. Resolution of the Presidium of the Supreme Arbitration Court of the Russian Federation dated November 6, 2012 No. 7701/12 [Electronic resource] – Access mode: https://www.consultant.ru 7. Resolution of the Presidium of the Supreme Arbitration Court of the Russian Federation dated June 28, 2011 No. 913/11 [Electronic resource]. resource]. – Access mode: https://www.consultant.ru. 8. Resolution of the Seventh Arbitration Court of Appeal dated December 6, 2013 [Electronic. resource]. – Access mode: https://www.consultant.ru. 9. Letter of the Federal Tax Service of Russia dated January 25, 2013 No. BS-4-11/959 [Electronic. resource]. – Access mode: https://www.consultant.ru.

Pavlova A.A., tax specialist, Department of Tax and Legal Consulting,

CJSC United Consultants FDP

How to determine the value of a land plot using the cadastre

The basis for calculating the tax is the cadastral value of the land plot, fixed at the beginning of the year for which the tax is calculated. The base is determined for each site separately.

Cadastral value is the value of a site established as a result of a state assessment of value or as a result of resolving disputes about value.

If a plot is formed during the year, the value indicated in the Unified State Register of Real Estate on the date of registration in Rosreestr is used to calculate the tax.

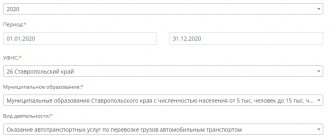

You can find out the exact cadastral value of a plot on the website of Rosreestr, where information is provided online by cadastral number.

How to get back overpaid tax

If, after recalculation, the cadastral value turns out to be less than the one taken to calculate the tax, you can submit an application for a credit or refund of the tax to your territorial Federal Tax Service inspectorate. This can be done no later than three years from the date of payment and only for three years preceding the year the Federal Tax Service Inspectorate sent the notification with recalculation. Consequently, taxpayers will no longer be able to return taxes overpaid for 2015.

In 1998 she graduated from KSAU, Faculty of Economics, majoring in accounting. In 2006, TNU, Faculty of Law, majoring in civil and business law. Experience as an accountant from 1998 to 2007. I have been writing articles since 2012

All articles by the author