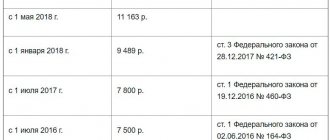

The minimum wage in Russia will increase to 11,163 rubles from May 1, 2021. As a result, there is an alignment of two previously different indicators - the subsistence minimum (LM) and the minimum wage (minimum wage). The law has already been signed by the President of the Russian Federation, but Federal Law No. 41 itself will come into force in the last month of spring. By the way, this is not the first increase in 2018. Since the beginning of the year, the minimum wage has increased to 9,489 thousand rubles.

Experts agree that the changes made will have almost no impact on people's wages and living standards. The changes will be felt only by those workers who received the minimum allowable income. Hospital payments and benefits depend more on the size of the minimum wage, but individual rules also apply here.

What is the essence of such an increase? How will it affect the incomes of ordinary citizens? Why do you need PM at all? We will consider these and other points in the article.

Once again about salary changes

As noted, the increase in the minimum wage from the beginning of May 2021 will have almost no effect on people’s salaries. This parameter is conditional. For an employer, the minimum wage is the amount below which it is prohibited to pay a person working at 100% full-time. But even in this case, the employer can be cunning and reduce costs. One way is to transfer the person part-time or change the work schedule - from a five-day to a three-day work week. As a result, wages are reduced, and it is difficult to undermine from the legal position.

The main parameter in determining wages is not even the minimum wage, but the minimum wage, which is typical for a certain region of the Russian Federation. But this rule does not always work and does not apply to all employees.

What is the minimum wage

This is the value that is used to calculate the amount of various benefits, taxes and fines . It is also the amount that the employer is obliged to pay the employee for a full working month.

When issuing an amount that is less than the minimum wage, the employee can file a complaint with the State Tax Inspectorate or the prosecutor's office. As a result, the employer will be held administratively or criminally liable.

Today the minimum wage determines:

- minimum wage for a full month worked;

- the amount of social benefits;

- the amount of fines to the Federal Tax Service and other government organizations;

- the amount of tax contributions of employers.

Many budget and commercial organizations work with this value. Therefore, its growth inevitably leads to higher prices on the domestic market.

Purpose of the minimum wage

If increasing the parameter does not affect anything, why do we need a minimum wage at all? This indicator is used when calculating the amount of basic benefits:

- When going on sick leave.

- Baby care (up to 1.5 years).

- For pregnancy and childbirth.

An exception is the presence of the required length of service or earnings exceeding the minimum established indicator. In other words, if a person receives a salary above the lower threshold and has a long experience, not the minimum wage, but the average income for the last months is used to calculate social payments. With a salary of 20-30 thousand rubles, the approved changes will not affect the amount of payments in any way.

If a citizen of the Russian Federation is not employed or receives an amount less than the minimum wage, the innovation is important for him - from May 1, 2018, he will be credited with a larger amount. As for mothers receiving child benefit, an increase in the minimum wage does not affect the amount of payments. This is due to the fact that the calculation uses the minimum wage that was in place on the day of going on vacation. The increase will be felt only by those who take maternity or parental leave after the law comes into force.

What should an employer do?

Despite the fact that the minimum wage as of May 1 has not yet been approved by law, the employer now needs to begin preparatory work in order to comply with the law. It is necessary to review the staffing table in order to identify positions that pay less than the minimum wage. It is worth noting that the minimum wage does not consist only of mandatory payments. The sum of all payments is taken into account. For clarity, let's look at an example.

Example 1.

All department employees work full time. Salary per month according to the staffing table in 2021 is:

| FULL NAME | Salary | Bonus for experience | Additional payment for increased volume of work | Total |

| Ivanov A.A. | 5 000,00 | 1 000,00 | 2 000,00 | 8 000,00 |

| Petrov N.N. | 7 000,00 | 500,00 | 3 000,00 | 10 500,00 |

| Sidorov E.P. | 10 000,00 | 1 500,00 | 5 000,00 | 16 500,00 |

Let's create an analytical table:

| FULL NAME | Salary for January | Minimum wage | Missing funds to comply with the minimum wage from January 1 |

| Ivanov A.A. | 8 000,00 | 9 489,00 | 1 489,00 |

| Petrov N.N. | 10 500,00 | 9 489,00 | — |

| Sidorov E.P. | 16 500,00 | 9 489,00 | — |

| Total | 1 489,00 |

The table shows that in order to comply with the minimum wage in the period from January to April 2021, the employer must additionally accrue Ivanov 1,489.00 rubles per month. To do this, it is not at all necessary to increase the salary; it is enough to pay the missing amount in the form of a bonus or financial assistance, for example. The legislation does not require that the staffing table provide for a monthly wage fund in the amount of the minimum wage

