It follows from the amendments that the debts of individual entrepreneurs, lawyers, notaries, and other persons engaged in legal private practice will be written off, including those who, as of January 1, 2021, have already lost their individual entrepreneur status or ceased private practice. The current 243-FZ provides for the possibility of writing off debts on insurance premiums, but in the case of an individual entrepreneur, this requires declaring him bankrupt or a court act on the impossibility of collecting arrears (there is no such basis as termination of the status of an individual entrepreneur).

The list of documents that will be needed to write off the debt and the procedure for writing off will be determined by the Federal Tax Service. Specific decisions on write-offs will be made by the tax authorities at the place of residence of individual entrepreneurs.

Read on RBC Pro

Hiring with a demotion: is it worth hiring a former manager for a line position? Founder of VkusVill: if the employee is not mistaken, he should be fired RBC Pro: run, be patient, look for profit. How to work with a toxic manager Prices for new Moscow buildings are almost at their peak. What should investors do?

What is a tax amnesty, and how will it affect the situation of individual entrepreneurs?

of the Russian Federation for settlement (reporting) periods expired before January 1, 2021, in the amount determined in accordance with Part 11 of Article 14 of the Federal Law of July 24, 2009 No. 212-FZ “On insurance contributions to the Pension Fund of the Russian Federation, the Social Fund insurance of the Russian Federation, the Federal Compulsory Medical Insurance Fund", debt for the corresponding penalties and fines accruing to individual entrepreneurs, lawyers, notaries engaged in private practice, and other persons engaged in private practice in accordance with the procedure established by the legislation of the Russian Federation, as well as to persons who, on the date of writing off the corresponding amounts, lost the status of an individual entrepreneur or lawyer or ceased to engage in private practice in accordance with the procedure established by the legislation of the Russian Federation.

2. Tax amnesty means the release of persons from the obligation to pay a certain type of tax to the state treasury, exemption from liability for non-payment of taxes, as well as penalties and fines incurred in connection with non-payment. Currently, 3 million individual entrepreneurs have debts on taxes and insurance premiums [about 15 billion rubles.

, as stated by Vladimir Putin at a press conference in December. – GARANT.RU]. An entrepreneur is obliged to report to the state, even if he does not conduct business; penalties are provided for failure to fulfill this obligation (Article 119 of the Tax Code of the Russian Federation). In the business environment, there are often cases when a business did not live up to the entrepreneur’s expectations and turned out to be unprofitable, and therefore its activities were discontinued.

However, the individual entrepreneur is not exempt from the obligation to pay taxes and insurance contributions to the state treasury; as a result, the amount of debt increases, penalties are imposed, including the termination of activities as an individual entrepreneur and the corresponding entry is made in the Unified State Register of Individual Entrepreneurs. With the adoption of Law No. 436-FZ, entrepreneurs have a legally recognized opportunity to get rid of the financial burden arising from non-payment of taxes and contributions.

What to follow 1 Federal Law of July 24, 2009 No. 212-FZ “On insurance contributions to the Pension Fund of the Russian Federation, the Social Insurance Fund of the Russian Federation, the Federal Compulsory Medical Insurance Fund and territorial compulsory medical insurance funds”; (hereinafter referred to as Law No. 212-FZ).

2 Decree of the Government of the Russian Federation dated October 17, 2009 No. 820 “On the procedure for recognizing as uncollectible and writing off arrears of insurance contributions to state extra-budgetary funds and debts on accrued penalties and fines”; (hereinafter referred to as Resolution No. 820). 3 The procedure for writing off arrears and debt on penalties, fines and interest recognized as uncollectible, approved.

Violations committed by entrepreneurs

Russian legislation provides for liability for violations identified during the consideration of a case. The debtor may be held liable under the Code of Administrative Offences, the Criminal Code of the Russian Federation, as well as subsidiary. Responsibility is provided for the actions of the entrepreneur, the final result of which was bankruptcy. Cases of bringing an individual entrepreneur to subsidiary liability are not common. The most common type of prosecution is provided for by the Code of Administrative Offenses of the Russian Federation, for example, creating obstacles to the work of the bankruptcy trustee is punishable by a fine, the amount of which can reach 100,000 rubles.

