Today we will talk about whether it is possible to assign remuneration to members of the HOA board in the form of a discount on the payment for the maintenance of common property in the apartment building. And if possible, how to do this - draw up a protocol or conclude an agreement?

Members of the HOA board participate in resolving partnership issues voluntarily without concluding any agreement. For the chairman of the HOA board, this is a regular activity, so usually the remuneration is paid only to him.

One of the obvious incentive options is preferential payment for the maintenance of the common property of apartment buildings. But how to make calculations without harming the budget?

The amount of remuneration for the chairman of the HOA board is approved at the general meeting of its members

Homeowners Association, in accordance with Part 2 of Art. 161 Housing Code of the Russian Federation, is one of three ways to manage an apartment building. Members of the partnership must be owners who have more than 50% of the total number of all votes in the house (Part 3 of Article 135 of the Housing Code of the Russian Federation).

The governing bodies of the HOA include the general meeting of the members of the partnership (hereinafter referred to as the GMS) and its board, at which the board of the partnership is elected (Part 3 of Article 147, Article 144 of the Housing Code of the Russian Federation). The chairman of the board is elected from among its members and must be the owner of the premises in the house. At the same time, the competence of the general meeting of HOA members also includes the issue of determining the amount of remuneration for members of the board, including the chairman.

When can the tax office charge additional VAT on maintenance work?

36480

Decision on payment of remuneration and bonuses

The Housing Code of the Russian Federation does not provide for other conditions for the appointment and payment of remuneration to members and the chairman of the board of the HOA, other than its size. At the same time, we believe that, by analogy with the payment of remuneration to members (chairman) of the house council, it is necessary to provide for the procedure and conditions for payment of remuneration, as well as the procedure for determining the amount of remuneration (clause 8.1 of Article 161.1 of the Housing Code of the Russian Federation).

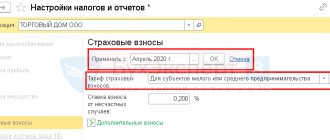

When choosing the amount of remuneration, you must understand that taxes and fees required by law must be paid on the amount received, so it is better to indicate that taxes are included in the amount of remuneration, or the amount of remuneration is fixed and the stipulated amount of taxes is collected from the owners in addition to the amount of remuneration.

The Sverdlovsk Regional Court came to an interesting conclusion in its appeal ruling dated September 2, 2014 in case No. 33-11033/2014. Thus, “a monthly collection of remuneration for the services of the chairman and members of the board of the partnership (including taxes) was approved in the amount of 3.03 rubles. / sq. m, of which the fee for remuneration of the chairman and members of the board of the partnership is 2.28 rubles. / sq. m, taxes - 0.75 rubles. / sq. m". Based on the above circumstances, the court of first instance concluded that the amount of remuneration for members of the board of the partnership, including the chairman of the board, was not actually established by the contested decision of the general meeting of members of the partnership. The panel of judges recognizes this conclusion as correct, since the amount paid by the members of the partnership to pay remuneration to the chairman and members of the board of the partnership may vary, since this amount is determined based on the area of the premises owned by the members of the partnership in a residential apartment building and depends on both the number of members of the partnership and and from their conscientious payment of such a fee, therefore, it is not possible to establish the amount of remuneration for the members of the board of directors of the partnership. Under such circumstances, the court of first instance came to the rightful conclusion that there were grounds to satisfy the claims regarding the recognition of the said decision of the general meeting of members of the partnership as illegal and the prohibition of charging a monthly fee for the remuneration of the services of the chairman and members of the board of the partnership in the amount of 3.03 rubles. / sq. m.

In the above ruling, the court pointed out that it is not enough to establish the amount that is paid depending on the area; it is necessary to indicate the actual amount of the remuneration. For example, not 1 ruble per square meter, but 1 ruble per square meter for a total of 10,000 rubles. Let us note that this position is quite controversial and is only the opinion of one of the courts of the subject.

It is possible to provide for the payment of bonuses based on performance. In the appeal ruling of the St. Petersburg City Court dated November 17, 2021 in case No. 33-23794/2016, the court sided with the chairman of the HOA on the issue of payment of bonuses - thus, “from the minutes of the meeting on issue 8 it follows that the HOA board has been given powers to results of the chairman’s work, pay him a one-time remuneration in the amount of no more than <...> rubles per quarter.” It should be noted that bonuses, their size, frequency and reasons for payment must also be provided for by a decision of the general meeting.

The relationship between the chairman of the board and the HOA is not always recognized as labor relations

The question of whether the relationship of the chairman of the board with the partnership is labor relations has been repeatedly considered by courts of various instances. There are two points of view in judicial practice:

- The Supreme Court of the Russian Federation, in its ruling dated June 24, 2019 in case No. 84-KA19-1, indicated that this is not an employment relationship.

