A tax return is a report submitted by payers of a certain taxation system. For each tax regime, the Federal Tax Service develops special forms and approves its deadlines for submission.

The simplified tax system declaration is submitted by all individual entrepreneurs who have switched to a simplified regime, reporting this on form 26.2-1. The absence of income or activity within the framework of the simplified procedure does not exempt the entrepreneur from submitting reports, in this case, zero.

What is a zero declaration

Officially, the Tax Code of the Russian Federation does not use the concept of “zero” for declarations, but in practice this concept is well known and is even mentioned in letters from the Ministry of Finance. Zero is called reporting in which there are no significant numerical indicators, for example, income of individual entrepreneurs or amounts of tax payable. Instead they are filled with dashes or zeros.

Not only declarations under the simplified tax system, but also for personal income tax, VAT, profit and other regimes where tax is calculated from income received can be zero. But there cannot be a zero declaration on UTII, because real income is not taken into account for calculating tax here. If there is a corresponding physical indicator on the imputation in the reporting quarter, tax will have to be paid.

There are no special forms for zero declarations for each regime. Reporting is submitted in the same form as declarations with significant numerical indicators. In addition, a single simplified declaration has been developed, which allows you to report the absence of taxable objects for several taxes at once. We'll tell you more about it below.

Prepare a simplified taxation system declaration online

What is this kit? Let's figure it out.

The very concept of “zero” reporting is a set of accounting, tax, and reporting to extra-budgetary funds, which is submitted by a taxpayer who is temporarily not carrying out financial and economic activities, or by a newly registered LLC and individual entrepreneur.

It is necessary to distinguish between zero reporting, which is submitted

- to extra-budgetary funds (Social Insurance Fund and Pension Fund of the Russian Federation)

- to the tax authorities

Simplified system - 1000 rub.

General system - 1500 rub.

Who must report on the zero declaration of the simplified tax system

A zero declaration under the simplified tax system for 2021 for individual entrepreneurs is required for the following situations:

1. An entrepreneur has registered, submitted a notice of transition to a simplified system, but is not engaged in business at all. In practice, this happens if individual entrepreneurs were registered only in order to pay insurance premiums for themselves and build up the length of service for calculating a pension.

2. An individual entrepreneur combines several tax regimes, for example, simplified tax system and UTII or simplified tax system and patent. And although he receives income from business, it is not within the framework of the simplified taxation system. This situation is more controversial, because there are a number of letters (dated October 10, 2012 No. 03-11-11/298), where the Ministry of Finance expresses a different point of view. In particular, if an entrepreneur combines the simplified tax system and UTII, but at the same time conducts activities only on imputation, then he does not need to report under the simplified regime.

In fact, in the case of combining regimes, it is still better to submit a zero declaration under the simplified tax system. In the same commented letter, the individual entrepreneur reports that he did not report under the simplified procedure for one year, because the tax office told him so. And the next year he was fined for failing to submit a zero declaration under the simplified tax system.

3. The simplifier has temporarily suspended business activities for the period of being on leave to care for a child under one and a half years old, a disabled person, an elderly person, or completing military service on conscription. These are the so-called grace periods for paying insurance premiums for yourself. And in order to prove not only these life circumstances, but also the lack of income, the simplifier must submit zero declarations.

The deadline for submitting a zero declaration under the simplified tax system is April 30 of the year following the reporting year. That is, the deadline for submitting reports for 2018 is 04/30/2019. And you must report under the simplified tax system for 2021 no later than 04/20/2020.

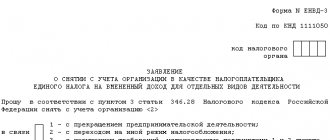

EUD: deadlines and how to submit

A simplified declaration is submitted in the absence of any movement of funds and the closure of the entrepreneur’s activities. It is a simplified analogy of the standard reporting form. The EUD has a controversial reputation. On the one hand, its provision is also mandatory for entrepreneurs. On the other hand, the owner of an individual entrepreneur can choose what to submit: a classic declaration or a simplified form. This is solely his choice, the right to which is granted by current legislation. Employees of the Federal Tax Service cannot force an entrepreneur to pay fines for late submission of the EUD if a regular tax return under the chosen tax regime was previously submitted.

