Reasons for recognizing tax debts as bad

Debts on taxes, contributions, penalties, fines, interest may be considered bad

for reasons (clause 1, clause 4 of article 59 of the Tax Code of the Russian Federation):

- liquidation of a legal entity if it is impossible to pay off arrears (penalties, fines) by the liquidated entity and its founders;

- bankruptcy of an individual or individual entrepreneur when there is insufficient property to repay the debt;

- death of an individual or declaration of his death - in part of the debt exceeding his inheritance;

- adoption by the court of an act, according to which the tax authority loses the ability to collect debts due to the expiration of the period for their collection;

- debiting funds from the taxpayer's current account, but not transferring them to the budget by the bank, if the specified bank is liquidated.

What debt to the budget can be written off?

Only uncollectible tax debt can be written off from a taxpayer’s personal account (clauses 1, 2, Article 59 of the Tax Code of the Russian Federation; clause 1 of the Procedure, approved by Order of the Federal Tax Service dated April 2, 2019 N ММВ-7-8/ [email protected] ). A debt on taxes, fees, insurance premiums, penalties or fines is considered hopeless if the tax inspectorate cannot collect it, for example, due to the expiration of the collection period (subclause 4, clause 1, article 59 of the Tax Code).

Attention. At the request of the tax authority, you must pay the tax within the period specified therein.

If there is no deadline, you have 8 working days from the date of receipt of the request to pay it (clause 4 of Article 69 of the Tax Code).

The Federal Tax Service Inspectorate loses the ability to collect the debt, in particular, if (Resolution 9 AAS dated 03.03.2020 N 09AP-824/2020; AS ZSO dated 06.18.2019 N F04-2294/2019):

- no measures have been taken to ensure the indisputable (extrajudicial) collection of tax debts within the established time frame;

- deadlines for filing a claim in court to collect the debt have been missed.

The period for collecting the tax debt must be counted from the date of expiration of the deadline for fulfilling the requirement for its payment. In case of extrajudicial collection, the deadlines for the Federal Tax Service to make a decision (Article 47 of the Tax Code of the Russian Federation):

- on collection from the debtor’s current account - 2 months;

- for collection from his property (if there is not enough money in the accounts) - 1 year.

The deadlines for applying the Federal Tax Service to the court are:

- 6 months if the deadline for making a decision on collection from the debtor’s current account is missed;

- 2 years if the deadline for making a decision on recovery at the expense of the debtor’s property is missed.

After the established deadlines have passed, tax authorities lose the right to collect tax debts.

What can a taxpayer do?

- the taxpayer has the right to initiate recognition of his tax debts (contributions, penalties, fines, interest) as uncollectible (Definition of the Constitutional Court dated May 26, 2016 N 1150-O);

- since pre-trial procedure for writing off tax debts at the initiative of the taxpayer, you should immediately go to court to recognize debts as bad (Decision of the Supreme Court dated November 2, 2016 N 78-КГ16-43);

- After the decision to recognize the debt as bad comes into force, you can contact the tax authority with an application to write off the debt based on a court decision.

When can you write off an old tax debt?

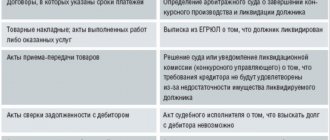

The only way to write off an old debt to the budget is through the courts. The basis for write-off will be:

- a judicial act stating that the debt has been declared uncollectible or that the inspection does not have the right to collect it due to the expiration of the collection period;

- decision of the tax authority to recognize the debt as uncollectible and write it off.

Most likely, the tax office itself will not “clean” the taxpayer’s personal account card of “illiquid” debt, so you will have to file a claim to recognize the amount of the debt as uncollectible (Cassation Ruling of the Supreme Court dated March 18, 2020 N 44-KA20-2; p. 9 Resolution of the Plenum of the Supreme Arbitration Court of July 30, 2013 N 57). And it’s better to do this when you are absolutely sure that the Federal Tax Service has really missed all the deadlines for collecting your debt.

When filing an application with the court, you will have to pay a state fee of 6,000 rubles. (Subclause 4, Clause 1, Article 333.21 of the Tax Code of the Russian Federation). But if you win, the paid state duty can be recovered from the defendant, that is, from the tax office.

In the application, indicate that you are asking to recognize the amount of tax debt as uncollectible and the obligation to pay it has been terminated. To confirm the amount of the old debt, attach to the application a reconciliation report with the tax office and a certificate of the status of settlements in the established forms (Orders of the Federal Tax Service dated 12/16/2016 N ММВ-7-17/ [email protected] , dated 12/28/2016 N ММВ-7-17/ [email protected] ).

Having received a judicial act according to which the tax authority does not have the right to collect an old debt, you can submit an application to the Federal Tax Service to recognize the debt as uncollectible and write it off.

