Salary for the second part of the month must be paid no later than 15 calendar days from the end of the period for which it was accrued (clause 6 of Article 136 of the Labor Code of the Russian Federation).

It is prohibited to issue salaries to employees with a break of more than 15 days. The gaps between the first and second parts of the salary should not be longer than 15 days (14–16 days, taking into account the number of days in the month).

Thus, wages for the first half of the month must be paid on the established day from the 16th to the 30th (31st) day, for the second half - from the 1st to the 15th of the next month. This is what the Russian Ministry of Labor noted in letter No. 14-2/OOG-1663 dated March 12, 2019.

note

If the day of payment of wages coincides with a day off or a non-working holiday, then the salary should be transferred on the eve of this day (Part 8 of Article 136 of the Labor Code of the Russian Federation).

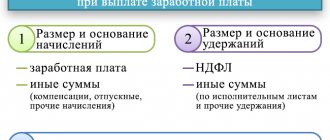

Personal income tax on salary advance

When paying an advance on wages, personal income tax is not withheld from the advance on the basis of the following provisions.

The date of receipt of income in the form of wages is the last day of the month for which it was accrued (clause 2 of Article 223 of the Tax Code of the Russian Federation).

Consequently, the date of receipt of wages for the first half of the month for the purpose of calculating personal income tax will be recognized as the last day of this month.

In this case, the organization as a tax agent must transfer personal income tax from wages no later than the day following the day of payment of income to the taxpayer (clauses 4, 6 of Article 226 of the Tax Code of the Russian Federation).

Thus, the tax agent calculates, withholds and transfers to the budget personal income tax from wages (including for the first half of the month) once a month upon the final calculation of the employee’s income based on the results of each month for which the income was accrued to him , within the time limits established by paragraph 6 of Article 226 of the Code (see Letter of the Ministry of Finance of Russia dated June 11, 2019 N 21-08-11/42596).

A similar point of view is expressed in Letters of the Ministry of Finance of Russia dated October 28, 2016 N 03-04-06/63250, dated October 27, 2015 N 03-04-07/61550:

Before the end of the month, income in the form of wages cannot be considered received by the taxpayer. Accordingly, tax cannot be calculated and withheld until the end of the month.Based on paragraph 4 of Article 226 of the Code, tax agents are required to withhold the calculated amount of tax directly from the taxpayer’s income upon actual payment.

Thus, the tax agent withholds from the taxpayer the amount of tax calculated at the end of the month from income when they are paid at the end of the month (on the last day of the month) in which the income taken into account when determining the tax base for personal income tax on an accrual basis was received.

Taking into account the above, in the situation described, the organization lawfully did not withhold personal income tax from the advance payment of wages.

Calculation formula

I recommend using the safest method for the employer: paying an advance in a fixed amount of 40% of wages, but on the condition that the employee will receive wages for the first half of the month in proportion to the time worked. That is, the advance must be set as a percentage, but the amount must be adjusted for the actual time worked. In this case, when calculating the advance, you must be guided by the time sheet for the first half of the month. If for any reason an employee does not work all the days, then you can adjust the amount of the advance in proportion to the time worked.

The formula for calculation with this approach will look like this:

| Advance amount | : | working days for the advance payment period | X | days actually worked by employees for the specified period |

With this method of calculating the advance, there will be no overpayment at the end of the month, even if the employee goes on vacation from the 13th, no matter for how many calendar days, since the advance under this scheme is adjusted to the actual time worked.

If an employee goes on vacation on the 16th, there will also be no overpayment due to the advance payment. Example

Let's calculate the advance payment using an example.

So: the employee’s salary is 20,000 rubles. We will calculate the advance based on 40% of the salary and the correlation for the time actually worked. The planned amount of the advance will be 8,000 rubles. (20,000 × 40%). The employee worked 6 days instead of 10, which means the advance amount will be equal to 4800 rubles. (8000 / 10 × 6).

The salary advance exceeded the amount of income accrued to the employee

According to the situation described, the wage advance exceeded the amount of income accrued to the employee.