The amount of remuneration to the head of the board is determined by the members of the HOA (clause 11, part 2, article 145 of the Housing Code of the Russian Federation). The owners who are on the board of the partnership cannot work there under an employment contract; this is prohibited by Part 3.1 of Art. 147 of the Housing Code of the Russian Federation, and the ban also applies to the chairman of the board of the partnership.

The Supreme Court of the Russian Federation unequivocally noted that the relationship of the chairman with the HOA is not of a labor nature, since:

- A homeowners' association is a form of self-organization of citizens for the management of common property.

- Members of the HOA board and its chairman, being the owners of premises in the house, act in the interests of all owners, including their own, and not in the interests of the employer.

There is no person in the HOA who could qualify as an employer, therefore the relationship of the chairman with the HOA cannot be considered labor - they do not meet the requirements of Art. Art. 20, 56, 57 Labor Code of the Russian Federation.

- The chairman of the board is bound to the HOA by an employment contract. This position is present, for example, in the decision of the Sixth Court of Cassation of General Jurisdiction dated December 18, 2020 in case No. 16 - 8547/2020.

The provisions of Art. 16 of the Labor Code of the Russian Federation determines that labor relations arise, in particular, as a result of election to a position. In accordance with Art. 17 of the Labor Code of the Russian Federation, such relations arise if the election presupposes the performance by an individual of a certain labor function.

The members and chairman of the board are elected at the PSC. Articles 148, 149 of the Housing Code of the Russian Federation assign certain functions to the chairman of the HOA in this elected position. Consequently, his work can be attributed to the labor activity of an individual, regardless of the fact of concluding the relevant contract.

On judicial practice on issues of taxation of income of self-government entities and homeowners' associations

89310

How is this reflected in the accounting records?

Since the performance of his functions by the chairman is in no way connected with the production and subsequent sale of any type of product, does not have labor relations, and is not related to the provision of services, purchase and sale of goods, no special acts are required to be maintained for this item of expenditure.

The accountant of the partnership issues remuneration to the head of the HOA as part of other expenses for maintaining the apartment building .

Important! If necessary, such preparation of documents can be justified by Article 11 of the Labor Code of the Russian Federation, since no employment contract was concluded with the Members of the Board and the Chairman of the HOA.

If any disputes arise regarding the calculation of remuneration to the chairman, you can seek advice from a lawyer . He will look at the situation specifically for a particular partnership and help you understand the current situation. In addition, if it is impossible to reach an agreement, members of the meeting have every right to choose a new head of the HOA without contacting other bodies.

The chairman of the HOA is responsible for fulfilling the requirements of the Tax Code of the Russian Federation

According to the provisions of Part 1, Part 3 of Art. 7 of the Federal Law of December 6, 2011 No. 402-FZ, accounting and storage of such documents are organized by the head of the organization. He is obliged to entrust accounting to the chief accountant or other official or to enter into an agreement with a contractor for the provision of such services.

Therefore, if the supervisory authority, during an inspection, records a violation of the norms of the Tax Code of the Russian Federation, including those expressed in the failure to include remuneration for members of the HOA board in the base for calculating insurance premiums, then the chairman of the partnership himself will be held accountable.

According to Art. 15.5 of the Code of Administrative Offenses of the Russian Federation, violation of the deadlines established by the Tax Code of the Russian Federation for submitting a tax return (calculation of insurance premiums) to the tax authority entails a warning or the imposition of an administrative fine on officials in the amount of 300 to 500 rubles.

There are examples in judicial practice when the chairman of the HOA board was punished for such a violation. For example, case No. A50-11151/2020 and the already considered case No. 16 - 8547/2020.

When can an official be paid for his efforts?

The chairman’s efforts can be paid in cases where they carefully fulfill a number of obligations . Among them:

- first, the chairman fulfills his duties in full and draws up an act of work performed on their basis;

- the document must specify the time frame of work, the amount of expenses, the final results and what the chairman himself directly did;

- after completion, the act is handed over to the members of the HOA board; if they cannot consider it at the moment, a decision and discussion on the document can be held at a house-wide meeting;

- after checking all the data, the percentage of remuneration is calculated from the amount of money spent, all management members and residents must agree with it;

- if it was not possible to reach an agreement, the certificate of work performed will be revised and carefully checked;

- after a positive decision, minutes of the meeting will be drawn up, according to which the chairman will be able to withdraw the payment assigned for his work from the current account of the partnership.

Important! The money is collected from a bank branch or from a regional operator, it all depends on where the partnership opened the account.

To receive a reward, you will need to provide a sheet of paper based on the results of the meeting .

