Special points on BDR

By determining your sales budget and projecting it onto your income and expense budget, you can determine how much profit you can make each month as you move into the budget period. Drawing up a BDR consists of the following stages:

1. Understanding your business

. They say that a journey of a thousand miles begins with one step. The first step before you begin your journey to profitability is to understand your business. Involving key personnel directly executing your strategic plans increases your chances of success. This will also ensure that your budget aligns with your goals and ensures that it is compiled and reviewed by the appropriate people.

2. Documenting the process.

Be sure to document your annual budget process to set standards and ensure the process is correct. Processes may include the following steps:

- review monthly profit and loss statements for the previous year;

- if necessary, modify monthly data to reflect changes under the new plan, such as transactions, costs, and quantities;

- identify and correctly record assumptions made for the budget period;

- Enter and prepare your income and expense budget using templates. Various financial templates are available online for use. Choose the one that is most convenient for you.

3. Monitoring and managing the budget of income and expenses.

After preparing a budget of income and expenses, it is important to track the budget against actual results, which should give you information about how your business is performing and whether it is going to achieve the expected goals in your strategic plan.

- monthly results from your income statement should be compared with the results of your budget;

- any deviation, positive or negative, must be taken into account and action plans must be developed to resolve the problems;

- various information can greatly help you in revising your plan at critical moments so that strategic goals can be achieved.

4. Determination of cost of sales.

The calculation of how much you earn is determined by taking your total sales revenue minus your total sales cost. When determining your cost of sales, you need to follow the following process:

- determine the cost of producing your product. Will include your labor and material costs. Your cost to produce a product is the cost per unit. Unit cost is the gross cost you pay to obtain or produce a product. You can then calculate the price per unit, which again includes bills for utilities, equipment, repairs and maintenance, storage, packaging, shipping costs and staff commissions.

- Costs per unit, such as utility bills, can be calculated as the average monthly cost divided by the number of units expected to be sold per month. You now have an average estimated cost per unit.

- Breaking down your costs by budget month should help you determine your total sales cost for the month.

- Again, from your sales budget, get your projected number of units per month and divide your sales expenses by the number of sales. This gives you the selling price per unit.

- Adding the price per unit to your selling cost per unit gives you your total selling cost per unit.

5. Determination of gross profit.

Gross profit is the amount of money after subtracting costs. When calculating gross profit you must:

- get annual sales from your budget. Selling value is also called turnover;

- get the sales value from the previous section;

- subtract the cost of sales from your turnover to get your gross profit.

6. Receiving net profit.

Your gross profit is not your actual profit. To get what you actually make, subtract other costs indirectly associated with sales and unit production, such as:

- staff salaries, which include government contributions such as pensions and other insurance;

- office and property operating costs, including cleaning;

- marketing, public relations, media, advertising and exhibition expenses;

- professional fees such as legal, accounting or consulting fees;

- financial expenses, which include bank interest and fees

Indirect costs are also called overhead or fixed costs. These costs tend to change over time, so your budget should be realistic about the rising costs that may arise.

7. Calculate your cash flow.

Another factor that is largely underestimated when calculating your P&L budget is your cash flow.

Cash flow refers to the amount of money coming in and out of your company at the beginning of a period of time or the opening balance in relation to the final amount at the end of that period or the closing balance at the end of the period. Cash flow is considered either negative or positive.

Positive cash flow occurs when the closing balance is higher than the opening balance, which means your company's assets are growing or increasing. They say you can't make money if you don't spend money. Companies that post good profits but have negative cash flow may face problems in the long run.

Cash flow is the ability to pay out cash before doing anything in return. Therefore, when planning your budget, it is vital to include or list all of your business's cash inflows and outflows and the expected timing for each. The ability to control how cash flows in and out of your business affects your business's ability to pay off any debt at any time.

How to create a BDR?

The budget of income and expenses does not have any legally approved form, and therefore the company can develop it independently, depending on the characteristics of its activities.

The development of a BDD involves several stages:

Stage 1. Sales forecast

At the initial stage, it is necessary to create a sales forecast, the procedure for drawing up which is based on the market planning principle. Forecasting begins with collecting sales statistics for previous periods. The sales forecast for the future period must be drawn up taking into account the market situation, seasonality, price levels in the company and among competitors for similar goods (work, services).

Stage 2. Production budget

The formation of the production budget should be guided by the indicators of the developed sales budget. The budget is constructed in such a way that the volume of manufactured products covers the volume of finished products required for sale and at the same time allows for the formation of the required amount of its reserves. In addition, the production budget should be focused on the company’s production capacity, availability of labor and financial resources.

