One of three

Let's start with the fact that there are three valid VAT declarations today.

- Declaration of indirect taxes - KND 1151088 (order of the Federal Tax Service of the Russian Federation dated September 27, 2017 No. SA-7-3/765). This form is used by importers of goods from the countries of the Eurasian Economic Union.

- VAT declaration for the provision of services by foreign organizations in electronic form - KND 1151115 (Order of the Federal Tax Service of the Russian Federation dated November 30, 2016 No. ММВ-7-3/646). Who is required to submit this report is clear from its name.

- VAT return – KND 1150001 (Order of the Federal Tax Service of the Russian Federation dated October 29, 2014 No. ММВ-7-3/558). This form is submitted by most VAT payers, and we will consider it in detail.

Deadlines for submitting reports for the 3rd quarter of 2021

We have prepared a taxpayer reporting calendar for the 3rd quarter of 2021.

Save it for yourself so you don’t have to look for it later. It’s convenient to share on social networks - you won’t lose it yourself, and you’ll help your friends. Under the header there are buttons for Facebook, VKontakte, Odnoklassniki and Twitter. To the right there are buttons to save the reporting schedule for the 3rd quarter of 2021 to “favorites” or to the diary on “Clerk”. You can also print the table.

And use our Google taxpayer calendar, which will remind you of the need to submit a particular report.

Table. Deadlines for submitting reports for the 3rd quarter of 2018

| Declaration form, calculation, information | Approved | Deadline |

| Social Insurance Fund | ||

| Form 4 FSS of the Russian Federation. Calculation of accrued and paid insurance premiums for compulsory social insurance against industrial accidents and occupational diseases, as well as expenses for payment of insurance coverage | FSS Order No. 381 dated 09/26/2016 (as amended by Order No. 275 dated 06/07/2017) | October 22 (hard copy) October 25 (in the form of an electronic document) |

| Personal income tax | ||

| Calculation of personal income tax amounts calculated and withheld by the tax agent (6-NDFL) | Order of the Federal Tax Service of Russia dated October 14, 2015 N ММВ-7-11/ [email protected] (as amended on January 17, 2018) | October 31 |

| Insurance contributions for pension and health insurance | ||

| SZV-M Information about the insured persons | Resolution of the Board of the Pension Fund of the Russian Federation dated 01.02.2016 N 83p | August 15 September 17 October 15 |

| DSV-3 Register of insured persons for whom additional insurance contributions for funded pension are transferred and employer contributions are paid | Resolution of the Board of the Pension Fund of the Russian Federation 06/09/2016 N 482p | 22 of October |

| Calculation of insurance premiums | Order of the Federal Tax Service of Russia N ММВ-7-11/ [email protected] dated 10.10.2016 | October 30 |

| VAT, excise taxes and alcohol | ||

| Presentation of the log of received and issued invoices in the established format in electronic form for the first quarter of 2021. The log is submitted by non-VAT payers, taxpayers exempt under Article 145 of the Tax Code, not recognized as tax agents, in the case of issuing and (or) receiving invoices by them - invoices when carrying out business activities under intermediary agreements. | Clause 5.2. Article 174 of the Tax Code of the Russian Federation | 22 of October |

| Submission of a tax return on indirect taxes when importing goods into the territory of the Russian Federation from the territory of member states of the Eurasian Economic Union | Order of the Ministry of Finance of the Russian Federation No. 69n dated 07/07/2010 | August 20 September 20 22 of October |

| Tax return for value added tax | Order of the Federal Tax Service of the Russian Federation No. ММВ-7-3/ [email protected] dated 10/29/2014 (as amended on 12/20/2016) | the 25th of October |

| Tax return on excise taxes on ethyl alcohol, alcohol and (or) excisable alcohol-containing products | Order of the Federal Tax Service of the Russian Federation No. ММВ-7-3/ [email protected] dated January 12, 2016 | August 27 September 25 the 25th of October |

| Tax return on excise taxes on motor gasoline, diesel fuel, motor oils for diesel and (or) carburetor (injection) engines, straight-run gasoline, middle distillates, benzene, paraxylene, orthoxylene, aviation kerosene, natural gas, cars and motorcycles | Order of the Federal Tax Service of the Russian Federation No. ММВ-7-3/ [email protected] dated January 12, 2016 | August 27 September 25 the 25th of October |