Therefore, before applying to arbitration, the debtor must analyze the current situation and make sure that bankruptcy is due to the real state of affairs and there is no other way out of the current situation. After the case is accepted for consideration, the manager will have to draw up a conclusion, which will reflect all the information about the nature of the upcoming process: whether it is due to an urgent need or a desire to write off the resulting amount of debt.

If any circumstances are identified that indicate the deliberate nature of the process, investigative authorities are involved and a case is initiated under Article 197 of the Criminal Code of the Russian Federation.

Responsibility under criminal law is provided for acts that contain signs of deliberate or fictitious bankruptcy.

Bankruptcy that is intentional in nature - the entrepreneur had the intent to commit actions aimed at destabilizing the financial position of the company.

Fictitious bankruptcy is filing an application with an arbitration court for recognition of financial insolvency, in a situation where the company has the ability to pay its obligations.

The Criminal Code of the Russian Federation provides for up to 6 years in prison for such criminal acts.

Online magazine for accountants

The Federal Tax Service of the Russian Federation, in a letter dated December 12, 2017 No. SA-4-7/25240, gave instructions to suspend work on collecting transferred debts due to numerous refusals by courts (see message on our website). *** So, debts on taxes and contributions can be written off in the general manner or by applying one of the special laws providing for this procedure.

For example, such a situation may arise when officials determine that the company does not have enough funds and assets to repay the debt. The decision to recognize debts as bad and write them off is made only if the Pension Fund of the Russian Federation has an extract from the Unified State Register of Legal Entities on the liquidation of the company (subparagraph a, paragraph 4 of Resolution No. 820). Let us remind you that after making a record in the Unified State Register of Legal Entities about the liquidation of a legal entity, the company actually no longer exists (clause.

8 tbsp. 63 Civil Code of the Russian Federation). It turns out that the Pension Fund of Russia can write off debts on insurance premiums only to those companies that formally no longer exist. When it comes to writing off the debts of existing companies, everything is much more complicated. If a company has a debt, then Fund officials, of course, will take all possible measures to collect it.

Please note: even if all the deadlines for debt collection expire, the Pension Fund of the Russian Federation will still not write off such debt. of the Russian Federation for settlement (reporting) periods that expired before January 1, 2017, in the amount determined in accordance with Part 11 of Article 14 of the Federal Law dated July 24, 2009 No. 212-FZ “On insurance contributions to the Pension Fund of the Russian Federation, the Social Insurance Fund of the Russian Federation, the Federal Compulsory Medical Insurance Fund”, debt for the corresponding penalties and fines accruing to individual entrepreneurs, lawyers, notaries involved in private practice, and other persons engaged in private practice in the manner established by the legislation of the Russian Federation, as well as for persons who, on the date of writing off the relevant amounts, lost the status of an individual entrepreneur or lawyer or ceased to engage in private practice in the manner established by the legislation of the Russian Federation. 2.

Measures to support individual entrepreneurs due to the coronavirus pandemic

Putin's decrees and the restrictive measures introduced due to coronavirus in 2021 have had a negative impact on business. A set of measures has been developed to support entrepreneurs.

You can check whether benefits will be provided through the Federal Tax Service service.

What payments are written off:

- Taxes and advance payments, except VAT, personal income tax and gambling business.

- Excise taxes.

- Trade fee.

- Insurance premiums for employees and partially (1 minimum wage) for yourself.

There is no need to submit an application. The Federal Tax Service itself does the calculations and takes into account the write-off. If the verification service shows that the individual entrepreneur is subject to write-off, the entrepreneur has the right not to pay taxes or count them towards those paid at the end of the year.

What debt of an individual entrepreneur is subject to write-off?