Attach to the application a copy of the judicial act that has entered into force, certified by the official seal of the court (subparagraph 4, paragraph 1, article 59 of the Tax Code of the Russian Federation; paragraph 5 of Appendix No. 2 to the Order of the Federal Tax Service of April 2, 2019 N ММВ-7-8 / [email protected ] ).

Within 6 working days after receiving the documents, the Federal Tax Service will make a decision to recognize the debt as uncollectible and write it off. And he will write off the debt from the personal account card.

Since the tax office has no obligation to give you a copy of the decision, request it yourself by submitting a written application (subclause 9, clause 1, article 21, subclause 12, clause 1, article 32 of the Tax Code of the Russian Federation; clauses 3, 5 of Appendix No. 1 to the Order of the Federal Tax Service dated April 2, 2019 N ММВ-7-8/ [email protected] ).

Reference. In the absence of a judicial act declaring a debt uncollectible (until it comes into force), in the certificate issued by the Federal Tax Service, calculations for taxes, penalties, and fines are reflected taking into account all debts. Including those for which the possibility of forced collection has been lost (clause 9 of the Resolution of the Plenum of the Supreme Arbitration Court of July 30, 2013 N 57). But in this case, the tax authority may indicate in the certificate that the possibility of collecting the amount of arrears has been lost due to the expiration of the collection period.

The procedure for writing off bad debts for taxes

Tax debt (penalties, fines, interest) written off in accordance with the law (including by court decision) is not recognized as income of the organization for profit tax purposes (clause 21, clause 1, article 251 of the Tax Code of the Russian Federation).

If accrued and unpaid taxes were previously reflected in tax expenses, the written off debt for them should be excluded from expenses that reduce taxable profit (clause 33 of Article 270 of the Tax Code of the Russian Federation).

There is no need to submit an updated declaration; the amount of debt must be reflected in non-operating income in the write-off period.

Transactions – Accounting – Manual Transactions

See also:

- Reconciliation of settlements with tax authorities

- The Federal Tax Service announced the abolition of mandatory reconciliation of payments

- Inventory of calculations for taxes and contributions

- How to prepare an application for a refund and offset of taxes in 1C

Did the article help?

Get another secret bonus and full access to the BukhExpert8 help system for 14 days free of charge

Related publications

- Writing off salary debts Good afternoon. Please tell me how an accountant can write off debt for...

- Provision for doubtful debts: regulatory regulation You do not have access to view. To gain access: Complete...

- Reserve for doubtful debts: basic rules for creation You do not have access to view. To gain access: Complete...

- Payment order, if the recipient is UFK UFSSP and withholding debts on an employee’s loan How to fill out the form. order - recipient of the UFK UFSSP debt retention...

Inclusion of written off arrears in “simplified” income

KOSOLAPOV Alexander Ilyich. State Councilor of the Russian Federation 1st class

— When determining the tax base, income in the form of amounts of accounts payable for the payment of taxes, fees, contributions, penalties and fines to the budget, written off and (or) reduced otherwise in accordance with the law or by decision of the Government of the Russian Federation (subclause 21, paragraph. 1 Article 251 of the Tax Code of the Russian Federation).

Therefore, tax arrears recognized as hopeless for collection, which were taken into account in expenses when accrued, do not form non-operating income when they are written off by decision of the Federal Tax Service.

It turns out that there is no exception for simplifiers. And they do not need to reflect the written-off old tax debt in income, regardless of whether they included the tax when accruing expenses or not.

Example . Reflection in accounting of writing off old tax debt

Condition . By decision of the tax inspectorate dated October 19, 2020, the organization’s debt in the total amount of 372,952 rubles was declared uncollectible and written off, of which:

- arrears on property tax - 103,208 rubles;

- debt on penalties and fines - 269,744 rubles.

Solution . The following entries must be made in accounting.

Contents of operations

| Contents of operations | Dt | CT | Amount, rub. |

| The amount of accrued fines and penalties is reflected (if not reflected before) | 99 subaccount “Fines and penalties for taxes” | 68 subaccount “Fines and penalties for taxes” | 269 744 |

| Property tax arrears deemed uncollectible were written off | 68 subaccount “Property tax” | 91 subaccount “Other income” | 103 208 |

| Tax fines and penalties deemed uncollectible have been written off | 68 subaccount “Fines and penalties for taxes” | 91 subaccount “Other income” | 269 744 |

| Constant tax income from fines and penalties is reflected (RUB 269,744 x 20%) (1) | 68 subaccount “Income Tax” | 99 subaccount “Permanent tax revenues” | 53 949 |

(1) Since in accounting when writing off debt on fines and penalties, income arises, but in tax accounting there is no such income, constant tax income must be shown in accounting (, 7 PBU 18/02).

