If a company has hired employees, it must necessarily pay the appropriate insurance premiums for them, which are required in the event of any occupational injuries, illnesses or other situations.

It is worth noting that the current legislation provides not only the obligation to pay payments, but also certain requirements for filling out payment documentation, the incorrect execution of which can lead to the fact that the payment simply will not be counted, and the company will encounter various problems from the control organ. In particular, the registration problem often lies in the correct indication of the BCC.

Dear readers! The article talks about typical ways to resolve legal issues, but each case is individual. If you want to find out how to solve your particular problem , contact a consultant:

+7 (499) 938-81-90 (Moscow)

+7 (812) 467-32-77 (Saint Petersburg)

8 (800) 301-79-36 (Regions)

APPLICATIONS AND CALLS ARE ACCEPTED 24/7 and 7 days a week.

It's fast and FREE !

In this regard, many entrepreneurs want to know what the KBK list for insurance premiums looks like in 2021 and a table with a breakdown.

When was the BCC for insurance premiums last updated?

The last update of the BCC on insurance premiums took place on April 14, 2019. Nothing else has changed yet, and these same BCCs will be in effect in 2021. But let's go in chronological order.

Since 2021, the bulk of insurance premiums (except for payments for accident insurance) began to be subject to the provisions of the Tax Code of the Russian Federation and became the object of control by the tax authorities. As a result of these changes, in most aspects, insurance premiums were equated to tax payments and, in particular, received new, budgetary BCCs.

The presence of a situation where, after 2021, contributions accrued according to the old rules can be transferred to the budget, required the introduction of special, additional to the main, transitional BCCs for such payments.

As a result, from 2021, there are 2 BCC options for insurance premiums supervised by the Federal Tax Service: for periods before December 31, 2021 and for periods after January 2021. At the same time, the codes for contributions to accident insurance that remain under the control of the Social Insurance Fund have not changed.

Read more about KBK in this material.

From April 23, 2018, the Ministry of Finance introduced new BCCs for penalties and fines on additional tariffs for insurance premiums paid for employees entitled to early retirement. KBK began to be divided not by periods: before 2017 and after - as before, but according to the results of a special labor assessment.

We talked about the details.

From January 2021, BCC values were determined in accordance with Order of the Ministry of Finance dated June 8, 2018 No. 132n. These changes also affected codes for penalties and fines on insurance premiums at additional tariffs. If in 2021 the BCC for penalties and fines depended on whether a special assessment was carried out or not, then at the beginning of 2021 there was no such gradation. All payments were made to the BCC, which is established for the list as a whole.

We talked about the nuances in the material “From 2021 - changes in the KBK.”

However, from April 14, 2019, the Ministry of Finance returned penalties and fines for contributions under additional tariffs to the 2021 BCC.

In 2021, the list of BCCs is determined by a new order of the Ministry of Finance dated November 29, 2019 No. 207n, but it has not changed the BCC for contributions. Find out which BCCs have changed.

All current BCCs for insurance premiums, including those changed as of April 14, 2019, can be seen in the table by downloading it in the last section of this article.

Budget classification codes for 2021. Value added tax

Let’s determine which code to indicate to an individual entrepreneur if there is a delay in paying the tax in the form of an individual entrepreneur’s contribution under compulsory pension insurance until 2021, and decipher KBK 18210202140062100160.

A block of numbers with serial numbers 14-17 in the code indicates what the individual entrepreneur is transferring and for what period (2016,2017 or 2021).

The number 1 at the beginning of the specified block will indicate the transfer of the contribution. KBK 18210202140062100160, where the specified block begins with 2, indicates that the individual entrepreneur in 2021, 2021 or 2021 made payment of penalties under compulsory pension insurance in a fixed amount for himself, accrued in the period until 2021.

So, KBK 18210202140062100160 looks like “Transfer of penalties for general public insurance for 2021.” Thus, under BCC 18210202140062100160 penalties for compulsory pension insurance contributions are transferred. However, it is worth remembering that the use of this code is justified when paying penalties for a period limited to 01/01/2017.

To pay penalties accrued by individual entrepreneurs on contributions to compulsory pension insurance for 2021, KBK 18210202140062100160 will not be suitable; the individual entrepreneur must indicate a new KBK 18210202140062110160. This code cannot be used when paying penalties on taxes accrued in 2021, in this case you should also indicate a new one BCC for payment of contributions - 18210202140061110160, which since 04/23/18 is the same for any income of an individual entrepreneur. KBK 18210202140063000160 - fines

When paying a fine on compulsory social security contributions until 2021, an individual entrepreneur should indicate KBK 18210202140063000160 for himself. To pay a fine for periods from 2017, an individual entrepreneur should use KBK 18210202140063010160.

The table shows changes since April 23, 2018 in the BCC of individual entrepreneurs’ contributions for themselves under compulsory pension insurance.

| Payment | KBC, valid until April 23, 2018. | New KBK |

| From income up to 300,000 rubles. | 182 1 0210 160 | 182 1 0210 160 |

| With income over 300,000 rubles. | 182 1 0210 160 |

- Pension contributions. Decoding codes for the budget classification of pension contributions for 2021.

- Contributions to compulsory social insurance. Decoding codes for the budget classification of contributions to compulsory social insurance for 2021.

- Contributions for compulsory health insurance. Decoding codes for the budget classification of contributions for compulsory health insurance for 2021.

