Zero declaration under the simplified tax system if there are no income and expenses

Zeros in the declaration can easily be explained by the lack of income.

The tax office may doubt the veracity of the information and check your bank account. If there was no income, the questions will disappear. If you did receive money into your account, you will most likely be sent a request for clarification. In such a situation, it is important to explain to the tax office what kind of money it is and why you did not show it in the declaration. For example, replenishing an account with personal money or repaying a debt does not need to be taken into account as part of your income.

Details about the simplified tax system in the article “Simplified taxation system”.

6-NDFL, if employees have not been paid all year

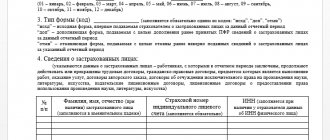

The 6-NDFL report must be submitted if individuals receive income from you - salary, dividends or interest-free loan. The annual 6-NDFL also includes 2-NDFL certificates, which were submitted separately until 2021.

If you haven't paid physicists all year, you don't need to report because you weren't a tax agent during the tax period. 6-NDFL may be zero.

If a person receives income from you at least once a year, you submit 6-NDFL for the quarter in which you paid, and then until the end of the year.

For example, on April 15, 2021, your LLC issued dividends to the founder. You will have to submit 6-personal income tax for six months, 9 months and a year based on the results of 2021.

About personal income tax reporting in the article “How to prepare a 6-personal income tax report.”

Blocking accounts

It is not entirely clear whether employees of the Federal Tax Service will be able to block the current account of the policyholder if he does not submit the payment for contributions. From the new wording of paragraph 11 of Article of the Tax Code of the Russian Federation it follows that the blocking rules apply to contribution payers. However, in paragraph 3 of Article of the Tax Code of the Russian Federation, which lists all acceptable grounds for blocking, payment of contributions not submitted on time is not listed.

It is possible that legislators will soon eliminate this contradiction. If this does not happen, then disputes will most likely arise between tax authorities and policyholders, which will be resolved in court.

RSV and 4-FSS, if there are no employees

Calculation of insurance contributions to the tax and 4-FSS to the social insurance fund is submitted by individual entrepreneurs with employees and all LLCs.

If an individual entrepreneur does not have employees during the year, there is no need to submit RSV and 4-FSS.

LLCs always report. If the organization has no employees, submit zero reports, but this may lead to claims from the state.

The fact is that an LLC is a separate organization in whose interests the director acts. Often in small companies the work of the director is performed by the founder himself. He does not pay himself a salary and receives income in the form of dividends. But according to labor law, a director is an employee like everyone else, so he is entitled to a salary.

Inspectors are especially suspicious of companies that receive income but pay zero money for employees. They may require clarification, charge additional fees and fine you.

We wrote more about the director of an LLC in the article “Even if the director is the founder of the LLC, he is entitled to a salary.”

Taxable object, taxable base and amount of contributions

The rules by which you need to calculate the amount of pension, medical contributions, as well as contributions to the Social Insurance Fund (except for contributions for injuries) will remain virtually unchanged. Thus, the taxable object will continue to be payments and other remuneration in favor of individuals accrued under employment and civil law contracts. The taxable base, as now, will be determined separately for each individual on an accrual basis from the beginning of the year. The maximum amount of the base for contributions in case of temporary disability and in connection with maternity will also remain (the size of the maximum amount is indexed annually). For pension contributions, a reduced rate will remain in relation to payments accrued in excess of the limit. All tariffs and benefits will remain the same.

The only innovation is provided for daily allowances. Now the entire amount of daily allowance fixed in the collective agreement or in a local regulation is exempt from these contributions. From January 2021 the situation will change. It will be possible not to pay contributions only for amounts not exceeding 700 rubles for domestic business trips, and for amounts not exceeding 2,500 rubles for foreign trips. This is enshrined in paragraph 2 of Article 422 of the Tax Code of the Russian Federation (see “Excessive daily allowances will be subject to insurance contributions”).

Plus, there will be clarification on how to determine the taxable base for income in kind. According to the current rules, the base includes the cost of goods, work or services specified in the contract. Starting next year, we will determine the price according to the rules of Article 105.3 of the Tax Code of the Russian Federation, that is, based on market prices. It is separately stipulated that VAT is not excluded from the taxable base (clause 7 of Article 421 of the Tax Code of the Russian Federation).

With regard to contributions “for injuries” everything will remain the same. Daily allowances will be released in full, and income in kind will be taken into account in the database at negotiated prices.

SZV-M without employees

SZV-M is a monthly report to the pension fund, which contains a list of all your employees.

If you are an individual entrepreneur without employees, you do not need to take the SZV-M.

But an LLC has at least one employee - a director, and he must be shown in SZV-M.

There is no consensus on whether it is necessary to submit SZV-M to a director who is the only founder with whom an agreement has not been drawn up. The Pension Fund itself issued two letters with opposing positions. According to the letter dated May 6, 2021, the SZV-M must be taken in any case, but in the letter dated July 27, 2021, the Pension Fund says that there is no such obligation.

We recommend employing the director at least part-time and submitting SZV-M and other reports for him as for a regular employee. If an employment contract has not been drawn up with the director, regulatory authorities may have questions. Read more about this in the article.

If you still do not want to employ the founder, ask your Pension Fund a question whether it is necessary to show the director without an employment contract to SZV-M - different departments may have different opinions.

If an organization has suspended its business, does not receive income, and has no hired employees, there is no need to submit the SZV-M. The Pension Fund provides such explanations on its website.