| Tax return on excise taxes on tobacco (tobacco products), tobacco products, electronic nicotine delivery systems and liquids for electronic nicotine delivery systems | Order of the Federal Tax Service of Russia dated February 15, 2018 No. ММВ-7-3/ [email protected] | August 27 September 25 the 25th of October |

| Submission of declarations on alcohol (with the exception of declarations on the volume of grapes) | Decree of the Government of the Russian Federation dated 08/09/2012 No. 815 (as amended on 05/13/2016) | 22 of October |

| UTII | ||

| Tax return for UTII | Order of the Federal Tax Service of the Russian Federation No. ММВ-7-3/ [email protected] dated 07/04/2014 (as amended on 10/19/2016) There is a new form! But, according to the law, it will come into force from the 4th quarter report. There is also a recommended form; they also have no right to demand it. However, if an individual entrepreneur plans to receive a deduction for the purchase of a cash register, it makes sense to submit the recommended form, since there is a section for deductions. | 22 of October |

| Unified (simplified) tax return | ||

| Unified (simplified) tax return | Order of the Ministry of Finance of the Russian Federation No. 62n dated February 10, 2007 | 22 of October |

| Income tax | ||

| Tax return for income tax of organizations calculating monthly advance payments based on actual profit received | Order of the Federal Tax Service of Russia dated October 19, 2016 No. ММВ-7-3/ [email protected] | August 28 September 28 29th of October |

| Tax return for income tax of organizations for which the reporting period is the first quarter, half a year and nine months | Order of the Federal Tax Service of Russia dated October 19, 2016 No. ММВ-7-3/ [email protected] | 29th of October |

| Tax calculation (information) on the amounts of income paid to foreign organizations and taxes withheld (when calculating monthly payments) | Order of the Federal Tax Service of Russia dated March 2, 2016 No. ММВ-7-3/ [email protected] | August 28 September 28 29th of October |

| Tax calculation (information) on the amounts of income paid to foreign organizations and taxes withheld | Order of the Federal Tax Service of Russia dated March 2, 2016 No. ММВ-7-3/ [email protected] | 29th of October |

| Tax return for income tax of a foreign organization | Order of the Ministry of Taxes and Taxes of the Russian Federation of January 5, 2004 No. BG-3-23/1 | 29th of October |

| Tax return on income received by a Russian organization from sources outside the Russian Federation | Order of the Ministry of Taxes and Taxes of the Russian Federation dated December 23, 2003 No. BG-3-23/ [email protected] | August 28 September 28 29th of October |

| Property tax | ||

| Calculation of advance payment for corporate property tax | Order of the Federal Tax Service of the Russian Federation No. ММВ-7-21/ [email protected] dated 03/31/17 | October 30 |

| MET | ||

| Tax return for mineral extraction tax | Order of the Federal Tax Service No. ММВ-7-3/ [email protected] dated 05/14/2015 (as amended on 04/17/2017) | August 31 October 1 October 31 |

| Water tax | ||

| Tax return for water tax | Order of the Federal Tax Service No. ММВ-7-3/ [email protected] dated 09.11.2015 | 22 of October |

| Gambling tax | ||

| Tax return for gambling business tax | Order of the Federal Tax Service of Russia dated December 28, 2011 No. ММВ-7-3/ [email protected] | August 20 September 20 22 of October |

Five out of thirty

If you open the declaration form approved by Order No. 558, the first thing that catches your eye is its volume. The report consists of a title page and 12 sections. Together with applications, this is almost three dozen sheets. However, not all VAT payers must fill out the entire form.

More precisely, almost no one fills out all sections at the same time, because they cover all possible options for calculating and refunding VAT.

The “shortest” version of the report is zero. It consists of a title page and section 1 containing the amount of tax payable or refundable (in this case, zeros). In this composition, the report is submitted only by taxpayers who do not have a taxable base and grounds for deduction for the period. Therefore, they do not need to fill out other sheets that contain breakdowns of VAT accruals and deductions.

Most businessmen who calculate VAT according to the “standard” scheme use the following set of five sections:

- Title page.

- Section 1 – the total amount to be paid or reimbursed from the budget.

- Section 3 – calculation of the tax amount

- Section 8 – tax deductions based on purchase ledger.

- Section 9 – accrued tax from the sales book.

