Accounting for fixed assets under the simplified tax system is used to reduce the tax base. However, this is not always possible. The fact is that there are two versions of the simplified system.

Under the simplified tax system “Income”, accounting for fixed assets will not lead to a reduction in the taxable base. In this case, there are no costs necessary for tax purposes. Accordingly, under the simplified tax system “Income”, accounting of fixed assets can only be carried out to analyze the condition of assets. This information can be used to make management decisions. But using the simplified tax system “Income minus expenses”, accounting for fixed assets is very advisable. Let's take a closer look at it.

OS characteristics

Regulatory acts in force in the field of accounting establish certain characteristics that OS must comply with. Fixed assets are considered material assets:

- Intended for use over a long period (more than a year).

- Used for profit.

- Are depreciable.

- The cost of which is higher than the established limits. For accounting, the maximum price is fixed in the accounting policy and must be at least 40 thousand rubles, in tax accounting the figure is higher - no less than 100 thousand rubles.

In accounting under the simplified tax system, expenses for fixed assets (their purchase, modernization, improvement, additional equipment, reconstruction, repairs) are included in the taxable base, reducing it.

What can be considered basic assets?

When deciding whether this or that material (intangible) value belongs to the fixed assets of an enterprise, it is necessary to answer the key questions:

- Will this material (intangible) value be used in production, management activities, provision of services, performance of any work, or rented out?

- Will this tangible (intangible) value be used for more than 12 months?

- Will this material (intangible) value be assigned to the enterprise on a permanent basis?

- Is it possible for an enterprise to make a profit using this material (intangible) value?

If affirmative answers are received to all 4 questions, then this material value will certainly be classified as the organization’s fixed assets.

Posting

Using the simplified tax system, accounting and tax accounting of fixed assets is usually carried out by organizations. Typically, documentation is prepared in a simplified form, since enterprises are small. Individual entrepreneurs may not keep accounting records. Nevertheless, they still need to determine the cost of the operating system, since the indicators are used for tax purposes.

In accounting under the simplified tax system, fixed assets are accounted for at their original cost. If an entrepreneur maintains abbreviated reporting, then the objects are accounted for:

- At a cost formed from the price indicated by the supplier in the accompanying documents and installation costs when purchasing the OS.

- According to the amount of payment for services to the contractor - when creating the facility.

The remaining costs that arise when purchasing or creating an OS are written off as other costs.

If fixed assets are accounted for in full under the simplified tax system, the initial cost, in addition to the amounts indicated above, includes:

- Interest on the loan if payment is made with borrowed funds.

- Expenses for transport services.

- Consulting costs.

- Fees and duties (customs, etc.).

- Other expenses. These include, for example, the cost of traveling to purchase an OS.

If a counterparty (supplier, contractor) issues a VAT invoice to an enterprise, the tax is also included in the cost of the object, since business entities using the simplified tax system are not its payers.

Rules for drawing up a write-off act

This act is drawn up in a form that must be approved in the company’s accounting policies. To develop an act, you can use the recommended forms of primary accounting documents approved by Decree of the State Statistics Committee of the Russian Federation dated January 21, 2003 No. 7. These include the following forms:

- OS-4, intended for write-off of property (excluding vehicles);

- OS-4a, which is used when decommissioning vehicles;

- OS-4b, used for writing off a group of fixed assets (except for vehicles).

The act contains data relating to the fixed asset object, such as the date the object is reflected in accounting, the year of its creation, the date of commissioning, the initial cost, the useful life, the amount of depreciation, etc.

The act of writing off a fixed asset in accordance with clause 78 of Order No. 91n must be approved by the head of the company. A duly approved act is the basis for writing off an object in accounting and tax accounting and putting a mark on its disposal in the inventory card.

Nuances

When accounting for fixed assets under the simplified tax system, the commissioning of an object is carried out on the day when the necessary installation, testing, and commissioning activities are completed. After completion of such work, its initial cost is calculated.

The day the object is posted does not depend on the date of transfer of the documentation required for state registration of rights. It is determined by the fact of determining the initial status of the OS. This rule applies only to those objects that must be registered (real estate, for example).

To account for fixed assets under the simplified tax system, unified forms of documents are used. They are the act according to f. OS-1 and inventory card f. OS-6.

