All persons who own property are required to pay land tax. This rule also applies to legal entities and individual entrepreneurs who engage in commercial activities on the sites.

In addition to taxation, they are required to independently draw up a declaration, which is subsequently submitted to the Federal Tax Service. This mandatory document is called a land tax return. The main requirement is to submit the document to the Federal Tax Service office where the registration process took place.

How to submit a land tax return

The land tax declaration must be submitted to the Federal Tax Service at the location of the land plot (clause 1 of Article 398 of the Tax Code of the Russian Federation).

However, if the company owns several plots, then the procedure for submitting the declaration is as follows.

If land plots are located on the territories of several municipalities and are under the jurisdiction of one Federal Tax Service, then one declaration is submitted with the completion of sections of the declaration according to the corresponding OKTMO codes. In this case, a separate section 2 is filled out for each of the sections.

If the sites are under the jurisdiction of different Federal Tax Service Inspectors, then you can submit a declaration for all sites to one of them, notifying other inspections in any written form.

If the plots are located in different municipalities and are controlled by the same Federal Tax Service, then you need to submit one declaration. In this case, a separate section 2 is filled out for each section indicating the corresponding OKTMO code.

If the municipalities where the sites are located supervise several inspections, then declarations are submitted to each of them.

The largest taxpayers submit declarations to the tax authority at the place of registration as such.

General filling rules

All sections of the declaration must be completed in accordance with the requirements contained in the Order.

The most important of them include:

- The values of all cost indicators must be entered in full rubles. If after calculations the indicator turns out to be in kopecks, then it is rounded in accordance with the general arithmetic rules: if there are less than 50 kopecks, then downwards, otherwise - up.

- All pages of the document are numbered consecutively. It starts with the Title Page and does not depend on the number of sections being filled out, as well as their presence or absence. The page number is written in a special field from left to right in the following form: 005 - for the third page, 015 - for the fifteenth, 105 - for the one hundred and fifth.

- Correcting errors using corrective means is not permitted. Also prohibited are erasures, typos or typos in the text, bold strikethroughs, and the use of an eraser or proofreader. If it is necessary to make changes, erroneous information must be crossed out with one thin line, after which the correct information must be indicated next to it, as well as the signature and surname of the person who made the entry.

- When filling out the declaration, the following colors of ink can be used: black, blue, violet. The text can be handwritten or typed on a computer. All letters in text fields must be printed.

- Double-sided printing of the form is not permitted. Each page should be printed on a separate sheet. It is also prohibited to fasten sheets in ways that could harm the paper medium (for example, stitching or stapling).

- All fields are filled in from left to right, starting from the first familiarity. Each field is intended for entering only one indicator (except for fractions, which can occupy several fields). If any of the indicators is missing, then a dash is entered in the corresponding field.

In principle, these requirements are not unique - they are established for most declarations and official documents that are submitted to government agencies.

However, compliance with them is mandatory, otherwise the document may be refused.

The declaration can be submitted both in paper and electronic form, using special telecommunication channels provided for in the Tax Code of the Russian Federation.

When submitting a document in paper form, it is necessary to prepare two copies of it, since one will be submitted to the tax authority, and the second, with the appropriate mark, will be returned to the payer. This can be done in person, by mail or through a legal representative.

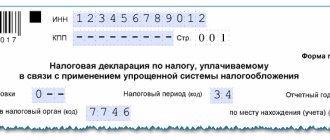

Land tax declaration form for 2019

The land tax declaration is submitted in the form approved by Order of the Federal Tax Service of the Russian Federation dated May 10, 2017 No. ММВ-7-21/ [email protected] By Departmental Order dated August 30, 2018 No. ММВ-7-21/ [email protected] this form was updated.

As often happens, the form was updated to adapt it to the changed legislation. Among the changes:

- now the form takes into account the change in the cadastral value of the land plot, which occurred due to a change in either its area, or type of use, or other characteristics;

- it became possible to calculate the payment when the site was allocated for housing construction, but stood idle for a long time, which is why the increasing coefficient increased;

- land category codes, which must be accurately indicated when filling out the form, have been updated.

Control ratios will help you check your declaration.

Required Applications

The Order contains not only general rules for filling out and processing the declaration, but also a list of certain applications that the responsible person may need when filling it out.

These include:

- Appendix No. 1. Codes defining the tax period. In general cases, this period is a calendar year, but there is also an option when the company is liquidated.

- Appendix No. 2. Codes of reorganization forms and code of liquidation of the organization. Each of these forms (merger, division, etc.) has its own digital value.

