Documents confirming the provision of services

Without evidence, it is difficult to confirm that the service was provided.

Therefore, we recommend that after execution of the contract, you draw up a document that will prove that you have fulfilled the conditions and the customer is satisfied with the result. The following are evidence of service provision:

- Certificate of provision of services or certificate of acceptance. This is the main evidence. It indicates exactly what services are provided.

- Performer's report. You can include in the service agreement a condition that the contractor must submit a report on the services provided. And even if there is no such condition, you still have the right to submit a report. This document certainly does not confirm the provision of services, but it will be taken into account along with other evidence.

- Correspondence with the performer. It is also indirect evidence that the service has been provided. Together with the executor's report, it can convince the court of your good faith. Correspondence can be in different forms, for example, on social networks, by email, or by regular mail.

The act of providing services

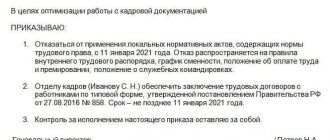

The document is drawn up in any form. In accordance with paragraph 4 of Art. 421 of the Civil Code of the Russian Federation, you can think through the form yourself. In the main service agreement, you can agree on the form in advance.

Most often, the document is drawn up by the contractor and handed over to the customer for signing.

The act should indicate the following information:

- Title of the document (for example, “Certificate of Services Rendered”).

- Date of compilation.

- Data about the customer (full name, address, if the customer is an individual or individual entrepreneur, or name, legal address, OGRN, if this is a legal entity).

- Data about the contractor, in the same volume as data about the customer.

- Data about the main agreement (for example: name, date of conclusion, number).

- Type and volume of services provided. The more detailed, the better, so that you can understand exactly what service was provided, completely or not.

- Price of services, with or without VAT.

- Information about identified deficiencies in the provision of services, if they were identified.

The deed is signed by both parties to the transaction.

“ConsultantPlus” has ready-made solutions, including how to draw up an act of provision of services. If you don't have access to the system yet, sign up for a free trial online. You can also get the current K+ price list.

Performer's report

This document, like the act, is drawn up in any form, since the legislation does not regulate the procedure for filling it out. However, please note that if the main service agreement stipulates how the report should be prepared, you must follow these rules. The contract may contain the form of this document.

The report states:

- The name of the document, for example: “Report of the contractor on the performance of the service.”

- Date of compilation.

- Link to the service agreement (date, number).

- The name of the service provided and the scope of its provision or a list of services provided.

If there are documents confirming the provision of the service, they are provided in the appendix.

Answer

The provision of services is documented with primary documents. Primary document - any document that is the basis for an accounting entry, recognition of income or expense in tax accounting. Examples: invoice, act, accounting certificate, advance report, PKO and RKO.

Each primary document must contain the following mandatory details:

- Title of the document;

- date of document preparation;

- name of the economic entity that compiled the document;

- content of the fact of economic life;

- the value of the natural and (or) monetary measurement of a fact of economic life, indicating the units of measurement;

- the name of the position of the person (persons) who completed the transaction, operation and is responsible (responsible) for the correctness of its execution, or the name of the position of the person (persons) responsible for the accuracy of the execution of the event;

- signatures of the named persons indicating their surnames and initials or other details necessary to identify these persons.

However, the organization providing services upon receipt of payment must use CCP. Except for the cases specified in Article 2 54-FZ “On the use of cash register systems”.

Therefore, when receiving payment for tire fitting and wheel painting services from individuals, the organization must issue a cash receipt receipt.

If the payment comes from an individual entrepreneur, then in this case the cash register is not used when making non-cash payments, with the exception of payments made using an electronic means of payment with its presentation.

If tire fitting services are provided by an individual entrepreneur and he does not have employees, then such an entrepreneur may not use the cash register until 07/01/2021.

Documents confirming payment for services

It is necessary not only for the contractor, but also for the customer to confirm the execution of the contract for the provision of services. It is necessary to prove that payment was made in full within the terms established by the contract. Various documents can serve as confirmation, depending on whether the customer is a legal entity or an individual.

Document confirming payment for services by non-cash method

In this case, it is easier to prove the fact of payment, since you will still have bank documents about the transaction. In addition, an act of services rendered or a cash receipt, if issued, will help confirm the provision of services.

Document confirming payment for services in cash

If the customer is an individual, payment for services will be confirmed by:

- Receipt from the contractor confirming receipt of funds in full.

- Cash receipt, if the performer has a cash register.

If the customer is a legal entity, payment for services can also be confirmed by:

- Cash order for the issuance of money to a representative of the organization.

- A cash book in which you indicate that you gave the employee cash.

- A check or other document issued by the contractor.

- Advance report.

- Accounting documents.

In both cases, the fact of payment for services can be confirmed by an act of services rendered. It also indicates that the services have been paid in full.

What documents must be provided to clients? №4 (129) 2013

The editors have received a request to answer this question, and we will be happy to tell you what needs to be provided to clients under different taxation systems.

Cash receipts

First, let's talk about receiving money from clients.