Stage 3. Inventory budget

This budget is closely related to the production budget, since its formation should be guided by the volume of products produced. Based on the inventory budget, it is established how much finished goods will be available in warehouses at a particular point in time. If there are a lot of stocks, it is advisable to reduce production volumes and sell off the remaining stocks. If inventory is very low, production should be increased so that the company always has finished goods available. The formation of the inventory budget is influenced by the seasonality of sales - the higher the demand for products, the more inventory should be kept in warehouses.

Stage 4. Business expenses budget

This budget is drawn up in relation to the sales budget, since the amount of commercial expenses often depends on the volume of sales of finished products. It should be noted that business expenses are variable in nature, and therefore their volume may not be the same at different periods of time.

Stage 5. Budget for administrative expenses

Administrative expenses are permanent in nature, since they relate to the maintenance of the company's management apparatus. In this regard, the amount of expenses may be constant over different periods of time. In addition, it may change depending on whether the company's management apparatus increases or decreases.

Stage 6. Supply budget

The supply budget (or purchasing budget) is prepared taking into account information from the sales budget and inventory budget, as well as from the production budget. The purpose of its formation is to determine when and in what volume it is necessary to replenish inventories so that the production process runs smoothly.

Stage 7. Budget for basic materials costs

This budget is formed in order to determine the cost of finished products. It is created keeping in mind the production budget. It includes information about how many raw materials, materials and components will be used to produce the planned volume of products. In other words, a budget is necessary to determine the need for material resources.

The budget can be formed not only in monetary terms, but also in kind. The problem with compiling in physical terms may be that there is not always a regulatory framework for the consumption of materials.

Step 8: Direct Pay Budget

Direct wages are the wages paid to workers involved in production. The direct wage budget is closely related to the production budget. In addition, if you add up the indicators of the direct salary budget and the budget of materials costs, you can determine the direct cost of production per unit of production, if you detail the information by type of product and per unit.

Stage 9. Budget for indirect production costs

These include expenses that the company incurs to maintain production in normal operating condition, but which cannot be attributed to a specific type of product. Indirect production costs calculated per unit of production, together with direct cost, allow us to determine the production cost per unit of production.

Stage 10. Cost budget

It is formed on the basis of information from the production budget, the budget for materials costs, the budget for direct wages, the budget for indirect production costs, the budget for commercial and administrative expenses. It allows you to determine the actual cost of manufactured products.

Stage 11. Budget of income and expenses

Based on all developed budgets, a budget of income and expenses is formed. Initially, the revenue side of the budget is formed in the areas of activity: operational, financial, investment. The budgets presented earlier relate to operating activities; corresponding budgets can also be developed for the other two areas.

After the revenue side has been collected, it is necessary to form the expenditure side of the budget. It is necessary to include in it all costs associated with the operating activities of the company (materials, labor, commercial and administrative expenses), and also, if necessary, include costs for financial and investment activities (if such are planned).

Based on the income and expenditure parts of the budget, the result of the company’s activities as a whole is determined.

BDR components

Every business is unique and every industry has its own nuances, but these elements are general enough to apply to most industries.

Income

Income is usually broken down into components. It is possible to forecast revenue on an annualized basis, but typically requires more detailed information, breaking down revenue into its main components.

Income components typically include:

- volume (units, contracts, customers, products, etc.)

- price (average price, unit price, segment price, etc.)

Variable costs

Variable costs are the costs incurred in producing a product. As an example, variable costs include the cost of raw materials, energy and fuel, and wages of production workers. The amount of variable costs varies depending on the volume of output.

Variable costs often include:

- cost of goods sold;

- direct sales;

- trading commissions;

- payment processing fee;

- transportation of goods;

- some aspects of marketing;

- direct labor costs;

Fixed costs

These expenses do not change much with changes in revenue and are largely constant, at least within the time frame of the operating budget.

Examples of fixed costs include:

- rent;

- head office;

- insurance;

- telecommunications;

- salary and benefits management

- public utilities.

Non-cash costs

BDR often includes non-cash expenses such as depreciation and amortization. Although these expenses do not affect cash flow (other than taxes), they do affect financial reporting results (that is, the numbers a company reports at the end of the year on its income statement).