- Personal income tax (NDFL). Deciphering the budget classification codes for personal income taxes (NDFL) 2021.

- Value added tax (VAT). Decoding the budget classification codes for value added tax (VAT) 2021.

- Income tax. Decoding the 2021 income tax budget classification codes.

- Excise taxes. Decoding the codes for the budget classification of excise taxes for 2021.

- Organizational property tax. Decoding the codes of the budget classification of property tax for organizations 2021.

- Land tax. Deciphering the codes for the budget classification of land tax for 2021.

- Transport tax. Deciphering the transport tax budget classification codes for 2021.

- Single tax with simplification. Decoding the codes of the budget classification of the single tax during simplification for 2021.

- Unified tax on imputed income (UTII). Decoding codes for the budget classification of the single tax on imputed income (UTII) 2021.

- Unified Agricultural Tax (USAT). Decoding the codes of the budget classification of the Unified Agricultural Tax (USAT) 2021.

- Mineral extraction tax (MET). Deciphering the budget classification codes for mineral extraction taxes (MET) 2021.

- Fee for the use of aquatic biological resources. Decoding the budget classification codes of the fee for the use of aquatic biological resources for 2021.

- Fee for the use of fauna objects. Deciphering the codes of the budget fee for the use of wildlife objects in 2021.

- Water tax. Decoding the codes of the budget classification of water tax for 2021.

- Payments for the use of subsoil. Decoding codes for the budget classification of payments for the use of subsoil for 2021.

- Payments for the use of natural resources. Decoding codes for the budget classification of payments for the use of natural resources for 2021.

- Gambling tax. Deciphering the budget classification codes for the gambling tax for 2021.

- Government duty. Decoding the codes of the budget classification of state duty for 2021.

- Income from the provision of paid services and compensation for state costs. Decoding codes for the budget classification of income from the provision of paid services and compensation for state expenses in 2021.

- Fines, sanctions, payments for damages. Decoding codes for the budget classification of fines, sanctions, payments for damages in 2021.

- Trade fee. Decoding the codes of the budget classification of trade tax for 2021.

- News. All news on changes in (KBK) budget classification codes for past and current years.

The BCC for payments is set for the entire list as a whole.

Additional pension contributions at tariff 1 (clause 1, part 1, article 30 of the law of December 28, 2013 No. 400-FZ)

| Additional tariff that does not depend on the results of the special assessment | Additional tariff depending on the results of the special assessment | |

| Contributions | 182 1 0210 160 | 182 1 0220 160 |

| Penalty | 182 1 0210 160 | 182 1 0200 160 |

| Fines | 182 1 0210 160 | 182 1 0200 160 |

Additional pension contributions at tariff 2 (clause 2-18, part 1, article 30 of the law of December 28, 2013 No. 400-FZ)

| Additional tariff that does not depend on the results of the special assessment | Additional tariff depending on the results of the special assessment | |

| Contributions | 182 1 0210 160 | 182 1 0220 160 |

| Penalty | 182 1 0210 160 | 182 1 0200 160 |

| Fines | 182 1 0210 160 | 182 1 0200 160 |

Contributions to the Health Insurance Fund and Social Insurance Fund for employees

The cloud service Kontur.Accounting helps generate payment orders with current BCCs for paying taxes.

Get free access for 14 days

The KBK 2021 and 2021 for transferring funds to the Federal Compulsory Medical Insurance Fund and the Social Insurance Fund from employee salaries have not changed, and the codes for maternity contributions remain the same, so we use the same codes as before. Let's remind them.

| Contributions for temporary disability and maternity | |

| Contributions | 182 1 0210 160 |

| Penalty | 182 1 0210 160 |

| Fines | 182 1 0210 160 |

| Contributions to the Social Insurance Fund for injuries and occupational diseases | |

| Contributions | 393 1 0200 160 |

| Penalty | 393 1 0200 160 |

| Fines | 393 1 0200 160 |

| Contributions to the FFOMS for compulsory health insurance | |

| Contributions | 182 1 0213 160 |

| Penalty | 182 1 0213 160 |

| Fines | 182 1 0213 160 |

- KBK for personal income tax in 2021

- KBK for insurance premiums

- Full table of BCC for insurance premiums 2021

- We pay insurance premiums

- We pay personal income tax for employees

- Innovations for 2021

18210202101082011160 KBK – transcript

18210202103081013160 KBK: transcript 2021 - what is the tax

Budget Classification Codes (BCC) for 2021

KBK for personal income tax 2016

KBK 182 1 0100 110: what is the tax 2018

What tax is paid under this code? Budget classification codes (BCC) are formed in accordance with the provisions of Order of the Ministry of Finance of the Russian Federation dated July 1, 2013 No. 65n. The code has a standard length of 20 characters, and each number has a specific meaning. BCCs are used when processing payment orders when funds are transferred to the budget in the form of taxes, fees or contributions, as well as penalties and fines on them. KBK are needed for the correct distribution of payments in payment cards maintained by the tax authority. Let's consider what the decoding for KBK 18210202140062100160 will be for 2018, what tax they indicate.