In this case, given that the advance was paid in an amount greater than the employee’s actual time worked, the advance paid should be offset against wages at the end of the month. The date of actual receipt of income in the form of wages for tax purposes is defined as the last day of the month for which the taxpayer was accrued income (clause 2 of Article 223 of the Tax Code of the Russian Federation). Since the advance payment is offset against accrued wages at the end of the month, the date of receipt of the specified income is considered to be the last day of the month. In turn, the object of personal income tax is the income received by the taxpayer (Article 209 of the Tax Code of the Russian Federation). Thus, personal income tax must be calculated on the advance amount on the last day of the month. According to paragraph 6 of Art. 226 of the Tax Code of the Russian Federation, the withheld personal income tax must be transferred to the budget no later than the date following the day of payment of income. In our case, this day is the last day of the month when the advance was counted towards wages.

Since the calculated amount of tax must be withheld directly from the employee’s income upon actual payment, during subsequent settlements with the employee, the calculated amount of personal income tax (clause 4 of Article 226 of the Tax Code of the Russian Federation) and the amount of the unearned advance issued on account of wages are withheld from his earnings ( Article 137 of the Labor Code of the Russian Federation).

Deadlines for payment of other income

Vacation payments must be made no later than three calendar days before the start of the vacation.

Compensation and severance pay upon dismissal are paid to the employee on the day of dismissal (Article 140 of the Labor Code of the Russian Federation).

Maternity benefits, monthly child care benefits up to 1.5 years (or up to 3 years), according to general rules, are paid on the day of salary payment.

The period for payment of sick leave by the employer is determined taking into account 10 calendar days from the date the employee submits a certificate of incapacity for work, allotted for the assignment of benefits. Benefits are paid on the nearest payday after the benefits are assigned (Part 1, Article 15 of Federal Law No. 255-FZ of December 29, 2006).

A one-time benefit for the birth of a child must be paid within 10 calendar days from the date when the employee brought documents for the assignment of benefits (clause 30 of the Procedure, approved by order of the Ministry of Health and Social Development of Russia dated December 23, 2009 No. 1012n).

Tax liability

The duties of a tax agent for personal income tax imply that he must calculate, withhold from the taxpayer and pay the amount of tax to the budget (clause 1, clause 3, article 24, clause 1, article 226 of the Tax Code).

Failure of a tax agent to fulfill the duties assigned to him entails liability under Art. 123 of the Tax Code of the Russian Federation. This provision establishes penalties for unlawful non-withholding and (or) non-transfer (incomplete withholding and (or) transfer) of tax amounts within the prescribed period.

However, it is obvious that non-calculation of personal income tax entails its non-withholding and, as a consequence, non-payment. The amount of sanctions in this case is 20 percent of the amount of tax subject to withholding and (or) transfer. In addition to penalties for paying taxes later than required by law, the organization will have to pay penalties for each day of delay.

GLAVBUKH-INFO

Is it possible to give wages to employees once a month if they themselves asked for it in writing by writing statements? Actually, you can't. Let's explain why.Salary payment terms

Part 3 of Article 136 of the Labor Code establishes that the salary is paid to the employee, as a rule, at the place where he performs the work or is transferred by bank transfer to the bank account specified by him on the terms determined by the collective or labor agreement. Turning to Part 3 of Article 136 of the Labor Code, some employers allow for an expanded interpretation: any conditions relating to the payment of wages, including frequency and deadlines, can be established by a collective agreement or an employment agreement. This is an erroneous interpretation that does not reflect the real content of the norm. This rule only indicates in which documents the specific nuances of salary payment should be recorded: dates, method of payment (from the cash register or by bank transfer).

