The reporting of companies and individual entrepreneurs using the simplified taxation system is somewhat different from the reports submitted by enterprises operating on OSNO. Simplified people do not pay income tax, in most situations - VAT and property tax. And these features affect the package of mandatory reports. Let's figure out what forms are included in the simplified tax system for reporting in 2021, having compiled the information provided in a table for ease of perception - a list of reports that simplifiers must submit to regulatory authorities within the specified time frame.

Simplified taxation system (STS)

A simplified system helps optimize taxation: simplify accounting and get additional benefits. Thanks to the choice of such a benefit, the enterprise gets rid of taxes on property and profits of organizations, VAT, and the entrepreneur gains the opportunity to be exempt from taxes on property and income of individuals.

Taxpayers and payments

An enterprise transferred to a simplified methodology that does not have additional tax bases (vehicles, land plots, real estate reflected in cadastral registration) is obliged to make the following payments:

- A single tax paid quarterly in advance payments for reporting periods - no later than the 25th of the next month, at the end of the tax period - no later than April 30 of the following year.

- Insurance premiums for their employees. Their tariffs in 2021 are as follows: for compulsory pension insurance - in the amount of 20%, for compulsory social insurance in case of temporary disability and in connection with maternity, for compulsory medical insurance - 0%, if income for the tax period does not exceed 79 million rubles.

At the same time, your business code must be among the preferential OKVED codes. These include, for example, codes from:

- Section 10 “Production of Food Products”;

- Section 13 “Production of textile products”;

- Section 14 “Clothing Production”;

- Section 15 “Production of leather and leather products”;

- Section 16 “Wood processing and production of wood products”;

- Section 20 “Production of Chemical Substances and Chemical Products”;

- Section 21 “Production of medicines and materials used for medical purposes”;

- Section 22 “Production of rubber and plastic products”;

- Section 23 “Production of other non-metallic mineral products”;

- Section 25 “Production of finished metal products”;

- Section 28 “Production of machinery and equipment”.

Table: some OKVED codes for which enterprises have the right to use reduced tariffs

| Main activity of OKVED in 2018 | OKVED code 2 |

| Production of sporting goods | 32.3 |

| Production of games and toys | 32.4 |

| Activities of sports facilities | 93.11 |

| Other sports activities | 93.19 |

| Processing of secondary raw materials | 38.3 |

| Vehicle maintenance and repair | 45.2 |

| Collection of wastewater, waste and similar activities | 37, 38.1, 38.2 |

| Production of musical instruments | 32.2 |

| Production of various products not included in other groups | 32.9 |

| Repair of household products and personal items | 95.2 |

| Property Management | 68.2, 68.32 |

| Activities related to the production, distribution and exhibition of films | 59.11–59.14 |

| Activities of libraries, archives, club-type institutions (except for the activities of clubs) | 91.01 |

| Activities of museums and protection of historical sites and buildings | 91.02, 91.03 |

| Activities of botanical gardens, zoos and nature reserves | 91.04 |

| Retail trade of pharmaceutical and medical goods, orthopedic products | 47.73, 47.74 |

| Production of bent steel profiles | 24.33 |

| Steel wire production | 24.34 |

Procedure and requirements, procedure for transferring to the simplified tax system

After accepting the decision to transfer accounting to a simplified system, you should notify the tax office of your choice until December 31 of the current year. The opportunity to apply the new rules appears with the onset of next year. The application can be submitted in person, but it is enough to send by mail a document containing information about the preferred option, as well as the residual value of fixed assets and the amount of income as of October 1 of the current year. It follows from this that the opportunity to change the tax payment method is provided only in the last months of the year: October - December.

New enterprises can declare the choice of a preferential system before the expiration of 30 calendar days after registering with the tax service. They are then considered to be using the simplified system from the date of registration. To qualify for this preferential treatment, it is important to meet many requirements.

Conditions for applying the simplified tax system for enterprises and individual entrepreneurs

Enterprises switching to the simplified tax system undertake not to engage in the types of activities presented in the list established by law. “Simplified” cannot be used:

- banks;

- insurers;

- non-state pension funds;

- investment funds;

- professional participants in the securities market;

- pawnshops;

- engaged in the production of excisable goods, as well as the extraction and sale of minerals, with the exception of common minerals;

- organizing and conducting gambling;

- notaries engaged in private practice, lawyers who have established law offices, as well as other forms of legal entities;

- being parties to production sharing agreements;

- switched to a taxation system for agricultural producers (unified agricultural tax);

- foreign organizations;

- microfinance organizations;

- private employment agencies engaged in providing labor to workers (personnel).