Money can come to you either in cash or by non-cash means.

If the funds arrived to you by non-cash means, then the confirming document for you will be a bank statement, and for the client - a payment order signed by the head of the LLC or the entrepreneur himself. With non-cash payments, you do not confirm the fact of payment to the client in any way, because the money has already come to you.

The second way to receive money is cash. In this case, it is important who your client is and what tax system you are on. This will determine what document you give to the client as confirmation of receipt of funds.

The process of receiving cash is regulated by Federal Law No. 54-FZ of May 22, 2003 “On the use of cash register equipment when making cash payments and (or) payments using payment cards.” Article 2 of this law lists all the cases when a cash register can be used, when it can not be used, and when strict reporting forms (hereinafter referred to as SSR) can be used, or a sales receipt can be issued.

The first case is if you provide services to the public. Services to the public mean a list of services that are listed in the All-Russian Classifier of Public Services (OKUN). Then you can issue a strict reporting form to the client – an individual. Please note that if you provide the same service not to an individual, but to an organization or entrepreneur, then you will have to issue a cash receipt.

The second case is if you are generally exempt from using a cash register in the cases specified in Article 2 of Law No. 54-FZ. When selling goods, works and services, you may not use cash register equipment or write anything out to customers. But if they ask, you can voluntarily issue a sales receipt to the individual. What are these cases? And they are not that common. This:

– sale of newspapers and magazines, as well as related products at newsstands, provided that the share of sales of newspapers and magazines in their turnover is at least 50 percent and the range of related products is approved by the executive authority of the constituent entity of the Russian Federation. Accounting for trading revenue from the sale of newspapers and magazines and from the sale of related products is carried out separately;

– sale of securities;

– sale of lottery tickets;

– sale of travel tickets and coupons for travel on public transport;

– providing meals to students and employees of secondary schools and equivalent educational institutions during school hours;

– trade in markets, fairs, exhibition complexes, as well as in other territories designated for trade, with the exception of shops, pavilions, kiosks, tents, auto shops, auto shops, vans, container-type premises and other similarly equipped premises located in these places of trade and ensuring the display and safety of goods of trading places (premises and vehicles, including trailers and semi-trailers), open counters inside covered market premises when selling non-food products;

– small-scale retail trade in food and non-food products (with the exception of technically complex goods and food products that require certain storage and sale conditions) from hand carts, baskets, trays (including frames protected from precipitation, covered with plastic film, canvas, tarpaulin) ;

– sale of tea products in passenger carriages of trains in an assortment approved by the federal executive body in the field of railway transport;

– trade in kiosks of ice cream and soft drinks on tap;

– trade from tanks in beer, kvass, milk, vegetable oil, live fish, kerosene, waddling vegetables and melons;

– acceptance of glassware and waste materials from the population, with the exception of scrap metal;

– sale of objects of religious worship and religious literature, provision of services for conducting religious rites and ceremonies in religious buildings and structures and on the territories related to them, in other places provided to religious organizations for these purposes, in institutions and enterprises of religious organizations registered in in the manner established by the legislation of the Russian Federation;

– sale at nominal value of state postage stamps (postage stamps and other signs applied to postal items) confirming payment for postal services.

Also, organizations and individual entrepreneurs located in remote or hard-to-reach areas (with the exception of cities, regional centers, urban-type settlements) specified in the list approved by the government authority of a constituent entity of the Russian Federation may not use cash register equipment; they may make cash payments and (or) payments using payment cards without the use of cash register equipment. In each region, such a list of settlements has been approved.

Also, pharmacy organizations located in paramedic and paramedic-obstetric centers located in rural settlements, and separate divisions of medical organizations licensed for pharmaceutical activities (outpatient clinics, paramedic and paramedic-obstetric stations, centers (departments) of general medical (family) practice) , located in rural settlements where there are no pharmacies, can make cash payments and (or) payments using payment cards when selling medicines without using cash register equipment.

So, if you do not fit this list, you need to consider the third case when you don’t need to use cash register equipment.

The third case - if you are payers of the single tax on imputed income or payers of the patent tax system for types of activities that do not fall under cases 1 and 2, you may not use cash register equipment, provided that, at the request of the buyer, you issue them a sales receipt or other document that will confirm payment of funds by the client (for example, a receipt).

In this case, the sales receipt (or other document) must contain the following information:

- Title of the document;

– serial number of the document, date of its issue;

– name for the organization (last name, first name, patronymic – for an individual entrepreneur);

– taxpayer identification number assigned to the organization (individual entrepreneur) that issued the document;

– name and quantity of paid goods purchased (work performed, services rendered);

– the amount of payment made in cash and (or) using a payment card, in rubles;

– position, surname and initials of the person who issued the document, and his personal signature.