- Appendix No. 3. Codes for submitting a tax return for land tax. With the help of this application, a code is determined that displays exactly where the declaration is submitted (at the location of the site, the payer’s account, etc.).

- Appendix No. 4. Codes defining the method of submitting a land tax return to the tax authority. This may be in paper or electronic form, in person or by post, etc.

- Appendix No. 5. Directory of land categories. For each of the categories provided for in the legislation (industrial, water or forestry, etc.) there is also its own code.

- No. 6. Tax benefit codes. If there are certain benefits, this is reflected in the declaration with the appropriate digital value, depending on their nature and type.

There are not very many of these codes, so choosing the correct and appropriate value for a particular situation will not be difficult for the payer.

How to fill out a land tax return

The declaration consists of:

- title page;

- Section 1 “Amount of land tax payable to the budget”;

- Section 2 “Calculation of the tax base and the amount of land tax.”

Section 1 is completed for all land plots located within the relevant municipalities (shares of land plots located within the boundaries of the relevant municipalities (federal cities of Moscow, St. Petersburg and Sevastopol), shares in the right to a land plot).

Section 2 is completed for each land plot (share of a land plot located within the boundaries of the corresponding municipal entity (federal cities of Moscow, St. Petersburg and Sevastopol), share in the right to a land plot), owned by right of ownership, right of permanent (perpetual) use organizations. In this regard, the declaration may include several sections 2, since section 2 of the declaration is filled out separately for each land plot with the corresponding OKTMO and KBK codes.

The declaration is generated in relation to the amounts of land tax payable to the budget according to the relevant OKTMO of the municipality. At the same time, the declaration submitted to the tax authority indicates the amounts of land tax, the OKTMO codes of which correspond to the territories of municipalities.

Registration

In section 2 you need to calculate the tax in relation to land of any category. In this case, Section 2 should be filled out separately for each land plot.

At the beginning of the section, in the appropriate field, indicate the cadastral number of the plot. Then, on line 010, indicate the KBK for paying the tax, and on line 020, the OKTMO code of the municipality on whose territory the site is located.

In line 030 you need to indicate the land category code in accordance with Appendix 5 to the Procedure for filling out the declaration (as amended by Order of the Federal Tax Service of Russia dated August 30, 2021 No. ММВ-7-21/ [email protected] ). These are the codes:

| 003001000000 | AGRICULTURAL LAND |

| 003001000010 | Agricultural grounds |

| 003001000020 | Land plots occupied by on-farm roads, communications, forest plantations intended to protect land from negative impacts, water bodies, as well as buildings and structures used for the production, storage and primary processing of agricultural products |

| 003001000030 | Other land plots from agricultural land |

| 003002000000 | LAND OF SETTLEMENTS |

| 003002000010 | Land plots classified as agricultural use zones |

| 003002000020 | Land plots occupied by housing stock and engineering infrastructure facilities of the housing and communal services complex |

| 003002000030 | Land plots acquired (provided) for individual housing construction |

| 003002000040 | Land plots acquired (provided) on the terms of housing construction on them (with the exception of individual housing construction) |

| 003002000060 | Land plots acquired (provided) for personal subsidiary farming, gardening and horticulture or livestock farming, as well as summer cottage farming |

| 003002000090 | Land plots classified as industrial territorial zones and zones of engineering and transport infrastructures |

| 003002000110 | Land plots for defense |

| 003002000120 | Land plots for security |

| 003002000130 | Land plots to meet customs needs |

| 003002000100 | Other land plots |

| 003003000000 | LANDS FOR INDUSTRY, ENERGY, TRANSPORTATION, COMMUNICATIONS, RADIO BROADCASTING, TELEVISION, INFORMATICS, LANDS FOR SPACE ACTIVITIES, DEFENSE LANDS, SECURITY AND LANDS FOR OTHER SPECIAL PURPOSE |

| 003003000010 | Land plots included in industrial lands |

| 003003000020 | Land plots included in the energy sector |

| 003003000030 | Land plots included in transport lands |

| 003003000040 | Land plots from the lands of communications, radio broadcasting, television, computer science |

| 003003000060 | Land plots from the defense lands |

| 003003000070 | Land plots from the security lands |

| 003008000010 | Land plots from the land to meet customs needs |

| 003003000080 | Land plots from lands for other special purposes |

| 003004000000 | LAND OF SPECIALLY PROTECTED TERRITORIES AND FACILITIES |

| 003005000000 | FOREST LAND |

| 003006000000 | WATER FUND LAND |

| 003007000000 | RESERVE LANDS |

| 003008000000 | LAND PLOTS FOR WHICH THE LAND CATEGORY IS NOT ESTABLISHED |

In accordance with Chapter 31 of the Tax Code, land tax is calculated based on the cadastral value of the land plot. Its value as of January 1 of the year, which is the tax period, must be indicated on line 050 of this section of the declaration.