There are other restrictions. In the capital structure of a company using the simplified tax system, no more than 25% of the equity participation of third-party companies is allowed (this restriction is not taken into account in relation to some government agencies and non-profit organizations listed in paragraph 14, paragraph 3, article 346.12 of the Tax Code of the Russian Federation, and is also not applicable in relation to individual entrepreneurs ).

A “simplified” enterprise must have an average number of employees of no more than one hundred people, and also must not have branches in its structure.

The organization's fixed assets should not have a residual value exceeding 150 million rubles. It is determined based on the results of accounting. When accounting, fixed assets are also taken into account, which are recognized as depreciable property according to tax accounting. Moreover, this requirement also applies to individual entrepreneurs, which is confirmed by Letters of the Ministry of Finance (in particular, dated January 20, 2016 N 03–11–11/1656) and the position of the highest judicial authorities (see Decision of the Supreme Court of the Russian Federation dated August 2, 2016 in case N AKPI16 –486).

The total income of the enterprise for the calendar year should be kept within 120 million rubles. — this established value is not subject to indexation until 2021. To be able to switch to a simplified methodology starting in 2021, the company needs to calculate its income for 9 months of 2021 and make sure that it does not exceed 112.5 million rubles. (for individual entrepreneurs, indicators on the volume of income for previous periods have not been established).

Objects of taxation, tax base

When transferring a case to simplified taxes, an important step is the selection of a taxable object. There are two alternatives for calculating the single tax and two rates:

- when the object of taxation is “income”, the tax is paid on the total turnover, the tax amount is 6%;

- with the object “income minus expenses”, the tax is paid on the net profit of the organization, its amount is 15%.

The tax base is the basis for calculating the tax amount, a quantitative, that is, monetary, embodiment of the object of taxation.

The payer is given the opportunity to annually choose which object will be subject to tax. To do this, you should analyze the financial results for the last 9 months.

The choice of taxation object when using the simplified tax system depends on the relationship between income and expenses

For an enterprise in which expenses exceed 60%, it is beneficial to pay taxes on income minus expenses.

At the end of the year, they should also be required to carry out calculations:

- a minimum tax of 1% of income payable (when the company is in a loss position);

- equality of income and expenses;

- if the minimum tax is higher than the amount of the single tax.

Choosing the 15% variety in such events is optimal, since 1% will turn out to be a smaller value compared to 6%. But there are also cases when 6% is chosen, although it is more profitable to pay 15%, this is explained by a reduction in the complexity of calculations.

Rules for determining and recognizing income and expenses under the simplified tax system

The unified procedure for accounting for income and expenses under the simplified regime does not depend on the choice of taxable object. In this case, the following are considered income:

- proceeds from the sale of goods, works, services, property and property rights;

- non-operating income.

Revenue is recognized using the cash method. That is, directly upon receipt of funds to a bank account or to the cash desk of an enterprise, acceptance of property or property rights, the accounting department must record the value of the amount of income in the Income and Expense Accounting Book.

When determining the object of taxation as a “simplified” tax, income provided for in Art. 251 Tax Code of the Russian Federation. In addition, income in the form of dividends received is not taken into account if they are taxed in accordance with the provisions of Articles 214 and 275 of the Tax Code of the Russian Federation.

Tax Code of the Russian Federation

If the method of paying income minus expenses is used, all items on the exhaustive list given in clause 1 of Art. 346.16 Tax Code of the Russian Federation. For example, it includes:

- expenses for the acquisition, construction and production of fixed assets, as well as for the completion, retrofitting, reconstruction, modernization and technical re-equipment of fixed assets;

- expenses for intangible assets;

- expenses for repairs of fixed assets (including leased ones);

- rental (including leasing) payments for property;

- material costs;

- expenses for wages, payment of temporary disability benefits for the first three days of the employee’s illness;

- input VAT on paid goods (works, services);

- interest on loans and borrowings, as well as costs for services of credit institutions;

- expenses for fire safety;

- consular, airfield fees, fees for the right of entry, passage, transit of automobile and other transport, for the use of sea canals, other similar structures and other similar payments and fees;

- payment to a public or private notary for processing documents within the approved tariffs.

