Extra-budgetary funds in organization accounting

Any organization is always supervised by regulatory authorities.

Some look at the correct payment of taxes, others at the correct transfer of contributions from employee salaries. State extra-budgetary funds were created to ensure the rights of citizens to pension, medical and social insurance. The funds' budget is formed from funds received from employers.

In 2021, the controlling bodies - funds for us are the Federal Tax Service and the Social Insurance Fund. In the first, we report on calculated and paid insurance premiums, contributions to pension, medical and social insurance, in the second, we submit calculations for the calculation of social security contributions.

Let us recall that in 2021 the Funds transferred the administration of contributions to the Federal Tax Service. Find out what to do if the Funds provided the tax authorities with an incorrect calculation balance in ConsultantPlus. If you don't already have access to the system, get a free trial online.

Insurance contributions, which are paid by employers to extra-budgetary funds, are designed to provide social support to the country's population - both able-bodied people and retirees. Therefore, control over these payments is quite high. Accordingly, there is a high risk of fines being assessed for incomplete transfer of funds or untimely provision of documents for the implementation of this control. This is why accounting in this area is so important.

There are several types of accruals:

- pension;

- medical (contributions to the Federal Compulsory Medical Insurance Fund);

- contributions for compulsory social insurance in case of sick leave and in connection with maternity;

- accident insurance premiums.

Contributions are paid by organizations and individual entrepreneurs that pay benefits to individuals (salaries to employees, fees for providing services to individuals).

IMPORTANT! If the employer is an individual entrepreneur, then he is obliged to pay contributions separately for himself and separately for his employees!

What payments are subject to contributions:

- Payments to employees under concluded employment contracts (salaries, bonuses, vacation pay, etc.)

- Payments under civil contracts. These may be concluded contracts for the performance of any work, provision of services, etc.

For more information about the taxation of payments under civil and civil construction agreements, read our article “Contractor agreement and insurance premiums - nuances of taxation.”

There is also a closed list of payments that are not subject to insurance premiums and “injury” contributions. For example, these are payments to an individual not related to his work activity - that is, payments outside of the employment relationship or within the framework of a GPC contract - a repayable loan or financial assistance to family members of a deceased employee.

Read more about such payments in our article “What is not subject to insurance premiums.”

Salary deductions

Deductions from salary reduce the amount of accruals and go through the debit of account 70. As a rule, all employees have one deduction - personal income tax. Here account 70 corresponds with account 68 “Calculations for taxes and fees”, posting:

D70 K68

In postings for other deductions, the credit account changes depending on where it goes. For example, when withholding under a writ of execution in favor of a third party, account 76 “Settlements with various debtors and creditors” is used, posting:

D70 K76

Insurance rates and basis for calculating premiums

For each individual, an organization or individual entrepreneur calculates contributions individually depending on the income received. The assessment base is calculated as a cumulative total during the calendar year. For some types of income, the tax base is limited. See the current limits for 2021 here.

The final amount of contributions is the taxable base multiplied by the corresponding insurance tariff (rate).

The following rates are currently in effect:

| Taxable base | Pension Fund | FSS | FFOMS | Total |

| Does not exceed the established limit value, % | 22 | 2,9 | 5,1 | 30 |

| More than the established limit, % | 10 | 0 | 5,1 | 15,1 |

For other tariffs, see the material “Insurance premium tariffs in the table”.

ATTENTION! From 01.04.2020 President of the Russian Federation V.V. Putin reduced insurance premium rates for small businesses to the widow. See here for details.

Tariffs for contributions “for injuries” depend on the occupational risk class assigned to the organization or enterprise.

These tariffs are described in detail in this material.

For a significant number of policyholders, STV tariffs have been reduced:

| Policyholders | Pension Fund | FSS | Compulsory Medical Insurance Fund |

| Companies, firms, individual entrepreneurs on the simplified tax system. A prerequisite is a maximum income of 79 million rubles. | 20,0 | 0 | 0 |

| Pharmacy establishments, individual entrepreneurs that have received a license to sell dosage forms on UTII. Reduced rates - only for workers engaged in pharmacy activities | 20,0 | 0 | 0 |

| IP for PSO | 20,0 | 0 | 0 |

| IT companies and firms | 8,0 | 2,0 | 4,0 |

| Participants of the Skolkovo project | 14,0 | 0 | 0 |

| Enterprises involved in free economics. zone in Crimea | 6,0 | 1,5 | 0,1 |

Important! This list contains incomplete information. To supplement it, you need to read Art. 427 NK.