KBK, Insurance premiums of the Pension Fund of the Russian Federation KBK for payment of insurance contributions to the Pension Fund of the Russian Federation and the Compulsory Medical Insurance Fund

KBK / 12:07 September 29, 2021 The Ministry of Finance adjusted the KBK

This code designation can be deciphered as follows:

- 182 – code designation of the payment administration operator, that is, in this case it is the Federal Tax Service;

- 1 – payment affiliation (1 – this is income, 2 – gratuitous deduction);

- 02 – digital designation of the receipt of contributions (02 – these are social);

- 02 — budget item/level (02 is regional or subject);

- 140 – sub-item of budget income;

- 06 – purpose of budget receipt or budget level (06 is the PFR budget). Other examples: 01 - federal, 02 - regional, and so on;

- 1110 – reason for expulsion. This combination of numbers means that deductions are related to the payment of insurance premiums;

- 160 – categorization of income (160 are insurance premiums). Other options: 110 - tax revenues and so on.

The code designation in question is valid in the current calendar year in accordance with order number 132n (dated June 8, 2018).

All types of legal entities are required to pay not only tax deductions, but also insurance contributions to various types of funds not related to the budget: medical, pension, and so on. Individual entrepreneurs are required to pay two types of insurance premiums:

- fixed : 29,354 rubles for 2021, with income up to 300 thousand rubles;

- additional : in the amount of 1 percent of income over 300,000 rubles.

We also note that since the beginning of 2021, the budget revenue administrator has changed in the code designation under consideration. Instead of the Pension Fund of Russia, it became the Federal Tax Service (the numbers “182” at the beginning of this KBK), so all insurance contributions now go through the tax office. As a result, legal entities must make all fixed payments from January 1, 2021 to the Pension Fund according to BCC 182 1 0210 160 to the Federal Tax Service.

Insurance premiums, charged at the rate of 1 percent when the income portion exceeds 300 thousand rubles, from time to time mislead individual entrepreneurs, since the Ministry of Finance periodically tries to supplement the KBK classifier with certain codes. Therefore, a reasonable question arises: “to which code should I pay these insurance premiums?” The Ministry of Finance planned at the beginning of 2021 to divide fixed and additional insurance premiums into two different BCC codes in order to separate them from each other. However, he decided to designate them with the same digital code (orders numbered: 255n - dated December 27, 2021 and 35n - dated February 28, 2018). Therefore, additional deductions in the amount of 1 percent when exceeding 300 thousand rubles must be paid to the Pension Fund of the Russian Federation according to BCC 18210202140061110160.

We also note that when agreeing on budget codes for 2021, a misunderstanding once again arose due to the fact that the Ministry of Finance of the Russian Federation, in order number 132n (dated June 8, 2018), did not explain in deciphering the code the deduction of additional contributions in the amount of 1- th percent if the income portion of the legal entity exceeds 300 thousand rubles. Nevertheless, according to order number 132n, in the coming year, payment of insurance contributions by an individual entrepreneur, fixed and additional, must also be made according to the code in question 18210202140061110160.

BCC for insurance premiums in 2019–2020 for the Pension Fund of Russia

Payment of insurance premiums to the Pension Fund is carried out by:

- Individual entrepreneurs working without hired employees (for themselves);

- Individual entrepreneurs and legal entities hiring workers (from the income of these workers).

At the same time, payment of a contribution by an individual entrepreneur for himself does not exempt him from transferring the established amount of payments to the Pension Fund for employees and vice versa.

Individual entrepreneurs who do not have staff pay 2 types of contributions to the Pension Fund:

- In a fixed amount - if the individual entrepreneur earns no more than 300,000 rubles. in year. For such payment obligations in 2019-2020, KBK 18210202140061110160 (if the period is paid from 2017) and KBK 18210202140061100160 (if the period is paid until 2017) are established.

IMPORTANT! The income of an individual entrepreneur on UTII for the purpose of calculating fixed insurance premiums is imputed income, not revenue (letter of the Ministry of Finance of the Russian Federation dated July 18, 2014 No. 03-11-11/35499).

- In the amount of 1% of revenue that exceeds RUB 300,000. in year. For the corresponding payment obligations accrued before 2021, KBK 18210202140061200160 has been established. But contributions accrued in 2017–2020 should be transferred to KBK 18210202140061110160. That is, the code is the same as for the fixed part (letter from the Ministry of Finance of Russia dated 04/07/201 7 No. 02-05-10/21007).

Find out about the current fixed payment amount for individual entrepreneurs at.

Individual entrepreneurs and legal entities that hire employees pay pension contributions for them, accrued from their salaries (and other labor payments), according to KBK 18210202010061010160 (if accruals relate to the period from 2017) and KBK 18210202010061000160 (if accruals are made for the period before 2021) .

Which changes

In 2021, the Ministry of Finance approved 98 new codes, with 15 existing BCCs receiving a new interpretation, while 20 others were completely canceled.

In any payments that relate to insurance premiums for the purposes of pension, social or health insurance of citizens, the administrator of the KBK has undergone changes, and now the first three digits of the budget classification must be indicated.

Previously, when preparing payment documents, it was necessary to indicate the Pension Fund and FFOMS codes, that is, “392” or “393”, while after the changes introduced, you will need to write the code “182”, which provides for sending the specified payment to a certain branch of the Tax Service .

Special attention should be paid to the fact that for all payments in 2021, you now need to indicate a new code for the income subtype group, and to be more precise, we are talking about 14-17 digits in the code. Previously, for medical and pension contributions, as well as various disability payments, it was necessary to indicate in the code “1000” and “1011”, while now it is necessary to indicate “1010” and “1013”.