When the taxable entity has declared income, expenses do not need to be taken into account. However, the tax itself can be reduced by the amount of the listed payments:

- insurance premiums paid for employees;

- fixed contributions for yourself;

- benefits paid for the first three days of illness;

- payments (contributions) under voluntary personal insurance contracts concluded with insurance organizations.

The amount paid can be reduced by a maximum of half. In addition, the simplified payment is reduced by the trade fee, but the limit (50%) then does not apply. The fee is taken into account only when the company has a certificate of registration as a trade tax payer.

The procedure for calculating the tax base when paying the simplified tax system depends on whether it is necessary to reduce income by the amount of expenses incurred

New insurance fee: for individual entrepreneurs and LLCs with employees

At the beginning of 2021, it was decided to levy a new single insurance fee on the income of employees. This deduction replaces two old contributions - pension and sick leave. ESSS rates are still being finalized, but they are unlikely to be higher than this year. For the new tax, reporting forms to the tax office under the simplified tax system have been approved in 2021, which can be found on the Finabi website.

The Federal Tax Service will administer the new insurance fee. In 2018, LLC tax reporting on the simplified tax system, as for private entrepreneurs, will be conducted according to data transferred from old funds. To do this, during the first quarter, old funds must be transferred to the tax cards of enterprises with the current state of affairs. If the company has overdue debt, outstanding penalties and fines, it is better to pay them off this year. For employees in 2021, the tax reporting deadlines for the simplified tax system will remain the same: the quarterly income tax form will be submitted after 3, 6, 9 months of the current year.

The Pension Fund and the Social Insurance Fund will not be left without work, although their area of activity will be greatly reduced. The Pension Fund of the Russian Federation will remain in charge of personalized reporting for each employee, which, as before, will have to be submitted every month to the local branch of the pension service.

Social insurance remains in charge of control over:

- level of occupational diseases at the enterprise;

- accident insurance;

- injuries at the enterprise.

By April 17, an enterprise or individual entrepreneur using the labor of hired employees must submit to the Social Insurance Fund a certificate about the main type of activity of the business entity. If such a certificate is not provided, the company will have to pay contributions at the rate of the type of activity where the professional risks are maximum.

Tax reporting using a simplified tax system

Tax authorities are just as attentive to representatives of smaller-scale businesses as they are to others. Therefore, it is worth appreciating the preferential conditions and treating reporting with full responsibility.

Tax and reporting period, tax rates

The tax period is a calendar year. The reporting period is the first quarter, six months and nine months of the calendar year.

Regional authorities have the right to reduce the tax percentage from “income reduced by expenses” to 5% (3% in the Republic of Crimea) instead of the standard 15%. The reduction in the tax rate will depend on the type of occupation and category of the enterprise itself, and the use of this benefit is allowed only for 5 years. The maximum collection from “income” is 6%, the rest remains at the discretion of the authorities of each region.

Regional laws sometimes approve a zero fee for individual entrepreneurs registering for the first time and operating in the production, social and (or) scientific spheres, as well as in the field of consumer services to the population. They can use a zero percentage of taxes from the date of registration of the individual entrepreneur continuously for two tax periods. The minimum tax is not paid in this situation. Entrepreneurs who have adopted these conditions should achieve a 70% share of income from the sale of the results of their activities in the overall income structure annually.

Rules for calculating and paying tax

After each reporting period, the amount of the advance payment must be calculated taking into account the tax rate and income actually earned (or income reduced by expenses). They are calculated on an accrual basis, taking into account previously calculated payments. That is, the values when calculating the tax each time begin to be considered in January, and the difference between the calculated amount and the one transferred earlier at the time of calculation is paid.

Payment of advance payments must be made no later than the 25th day of the month following the reporting period. The final tax amount is transferred no later than the deadline for submitting the tax return, which, in turn, is submitted based on the results of the tax period within the established deadlines:

- organizations - no later than March 31 of the following year;

- individual entrepreneurs - no later than April 30 of the following year.