Results

Let's summarize the above:

- fixed assets on the simplified tax system are written off according to the general procedure; for this, a special commission must draw up a corresponding act, which is approved by the head of the company;

- recalculation of the tax base when writing off a fixed asset is not required, and this rule also applies to the case when objects that have been in use for less than 3 years are written off;

- expenses for the purchase of an object not taken into account in expenses cannot be attributed to expenses for the purposes of calculating the simplified tax;

- the cost of spare parts and materials generated during the dismantling of a fixed asset is the income of the simplifier; However, dismantling work cannot be included in expenses.

Read more about simplified fixed asset accounting in this article.

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Accounting for fixed assets under the simplified tax system: postings

For convenience, transactions and the accounts in which they are reflected are presented in the table.

| Fact of economic activity | db | CD |

| Reflection of the cost of purchasing or creating an object | 08 | 02, 70, 69, 10, 60 |

| Reflection of installation costs | 07 | 60 |

| Passing an object for assembly | 08 | 07 |

| Capitalization of an asset as a fixed asset | 01 | 08 |

The amount indicated in the last entry is the initial cost of the operating system, i.e. the total amount of all costs.

Useful life

In accounting under the simplified tax system, depreciation of fixed assets is accrued during the period of use of the object. It is determined by the Classifier, broken down into groups.

The period is reflected in the inventory card for the object.

Errors in writing off fixed assets

Errors, unfortunately, are quite common when writing off fixed assets. It must be remembered that these errors may be considered by supervisory authorities as a violation of the law with all the ensuing consequences.

- Error 1. Entrepreneurs do not indicate all fixed assets.

- Error 2. When writing off an object, lower expenses are indicated.

- Error 3. Incorrect accounting entries are indicated when writing off fixed assets.

These errors will be considered as a violation of the law, namely Article 120 of the Tax Code of the Russian Federation, with the involvement of appropriate sanctions

Depreciation

In accounting under the simplified tax system, deductions for the depreciation of an object can be made at different frequencies - once a quarter or a year. For inventory for economic or industrial purposes, write-off can be made immediately and in full upon receipt.

Depreciation begins in the month following the month the asset was accepted for accounting, and ends after the month in which the asset was written off. For the period of modernization, repair, reconstruction, conservation, re-equipment, accrual is suspended.

The table below shows the accounts used to reflect depreciation for different purposes of fixed assets.

| Purpose of the object | db | CD |

| Use for production of products | 20 | 02 |

| Operation for management purposes | 26 | 02 |

| Trade | 44 | 02 |

Tax accounting

When maintaining it, the moment the object arrives at the enterprise is of particular importance. The main remedy can be received either before the transition to the simplified tax system or during the application of this special regime.

A peculiarity of tax accounting is that fixed assets expenses are recognized after payment and provided that the object has already been capitalized and is being operated by the enterprise.

The allocation of fixed assets costs to expenses for taxation purposes is carried out in the year the facility is put into operation. Slightly different rules apply to real estate. Expenses for it are included in the taxable base only after state registration.

Another condition for tax accounting is that tangible assets must be depreciable.

The costs of modernization and re-equipment are reflected in the same way as the costs of acquiring and creating an object. In this case, one should be guided by the provisions of paragraph 3 of Article 346.16 of the Tax Code.

Expenses for the acquisition of fixed assets and intangible assets for tax accounting purposes under the simplified taxation system

According to clause 4 of Article 346.16 of the Tax Code of the Russian Federation, fixed assets and intangible assets include those assets that are recognized as depreciable property in accordance with Chapter 25 of the Tax Code of the Russian Federation.

Expenses for the use of fixed assets and intangible assets when applying the simplified taxation system are accepted in the following order (clause 3 of article 346.16 of the Tax Code of the Russian Federation):

- In relation to the costs of purchasing (construction, manufacturing) OS during the period of application of the simplified tax system :

- from the moment these OS are put into operation.

- In relation to acquired (created by the taxpayer himself) intangible assets during the period of application of the simplified tax system:

- from the moment these assets are accepted for accounting.

- In relation to acquired (constructed, manufactured) fixed assets, as well as acquired (created by the taxpayer himself) intangible assets before the transition to the simplified tax system, the cost of fixed assets and intangible assets is included in expenses in the following order:

In relation to fixed assets and intangible assets with a useful life of up to 3 years inclusive:

- during the first calendar year of application of the simplified tax system.