An example of filling out a VAT return for the 3rd quarter of 2021 can be downloaded here .

Visual diagrams and tables: legitimate cases of late reporting

In 2021, the VAT return must be submitted no later than the 25th day of the month following the expired quarter (Articles 163, 174 of the Tax Code of the Russian Federation). The deadline is the same for submitting a declaration on paper and in electronic form. The reporting months in 2021 are January, April, July, October.

In 2021, VAT payers can submit a VAT report via the Internet. And only tax agents can submit a declaration “on paper”. The exception is an agent who does not pay VAT. That is, a person applies a special regime or is exempt from paying tax under Article 145 of the Tax Code of the Russian Federation. Then it is allowed to submit the declaration “on paper” or electronically.

If the deadline for submitting the declaration falls on a weekend or holiday, you can, as a general rule, report on the next working day (Clause 7, Article 6.1 of the Tax Code of the Russian Federation). However, in 2021, none of the deadlines for submitting the declaration coincide with a weekend or holiday. Below is a table with the deadlines for submitting the VAT declaration in 2018.

| Reporting period | Deadline for submitting the VAT return |

| 4 sq. 2021 | January 25, 2021 |

| 1 sq. 2021 | April 25, 2021 |

| 2 sq. 2021 | July 25, 2021 |

| 3 sq. 2021 | October 25, 2021 |

| 4 sq. 2021 | January 25, 2021 |

Late reporting is usually fraught with punishment (we will talk about it in the last section of our article). But there is also a legal way to delay submitting a report. It is provided to us by Art. 6.1 of the Tax Code of the Russian Federation, which provides for the possibility of rescheduling dates if they coincide with a weekend or holiday.

We have prepared detailed tables for you, with which you can easily determine the reporting dates (including reporting dates for VAT for the 1st quarter of 2021).

All quarterly reporting dates for VAT in 2021 fell on business days, so when filing returns with the tax authorities, rely on the specified dates as final dates (without deferment for weekends or holidays). But the deadline for the report for the 4th quarter in 2020 will shift.

For importers (when importing goods from the EAEU), reporting dates for VAT in 2021 fall on weekends three times (in April, July and October 2021), so the deadlines for reporting in these months occur 1-2 days later than those established by law.

The deadlines for submitting the invoice journal (hereinafter referred to as the journal) in 2021 are postponed three times (in April, July and October 2021).

As can be seen from the table diagrams, for VAT reporting for the 1st quarter of 2019, the deadline is not postponed only for the VAT return, since the deadline for reporting coincides with a working day. The indirect declaration and invoice journal can be submitted later.

In 2021, the VAT return must be submitted no later than the 25th day of the month following the expired quarter (Articles 163, 174 of the Tax Code of the Russian Federation). The deadline is the same for submitting a declaration on paper and in electronic form. The reporting months in 2021 are January, April, July, October.

If the deadline for submitting the declaration falls on a weekend or holiday, as a general rule, you can report on the next working day (Clause 7, Article 6.1 of the Tax Code of the Russian Federation). Below we provide a table with the deadlines for submitting the VAT declaration in 2021.

| Reporting period | Deadline for submitting the VAT return |

| 4 sq. 2021 | January 25, 2021 |

| 1 sq. 2021 | April 25, 2021 |

| 2 sq. 2021 | July 25, 2021 |

| 3 sq. 2021 | October 25, 2021 |

| 4 sq. 2021 | January 25, 2021 |

Information sources

The taxpayer takes information for the report from the following documents:

- Books of purchases and sales . This is the main source of information on the basis of which the declaration is formed.

- Separate invoices . Data from them is used by businessmen who are not VAT payers, but are required to fill out a declaration if they have issued an invoice with the allocated tax amount.

- Logs of received and issued invoices . Data from these registers are used by taxpayers working in the interests of other persons (agents, commission agents).

- Other accounting and tax registers are used if necessary.

Deadlines for submitting the journal of received and issued invoices in 2019

In 2021, intermediaries acting in the interests of third parties on their own behalf are required to submit logs of invoices received and issued. They are:

- commission agents;

- agents;

- forwarders (involving third parties without their own participation);

- developers (involving third parties without their own participation).