REPORT ON THE FULFILLMENT OF THE INCOME AND EXPENSES BUDGET

Generating a report on the implementation of the budget of income and expenses at a manufacturing enterprise is a rather labor-intensive and responsible procedure, since its execution indicators require information on business transactions in the following sections :

- sales of products in quantitative and total terms in the analytics of sales directions and product groups;

- production cost of goods sold in quantitative and total terms in the following analytics:

– raw material cost of products sold (by sales directions and product groups);

– operating costs for production of products in the Central Federal District (production divisions of the company);

– operating costs for servicing the production of products in the Central Federal District (divisions of the company’s auxiliary production);

- data on the amount of operating costs for product sales for the reporting period in the analytics for the Central Federal District (commercial divisions of the company);

- data on the amount of operating costs for managing the company for the reporting period in the analytics for the Central Federal District (general business divisions of the company);

- data on non-operating income and expenses of the company in the analytics of their types;

- data on the costs of servicing the company's loans and borrowings in analytics by their types.

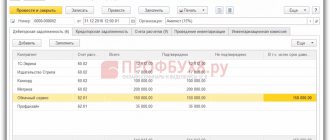

The budget of income and expenses ( BDR ) can be considered as a managerial analogue of accounting form No. 2 (Profit and Loss Statement), therefore it is advisable to build the structure of the report on its execution as close as possible to the sections of this form of financial statements.

This approach will allow the company's economic service to save time on generating a report on the execution of financial statements using accounting data from the accounting database. It will significantly simplify checking the correctness of the report indicators due to the ability to compare its data with the turnover in the accounting accounts of business transactions.

OBD report form

Your business will benefit from budgeting if you update your budget monthly using your expenses and income from the previous month as a guide, and consider your company's financial goals or objectives for the year.

Also, work with your senior employees to see if they have information about upcoming issues that could impact planned sales and expenses, either positively or negatively. This allows you to adjust your budget and financial expectations as needed.

A monthly review of your company's budget can indicate where efforts to achieve business goals have been successful. For example, if you switch health insurance providers to get cheaper coverage, you'll see how that change affects your bottom line month after month and year after year.

A monthly review of your business budget can also help you identify potential problems. For example, if you own a retail business, you may realize that you need to increase your advertising spend in the fall to take advantage of the holiday shopping season. Or, if you have made changes that may have tax implications for your company, you may need to increase your budget for accountant fees in anticipation of the additional accounting work needed to overcome the implications.

The following worksheet provides income statement line items that you can use to set up a basic business budget. Depending on your specific type of business, you may have to include additional types of income or expenses, but this worksheet should give you a general idea of the types of items you should include in your business budget.

| Basic Business Budget Worksheet | |||

| CATEGORY | BUDGET AMOUNT | ACTUAL AMOUNT | DIFFERENCE |

| Sales income | |||

| Interest income | |||

| Income from investments | |||

| Other income | |||

| TOTAL PROFIT | |||

| EXPENSES | |||

| Accounting services | |||

| Bank service fee | |||

| Credit card fee | |||

| Shipping costs | |||

| Deposits for utilities | |||

| Estimated taxes | |||

| Medical insurance | |||

| Hiring costs | |||

| Equipment Installation/Repair | |||

| Interest on debts | |||

| Inventory of purchases | |||

| Legal expenses | |||

| Licenses/Permits | |||

| Loan payments | |||

| Office tools | |||

| Payment statement | |||

| Payroll taxes | |||

| seal | |||

| Professional fees | |||

| Rent/leasing payments | |||

| Pension contributions | |||

| Subscriptions and fees | |||

| Utilities and telephone | |||

| Fare | |||

| Another | |||

| TOTAL COSTS | |||

| TOTAL INCOME MINUS TOTAL EXPENSES |

Formation of BDR and BDDS

The formation of BDR, BDDS, as well as their achievement, provide a clear understanding of the current and future financial situation of the company in terms of profits and cash balances.

Typically, budgeting for BDR and BDDS starts with the latter. Everyone has a rough cash flow plan in one form or another. BDDS consists of different blocks: main, investment, financial activities, block of balances at the beginning and end of periods. The rules for the formation of BDDS and DDS imply planning, accounting and analysis:

- Direction of cash flows.

- Volumes of specific payments and receipts.

- Dates of payments and receipts.

- Cash turnover for the period (with the required frequency).

- The balance (balance) of funds in the cash register and in accounts as of specific dates.

The BDR reflects:

- Sources of enterprise income.

- Direction of spending of funds.

- Volumes of income and expenses.

- The difference (i.e. profit or loss) between income and expenses for a certain period.

At first glance, both budgets are no different: money came in, money went out, income and expenses were recorded. Nevertheless, the difference between BDDS and BDR exists and is explained by the fact that not every movement of money generates income or expenses, just as changes in the income and expenses of an enterprise do not always occur through payments and receipts.