In relation to fixed assets and intangible assets with a useful life from 3 to 15 years inclusive:

- during the first calendar year of application of the simplified tax system - 50% of the cost,

- second calendar year – 30% of the cost,

- third calendar year – 20% of the cost.

In relation to fixed assets and intangible assets with a useful life of over 15 years :

- during the first 10 years of application of the simplified tax system in equal shares of the cost of the operating system.

At the same time, during the year, expenses are accepted for each quarter in equal shares .

If the simplified tax system is used by an organization from the moment of registration with the Federal Tax Service, the cost of fixed assets and intangible assets is accepted:

- at the original cost of this property, determined in the manner established for accounting .

If the taxpayer switched to the simplified tax system from other taxation regimes, the cost of fixed assets and intangible assets is taken into account in the manner established by clause 2.1 and clause 4 of article 346.25 of the Tax Code of the Russian Federation.

The useful life of assets is determined on the basis of the Decree of the Government of the Russian Federation dated January 1, 2002. No. 1 “On the Classification of fixed assets included in depreciation groups” in accordance with Article 258 of the Tax Code of the Russian Federation, classification of fixed assets included in depreciation groups.

The useful life of fixed assets that are not specified in this classification are established by the taxpayer:

- in accordance with the technical specifications or recommendations of manufacturers.

OS, the rights to which are subject to state registration in accordance with the law*, are taken into account in expenses:

- from the moment of documented fact of filing documents for state registration of these rights**.

*Ownership rights and other real rights to immovable things , restrictions on these rights, their occurrence, transfer and termination are subject to state registration in accordance with clause 1 of Article 131 of the Civil Code of the Russian Federation.

**Does not apply to operating systems put into operation before January 31, 1998.

The useful life of intangible assets is determined in accordance with clause 2 of Article 258 of the Tax Code of the Russian Federation.

If fixed assets and intangible assets are sold (transferred) before 3 years* have elapsed from the moment they were taken into account as expenses, the organization will have to recalculate the tax base for the entire period of use of such assets.

*For fixed assets and intangible assets with a useful life of over 15 years - before 10 years have expired from the date of their acquisition.

Recalculation is carried out according to the rules of Chapter 25 from the moment such assets are taken into account as expenses until the moment of their sale (transfer).

In this case, the company will have to pay not only the tax amount, but also penalties.

Note:

According to paragraph 4 of paragraph 2 of Article 346.17 of the Tax Code of the Russian Federation, expenses for the acquisition (construction, production) of fixed assets and intangible assets are reflected:

on the last day of the reporting (tax) period in the amount of amounts paid .

In this case, these expenses are taken into account only for fixed assets and intangible assets used in carrying out business activities.

The Ministry of Finance reminds us of this in its Letter dated November 5, 2013. No. 03-11-11/47086:

“According to paragraph 2 of Art. 346.17 of the Code, the costs of a taxpayer applying the simplified taxation system are recognized as expenses after they are actually paid.

Thus, expenses for the acquisition of fixed assets, in particular real estate, are accepted only after their actual payment, from the moment of its commissioning and, if necessary, from the moment of documented submission of documents for state registration of rights to fixed assets.

These expenses are reflected in tax accounting on the last day of the reporting (tax) period in the amount of amounts paid (clause 4, clause 2, article 346.17 of the Code).”

If a company applies the simplified tax system with the object of taxation “income” and decides to start construction/purchase of expensive real estate*, it makes sense to consider the possibility of changing the object of taxation to “income reduced by the amount of expenses” in order to accept the expenses incurred for tax accounting purposes.

*Please note that in accordance with clause 3 of Article 346.12 of the Tax Code of the Russian Federation, organizations whose residual value of fixed assets, determined in accordance with the legislation of the Russian Federation on accounting, exceeds 100 million rubles, are not entitled to use the simplified tax system.

At the same time, even if expenses (part of them) for the acquisition/construction of fixed assets were incurred before the company began to apply the object of taxation “income reduced by the amount of expenses”, they can still be taken into account for tax purposes.