To calculate the tax base, a book of income and expenses of organizations and individual entrepreneurs using the simplified taxation system is kept in an approved form, where all the facts of economic life for the reporting period are reflected in chronological order in accordance with the primary documentation.

From 2021, instructions on the transition to the use of online cash registers came into force. Those who have not previously used cash registers are now required to purchase new cash register equipment that allows them to transmit payment data to the relevant inspection office via the Internet in real time. Such cash registers can generate both paper and electronic receipts sent to the buyer by email. From January 1, 2021, the transfer to online cash registers was carried out by all entrepreneurs and organizations. If they provide services to the public, then strict reporting forms can be used instead of a cash receipt.

Advantages of using the simplified tax system for enterprises and individual entrepreneurs

Tax return

A tax return is the primary method of reporting. For companies operating under a simplified system, a special tax return form has been approved.

Rules and sample filling, zero reporting

The simplified tax system declaration for 2021 should be submitted in the form approved by order of the Federal Tax Service of Russia dated February 26, 2021 No. ММВ-7–3/ [email protected] and taking into account the conditions of zero percent, as well as tax reduction on the amount of trade duty paid.

“Simplified” payers submit a declaration after the end of the tax period (calendar year). The reporting document is submitted even if the company did not actually conduct any activity (then it is called a “zero” declaration of the simplified tax system) or it was decided to close the individual entrepreneur or liquidate the LLC (which means the declaration is submitted for less than a full year).

In order to correctly complete the declaration, you must adhere to the following instructions:

- If the declaration sheets do not contain any data, the report must be numbered without them.

- Place dashes in empty cells.

- Financial data must be rounded (round kopecks to the nearest ruble).

- Do not allow corrections in the document.

- Sheets of the declaration must not be stapled to avoid damaging the paper media.

- After filling out, all sheets must be numbered (001, 002).

- The declaration can be filled out manually (in printed capital letters, using a dark pen) or on a computer.

Rules for filing a tax return

The tax return is submitted to the tax office at the place of registration of the enterprise:

- Individual entrepreneur - at the place of residence;

- LLC - at the location (legal address of the main office).

You can use one of three methods:

- By contacting the tax office in person or through a representative.

- By sending the declaration by mail.

- By transmitting electronically via the Internet through specialized services (or through the Federal Tax Service website).

Rules for amending a tax return

If a payer of a simplified tax finds errors in his accounting that result in an underestimation of the amount paid, he is obliged to submit an updated declaration for this tax (Clause 1 of Article 81 of the Tax Code of the Russian Federation). There is no time limit for filing updated declarations.

To correct the inaccuracy, the following actions are necessary:

- Find the error and determine the period to which it relates.

- Calculate the amount of arrears, calculate penalties and transfer these amounts to the budget. This must be done before filing a declaration of treason (clause 4 of Article 81 of the Tax Code of the Russian Federation). In this case, it is important to correctly indicate the BCC so that the funds are immediately credited for their intended purpose.

- To draw up an updated declaration under the simplified tax system, use the form of the document that was in force during the period of error (clause 5 of article 81 of the Tax Code of the Russian Federation). If in 2021 an error is found in the calculation for 2021, then the form for the updated declaration must be for 2021. On the title page of the declaration, put its serial number in a special field.

- Indicate the correct data in the updated declaration (fill it out again, and do not enter the difference between the primary and secondary amounts).

- Drawing up a cover letter for the updated declaration is not a requirement, but a recommendation.

If an error discovered in the declaration led to an overpayment of tax, i.e. there was no underestimation of the tax base, the taxpayer has the right, but not the obligation, to submit an updated declaration. Most likely, filing such a declaration will attract the attention of tax inspectors, and the likelihood of a tax audit for the specified period will increase sharply.

Responsibility for violations when providing information

The following penalties are imposed for late submission of the declaration:

- if the simplified tax system has been paid - 1,000 rubles;

- if the simplified tax system has not been paid - 5% of the amount of tax payable on the basis of this declaration, for each full or partial month from the day established for its submission, but not more than 30% of the specified amount and not less than 1,000 rubles.

If the declaration is not submitted to the relevant authorities within the prescribed period, a desk audit may be carried out against the payer based on information already available to the tax authorities. Tax officials have the legal right to inspect documents, objects, premises, and territories.