Companies that have purchased or received sites for housing construction should pay attention to line 040 of section 2. In it they must note whether the design and construction period exceeded the three-year period (put “1” on the line) or not (put “2” on the line "). The amount of tax depends on this. If the taxpayer indicates that the construction period is more than three years, then the tax will have to be paid at a rate with a coefficient of 4. Otherwise, the coefficient will be equal to 2 (clause 15 of Article 396 of the Tax Code of the Russian Federation).

If the change from coefficient 2 to coefficient 4 occurred in the middle of the year, fill out two sheets of section 2. On line with code 040 of one sheet of section 2 the value “1” is indicated, and on line with code 040 of the second sheet of section 2 the value “2” is indicated.

For example, if the three-year period from the date of state registration of the right to a land plot ends on April 1 of the tax period, when filling out one sheet of Section 2 indicating the value “1” on line with code 040, “0.2500” is indicated on line with code 140, and when filling out the second sheet of Section 2 indicating the value “2” on the line with code 040, “0.7500” is indicated on the line with code 140.

In some cases, you need to fill out line 060, which indicates the taxpayer’s share of the right to the land plot in the form of a regular simple fraction. Thus, line 060 is filled in in relation to land plots that are in common shared or joint ownership. The share must also be indicated if the right to part of the land plot was transferred to the taxpayer when purchasing real estate.

Further in the declaration, data on tax benefits is provided. All benefits have their own codes, which are given in Appendix 6 to the Procedure for filling out the declaration.

Line 070 indicates the tax benefit code in the form of a tax-free amount. This line is filled in by those taxpayers who enjoy benefits established in accordance with paragraph 2 of Article 387 of the Tax Code. In this case, the second part of the indicator on line 070 is filled in only if the first part of the indicator indicates the benefit code 3022100. Here the number, paragraph, subparagraph of the article of the regulatory legal act in accordance with which the corresponding benefit is provided are sequentially indicated.

For example, if the corresponding benefit is established by subclause 15.1 of clause 3 of Article 2, then on the line with code 070 the following is indicated:

| 3 | 0 | 2 | 2 | 1 | 0 | 0 | / | 0 | 0 | 0 | 2 | 0 | 0 | 0 | 3 | 1 | 5 | . | 1 |

On line 080, indicate the appropriate tax-free amount that reduces the tax base.

Line 090 indicates the tax benefit code in the form of a share of the non-taxable area of the land plot provided in accordance with paragraph 2 of Article 387 of the Tax Code. The second part of this indicator is filled out only if the first part of the indicator indicates the benefit code 3022300. The procedure for filling out the second part of the indicator is similar to the procedure for filling out line 070. Next, in line 100, indicate the share of the non-taxable area of the land plot in the total area of the land plot in the form of the correct simple fraction.

Next, line 110 is filled in. It indicates the tax base, which is defined as the cadastral value (share of the cadastral value) of the land plot as of January 1 of the year that is the tax period.

On line 120, enter the applicable tax rate.

On line 130 you need to indicate the number of full months of ownership of the land plot during the tax period. Moreover, if the emergence of the right to a land plot (its share) occurred before the 15th day of the corresponding month inclusive, or the termination of the specified right occurred after the 15th day of the corresponding month, the month of emergence (termination) of the specified right is taken as the full month. If the emergence of the right to a land plot (its share) occurred after the 15th day of the corresponding month or the termination of the specified right occurred before the 15th day of the corresponding month inclusive, the month of emergence (termination) of the specified right is not taken into account (clause 7 of Article 396 of the Tax Code RF, letter of the Ministry of Finance of Russia dated March 12, 2021 No. 03-05-05-02/14969).

A full month is taken to be one in which:

- ownership of the plot is registered if this happened before the 15th day of the month inclusive. If the property right is registered after the 15th day, then this month is not taken into account when calculating the tax;

- termination of ownership of the plot is registered if this occurred after the 15th day of the month. If ownership ceased before the 15th day inclusive, then this month is not taken into account when calculating the tax.

Thus, in these cases, the cadastral value changed during the tax period by a court decision is applied from the moment such a decision enters into force.