In addition to the main features of contributions, starting from 2021, new codes have also come into effect, which must be indicated in payment documents for income tax, as well as when paying taxes under the simplified system. Some codes are detailed in the new edition, while some have been completely eliminated.

What BCCs for FFOMS contributions are established in 2019–2020

Contributions to the FFOMS, as well as contributions to the Pension Fund, are paid by:

- IP - for yourself;

- Individual entrepreneurs and legal entities - for hired employees.

Contributions for individual entrepreneurs to the FFOMS are paid for themselves using BCC 18210202103081013160 (if related to the period from 2021) and BCC 18210202103081011160 (if related to the period until 2021).

For hired employees, individual entrepreneurs and legal entities must pay contributions to the Federal Compulsory Medical Insurance Fund using KBK 18210202101081013160 (for payments accrued from 2021) and KBK 18210202101081011160 (for accruals made before 2021).

KBK 2021 — 182 1 0200 160

| Payment Description | KBK |

| Pension contributions at basic and reduced rates | 182 1 0210 160 |

| Pension contributions at an additional tariff that does not depend on the special assessment (list 1) | 182 1 0210 160 |

| Pension contributions at an additional tariff depending on the special assessment (list 1) | 182 1 0200 160 |

| Pension contributions at an additional tariff that does not depend on the special assessment (list 2) | 182 1 0210 160 |

| Pension contributions at an additional tariff depending on the special assessment (list 2) | 182 1 0200 160 |

| Medical fees | 182 1 0213 160 |

| Social contributions | 182 1 0210 160 |

| Contributions for injuries | 393 1 0200 160 |

Individual entrepreneurs pay the BCC on their own. If an individual entrepreneur simultaneously works as an employee, he still must pay contributions for himself - as an individual entrepreneur.

Entrepreneurs are required to pay mandatory contributions to their own pension and health insurance until they are “listed” as individual entrepreneurs and have a Unified State Register of Entrepreneurs (USRIP) entry about them. The age of the entrepreneur and occupation does not matter. And most importantly, contributions must be paid even if the individual entrepreneur does not receive any income.

KBK: individual entrepreneur contributions “for oneself” in 2021

KBK 18210202090071010160: what tax?

Insurance premiums in 2021: changes

Insurance premiums for individual entrepreneurs in 2021 for themselves

KBK 18210202010061010160 – what tax?

KBK codes for 2021 were approved by the Ministry of Finance in order No. 65n dated 07/01/13. Each type of tax or contribution has its own indicator value. From this article you will learn in what cases and to whom you need to enter KBK 18210202140061200160 in the payment document.

KBK / 9:41 March 28, 2021 New KBK for insurance premiums

From 01/01/17, KBK 18210202140061200160 was cancelled, code 18210202140061210160 was approved instead, and from 04/23/18, the codes for all types of individual entrepreneur income were replaced by a single KBK, the decoding of which determines the purpose of the payment in the form of “Fixed contributions for the payment of an insurance pension”.

The table provides comparative information on the BCC for the transfer of contributions under compulsory pension insurance for individual entrepreneurs in the period before and after 04/23/18.

Question: KBK 18210202140061110160: how to decipher the code in 2019, what tax should I pay?

Answer: KBK 18210202140061110160 is valid from January 1, 2021. And in 2021 too. It is intended for payment of insurance premiums for compulsory pension insurance of individual entrepreneurs:

in a fixed amount to the Pension Fund for income over 300 thousand rubles. to the Pension Fund

| Payment Description | KBK |

| Income tax, which is credited to the federal budget | 182 1 0100 110 |

| Income tax, which is credited to the regional budget | 182 1 0100 110 |

| VAT | 182 1 0300 110 |

| Property tax | 182 1 0600 110 |

| Simplified tax with the object “income” | 182 1 0500 110 |

| Simplified tax with the object “income minus expenses” | 182 1 0500 110 |

| UTII | 182 1 0500 110 |

| Unified agricultural tax | 182 1 0500 110 |

| Personal income tax for a tax agent | 182 1 0100 110 |

| Transport tax | 182 1 0600 110 |

| Land tax from plots of Moscow, St. Petersburg, Sevastopol | 182 1 0600 110 |

Since 2021, the procedure for calculating fixed contributions paid by individual entrepreneurs, as well as lawyers and other “private traders” has changed significantly. Previously, the amount of individual entrepreneur’s contributions “for himself” was determined by a formula that included the minimum wage and the tariff rate. From 2018, this formula will be abolished. However, since 2021, instead of it in Article 430 of the Tax Code of the Russian Federation, fixed contribution values have appeared that do not depend on the minimum wage or on any other indicators.

“Pension” contributions from income exceeding 300,000 rubles. in 2018, as before, are calculated as 1 percent of the excess amount. The maximum allowable amount of “pension” contributions also remains. But if now it used to depend on the minimum wage, then in 2021 and beyond its size will be constant and will be a fixed value of “pension” contributions multiplied by 8. All important figures for individual entrepreneurs are in the table below.

