Home — Articles

- Conditions and restrictions on the application of the tax regime

- Features of accounting for agricultural producers' expenses

An agricultural producer has the right to apply any of the above taxation regimes (USNO and Unified Agricultural Tax). Both regimes are classified as preferential (which is important). To choose one of them, a business entity needs to evaluate the advantages and disadvantages of each, taking into account the specifics of its activity. In the material we bring to your attention, we analyzed and compared the characteristics of these tax regimes. This is what we got.

Checking eligibility criteria

The transition to the unified agricultural tax is possible for:

- firms and individual entrepreneurs;

- agricultural consumer cooperatives (the requirements for them are established by the law of December 8, 1995 No. 193-FZ on agricultural cooperation);

- peasant (farm) farms,

if they are agricultural products:

- produce;

- recycle;

- implement.

And at the same time, the share of income from the sale of agricultural products produced by them (including primary processing) in the total amount of income is at least 70%.

If the agricultural producer deals with fish (catch, grows or processes it), in addition to the above criteria, he needs to check the one-time fulfillment of special conditions.

So, the following can switch to Unified Agricultural Tax:

- fishing companies and individual entrepreneurs;

- domestic city- and settlement-forming fishery companies, if the number of family members working and living with them is at least half the population of such a settlement;

- fishing artels (collective farms) and agricultural cooperatives.

The specified categories of “fishermen, fish breeders and fish processors” can make the transition to the Unified Agricultural Tax if they:

- small (average number of employees no more than 300 people per year);

- use your own or chartered vessels of the fishing fleet for fishing;

- have a minimum acceptable share of income from the sale of catch and (or) fish products produced on their own (or other products from aquatic biological resources) in total income - 70%.

If all criteria are met, the transition to unified agricultural tax is possible.

Who has the right to switch to paying unified agricultural taxes?

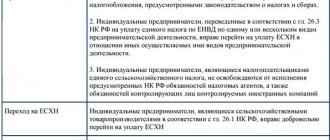

The Federal Tax Service in Letter dated March 11, 2020 No. AB-4-19/ [email protected] invites UTII payers to choose the optimal tax regime for use from 2021 instead of imputation:

- For individual entrepreneurs, you can choose from 4 options: simplified tax system, unified agricultural tax, PSN and NPD. Some modes are even allowed to be combined.

- There are fewer options for organizations: only the simplified tax system and the unified agricultural tax.

The Unified Agricultural Tax regime has the right to apply to agricultural producers, i.e. enterprises and individual entrepreneurs whose 70% of total revenue is income:

- from the sale of agricultural products of own production;

- from the provision of services to agricultural producers.

In order not to violate this restriction, Unified Agricultural Tax payers have to refuse to sell expensive fixed assets.

Clause 2.1 art. 346.26 of the Tax Code of the Russian Federation indicates the types of activities common to UTII and Unified Agricultural Tax:

| Retail | Provision of catering services |

|

|

In relation to these types of activities, the Tax Code of the Russian Federation requires choosing one of two taxation systems.

How could it happen that an agricultural producer ended up being imputed instead of the Unified Agricultural Tax? Possible reasons:

- UTII was cheaper than Unified Agricultural Tax;

- from January 1, 2021, Unified Agricultural Tax payers were required to pay VAT, and the timely transition to UTII freed them from such obligation;

- the agricultural producer was not sure that the revenue from the products he produced would be at least 70% of his income.

By the way, payers whose average number of employees does not exceed 300 people have the right to switch to the Unified Agricultural Tax, in contrast to imputation - no more than 100 people. Therefore, after the transition to the unified agricultural tax, it is possible to increase the number of employees.

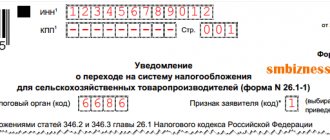

Notification to tax authorities

Persons who wish to switch to the Unified Agricultural Tax, in respect of whom all the above criteria are met, notify the tax authorities:

- companies - by location;

- Individual entrepreneur - at the place of residence.

The form of notification of the transition to the unified agricultural tax was approved by order of the Ministry of Finance of Russia dated January 28, 2013 No. ММВ-7-3/ [email protected]

The notification contains information:

- identifying the taxpayer (name, TIN, KPP);

- detailing the date of transition to the unified agricultural tax;

- clarifying the criteria (data on the share of income from the sale of agricultural products);

- certifying the specified data (signature of the responsible person and date of registration of the notification).

An important nuance is the maximum calendar limit, before the expiration of which a company or individual entrepreneur must submit a notification:

- no later than December 31 of the calendar year preceding the year of transition to the unified agricultural tax, if the merchant previously applied a different taxation regime;

- within 30 calendar days from the date of registration with the tax authority - for newly created companies and individual entrepreneurs.

How to use the Unified Agricultural Tax and what is the difference and commonality compared to other special modes is described in the ready-made solution ConsultantPlus. Sign up for a free trial access to K+ and you will find out what are the advantages of the unified agricultural tax and what are the negative aspects of the unified agricultural tax. This comparative analysis will help you make an informed decision when choosing a tax system.

Let's sum it up

- The transition to the Unified Agricultural Tax from 2021 is possible for a small number of retail and public catering operators, provided that the share of their income from the sale of agricultural products of their own production is at least 70% of total revenue.

