Today, car leasing without purchase is no longer as popular as regular rental of movable property with subsequent re-registration to the client. Indeed, in the second case, the buyer’s costs are fully justified, and the overpayment with this option for purchasing a vehicle is minimal. Therefore, most car enthusiasts choose to rent a car with the possibility of its further privatization. We will find out in the article how to complete such a deal and whether it will be possible to close it ahead of schedule.

Features of the purchase of leased cars

The main goal pursued by all sellers of movable property is to obtain financial income. If the lease is repaid early, the client does not have time to pay the entire amount in excess of the cost of the car specified in the contract, which is why the leasing company is left with virtually no profit.

To reduce the likelihood of a deal being canceled before its original expiration date, lessors often resort to the following measures:

- Imposing a moratorium on early debt closure (usually such a restriction lasts no longer than a year);

- An increase in the redemption value of the leased property by 1000 - 2000 rubles for each month remaining until the end of the contract (on average, in this situation, the movable property rises in price by 20 - 40 thousand rubles);

- Accrual of additional costs for expenses incurred by the lessor company (this measure is applied in the absence of a moratorium and the possibility of increasing the redemption price of the vehicle).

It is important to know! The listed problems with early repayment of leasing occur quite often, since for owners of rental property this is the only way to receive their income. Therefore, it would be a good idea to prepare in advance for the occurrence of the mentioned difficulties, saving yourself from senseless overpayment.

Reasons for early redemption

There are many reasons that force you to close a deal ahead of schedule. Most often, debtors resort to early redemption of the leased asset for the following reasons:

- The emergence of available funds to repay the debt (such a transaction must take place by prior agreement with the lessor company);

- The need for urgent re-registration of movable property in the name of the buyer (while the car is in rent, the lessee cannot register it in his name under any circumstances);

- The client needs to change the terms of use of the vehicle taken into temporary possession (the contract clearly states the rules for operating the vehicle during the rental period and its redemption price. These data can only be changed if the agreement is canceled early).

Less often, the reason for early repayment of debt is the client’s personal circumstances. But regardless of the grounds, the termination of the transaction will occur strictly according to a single algorithm.

What is redemption value

Many lessees ask the same question - what is the redemption value of a car and how does this value affect the early closure of the debt. The answer to this will be as follows: when drawing up a contract, the seller of movable property indicates the initial price of the rental vehicle, taking into account all overpayments by the client on monthly installments. It is this amount that is called transactions or the redemption value of the vehicle.

In case of early repayment of the debt, the buyer makes only part of the established overpayment during the time the agreement was in force. And this is 5-7% less money than the lessee had to give to the seller during the entire transaction. Therefore, the lessor increases the BC of the car in order to receive his initial income.