Article: how to report after all employees have been fired

Reimbursement of social insurance expenses

In 2021, employers will still have the right to reimburse benefits (except for the first three days on a “non-maternity” ballot) from the Social Insurance Fund. The policyholder will be able to transfer contributions minus benefits. If the amount of contributions turns out to be less than the amount of benefits, then the difference is allowed to be offset against the payment of contributions in subsequent periods, or to request the missing funds from the Social Insurance Fund.

The expenses will be checked as follows. Tax authorities, having received a single quarterly calculation from the policyholder, will transfer the information to the territorial body of the Social Insurance Fund. Inspectors from social insurance will verify the accuracy of the declared expenses by conducting a desk or on-site inspection. They will report the results to the tax authorities. If the result is negative, the Federal Tax Service will send the policyholder a demand for payment of the missing contributions. If the audit result is positive, the expenses will be accepted, and the tax office, if necessary, will offset or return the difference between contributions and expenses. We would like to add that the above algorithm will be applied until December 31, 2021 inclusive. And not everywhere, but only in regions that have not yet joined the pilot project for paying benefits directly from the Social Insurance Fund. Starting from January 2019, the reimbursement procedure will become a thing of the past, since all regions without exception will begin to receive benefits directly from social insurance.

SZV-TD when there are no employees

SZV-TD - a report to the Pension Fund on personnel events.

Individual entrepreneurs without employees do not submit SZV-TD; the individual entrepreneur himself does not need to be shown in the report. A zero report form is not provided.

If the director is employed in an organization under an employment contract, then the SZV-TD must be submitted, just like for any other employee. For hiring and dismissal - no later than the next working day after the order is issued. If other personnel events occurred, the report is sent by the 15th of the next month.

If an employment contract has not been concluded with the founder, then you do not need to submit the SZV-TD.

Article: electronic work books and SZV-TD

Refund of overpaid insurance premiums

In January of next year, policyholders will retain the right to a refund of overpayments on premiums, but it will be the tax authorities who will return it, not the funds. The refund procedure will be the same as for taxes, but a new condition will appear. If overpaid pension contributions are reflected in personalized reporting, and the Pension Fund of the Russian Federation posted them to personal accounts, the tax authorities will not return the overpayment. This rule is enshrined in the newly created paragraph 6.1 of Article of the Tax Code.

Excessively paid contributions “for injuries” will be returned by the Social Insurance Fund. In the new edition of the Law on Compulsory Social Insurance against Accidents at Work, Article 26.12 will appear, which provides an algorithm for offsetting and returning overpayments. This algorithm is similar to that applied to other contributions.

SZV-STAZH without employees

SZV-STAZH - an annual report to the Pension Fund of Russia on the length of service of employees.

Individual entrepreneurs who do not have employees do not submit reports. There is no zero form of SZV-STAZH.

Organizations must submit a report, even if an employment contract has not been concluded with the founder. This is stated in the Resolution of the Board of the Pension Fund of the Russian Federation dated December 6, 2018 No. 507P. If the sole founding director does not receive a salary, in the field Calculation of length of service → Additional information indicate “NEOPL”.

Article: reporting to the Pension Fund for employees

Fines

Starting from 2021, tax authorities will begin to punish violations related to contributions (except for contributions for injuries). Moreover, all sanctions provided for tax violations will also apply to contributions. In particular, for failure to submit a calculation of contributions, the policyholder will be fined on the basis of Article 119 of the Tax Code of the Russian Federation, for a gross violation of the rules for accounting for the base of contributions - on the basis of Article 120 of the Tax Code of the Russian Federation, etc.

FSS employees will continue to be punished for violations related to “injury” contributions. The types of sanctions are listed in the new edition of the Law on Compulsory Social Insurance against Occupational Accidents. For example, for refusing to provide documents for verification, the policyholder will be fined 200 rubles. for each document not submitted (Article 26.31 of the said Law).

The pension fund will be able to apply two types of sanctions: for failure to provide annual information about the length of service (500 rubles for each insured person), and for violation of the procedure for submitting reports in the form of electronic documents (1,000 rubles). This is spelled out in the new version of Article 17 of the Law on Personalized Accounting.

Zero accounting for LLC

Every year, all LLCs submit financial statements, which reflect the annual results of activities - money in accounts, property, debts, profits or losses.

Accounting is never zero, even if you did not run a business. Each organization has an authorized capital, the amount of which you determine when registering a business and deposit it into a bank account. It must be reflected in the accounting reports.

An article about how to do accounting yourself - “Accounting without an accountant: what you need to know for an LLC.”

In Elba there is a special tariff for LLCs that submit zero reports. Read about the details on the special page.

Submit reports in three clicks

Elba - online accounting for individual entrepreneurs and LLCs. The service will prepare reports, calculate taxes and free up time for useful things.

Try 30 days free Gift for new entrepreneurs A year on “Premium” for individual entrepreneurs under 3 months

What has changed for individual entrepreneurs and other “individuals”

Citizens who work for themselves will continue to pay fixed payments for health insurance. Premiums for temporary disability and maternity insurance will remain voluntary for them. As now, they will not pay “injury” contributions. There is one change regarding pension contributions. It applies to “individuals” who received income over 300,000 rubles. As now, they will add 1% of the amount of income exceeding 300,000 rubles to the fixed amount of contributions. As now, information about income will be received by inspectors from tax returns. But they will cancel the rule according to which, in case of failure to submit a declaration, auditors charge contributions in the maximum amount. In other words, starting next year, a failed declaration will not result in an increase in contributions “for oneself” for individual entrepreneurs.

As for reporting, there are not many changes. Entrepreneurs and other “individuals” will still not submit payments for fixed contributions. But for the heads of peasant (farm) households, new deadlines are provided. They will submit payments no later than January 30 of the year following the billing period (currently the deadline for submission is the last day of February).