Author: Alena Donmezova – Specialist in RKO

Date of publication: 09.10.2019

Current for May 2021

The administration of insurance contributions to extra-budgetary funds (PF, Social Insurance Fund, Compulsory Medical Insurance Fund) is carried out by the Federal Tax Service. An exception is “injury” insurance. They are administered by the FSS. Reporting on insurance premiums resembles tax reporting - these are calculations made according to special instructions on special forms. However, there is a difference. Reporting on insurance premiums is done for the billing and reporting periods, and not for the tax period.

The billing period is a calendar year. Reporting period - first quarter, half year, 9 months of the calendar year, year.

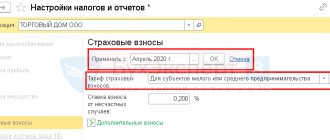

Setting up insurance premium rates

Setting up the calculation of insurance premiums in an organization is done in Setting up taxes and reports , tab Insurance premiums , section Main - Settings - Taxes and reports.

The following parameters are set:

- Insurance premium rate - the rate at which the policyholder pays insurance premiums;

- Accident contribution rate - the percentage of insurance premiums for NS and PZ established for the FSS policyholder;

- in the Additional contributions - checkboxes in front of the categories of employees in the organization for which additional contributions are paid to the Pension Fund.

Enter Lists of positions (the link becomes active) if the checkboxes are selected:

- Pharmacists;

- Miners;

- Flight crew members.

Specify Divisions with preferential contribution rates :

- sea vessels;

- separate divisions located in the SEZ and the Kaliningrad region.

Reflect Whether the results of a special assessment of working conditions are applied or not (the checkbox becomes active) if the checkbox is selected:

- Workers engaged in work with harmful or difficult working conditions.

All current insurance premium rates, types of income and their taxation with insurance premiums, as well as the maximum values of the base for insurance premiums since 2010 can be viewed in the journal Contribution Calculation Parameters .

This journal is located in the Salary Settings :

- Directories – Salaries and personnel – Salary settings – Classifiers – link Insurance premiums;

- Salaries and personnel – Directories and settings – Salary settings – Classifiers – link Insurance premiums.

Sample of filling out reports

The calculation form for insurance contributions to the Federal Tax Service consists of three sections, each of which contains information about the payer and social payments withheld. The new form for calculating insurance premiums is coded according to the form KND 1151111, this number is indicated on the title page.

The title page is filled out by the payer and the tax office. Here they indicate the TIN, KPP, adjustment number, the period for which the report on insurance premiums was submitted to the Federal Tax Service, tax code, location code of the inspection, full name of the company, reorganized form of the company, OKVED.

- Next page Information about a legal entity that is not an individual entrepreneur. Individuals who submit reports for employees write information about themselves here.

- Section 1. The entire amount of insurance payments for employees is reflected here. For each contribution (to the Pension Fund, Social Insurance Fund, Federal Compulsory Medical Insurance Fund separately) a separate total amount. It contains many lines - from 010 to 123. In addition to the amount of contributions, OKTMO is indicated.

- Appendix 1 of Section 1, which reflects medical and pension payments. The application consists of four subsections.

- Subsection 1.1 Pension calculations contains information about the base and amount of contributions to the pension fund.

- Subsection 1.2 Medical payments includes information on amounts for compulsory medical insurance.

- Appendix 2. Here all the amounts describe the amounts for compulsory social insurance, in case of unemployment and child care.

- Appendix 3. Benefit income. Includes data on spending on social expenses: unemployment payments, sick leave, maternity leave, one-time benefits for women who registered with a medical institution in the early stages of pregnancy, etc. If there were no such additional payments, then leave the application blank.

- Appendix 4 of Section 1 describes benefits from the company’s budget.

- Appendix 5 for companies involved in the IT field: software development, databases, provision of IT services on a commercial basis, with accreditation, the company employs at least 7 employees, the total income is at least 90%.

- Appendix 6 is filled out by firms that operate under a simplified taxation system and calculate insurance premiums at reduced rates.

- In Appendix 7, information is provided by non-profit companies engaged in the social security of citizens, engaged in science, art, and sports.

- Appendix 8 - for individual entrepreneurs working on the patent tax system.

- Appendix 9 provides information about employees with citizenship of another country.

- Appendix 10 requires entering data on student payments.

- Section 2 - heads of farms. It must only be completed by relevant persons.

- Appendix 1 of Section 2 indicates the calculated amounts of payments for the manager and employees of the peasant farm.

- Section 3 - personalized accounting of individuals who receive wages and are subject to insurance payments.

- Beginning of the sheet. 010 - correction number of the third section, if there were no corrections, then enter the number 0; 020 - indicate the code of the period for which the report was provided; 030 - current year; 040 - data number; 050 - date of calculation.

- Subsection 1 of Section 3 contains information about the individual who received the funds.