Frequency of salary payment

Part 6 of Article 136 of the Labor Code clearly establishes that the employer is obliged to pay wages at least every half month on the day designated by the internal labor regulations, collective agreement, or employment contract. The requirements of Part 6 of Article 136 of the Labor Code are imperative, that is, mandatory for execution by the employer. Labor legislation does not provide for any exceptions to the established rule. The employer is obliged to actually pay wages to employees at least twice a month. Rostrud specialists point to this in their explanations (letters from Rostrud dated May 30, 2012 No. PG/4067-6-1 and dated November 30, 2009 No. 3528-6-1). Similar explanations are given by the head of the department of supervision and control over compliance with labor legislation of the Federal Service for Labor and Employment (Rostrud), Igor Ivanovich Dudoladov. In his material on Rostrud inspections, he writes: “The question is often asked: is it possible to pay wages without an advance once a month if employees have written an application with such a request? Is it possible to include a corresponding clause in the internal labor regulations? The answer is negative: it is impossible to pay wages once a month, since this is a violation of Article 136 of the Labor Code and worsens the situation of workers in comparison with the current labor legislation (Part 4 of Article 8 of the Labor Code of the Russian Federation).”

Responsibility for payment once a month

An employer who pays wages to employees once a month will bear administrative and financial liability. What is the danger of paying wages without an advance?

Administrative responsibility

If an employer pays employees wages only once a month, he violates the requirements of labor legislation and may be brought to administrative liability by the labor inspectorate or the court under Article 5.27 of the Code of Administrative Offenses of the Russian Federation. For such an offense the following sanctions are provided: - a fine from 30,000 to 50,000 rubles. or administrative suspension of the organization’s activities for a period of up to 90 days - in relation to the organization; - fine from 1000 to 5000 rubles. - in relation to an official (for example, the head of an organization). If a similar offense is repeated, the official may be disqualified by the court for a period of one to three years (Part 2 of Article 5.27 of the Code of Administrative Offenses of the Russian Federation). A similar offense is understood as the commission by an official of the same, and not any violation of labor legislation. For example, the first time the head of the company paid wages once a month to one, and later - to another employee (clause 17 of the resolution of the Plenum of the Supreme Court of the Russian Federation dated March 24, 2005 No. 5 “On some issues that arise for the courts when applying the Code of the Russian Federation on Administrative Offenses ").

Material liability

It follows from the question that for several months employees were paid wages once a month. Consequently, there was a delay by the employer in paying wages. According to Article 236 of the Labor Code, if the employer violates the deadline for paying wages or other payments due to the employee, the employer is obliged to pay them with interest (monetary compensation). The amount of monetary compensation must be at least 1/300 of the current refinancing rate of the Central Bank of the Russian Federation. An employment or collective agreement may provide for a larger amount of such compensation. Cash compensation is paid for each day of delay in payment of wages, starting from the next day after the established payment deadline until the day of actual payment, inclusive.

If the employer still agrees to the meeting

According to Rostrud specialists, an employee’s statement of consent to receive wages once a month does not relieve the employer from liability for violation of labor laws (Rostrud letter No. 472-6-0 dated March 1, 2007). The mandatory rules established by Part 6 of Article 136 of the Labor Code cannot be changed either by agreement of the parties or by statements of employees. The judicial practice of courts of general jurisdiction also confirms the legality of bringing employers who pay employees wages once a month to administrative liability (resolution of the Supreme Court of the Russian Federation dated September 14, 2010 No. 10-AD10-1, decision of the Supreme Court of the Republic of Karelia dated September 9, 2011 on case No. 21-175/2011).

Who will judge the employer with the labor inspectorate?

Disagreements between the labor inspectorate and the employer on the issue of bringing him to administrative responsibility under Part 1 of Article 5.27 of the Code of Administrative Offenses of the Russian Federation are resolved in a court of general jurisdiction, since this is a dispute arising from labor relations. The arbitration court has jurisdiction over complaints in cases of administrative offenses committed in connection with the implementation of entrepreneurial and other economic activities (resolution of the Federal Antimonopoly Service of the Volga-Vyatka District dated November 2, 2006 in case No. A39-2361/2006). If an employer plans to appeal the decision of the state labor inspectorate to prosecute under Part 1 of Article 5.27 of the Code of Administrative Offenses of the Russian Federation, it should appeal to a court of general jurisdiction (for example, a district court).