Such clarifications were given by the Ministry of Finance in a Letter dated August 21, 2013. No. 03-11-06/2/34289:

“According to paragraphs. 1 clause 3 art. 346.16 of the Code, expenses for the reconstruction and modernization of fixed assets made during the period of application of the simplified taxation system are accepted from the moment these fixed assets are put into operation .

During the tax period, the above expenses are accepted for the reporting periods in equal shares.

Fixed assets, the rights to which are subject to state registration in accordance with the legislation of the Russian Federation, are taken into account in expenses from the moment of the documented fact of filing documents for registration of these rights (clause 3 of Article 346.16 of the Code).

According to paragraphs. 4 paragraphs 2 art. 346.17 of the Code, expenses for the reconstruction and modernization of fixed assets, taken into account in the manner provided for in paragraph 3 of Art. 346.16 of the Code are reflected on the last day of the reporting (tax) period in the amount of amounts paid. In this case, these expenses are taken into account only for fixed assets used in carrying out business activities.

Taking into account the above, an organization applying a simplified taxation system with the object of taxation in the form of income reduced by the amount of expenses, when determining the object of taxation, costs for the reconstruction and modernization of fixed assets are taken into account in the above order after putting these fixed assets into operation.

Expenses are also taken into account in a similar manner if the reconstruction (modernization) of a real estate property was started in the tax period in which the organization applied a simplified taxation system with the object of taxation in the form of income, and was completed during the period of application of the simplified taxation system with the object of taxation in the form of income reduced by the amount of expenses.»

Receipt of an object under the simplified tax system

For tax purposes, fixed assets are accepted at their original cost (as in accounting). It is transferred to expenses in equal shares throughout the year on the last day of each quarter. Depending on the time of capitalization of material assets, costs can be written off:

- In 1 sq. – at 1/4 of the cost at the end of the 1st quarter, half year, 9 months. and year;

- In the 2nd - 1/3 at the end of 6, 9, 12 months;

- In the 3rd – 1/2 at the end of 9, 12 months;

- In the 4th – the total amount at the end of the year.

How to write off operating system expenses in a simplified manner

The generated cost of fixed assets, for which the conditions for writing off as expenses are met, can be attributed there as follows:

- during the calendar year (when all conditions for write-off are met);

- in equal shares on the last day of each remaining quarter and the year itself.

Example

The OS facility was purchased and put into operation in May 2021. The cost according to the BU is 900,000 rubles. The following should be written off as expenses during 2021:

- 06/30/2021 – 300,000 rubles

- 09.30.2021 – 300,000 rubles

- 12/31/2021 – 300,000 rubles.

If the conditions for recognizing expenses (for example, the fact of commissioning) had been met only in the 4th quarter of 2021, the entire amount of 900,000 rubles would have been written off on December 31, 2021.

Expenses on an asset purchased in installments are taken into account in the same way. If the facility is already in operation, and payments for it are still in progress, there is no need to wait for the moment of full payment. In fact, partial amounts paid are accepted in the same way as full payments. For each payment, the last numbers of quarters remaining until the end of the year and equal shares for write-off are calculated and included in expenses.

Receipt of an object before the transition to the simplified tax system

If the capitalization of fixed assets occurred during the period when the enterprise used OSNO, write-off of expenses for taxation purposes is necessary in a different order.

At the end of December of the last year of operation of the organization under the main tax regime, the residual value of the object is taken into account. This indicator is reflected in column 8 of the Book of Accounting for Income and Expenses.

The method of transferring cost to expenses under the simplified tax system is influenced by the period of use.

If the period is less than 3 years, the entire cost for the year of operation established at the time of starting to use the simplified tax system is written off. 1/4 of the price is calculated and included in expenses on the last date of each quarter. For a period of 3-15 years, half the cost is written off during the first year (12.5% per quarter), in the second - 30%, in the third - 20%. If the period of use exceeds 15 years, write-off is carried out at 10% for 10 years.

How to take into account fixed assets on the simplified tax system for writing off as expenses

To take an asset into account as an expense, you need to follow the rules for its recognition in accounting and the formation of value (which can be written off in the future).

The cost of an asset in a simplified form is formed in the same way as the initial cost of a fixed asset according to accounting rules. That is, the cost of an object includes the purchase price (creation) and the cost of its delivery, assembly, adjustment and other activities that bring the object into a condition suitable for operation.