Remember

An analysis of judicial practice and letters from the Federal Tax Service and the Ministry of Finance of Russia shows that an HOA should always include in the base for calculating insurance premiums the amounts of remuneration that are paid by decision of the OSCh to the chairman and/or members of the board of the partnership. This obligation is not affected by the absence of an employment or civil law contract concluded with these owners.

According to the legal position reflected in the rulings of the Constitutional Court of the Russian Federation dated 06.06.2016 No. 1169-O and No. 1170-O, insurance contributions for compulsory pension and health insurance form the financial basis for providing insurance coverage to insured persons. That is, imposing on the HOA the obligation to pay them is a guarantee of the implementation of the constitutional rights of the insured persons - the chairman and members of the board of the partnership.

Personal income tax

Is it necessary to pay taxes, even on non-material incentives? Yes, remuneration in the form of a discount on housing costs is taxable income of board members received in kind.

In this case, the HOA acts as a tax agent who performs the duty of calculating tax. The date of actual receipt of income will be considered the day of transfer of income in kind. As a rule, this is the last day of the month when rent for residential premises is calculated and the accounting reflects the write-off of part of the debt.

Since income is not paid in cash, personal income tax cannot be withheld. The HOA must provide taxpayers and the tax authority with data on the amounts of income and tax no later than March 1 of the following year - submit a certificate in form 2-NDFL (clause 5 of Article 226 of the Tax Code of the Russian Federation).

Thus, if at a general meeting of HOA members it was decided to award incentives to board members and exempt them from paying part of the costs of maintaining the common property:

- include the remuneration amount in the HOA cost estimate,

- calculate insurance premiums,

- calculate personal income tax and report the impossibility of withholding tax to the taxpayer and the tax authority.

In accounting, payments for living quarters to members of the board are calculated in accordance with the general procedure; their exemption from bearing part of the expenses is reflected by writing off part of the accrued fee as expenses. to enter into an agreement between the HOA and the board members if the board members are not on staff as board members.

0

Author of the publication

offline 1 day

Lack of separate accounting of target contributions

If the HOA collects money from residents for specific needs, for example, for the construction of a playground, it is necessary to draw up a separate estimate and approve it at a general meeting. It is necessary to organize separate accounting of the expenses of targeted contributions. Based on the results of the execution of this estimate, a report is drawn up, which displays information about savings or overspending of the target contribution. If savings are achieved, the rest of the money must be returned to the owners or a decision must be made at a general meeting to offset this amount against any item in the current budget. If there is an overspending, then it is necessary to make a decision at the meeting to raise the missing amount. If you do not keep separate records, tax authorities can recognize all receipts as income and tax them.

Lack of information from minutes of meetings and boards

The accountant must be aware of the decisions made by the general meeting and the board. For example, if the chairman of the HOA cannot enter into agreements above a certain amount without the approval of the board, then the accountant needs to know about this so as not to miss such an agreement.

Also, the accountant must have the right to vote in order to correctly evaluate decisions made from the point of view of tax legislation. Almost the only source of financing is contributions from owners. And if the owners consider themselves offended, they begin to write complaints to all authorities. One such owner with his complaints can paralyze the work of the HOA.

Incorrect accounting of fixed assets acquired through contributions

If a fixed asset was acquired through contributions, it is a common property. When registering such a fixed asset, you need to reflect the use of target funds:

- Dt 08 Kt 60;

- Dt 01 Kt 08;

- Dt 86 Kt 83 (86/Targeted funds used for the acquisition of fixed assets).

Depreciation is not charged on such fixed assets. Instead, depreciation is charged on off-balance sheet account 010.

When such fixed assets are disposed of, the following entry is made:

- Dt 83 (86/Targeted funds used for the acquisition of fixed assets) Kt 01.

Incorrect accounting of utility bills

Accounting for utility bills can be organized in one of two possible ways. Others are incorrect.

- Utility fees are not considered earmarked revenue. These are transit payments, and they need to be taken into account in account 76. Periodically, you need to display the difference between what was collected from the owners and what was paid to the resource supplying organization. If you collected more, this is a payable, and it must be returned to the owners or offset against future payments. If less, collect the difference from the owners.

- Payments for utilities are considered target revenues. Then it is taken into account in account 86.

The selected option must be specified in the accounting policy.

Wrong choice of taxation system

Taxes are imposed only on the HOA's business activities, which typically constitute a small portion of the association's overall activities. This mainly involves the leasing of space, penalties for late payment of housing and communal services, or the provision of services to owners by full-time employees of the HOA. As a rule, the most profitable option for taxing such activities is the simplified tax system. Therefore, already when creating an HOA, you need to take care to switch to the simplified tax system on time, otherwise you will have to keep complex accounting on the general system, pay more taxes and submit more reports. Of the two options for the simplified tax system for HOAs, it is better to choose the “Income” simplified tax system, because the expenses in the commercial activities of the HOA are insignificant.