* * *

The tax service cannot independently set off any amounts paid to the budget to pay off the debt on taxes, fines and penalties, the possibility of forced collection of which has been lost due to the expiration of the deadline for its collection in an indisputable manner and through the court (Letter of the Ministry of Finance dated 05.22.2014 N 03-02-07/1/24281).

If she did count them, she did so illegally. And you have the right to demand their return, as well as payment of interest (clause 5 of Article 79 of the Tax Code of the Russian Federation).

The article was first published in the journal "Glavnaya Ledger" N 06, 2021

Tax burden of an individual

What main taxes must a citizen of the Russian Federation pay as an individual? There are several of these taxes:

- Personal income tax (or as it is also abbreviated as personal income tax or “income tax”).

The obligation to pay income tax arises for a citizen when receiving income (for example, when receiving wages, when receiving income from renting out an apartment or selling it. Self-employment is also work. And you also have to pay taxes on income from it.); - Property tax for an individual. The obligation to pay the specified tax occurs when a person owns real estate: an apartment, a garage, a plot, a house.

- Transport tax - vehicle owners pay, even if the vehicle turns into immobilized real estate (serious accident, or engine or gearbox malfunction. No brakes, after all!).

Personal income tax

If you work as an employee in a company or government agency, then the responsibility for withholding and transferring income tax to the budget rests with your employer.

When receiving income from renting an apartment, selling or acquiring property for free, you are required to notify the tax office within the period prescribed by law.

According to current legislation, your income is subject to personal income tax in the following amount:

- 13% if the amount of income does not exceed 5 million rubles per year;

- 15% if the amount of income exceeds 5 million rubles per year.

The tax rate - 15% - is paid not on the entire amount of income, but only on that part that exceeds 5 million rubles.

For example, your income for the year was 6 million rubles. Personal income tax will be calculated as follows: 13% of 5 million rubles is 650 thousand rubles and 15% of 1 million rubles is 150 thousand rubles. The total personal income tax amounted to 800 thousand rubles.

Income received as a result of the sale of property, or the receipt of property as a result of a gift, is taxed at a rate of 13%, even if its value exceeds 5 million rubles.

For example: you own an apartment and you want to sell it. In order not to pay income tax on the income received from the sale of an apartment, the minimum period of ownership of the property must have passed, which by law is:

- 3 years if the apartment was given to you as a gift, inherited or as a result of privatization;

- 5 years if the apartment was purchased by you.

Another example: you were given an apartment worth 10 million rubles by your parents or successful children “Tiktokers” - such a gift is not subject to taxation. Well, if you received an apartment as a gift from a friend or distant relative, then please pay the state 13% of its value.

Personal property tax

Property tax for individuals is a local tax, the amount of which, for example, in Moscow, is established by the law of the city of Moscow.

The tax is calculated based on the cadastral value of the property multiplied by the tax rate in the amount of:

- 0.1% - for real estate value less than 10 million rubles;

- 0.15% - for real estate value from 10 to 20 million rubles;

- 0.2% - for real estate value from 20 to 50 million rubles;

- 0.3% - with a property value of more than 50 million rubles.

The law also provides for tax deductions - part of real estate that is not subject to tax:

- 50 meters for a residential building;

- 20 meters for an apartment;

- 10 meters for a room.

According to the law, all these calculations must be made by the tax office and send you ready-made receipts indicating the tax amounts.

Transport tax

Transport tax is a regional tax, established and enforced by the laws of the relevant constituent entity of the Russian Federation. Transport tax is charged for road, water and air transport.

The transport tax on motor vehicles is calculated as the product of the vehicle capacity and the tax rate. In Moscow, the tax rate ranges from 12 to 150 rubles, depending on the power of the car.

In addition, the Russian Federation currently has a “luxury tax”. This is an increasing coefficient for transport tax, depending on the cost of the car, in the amount of:

- 1.1 - for cars worth from 3 to 5 million rubles and not older than 3 years;

- 2 - for cars worth from 5 to 10 million rubles and not older than 5 years;

- 3 - for cars worth from 10 to 15 million rubles and not older than 10 years, as well as more expensive than 15 million rubles and not older than 20 years.

Well, as you probably already guessed, these calculations should also be handled not by you, but by the tax inspectorate.

So, when we figured out how tax debt is formed, it’s time to talk about how to get rid of it, at least partially.

If you have debts to the state, it will sue you

According to current Russian legislation, the tax inspectorate cannot arbitrarily write off funds from your accounts to pay off debt, as is done in relation to companies and individual entrepreneurs. If you have a debt, the tax office is obliged to go to court in the manner prescribed by law.

The tax inspectorate has the right, within six months from the date of expiration of the deadline for fulfilling the tax payment requirement (8 days), to file an application against you in court for the collection of tax debt, provided that your debt is more than 10 thousand rubles.