Deputies considered and approved another amendment to the Tax Code, specifically Article 217. The adjustments increase the list of income that will be exempt from taxation. It is proposed to include among these incomes that were received in the period from January 1, 2015 to December 1, 2021 (from which tax was not withheld).

Experts explain that by introducing the proposed changes, the problem of accumulated debts to the tax system will be eliminated, when collection authorities assessed personal income tax to citizens as a result of writing off their debts to banks, telecommunications companies, etc. President Vladimir Vladimirovich Putin called this practice meaningless.

The law provides that a tax agent who has not withheld personal income tax is obliged to report this to the tax authorities. Such situations arise if a person received some economic benefit, but not with money in the physical sense. For example, if the bank wrote off the payer’s debt or the company allowed the employee not to pay for a previously taken out loan.

Situations often arise in which the agent is simply unable to withhold tax. For example, if an organization gives salaries to employees in kind or holds a lottery and gives away prizes.

Deadlines for writing off tax debts Art. 59 of the Tax Code of the Russian Federation does not establish; some procedural deadlines are provided for by the rules of the Procedure:

- 5 workers days are allotted for issuing a certificate of arrears in accordance with Appendix 2 to the Procedure if there are grounds provided for in Art. 59 of the Tax Code of the Russian Federation and paragraphs. 2.1–2.7 (clause 4 of the Procedure);

- 1 worker day - to make a decision on recognizing arrears and debts for taxes, penalties and fines as hopeless for collection and writing off in the form established by Appendix 1 to the Procedure (clause 5 of the Procedure).

The procedure described in the Procedure ends here. Further enforcement of the adopted decision, in particular the timing of making changes to the taxpayer’s card, is not regulated.

Let us consider the grounds upon which the tax authority is obliged to carry out the debt write-off procedure.

The Procedure does not indicate the obligation of the tax authority to notify of the decision made to write off debts or to send a copy of this document to the person in respect of whom it was made. However, sub. 9 clause 1 art. 21 of the Tax Code of the Russian Federation establishes the right of the taxpayer to receive copies of decisions of tax authorities, and in sub. 12 clause 1 art.

Inaction to consider an application for debt forgiveness or failure to issue a copy of the decision can be appealed (Article 137 of the Tax Code of the Russian Federation). In this case, a mandatory administrative appeal procedure is provided (clause 2 of Article 138 of the Tax Code of the Russian Federation): you can go to court only after sending a complaint to a higher tax authority.

In addition to the general procedure, special debt write-off procedures will be applied in 2021:

- in the form of a tax amnesty;

- and in connection with the transfer of administration of insurance premiums to the Federal Tax Service of the Russian Federation.

According to Law No. 436-FZ, until 03/01/2018, the following is written off as of 01/01/2015:

- debts on property taxes (transport, property and land) together with penalties - for individuals;

- debts on taxes related to business activities (exceptions - mineral extraction tax, excise taxes, taxes on export-import transactions), as well as penalties and fines - for individual entrepreneurs (including former ones).

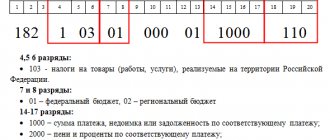

C = 8 × minimum wage × T × H,

where: C is the amount by which the amount of debt will be reduced;

Minimum wage - the amount of the minimum wage in force in the corresponding tax period (indicators can be found in the article “The size of the minimum wage in 2018”);

T—rate of insurance premiums;

N is the number of months of activity.

Information for debt write-off is transferred to the tax authorities by the Pension Fund of Russia. An application from the taxpayer is not required for this.

Also, the specified legal act, instead of a benefit in the form of a tax-free land tax minimum of 10 thousand rubles, introduced benefits in the amount of a tax-free cadastral value of 600 square meters. m (6 acres) of land area for preferential categories of taxpayers (which now includes pensioners). Debt from individual entrepreneurs and individuals will be written off by the tax authority independently, without prior application from the taxpayer.