Now let’s look at the wages of these same employees in light of the May increase in the minimum wage

| FULL NAME | Salary for May | Minimum wage | Missing funds to comply with the minimum wage from January 1 |

| Ivanov A.A. | 8 000,00 | 11 163,00 | 3 163,00 |

| Petrov N.N. | 10 500,00 | 11 163,00 | 663,00 |

| Sidorov E.P. | 16 500,00 | 11 163,00 | — |

| Total | 3 826,00 |

As you can see, now not only Ivanov, but also Petrov needs to pay extra to the minimum wage. The total additional labor costs will be 3,826.00 per month.

Now let's look at an example where employees work part-time.

Example 2

Salaries of employees according to the staff schedule

| FULL NAME. | Bid | Salary | Additional payment for experience | Total | Salary taking into account the rate (column 5 x gr.2) |

| 1 | 2 | 3 | 4 | 5 | 6 |

| Gavrilova N.V. | 0,75 | 6 000,00 | 1 000,00 | 7 000,00 | 5 250,00 |

| Terentyev I.G. | 0,5 | 6 000,00 | 1 000,00 | 7 000,00 | 3 500,00 |

The table shows that wages even for a full-time employee (RUB 7,000.00) are below the minimum wage. How much should these employees be paid up to the minimum wage? Proportional to the borrowed rate. Simply put, from January to April Gavrilova should receive at least 7,111.50 rubles (9,489.00 rubles x 0.75 rates), and Terentyev - at least 4,744.50 rubles (9,489.00 rubles x 0.5 rates), and from May - 8,372.25 and 5,581.50 rubles, respectively (11,163.00 x 0.75 and 11,163 x 0.5).

Let’s conclude what an employer needs to do in order not to “run into” a fine

| Necessarily | Not necessary |

| Check monthly total accrued wages for each employee | Review staffing |

| Pay the amount missing up to the minimum wage (in the form of bonuses, financial assistance and other incentive payments) | |

| Be aware of changes in the regional minimum wage, as there is a possibility that the regional minimum wage will be increased compared to the federal one |

Why equalize the monthly wage and minimum wage?

The reason for this government action is because of a promise that was made long before the changes were made. Taking into account the innovations, it is planned that the lower wage threshold will increase annually, starting in May 2018. The minimum wage parameter is equal to the monthly minimum wage for the 2nd quarter of last year. Thus, the minimum wage in 2019 will be equal to the monthly minimum wage for the 2nd quarter of 2018.

As for social payments, the approach here is more honest. Before the changes were made, the cost of living was 11,000 rubles, and benefits were paid based on 7,000 rubles. In practice, PM is more important than the minimum wage threshold. For example, alimony payments, additional payments to pension accruals, as well as payments for the 1st and 2nd child depend on the subsistence level.

Why is the minimum wage needed?

The minimum wage is the smallest amount of payment for people working under an employment contract, provided that they have worked out the fixed standard duration of work per month.

It is enshrined in legislation by special acts and is used in regions throughout the country. Compliance with it is the responsibility of the employer. If the administration determines the amount of earnings for an employee below the current minimum wage, then, if this fact is discovered, it will be held accountable. In addition, the company will remain obligated to review this salary for the employee even if it is punished for this.

There is a federal minimum wage and a regional one. The latter is determined independently by the authorities of the subject of the federation on the basis of the prevailing working conditions in the region. It cannot be assigned below the federal level. The regional minimum wage must be observed in the territory of the entity that established it. Today, regional minimum wages are established in 85 constituent entities of the federation.

Regulatory acts determine that the minimum wage must be used when calculating sick leave benefits in certain situations, which are financed both by the employer and by using Social Insurance Fund funds. This provision also applies to maternity benefits.

On May 1, the multi-stage procedure for bringing together the minimum wage and the subsistence level will end. Before this, it was assumed that this step would take place from May 1, 2021, and the minimum wage from January 1, 2021 in Russia was increased by another amount. However, by decision of the President of the country, the equalization was completed a year ahead of schedule. The minimum wage from May 1 will be determined at RUB 11,163.00.

In subsequent years, the minimum wage will be recalculated strictly to the subsistence level, which was established for the second quarter of the previous year. If a decrease in value is recorded, the minimum wage value will be fixed at the previous level.

