Production calendar for 2021, download

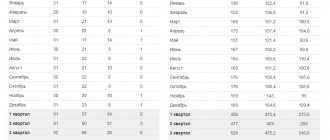

A visual summary table of the number of calendar, working and weekend days, as well as the number of working hours for 40-, 36-, 24-hour working weeks by period is presented below.

| 15 | 16 | 120 | 108 | 72 | ||

| February | 28 | 19 | 9 | 151 | 135,8 | 90,2 |

| March | 31 | 22 | 9 | 176 | 158,4 | 105,6 |

| 1st quarter | 90 | 56 | 34 | 447 | 402,2 | 267,8 |

| April | 30 | 22 | 8 | 175 | 157,4 | 104,6 |

| May | 31 | 19 | 12 | 152 | 136,8 | 91,2 |

| June | 30 | 21 | 9 | 167 | 150,2 | 99,8 |

| 2nd quarter | 91 | 62 | 29 | 494 | 444,4 | 295,6 |

| 1st half of the year | 181 | 118 | 63 | 941 | 846,6 | 563,4 |

| July | 31 | 22 | 9 | 176 | 158,4 | 105,6 |

| August | 31 | 22 | 9 | 176 | 158,4 | 105,6 |

| September | 30 | 22 | 8 | 176 | 158,4 | 105,6 |

| 3rd quarter | 92 | 66 | 26 | 528 | 475,2 | 316,8 |

| 9 months | 273 | 184 | 89 | 1469 | 1321,8 | 880,2 |

| October | 31 | 21 | 10 | 168 | 151,2 | 100,8 |

| November | 30 | 20 | 10 | 159 | 143 | 95 |

| December | 31 | 22 | 9 | 176 | 158,4 | 105,6 |

| 4th quarter | 92 | 63 | 29 | 503 | 452,6 | 301,4 |

| 2nd half | 184 | 129 | 55 | 1031 | 927,8 | 618,2 |

| 2021 | 365 | 247 | 118 | 1 972 | 1 774,4 | 1 181,6 |

In accordance with Art. Art. 91, 92 of the Labor Code, in the Russian Federation a gradation of working time is established, namely 24, 35, 36 and 40 hours.

For the convenience of users, our PC 2021:

- unifies this scale quarterly with appropriate differentiation;

- divides the upper values of the working hours of the scale by the number of working days in the week, that is, calculates the daily rate for each value of the scale;

- multiplies daily standard hours by the number of working days in a month to calculate the monthly standard for each of the scale values;

- in order to establish the maximum working time values for one year for each value of the scale, it multiplies the daily standard hours by the number of working days in the year as a whole.

Of course, no production calendar can take into account all possible variations of indicators that may exist within the framework of specific employment contracts. That is, the indicators of working time in the PC are leveled at the level of the upper limits of standard hours provided for by the Labor Code of the Russian Federation.

This means that some adjustment will be required in the calculations if the terms of the employment contract do not fit into the framework of standard hours. For example, exceeding the limits provided for by the Labor Code and calculated in our PC-2021 should be spent as overtime hours worked.

The following national holidays have been established for 2021:

HolidaysHolidayExtra days offShortened days1-6, January 8New Year holidaysDecember 31, 2021January 7Nativity of ChristFebruary 23Defender of the Fatherland DayFebruary 22February 8MarchInternational Women's DayMay 1Spring and Labor DayMay 33April 9MayVictory DayMay 1012 JuneRussia DayJune 1411 June4NovemberUnity DayNovember 5 November 3There are two types of holidays - all-Russian, that is, federal and local.

Federal holidays are named in Art. 112 of the Labor Code of the Russian Federation and their transfer or cancellation are unacceptable without the adoption of the corresponding federal regulatory act.

This production calendar for 2021 presents all-Russian holidays. As for regional PCs, they include both all-Russian and local holidays of national or religious significance.

New in reporting for the last quarter of 2021

Let's consider what changes have occurred in the reporting procedure that need to be taken into account when submitting documents to regulatory authorities. All innovations can be seen in the table.

| Reporting form | What's new |

| Accounting statements (BO) | Reports for 2021 must be submitted only to the tax office in electronic form through electronic document management operators. Small businesses (average headcount does not exceed 100 people, income does not exceed 800 million rubles) in 2021 can still submit a BO on paper. |

| 2-NDFL | From January 1, 2021, the deadline for submitting 2-NDFL with sign 1 for 2021 will be reduced by a month - now the deadline is March 2, 2021; from January 1, 2021, the minimum wage will increase by 7.5% and amount to 12,130 rubles. |

| 3-NDFL | Beginning in January 2021, complete the report using the new form when filing your 2021 return. |

| 6- Personal income tax | The deadline for filing 6-NDFL has been shortened to March 2, 2021. |

| Declaration according to the simplified tax system | According to the project of the Ministry of Finance, from July 1, 2021, organizations using the simplified form will not submit declarations. This applies to those who pay tax on the “Income” object and use online cash registers during the tax period. |

| Income tax | A new form is in effect for the 2021 declaration. |

| Property tax | When reporting for 2021, use the new return form. |

| Calculation of insurance premiums | From the 1st quarter of 2021, a new form must be used; the limits on pension contributions were increased - to 1.292 million rubles and contributions to the Social Insurance Fund - to 912,000 rubles; Fixed contributions for individual entrepreneurs will increase to 40,874 rubles per year. |

Astronomical year

For chronology, a period of time is used that corresponds to the phase of revolution of the planet Earth around the Sun. This period is equal to 365 days, 5 hours, 48 minutes, 51 seconds. In the Julian and Gregorian calendars, the duration of the time cycle is 365 days.