- Subsection 2 of Section 3 on payments and accrued payments for insurance for individuals.

Setting up cost items for insurance premiums

To correctly account for insurance premiums, you need to set up the Cost Items directory, which is available from the Directories - Income and Expenses - Cost Items section.

Parameters for setting up cost items for insurance premiums:

- For insurance contributions to the Social Insurance Fund for personal and personal income: Cost item - Contributions to the Social Insurance Fund from personal income and personal income .

- Type of expenses NU - Other expenses .

- Cost item - Insurance premiums .

It is important to establish a separate item for contributions to the Social Insurance Fund from NS and PZ, since this type of expense is taken into account for tax accounting purposes for income tax separately from other insurance contributions on the basis of paragraphs. 45 clause 1 art. 264 Tax Code of the Russian Federation.

If an organization combines tax regimes, for insurance premium items you need to define the type of activity in setting up the directory element Cost Items by setting the switch:

- For activities with the main tax system (general or simplified) - if insurance premiums relate to OSNO or simplified tax system.

- For certain types of activities with a special taxation procedure - if insurance premiums relate entirely to activities on UTII or PSN.

- For different types of activities - for insurance premiums that cannot be clearly attributed to one type of activity, so they need to be distributed.

Insurance premiums for industrial accidents: tariffs and reporting features - 2021

* The procedure for confirming the main type of economic activity of the policyholder under OSS from NSPiPZ - a legal entity, as well as the types of economic activity of the policyholder's divisions, which are independent classification units (approved by order of the Ministry of Health and Social Development of Russia dated January 31, 2006 No. 55).

For commercial organizations

the main type of economic activity is the one that, based on the results of the previous year, has the largest share in the total volume of products produced, work performed and services provided (excluding VAT).

For a non-profit organization

The main activity is the type of activity in which, based on the results of the previous year, the largest number of employees of the organization were employed.

The influence of subsidies on determining the share of an activity

Organizations that were most affected in 2021 by restrictions related to coronavirus infection could receive government subsidies.

The note to paragraph 9 of the confirmation certificate form (Appendix 2 to order No. 55) indicates that income data must be filled out on the basis of accounting records for the previous year.

In accounting, subsidies are taken into account in accordance with PBU 13/2000 (approved by order of the Ministry of Finance of Russia dated October 16, 2000 No. 92n). The same document should be used to guide the formation of accounting information about state assistance (in the form of subsidies, etc.) related to the recipient’s activities in the sectors of the economy most affected by the spread of coronavirus infection (clause 6 of the information of the Ministry of Finance of Russia No. PZ -14/2020). Information about the types of specified state assistance is disclosed in the accounting (financial) statements based on analytical accounting data in accounts 86 “Targeted financing” or 76 “Settlements with various debtors and creditors.”

Such subsidies are not taken into account in income either in accounting or tax accounting.

(Subclause 60, Clause 1, Article 251 of the Tax Code of the Russian Federation).

The subsidy could be provided in order to partially compensate for the costs associated with the recipient’s activities in the context of a worsening situation due to coronavirus infection, including maintaining employment and remuneration of workers (clause 1 of the Rules for the provision of subsidies from the federal budget in 2021, approved. Decree of the Government of the Russian Federation dated April 24, 2020 No. 576). In this case, the subsidy compensates for costs, so it also does not apply to revenue (letter of the Ministry of Finance of Russia dated September 2, 2020 No. 03-03-06/1/76953).

At the same time, when calculating the share of an activity in total revenue, the amount of income consists of two groups:

- income

by type of economic activity (column 3 of the confirmation certificate);

- targeted revenues

and financing (including budget financing, grants, etc.) (column 4 of the confirmation certificate).

Subsidies were allocated to economic entities with certain OKVED codes. In this case, they will be accounted for by type of economic activity with the same codes. Therefore, the mentioned subsidies will affect the size of the share of income by type of activity.

Subsidies may be provided to compensate for lost income and (or) financial support (reimbursement) of costs in connection with the production (sale) of goods (work, services) on a contractual basis. In this case, state aid is recognized as an economic benefit and PBU 13/2000 does not apply to it (paragraph 5, clause 3 of PBU 13/2000, letter of the Ministry of Finance of Russia dated September 11, 2020 No. 07-01-09/79827). We believe such subsidies should be reflected as part of sales revenue in accordance with PBU 9/99 “Organizational Income”.

It turns out that subsidies in any case affect the share of income by type of activity. In column 5 “Share of income and receipts by type of activity...” you should indicate the quotient of dividing the total amounts reflected in columns 3 “Income by type of economic activity” and 4 “Targeted receipts and financing...” by the total amounts indicated in columns 3 and 4 on the “Total” line of the confirmation certificate.