If you suddenly thought that the state would happily forgive you a tax debt of less than 10 thousand rubles, then I hasten to disappoint you. The tax office will wait 3 years until your tax debt exceeds the 10 thousand ruble threshold and the six-month period will begin from this date.

If the size of your tax debt does not exceed the amount of 10 thousand rubles, then this will greatly upset the tax authorities, but still will not stop them; they will wait 3 years and go to court.

Is there a chance to moderate the state’s appetites and write off tax debt, at least partially? Well, of course, YES! Otherwise, what would be the point of this article?

To write off a tax debt, you first need to figure out what tax it was accrued for and for what period.

For example. You deregistered and sold the car, but receipts with accrued transport tax continue to arrive to you, because for some reason the traffic police did not transfer the data on the deregistration of the car to the tax inspectorate.

In this case, it will be enough to contact the tax authority with an application for recalculation of the transport tax and copies of documents confirming the deregistration of the car and its sale.

Such an application can be sent to the tax office by mail, a valuable letter, or through the taxpayer’s personal account.

A similar situation may arise with property tax on an apartment, garage, plot or house. The principle of operation is the same as for transport tax.

There are situations when the tax inspectorate justifiably charges taxes to you, you, as a law-abiding citizen, pay them on time and in full, but, for some reason, the tax office “does not see” your money.

Well, everything here is also relatively simple, the main thing is to save receipts if you pay in cash, copies of which will need to be provided to the tax office.

In addition, you have the right to file an administrative claim against the tax inspectorate to declare a tax debt, the possibility of forced collection of which has been lost by the tax authority, hopeless for collection and the obligation to pay it has ceased.

If translated from legal language into Russian. You have a tax debt, but, for some reason, the tax office did not manage to collect it from you within the period established by law.

Yes, and this happens, the tax office can “lose” not only your payment, but also your tax debt, and then suddenly “find” it. In this case, such debt will remain listed as yours in the tax base and in your personal taxpayer account. It can only be removed by a court decision.

In 2021, on behalf of the President of the Russian Federation, a tax amnesty was held. For citizens, tax debt incurred before January 1, 2015 for transport, land taxes, as well as property tax for individuals was subject to write-off.

Most likely, one of the reasons for this measure was the state’s perceived futility in collecting such debts through the courts.

Well, for those who paid and had no debts, the state, of course, did not return anything.

Statute of limitations

The general limitation period is three years (Article 196 of the Civil Code of the Russian Federation). However, according to the law, for certain types of requirements the period can be reduced or increased (Article 197 of the Civil Code of the Russian Federation). For example, a transaction can be declared invalid within a year (clause 2 of Article 181 of the Civil Code of the Russian Federation). One of the shareholders can challenge the sale of a share in the common property within three months if his pre-emptive right to purchase has been violated (clause 3 of Article 250 of the Civil Code of the Russian Federation). The duration of the limitation period is determined in the following order:

- for obligations for which the fulfillment period is determined - at the end of the obligation fulfillment period;

- for obligations for which the fulfillment period is not defined or is determined by the moment of demand - from the day the creditor submits a demand for fulfillment of the obligation. If the creditor has given the debtor some time to fulfill the demand - after the end of the last day of the obligation to fulfill the obligation.

This is stated in paragraph 2 of Article 200 of the Civil Code of the Russian Federation.

The limitation period may be interrupted. The basis for interrupting the limitation period is the actions of a person indicating the recognition of a debt. After a break, the limitation period begins anew; the time elapsed before the break is not counted in the new period. However, there is a limitation: the limitation period cannot exceed 10 years from the date of violation of the right, even if the period was interrupted. The exception is the cases established by the Law of March 6, 2006 No. 35-FZ on countering terrorism.

This procedure follows from the provisions of Article 203 and paragraph 2 of Article 196 of the Civil Code of the Russian Federation.

OSNO and UTII

If an organization applies a general taxation system and pays UTII, it is obliged to keep separate records of income, expenses and business transactions (clause 7 of Article 346.26 of the Tax Code of the Russian Federation). When calculating income tax, include in non-operating income only those written-off accounts payable that arose as part of activities under the general taxation system. For more information about this, see How to take into account expenses if an organization combines the general taxation system and UTII.

If accounts payable arose for goods (works, services) that were used in both types of activities, then when writing them off, include the entire amount of non-operating income in the calculation of the tax base for income tax. This was stated in the letter of the Ministry of Finance of Russia dated March 15, 2005 No. 03-03-01-04/1/116. This position is based on the fact that the current tax legislation does not contain a mechanism for distributing non-operating income between different types of activities.

Debt inventory

Accounts payable must be written off separately for each obligation. Determine the amount of overdue accounts payable based on the inventory results.