If the monthly salary norm is already fixed in the contract

Recording the payment of wages once a month violates the requirements of Part 6 of Article 136 of the Labor Code. If such a condition is included in the employment contract, it is not subject to application by virtue of the direct instructions of the law (Part 2 of Article 9 of the Labor Code of the Russian Federation). In this situation, it is necessary to make changes to the employment contract. To do this, it is necessary to conclude an additional agreement with the employee to the employment contract, which will exclude the entry on the payment of wages without advance payment once a month from a specific clause of the employment contract (Article 72 of the Labor Code of the Russian Federation).

| Next > |

Where to display salary payment terms

A rather controversial issue is where to indicate the timing of salary payments. The fact is that Rostrud and judges have different points of view on this matter. The range of documents is as follows:

- labor regulations;

- collective agreement;

- labor contract.

Previously, in the Labor Code of the Russian Federation, these documents were indicated separated by commas. Then Rostrud obliged to reflect the deadlines in all three papers. Although for the judges it was enough to mention salary days in only one of them.

After the introduction of changes to the Labor Code of the Russian Federation in the fall of 2016, Rostrud allowed information about deadlines to be included only in the labor regulations and in one of the contracts. Meanwhile, based on the wording of the law, it is enough to mention just one of the documents. But in order not to cause claims from labor inspectors, it is better to make notes about the timing of payments in two documents at once.

If information about deadlines is displayed only in the collective agreement, then it is better to include dates in employment contracts. Since one of their mandatory points is the conditions for calculating wages. It is not necessary to enter exact dates. You can simply provide a link to the collective agreement or rules where these dates are already specified.

It is better not to use floating dates in documents. This could result in a difference of more than 15 days between payments, which would violate employee rights. The exact days of the month should be specified in the rules and contracts.

Risky option

Note that some employers have previously made payments to their employees, for example, as follows:

- the advance was issued on the 20th;

- the rest of the salary was transferred on the 15th of the following month.

It is better not to use this option from 2021, as it violates labor laws. It turns out that about 25 days pass between payments. But the law does not allow salary transfers less than 15 days later.

Such a violation can result in a fairly serious fine for the employer. Its amount, in accordance with Part 6 of Article 5.27 of the Code of Administrative Offenses of the Russian Federation, can reach up to 50,000 rubles. Judicial practice shows that such a fine is legal.

How to properly issue it to new employees

Employers also have questions regarding wages for newly hired employees. Thus, the first part of the salary should not be issued later than 15 days after hiring. It turns out that you can transfer money at the end of the month only if the employee was officially employed later than the 15th.

What to do if a new employee has been working in the organization, for example, since the 2nd? By paying him a salary only by the 30th (later than 15 days after employment), the employer will violate labor laws. In this case, a fine of 50,000 rubles may also be applied to him.

If the employer is determined to issue wages in accordance with the Labor Code of the Russian Federation, then in the first month of work it is best to make 3 payments to the new employee at once within the following terms:

| When to issue salaries to new employees | ||

| Payment serial number | When to pay | How much to pay |

| 1 | On the day of payment of salaries to the workforce for the previous month | In accordance with the number of shifts/days worked in the current month |

| 2 | On the day of payment of the advance | Calculate as a regular advance, but subtract money already issued this month from the amount received |

| 3 | At the time of payment of salary for the coming month | Transfer the rest of your salary |

Starting from the 2nd month, salaries can be paid, like other employees.

EXAMPLE

The new employee started working on August 2, 2021. Staff salaries are paid on the 26th and 11th. The salary of a new worker is 22,000 rubles.

There are 23 working days in August 2021. The daily salary is:

22,000 rub. / 23 days = 956.52 rubles.

On August 11, you need to pay for the period from August 2 to August 11 inclusive. There will be 8 working days. Therefore, the payout will be equal to:

RUB 956.52 × 8 days = 7652.16 rubles.

On August 26 we issue salaries for the period from August 12 to 25. Number of working days – 10. Payment due:

RUB 956.52 × 10 days = 9565.2 rubles.