Once every four years, it is customary to add a day to avoid shifting the day of the vernal equinox. The extra hours, minutes and seconds add up to make a leap year. Then a new date appears on the calendar - February 29.

The year is divided into 12 months. During the Earth's revolution, due to the inclination of its axis to the ecliptic plane, a change of seasons occurs. For convenience, in Russia they are counted from the first day of a specific month: autumn - from September 1; winter - from December 1, spring - from March 1, summer - from June 1.

How many quarters are there in a year, and for what purpose did this unit of measurement appear?

What year is 2021 according to the Chinese calendar?

New Year's celebrations in China began on February 16 and ended on March 2. Since the Chinese count years according to the lunisolar calendar, the year 4716 has arrived for them. According to the scheme of the elements, this year belongs to the earth, and according to the animal zodiac, it is the year of the dog. Thus, this year is called the year of the yellow earthen dog.

The Year of the Dog has always been favorable for humanity. In 1910, there was a serious leap in the development of the world economy, in 1948 all efforts were aimed at restoring the world after the war, and 1970 was marked by the production of VAZ cars and Boeing 747 aircraft.

This year it is recommended to exhibit the following character traits:

- Patience;

- Conservative;

- Reliability;

- Caution;

- Lack of greed and aggression.

Attention! Opposite qualities can anger an earth dog and direct its power against a person.

How long is a quarter?

There are also four seasons, and each lasts 3 months. Does this mean that the concepts of “season” and “quarter” are identical? And under what circumstances is this possible? Indeed, a quarter also lasts 3 months. But he counts from the beginning of the year and further - in order, regardless of the season. We would observe a complete coincidence when celebrating the New Year, for example, on the first of March.

This could also have been the case among the ancient Slavs, who celebrated the transition of the calendar in the fall. For them, the New Year began on the first of September.

So how many quarters are there in a year? There are four of them, let's call them by month (there are three of them) and compare them with the seasons.

| I (Q1) | January March | December - February (winter) |

| II (Q2) | April June | March-May (spring) |

| III (Q3) | July - September | June - August (summer) |

| IV (Q4) | October December | September - November (autumn) |

Composition and reporting forms for the 4th quarter of 2021

For the 4th quarter of 2021, business entities need to submit the following reporting forms:

Reporting to the Federal Tax Service

- Financial statements. All organizations must report annually, regardless of the tax system and legal form. The BO for 2021 needs to be submitted only to the Federal Tax Service. Submit your reports for 2021 by 03/31/2020.

— UTII. Organizations subject to imputation submit a declaration by 01/20/2020.

— Unified simplified tax return. To be filled out if your organization has not conducted business and does not have data for declarations on VAT, income tax, simplified tax system and unified agricultural tax. It must be submitted by January 20, 2020.

— VAT. All taxpayers and organizations that issue invoices must submit a VAT return. From the 1st quarter of 2021, the VAT return must be filled out using a new form. Also, starting from 2021, this report form will also be submitted by agricultural producers to the Unified Agricultural Tax. The declaration must be submitted by 01/27/2020.

- Property tax. Companies on OSNO submit a report by March 30, 2020 in electronic form. Those enterprises that have less than one hundred employees can submit a declaration on paper. Due to changes in the taxation of movable property from 2021, use the new declaration form.

— Income tax. Those who apply OSNO must submit the declaration by March 30, 2020.

— 6-NDFL. This report reflects data on calculated and transferred taxes for all employees of the enterprise. You must submit your tax return electronically by March 2, 2020. Only if you have 10 or less than 10 employees, then it is possible in paper form. This innovation is effective from 01/01/2020.

— RSV. Calculations are submitted by employer-insurers by 01/30/2020 for all listed insurance premiums in electronic form (except for contributions for “injuries” and in the case of occupational diseases). If you have 10 or fewer employees on your staff, then it is possible on paper (clause 10 of Article 431 of the Tax Code of the Russian Federation).

Reporting to the Social Insurance Fund

- 4-FSS. This report includes the calculation of contributions for “injuries” and in the case of occupational diseases. It must be submitted to all business entities by January 20 on paper or by January 27 in electronic form. You can report on paper if the number of full-time employees is no more than 25 people. All others submit the report only in electronic form.