The UTII declaration is submitted within the deadlines specified in Article 346.32 of the Tax Code of the Russian Federation - no later than the 20th day of the first month following the reporting quarter. The rule applies: if the deadline for submitting a declaration falls on a weekend or holiday, it is postponed to the next business day. However, in 2021, all these days will be working days, so there will be no postponement of the deadline. Deadlines for submitting UTII declarations in 2021 for individual entrepreneurs and organizations

| Reporting period | Deadline for submitting the declaration |

| 4th quarter 2021 | 20.01.2020 |

| 1st quarter 2021 | 20.04.2020 |

| 2nd quarter 2021 | 20.07.2020 |

| 3rd quarter 2021 | 20.10.2020 |

| 4th quarter 2021 | 20.01.2021 |

We recommend using our online service to prepare your UTII declaration. Spend just a few minutes and you will receive a print-ready and correctly completed report.

Create a UTII declaration

The UTII declaration contains information about the amount of tax to be transferred to the budget, so the Federal Tax Service will immediately be able to control their timely and full payment. Only 5 days are allotted for this, i.e. The deadline for transfer is no later than the 25th day of the first month following the reporting quarter. Deadlines for paying UTII in 2020 (taking into account the postponement of weekends)

| Reporting period | Tax payment deadline |

| 4th quarter 2021 | 27.01.2020 |

| 1st quarter 2021 | 27.04.2020 |

| 2nd quarter 2021 | 27.07.2020 |

| 3rd quarter 2021 | 26.10.2020 |

| 4th quarter 2021 | 25.01.2021 |

Not sure if you calculated the tax on imputed income correctly? Check the amount on our UTII calculator. And if necessary, you can contact 1C:BO specialists for a free consultation.

Free accounting services from 1C

What BCCs for insurance premiums are established for the Social Insurance Fund in 2019–2020

Payments to the Social Insurance Fund are classified into 2 types:

- paid towards insurance for sick leave and maternity leave;

- paid towards insurance for accidents and occupational diseases.

Individual entrepreneurs working without hired employees do not list anything in the Social Insurance Fund.

Individual entrepreneurs and legal entities working with hired personnel make payments for them:

- for sick leave and maternity insurance - using KBK 18210202090071010160 (if we are talking about accruals made since 2017) and KBK 18210202090071000160 (if accruals were made before 2017) - contributions are administered by the Federal Tax Service;

- for insurance against accidents and occupational diseases - in the amount determined taking into account the class of professional risk by type of economic activity, using BCC 393 1 0200 160 - contributions are transferred directly to the Social Insurance Fund.

Individual entrepreneurs and legal entities concluding civil contract agreements with individuals pay only the second type of contributions, provided that this obligation is specified in the relevant agreements.

Read more about the specifics of calculating insurance premiums when signing civil contracts in the article “Contract and insurance premiums: nuances of taxation.”

What are fixed contributions and why are they no longer fixed?

Fixed contributions were insurance contributions for compulsory pension insurance and compulsory health insurance paid by individual entrepreneurs, lawyers, notaries and other persons engaged in private practice.

Until 2014, defined contributions were truly fixed (set for the year) and the same for all persons paying them. Then amendments to the legislation came into force, changing the procedure for calculating contributions and, in fact, contributions ceased to be fixed, since part of the contributions depends on the income of the entrepreneur.

And from 2021, this name has been removed from regulatory documents. We will continue to call these contributions fixed for convenience and because the name is familiar to entrepreneurs.

Since 2021, the procedure for paying fixed insurance premiums is regulated by Chapter 34 of the Tax Code and contributions are paid not to extra-budgetary funds, but to the territorial tax inspectorates at the place of registration of the individual entrepreneur.

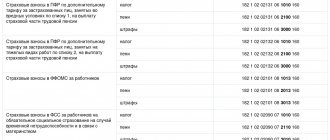

Current KBK table (insurance premiums in 2019–2020)

In the table below, the BCC codes indicated above are supplemented with codes used when paying penalties and fines for each type of payment in 2019-2020.

You can see the BCC for penalties and fines on additional tariffs for insurance premiums for hazardous types of work in this table.

BCC for the payment of different types of taxes reflected in the payment slip are listed in the Ready-made solution from ConsultantPlus. There you can also check the correctness of the KBK instructions for insurance premiums.

Results

Insurance premiums intended for extra-budgetary funds are required to be paid by both individual entrepreneurs and legal entities. BCC for insurance premiums for 2019–2020 when making payments, you should use only current ones - this is an important factor in the timely recording of payment by its recipient.

Budget classification codes (BCC) are used when transferring taxes and fees to the budget. BCCs consist of twenty digits; they are used to determine what payment is being paid. First of all, they are necessary for the correct distribution of funds received in the treasury. For 2021, codes have already been approved (order of the Ministry of Finance of the Russian Federation dated June 8, 2018 No. 132n). Let's consider 18210202101082013160 KBK, what tax is paid on it.

What determines the size of contributions?

Until January 1, 2021, the amount of individual entrepreneur contributions depended on the minimum wage.

However, due to the fact that the minimum wage was increased to the subsistence level, it was decided to “delink” individual entrepreneurs’ contributions from it, and starting from 2021, the fixed amount of contributions paid per year is indicated in the Tax Code.

Since 2014, the amount of fixed contributions also depends on the annual income of the individual entrepreneur, since if the income exceeds 300 thousand rubles during the year. it is necessary to charge another 1% contribution on the amount of income exceeding 300 thousand rubles.