Accounting for settlements with extra-budgetary funds

For accounting of settlements with extra-budgetary funds, account 69 “Settlements for social insurance and security” is provided. Sub-accounts are opened for each type of payment.

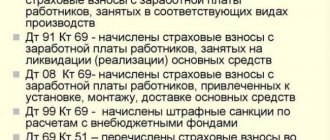

Let's look at typical transactions for calculating contributions to funds:

| Account Dt | Account name | CT | Contents of operation |

| 20,25,26 | "Primary production" | 69.01 “Settlements with the Social Insurance Fund for contributions in case of temporary disability and maternity” 69.02 “OPS” 69.03 “Settlements with the Federal Compulsory Medical Insurance Fund” 69.11 “Calculations for compulsory social insurance against accidents at work and occupational diseases” | Calculation of contributions depending on the type at a manufacturing enterprise |

| 44 | "Sale expenses" | Calculation of contributions in a trade organization | |

| 08 | "Fixed assets" | Calculation of contributions during construction, when the salaries of workers form the initial cost of the object | |

| 69 | 51 “Current account” | Payment of contributions (by subaccounts) | |

| 69 "Penny" | 51 “Current account” | Payment of fines | |

| 69 | 70 “Wages of employees” | Benefit reimbursed from the Social Insurance Fund |

As a rule, on a monthly basis we pay all contributions calculated according to the above formula. But if you have accrued sick leave or an employee went on maternity leave, the situation will change.

Accounting for settlements for social insurance and security is reflected by posting Dt 69 “Contributions” Kt 70 “Calculations for wages”. With this posting you will accrue sick leave (for those days paid by the Social Insurance Fund) - accordingly, the payment at the end of the month will not be the insurance premium calculated from the salary, but the account balance 69 at the end of the month. Here you have two options:

- You pay the fully calculated contributions, submit documents to the Social Insurance Fund and, after the money arrives in the current account, you formalize this by posting Dt 51 Kt 69.

- Or you immediately, within one calendar year, reduce the amount of accrued insurance premiums by the amount of calculated sick leave.

Find out how to offset and refund insurance premiums in ConsultantPlus. Get trial access to the system and get expert explanations for free.

How benefits are paid from 01/01/2021 as part of the general pilot project of the Social Insurance Fund, read here.

Payroll

Wage expenses are written off against the cost of production or goods, therefore the following accounts correspond to account 70:

- for a manufacturing enterprise - 20 account “Main production” or 23 account “Auxiliary production”, 25 “General production expenses”, 26 “General (administrative) expenses”, 29 “Servicing production and facilities”;

- for a trading enterprise - account 44 “Sales expenses”.

The wiring looks like this:

D20 (44.26,…) K70

This posting is made for the total amount of accrued salary for the month, or for each employee, if accounting on account 70 is organized with analytics for employees.

Example of accounting entries for settlements with extra-budgetary funds

Let's look at accounting for insurance premiums in accounting using an example.

Books LLC sells printed materials. Salary for February amounted to 120,000 rubles. The employee provided sick leave in the amount of 5,600 rubles. (of which 2,300 are at the expense of the employer, 3,300 are at the expense of the Social Insurance Fund). We will reflect all transactions with accounting entries:

Dt 44 Kt 70 - 120,000 rub. - wages accrued.

Dt 70 Kt 68.01 “NDFL” - 15,600 rubles. — personal income tax is withheld from wages.

Dt 44 Kt 69.01 - 3,480 rub. (120,000 × 2.9%) - an insurance contribution to the Social Insurance Fund has been charged.

Dt 44 Kt 69.02 - 26,400 rub. (120,000 × 22%) - an insurance premium has been charged to the Pension Fund.

Dt 44 Kt 69.03 - 6,120 rub. (120,000 × 5.1%) - reflects the insurance contribution to the FFOMS.

Dt 44 Kt 69.11 — 240 rub. (120,000 × 0.2%) - a contribution for “injuries” has been added.

Dt 44 Kt 70 - 2,300 rub. — accrual for sick leave is reflected.

Dt 69 Kt 70 — 3,300 rub. — the calculation for sick leave was accrued in the part reimbursed by the Social Insurance Fund.

Dt 69.01 Kt 51 — 180 rub. (3480 – 3300) — contributions to the Social Insurance Fund have been paid.