However, if any type of reporting is not provided on time, the Federal Tax Service still has the right to apply penalties against the entrepreneur.

Enterprises that fully meet certain conditions have the right to submit a simplified declaration:

- No transactions on the current account. This implies a complete absence of movement of funds, i.e. both income and expenses. These include rent, receipt of payment for services provided, payment of housing and communal services, etc. An interesting feature is that the right to use the simplified form is lost even if erroneous transactions are carried out on the current account.

- Complete absence of tax transactions. In this case, the absence of any tax charges is implied.

Individual entrepreneurs working on the Unified Agricultural Tax, the simplified tax system, and VAT will be able to submit a simplified declaration. This right does not apply to personal income tax. A simplified declaration must be drawn up and submitted to the tax service no later than the 20th day of the period following the reporting period.

For example: according to the simplified tax system for 2021, it is necessary to submit a declaration by January 20, 2021, this date is also relevant for submitting the VAT return for the fourth quarter.

How to pass the EUD? Simplified zero reporting of individual entrepreneurs is submitted to the tax office in both electronic and paper form. The choice is entirely up to the entrepreneur. The simplified declaration form consists of one sheet. This easily explains the title of this document. The entrepreneur fills out:

- Reporting period.

- Document type.

- OKATO.

- OKVED.

- Name of taxes.

The second column must indicate the chapter of the Tax Code containing information about the taxation system used. In the third - the reporting period, in the fourth - the quarter number. For VAT there is an indication “3”, indicating the quarter, the number is first, second, third or fourth. For the simplified tax system, “0” is indicated, indicating the year, while the fourth column must be left blank.

What is the penalty for failing to submit a zero declaration?

At first glance, the fine for not filing a zero declaration is small - 1000 rubles. Moreover, Article 119 of the Tax Code of the Russian Federation provides for a more serious sanction for violating the deadline for submitting tax reports - from 5% to 30% of the amount of tax unpaid according to the declaration. And considering that there is no data on income in the zero declaration of the simplified tax system, then there is no arrears here.

But the fact is that if the delay in submitting reports exceeds 10 days, the Federal Tax Service has the right to suspend operations on the individual entrepreneur’s current account. Of course, this measure is not particularly effective if the entrepreneur’s business does not work or there is no current account at all.

It’s worse if an individual entrepreneur operates on a different taxation system and has a valid current account. Then an unsubmitted zero return under the simplified tax system will greatly complicate running a business, even if the entrepreneur reported on time under another tax regime.

In addition, until 2021, the Pension Fund of Russia issued an invoice for the maximum possible amount of insurance premiums to an entrepreneur from whom a declaration was not received. For example, for 2021 it was an amount of 154,851 rubles. Now this norm has been abolished, but it cannot be guaranteed that the Federal Tax Service will not introduce it again to discipline taxpayers.

Features of zero reporting

There are various ways to report nil reporting. First of all, they depend on the chosen tax regime. The declaration can be completed in two ways:

- zero indicators are reflected for all types of business activities, including expenses and income. Such a document indicates that the entrepreneur did not receive any income during the reporting period and, accordingly, did not incur expenses. At the same time, the tax amount is also zero;

- the statements contain a zero amount of tax payable. It decreases in proportion to the amount of expenses.

If the performance indicators are zero, the entrepreneur fills out a standard form or a simplified declaration. This document actually speaks of the cessation of the work of the individual entrepreneur and the complete absence of income for the tax period.

If you have no income and expenses, you should understand that the declaration is still subject to submission. The entrepreneur is not exempt from providing it within the time limits specified by law. The document contains dashes that prove the absence of economic activity for the reporting period.

How to prepare a zero declaration according to the simplified tax system

It will take you no more than 15 minutes to prepare a zero declaration using the simplified system if you fill it out on a computer. Manually filling out reports is also allowed, but you will spend more time on this, because you need to write carefully, in capital block letters. In addition, if there is any inaccuracy, you will have to fill out the declaration again. No errors, omissions or corrections are allowed here.

So, first you need to download the current declaration form for the simplified tax system. The current form was approved by order of the Federal Tax Service of Russia dated February 26, 2016 No. ММВ-7-3/ [email protected] Check that it has the linear barcode 0301 2017.