Income is calculated as follows:

- Under OSNO - income accounted for in accordance with Article 210 of the Tax Code of the Russian Federation. i.e. those incomes that are subject to personal income tax (applies only to income received from business activities). When determining these incomes, expenses are taken into account (Resolution of the Constitutional Court of November 30, 2016 No. 27-P>);

- Under the simplified tax system with the object of taxation, “income” is income taken into account in accordance with Article 346.15 of the Tax Code of the Russian Federation. Those. those incomes that are taxed under the simplified tax system (such income is indicated in column 4 of the book of income and expenses and is indicated in line 113 of the tax return under the simplified tax system);

- Under the simplified tax system with the object of taxation “income reduced by the amount of expenses” - income taken into account in accordance with Article 346.15 of the Tax Code of the Russian Federation. Those. those incomes that are taxed under the simplified tax system (such income is indicated in column 4 of the book of income and expenses and is indicated in line 213 of the tax return under the simplified tax system). However, there are decisions of courts, including the Supreme Court, that expenses can be taken into account. However, the Ministry of Finance still maintains that all income is taken to calculate contributions.

- Under the Unified Agricultural Tax - income accounted for in accordance with paragraph 1 of Article 346.5 of the Tax Code of the Russian Federation. Those. those incomes that are taxed under the Unified Agricultural Tax (such income is indicated in column 4 of the book of income and expenses and is indicated in line 010 of the tax return under the Unified Agricultural Tax). Expenses are not taken into account when determining income for calculating contributions;

- For UTII - the taxpayer's imputed UTII income, calculated according to the rules of Article 346.26 of the Tax Code of the Russian Federation. Imputed income is indicated in line 100 of section 2 of the UTII declaration. If there are several sections 2, then the income is summed up across all sections. When determining annual income, imputed income from declarations for the 1st-4th quarter is added up.

- With PSN - potential income, calculated according to the rules of Article 346.47 of the Tax Code of the Russian Federation and Article 346.51 of the Tax Code of the Russian Federation. Those. the income from which the cost of the patent is calculated.

- If an individual entrepreneur applies several tax systems at the same time, then the income from them is added up.

KBK 18210202101082013160: what does the 2021 tax mean?

The code is used to pay penalties on insurance premiums for compulsory health insurance, credited to the Federal Compulsory Health Insurance Fund, for periods starting from January 1, 2017. KBK 18210202101082013160 must be indicated in field “104” of the payment order.

Contributions to the Compulsory Medical Insurance Fund are calculated by employers (organizations, individual entrepreneurs, individuals) who use hired labor from the amounts of employee income. The due date for payment of contributions is no later than the 15th day of the month following the accrual period. If payment is late, the Federal Tax Service will impose financial sanctions in the form of penalties, which you can calculate and transfer yourself.

Penalty amount

Let us remind you that for organizations and individuals, penalties are accrued differently from October 1, 2017 (clause 4 of Article 75 of the Tax Code). Formula for calculating penalties:

Pe = N x St x D, where

Pe - fine;

N – amount of unpaid tax or fee;

D – number of calendar days of delay.

St - refinancing rate (key rate of the Central Bank), which is multiplied by the corresponding coefficient (for individual entrepreneurs and individuals it is equal to 1/300 of the refinancing rate in force during the period of delay in payment; for organizations - the first 30 days of delay 1/300 of the refinancing rate, from 31 days of delay payment - 1/150).

Financial sanctions in the form of penalties are not applied if:

- tax authorities seized property (clause 3 of article 75 of the Tax Code);

- the court suspended transactions on the accounts as an interim measure (clause 3 of Article 75 of the Tax Code);

- the arrears arose as a result of the implementation of written explanations from the Federal Tax Service or another authorized government agency on the procedure for calculating and paying contributions and taxes (clause 8 of Article 75 of the Tax Code).

For which contributions are thresholds relevant?

The most frequently considered threshold value is the level of annual income of 300 thousand rubles, since when income reaches this mark, it becomes relevant for individual entrepreneurs to consider a new formula for calculating a fixed insurance contribution for pension insurance.

When the entrepreneur’s income does not reach the threshold amount or is equal to it, then the calculation of contributions is simple. The minimum wage is multiplied by the interest rate, and then by the number of workers for a given individual entrepreneur months.

If the individual entrepreneur has high income, then the contribution amount will increase accordingly. But how much depends on the income itself. Indeed, to determine the amount added to the standard formula, they do not use the entire amount of income, but the amount by which it exceeds 300 thousand.

So, if an individual entrepreneur has an income greater than 300 thousand, then to determine the amount of the contribution he will need the following indicators:

- The current minimum wage. For 2021 it is 7,500 rubles.

- Interest rate. For pension insurance it is 26%.

- Work time. This refers to the number of working months.

- The difference between the income received and the threshold amount.

- The rate is 1%. It is this that is used to determine the amount added to the standard contribution.

18210202101082013160 KBK transcript 2021

What tax the KBK denotes can be understood from the set of numbers included in it:

- the first three digits (182) indicate the payment administrator (FTS);

- the next eight digits indicate groups, subgroups, articles and sub-items of payment (in this case, the budget receives insurance premiums);

- the twelfth and thirteenth digits are an element that characterizes the recipient (MHIF);

- from fourteenth to seventeenth (2013) – type of payment (penalty);

- the last three digits indicate what the budget receives (160 - insurance premiums).