Dt 69.02 Kt 51 - 26,400 rub. — contributions to the Pension Fund have been paid.

Dt 69.03 Kt 51 - 6,120 rub. — contributions to the FFOMS have been paid.

Dt 69.11 Kt 51 — 240 rub. — the “injury” contribution has been paid.

Features of control over STV

For a long time, issues of calculation and payment of STV were regulated by a law adopted in 2009. Since 2021, their administration has been entrusted to tax authorities, and issues regarding payment are covered in the Tax Code (Chapter 34). At this time, ETS payers should be guided by the provisions of this chapter. The basic principles relating to taxes have also been extended to the STV.

Starting from the first quarter of 2021, STS payments are sent not to the Pension Fund of Russia, but to the tax authorities. They become part of NK.

Only regulations regarding injuries remain under the control of the FSS. The Fund continues to accept proper reporting.

Personalized reporting continues to be under the control of the Pension Fund (

Results

Extra-budgetary funds of the Russian Federation were created for the accumulation and targeted use of funds in accordance with state projects for the socio-economic development of the state. The funds are replenished from employers' funds. For correct accounting, an accountant needs to be aware of the current tax rates, tariffs and income limits. Correct accounting of insurance premiums, as well as any other mandatory payments, will avoid the accrual of fines and penalties.

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Insurance for individual entrepreneurs

Insurance coverage for individual entrepreneurs (in relation to themselves) differs significantly from the norms provided for employers. Thus, for the reporting year, a businessman is obliged to transfer fixed payments to the budget:

- 29,354 rubles in 2021 - for OPS;

- 6884 rubles - for compulsory medical insurance.

However, if his income exceeds 300,000 rubles per year, then from the excess amount he will have to additionally transfer 1% to the Federal Tax Service for compulsory pension insurance. For more information about mandatory payments of individual entrepreneurs for themselves, read the article “What contributions should individual entrepreneurs pay for themselves in 2021.”

How to make postings? If the individual entrepreneur does not resort to hiring employees, then there is no need to reflect the calculation of insurance premiums of the individual entrepreneur for himself with postings. Why? Small businessmen are exempt from the obligation to maintain accounting records according to general rules. They have the right to keep simplified accounting, complete accounting, or completely abandon accounting. Therefore, it is not necessary to reflect the SV with postings.

However, if the individual entrepreneur decided to conduct accounting according to generally accepted standards and enshrined such a decision in his accounting policy, then the accrual of fixed payments to the individual entrepreneur (postings) is drawn up in a similar way, using accounting account 69 and the corresponding subaccount to it.

Answers to pressing questions

Question No. 1 : To which accounts are social contributions calculated?

Answer : In accounting, insurance premiums are charged to the same expense accounts as salaries.

Question No. 2 : What should an accountant focus on when filling out settlement documents about the Pension Fund or Compulsory Medical Insurance Fund?

Answer : The procedure for filling out settlement documents for the transfer of fund contributions is stipulated by letter of the Pension Fund No. 30/187 dated 12/08/09.

Question No. 3 : What are the consequences of incorrectly filling out the KBK code in a payment order?

Answer : Insurance premiums are considered unpaid (Federal Law No. 212 of July 24, 2009, Article 18, Part 6, Clause 4).

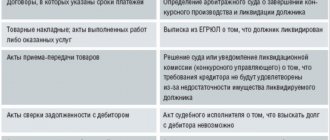

Question No. 4 : When do you need to submit calculations when liquidating an individual entrepreneur or organization?

Answer : Calculations are submitted from the moment of filing an application for liquidation of an organization or termination of business activities by an individual (Federal Law 212, Article 15, Part 15). A calculation of the payment and accrual of insurance premiums from the beginning of the billing period is presented.

Question No. 5 : What is the current health insurance rate?

Answer : From January 1, 2012, a tariff of 5.1% was established (Federal Law No. 272 of October 16, 2010).

Question No. 6 : How can I change or supplement the calculation of insurance premiums with incomplete information?

Answer : In such circumstances, the payer must make the necessary changes or additions and submit the updated document to the regulatory authorities (Federal Law No. 212, Article 17).

Question No. 7 : What is the maximum contribution per employee for health insurance?

Answer : The maximum limit is 624 thousand rubles. in year. If the employee's annual income exceeds the specified limit, contributions from the excess amount are not paid.