We have already discussed “One-page charter of an LLC with two directors electronically and opening a bank account remotely” and “A good agreement is a short agreement”, now let’s talk about the account.

The invoice for payment is a very simple basic document, but it also causes a lot of pain and unnecessary labor costs if it is drawn up crookedly or they are paid crookedly.

Let's try to throw out everything unnecessary and make it clear and beautiful. Here we will mainly talk about Russia, but foreign accounts can also be confusing. I’ll say a little about the European Union.

Is an invoice required?

The legislation of the Russian Federation does not regulate the mandatory use of an invoice in business documentation; payment can be made simply on the terms of an agreement. However, the law calls the conclusion of an agreement an indispensable condition of any transaction. An invoice does not exist separately from the contract; it is a document accompanying the transaction. It represents, as it were, a preliminary agreement on payment according to the conditions established by the seller - the price that the buyer of the product or service must pay.

The invoice makes calculations much more certain, so entrepreneurs prefer to use it, even if this condition is not specified in the terms of the contract.

IMPORTANT! Since the requirement for an account is not legally required, it does not relate to accounting reporting documents, but is intended for internal use.

When is an account absolutely necessary?

The legislation specifies the moments when issuing an invoice is mandatory support for a transaction:

- if the text of the agreement did not specify the amount to be paid (for example, for communication services, etc.);

- for transactions involving the payment of VAT;

- if the selling organization is exempt from VAT;

- a selling company located on OSNO sells goods on its own behalf or provides services under agent agreements;

- if the customer made an advance payment to the seller company or transferred an advance payment for a product or service.

So, an invoice for payment is not a mandatory document , just like an accountable document.

It cannot in any way influence the movement of financial funds, it can be suspended or not paid at any time - such phenomena occur quite often and do not have any legal consequences. However, this document is equally important for the parties to the transaction, as it allows them to enter into a kind of preliminary agreement on the transfer of funds.

The third part is buyer information

It contains information:

- The name of the payer, his registration data according to the constituent documents.

- Name of the consignee. As in the case of the seller, the payer may be the parent organization, and the recipient may be its separate division.

In this case, it is not necessary to provide the buyer’s bank details.

But if the contract specifies a specific bank and this is important for the seller, then the buyer’s bank details should be entered in accordance with the contract.

Who issues invoices for payment?

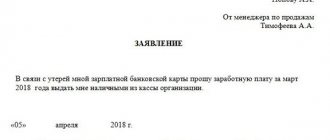

An invoice for payment is always issued by an employee of the accounting department. After the form is completed, the document is handed over to the head of the organization, who certifies it with his signature. It is not necessary to put a stamp on the document, since individual entrepreneurs and legal entities (since 2021) have the right not to use the seal.

An invoice for payment is drawn up in two copies , one of which is sent to the service consumer or buyer, the second remains with the organization that issued it. You can fill out the invoice either on a regular A4 sheet or on the organization’s letterhead. The second option is more convenient, since you do not need to enter information about the company each time.

This document does not have a unified template, therefore organizations and individual entrepreneurs have the right to develop and use their own template or issue an invoice for payment in free form. As a rule, for long-established organizations and individual entrepreneurs the form of the form is standard; only the information about the invoice recipient, the name of the product or service, as well as the amount and date change. Sometimes organizations additionally indicate in the invoice the terms of delivery and payment (for example, percentage or prepayment amount), the validity period of the invoice and other information.

If any errors are made in the document during registration, it is better not to correct them, but to issue the invoice again.

It should be remembered that in some cases, when resolving disagreements between the parties in court, the invoice for payment is a document of legal force and can be presented in court.

First part - general information

This part contains registration data:

- Name;

- number;

- date of;

- invoice payment deadline.

Pay attention to the last line.

Given the floating exchange rate of the Russian ruble against other currencies, the terms of delivery also change. Therefore, the seller has the right to specify the number of days during which the invoice is valid for payment.

Instructions for preparing an invoice for payment

From an office management point of view, this document should not cause any particular difficulties in developing and filling out.

At the top of the document information about the recipient of the funds is indicated. Here you need to indicate

- full name of the company,

- his TIN,

- checkpoint,

- information about the bank servicing the account,

- account details.

Next, in the middle of the line, write the name of the document, its number according to internal document flow, as well as the date of creation.

Then the payer of the invoice (also the consignee) is indicated: here it is enough to indicate only the name of the company that received the goods or services.

The next part of the document concerns the services directly provided or goods sold, as well as their cost. This information can be presented either in a simple list or in the form of a table. The second option is preferable, as it avoids confusion and makes the score as clear as possible.

In the first column of the table of services provided or goods sold, you must enter the serial number of the product or service in this document. In the second column - the name of the service or product (without abbreviations, concisely and clearly). In the third and fourth columns, you must indicate the unit of measurement (pieces, kilograms, liters, etc.) and quantity. In the fifth column you need to put the price per unit of measurement, and in the last column - the total cost.