Don't forget about payment. If the expenses represent the payment of funds, we take them into account on the date of payment. If obligations are fulfilled differently (for example, by barter), we take into account payment at the time of closing the transaction from both parties.

If an organization uses a simplified accounting procedure, it is also possible to calculate the initial cost of fixed assets in a simplified manner. Let us recall the main points of the simplified order for the OS:

- The price can only include direct expenses for the purchase of an object or its creation (for example, payments to contractors). Other costs (for example, transportation or commissioning) can be taken into account immediately in the expenses of the period in which they were incurred;

- Discounts, bonuses, benefits provided by suppliers can be accepted as income for the period in which they are received, without adjusting the formed cost of capital investments;

- If the seller or contractor has provided a long deferment in payment and interest is not separately specified in the contract, they can not be separated from the contractual cost of the fixed asset. The capital investment includes the entire amount under the contract as if there had been no deferment.

Example

Let’s say an enterprise switched from OSNO to simplified tax system in 2021, and at the time of the transition it had a machine whose residual value at the end of December 2015 was 160 thousand rubles. The service life of the equipment is 5 years.

In 2021, only 50% of the cost is taken into account in expenses - 80 thousand rubles. This value must be divided into 4 equal parts. Each of them is 20 thousand rubles. – written off on the last day of the corresponding quarter.

In 2021, 48 thousand rubles will be transferred to expenses. – 30% of the remaining price. This amount should also be divided into 4 equal parts (12 thousand rubles). In 2021, 32 thousand rubles will be written off. This is 20% of the residual value. The amount is also divided into 4 parts and 8 thousand rubles are written off at the end of each quarter.

How to show write-off of OS in accounting registers

Information that the cost of the operating system is included in expenses is entered into the KUDiR.

To decipher the conditions and procedure for accepting expenses for fixed assets, the book has a special section II. It will need to be filled out for each quarter, on the last day of which they were written off as expenses for fixed assets.

Data from section II is transferred to section I for the corresponding quarter. In the amount accepted as expenses for the quarter, as of its last date. Thus, the result from writing off fixed assets will be summed up with other expenses and taken into account when calculating the advance payment for the quarter or payment for the year.

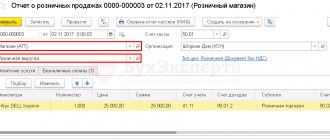

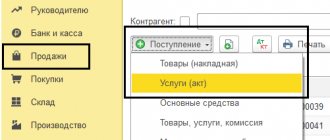

Accounting for fixed assets using the simplified tax system in 1C

As mentioned above, in order to accept an object for registration, it must be purchased and put into operation. To recognize expenses in tax accounting, it is necessary to record the fact of payment for the purchase.

To reflect a purchase transaction in the program, you need to open the “Purchase” tab and create a “Receipt of Products and Services” document. “Equipment” is selected as the type of operation. In the tabular section you need to indicate the nomenclature, quantity and cost of the purchased item. The “Account” column is entered as 08.04.

To reflect the payment, a payment order is filled out.

On the day the OS is put into operation, the “Acceptance for Accounting” document is drawn up. In addition to general information about the object, it contains two tabs. The first is accounting, and the second is tax accounting. If the accountant is well versed in the specifics of recording information, he will be able to fill out all the fields correctly. In this case, accounting operations (accounting and tax) in the program will be automatically performed when posting the “Period Closing” document.

Let's say an enterprise purchased a computer worth 25 thousand rubles. The object was put into production use on February 12, 2010. Accordingly, the document “Acceptance for accounting” should contain the same date.

In the “OS” tab, you must specify the name of the asset. It must be assigned an inventory number. In addition, the account from which the fixed assets were written off is indicated (08.04). Next, the type of operation performed on the object is indicated. This will be “Acceptance for accounting with subsequent commissioning.” Next, the method of reflecting depreciation costs is determined, and the appropriate account is indicated to which depreciation amounts will be written off.

Particular attention should be paid to the “Tax Accounting” tab. In the “Cost” field (expenses for the simplified tax system) of the object, the full amount of the initial price of the asset should be indicated. The amount and dates of payments actually made for the fixed asset are reflected separately in the corresponding columns. If the cost of the equipment has been fully repaid, then the entire amount (for example, the same 25 thousand rubles for a computer) can be recognized as expenses.