At the same time, this bill does not provide for the obligation to inform entrepreneurs or citizens about the written-off debt and its amount, in connection with which the individual entrepreneur or citizen will need to independently clarify this information with the Federal Tax Service at the place of registration. Additionally, it should be noted that the tax amnesty will only affect individual entrepreneurs and citizens; organizations are not included in the list of amnestied persons.

Where can I find an example of such an arbitrary statement? The tax office still doesn’t know anything about how debts will be written off. If we take into account tax calculations, they can write off only for 2013.

It’s just not clear at all what these billing periods are? What can be understood by the words “did not conduct business”? In any case, the tax office requires you to submit zero returns. In 2014, I did not run a business; I closed the individual entrepreneur in January 2015 (an individual entrepreneur can be closed with debts), but no one said that it was necessary to submit zero declarations.

And only in 2021 I found out about it. Now, fines and penalties have been added to everything. And it’s not clear whether I’ll be written off or not. Article 111.

For individuals, the amount of tax debt for property taxes (which includes transport tax, personal property tax and land tax) generated as of 01/01/2015, as well as the corresponding amount of penalties accrued on the specified debt, is subject to write-off.

2For individual entrepreneurs and individuals who were previously engaged in entrepreneurial activities, the amount of tax debt for taxes, the payment of which is related to the implementation of entrepreneurial activities, is subject to write-off (with the exception of mineral extraction tax, excise taxes and taxes payable in connection with the movement of goods across the border Russian Federation), formed as of 01/01/2015, as well as the corresponding amount of penalties accrued on the specified debt, and the debt on fines.

In relation to individual entrepreneurs, the amnesty applies to:

- Taxes. Individual entrepreneurs apply one of the five available taxation systems (OSNO, UTII, Unified Agricultural Tax, simplified tax system or PSN) and pay tax payments within the chosen tax system. Arrears on any taxes, debt on fines and penalties incurred in connection with such arrears as of January 1, 2015 for individual entrepreneurs and persons who lost their individual entrepreneur status before the date the tax authority made a decision on write-off are recognized as hopeless and subject to write-off (Article 12 of Law No. 436-FZ). The exceptions are excise taxes, taxes that must be paid when moving goods across the border of Russia, and taxes on the extraction of mineral resources - the amnesty does not apply to these payments.

The law does not limit the amount of debt that can be written off.

- Insurance premiums. A large debt for individual entrepreneurs could arise due to non-payment of insurance contributions to state extra-budgetary funds. Law No. 436-FZ provides for the possibility of writing off debts of individual entrepreneurs on insurance premiums, as well as penalties and fines arising in connection with them. The amnesty applies to debt on contributions incurred before January 1, 2021 and applies to existing and terminated individual entrepreneurs, notaries and lawyers, and other persons engaged in private practice.

Debts on contributions up to January 1, 2021 will be written off for entrepreneurs who did not operate and did not report to the state, in which case contributions were accrued in the maximum amount, in accordance with Art. 14 of the Federal Law of July 24, 2009 No. 212-FZ “On insurance contributions to the Pension Fund of the Russian Federation, the Social Insurance Fund of the Russian Federation, the Federal Compulsory Medical Insurance Fund” [the law became invalid as of January 1, 2021. – GARANT.RU].

It is worth noting that, on the basis of this article, the Pension Fund could charge an individual entrepreneur who did not transfer data on income received to the tax service, contributions according to the following formula: 8 minimum wage x 26% (insurance premium rate) x 12 (number of months in a year). Thus, the maximum amount of contributions accrued by the Pension Fund could exceed 154 thousand rubles. per year, with the adoption of Law No. 436-FZ, individual entrepreneurs will get rid of such large amounts of debt.

https://www.youtube.com/watch?v=0GzYgLnYMX4

It is important to note: if an entrepreneur paid contributions on time until 2021 and submitted reports on them on time, but missed one or more payments, he will not be able to qualify for debt forgiveness under the amnesty.