Calculation example

Let us consider the procedure for calculating the amount of tax using the example of an individual entrepreneur using the “income minus expenses” taxation option.

The organization at the end of the year has the following indicators:

- amount of income - 23976686 rubles;

- amount of expenses - 13296348 rubles.

The calculation of the simplified tax system amount looks like this:

- We determine the tax base: 23976686–13296348 = 10680338 rubles.

- We determine the tax amount: 10680338 * 15% = 1602051 rubles.

- We calculate the minimum tax: 23976686 * 1% = 239767 rubles.

In accordance with the Tax Code of the Russian Federation, an individual entrepreneur must pay the larger of these amounts, that is, 1,602,051 rubles.

The procedure for calculating the simplified tax system assumes that the amount of tax payable must be greater than the minimum

Reports and taxes for simplified people. Null declarations

Basic changes affected the filling out of the main document according to which the corporate income tax is administered using the simplified tax system. The deadline for submitting tax reports under the simplified tax system in 2021 has not changed: quarterly, an enterprise or individual entrepreneur independently calculates payments and pays them to the budget. Confirmation of the correctness of the accrued fees is submitted once a year - until the end of the 1st quarter of the following reporting year. For individual entrepreneurs, the final submission of tax reports under the simplified tax system in 2018 has been extended by a month - the declaration can be submitted until April 30.

Organizations that accept reports from individual entrepreneurs and enterprises are also divided:

- LLCs submit reports at the place of registration of the company;

- Individual entrepreneurs submit tax reporting under the simplified tax system in 2021 at the place of registration of the merchant, even if the actual activity is carried out in another region of Russia.

The “simplified” declaration reporting forms were approved in 2018, and so far no changes have been made to them. Current forms for individual entrepreneur tax reporting on the simplified tax system in 2021 can also be downloaded on our website. If the business closes and the enterprise finally settles with the budget for taxes and duties, the declaration under the simplified tax system is submitted out of turn - before the 25th of the next month. So, an enterprise that closes in May submits its last simplified declaration by June 25, etc. After this, tax reporting when applying the simplified tax system 2021 is not submitted.

Sometimes the income received by an enterprise “knocks” the company out of the established limit, and the company loses the right to operate under a simplified taxation system. The loss of the right to work under the simplified tax system is accompanied by the submission of Form 26.2-2 of the Tax Code to the tax service - reporting under the simplified tax system in 2021 after exceeding the limit is prohibited.

If an enterprise has been idle for a whole year and has not conducted any business activities, the report is submitted without the calculated amounts - a so-called “zero” declaration is submitted to the Federal Tax Service. Zero reporting to the tax authorities under the simplified tax system in 2021 is submitted based on the results of the year in which the company did not transfer advance payments. Sometimes an explanatory note is submitted with the declaration, which explains the reasons for the inactivity of the enterprise. You can learn about tax reporting forms under the simplified tax system in 2021, including all changes, from Finabi consultants.

Maintaining accounting records and reporting on the simplified tax system

For individual entrepreneurs there is no obligation to maintain accounting records; instead, they keep tax records, and the tax return is filled out in accordance with it.

Organizations are required to maintain accounting records and prepare accounting (financial) statements. Companies must decide how to organize accounting, maintain accounting themselves, hire an accountant, or transfer it to a specialized company.

Enterprises that have switched to a simplified system have the right to carry out accounting in an incomplete volume . The tax office does not have the right to fine organizations for incorrect accounting of income and expenses. In addition, “simplified” payers are not required to submit financial statements to the Federal Tax Service inspection, which significantly simplifies the accounting procedure.

Features of accounting and reporting to the simplified tax system

Organizations using a simplified methodology are allowed to maintain simplified accounting records and generate simplified reporting. The company's annual financial statements using the simplified tax system are:

- balance sheet;

- income statement;

- report on the intended use of funds.

The balance is five lines in the asset and six lines in the liability. In the case when the balance sheet of an enterprise includes several sections, for example, assets are divided into non-current and current, in the simplified version no grouping is performed. There are only active and passive.