The most important thing when reflecting fixed assets is to correctly enter information in the “Procedure for including items in expenses” field. The program will offer to include it in expenses or depreciable property or not include it in expenses. If the OS was purchased for a fee, the period of its use exceeds a year, and the cost exceeds 20 thousand rubles, it is classified as depreciable property.

In the “Accounting” tab, you should indicate the accounts on which the accounting and depreciation calculation operations will be taken into account, and the method for calculating it. The enterprise may not be limited to the common linear method. Here it is necessary to assess the situation. It is likely that it is more convenient to calculate depreciation using the reducing balance method using an acceleration factor.

If the OS is purchased in installments, the costs for it are subject to write-off in the amount actually transferred to the seller.

Fixed assets purchased during the period of application of the simplified tax system

To include in expenses the cost of fixed assets acquired during the period of application of the simplified tax system, they must be paid for, put into operation and used to generate income. If a company acquired (built, manufactured) fixed assets while already working on a simplified basis, then it must take them into account as expenses at their original cost.

The initial cost of fixed assets must be determined according to accounting rules. This is stated in paragraph 3 of Article 346.16 of the Tax Code. Consequently, the initial cost of fixed assets is recognized as the sum of the company’s actual costs for the acquisition, construction and production, with the exception of VAT and other refundable taxes (clause 8 of PBU 6/01), and the costs of bringing fixed assets to actual readiness for operation.

Read also “Cost of fixed assets under the simplified tax system”

Expenses for the acquisition of fixed assets

The actual costs for the acquisition, construction and production of fixed assets are:

- amounts paid in accordance with the contract to the supplier (seller), as well as amounts paid for delivering the object and bringing it into a condition suitable for use (transportation of the fixed asset to the place of its use, installation costs);

- amounts paid to organizations for carrying out work under construction contracts and other contracts;

- amounts paid to organizations for information, consulting and intermediary services related to the acquisition of fixed assets;

- customs duties and customs fees;

- non-refundable taxes, state duties paid in connection with the acquisition of fixed assets;

- other costs directly related to the acquisition, construction and production of fixed assets.

You can write off the initial cost as expenses from the moment the paid fixed assets are put into operation.

Expenses for the acquisition of fixed assets are accepted in equal shares throughout the year, starting from the reporting period in which such expenses were incurred (see letter of the Ministry of Finance of Russia dated November 17, 2006 No. 03-11-04/2/244). EXAMPLE.

HOW TO WRITE OFF THE COST OF ASSEMBLY PURCHASED UNDER THE STS A company using the simplified tax system (“income minus expenses”) purchased a fixed asset – a passenger car worth 300,000 rubles. The car was paid for on April 25, and put into operation on April 28 of this year. The entire cost of the car can be included in expenses in the current year. There are still 3 quarters left before the end of the tax period (year) (including the quarter of acquisition of fixed assets). The share of the cost of the car included in expenses for each quarter will be 33.3% (100%: 3), and the amount will be 100,000 rubles. (RUB 300,000 × 33.3%). On the last day of each of the 3 quarters of the current year, the cost of the car will be included in expenses. Thus, a company can include only 1/3 of the costs in its expenses for the second quarter, that is, 100,000 rubles. An organization can also include 100,000 rubles in expenses for the third and fourth quarters.

note

If an object is purchased and put into operation in the last quarter of the tax period, then its full cost will be written off as expenses in the last month of this quarter.

Depreciation bonus under simplified tax system

An organization under the general tax regime can write off part of the initial cost of fixed assets as expenses immediately in the period in which it begins to depreciate them in tax accounting (clause 9 of Article 258 of the Tax Code of the Russian Federation). This depreciation procedure is called “bonus depreciation.” Its size for fixed assets from the third to seventh depreciation groups is 30% of the original cost, and for the rest - 10%.

A company can apply a depreciation bonus if it purchased a fixed asset, created it, modernized it, completed construction, retrofitted it, or technically re-equipped an existing facility.

But if the fixed asset was put into operation during the period of work on the simplified taxation system, then when switching to the general taxation system, the depreciation bonus can no longer be applied (letter of the Ministry of Finance of Russia dated April 27, 2021 No. 03-11-06/2/25443).