On September 10, you need to withhold tax, as well as deduct the amount from your salary and transfer the remaining amount:

22,000 rub. – 22,000 rub. × 13% – 7652.16 rub. – 9565.2 rub. = 1922.64 rubles.

Also see “What are the deadlines for paying salaries upon dismissal?”

Changes in the Labor Code of the Russian Federation

Let’s say right away that the deadlines for paying salaries and advances in 2021 need to be adjusted in accordance with the latest amendments to the Labor Code of the Russian Federation. They were introduced by Law No. 272-FZ of July 3, 2021 and came into force on October 3 of the same year. Starting from this date, employers were prohibited from giving employees salaries with a break of more than 15 days.

This leads to another feature: the salary for the previous month must be paid no later than the 15th day of the current month. Therefore, if management does not want to be held responsible for violating the deadlines for paying wages in 2021, then it should not make gaps between wages longer than 15 days.

It is now clear what the approximate interval between payments should be. Moreover, the law does not prohibit the payment of the second part of the salary for the past month and on the 15th of the new month. This follows from the text of amendments to labor legislation (Article 136 of the Labor Code of the Russian Federation).

Also see “Changes to the Labor Code of the Russian Federation from June 29, 2021: new rules for calculating wages and other amendments.”

Advance to a new employee in the first month of work - all about taxes

What is an advance payment as a method of payment when hiring?

Advance as the first part of a new employee’s salary

Advance payment as a prepayment to a newly hired employee

Advance as prepayment: what an employer needs to know

Vacation in advance for a new employee: nuances

Advances to new and current employees: reinforcement in local regulations

What is an advance payment as a method of payment when hiring?

An “advance” in labor relations involving new employees can be understood as:

- The first part of the employee’s monthly salary (the second, therefore, is called “salary”).

Salaries must be paid at least once every half month (Article 136 of the Labor Code of the Russian Federation). As a rule, Russian employers divide it into 2 parts:

- “advance” (usually paid from the 15th to the 30th of the billing month);

- “salary” (paid from the 1st to the 15th of the next month).

It is important that the “advance” and “salary” are approximately the same. In any case, the advance payment for half a month should not be less than the salary in proportion to the time worked (letter of the Ministry of Health and Social Development of the Russian Federation dated February 25, 2009 No. 22-2-709). The same applies to salaries.

Read us on Yandex.Zen

Yandex.Zen

- Prepayment for work under an employment contract.

In general, a salary is given to an employee only upon completion of work. But it happens that the employer is forced to transfer an advance payment for labor before the end of the period for which it should be calculated. For example, this is possible if:

- for the reporting month is paid until the 25th day of a given month, “salary” - until the 10th day of the next;

- the reporting month is December, and in order for the “salary” to be accurately credited to employees, including newly hired ones, before January 10 - taking into account holidays and weekends, the accounting department transfers the “salary” in December as an advance payment.

- Vacation pay provided in advance.

Working full time, an employee has the right to paid leave of 28 days (excluding northern and regional benefits that increase leave) after 1 year of work. But after 6 months of work, the employee has the right to request a vacation, and, moreover, paid for all 28 days - in advance (Article 122 of the Labor Code of the Russian Federation).

Advance as the first part of a new employee’s salary

So, the first scenario is to pay the new employee an “advance”, represented by the first part of the salary.

If the employer’s local regulations establish, for example, that an “advance” is paid before the 25th of the reporting month, and the main “salary” is paid before the 10th of the next month, then a new employee who comes to work must receive either an “advance” ”, or “salary” - depending on the start date of work.

For example, if a person started working on the 1st, then he will receive the first salary payment only on the 25th. Consequently, the requirement of Art. 136 of the Labor Code of the Russian Federation regarding the payment of wages every half month will not be fulfilled.

It is quite acceptable to issue advances to newly hired employees as separate interim payments - albeit later than the salary, but earlier than the advance “for everyone”, in order to comply with the rule on transferring wages for half a month. But such a payment should not discriminate against other employees (Article 136 of the Labor Code of the Russian Federation), and therefore the rules for its provision must be enshrined in local regulations.