Attention! At their core, the minimum wage and the living wage are completely different concepts. If the first determines what minimum salary is required to be paid to employees, then the second characterizes the general standard of living in the country.

How is the cost of living determined?

The PM is calculated quarterly, and now this indicator is equal to the minimum wage. But not everything is clear here, because PM is divided into four categories and is determined for a specific population group. As for the lower threshold of wages, it is provided for one of the categories - able-bodied citizens. When calculating the cost of living, the consumer basket is taken into account - a list of goods (goods and services) that are necessary to cover needs. For example, the annual “ration” for one person is:

- Eggs - 210 pieces.

- Meat - 58 kg.

- Fruits - 60 kg and so on.

Each region of the Russian Federation has an individual PM. In this case, the calculation of additional payments to pensions is carried out taking into account local standards. This also applies to alimony paid in a “fixed” amount. In addition, when determining the right to legal assistance, the regional PM is taken into account, and not the state minimum wage. For a better understanding, here are the cost of living figures for the 3rd quarter of 2017:

- For Moscow - 18,453 rubles.

- For St. Petersburg - 11,868 rubles.

- For Khabarovsk - 13,807 rubles.

- For Tula - 10,194 rubles.

Few people know, but PM can not only increase, but also fall. This trend manifests itself at the state and regional level. As for the minimum wage, this parameter is not adjusted downwards.

What is the penalty for paying wages to employees below the established minimum wage?

The amount of the fine for non-compliance with the minimum wage is regulated by the Code of Administrative Offenses of the Russian Federation, Part 6, Art. 5 clause 27 and amounts to:

- If the penalty is imposed on an official - from 10 to 20 thousand rubles.

- If the protocol is drawn up for the organization as a legal entity - from 30 to 50 thousand rubles.

- If an individual entrepreneur violates it - from 1 to 5 thousand rubles.

If the violation is committed for the first time, there is a chance that you will get off with a warning, but if the violation is detected again, the amount of sanctions will increase:

- Official – 20-30 thousand rubles

- Legal entity – 50-100 thousand rubles

- Individual entrepreneur – 10-30 thousand rubles.

But that's not all. If earnings below the minimum wage were paid for two months or more, the issue of the manager’s selfish motives will be considered. This already provides for criminal liability (Clause 2 of Article 145.1 of the Criminal Code of the Russian Federation).

Punishment in case of proof of such intent:

- a fine of 100 to 500 thousand rubles or in the amount of the total income of the perpetrator for a period of 1 to 3 years;

- or forced labor for up to 3 years, with removal from office and a ban on engaging in certain types of activities;

- or imprisonment for up to 3 years.

As you can see, everything is quite serious.

What will happen to contributions for individual entrepreneurs, and what should employers do?

The change will not affect entrepreneurs, because from the beginning of 2021, insurance premiums have been fixed, and they do not depend on changes in the minimum wage threshold. The Tax Code of the Russian Federation indicates how much individual entrepreneurs must pay until 2021.

As for employers, they are obliged to pay employees a salary not lower than the established minimum wage, taking into account the norms in force at the regional level. The comparison is made before personal income tax is deducted. If an employer ignores legal requirements, sanctions may be imposed in the form of a fine.

If the company employs people who receive the minimum wage, from May 1 it will be necessary to plan an increase in expenses - for salaries and contributions.

Minimum wage in Russia from May 1, 2021: regional aspect

In the territory of certain constituent entities of the Russian Federation, increased minimum wage values may apply (Article 133.1 of the Labor Code of the Russian Federation). This is possible if a regional agreement has been drawn up. Everyone who joined it is obliged to be guided by the regional minimum wage, and not the federal one. In order to maintain priority for the federal minimum wage limit, enterprise managers must, within a month after the publication of the text of the regional agreement, send a refusal to join in writing to the labor authority in their region.

For example, Moscow has set its own minimum wage - from May 1, 2021, the value of this indicator is 18,742 rubles. and corresponds to the cost of living in the city (Resolution No. 663-PP dated September 12, 2017, issued by the Moscow Government).

To approve the regional minimum wage, a tripartite agreement must be signed, the parties to which are:

- governmental body of a constituent entity of the Russian Federation;

- unification of trade union structures in the region;

- a united body of employers in a specific constituent entity of the Russian Federation.

If increasing coefficients or regional bonuses are used in the region, they are calculated in excess of the minimum wage and are not included in it.

What should ordinary workers do?