An error in the KBK is not considered critical; it can be clarified by submitting a corresponding application to your tax office.

KBK taxes: for paying taxes for organizations and individual entrepreneurs on OSN

| from fourteenth to seventeenth | reason for payment | |

| from eighteenth to twentieth | state budget income category | — insurance premiums |

| Name of tax, fee, payment | KBK |

| Corporate income tax (except for corporate tax), including: | |

| — to the federal budget (rate — 3%) | 182 1 0100 110 |

| — to the regional budget (rate from 12.5% to 17%) | 182 1 0100 110 |

| VAT | 182 1 0300 110 |

| Property tax: | |

| - for any property, with the exception of those included in the Unified Gas Supply System (USGS) | 182 1 0600 110 |

| - for property included in the Unified State Social System | 182 1 0600 110 |

| Personal income tax (individual entrepreneur “for yourself”) | 182 1 0100 110 |

KBK taxes: for paying taxes for organizations and individual entrepreneurs in special modes

| Name of tax, fee, payment | KBK |

| Tax under the simplified tax system, when the object of taxation is applied: | |

| - “income” | 182 1 0500 110 |

| — “income minus expenses” (tax paid in the general order, as well as the minimum tax) | 182 1 0500 110 |

| UTII | 182 1 0500 110 |

| Unified agricultural tax | 182 1 0500 110 |

What are they used for?

Codes were introduced to organize tax and other budget revenues, as well as the subsequent expenditure of financial resources. With the help of the KBK, budget revenues are grouped - tax transfers, including personal income tax and insurance contributions. Separate numbers are provided for these transactions.

Where are they indicated?

BCC are reflected in payment orders that are issued in the process of paying taxes, insurance fees, fines and penalties. In the current version of the payment order, field 104 is provided to indicate the code (the form of the document is specified in Appendix 3 of the Regulations of the Central Bank No. 383-P). Each form contains only one number. When paying several installments, it is necessary to prepare and post a similar number of payment orders.

Decoding

The BCC includes 20 digits called digits:

KBK-2018 for payment of other taxes for all organizations and individual entrepreneurs

| Name of tax, fee, payment | KBK |

| Personal income tax on income the source of which is a tax agent | 182 1 0100 110 |

| VAT (as tax agent) | 182 1 0300 110 |

| VAT on imports from Belarus and Kazakhstan | 182 1 0400 110 |

| Income tax on dividend payments: | |

| — Russian organizations | 182 1 0100 110 |

| - foreign organizations | 182 1 0100 110 |

| Income tax on the payment of income to foreign organizations (except for dividends and interest on state and municipal securities) | 182 1 0100 110 |

| Income tax on income from state and municipal securities | 182 1 0100 110 |

| Income tax on dividends received from foreign organizations | 182 1 0100 110 |

| Transport tax | 182 1 0600 110 |

| Land tax | 182 1 06 0603х хх 1000 110 where xxx depends on the location of the land plot |

| Fee for the use of aquatic biological resources: | |

| — for inland water bodies | 182 1 0700 110 |

| — for other water bodies | 182 1 0700 110 |

| Water tax | 182 1 0700 110 |

| Payment for negative impact on the environment | 048 1 12 010x0 01 6000 120 where x depends on the type of environmental pollution |

| Regular payments for the use of subsoil, which are used: | |

| - on the territory of the Russian Federation | 182 1 1200 120 |

| — on the continental shelf of the Russian Federation, in the exclusive economic zone of the Russian Federation and outside the Russian Federation in territories under the jurisdiction of the Russian Federation | 182 1 1200 120 |

| MET | 182 1 07 010хх 01 1000 110 where хх depends on the type of mineral being mined |

| Corporate income tax on income in the form of CFC profits | 182 1 0100 110 |

Read more: Traveling a child abroad without parents documents

KBK for insurance premiums

The responsibility for transferring insurance contributions falls on organizations and entrepreneurs engaged in commercial activities. In 2021, the following codes are provided for these payments.

| Transaction type | Basic payment | Penalty | Fines |

| Contributions from VNiM (temporary disability and maternity) | 18210202090071010160 | 18210202090072110160 | 18210202090073010160 |

| Contributions to the Social Insurance Fund “for injuries” | 39310202050071000160 | 39310202050072100160 | 39310202050073000160 |

| Contributions for compulsory medical insurance (health insurance) | 18210202101081013160 | 18210202101082013160 | 18210202101083013160 |

| Contributions to the pension fund (pension fund) for employees (basic and reduced tariffs) | 18210202010061010160 | 18210202010062110160 | 18210202010063010160 |

| Contributions to mandatory pension insurance for individual entrepreneurs (fixed part and 1% on income over 300,000 rubles) | 18210202140061110160 | 18210202140062110160 | 18210202140063010160 |

The BCC for penalties and fines on insurance payments under additional tariffs has changed. Now the codes do not depend on the special assessment (more details in Order of the Ministry of Finance No. 132n, 2021)

| Transaction type | Basic payment | Penalty | Fines |

| Additional pension contributions according to list 1, independent of the special assessment | 18210202131061010160 | 18210202131062110160 | 18210202131063010160 |

| Additional pension contributions according to list 2, depending on the special assessment | 18210202131061020160 | 18210202131062110160 | 18210202132063010160 |

- List 1 – specialties with difficult, dangerous and unhealthy working conditions.