Grounds for writing off taxes, penalties and fines

The grounds for writing off arrears include (clause 1 of Article 59 of the Tax Code of the Russian Federation):

- A judicial act, in particular a court decision made according to the rules of Chapter. 32 of the CAS of the Russian Federation, on the refusal to satisfy an administrative claim for debt collection (see, for example, the decision of the Dimitrovsky District Court of Kostroma dated December 19, 2017 in case No. 1036/2017) or on recognizing the debt as bad (see the decision of the Chekhov City Court of the Moscow Region dated 01.09.2017 in case No. 2a-3633/2017). More information about how the period for going to court to recover taxes is calculated can be found in the article “What is the statute of limitations for paying taxes?”

- Declaration of bankruptcy. The procedure is described in the article “Conditions and features of bankruptcy of individuals.”

- Death.

- Return of a writ of execution by a bailiff after termination of proceedings due to the impossibility of collection or lack of property from the debtor, if more than 5 years have passed since the debt arose and the amount is insufficient to initiate bankruptcy proceedings or the court has terminated the bankruptcy case.

Loss of individual entrepreneur status does not apply to such grounds.

Individual entrepreneurs will forgive debts on insurance premiums

Before considering the above adjustments, the Budget Committee of the Lower House of the Russian Parliament approved another draft amendment. The talk was about exempting individual entrepreneurs from debts on insurance premiums. It is reported that this amendment was developed within the walls of the Federal Ministry of Finance and was subsequently supported by deputies of the State Duma.

Not all businessmen will be exempt from payment. Asking for debts is suggested only to those who did not conduct actual activities, but did not close the individual entrepreneur. Contributions to such entrepreneurs were accrued regardless of their actual condition, and in some cases in the amount of eight minimum wages. This is due to the fact that social contributions are also considered imputed payments.

These adjustments, which will relieve businessmen working as individual entrepreneurs from debts, are being introduced into two federal laws - N 243, N 250. In total, we are talking about forgiving debts in the amount of about 15 billion rubles, which have accumulated 2.9 million entrepreneurs throughout the country. Such data were previously announced by the country's President Vladimir Vladimirovich Putin.

The previous law allowed for the possibility of writing off debts on insurance premiums, but for this, an individual entrepreneur had to go bankrupt or the court had to recognize by its decision the impossibility of collection. Moreover, the termination of the activities of an individual entrepreneur under the previous legislation was not a basis for writing off debts.

Later, the Federal Tax Service will name a list of documents that will be needed to eliminate the debt and announce the procedure by which the write-off will be carried out. Decisions on debt liquidation will be made locally, at the place of registration of the entrepreneur.

Two departments will “forgive” debts - partly the tax office will deal with this issue, partly the Pension Fund. This is due to the fact that when the function of administering insurance premiums was transferred from the Pension Fund to the tax authorities (occurred on January 1, 2017), part of the debts that were recognized as bad by a court decision remained under the jurisdiction of the Pension Fund.

Minimum wage), the tariff of insurance premiums and the number of months and (or) days of activity, as well as the corresponding amount of penalties accrued on the specified debt. For reference:

- in 2014, the minimum wage was 5,554 rubles;

- in 2015, the minimum wage was 5,965 rubles;

- in 2021, the minimum wage was 6,204 rubles.

The said debt on insurance premiums will be written off after receiving the necessary information from the authorities of the Pension Fund of the Russian Federation.

The tax amnesty was also extended to some income of individuals

Let us say right away that the tax amnesty affected individuals and individual entrepreneurs. However, for a clearer perception of the material, let us explain the difference between these categories.

| Individuals | IP |

| The subjects of rights and obligations are individuals, namely citizens who have the right and legal capacity. Legal capacity arises from birth for all citizens, without exception, legal capacity after adulthood. | An individual entrepreneur (IP) is an individual who has undergone a certain registration procedure in this capacity. Only having received such status, an individual has the right to carry out entrepreneurial activities, i.e. enter into transactions in order to make a profit. In the absence of individual entrepreneur status, an individual can make transactions aimed only at satisfying his own needs. |

Next, let’s look at how exactly “Putin’s” tax amnesty will affect “physicists” and individual entrepreneurs.