Reporting to the Pension Fund

- SZV-M. This report must be submitted to all business entities with hired employees for each month before the 15th of the next month. That is, for the 4th quarter you need to send reports for October, November and December.

— SZV-STAGE. Organizations report every year on the periods of work of their employees, as well as on the insurance premiums accrued from payments. Submit the form by March 2, 2021.

— DSV-3. The report is submitted only by those who make additional insurance contributions for their employee - until January 20, 2020.

Reporting to Rosstat

Organizations need to constantly report to the statistics service. The complete list of all reports to Rosstat is quite large. To find out which reports your organization must submit, you need to go to the official website of the statistics service and indicate one of the following details - TIN, OGRN or OKPO, after which you will see a complete list of reports that you need to submit and the deadlines for their submission.

Who uses a quarterly calendar

The production calendar for the new reporting year is necessary for all organizations and enterprises. It will help accountants prepare annual and quarterly reports correctly. A grid divided into quarters, including months and working days, will allow you to accurately plan production and other activities and monitor the step-by-step implementation of tasks. Organizations can print a new calendar plan with quarterly periods in the quantity they need from a free original layout for:

- employees involved in reporting activities;

- middle and senior managers;

- personnel officers;

- personnel keeping records of material assets;

- financial workers.

Digital printing allows you to produce the required number of such calendar grids, divided into quarters.

Origin of the term "quarter"

The word is of Latin origin and has become part of the German language. It is literally translated as “quarter”. The very meaning of the term seems to carry the answer to the question of how many quarters there are in a year. There are four of them, because we are talking about the fourth part.

In the Russian Federation, this period is usually denoted by Roman numerals: IV, III, II, I. And in English-speaking countries (including the USA) - by Arabic numerals, preceded by the Latin letter Q. For example, Q4. This unit of measurement is used in economic statistics and accounting to summarize the interim results of the year.

Fines

Late submission of reports may result in severe sanctions from regulatory authorities. Let's figure out what fines are provided in this case.

| Report | Fines for failure to meet deadlines |

| Financial statements | 200 rubles for each form |

| VAT declaration | 5% of the amount of tax (contributions) for each month from the date of violation, but not less than 1000 rubles. The maximum amount is 30% of the amount of tax (contributions). |

| Income tax return | |

| Property tax declaration | |

| Declaration according to the simplified tax system | |

| Declaration on Unified Agricultural Tax | |

| Declaration on UTII | |

| Unified (simplified) tax return | |

| Water tax declaration | |

| Gambling tax return | |

| Transport tax declaration | |

| Land tax declaration | |

| Declaration on mineral extraction tax | |

| 4-FSS | |

| RSV | |

| 3-NDFL | |

| 6-NDFL | 1,000 rub. monthly |

| SZV-M | 500 rubles for each employee |

| SZV-STAZH | |

| DSV-3 | |

| 2-NDFL | 200 rubles for each certificate |

| Information on the average number of employees | 200 rubles for each document |

Please note that for submitting a report on paper instead of an electronic form, you will be subject to a fine of two hundred rubles. The criteria for submitting some reports in paper form have also changed. Thus, starting from 2021, only enterprises with 10 or fewer employees can file DAM, 2-NDFL and 6-NDFL on paper. We recommend purchasing an electronic signature key in advance.

Due dates

For clarity, we will draw up a table on the deadlines for submitting reports for the fourth quarter of 2021.

| Report | Submission deadline |

| To the Federal Tax Service | |

| Financial statements | 31.03.2020 |

| VAT declaration | 27.01.2020 |

| Income tax return | 03/30/2020 For those who make advance payments: 11/28/2019 12/30/2019 01/28/2020 |

| Property tax declaration | 30.03.2020 |

| Declaration according to the simplified tax system | 03/31/2020 for organizations 04/30/2020 for individual entrepreneurs |

| Declaration on Unified Agricultural Tax | 31.03.2020 |

| Declaration on UTII | 20.01.2020 |

| Unified (simplified) tax return | 20.01.2020 |

| Water tax declaration | 20.01.2020 |

| Gambling tax return | 20.11.2019 20.12.2019 20.01.2020 |

| Transport tax declaration | 03.02.2020 |

| Land tax declaration | 03.02.2020 |

| Declaration on mineral extraction tax | 02.12.2019 31.12.2019 31.01.2020 |

| Declaration on mineral extraction tax | 02.12.2019 31.12.2019 31.01.2020 |

| Certificates 2-NDFL | 02.03.2020 |

| 3-NDFL | 30.04.2020 |

| 6-NDFL | 02.03.2020 |

| RSV | 30.01.2020 |

| Information on the average number of employees | 20.01.2020 |

| In the FSS | |

| 4-FSS | 01/20/2020 in paper form 01/27/2020 in electronic form |

| To the Pension Fund | |

| SZV-M | 15.01.2020 |

| SZV-STAZH | 02.03.2020 |

| DSV-Z | 20.01.2020 |