News

The second part of the issue examines current problems of accounting for leasing operations for lessees and lessors: the formation of the initial cost and determining the useful life of the leased asset, replacement of the lessee, and insured events. 1. Initial cost of the leased item. There are two positions for determining the initial cost of the leased asset when reflected on the lessee’s balance sheet: without taking into account leasing interest and taking into account leasing interest. 1.1. Formation of the initial cost of the leased asset when accounting for property on the lessee's balance sheet for accounting and tax accounting purposes. In tax accounting, the initial cost of property should be determined based on the amount of the lessor's expenses for the acquisition of property. In accounting, there are two options for forming the initial cost of the leased asset. Option 1: The initial cost of the leased asset is determined as the amount of the leasing agreement excluding VAT. Rationale: Order No. 15 of the Ministry of Finance of the Russian Federation, clause 8 - the cost of the received property is equal to the cost of the costs associated with receiving the property, the costs also include interest. Order of the Ministry of Finance of the Russian Federation dated 02.17.1997 N 15 (as amended on 01.23.2001) “On the reflection in accounting of transactions under a leasing agreement” { ConsultantPlus } PBU 6/01 clause 8 - the initial cost of a fixed asset includes all the actual costs of the organization for acquisition, construction, production of fixed assets, excluding VAT. Option 2: The initial cost of the property is determined without taking into account leasing interest. Rationale: analogy with bank interest, when when purchasing property through a loan, the initial cost does not include interest on the loan agreement. The cost of the same type of property acquired from different sources should not differ significantly. If interest is included in the initial cost, a difference arises in the value of the property when reflected on the balance sheet of the lessor and the lessee, i.e. the value of the property depends on the balance holder. Leasing interest is the cost that the lessee will incur in the future and which may change significantly during the lease agreement. According to PBU 6/01 clause 8, the value of property should be determined based on the actual costs incurred. 1.2. If leasing interest is included in the initial cost of the leased asset, how is the change in the value of the property reflected when the contract amount changes (for example, an increase/decrease in leasing interest)? How in this case is the contradiction with PBU 6/01 resolved, according to which the initial cost of fixed assets is not subject to change? In tax accounting, changing the amount of the leasing agreement does not affect the initial cost of the property. In accounting, two options are possible: Option 1: When the amount of the leasing agreement changes, the difference with the initial amount of the agreement is reflected as other income/expenses and the entire remaining term of the agreement is evenly written off to costs/profit. Option 2: Since clause 14 of PBU 6/01 applies to assets that the organization not only owns and uses, but also disposes of, and the lessee does not dispose of the leased property (for example, cannot sell it), the initial value of the property can be changed when the amount of the leasing agreement changes. The lessee can choose one of two proposed accounting options, and the corresponding position must be reflected in the company’s accounting policy. 1.3. How to take into account the lessee's expenses incurred in relation to the leased property, aimed at bringing the property to a state suitable for use for accounting and tax purposes? Accounting. If the property is taken into account on the balance sheet of the lessee, the initial cost of the leased asset includes costs associated with bringing the property to a condition suitable for use (PBU 6/01 clauses 7 and 8). If the property is accounted for on the lessor's balance sheet, then expenses are classified depending on their type: • expenses for the acquisition of any asset can be accounted for as a separate item as part of fixed assets; • works and services are written off as expenses classified as expenses incurred to generate income. Letter from the Ministry of Finance dated February 3, 2012 N 03-03-06/1/64 proposes to write off these expenses during the term of the leasing agreement. Question: The LLC, as part of its activities, purchased a vehicle on lease. According to the leasing agreement, the balance holder of the leased asset is the lessee. The amount of leasing payments does not include the costs of delivering the vehicle, which are at the expense of the lessee. How should the lessee's expenses for the delivery of leased equipment be taken into account in the income tax base: as a one-time expense on the basis of Art. 264 of the Tax Code of the Russian Federation, in equal shares during the term of the leasing agreement, or included in the initial cost of the vehicle in accordance with Art. 257 of the Tax Code of the Russian Federation? (Letter of the Ministry of Finance of the Russian Federation dated 03.02.2012 N 03-03-06/1/64) { ConsultantPlus } Tax accounting. Since the initial cost of the property is formed by the lessor (clause 1 of Article 257 of the Tax Code of the Russian Federation), the lessee's expenses are not included in the initial cost of the property. They can be taken into account for profit tax purposes provided they meet the criteria of Art. 252 of the Tax Code of the Russian Federation (Letter of the Ministry of Finance dated January 20, 2011 N 03-03-06/1/19). Expenses can be accounted for as a separate item of fixed assets or as deferred expenses and written off over the term of the leasing agreement. Question: ...Under a leasing agreement, the LLC received equipment (induction steel-smelting electric furnace). The equipment is accounted for on the lessor's balance sheet. The LLC installed the equipment on its own in a rented premises (foundry). To install the equipment, a project was made for the technical re-equipment of the premises and an examination of its safety was carried out. The LLC equipped the premises with a ventilation system, carried out electrical work, and installed a