People who work and receive a salary do not need to do anything, because the minimum wage and minimum wage do not depend on them. The changes do not affect most payments at all. But one point is worth taking into account. So, when going on sick leave, it is prohibited to violate the regime. If you take risks, even with a large salary, you can lose money due to accrual of sick leave according to the minimum wage. If the patient comes a day later than the doctor said, this is a violation. If there is a good reason, it is important to ask the doctor to make a note accordingly on the certificate.

Minimum wage in 2021 for calculating sick leave

Payment for sick leave, taking into account MPOT, is made if, on average, over the two years preceding going on sick leave, the employee received less than 11,163 rubles per month.

or, if his insurance period does not exceed six months. In other cases, according to Federal Law No. 255, MPOT does not affect the amount of sick leave .

The insurance period is considered to be the period of work of the employee, which was accompanied by the payment of taxes to the Pension Fund.

Minimum wages in the regions

After the changes, the federal minimum wage became higher than some regional ones; now organizations that pay people wages that are less than 11,163 rubles are required to accrue it according to the required figures. If the new amendment is ignored, an employer operating in the Russian Federation will be required to pay a fine, which can reach an amount of 50 thousand rubles. After the change, regional authorities have the right to set their own minimum wage. The minimum wage in certain territories may differ greatly from the general federal value, but should not be less.

Allowances and bonuses are not included in the accrued amount, since these values are not constant, and may be present in one month and not in another. Many workers are interested in how an increase in the minimum wage will affect their wages. Basically, massive changes in wages will not be observed, because all regional minimum wages are significantly higher than the federal one. Employers must adhere to this value if the employee has worked the standard required by the work schedule for a month.

Cost of living for 2021 by region - table

| Region | Year | Per capita | For the working population | For pensioners | For children |