In this regard, the taxpayer fills out several sections 2 of the land tax declaration for this plot - for the period before the change in its cadastral value and for the period after the change, while the taxpayer reflects:

- on line 110 of one Section 2 of the declaration, the initial cadastral value of the land plot as of January 1 of the year that is the tax period (before the court decision entered into force), and on line 130 - the number of full months during which this cadastral value was valid;

- on line 110 of another Section 2, the changed cadastral value as of the date of entry into force of the court decision, on line 130 - the number of full months during which the changed cadastral value of the land plot was in effect.

If the rights to the plot belonged to the taxpayer during an incomplete tax period, then the coefficient Kv is indicated on line 140. It is defined like this:

| page 140 | = | page 130 | : | 12 |

In this case, the value on line 140 is given in decimal fractions with an accuracy of ten thousandths.

If the rights to the land plot belonged to the taxpayer during the entire tax period, then “12” is indicated on line 130, and “1.0—” is indicated on line 140.

Line 145 indicates the Ki coefficient. It is used to calculate land tax in the event of a change in the cadastral value of a land plot during the tax period due to changes in the qualitative and (or) quantitative characteristics of the land plot.

It needs to be calculated if during the year the cadastral value of the plot has changed due to:

- changes in the type of permitted land use;

- transfer of a plot from one category of land to another;

- changes in the area of land.

The Ki coefficient is defined as the ratio of the number of full months during which in a given tax period the land plot had a cadastral value established for a given qualitative and (or) quantitative characteristic of the land plot, to the number of calendar months in the tax (reporting) period.

If the cadastral value changed in the same year in which the organization bought or sold the plot, two Sections 2 with two Ki coefficients must be filled out in the land tax return (Letter of the Federal Tax Service of Russia dated June 19, 2021 No. BS-4-21/11751) .

In the first section 2, the Ki coefficient is determined by the ratio of the number of full months when you had ownership of the plot with the old cadastral value to the number of complete months when you had ownership of the plot (before the change in cadastral value and after).

In the second section 2, the Ki coefficient is determined by the ratio of the number of full months when you had ownership of the plot with a new cadastral value to the number of full months when you had ownership of the plot (before the change in cadastral value and after).

Define the full month for the numerator as follows. If the cadastral value has changed before the 15th day of the month (inclusive), then for the old cadastral value this month is not considered full, but for the new one it is. When the cadastral value changed after the 15th day of the month, then vice versa.

For the denominator, determine the full month in the same way. Just instead of the month in which the cadastral value changed, take the month when ownership of the plot was registered.

In this case, the value in line with code 145 is indicated in decimal fraction with an accuracy of ten thousandths.

For example, if information that is the basis for determining the cadastral value due to changes in the qualitative and (or) quantitative characteristics of a land plot is entered into the Unified State Register of Real Estate (hereinafter referred to as the USRN) on October 10 of the current year, then when filling out one sheet of Section 2 of the declaration indicating line with code 050 of the cadastral value as of January 1 of the current year, the Ki coefficient is determined as:

Ki = 9 months : 12 months = 0.7500 and line with code 145 indicates “0.7500”,

and when filling out the second sheet of Section 2 of the declaration indicating on line code 050 the cadastral value changed in the current tax period due to changes in qualitative and (or) quantitative characteristics, the Ki coefficient is determined as:

Ki = 3 months : 12 months = 0.2500 and “0.2500” is indicated on the line with code 145.

Responsibility

For failure to submit a land tax return on time, liability is provided under Art.

119 of the Tax Code of the Russian Federation. For each full or partial month of delay in the declaration, a fine of 5 percent of the tax not paid on time is collected. The maximum penalty is 30 percent of the tax not paid on time on a late return.

If the company did not pay the tax on time or violated the deadline for submitting the zero declaration, then the fine will be collected in the minimum amount - 1 thousand rubles.

In addition, officials of the organization may be fined in the amount of 300 to 500 rubles on the basis of Art. 15.5 Code of Administrative Offenses of the Russian Federation.

How to fill out the first section of the reporting form?

The first part of the report summarizes the amount of the budget commitment. The results of the calculations made in the second section are transferred here.

It states:

- KKB and OKTMO of the site;

- calculated tax amount (this is the sum of all values of lines 250);

- amounts of advances paid during the year;

- the total amount to be transferred to the budget, found as the difference between the calculation data and the amount of advances.

At the bottom of the first section, the signature of the director or other authorized person is affixed, confirming the relevance and correctness of the specified information.