Carry out the inventory by order of the manager. You can use the standard form of this order (Form No. INV-22). Or you can develop a template yourself, approving it in the appendix to the accounting policy.

Written justification for writing off a specific obligation is an inventory act (you can use standard form No. INV-17 or a self-developed form) and an accounting certificate. Based on these documents, the manager issues an order to write off accounts payable.

This is stated in paragraph 78 of the Regulations on Accounting and Reporting.

BASIC

The amount of accounts payable written off due to the expiration of the limitation period, as well as for other reasons, should be included in non-operating income (clause 18 of Article 250 of the Tax Code of the Russian Federation). Other grounds, in particular, include the exclusion of the creditor from the Unified State Register of Legal Entities:

- in connection with its liquidation (Article 21 of the Law of August 8, 2001 No. 129-FZ, letters of the Ministry of Finance of Russia dated October 1, 2009 No. 03-03-06/1/636, Federal Tax Service of Russia dated June 2, 2011 No. ED-4-3/8754);

- at the initiative of the tax inspectorate, if the organization does not actually carry out activities (Article 21.1 of the Law of August 8, 2001 No. 129-FZ, letter of the Ministry of Finance of Russia dated March 25, 2013 No. 03-03-06/1/9152).

In these cases, the amount of accounts payable must be included in the tax period when the creditor was excluded from the Unified State Register of Legal Entities. This is confirmed by arbitration practice (see, for example, decisions of the FAS Moscow District dated April 3, 2014 No. A40-17207/13, West Siberian District dated July 27, 2011 No. A46-12818/2010, Far Eastern District dated February 9, 2010 No. F03-8171/2009).

At the same time, do not include accounts payable for taxes (fees, penalties, fines) written off or reduced in accordance with current legislation or by decision of the Government of the Russian Federation when calculating income tax (subclause 21, clause 1, article 251 of the Tax Code RF).

Situation: in what period, when calculating income tax using the accrual method, should written-off accounts payable be included in income? The debt is written off due to the expiration of the statute of limitations.

Include the amount of overdue accounts payable in non-operating income on the last day of the period in which the statute of limitations expired.

As a general rule, under the accrual method, income is recognized in the reporting (tax) period in which it arose (Clause 1, Article 271 of the Tax Code of the Russian Federation). In the situation under consideration, such a period is recognized as the period in which the statute of limitations on accounts payable has expired. On the last day of this period, the amount of overdue accounts payable, confirmed by documents, must be included in non-operating income (subclause 5, clause 4, article 271 of the Tax Code of the Russian Federation). Similar clarifications are contained in the letter of the Ministry of Finance of Russia dated January 28, 2013 No. 03-03-06/1/38.

Arbitration practice confirms this conclusion (see, for example, resolutions of the Presidium of the Supreme Arbitration Court of the Russian Federation dated February 22, 2011 No. 12572/10, dated June 8, 2010 No. 17462/09, determinations of the Supreme Arbitration Court of the Russian Federation dated July 1, 2010 No. VAS-8633 /10, dated January 22, 2010 No. VAS-18173/09, resolution of the Federal Antimonopoly Service of the West Siberian District dated April 28, 2012 No. A27-10579/2011, dated June 23, 2011 No. A81-5014/2010, dated 22 April 2010 No. A27-18504/2009, Far Eastern District dated March 23, 2012 No. F03-845/2012, Volga District dated September 22, 2009 No. A65-20719/2008). The listed court decisions were made on disputes, the subject of which was the need for written reasons for writing off debt. The courts recognized that the presence of unclaimed accounts payable must be confirmed by the results of the inventory, and the decision to write it off must be formalized by order (instruction) of the head of the organization. However, the absence of such documents is not a reason for not including unclaimed debt as income. The Presidium of the Supreme Arbitration Court of the Russian Federation, in Resolution No. 17462/09 of June 8, 2010, indicated that organizations are required to include unclaimed accounts payable in their income in the period in which the statute of limitations for them has expired. This follows from the totality of the provisions of paragraph 18 of Article 250 of the Tax Code of the Russian Federation, paragraph 27 of the Regulations on Accounting and Reporting. This must be done regardless of whether an inventory of the debt was carried out and whether administrative documents on its write-off were issued. Violation of the established inventory procedure does not relieve organizations from fulfilling this obligation. There are examples of court decisions on a similar situation (see, for example, the resolution of the Federal Antimonopoly Service of the Volga District dated December 24, 2013 No. A49-132/2013).