| Adygea | 2018 | 8975 | 9590 | 9343 | 7365 |

Altai Republic | 2018 | 10025 | 10491 | 8349 | 10107 |

| Amur region | 2018 | 11099 | 11795 | 9313 | 11463 |

| Arhangelsk region | 2018 | 11932 | 13011 | 9965 | 11766 |

| Astrakhan region | 2018 | 9518 | 10009 | 7657 | 10325 |

| Republic of Bashkortostan | 2018 | 8611 | 9187 | 7061 | 3433 |

| Belgorod region | 2018 | 3371 | 9302 | 6953 | 8233 |

| Bryansk region | 2018 | 9732 | 10428 | 8365 | 9619 |

| The Republic of Buryatia | 2018 | 10036 | 13439 | 7957 | 10537 |

| Vladimir region | 2018 | 9739 | 10594 | 3177 | 9731 |

| Volgograd region | 2018 | 9319 | 9665 | 7313 | 9219 |

| Vologda Region | 2018 | 10718 | 11578 | 3842 | 10520 |

| Voronezh region | 2018 | 8563 | 9271 | 7165 | 3424 |

| Jewish autonomous region | 2018 | 12422.38 | 13122 | 9933.62 | 13067.19 |

| The Republic of Dagestan | 2018 | 9463 | 9121 | 7442 | 9645 |

| Transbaikal region | 2018 | 10782.97 | 11254.32 | 8552.36 | 11205.34 |

| Ivanovo region | 2018 | 10145 | 10993 | 3459 | 10143 |

| The Republic of Ingushetia | 2018 | 8975 | 9274 | 7038 | 9145 |

| Irkutsk region | 2018 | 10226 | 10358 | 3240 | 10338 |

| Kabardino- Balkarskaya Republic | 2018 | 10570 | 10999 | 8538 | 11593 |

| Kaliningrad region | 2018 | 10920 | 11710 | 8960 | 10526 |

| Republic of Kalmykia | 2018 | 8765 | 9179 | 7039 | 3837 |

| Kaluga region | 2018 | 1С028 | 10306 | 3423 | 9941 |

| Kamchatka Krai | 2018 | 19378 | 20275 | 15345 | 20342 |

| Karachay-Cherkess Republic | 2018 | 9052 | 9534 | 7329 | 9296 |

| Kemerovo region | 2018 | 9561 | 10132 | 7681 | 9995 |

| Kirov region | 2018 | 9627 | 10286 | 7849 | 9859 |

| Komi Republic | 2018 | 12539 | 13420 | 10235 | 12614 |

| Krasnodar region | 2018 | 10143 | 10964 | 8377 | 9773 |

| Republic of Crimea | 2018 | 9803 | 10481 | 8035 | 10423 |

| Kurgan region | 2018 | 9699 | 10371 | 8035 | 10127 |

| Kursk region | 2018 | 8878 | 9549 | 7363 | 8847 |

| Leningrad region | 2018 | 9533 | 10147 | 8319 | 9356 |

| Lipetsk region | 2018 | 8699 | 9356 | 7275 | 8885 |

| Magadan Region | 2018 | 17963 | 18852 | 14131 | 18985 |

| Mari El Republic | 2018 | 9366 | 9989 | 7656 | 9673 |

| The Republic of Mordovia | 2018 | 8280 | 8898 | 6805 | 8562 |

| Moscow | 2018 | 16160 | 18453 | 11420 | 13938 |

| Moscow region | 2018 | 11865 | 13146 | 8918 | 11522 |

| Murmansk region | 2018 | 14483 | 15097 | 12073 | 14861 |

| Nenets Autonomous Okrug | 2018 | 21049 | 22117 | 17151 | 22135 |

| Nizhny Novgorod Region | 2018 | 9370 | 10065 | 7715 | 9717 |

| Novgorod region | 2018 | 10447 | 11349 | 8661 | 10361 |

| Novosibirsk region | 2018 | 10913 | 11590 | 8772 | 11272 |

| Orenburg region | 2018 | 8706 | 9218 | 7121 | 8907 |

| Oryol Region | 2018 | 9554 | 10251 | 7923 | 9553 |

| Penza region | 2018 | 8783 | 9465 | 7246 | 9058 |

| Perm region | 2018 | 10098 | 10804 | 8279 | 10289 |

| Primorsky Krai | 2018 | 12397 | 13054 | 9916 | 13458 |

| Pskov region | 2018 | 10763 | 11671 | 8888 | 10589 |

| Rostov region | 2018 | 9784 | 10407 | 7909 | 10264 |

| Ryazan Oblast | 2018 | 9544 | 10324 | 7928 | 9478 |

| Saint Petersburg | 2018 | 10791.60 | 11868.20 | 8612.20 | 10403,20 |

| Saratov region | 2018 | 8750 | 9402 | 7206 | 9003 |

| The Republic of Sakha (Yakutia) | 2018 | 16559 | 17586 | 13326 | 16873 |

| Sakhalin region | 2018 | 13617 | 14311 | 10776 | 14453 |

| Sverdlovsk region | 2018 | 10183 | 10865 | 8421 | 10492 |

| Sevastopol | 2018 | 10284 | 11020 | 8432 | 10803 |

| Republic of North Ossetia (Alania) | 2018 | 9129 | 9651 | 7400 | 9357 |

| Stavropol region | 2018 | 8604 | 9144 | 6968 | 8884 |

| Tambov Region | 2018 | 8738 | 9485 | 7323 | 8692 |

| Republic of Tatarstan | 2018 | 8669 | 9269 | 7109 | 8521 |

| Tver region | 2018 | 10261.84 | 11050.61 | 8507.21 | 10706.39 |

| Tomsk region | 2018 | 11219 | 11829 | 8953 | 11553 |

| Tula region | 2018 | 9498 | 10194 | 8137 | 9310 |

| Tyva Republic | 2018 | 9894 | 10257 | 7805 | 10343 |

| Tyumen region | 2018 | 10900 | 11487 | 8711 | 11140 |

| Udmurt republic | 2018 | 9340 | 9574 | 7344 | 9130 |

| Ulyanovsk region | 2018 | 9619 | 10326 | 7889 | 9821 |

| Khabarovsk region | 2018 | 12954 | 13807 | 10492 | 13452 |

| The Republic of Khakassia | 2018 | 9538 | 10079 | 7671 | 9974 |

| Khanty- Mansi Autonomous Okrug (Ugra) | 2018 | 14475 | 15632 | 11857 | 14260 |

| Chelyabinsk region | 2018 | 9520 | 10185 | 7865 | 9830 |

| Chechen Republic | 2018 | 9542 | 9844 | 7924 | 9520 |

| Chuvash Republic | 2018 | 8779 | 9303 | 7134 | 8916 |

| Chukotka Autonomous Okrug | 2018 | 19930 | 20396 | 15306 | 20899 |

| Yamalo-Nenets Autonomous Okrug | 2018 | 16069 | 16711 | 12638 | 15810 |

| Yaroslavl region | 2018 | 9560 | 10469 | 7747 | 9648 |

Taking into account the fact that the minimum wage is now equal to the subsistence level, including in the regions, these indicators do not always have to correspond to each other. In particular, certain regional regulations stipulate that the minimum wage in the region should be higher than the subsistence level - for example, be 1.2 parts of it in some cases.