If the company operates under the VAT system, then this must be indicated and highlighted in the invoice. If there is no VAT, you can simply skip this line. Then, below the right, the full cost of all goods or services is indicated, and under the table this amount is written in words.

Finally, the document must be signed by the organization’s chief accountant and manager.

The second part is supplier information

The second part consists of the following:

- Name of the supplier according to the statutory documents. This name must be indicated in the payment order. If it is incorrect, the bank will reject the transfer.

- Bank payment details of the supplier organization (detailed).

- Name of the shipper (provider of services, works). This detail is indicated if the payment is made to the parent organization, and the consignor is its structural unit.

Invoice for VAT payers

Legal entities and other VAT payers use an invoice : a responsible financial document that is issued not in advance, but upon completion of work, services provided or goods shipped. It is no longer needed to speed up payment, but to confirm that excise duties and VAT have been paid in full, so that VAT can be withheld from the payer (buyer). This document has a prescribed form; it may also contain information about the origin of the goods, and if it is imported, then the number of the customs declaration for it.

The invoice is issued in two copies.

Account elements

There is no specific form for drawing up an invoice, but there are mandatory components that must be contained in it.

- Requisites individual entrepreneur or LLC (both seller and buyer):

- name of the enterprise;

- legal form of organization;

- legal address of registration;

- Checkpoint (for legal entities only).

- Information about the bank servicing the transaction:

- name of the banking institution;

- his BIC;

- numbers of current and correspondent accounts.

- Payment codes:

- OKPO;

- OKONH.

- Account number and date of its registration (this information is for internal use of the company; numbering is continuous, starting from the beginning every year).

- VAT (or lack thereof). If VAT is present, its amount is indicated.

- Last name, initials, personal signature of the compiler.

FOR YOUR INFORMATION! According to the latest legal requirements, printing on the invoice is not required.

For a product or for a service?

An invoice may be issued as an arrangement to pay for a product or service provided, or for a type of work performed. The difference lies in the “Purpose of payment” column that the invoice contains.

To pay for goods, this column must contain a list of all types of goods sold, as well as the units in which they are measured (pieces, liters, kilograms, meters, rubles, etc.). It is necessary to indicate the quantity of goods and the amount for them (separately without VAT, if any, and the full amount).

When paying, you must indicate the type of service or work performed. Don't forget to mark the required quantity, as well as the amount with and without VAT.

REFERENCE! If the entrepreneur does not want, he may not fully decipher all types of supplies, indicating only the number of the contract under which the transaction is carried out. However, this information must still be reflected in detail in the delivery note or in the estimate. Therefore, it is in the interests of the entrepreneur to indicate in the invoice a complete list of paid goods or services.

Accounts that blow your mind

Don't make the client think and fuss!

- Invoice in picture format or scanned into pdf. Kill yourself, you bastards, against the wall, whoever does this. We always require that you send it in a format where you can easily copy-paste the details.

- There are two bank accounts. Ahhh... what should I pay for?!

- No payment purpose. The accountant begins to think and writes nonsense, from which it is then impossible to understand what they paid for.

- VAT is indicated in small print and not in the most visible place. Oh... again we paid the amount without VAT.

- It does not say that VAT is not subject to VAT. Oh... and the payment automatically included: “including VAT.”

- Full of unnecessary information.

- There is no phone number or email to whom to ask questions.

- The details do not match those entered using the TIN and BIC.

Don't make mistakes!

Let's look at the most common inaccuracies that entrepreneurs can make when registering an invoice.

- The signature has not been decrypted. A painting alone is not enough: there must be information about who signed it. In the online version of the document, such an error cannot be made, since it requires an electronic signature.

- Missing invoice deadlines. The date of issue of the invoice must coincide with the date of issue of the invoice and not exceed 5 days from the date of release of the goods or provision of the service.

- Delay in receiving an invoice for VAT deduction. The tax deduction for tax purposes must be claimed in the same tax period in which the document confirming this, that is, the invoice, was received. To prevent this problem, it is necessary to store evidence of the date of receipt of invoices (mail notices, envelopes, receipts, entries in the incoming correspondence journal, etc.).

- The dates on the invoice copies are mixed up. Both parties to the transaction must have identical copies, otherwise the invoice does not prove the legality of the transaction.

- "Hat" with errors. If there are inaccuracies in the names of organizations, their tax identification numbers, addresses, etc. the document will be invalid.

IMPORTANT INFORMATION! If the organization issuing the invoice notices an error, it has the right to correct it in the text of the invoice. To do this, the incorrectly recorded indicator is crossed out and the correct one is put in its place. The change made is certified by the manager’s signature, and, if necessary, by a seal, and the date on which it was made is noted. Other organizations are not authorized to make corrections to the invoice.