The deadline for submitting the log of received and issued invoices is no later than the 20th day of the month following the expired quarter. Below in the table we present the deadlines for submitting the journal of received and issued invoices in 2021.

| Reporting period | Deadline |

| 4 sq. 2021 | January 22, 2021 (postponed from January 20) |

| 1 sq. 2021 | April 20, 2021 |

| 2 sq. 2021 | July 20, 2021 |

| 3 sq. 2021 | October 22, 2021 (postponed from October 20) |

| 4 sq. 2021 | January 21, 2021 |

The deadline for submitting the log of received and issued invoices is no later than the 20th day of the month following the expired quarter. Below in the table we present the deadlines for submitting the journal of received and issued invoices in 2021.

| Reporting period | Deadline |

| 4 sq. 2021 | January 21, 2021 |

| 1 sq. 2021 | April 22, 2021 |

| 2 sq. 2021 | July 22, 2021 |

| 3 sq. 2021 | October 21, 2021 (postponed from October 20) |

| 4 sq. 2021 | January 20, 2021 |

Title page

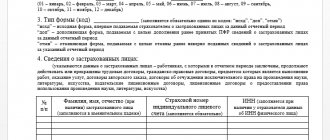

This section of the return contains information about the taxpayer and the return itself.

- TIN and KPP codes assigned upon registration with the Federal Tax Service.

- The correction number has the format “0- -”, “1 – -”, etc. It shows the serial number of the “version” of the report.

- The tax period must be selected from Appendix 3 to the Procedure for filling out, approved by Order of the Federal Tax Service of the Russian Federation dated October 29, 2014 No. ММВ-7-3/558 (hereinafter referred to as the Procedure). The code for the 3rd quarter is “23”.

- Reporting year – 2021.

- Tax office code.

Section 1 of the declaration for the 3rd quarter. 2018

This part of the report includes summary information on the amounts of VAT calculated for payment or reimbursement.

- Line 010 contains the OKTMO code of the municipality in whose territory the tax is paid.

- Line 020 indicates the KBK.

- Line 030 reflects the amount of tax payable, calculated on the basis of an invoice by persons who are not taxpayers or for transactions exempt from VAT (clause 5 of Article 173 of the Tax Code of the Russian Federation).

- Line 040 contains the amount of VAT calculated for payment to the budget “on a general basis” (clause 1 of Article 173 of the Tax Code of the Russian Federation).

- Line 050 is filled in if, based on the results of the calculation, the taxpayer declares the amount to be reimbursed from the budget.

- Lines 060 – 080 are filled in only if the declaration is submitted by the managing partner under an investment partnership agreement. They contain the number of this agreement and the period of its validity.

Deadlines for payment of import VAT in 2021

In 2021, VAT when importing goods from the EAEU countries must be paid “import” VAT within the usual time limits - no later than the 20th day of the month following the one in which (clause 19 of Appendix 18 to the Treaty on the EAEU):

- the goods have been accepted for accounting;

- the payment deadline under the leasing agreement has arrived (if goods are imported into Russia under a leasing agreement, which provides for the transfer of ownership of the goods to the lessee).

Table 2. Deadlines for payment of import VAT in 2020

| VAT payment period | Deadline for VAT payment |

| January 2020 | February 20, 2020 |

| February 2020 | March 20, 2020 |

| March 2020 | April 20, 2020 |

| April 2020 | May 20, 2020 |

| May 2020 | June 22, 2020 |

| June 2020 | July 20, 2020 |

| July 2020 | August 20, 2020 |

| August 2020 | September 21, 2020 |

| September 2020 | October 20, 2020 |

| October 2020 | November 20, 2020 |

| November 2020 | December 21, 2020 |

| December 2020 | January 20, 2020 |

Section 3 of the VAT return for Q3. 2018

This section can be called “key” for the VAT return. It is here that the amount of tax to be paid or refunded is calculated.

- Lines 010 – 060 reflect sales for various categories of objects and tax rates.

- Line 070 contains the calculation of VAT on advances received.

- Lines 080 – 100 reflect VAT subject to recovery.

- Lines 105 – 109 indicate information about the sales adjustment and the corresponding tax amounts.

- Lines 110 and 115 reflect the calculation of VAT amounts paid upon customs declaration.

- Line 118 contains the total amount of accrued VAT (the sum of lines 010 - 080 and 105 - 115).

- Lines 120 – 185 indicate the amount of “input” VAT that is subject to deduction on various grounds.

