The current legislation provides for a procedure for reorganizing a legal entity in the form of transformation. For example, a joint stock company can be transformed into a limited liability company, a production cooperative or a non-profit partnership, and a limited liability company into a public or non-public joint stock company, a business partnership or a production cooperative.

During transformation, questions often arise about who (the transformed person - the legal predecessor, or the person created during the transformation - the legal successor) and when (before the state registration of the transformation or after) must submit tax and accounting reports, as well as reports to social funds.

When is a separation balance required?

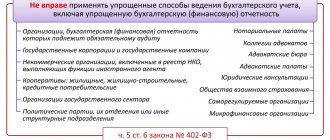

Reorganization of enterprises is a change in their organizational and legal form. The previous legal entity ceases to exist, and its rights are “inherited” by another legal entity that becomes a legal successor as a result of one of the processes:

- mergers;

- transformations;

- divisions;

- discharge.

If a company is reorganized through separation or division, then the property assets are transferred to the successor company on the basis of a special document - separation balance sheet .

Question: In March 2021, a joint decision was made by the owners to reorganize company A by merging company B with it. Both companies are LLCs. The merger took place in June 2021. The transfer of assets, liabilities and other things was carried out according to the transfer act and reconciliation acts as of the date of accession. In connection with newly discovered facts - it turned out that significant amounts of accounts payable were not reflected in the transfer act - one of the participants in company A initiated the cancellation of the merger. In March 2021, by a court decision, the reorganization transaction in the form of merger was declared invalid. What actions should Company A (the divesting entity) take to separate Company B's assets and liabilities? Do I need to draw up a separation balance sheet, draw up final financial statements and submit them to the tax authority? View answer

Division stops the activities of the primary legal entity, transferring its rights to several newly created organizations. A spin-off does not liquidate the parent company, but allows for the transfer of some rights and responsibilities to new companies that arise from it. In any case, it is necessary to adequately divide property between the reorganized enterprises. This issue regulates the separation balance sheet, determining the finances, property assets and liabilities transferred to the newly formed business units.

IMPORTANT INFORMATION! It is impossible to divide property without a separation balance sheet.

But the act of writing this document itself is not mandatory.

Personal income tax reporting

The Federal Tax Service and the Ministry of Finance indicated in a number of their letters that the legal successor does not have the opportunity to provide 2-NDFL certificates on the income of individuals for the legal predecessor. In their opinion, the transformed person must submit 2-NDFL for his period before the moment of transformation, and the legal successor must submit information for the period from the date of transformation to the end of the year by April 1. This position is set out in the letter of the Ministry of Finance of Russia dated July 19, 2011 No. 03-04-06/8-173, letters of the Federal Tax Service of Russia for Moscow dated April 21, 2010 No. 16-15 / [email protected] , dated April 1, 2008 No. 09- 14/031191, as well as in a number of others.

At the same time, the position expressed in these letters is not indisputable. In our opinion, the successor can submit certificates of employee income for the person being transformed.

Legislative norms

- Various forms of reorganization are justified in paragraph 5 of Art. 58 of the Civil Code of the Russian Federation.

- The nuances of changing the legal form between a CJSC and an LLC are described in Federal Law No. 208-FZ “On Joint Stock Companies” of December 26, 1995.

- The procedure for making a decision on reorganization is regulated by Art. 57 Civil Code of the Russian Federation and Art. 20 of Federal Law No. 208-FZ.

- Registration of new legal entities formed after the reorganization is carried out within the framework of Federal Law No. 129-FZ “On State Registration of Legal Entities and Individual Entrepreneurs” dated August 8, 2001.

- Succession is regulated by the provisions of the Tax Code of the Russian Federation.

- The transfer deed is drawn up on the basis of the references in Art. 58, 59 of the Civil Code of the Russian Federation and Methodological guidelines for the preparation of financial statements during the reorganization of organizations No. 44n, approved by Order of the Ministry of Finance of Russia on May 20, 2003.

separation balance contain ?

Tax reporting

The general rules that must be followed when submitting tax reports during the transformation process are established by Article 55 of the Tax Code of the Russian Federation.

It states that for a transformed organization, the tax period ends on the date of transformation. However, there is a caveat that this provision does not apply to VAT and other taxes with a tax period of a month or quarter. Income tax return

The tax period for the transformed organization is the period from the beginning of the year until the moment of registration of the transformation. Theoretically, she could try to submit her return before her conversion date. Of course, this should only be done if the legal predecessor does not conduct business from the moment of filing the declaration until the moment of registration, otherwise the declaration will be unreliable. But in practice, he may have difficulty submitting the report early, so most organizations prefer to submit reports after registering the transformation.

In this case, the successor must submit a declaration for the predecessor. The header of the declaration indicates the TIN and KPP of the legal successor, and in the special fields of the title page the TIN and KPP of the legal predecessor are indicated, as well as the reorganization form code and tax period code 50, and the OKTMO field of the legal predecessor is indicated in the OKTMO field. In addition to this declaration, the legal successor submits a regular declaration for himself. He must submit both returns within the normal period provided for by the Tax Code.

Value added tax declaration

The tax period for VAT is a quarter. Therefore, separate rules have been established for VAT. The Federal Tax Service of the Russian Federation in its letters dated 05.12.14 No. GD-4-3/ [email protected] and dated 05.13.15 No. 24-15/ [email protected] considered the case of converting a closed joint stock company into an LLC and explained that the submission of a declaration by the legal predecessor (the closed joint stock company) VAT for the last tax period is possible only with the prior written consent of the territorial Federal Tax Service. In this case, the CJSC submits a declaration for the period before the date of registration of the transformation. The legal successor (LLC), in turn, submits a declaration for the period after the date of transformation.