Accounting for fixed assets costs when changing the object of taxation

Organizations and entrepreneurs who apply the simplified tax system with the object of taxation “income” and switch to the object of taxation “income minus expenses” do not take into account expenses related to tax periods when the object of taxation “income” was applied (clause 4 of article 346.17 of the Tax Code of the Russian Federation).

But this rule does not apply to the situation when a “simplifier”, who has replaced the object of taxation “income” with the object “income minus expenses”, acquires fixed assets. In this case, he can take into account the costs of acquiring fixed assets after putting them into operation, regardless of the previously applied object of taxation. This opinion was expressed by the Russian Ministry of Finance in letter dated June 21, 2021 No. 03-11-11/36120.

Expenses for modernization and reconstruction of OS under the simplified tax system

Modernization and reconstruction are usually understood as improving the quality characteristics of a fixed asset (for example, increasing its capacity, service life, etc.). Completion and retrofitting is a change in the technological or service purpose of equipment (buildings, structures) associated with increased loads or other new qualities (for example, an increase in the usable area of the building).

“Simplers” can take into account the costs of completion, additional equipment, reconstruction, modernization and technical re-equipment of fixed assets in expenses.

These expenses are recognized from the moment the fixed asset is put into operation, regardless of whether it was acquired after the transition to a special regime or before such a transition (clause 1, clause 3, article 346.16 of the Tax Code of the Russian Federation). This refers to the commissioning of a fixed asset after completion and payment of the relevant work on completion, reconstruction, modernization, etc. (letter of the Ministry of Finance of the Russian Federation dated January 28, 2008 No. 03-11-04/2/14).

These expenses must be written off evenly until the end of the year in which the reconstruction, completion, technical re-equipment, etc. work is completed. Only paid expenses can be accepted and reflected on the last date of each quarter.

EXAMPLE.

HOW TO WRITE OFF THE COST OF A RECONSTRUCTED Fixed Asset UNDER THE STS A company using the simplified tax system (“income minus expenses”) reconstructed a fixed asset in June of this year. In the same month, the main facility was put into operation. The reconstruction costs amounted to 90,000 rubles, they were fully paid. In this case, the company’s accountant must take into account reconstruction costs of 30,000 rubles on June 30, September 30 and December 31. (RUR 90,000: 3).

According to financiers, the costs of preparing project documentation for the reconstruction and modernization of fixed assets are expenses that increase the initial cost of such objects. They are also taken into account in equal shares throughout the year, starting from the moment the reconstructed fixed assets are put into operation, and are reflected in accounting on the last day of each quarter.

Expenses are taken into account in a similar manner if the reconstruction of the facility was started in the period when the company used the “income” object, and was completed in the period when the “income minus expenses” object was used.

But costs in the form of fees for connecting reconstructed power receiving devices to existing electrical networks cannot be taken into account in “simplified” costs (letter of the Ministry of Finance of the Russian Federation dated August 21, 2013 No. 03-11-06/2/34289).

Costs for purchasing real estate under the simplified tax system

Ownership of some fixed assets is subject to state registration with the Federal Service for State Registration, Cadastre and Cartography (Rosreestr). If a company applying the simplified tax system has purchased real estate, then the costs of its purchase can be recognized only after the documented fact of filing documents for state registration. Of course, by this time all other conditions must be met (payment and commissioning). Transactions with land and with certain types of movable property (cars, equipment for the production of alcoholic beverages, etc.) must also be registered.

For comparison: in relation to general-regime companies, the provisions on the need to submit documents for state registration to begin calculating depreciation (for the purpose of calculating income tax) have been cancelled. The exception is fixed assets put into operation before December 1, 2012, the rights to which are subject to registration. Depreciation without filing documents for state registration for such objects is prohibited.

“Simplers” also have the right to take into account expenses for the reconstruction and modernization of fixed assets from the moment of the documented fact of filing documents for state registration (letter of the Ministry of Finance of the Russian Federation dated December 9, 2013 No. 03-11-06/2/53652). Expenses are recognized in the period in which a set of conditions are met:

- the object has been paid for;

- the facility was put into operation;

- there is documentary evidence of the fact of filing documents for registration of rights to this object.