- Line 190 contains the total amount to be deducted.

- Based on the results of the calculation, line 200 is filled in if the accrued VAT is greater than the refundable one or 210 in the opposite case.

Section 3 (end)

If necessary, the following annexes can be filled out to section 3:

- Appendix 1 – when restoring VAT on fixed assets in accordance with Art. 171.1 Tax Code of the Russian Federation.

- Appendix 2 – for calculating VAT by a structural unit of a foreign organization.

Section 8 of the VAT return

This part of the report contains a breakdown of tax deductions and is completed based on the purchase book.

- Line 001 contains the information relevance code:

– for the primary declaration – a dash;

– to replace information with updated information – “0”;

– if the information previously provided in this section is reliable – “1”; in this case, dashes are placed in the remaining lines of section 8.

- Line 005 contains the entry number from the purchase book.

- Line 010 contains the transaction type code (appendix to the order of the Federal Tax Service of the Russian Federation dated March 14, 2016 N ММВ-7-3/ [email protected] ).

- Lines 020 – 090 indicate the details of the seller’s invoice, taking into account adjustment documents (if any).

- Lines 100 – 110 contain the date and number of the document confirming the payment of the tax.

- Line 120 reflects the date of registration of goods (work, services).

- Lines 130 and 140 contain the TIN/KPP of the seller or intermediary.

- Line 150 reflects the customs declaration number.

- Line 160 contains the currency code (for Russian rubles - 643).

- Line 170 reflects the purchase price according to the invoice, including VAT.

- Line 180 contains the VAT amount on the invoice.

- Line 190 reflects the amount of tax for the purchase book as a whole.

Section 8 (end)

Appendix 1 to Section 8 is completed if the taxpayer made changes to the purchase book by drawing up additional sheets. The procedure for filling out the application is the same as for the main section.

Section 9

This section of the declaration reflects information about accrued tax from the sales ledger.

- Line 001 indicates the relevance of the information, similar to section 8.

- Lines 005 – 090 are also filled in similarly to the corresponding lines of section 8. The exception is line 035. It is used during import and contains the details of the “incoming” customs declaration.

- Lines 100 and 110 contain the TIN and KPP of the buyer (intermediary).

- Lines 120 and 130 reflect the details of the document confirming payment.

- Line 140 contains the currency code.

- Lines 150 – 160 contain the total sales value of the invoice, including VAT.

- Lines 170 -190 show the amount of sales excluding VAT broken down by rates.

- Lines 200 -210 reflect the amount of VAT on the invoice at rates of 10% and 18%.

- Line 220 shows the value of tax-exempt sales.

- Lines 230 – 250 reflect the amount of revenue excluding VAT for the sales book as a whole, broken down by rates.

- Lines 260 – 270 show the amount of VAT on the sales book separately at rates of 10% and 18%.

- Line 280 reflects the value of tax-exempt revenue in the sales book.

Section 9 (end)

If changes were made to the sales book related to the compilation of additional sheets, then you need to fill out Appendix 1 to Section 9. Its structure is similar to the main section.

The procedure for filling out the “additional” sections of the declaration for the 3rd quarter. 2021

The sections of the report listed below must be completed if the taxpayer has a special status or carries out transactions that are taxed in a special manner.

- If the economic entity is a tax agent for VAT, then you need to fill out section 2. It contains the calculation of the tax amount and information about the person in respect of whom the filer of the declaration acts as a tax agent.

- If the taxpayer performed transactions taxed at a 0% rate, then the following sections are completed:

– section 4 – tax calculation for transactions for which the 0% rate is confirmed;

– Section 5 – calculation of deductions for “zero” transactions relating to previous periods;

– Section 6 – tax calculation for transactions with an unconfirmed rate of 0%.

- When carrying out non-taxable transactions (for example, outside the Russian Federation), section 7 is completed.

- If the taxpayer acts in the interests of another person (for example, under a commission agreement), then fill in:

– information from the journal of issued invoices (section 10);

– information from the journal of received invoices (section 11).

- Taxpayers exempt from VAT, when preparing invoices with the allocated tax amount, fill out section 12.