If there is no written consent of the Federal Tax Service, then, in the opinion of the Federal Tax Service, within the period prescribed by the Tax Code (January 25, April 25, etc.), the successor submits a VAT return, which includes data on both the activities of the legal predecessor and his own activities.

Property tax declaration

For property tax, the tax period for the transformed person will also be the period from the beginning of the year until the registration of the transformation. Accordingly, you should follow the same rules as when filing your income tax return. It is worth noting that for the last reporting period (in which the transformation took place), it is necessary to submit not a calculation of the advance payment for the reporting period, but a tax return for the tax period.

Declaration according to the simplified tax system

For the simplified taxation system, the tax period for the legal predecessor will also be the period from the beginning of the year until the moment of registration of the transformation. Accordingly, you should follow the same rules as when filing your income tax return.

Corrective declarations

In the case of filing corrective declarations for any taxes for the period of activity of the predecessor, the successor indicates his TIN and KPP in the header of the declaration, and in special fields the TIN and KPP of the legal predecessor and the reorganization code. The OKTMO field also indicates the OKTMO of the legal predecessor.

Time for drawing up the separation balance sheet

When to start dividing the company's property? The stage of drawing up a separation balance sheet naturally occurs after the following steps are completed:

- approval of a decision on reorganization as a result of a meeting of participants or shareholders, a court order or an order from government bodies;

- start of the process;

- inventory of material assets of the parent enterprise;

- audit of obligations.

The founders themselves have the right to choose the timing for writing the separation balance sheet.

FOR YOUR INFORMATION! For convenience, regulatory authorities recommend that the preparation of the separation balance sheet be timed to coincide with the end of the reporting period, preferably a year.

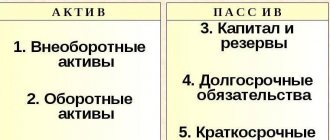

Form and content of the separation balance sheet

The legislation does not approve the procedure for drawing up and the form of this document - this is an internal matter of the reorganized company. The only mandatory regulatory requirement is the “ provision on succession ”, in other words, comparative data on property values and debts of the “old” and “new” (new) companies should be provided.

ATTENTION! The founders themselves decide how to value the property: at market price or at residual value.

It is convenient to use a standard accounting balance sheet for registration, which contains columns for the reorganized company and all successors. The figure shown in the first column for the predecessor organization should be the sum of all the others. For example, if one company is spun off into another, three columns must be provided in the balance sheet: for the original company, for the separated part and for the remaining one.

In the appendix to the balance sheet, it is necessary to describe in detail all the amounts indicated in the table: the value of each asset and the number of debt obligations.

How assets and debts are divided during reorganization

The main factor determining the figures in the separation balance sheet is the agreement between the founders of the companies undergoing reorganization. By mutual agreement, decisions are made on the transfer or retention of property, funds, and obligations to creditors. There are accepted rules by which the balance is most often distributed, unless the parties decide otherwise:

- material assets (property, inventories, materials, unfinished production, etc.) are divided according to the principle “who needs it more”;

- debt obligations - “minus” assets are distributed in proportion to “plus” ones, that is, the one who took on more property takes on greater obligations;

- money - the amount from various accounts and cash balances is divided as the participants agree.

Documentary basis of the separation balance sheet

In order for new accounting reports to be generated correctly and not cause any complaints from the inspection authorities, the separation balance sheet must be drawn up correctly. For this, the following supporting documentation is required:

- the founders’ decision on reorganization: for the first time, it fixes the rules for dividing assets and distributing debts, as well as the method of assessing property;

- accounting reports of the “old” company - they are the basis for assessing the dividing property;

- papers on the latest inventory - contain the valuation of assets;

- invoices for the purchase of assets, if it was made after the inventory - forms must be attached to the inventory documents;

- acts deciphering the parent’s obligations for the acceptance and transfer of fixed assets, inventories, materials, and material assets;

- an inventory of other property that will be transferred, but is not listed in the primary documents;

- listing of accounts payable and receivable with confirmation of timely notification of creditors about the reorganization;

- papers confirming settlements with various bodies, structures, funds (municipal and commercial);

- agreements with newly created companies (in case of legal claims regarding transferred obligations);

- An extract from the Unified State Register of Legal Entities indicating the fact of reorganization is attached after registration.

Reporting to funds

The legislation does not establish any special standards for submitting reports to the Social Insurance Fund and the Pension Fund of the Russian Federation during transformation.

Accordingly, the successor may file reports for the predecessor. But according to clause 3 of Article 11 of the Law on Personalized Accounting No. 27-FZ, the converted person must provide information about the insurance premiums paid and the insurance period within a month from the date of approval of the transfer act, but no later than the day the documents for transformation are submitted to the registration authority. This information is submitted at the time of submission of documents for transformation. For example, if documents are submitted on October 10, then the legal predecessor must submit information for both the 3rd quarter and the 4th quarter.

It should also be taken into account that the legal successor will have a new registration number in the Social Insurance Fund and the Pension Fund of the Russian Federation. Accordingly, based on practice, we advise the legal predecessor to provide reports to the funds for his period before the registration of the transformation. The legal successor will provide reports to the Social Insurance Fund and the Pension Fund of the Russian Federation with his new registration number for the period from the moment of registration of the transformation within the time limits prescribed by law.