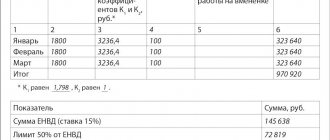

Example

(figures are conditional) The organization publishes magazines in printed form (OKVED code 58.14.1). Income from this type of activity for 2021 amounted to RUB 17,500,000. (line 1, column 3 of the confirmation certificate). In addition, the organization rents out vacant non-residential premises (OKVED code 68.20.2). Income from this type of activity for 2021 amounted to RUB 18,200,000. (line 2, column 3 of the confirmation certificate). In order to partially compensate for the costs associated with the organization’s activities under the conditions of covid restrictions, the organization received a subsidy from the federal budget in the amount of 1,800,000 rubles.

For 2021, the share of activities was:

- from publishing magazines – 51.47% ((RUB 17,500,000 + RUB 1,800,000): (RUB 17,500,000 + RUB 1,800,000 + RUB 18,200,000) x 100%);

- from the rental of premises - 48.57% (18,200,000 rubles: (17,500,000 rubles + 1,800,000 rubles + 18,200,000 rubles) x 100%).

The main activity for the organization will be the publication of magazines in printed form (I class profrisk). The contribution rate will be 0.2%.

The territorial branch of the fund will notify the policyholder of the tariff established for 2021 by 05/01/2021. Until such notification, contributions are calculated at last year's rate. If the tariff changes, contributions will need to be recalculated (clause 4, 11 of the procedure).

Consequences of missing the confirmation deadline

Missing the deadline for confirming the main activity can lead to undesirable consequences. And this will not be a fine (it is not provided for by law). The Fund has the right to establish the maximum possible tariff of contributions for OSS from NSPiPZ.

If the documents are not submitted by April 15, the territorial branch of the fund will classify the policyholder as having the highest class of professional risk type of economic activity.

Types of activities will be selected in accordance with the OKVED codes indicated in relation to this policyholder in the Unified State Register of Legal Entities.

This right of the fund is not a sanction

applied to the policyholder for violating the deadlines for submitting documents confirming the main type of economic activity.

According to the court (for example, resolution of the Court of Justice of the West Siberian District dated 07/04/2019 No. F04-6455/2018 in the case No. A45-16531/2017), this is a measure that is designed to guarantee the rights of the insured to insurance coverage

in the event of failure by the insured their responsibilities to confirm the main type of economic activity.

Change in reporting form

From 01/01/2021, a direct payment mechanism has been implemented. Therefore, from the first quarter of 2021, the calculation form is filled out taking into account the following features:

- in table 2

“Calculations for compulsory social insurance against accidents at work and occupational diseases”

the indicators in line 15

“Expenses for compulsory social insurance”

are not filled in

; - table 3

“Expenses for compulsory social insurance against accidents at work and occupational diseases”

is not filled out and is not presented.

In conclusion, we note that the Russian Ministry of Labor plans to update the list of preventive measures financed by the Federal Social Insurance Fund of the Russian Federation. According to the draft order (ID No. 02/08/04-21/00114735), they want to add preventive measures to monitor the health status of the employee in the workplace.

In 2021, the policyholder will be able to submit an application for financial support for preventive measures to the territorial branch of the Federal Social Insurance Fund of the Russian Federation until

October 1, 2021.

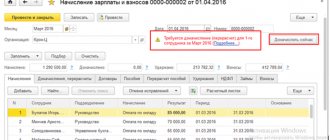

Contribution accounting operation

Some income subject to insurance premiums cannot be accrued by regular documents, which means that insurance premiums will not be automatically accrued either. An example of such income could be remuneration under a contract to a person who is not an employee of the organization.

For such cases, the Contribution Accounting Transaction document is provided. The document is available from the section Salaries and Personnel – Insurance Contributions – Contribution Accounting Operations.

You can consider filling out the document in more detail using the example of the article Calculations under a GPC agreement.

Test yourself! Take a test on this topic using the link >>

See also:

- Reduced insurance premium rates for small businesses from April 2020

Did the article help?

Get another secret bonus and full access to the BukhExpert8 help system for 14 days free of charge

Related publications

- Setting up accounting policies for NU in 1C: USN If an organization uses the simplified tax system, the procedure for recognizing expenses in its tax...

- Test No. 26. Setting up accounting policies for NU in 1C: VAT...

- VAT, setting up accounting policies in 1C Hello, please tell me, we are working in two areas:...

- Setting up Accounting Policies when switching from UTII to OSNO...

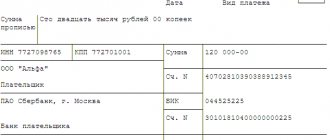

Rules for completing the form

The legislation regulates the filling out of the form, which is described in detail in Order No. ММВ 7–11 / [email protected] For accountants, the following basic requirements are sufficient:

If you do not follow the rules, the Federal Tax Service will not accept the report on insurance premiums and the funds will not be credited to the account. And this leads to the application of penalties in relation to the payer. Reporting is submitted in the same way as a payment order - in person, via e-mail, or by registered mail.