It should be noted that previously many courts (including the Presidium of the Supreme Arbitration Court of the Russian Federation) took a different point of view on this issue (see, for example, Resolution of the Presidium of the Supreme Arbitration Court of the Russian Federation dated July 15, 2008 No. 3596/08, determinations of the Supreme Arbitration Court of the Russian Federation dated June 28, 2010 No. VAS-7601/10, dated May 20, 2010 No. VAS-5700/10, dated November 25, 2009 No. VAS-15439/09, dated October 31, 2008 No. 14252/08, dated January 31, 2008 No. 16192/07, resolution of the Federal Antimonopoly Service of the Ural District dated February 17, 2010 No. F09-564/10-S3, Far Eastern District dated January 25, 2010 No. F03-8058/2009, dated December 14, 2009 No. F03-6832/2009, dated August 25, 2009, No. F03-3449/2009, dated June 8, 2009, No. F03-2324/2009, Central District, dated August 21, 2008, No. A09-6013/07-24, Volga District dated November 21, 2007 No. A57-10603/06, East Siberian District dated September 12, 2007 No. A33-12062/06-F02-5493/07, Moscow District dated September 9, 2009 No. KA-A41 /8500-09, North Caucasus District dated January 22, 2009 No. A53-8888/2008-C5-14, Northwestern District dated December 18, 2007 No. A05-13752/2006-11, West Siberian District dated March 9, 2006 No. F04-8885/2005(20013-A27-3)). When making decisions in favor of taxpayers, the courts proceeded from the fact that the fact that the statute of limitations had expired in itself is not enough to write off unclaimed accounts payable. Based on the norms of paragraph 78 of the Regulations on Accounting and Reporting, they came to the conclusion that without written grounds (an inventory report in form No. INV-17 and an order from the head of the organization), accounts payable cannot be written off. That is, the obligation to include this debt in income arises only in the period when such documents are drawn up.

However, with the release of the Resolution of the Presidium of the Supreme Arbitration Court of the Russian Federation dated June 8, 2010 No. 17462/09, one should expect that arbitration practice on the issue under consideration will become homogeneous.

Situation: should the amount of bad accounts payable be included in income when calculating income tax? The organization uses the cash method.

Include the amount of bad accounts payable as part of your income when calculating your income tax.

Letter No. 03-11-04/2/66 of the Ministry of Finance of Russia dated March 23, 2007 states that the amount of accounts payable written off due to the expiration of the statute of limitations must be included in non-operating income. This position is based on the fact that Article 250 of the Tax Code of the Russian Federation is mandatory for use by all organizations, regardless of the method by which they determine income and expenses. Consequently, written off accounts payable with an expired statute of limitations increases the tax base for income tax. An exception is accounts payable for taxes (fees, penalties, fines) written off or reduced in accordance with current legislation or by decision of the Government of the Russian Federation. Such debt is not included in income when calculating income tax (subclause 21, clause 1, article 251 of the Tax Code of the Russian Federation). Similar explanations are contained in the letter of the Ministry of Finance of Russia dated July 3, 2009 No. 03-11-06/2/118. Despite the fact that these letters are addressed to organizations using the simplified tax system, they are also applicable to organizations using the general taxation system.

Earlier, in letter dated August 26, 2002 No. 04-02-06/3/61, the Russian Ministry of Finance gave other explanations. It followed from the letter that income should include accounts payable only for those expenses that previously reduced the tax base. Under the cash method, unpaid expenses do not reduce taxable income. Income is recognized on the date of receipt of funds (receipt of other property) or on the date of repayment of debt in another way (clause 2 of Article 273 of the Tax Code of the Russian Federation). Based on this rule, the expiration date of the limitation period is not the moment of recognition of income. Therefore, writing off overdue accounts payable cannot be equated to receiving payment. Consequently, the organization has no reason to increase taxable profit by the amount of this debt.

It should be noted that with the release of later clarifications, organizations that adhere to the previous point of view of the Russian Ministry of Finance may have conflicts with inspectors.

An example of how the amount of written off accounts payable is reflected in accounting and tax purposes. The organization uses the cash method

In January 2013, Alpha LLC received materials worth 120,000 rubles from Torgovaya LLC. (including VAT – 18,305 rubles). According to the supply agreement, Alpha was required to pay for the supplied materials on January 20, 2013. The materials were not paid for on time. For three years, Hermes made no attempts to collect the amount of accounts payable from Alpha. The statute of limitations for Alpha's debt starts on January 21, 2013 and expires on January 20, 2016.

On January 23, 2021, Alpha's accountant conducted an inventory of accounts payable. Based on its results, accounts payable with an expired statute of limitations were identified in the amount of 120,000 rubles. Based on the results of the inventory, the head of Alpha decided to write off accounts payable with an expired statute of limitations.

The following entries were made in Alpha's accounting.

In January 2013:

Debit 10 Credit 60 – 101,695 rub. – materials are capitalized;

Debit 19 Credit 60 – 18,305 rub. – input VAT is reflected;

Debit 68 subaccount “Calculations for VAT” Credit 19 – 18,305 rub. – accepted for deduction of VAT on capitalized materials.