Many entrepreneurs immediately begin to say: how is it that many household services (for example, hairdressing salons, technical services, photographic services) fall under UTII, why should we issue strict reporting forms and not issue a sales receipt? After all, strict reporting forms, even by their name - “strict reporting” - are much more expensive and less convenient. Moreover, when providing services to the public, we are obliged to issue a strict reporting form in any case, regardless of whether the client requests it or not, but a sales receipt is only required by the buyer. Unfortunately, this is so - when providing services to the public, we are always required to issue a strict reporting form, and when selling goods, we issue a sales receipt only at the buyer’s request.

Case four – all other situations. In other situations, we are obliged, when receiving funds from clients, to knock out a cash receipt and give it to the client, regardless of whether he needs it or not. A cash register must not only be purchased (its cost varies from 10-12 thousand rubles), but also serviced in a specialized center (service cost ranges from 400 to 500 rubles per month). There is also a special block in the cash register that costs approximately 7,000 rubles - this is the EKLZ block. This abbreviation stands for \"electronic cash register tape protected\". It is this block that protects the cash register from hacking and counter twisting. In total, servicing a cash register per year will be approximately 12,000 rubles.

What if you don’t use a cash register, or don’t write out a strict reporting form, or don’t write out a sales receipt at the buyer’s request? You face a fine: for an entrepreneur - from 3,000 to 4,000 rubles, and a legal entity can be fined in the amount of 30,000 to 40,000 rubles (Article 18.15 of the Code of Administrative Offenses of the Russian Federation). However, there is a loophole for you - if this is your first time breaking the law in this area, then you can apply to be given a warning as the first measure of punishment. You will still be issued a protocol on the identification of the offense, but you can ask for a punishment for the first time as a “warning.” The Code of Administrative Responsibility allows you to do this. The main thing is not to ignore the call to the tax office to review the protocol.

This is where you have to decide: either use a cash register, or face a fine, but don’t spend 12 thousand a year.

So, we sorted out the money issue. With non-cash payments, you do not give the client anything; with cash payments, depending on what “case” you find yourself in - either a cash receipt, or a strict reporting form, or a sales receipt, or nothing.

Let's move on to the process of transferring goods or providing services.

What should be written to the client when transferring the goods?

The fact of transfer of goods is confirmed by the invoice. It indicates who transfers the goods and what kind, in what quantity, and who receives it. The invoice is drawn up mainly according to the TORG-12 form. This is the most common form in business and is accepted for tax and accounting purposes as a document confirming the movement of goods from the seller to the buyer. If your buyer is a legal entity, then you need to issue a delivery note. And if your buyer is an individual, then you can issue a sales receipt (whether you issue a cash receipt or not depends on what “case” you are in - read above). In addition, the only difference between a sales receipt and an invoice is the absence of the “buyer” line. All other details are indicated in the document - number, date, name of the seller, what kind of product is being transferred and at what cost.

If you are a VAT payer, then, in addition to the invoice, you also need to issue an invoice. Your buyer must sign and stamp in the appropriate “accepted” field on the invoice. Or leave a power of attorney. Only in this way will you prove that the goods were shipped to the buyer.

What should be written to the client when providing the service?

Unlike a product that can be touched, a service is provided, and the fact that the service is provided is confirmed by a certificate of completion. The form of the work completion certificate can be any. For example, like this

The act reflects the provision of the service, but does not indicate payment for it. Payment is made by bank transfer or in cash, which we described above.

If you work with VAT, you will need to issue an invoice.

Invoice

If you are a VAT payer, then for any sale you are required to issue an invoice, even if the client does not need it. If you are not a VAT payer (for example, you are exempt from paying this tax under Article 145 of the Tax Code, or you pay a single tax under a simplified taxation system, a single agricultural tax), then you can issue an invoice, but in the column dedicated to the rate and amount VAT you must write \"Without VAT\".

Also, if you are not a VAT payer for the reasons stated above, but your supplier provides an invoice and bills you for payment with VAT, then there is nothing wrong with that. After all, he pays this indirect tax, not you. These are incoming documents for you, so you should not be alarmed by the amount of VAT billed to you.

Agreement

Our clients very often ask: is there a need for an agreement between you and the buyer (service customer)? A contract is a written confirmation of your oral agreement. In the contract you indicate all the terms of the transaction. And the agreement is important, rather, so that your rights are not suddenly violated, because with this document you can go to court, but an oral agreement, as they say, “can’t be attached to the case.” And even with a verbal agreement, you can misunderstand each other. But in writing, everything is written on paper, and as they say, “you can’t erase the words from a song.” Therefore, please read all contracts that you sign to such an extent that it is clear to you, otherwise you may find yourself in an unpleasant situation.

There are several standard contracts. All main types of contracts are listed in the Civil Code of the Russian Federation. This document approves the basis of contracts, which respects all the rights and obligations of each party to the contract. When drawing up an agreement, it is necessary to take into account the provisions of the Civil Code regarding this type of document.

N. Skvortsova

Results

Thus, to confirm the fact of service provision, an act of services rendered, a report from the contractor and correspondence with the customer will help.

To confirm payment for services, you will need an act of services rendered, receipts, cash receipts, cash order, cash book, bank documents, expense report, and accounting documents. You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.