cooling system. After the preparatory work, the supplier carried out commissioning work. How to take into account for income tax purposes the costs of design work, examination, supply and installation of a ventilation system, electrical installation work, installation of a cooling system, and commissioning work? (Letter of the Ministry of Finance of the Russian Federation dated January 20, 2011 N 03-03-06/1/19) { ConsultantPlus } 1.4. How to account for inseparable improvements to property if they are not reimbursed by the lessor? Accounting. Inseparable improvements are included by the lessee in the composition of its own fixed assets in the amount of actual costs incurred (clause 47 of the Regulations on accounting and financial reporting in the Russian Federation, approved by Order of the Ministry of Finance of Russia dated July 29, 1998 N 34n, paragraph 2, clause 5 of the Regulations on accounting “Accounting for fixed assets” PBU 6/01). For the specified amount, a separate inventory card is opened or adjustments are made to the inventory card of the upgraded OS object. Depreciation is accrued monthly for the specified object. (clauses 17, 18, paragraph 2, 5 clause 19, clause 21 PBU 6/01). In this case, the accelerated depreciation rate cannot be applied to the specified fixed asset item. Tax accounting. Inseparable improvements to the leased asset are recognized as depreciable property (paragraph 4, clause 1, article 256 of the Tax Code of the Russian Federation), and are depreciated during the term of the lease agreement according to the standards established by the classification of fixed assets. 2. The useful life of the leased asset in accounting and tax accounting when accounting for property on the balance sheet of the lessee. Currently, there are differences in determining the useful life of the leased asset in accounting and tax accounting. In accordance with PBU 6/01, the useful life of an object of fixed assets is determined by the organization independently, based on the terms of use of the object, incl. based on the rental period. In accordance with the Tax Code, the useful life is determined in accordance with the classification of fixed assets; it is possible to use an accelerated depreciation rate of up to 3. Letters from the Ministry of Finance and the Tax Inspectorate on this issue state that the useful life of an object in both accounting and tax accounting should be determined based on the classification of fixed assets, without taking into account the accelerated depreciation rate using the straight-line depreciation method. The courts support the same position. 2.1. How to determine the useful life of a leased asset in accounting? When the property is returned at the end of the leasing agreement to the lessor, the useful life can be established based on the term of the leasing agreement. When the ownership of property is transferred at the end of the leasing agreement to the lessee, the useful life is determined in accordance with the classification of fixed assets (Resolutions of the Federal Antimonopoly Service of the Russian Federation dated June 3, 2010 N A29-9910/2009, FAS UO dated December 10, 2007 N F09-10017/07-C3 ). It is recommended to indicate the procedure for determining the useful life in the Accounting Policy. If the Accounting Policy does not contain relevant information, the useful life can be determined using the Classifier of fixed assets. The Accounting Policy may also establish a useful life equal to the term of the leasing agreement, but even in this case, disputes with the tax office are possible. Question: ...Under the terms of the leasing agreement, at the end of the leasing period, the lessee buys the leased asset. The expected lifespan is 37 months. The period of actual use of the fixed asset is 24 months. Is it possible to set a useful life of 13 months when purchasing a leased asset for accounting purposes and calculating income tax? (Expert Consultation, 2010) { ConsultantPlus } Question: An organization buys a leased asset for 11,800 rubles, including VAT. The period of actual use of this fixed asset is equal to the useful life determined by the Classification of fixed assets approved by the Government of the Russian Federation. How to determine the useful life of a fixed asset when purchasing a leased asset for accounting purposes and calculating income tax? (Expert Consultation, 2010) { ConsultantPlus } Question: Does the lessor, when accepting the leased asset for accounting purposes, have the right to establish a useful life equal to the term of the leasing agreement, provided that upon expiration of the agreement the transfer of ownership of the leased asset to the lessee is provided? (Letter of the Department of Tax Administration of the Russian Federation for Moscow dated October 17, 2003 N 23-10/2/58256) { ConsultantPlus } 3. Calculation of accelerated depreciation of fixed assets In accordance with the Law “On Leasing” (Article 31) and the Tax Code (subparagraph 1 of paragraph 2 of Article 259.3) the balance holder of the leased asset has the right to apply accelerated depreciation with a coefficient of up to 3 in relation to the leased property. However, there is a limitation: the accelerated depreciation rate does not apply to property belonging to the first – third depreciation groups (i.e., with a useful life of more than 1 year to 5 years). When applying an accelerated depreciation factor, the current depreciation rate is multiplied by an increasing factor. In this case, the coefficient can be selected in the range from 1 to 3 and take not only integer values, but be equal to, for example, 1.5; 1.63; 2,3, etc. 3.1. The accelerated depreciation method for leasing has a number of advantages: 3.1.1. Reducing property taxes when using the accelerated depreciation mechanism. When using accelerated depreciation of fixed assets, their residual value will decrease much faster than when calculating depreciation using the usual method. In addition, the complete write-off of fixed assets when using accelerated depreciation with a coefficient, for example, 3, is carried out three times faster. All this allows you to significantly reduce the amount and period of payment of property tax when using the accelerated depreciation method. 3.1.2. Reduction of income tax during the period of the leasing transaction when using the accelerated depreciation method.