There are three main differences between the BDR and BDDS reports:

| BDDS | BDR |

| Contains only those transactions that are expressed in monetary terms. | Consists of cost and revenue data. |

| Distributes the flow of all funds among existing accounts and cash desks. | Generates planned profit. |

| The articles of the BDR and BDDS are repeated, but there is a difference: some are reflected in the BDDS and are absent from the BDR and vice versa. BUT the main result is the forecasted profit and, of course, an assessment of the profitability of the business. | |

What is the difference between BDR and BDDS using the example of an article classifier (not a complete list).

| Article classifier | BDDS | BDR |

| Depreciation | + | |

| Commissioning of fixed assets | + | |

| Write-off of materials to the cost of production | + | |

| Product shipment | + | |

| Damage and other losses/Shortages based on inventory results | + | |

| Exchange differences | + | |

| VAT | + | |

| Receipts and payments on investments | + | |

| Obtaining/repaying loans (loans) | + | |

| Purchase of fixed assets | + | |

| Payments for products/services from buyers | + | |

| Purchase of materials | + | |

| Major repairs | + | |

| Indirect taxes | + |

One more difference is worth noting. BDDS is the most important document for managing the current cash flow of an enterprise. It can be compiled for a year, broken down by month, adjusted depending on the current state, indicating planned and actual data. The result of BDDS is the value of the company's cash balances.

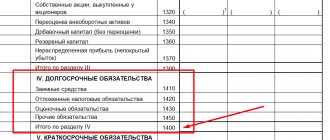

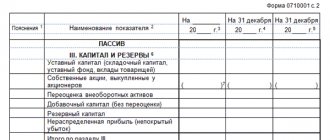

The BDR actually reflects the balance sheet of the enterprise, and its form is similar to Form 2 of the “Profit and Loss Statement” application, but if in the latter all items are strictly regulated, then items can be added to the BDR, making the budget more detailed. On many resources you can find filling out the BDR and BDDS with samples in Excel.

Sample form 2 (form and filling out)

One way or another, the result and analysis of BDR and BDDS reporting is a step towards increasing business efficiency. The main thing at first is to build a budgeting model, work out budgets and ultimately draw up a forecast balance based on the BDR and BDDS.

The difference between BDR and BDDS

You have an income and expense budget, where you record all your income and expenses as they occur (without reference to the date of receipt or expenditure of money), and there is a cash flow budget, with which you track the movement of cash flows. You can do this monthly, quarterly or semi-annually and in real time, you can see how you are doing towards achieving your financial goals. When unexpected expenses cause your financial plan to go off course, you can quickly correct the situation by adjusting your needs.

The bottom line is that by taking the time to create a profit and loss budget, your company will have a framework that can be used as a roadmap for your business. The ability to recognize and respond quickly to deviations occurring in budget versus actual data prevents any strategic plan from failing to achieve any goal set during strategic planning.

Budgeting and budgets: drawing up BDR and BDDS

Let's look at the compilation of BDR and BDDS using an example. Let's imagine an ordinary family. The head earns 100 thousand rubles, and the wife stays at home; she is a housewife. In order to live “from paycheck to paycheck,” the wife calculates all the family’s income and expenses: she takes into account payment of bills, expenses for food, basic necessities, in other words, she draws up budgets. Based on the results of their execution, the housewife plans cash balances, assesses the family's future possibilities for vacations, unintentional expenses, and savings.

The director of the company does everything the same, but according to accounting rules. He compares income with the company's expenses, similarly calculates planned cash balances, and makes decisions on the efficiency of expenses. All these are elements of budgeting - planning the future activities of the company, monitoring results and preparing management decisions based on the final deviations of actual indicators from planned ones.

Budgeting is based on key budgets - BDDS, BDR and BBL (income and expenditure budget; cash flow budget, balance sheet budget). In fact, they represent a company plan that reflects two key indicators:

- profit,

- cash balances.

In BDDR and BDR, using the example of a housewife and director, these indicators look like this:

| Indicators | Housewife | Director of the company |

| Profit | Does your spouse earn enough? | Is the company’s activities profitable, what is the profitability of my business? |

| Cash balances | Can I pay all my bills, save for a vacation and a new fur coat? | Do I have the means to pay taxes, pay wages, make new investments? |

Also, the BDR and BDDS budgets reflect sales volumes, prices for products, materials, etc., that is, they affect those aspects that have the greatest impact on the functioning of the company.