Table: simplified balance sheet indicators and codes

| Assets | Codes offered by the Ministry of Finance | Passive | Codes offered by the Ministry of Finance |

| Tangible non-current assets | 1150, 1155, 1160, 1140 | Capital and reserves | 1300 |

| Intangible, financial and other non-current assets | 1110, 1120, 1130, 1170, 1180, 1190 | Long-term borrowed funds | 1410 |

| Reserves | 1210 | Other long-term liabilities | 1450 |

| Cash and cash equivalents | 1250 | Short-term borrowed funds | 1510 |

| Financial and other current assets | 1230, 1240, 1260 | Accounts payable | 1520 |

| Other current liabilities | 1550 | ||

| Balance | 1600 | Balance | 1700 |

To reflect the financial results of a small enterprise, a simplified form has been established. A simplified statement of financial results contains only seven lines, including: “Gross profit (loss)”, “Profit (loss) before tax”, “Income from participation in other organizations”.

Table: indicators of the financial results statement in a simplified form and codes

| Indicator name | Codes offered by the Ministry of Finance |

| Revenue | 2110 |

| Expenses for ordinary activities | 2120, 2210, 2220 |

| Percentage to be paid | 2330 |

| Other income | 2340 |

| other expenses | 2350 |

| Profit taxes (income) | 2410, 2430, 2450 |

| Net income (loss) | 2400 |

With regard to the place and date of reporting, Law No. 402-FZ defines:

- Economic entities obligated to provide financial statements submit one legal copy of annual financial statements to the statistical government agency at the place of their legal registration.

- A mandatory copy of the prepared annual financial statements is provided no later than 3 months after the end of the reporting period. Annual reports must be submitted no later than 3 months after the end of the reporting year.

Tax accounting: form and filling rules, samples

Tax accounting is the responsibility of all companies, including those applying preferential conditions. Tax accounting is carried out in a simplified manner: the taxpayer records the data of financial and economic life in a single document - the book of income and expenses (KUDiR) . Individual entrepreneurs, as well as organizations, are obliged to ensure its maintenance. It is from the results in the books that the information is copied into the declaration, where the tax is calculated.

You need to fill out the book based on primary documents: cash receipt orders, invoices, and other information indicating the receipt of income or the assumption of expenses. Corrections, erasures, and factual errors are not permitted on official form.

Basic rules for conducting KUDiR:

- For each tax period, a new book of income and expenses is opened.

- Each operation is entered in chronological order on a separate line and confirmed by the appropriate document (agreement, check, invoice, payment order, etc.).

- Replenishing the account and increasing the authorized capital are not recognized as income and, accordingly, are not entered into the KUDiR.

- KUDiR can be used in paper or electronic form. When maintaining a book in electronic form, at the end of the tax period, KUDiR must be transferred to paper.

- The book must be laced, numbered and confirmed by the manager’s signature and seal (if any).

- Unfilled sections of KUDiR are also printed and stapled in the general order.

- In the absence of activity, profit or expenses, individual entrepreneurs and organizations must have zero KUDiR.

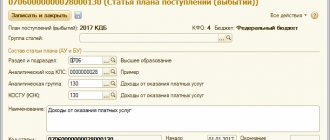

Photo gallery: sample of filling out KUDiR on the simplified tax system

Title page KUDiR

Section I (I and II quarter) KUDiR

Section I (III and IV quarter) of the Income and Expense Book

Help for Section I of the KUDiR of companies and individual entrepreneurs using a simplified taxation system

Section II KUDiR (filling sample)

Section III KUDiR of organizations and individual entrepreneurs using the simplified tax system

Section IV KUDiR of taxpayers using the simplified taxation system

Drawing up and submitting reports to the simplified tax system - features of the procedure, deadlines

The simplified taxation system (STS) is a tax regime that is aimed at reducing the tax burden on small and medium-sized businesses - to simplify tax and accounting records.

A simplified system was introduced by Federal Law No. 104-FZ of July 24, 2002. Submitting reports under the simplified tax system means submitting reporting forms to regulatory authorities according to established deadlines.

There are a number of peculiarities in the procedure for submitting reports to the simplified tax system, as well as in maintaining the records themselves. It is known that accounting under the simplified taxation system is less burdensome compared to the general taxation regime. In submitting reports to the simplified tax system

Income and expenses that affect the formation of the tax base are subject to accounting.

Application of the simplified tax system, which may be compatible with the single tax on imputed income

(UTII) does not fully exempt the organization from maintaining accounting records, and also retains the obligation to submit financial statements to the tax office.