The documents presented in the digest are included in the ConsultantPlus System.

The procedure for purchasing the leased asset

Early redemption of leased cars must take place by prior agreement with the seller, and only according to the established algorithm. Namely:

- The client, based on his financial situation, calculates the approximate date for making a single payment on the debt, with the aim of premature cancellation of the transaction;

- The buyer notifies the lessor of his intentions in writing, 1-2 weeks before repayment of the remaining debt;

- In the absence of a moratorium imposed by the seller, the purchaser of the vehicle carries out the transaction, taking into account additional taxes for early termination of the transaction (if any are specified in the agreement).

It should be noted that the redemption value of movable property does not change if the transaction is closed prematurely. Therefore, before announcing to the client the final amount of the debt, the seller is obliged to recalculate the lease, writing off funds from the buyer only for the period of validity of the contract.

Regulatory regulation

Depending on the terms of the agreement (clauses 1-2 of article 624 of the Civil Code of the Russian Federation, clause 1 of article 19, clause 1 of article 28 of the Federal Law of October 29, 1998 N 164-FZ):

- the leased property becomes the property of the tenant upon expiration of the lease term or before its expiration, subject to the tenant paying the entire redemption price stipulated by the agreement (if this is expressly stated in the agreement);

- The parties have the right to enter into an additional agreement, establishing in it the conditions for early redemption.

The redemption price of the leased asset is determined by agreement of the parties (Article 421 of the Civil Code of the Russian Federation, clause 1 of Article 424 of the Civil Code of the Russian Federation, clause 1 of Article 485 of the Civil Code of the Russian Federation).

Will there be a recalculation?

As with the early repayment of the loan, and with the premature closure of a transaction for the lease of movable property with further repurchase, the borrowing company assumes the responsibility to write off the interest accrued in the name of the client after the cancellation of the agreement. But unlike a bank, the lessor also reserves the right to refuse such a service to the buyer if he does not notify the lessor of his intentions in advance.

Moreover, the provision on recalculation of the redemption value is specified in the leasing agreement. And therefore, from the point of view of the law, the organization that issued a car to a person for temporary use with subsequent re-registration will be absolutely right. And the driver will have no choice but to cover the original price of the car, taking into account interest over the entire rental period.

Transfer of payment to the lessor

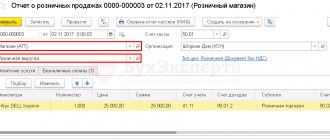

Repayment of debt to the lessor is reflected in the document Write-off from the current account transaction type Payment to the supplier in the Bank and cash desk - Bank statements section.

Please indicate:

- Amount - the amount under the additional agreement on early repurchase (in our example - RUB 2,210,880);

- Expense item - Acquisition, creation, modernization and reconstruction of non-current assets (in our example, the entire amount is the redemption value of the fixed assets).

Postings according to the document

The document generates the posting:

- Dt 60.02 Kt - advance payment transferred to the lessor.