Tax amnesty for individuals

| Type of tax | Who pays |

| Transport tax | Transport tax is required to be paid by the person to whom the vehicle subject to this tax is registered (paragraph 1 of Article 357 of the Tax Code of the Russian Federation). |

| Property tax | All owners of real estate that is subject to taxation and located in Russia must pay property tax. It does not matter who the owner is: a foreign citizen, a citizen of Russia or a stateless person (Article 400 of the Tax Code of the Russian Federation). |

| Land tax | Land tax is levied on land plots that are owned or owned by the right of permanent (perpetual) use, the right of lifelong inheritable possession (Article 388 of the Tax Code of the Russian Federation). |

Citizens pay land and transport taxes, property tax on individuals on the basis of tax notices. Also see “Consolidated tax notices in 2021: distribution”, “Generation of consolidated tax notices”. When people receive notifications from the Federal Tax Service, they often see in them accrued taxes, as well as debt on them and increased penalties.

All listed taxes for individuals are covered by the new tax amnesty. Thanks to the commented amendments, the arrears accrued by “physicists” as of January 1, 2015 are completely written off. Also, penalties accrued on this arrears are subject to write-off (Article 12 of the law under comment).

Please note that no special conditions are provided for writing off debts for transport, land and property taxes, in particular:

- it does not matter whether a person is a pensioner or not;

- the size of the income of the debtor and his family does not matter;

- the reason why a person did not pay taxes on time does not matter.

There are also no restrictions on the minimum and maximum amount of taxes - all arrears as of January 1, 2015 are subject to write-off. And penalties are canceled as of the date the tax inspectorate (IFTS) made the decision to write off.

Let’s assume that as of January 1, 2015, an individual had a transport tax arrears of 9,000 rubles. By the end of 2021, penalties were charged for the arrears - 3,447 rubles. Total debt: 12,3447 rubles. This entire amount will fall under “Putin’s” tax amnesty.

Tax amnesty for individual entrepreneurs

An individual entrepreneur can apply one of five taxation systems and pay taxes within this system. Let's list the main taxes that businessmen pay.

| Tax system | What taxes are paid by individual entrepreneurs? |

| General system (OSNO) | Individual entrepreneurs pay personal income tax and VAT on income from business activities. |

| Simplified system (STS) | Instead of personal income tax and VAT, individual entrepreneurs pay one single simplified tax (STS). |

| "Imputement" (UTII) | Instead of personal income tax and VAT, the entrepreneur pays UTII, which does not depend on real income. |

| Patent system (PSN) | It is similar to UTII, but there are differences in the types of activities and conditions of use. The cost of the patent is paid. |

| Unified Agricultural Tax (USAT) | Can only be used by agricultural producers. Unified agricultural tax replaces personal income tax and VAT. |

Article 12 of the law under comment provides for the write-off of tax debts of individual entrepreneurs. It is stipulated that the following are considered uncollectible and subject to write-off:

- arrears on all taxes as of January 1, 2015 (except for the mineral extraction tax, excise taxes and taxes payable in connection with the movement of goods across the border of the Russian Federation);

- arrears of penalties for the specified arrears and arrears of fines as of the date the tax inspectorate made a decision to write off debts.

In relation to individual entrepreneurs, we are talking about writing off any amounts of tax debt. So, for example, tax authorities will be required to write off debts for any amount, for example, under the simplified tax system, UTII or patent tax. All penalties and fines are also cancelled. There are also no special requirements or conditions for applying the tax amnesty for individual entrepreneurs. That is, the very fact of having a tax debt as of January 1, 2015 is in itself grounds for amnesty.

Where should “physicists” and individual entrepreneurs go to write off debts?