January 23, 2021:

Debit 60 Credit 91-1 – 120,000 rub. – the amount of accounts payable for unpaid materials is written off.

When calculating income tax, the accountant included the amount of written-off debt in income (RUB 120,000).

Situation: is it possible to take into account when calculating income tax using the accrual method, input VAT accepted for deduction on capitalized goods (work, services) not paid for by the organization? The organization writes off accounts payable due to the expiration of the statute of limitations.

Yes, you can. However, the inclusion of VAT, previously accepted for deduction, in non-operating expenses may be considered economically unjustified.

Based on the literal interpretation of subparagraph 14 of paragraph 1 of Article 265 of the Tax Code of the Russian Federation, when calculating income tax, an organization has the right to include in non-operating expenses input VAT, which relates to written-off accounts payable for capitalized goods (work, services).

However, in private explanations, representatives of the Russian Ministry of Finance express a different point of view. They believe that in the situation under consideration, the application of this rule will lead to the organization reducing its tax liabilities twice by the same amount:

- tax base for VAT, accepting input tax for deduction from the budget;

- tax base for income tax if input VAT is taken into account in expenses.

In such conditions, the inclusion of VAT, previously accepted for deduction, into non-operating expenses may be considered economically unjustified (clause 1 of Article 252, clause 49 of Article 270 of the Tax Code of the Russian Federation).

An example of how to reflect in accounting and taxation the write-off of accounts payable with an expired statute of limitations. The organization uses the accrual method

Alpha LLC pays income tax monthly. Accounting for income and expenses is carried out using the accrual method. On September 10, 2013, the organization received materials worth RUB 59,000. (including VAT – 9000 rubles). The payment period under the contract is seven banking days, not counting the day of delivery. For three years the materials were not paid for. Moreover, the supplier did not make any claims (in court), and Alpha did not take any measures to repay its debt.

Based on the results of the inventory carried out on September 24, 2021, the head of Alpha decided to write off accounts payable with an expired statute of limitations (accounting certificate, order of the manager).

The following entries were made in Alpha's accounting records.

September 10, 2013:

Debit 10 Credit 60 – 50,000 rub. – materials are capitalized;

Debit 19 Credit 60 – 9000 rub. – input VAT is reflected;

Debit 68 subaccount “Calculations for VAT” Credit 19 – 9000 rub. – accepted for deduction of input VAT.

September 24, 2021:

Debit 60 Credit 91-1 – 59,000 rub. – the amount of accounts payable with an expired statute of limitations is written off.

When calculating income tax for September 2021, Alpha’s accountant included 59,000 rubles in income. The accountant does not take into account the input VAT, previously accepted for deduction in the amount of 9,000 rubles, in expenses (clause 49 of article 270, clause 1 of article 252 of the Tax Code of the Russian Federation).

Accounts payable may arise if the organization has not shipped goods (work, services) to the buyer (customer) against the received advance payment. If, after the expiration of the statute of limitations or for other reasons, such debt is subject to inclusion in non-operating income, writing off VAT on it has some features.

In accounting, reflect the write-off of VAT by posting:

Debit 91-2 Credit 76 subaccount “Calculations for VAT from advances received” - the amount of VAT paid to the budget from an advance for which goods (work, services) were not shipped (performed, provided) is written off.

This procedure follows from paragraphs 11, 16 and 18 of PBU 10/99.

When writing off accounts payable for an unprocessed advance received on account of transactions that are subject to VAT at a rate of 0 percent (exempt from taxation), the obligation to accrue and pay VAT does not arise (letter of the Ministry of Finance of Russia dated July 20, 2010 No. 03-07-08 /208).

Situation: in what period, when calculating income tax, should written-off accounts payable be included in income? The organization uses the accrual method. The debt is written off due to the liquidation of the creditor.

Recognize the amounts of such accounts payable on the last day of the period corresponding to the date of making an entry in the Unified State Register of Legal Entities on the liquidation of the creditor.

The amount of accounts payable written off in connection with the liquidation of the organization must be included in non-operating income (clause 18 of Article 250 of the Tax Code of the Russian Federation). As a general rule, under the accrual method, income is recognized in the reporting (tax) period in which it arose (Clause 1, Article 271 of the Tax Code of the Russian Federation). In the situation under consideration, this period is the date of liquidation of the creditor. The organization is considered liquidated from the moment of its exclusion from the Unified State Register of Legal Entities (clause 3 of Article 49 of the Civil Code of the Russian Federation). From this moment all obligations of the organization cease (Article 419 of the Civil Code of the Russian Federation). Consequently, the amounts of such accounts payable must be recognized by the taxpayer on the last day of the period corresponding to the date of making an entry in the Unified State Register of Legal Entities on the liquidation of the creditor (subclause 5, clause 4, article 271 of the Tax Code of the Russian Federation).