Consequences of late filing of VAT reports

Violation of reporting deadlines for the specified tax is a tax offense that provides for sanctions. Namely, the taxpayer is obliged to pay a tax penalty. It is important that the amount of the fine is not fixed, but flexible, since it depends on the unpaid amount of tax and is 5% of such amount. Please note that despite this, such a fine should not exceed 30% of the amount of unpaid tax, but not less than 1000 rubles.

We hope that our article was useful and interesting. And now you will not have any difficulties in determining the correct deadline for filing your tax return. Do not violate tax laws and submit your returns on time.

The procedure for submitting a declaration and sanctions for its violation

The tax period for VAT is a quarter. In accordance with paragraph 5 of Art. 174 of the Tax Code of the Russian Federation, the declaration must be submitted by the 25th day of the month following the expired quarter. Thus, the VAT return for the 3rd quarter of 2021 must be submitted no later than October 25, 2018.

A special feature of the regulations for submitting this report is that almost all economic entities must submit it electronically. An exception is made only for tax agents who are not taxpayers. A VAT return submitted “on paper”, if it should have been sent electronically, is considered not submitted.

The meaning of this provision of the law is to ensure the ability to control the calculation and refund of VAT automatically.

Penalties for late submission of VAT returns are established in clause 1 of Art. 119 of the Tax Code of the Russian Federation. They vary from 1000 rub. for a small or zero tax amount, up to 30% of the amount indicated in the declaration, if the delay exceeded 6 months.

In addition, an administrative fine in the amount of 300 to 500 rubles may be imposed on officials. according to Art. 15.5 Code of Administrative Offences.

If the delay exceeds 10 days, then the tax authorities have the right to block the payer’s accounts (clause 3 of Article 76 of the Tax Code of the Russian Federation).

How VAT evaders report: deadlines and form

When issuing an invoice with an allocated tax amount, VAT defaulters are required to transfer VAT to the budget and submit VAT reports. It is necessary to take into account that VAT evaders:

- use the same declaration form as the payers of this tax (KND form 1151001);

- are required to submit a declaration at the end of the quarter in which the VAT invoice was issued - based on the results of the 2nd quarter, the deadline for reporting falls on 07/25/2019;

- the declaration includes (in addition to the mandatory title page) an abbreviated set of sections (1 and 12).

The legal requirements for the timing and execution of VAT reporting for such situations are determined:

- clause 5 art. 174 Tax Code of the Russian Federation.

- para. 7 clause 3 of section I of Appendix No. 1 to the Procedure for filling out the VAT return, approved by Order of the Federal Tax Service dated October 29, 2014 No. ММВ-7-3/558.

Example 1

In May 2021, simplified Tourist-Inter LLC issued an invoice to the counterparty with the allocated amount of VAT = 334,667 rubles. This was done in order to maintain important partnerships. The chief accountant of Tourist-Inter LLC is familiar with the responsibilities established in clause 5 of Art. 174 of the Tax Code of the Russian Federation - at the end of the 2nd quarter (no later than July 25, 2019), he will issue a payment order for the transfer of VAT in the amount of 334,667 rubles. to the budget.

Despite the fact that the declaration form in such situations is the same as for VAT payers, splitting the payment into 3 payment terms is not allowed. The entire amount allocated in the invoice of the VAT defaulter must fall into the budget for one payment period.

In 2021, prepare a declaration in the form approved by order of the Federal Tax Service of Russia dated October 29, 2014 No. ММВ-7-3/558.

As part of the declaration, each organization that pays VAT must submit to the tax office:

- title page;

- Section 1 “The amount of tax subject to payment to the budget (reimbursement from the budget), according to the taxpayer.”

Include the remaining sections in the declaration only if the organization performed transactions that should be reflected in these sections. For example, sections 4–6 must be completed and submitted if during the tax period the organization carried out transactions subject to VAT at a rate of 0 percent. And section 7 - if there were transactions exempt from VAT taxation.

In 2021, prepare a declaration in the form approved by order of the Federal Tax Service of Russia dated October 29, 2014 No. ММВ-7-3/558.

Include the remaining sections in the declaration only if the organization performed transactions that should be reflected in these sections. For example, sections 4–6 must be completed and submitted if during the tax period the organization carried out transactions subject to VAT at a rate of 0 percent. And section 7 - if there were transactions that were exempt from VAT.

For the 4th quarter of 2021, draw up a declaration in the form approved by Order of the Federal Tax Service dated October 29, 2014 No. ММВ-7-3/558.