Example

- The procedure for paying wages (Section 3 of the Regulations on Remuneration).

3.1. Salaries at Trading-Consulting LLC are paid:

- 25th day of the current month - for the 1st half of the month;

- On the 10th of the next month - for the 2nd half of the previous month.

3.2. Newly hired employees are paid:

- when starting a job from the 1st to the 14th - on the 15th of the corresponding month;

- for admission from the 15th to the 24th - on the 25th of the corresponding month;

- for admission from the 25th to the end of the month - on the 10th of the next month.

At the end of the first month of work, the employee ceases to be considered newly hired and receives wages in accordance with clause 3.1 of the Regulations.

Advance payment as a prepayment to a newly hired employee

Payment of an advance in the form of prepayment for labor - as a method of calculation when hiring a new employee - for many legal reasons does not correspond to wages, because:

- In accordance with Art. 132 of the Labor Code of the Russian Federation, wages are set based on the “quantity and quality of labor expended.”

Obviously, the “quantity and quality” of work can only be assessed by the fact of its completion. In the case of the advance in question, such an assessment cannot be made.

- In accordance with Art. 136 of the Labor Code of the Russian Federation, when paying wages, the employer is obliged to issue pay slips to employees, which reflect the data on the basis of which wages are calculated. For example:

- number of hours worked;

- level of plan implementation;

- volume of work performed.

Source:

Advance amount for a new employee in the first month of work in 2017

When calculating advance wages, bonuses, sick leave payments, incentives and other amounts paid not for time worked, but according to other criteria, for example, for results achieved, are not taken into account. When calculating the minimum amount, the monthly amounts are first reduced by the number of taxes withheld, and 50% is taken from the remaining amount.

Necessary indicators when calculating When calculating advance payments, the accountant does not have final information on the work of the enterprise and each employee for the first part of the month, since this data is prepared only based on the results of the month. As a result, accrual may have certain inaccuracies, which are corrected during the final payroll calculation.

How much advance should I give in May?

Tax Code of the Russian Federation, determination of the Supreme Court of the Russian Federation of May 11, 2021 No. 309-KG16-1804). As a result, during these months you will have to withhold personal income tax twice. And in months with 31 days - only once. This creates confusion for both the accountant and the tax authorities.

ImportantNew rules for calculating advances in 2021 Salary advances in 2021, calculation according to the new one. Deadlines for payment of salaries and advances in 2018 The company does not have the right to transfer salaries to employees less than twice a month. It is not prohibited to transfer money more often.

For example, some firms pay employees compensation every week. But you cannot pay less frequently than every half month, even if the employee has asked for it in writing. From October 3, 2016, employers, according to new rules, determine the terms for issuing wages and advance payments.

The final payment must be paid no later than the 15th of the next month (Article 136 of the Labor Code of the Russian Federation).

Source:

Check Also

What to do and where to go if the upstairs neighbor flooded? Living in an apartment building imposes a number of...

Small volume purchases under the laws of 44-FZ and 223-FZ Purchases of up to 100 thousand under 44-FZ Legislation ...

Laws and other regulations in the field of labor protection Labor Code, Federal Law “On the fundamentals of protection ...

Your driver's license has expired: what to do? And the expiration date of the driver's license is...

The bill on limiting the retroactive effect of the 10-year limitation period passed the first reading The Government of the Russian Federation proposed...

The bill on combating anonymous SIM cards passed the first reading 09.15.2017 The State Duma approved the first reading...

Legal regime of spouses' property The legal regime of spouses' property, as the name implies, is established by regulations. ...

Price in conventional units - is it legal? Against the backdrop of erratic fluctuations in the ruble exchange rate...

All conversations are recorded - the Yarovaya package has come into force. The last, and most discussed part of the anti-terrorism ...

Consumer protection law - how to return defective shoes Hello! I bought women's...

The Federation Council approved the law on alimony defaulters. This new status of a parent on the run will allow...

The fact that an airline hooligan has been blacklisted will be notified in advance. Carriers will receive more grounds to punish...