Features of accounting for early repurchase

After the early purchase of the leased asset from the lessee, the entry of “entries” into the accounting records of the lessor company will directly depend on whose balance sheet the movable property was listed on. Let's consider a specific example: a car was sold under a contract, remaining registered in the name of the organization, and not in the name of the buyer. At the same time, the price of the car is 100 thousand rubles, and its residual value reaches 300,000 rubles.

In such a situation, a larger value is entered into the summary as an independent payment covered by the purchaser of the vehicle on the day of cancellation of the transaction. Data on the premature repurchase of a vehicle is transmitted to the Federal Tax Service to assess additional tax on the client.

Advice! Thus, the lessor cancels the agreement, saving himself from further payment of duties, and gives the driver the opportunity to re-register the car in his name.

Entry into leasing in 1C 8.3

Capitalization of the leased asset

Enter the document Acceptance of leasing . To do this, go to the section OS and intangible assets .

Fill it out according to the transfer documents. The settlement account and VAT will be set automatically; changing them is not recommended.

In the Total the total amount under the contract should be formed, check it.

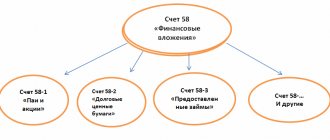

By default, subaccounts of account 76.07 “Rent payments” are used.

Postings

Reflection on the balance sheet of equipment accepted for leasing

In the same section, enter the document Acceptance for accounting of fixed assets.

Specify the method of receipt - Under a leasing agreement , then fill in the name of the counterparty and its agreement. By selecting these settings, you will be able to specify the Initial cost of equipment in NU from the lessor’s book value, and leasing payments will be determined automatically for this equipment.

The remaining fields are filled in as standard.

Next, determine whether depreciation is required.

Costs of leasing payments are reflected as part of other (indirect) expenses in NU, so for them select an article whose type of expense Other expenses .

Postings

The difference between the cost in BU and NU will be reflected in Dt 01.K: this is the part of the cost that is not depreciated in NU.

Account Dt 01.K is closed when the costs of leasing payments are recognized. The account will be closed completely upon redemption of the leased property.

Things to remember

Before covering the debt to the lessor before the end of the transaction period, the client is obliged to notify the seller of his intentions. This is the golden rule, the observance of which will save you from a crazy overpayment on the cost of the purchased car. Also, timely waiver of the moratorium imposed at the time of filling out the contract will help reduce the risk of paying taxes for the entire period of validity.

If the lessor does not agree to such conditions, then in this case the buyer has two options: find another vehicle supplier or come to terms with the restrictions imposed on him, partially saving himself from a meaningless overpayment. Well, don’t forget about the timely re-registration of movable property in your name. Otherwise, the car may remain on the company’s balance sheet, even after the purchaser has paid its cost in full.

We learned how the leased asset is purchased from the lessee. In conclusion, it remains to add that for maximum peace of mind, it is better for the client to contact a legally savvy person for advice. Indeed, in case of incorrect actions, the buyer risks being left without money and without movable property.

Adjustment of the value of leased property in NU

The initial cost in the NU of the OS that has become its own is the redemption price of the leased property. In the future, it is recognized as expenses through the calculation of depreciation (clause 1 of Article 256 of the Tax Code of the Russian Federation, clause 1 of Article 257 of the Tax Code of the Russian Federation).

Analyze the report Balance sheet for account 01 with selection by fixed asset - leasing object. Indicators - BU and NU.

In the program, account 01 in the accounting system reflects the initial cost of the fixed assets, taking into account all leasing (rental) payments. In connection with the decrease in the lease obligation, the difference between the cost of the used book and the standard for it decreases, accordingly. Therefore, you need to reduce the balance in account 01.K on the date of conclusion of the agreement using the Transaction document entered manually in the Transactions .

Please indicate:

- Debit - 000 “Sub account”;

- Loan - 01.K “Adjustment of the value of leased property”; Subconto 1 - leasing OS.