The debt of individuals for transport, land and property taxes will be accepted by the tax inspectorate independently. No statements or documents are required from the person for this. The Federal Tax Service Inspectorate at the place of residence of an individual (location of real estate and transport) is an example of a decision to write off debts based on its data.

The same situation applies to individual entrepreneurs. Tax authorities at the place of residence (or registration) of individual entrepreneurs must independently write off tax debts. The commented law does not provide that entrepreneurs must send applications to the Federal Tax Service with a request to write off debts.

Please note: if a person or individual entrepreneur regularly paid taxes and has no debt, then the tax amnesty is not a basis for demanding a refund of paid taxes to “restorate justice.”

Tax amnesty" was also announced in relation to income received by individuals from January 1, 2015 to January 1, 2021, upon receipt of which personal income tax was not withheld by the tax agent and information about which was submitted by the tax agent to the Federal Tax Service in the form of a 2-NDFL certificate with the attribute "2 " Let's look at this in more detail.

| Sign in 2-NDFL | What does it mean |

| Sign 1 | Such a 2-NDFL certificate reflects what income was paid to an individual, how much personal income tax was accrued from them, withheld and transferred to the budget (clause 2 of Article 230 of the Tax Code of the Russian Federation). |

| Sign 2 | Such a 2-NDFL certificate is a message to the Federal Tax Service that you paid income to an individual, but were unable to withhold tax from it (clause 5 of Article 226 of the Tax Code of the Russian Federation). |

Let’s assume that the Stella organization gave a former employee a gift worth more than 4,000 rubles. A gift is income in kind; it will not be possible to withhold personal income tax from it immediately upon issuance. In this case, the organization must withhold personal income tax from the nearest cash income paid to this person (clause 4 of article 226 of the Tax Code of the Russian Federation).

But since the person no longer works, there is no way to withhold personal income tax from income. Therefore, you need to report this to the inspectorate by sending a certificate with sign “2”. A 2-NDFL certificate with attribute “2” must also be issued to an individual (clause 5 of Article 226 of the Tax Code of the Russian Federation). The person, in turn, is obliged to submit a declaration and pay the tax on his own. If this is not done, then the person becomes a debtor to pay personal income tax.

The commented law supplements the list with new non-taxable income - income received by taxpayers from January 1, 2015 to December 1, 2021, upon receipt of which personal income tax was not withheld by the tax agent and certificate 2-NDFL with attribute “2” was submitted to the Federal Tax Service Inspectorate (new paragraph 72, article 217 of the Tax Code of the Russian Federation). Taxpayers do not need to file a return or pay income tax on such income.

What incomes were not included in the amnesty?

| Income in the form of remuneration for the performance of labor or other duties, performance of work, provision of services. |

| Income in the form of dividends and interest. |

| Income in the form of material benefits, determined in accordance with Article 212 of the Tax Code of the Russian Federation. |

| Income in kind, determined in accordance with Article 211 of the Tax Code of the Russian Federation, including gifts received by taxpayers from organizations or individual entrepreneurs. |

| Income in the form of winnings and prizes received in competitions, games and other events. |

As you can see, the list of income not subject to the tax amnesty is quite wide. It includes, in particular, payments and remuneration under civil law and employment contracts. But then what kind of income received from 01/01/2015 to 12/01/2017 fell under the tax amnesty? For what income was a new paragraph 72 of Article 217 of the Tax Code of the Russian Federation introduced?

We are talking about writing off tax debts from “notional income”. These are incomes that in fact do not really exist. For example:

- Banks sometimes write off part of the debt as interest on a loan when they see that a person is unable to repay the loan. In accordance with current tax law, all these funds, once written off, become the person's income, and, therefore, having carried out such debt forgiveness, the bank or company must immediately notify the tax service that the person must pay income tax on these incomes (that is, send certificate 2-NDFL with sign “2”);

- Sometimes companies servicing the housing and communal services complex write off penalties on utility bills when people in difficult life situations simply cannot pay them. In such a situation, people also have income on which they need to pay personal income tax.