How much noise can you make in an apartment according to the law in 2021? In big cities, people...

Law “on parasitism” in Russia: tax or social payment The crisis has had a strong impact not only on...

A law on regulating gasoline prices will be considered. The rise in gasoline prices has always been one...

Deputies have prepared another bill on a progressive tax scale. The draft law provides for a five percent increase in tax on ...

The new law on preventing the theft of money from bank cards has passed its third and final reading...

Consumer Rights Law: refund for technically complex goods I bought a used laptop in a store. ...

Messengers are in no hurry to register. Their authors were experts from the Ministry of Telecom and Mass Communications. This is what they came up with...

Law on the protection of consumer rights to return goods within 14 days Hello, I bought a phone in ...

Smoking ban law 15-FZ: where is smoking prohibited now and what is the fine? The prohibition law...

Temporary registration law: validity period of departure sheets How long are arrival and departure sheets kept? What does this say about...

The law is not retroactive - what does that mean? What does retroactive law mean? Legal...

All high-rise buildings will be converted for the convenience of people with disabilities. For this positive decision, the meeting ...

Source:

Salary advance, how to calculate it in a new way in 2018

When concluding labor agreements with its employees, the administration of an economic entity is obliged to issue appropriate remuneration for their work within the established time frame.

In this case, payments can be made several times during the month, the first of which is usually called an advance. Regulatory acts have clarified the salary advance in 2021 with a new calculation.

Now the size of the wage advance according to the Labor Code of the Russian Federation depends on the time actually worked.

Is the employer obligated to pay salary advances?

The procedure for paying remuneration to employees of the enterprise is regulated by the provisions of legislative acts, as well as internal documents of the enterprise itself.

It is stipulated that salary payments to employees must be made at least twice a month. However, it is necessary to take into account whether these people had working days during the period under review. If the employee worked, then he has the right to receive the first part of the salary.

However, the management of the organization does not have the right to cancel the transfer. For this, appropriate measures may be applied to him, including payment of compensation to the employee for days of delay in the employee’s remuneration.

In addition, concluded agreements with people working at the enterprise may provide for more frequent payment terms. If they are specified in the employment contract or internal local regulations of the organization, the company administration is obliged to comply with them.

bukhproffi

Attention! The company's management will not be saved by an employee's voluntary refusal to receive his salary in installments in several stages. The only option not to pay the first part to the employee is his absence from work during this period of time.

Failure to meet wage payment deadlines

Violations of the deadlines for payment of advance payments and wages entail administrative liability of employers, which is prescribed in the Code of Administrative Offenses, in Article 5.27.

From 2021, according to the Government Resolution, the amount of penalties for late payments is:

- for officials – 10,000-20,000 rubles;

- for individual entrepreneurs – 1,000-5,000 rubles;

- for an organization – 30,000-50,000 rubles.

For repeated delays, the fines increase:

- up to 20-30 thousand rubles (or disqualification for up to three years) for officials;

- 10-30 thousand rubles for individual entrepreneurs;

- 50-100 thousand rubles. for the organization.

If wages are delayed by more than 15 days, the employee has the right not to go to work until the money is fully received. At the same time, he retains his average earnings.

How many times a month can you pay a salary?

The employer has the right to transfer wages more than 2 times a month. For example, 3 or 4 times. You can make payments at least every week. But the employer cannot pay a salary once a month. This will be a violation even if consent is obtained from the subordinate.

The exception is situations where the employee turned to management with a written request for a monthly salary at the time of issuing the advance. Then the organization can completely legally not make any payments to the employee for a whole month. If such an application has not been received, then the employer has no right to withhold more than 20% of the income.

You should not pay your salary in advance. In the event of dismissal, it will be difficult to withhold the overpayment, because the resigned employee will no longer receive more money from the company. In addition, difficulties arise with filling out 6-NDFL.

If the employee himself asks for an advance, then it is better to lend him the money and return the funds after receiving his salary (issue it as a loan).

Also see “Advances in the calculation of 6-NDFL”.