If an organization includes the specified debt in income in later periods, then it will have to adjust the tax base for the corresponding reporting period and submit updated tax returns (clause 1 of Article 54 of the Tax Code of the Russian Federation).

Similar clarifications are contained in letters of the Ministry of Finance of Russia dated September 11, 2015 No. 03-03-06/2/52381 and the Federal Tax Service of Russia dated June 2, 2011 No. ED-4-3/8754.

If the organization does not recalculate the tax base and does not submit updated tax returns, tax inspectors may assess additional taxes, penalties and fines based on the results of the tax audit. Arbitration practice on this issue is developing in favor of tax inspectorates (see, for example, the ruling of the Supreme Arbitration Court of the Russian Federation dated June 7, 2011 No. VAS-6518/11, resolution of the Federal Antimonopoly Service of the West Siberian District dated January 27, 2011 No. A46-4108/2010 , Ural District dated January 25, 2010 No. Ф09-10607/09-С3).

Situation: how can a subscriber organization reflect in accounting and taxation the funds that were mistakenly credited to its personal account opened with a telecom operator? The money is transferred through the payment terminal.

Incorrectly received funds will have to be reflected in income only when the statute of limitations expires, usually three years. And provided that during this period, the one who mistakenly transferred the money will not demand it back. And he has the right to do so. Until this happens, take into account erroneous amounts as part of unexplained receipts. This is explained as follows.

Telecom operators open personal accounts for each subscriber to account for advances transferred by subscribers and payments for services rendered. To reconcile calculations, the subscriber can request a special report from the operator - account details. It must reflect all payments, including amounts received from unknown payers. Formally, the organization does not have the right to immediately use these amounts. After all, anyone who made a mistake in their personal account number has the right to demand it back from the telecom operator.

This conclusion follows from subparagraph “d” of paragraph 27, paragraphs 43 and 45 of the Rules, approved by Decree of the Government of the Russian Federation of May 25, 2005 No. 328.

So, until the statute of limitations has expired, take into account erroneously received amounts as part of unexplained receipts. To do this, you can open a corresponding subaccount for account 76 “Settlements with various debtors and creditors” - “Settlements for outstanding payments”. Make an entry in accounting:

Debit 60 Credit 76 subaccount “Settlements for outstanding payments” - erroneously received funds are reflected as accounts payable.

If the statute of limitations has expired and the payer has not demanded a refund, then reflect the unclaimed amounts in other income (clause 7, 10.4 of PBU 9/99, clause 78 of the Regulations on Accounting and Reporting). To do this, make the wiring:

Debit 76 “Settlements for outstanding payments” Credit 91-1 – the amount not claimed by the creditor is reflected as part of other income.

Apply the same rule when taxing. Include the unclaimed amount in non-operating income on the last day of the period in which the statute of limitations expired (clause 18 of Article 250, subclause 5 of clause 4 of Article 271 of the Tax Code of the Russian Federation).

Advice: if there are sufficient grounds, unexplained amounts can be reimbursed to the payer or taken into account in income without waiting for the expiration of the statute of limitations.

For example, this is possible in the case where, without the knowledge of the organization, money was transferred by an employee to whom the subscriber number is assigned. Request an explanatory note from him regarding this matter. By decision of the manager, the amount of expenses for communication services can be reimbursed to the employee upon his written application accompanied by supporting documents. But if he lost the payment receipt or refused a refund, include the unknown amounts in income without waiting for the expiration of the statute of limitations, based on the explanatory and detailed account. This approach will protect the organization from possible claims from tax inspectors regarding distortion of the base when calculating income tax. Do this if you have full confidence that the “unclarified” amount will not be claimed by the payer. Otherwise, it is better to wait until the statute of limitations expires.

Accounting

If the accounts payable are not repaid by the organization in a timely manner and are not claimed by the creditor, then in accounting they are subject to write-off after the expiration of the statute of limitations (clause 7 of PBU 9/99, clause 78 of the Regulations on Accounting and Reporting). An exception to this rule is tax debt (fees, penalties, fines). The expiration of the limitation period is not a basis for writing off such debt.

The amount of written off accounts payable for which the statute of limitations has expired should be included in other income in the amount in which this debt was reflected in accounting (clause 7, 10.4 of PBU 9/99).

In accounting, reflect the write-off of accounts payable by posting:

Debit 60 (62, 66, 67, 70, 71, 76-4) Credit 91-1 – the amount of accounts payable with an expired statute of limitations is written off.

Make such an entry in the period in which the statute of limitations for accounts payable expired (clause 16 of PBU 9/99).