The declaration form is common for all simplified forms: organizations and individual entrepreneurs, for the “Income” and “Income minus expenses” options, but only certain pages need to be completed in it.

The general rules are:

- payers of the simplified tax system 6% fill out: title page, sections 1.1 and 2.1.1. In addition, if a simplifier pays a trade tax on the taxation object “Income”, then section 2.1.2 must also be prepared;

- payers of the simplified tax system 15% fill out: title page, sections 1.2 and 2.2.

If an entrepreneur received targeted financing using any version of the simplified tax system, then section 3 is additionally completed.

We will consider a sample of filling out a zero declaration for individual entrepreneurs without employees under the simplified tax system of 6 percent, as the most popular option. If you have the simplified tax system Income minus expenses, the declaration is filled out in the same way, only other sections are submitted (1.2 and 2.2).

1.The title page reflects the standard registration data of the entrepreneur:

- TIN number (checkpoint code can only be filled in by organizations);

- adjustment number (for the first time filed declaration it is “0”);

- tax period (for the year-end declaration, this is code “34”);

- reporting year (in this case – 2018);

- inspection number where the individual entrepreneur is registered (it can be found in the TIN certificate);

- code at the location of the account (for individual entrepreneurs this is “120”);

- full name of the entrepreneur (each word on a separate line);

- main activity code according to OKVED (the code is indicated in accordance with the current edition of OKVED-2. If you were registered before July 2021, your code was indicated according to the edition of OKVED-1. In this case, the new spelling of the code can be found from the free service of the Federal Tax Service);

- telephone number where the inspector can contact you in case of questions;

- number of pages (for a zero declaration of the simplified tax system this will be “3”);

- who submits the declaration (“1” if it is the individual entrepreneur himself, or “2” if the report is submitted by a representative. For the second option, you need to prepare a notarized power of attorney and indicate its details in the lower left block);

- date of submission of the declaration.

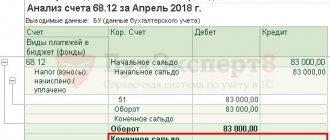

2. Section 1.1 includes the amounts of advance payments and annual tax payable. But since the declaration is zero, it will not contain this data. All you need to indicate here is your OKTMO code.

If you have not changed your municipality during the year, then enter the code only once, in line 010. If you have moved and your OKTMO code has changed, then enter all your codes in lines 030, 060, 090. All other fields will be empty.

3.Section 2.1.1 is intended to indicate the income received, the tax rate, and insurance contributions that reduce tax payments. There is no income in the zero declaration, which means there will be no indicators in the corresponding lines. The standard tax rate for the simplified tax system in Russia is 6%, although regions have the right to reduce it to 1%. In addition, individual entrepreneurs enjoy a zero rate during tax holidays. You can check the rate at your inspection office or on the Federal Tax Service website.

As for insurance premiums, an entrepreneur is obliged to pay them, even if he does not conduct business or does not receive income (except for grace periods for non-payment). However, the contributions paid are not reflected in the zero declaration, because they do not affect the tax reduction.

Thus, on the third page of the reporting only the tax rate by quarter is indicated. The remaining cells are marked with dashes. By the way, dashes are required only when filling out reports manually; when filling out on a computer, they can be omitted.

Zero declaration under the simplified tax system for 2021 for individual entrepreneurs (filling sample)

Please note: the procedure for preparing a zero declaration can be significantly simplified and speeded up if you use a specialized online service.

Prepare a simplified taxation system declaration online

Single simplified declaration

As we have already noted, instead of a zero declaration under the simplified tax system, you can submit a single simplified declaration. It only has one page, making it even easier to fill out.

But the fact is that you can pass the EUD only if two conditions are met:

- absence of an object of taxation (for the simplified tax system this is income from activities);

- lack of cash movements in the current account and cash register (in the case where an entrepreneur combines simplified taxation with another regime, this is hardly possible).

In addition, the deadline for submitting a single simplified declaration is 20 days after the end of the reporting period. For the annual declaration under the simplified tax system, this will be January 20.

So, if you did not know about this possibility, you can submit the EUD already for 2021, and for 2021 you must report using the usual simplified taxation system declaration form.