- List 2 – specialties with difficult and dangerous working conditions, but to a lesser extent than in List 1.

Payment order

Since 2021, insurance transfers are made to the accounts of the Federal Tax Service, as follows from the KBK (code 182). Exceptions are provided only for contributions for the risk of injury at work, which, as before, are transferred to the social insurance fund (code 393).

Payment of insurance funds by organizations and individual entrepreneurs must be made before the 15th day of the month following the reporting month.

Transferring individual entrepreneur amounts “for yourself” can be done in two ways:

- One-time payment until December 31st.

- Advance transactions monthly, quarterly or once every six months - exact dates have not been established, the main thing is to pay the entire amount before the end of the calendar year.

If December 31st falls on a holiday, payment can be made on the next business day in January. Indicating an old code in a payment order is considered an error. The search for money is carried out by authorized inspectors in the accounts of the Federal Tax Service. The procedure takes a certain time, so until the funds are found, the payer will be in arrears. To avoid sanctions, you must submit a timely application to the territorial tax office at the place of registration.

Payment procedure

So, when the amount of the contribution to be paid to the budget has been calculated, the entrepreneur should decide how he will pay this amount: once or in parts.

There is a certain deadline for paying standard fixed fees. It is one year from the beginning of the reporting annual period. That is, regular fixed contributions must be paid before December 31, 2021.

In the event that the threshold income value is exceeded, the fixed contribution from this amount has a different, final date for payment, which falls at the end of the first quarter of the new reporting period. Simply put, you must pay a fixed amount before April 1, 2021.

As for payment documents, the decoding KBK39210202140061200160 remains the same and means fixed insurance contributions for pension insurance at an increased level of income. The KBK, which is current for 2021, will be: 18210202140061200160. As you can see, only the structure of the code has changed here. But it must be noted that this code should be used to pay fees for the period until December 31, 2021. Contributions for subsequent periods will be made using a different BCC.

So, information for those who were looking for the transcript of KBK39210202140061200160 for 2021. This code is losing its relevance due to changes in the structure of legislation, or rather the transfer of insurance premiums under the management and control of the Federal Tax Service. In order to pay a fixed contribution for an amount of income over 300 thousand rubles for the period after December 31, 2021, in payment orders it is worth indicating KBK 39210202140061210160, which is relevant for the new year 2021.

KBK for personal income tax

There are no changes to personal income tax codes in 2021. The choice of number depends on who carries out the transaction (withholding agent or taxpayer). Enterprises making contributions for employees, individual entrepreneurs paying tax for themselves or individuals. persons who have recorded profits from sold property use different BCCs.

| Transaction type | Basic payment | Penalty | Fines |

| From profits paid by the tax agent, including KBK dividends in 2021, personal income tax on which the tax agent transfers | 18210102010011000110 | 18210102010012100110 | 18210102010013000110 |

| From the profits of individual entrepreneurs, private notaries, and other persons conducting business activities | 18210102020011000110 | 18210102020012100110 | 18210102020013000110 |

| From profits received by citizens not from tax agents, as well as from the sale of property, winnings, etc. | 18210102030011000110 | 18210102030012100110 | 18210102030013000110 |

| Fixed advance payments from the profits of non-residents working under a patent | 18210102040011000110 | 18210102040012100110 | 18210102040013000110 |

| From the profit of a controlled foreign company received by inspectors | 18210102050011000110 | 18210102050012100110 | 18210102050013000110 |

Several years ago, a rule was introduced according to which the tax agent (employer) is obliged to calculate personal income tax on the next day after paying salaries to staff. The situation is similar with the transfer of dividends to shareholders. Taxes are paid no later than the next day after income is accrued (for more details, see Article 226 of the Tax Code of the Russian Federation).

A different period is provided for vacation and sick leave. The payer is obliged to transfer funds before the end of the month in which the compensation was paid. Code – 18210102010011000110 individuals can use to receive a property deduction under the 3-NDFL declaration.

Who pays fixed fees

Contributions in a fixed amount are required to be paid by all individual entrepreneurs, regardless of the taxation system for individual entrepreneurs, business activities and the availability of income. In particular, if an individual entrepreneur works somewhere under an employment contract, and insurance premiums are paid for him by the employer, this is not a basis for exemption from paying contributions calculated in a fixed amount.

Since 2013, you can avoid paying fixed contributions for the following periods:

- conscription service in the army;

- the period of care of one of the parents for each child until he reaches the age of one and a half years, but not more than three years in total;

- the period of care provided by an able-bodied person for a group I disabled person, a disabled child or a person who has reached the age of 80 years;

- the period of residence of spouses of military personnel serving under contract with their spouses in areas where they could not work due to lack of employment opportunities, but not more than five years in total;

- the period of residence abroad of spouses of employees sent to diplomatic missions and consular offices of the Russian Federation, permanent missions of the Russian Federation to international organizations, trade missions of the Russian Federation in foreign countries, representative offices of federal executive authorities, state bodies under federal executive authorities or as representatives these bodies abroad, as well as to representative offices of state institutions of the Russian Federation (state bodies and state institutions of the USSR) abroad and international organizations, the list of which is approved by the Government of the Russian Federation, but not more than five years in total.

However, if entrepreneurial activity was carried out during the above periods, then contributions will have to be paid (clause 7 of Article 430 of the Tax Code of the Russian Federation).