- To apply the unified agricultural tax in 2021, you must notify the tax office before December 31, 2021.

- If you refuse to voluntarily choose a tax system from January 1, 2021, the UTII payer will find yourself in a general regime, characterized by a maximum tax burden.

Start of application of the unified agricultural tax

Manufacturers are starting to use unified agricultural tax:

- from January 1 of the year following the year in which they achieved compliance with all the necessary criteria for applying this special regime and notified the tax authorities;

- from the moment of the start of commercial activity, if the notification of the beginning of the Unified Agricultural Tax is submitted within the time limits established by the Tax Code of the Russian Federation (for beginning agricultural producers).

IMPORTANT! If an agricultural producer forgot to notify the tax authorities about the transition (start of application) to the unified agricultural tax or did not manage to do this within the time limits established by the Tax Code of the Russian Federation, he is not considered a taxpayer of the unified agricultural tax.

Such “forgetfulness” results in the need to apply the previous taxation regime, without having the right to apply for the Unified Agricultural Tax until next year.

How to draw up an accounting policy for the unified agricultural tax, read our article “Accounting policy for the unified agricultural tax - features of formation”

UTII and the unified agricultural tax do not get along together

On the impossibility of combining special taxation regimes: UTII and the unified agricultural tax

Letter of the Department of Tax and Customs Tariff Policy of the Ministry of Finance of the Russian Federation dated June 25, 2004 No. 03-05-13/11

Clause 1 Art. 346.1 Tax Code of the Russian Federation

It has been established that the taxation system for agricultural producers (unified agricultural tax) is established by the Tax Code of the Russian Federation and is applied along with the general taxation regime.

At the same time, based on the provisions of Chapter 26.1 of the Tax Code of the Russian Federation, it follows that organizations and individual entrepreneurs recognized as agricultural producers in accordance with clause 1 of Art. 346.2 Tax Code of the Russian Federation

and complying with the conditions established

by clauses 2 and 3

of this article of the Tax Code of the Russian Federation.

Clause 3 art. 346.2 Tax Code of the Russian Federation

Strict restrictions have been introduced

that do not allow the transition to the payment of a single agricultural tax, in particular, for organizations transferred to the taxation system in the form of a single tax on imputed income

for certain types of activities in accordance with Chapter 26.3 of the Tax Code of the Russian Federation (clause 2), as well as organizations with branches and (or) representative offices (clause 3).

In contrast to the taxation system in the form of a single tax on imputed income for certain types of activities established by Chapter 26.3 of the Tax Code of the Russian Federation, it is not the specific type of business activity carried out by the organization that is transferred to the payment of the unified agricultural tax, but the organization as a whole

.

Taking this into account, the provisions of Chapter 26.1 of the Tax Code of the Russian Federation do not provide for the possibility of simultaneous application

taxation systems for agricultural producers and other taxation regimes.

An organization contacted the Ministry of Finance of the Russian Federation with the following situation.

In January 2004, the LLC submitted an application to the tax authority for the transition from January 1, 2004 to the payment of the unified agricultural tax.

At the same time, in February 2004, the organization decided to open retail outlets for the sale of its own agricultural and related products in the territory of the constituent entity of the Russian Federation, where a single tax on imputed income for retail trade was introduced.

In this case, it is necessary to take into account that for the purposes of applying Chapter 26.3 of the Tax Code of the Russian Federation, retail trade means the sale of goods and the provision of services to customers in cash and using payment cards.

Thus, if an organization carries out retail sales of goods in cash and using payment cards, then this activity is subject to transfer to the payment of a single tax on imputed income.

Entrepreneurial activity in the field of retail trade is associated with the provision of services and work on the sale (resale without modification) of new and used goods purchased by the seller for further sale in order to carry out its activities or received in any other way not prohibited by the current legislation of the Russian Federation.

Goods sold through the retail chain also include products of our own production.

However, activity in the production of finished products is an independent type of business activity aimed at generating income from the sale of manufactured products both through retail and wholesale distribution networks.

At the same time, the sale of products of their own production through the retail network is one of the ways for business entities to extract income from activities in the production of finished products.

Considering that this type of activity does not fall under Chapter 26.3 of the Tax Code of the Russian Federation, income received by an organization from the sale of products of its own production through the distribution network facility it uses is subject to taxation in accordance with a different taxation regime

.

When using pp. 3 p. 3 art. 346.2 Tax Code of the Russian Federation

should be based on the provisions of

paragraph 1 of Art.

11 of the Tax Code of the Russian Federation and Art. 55 of the Civil Code of the Russian Federation , according to which a representative office is a separate division of a legal entity, located outside its location, which represents the interests of the legal entity and protects them.

The branch is

a separate division of a legal entity located outside its location and performing all or part of its functions, including the functions of a representative office.

Representative offices and branches are endowed with property by the legal entity that created them and act on the basis of the provisions approved by it.

Representative offices and branches must be indicated in the constituent documents of the legal entity that created them.

Thus, organizations that have separate divisions that are branches and representative offices do not have the right to switch to a taxation system for agricultural producers

and indicated as such in the constituent documents of the organizations that created them.

The organization has a separate division that meets the criteria defined in clause 2 of Art. 11 Tax Code of the Russian Federation

, but not specified in the constituent documents of the organization, is not a basis for denying the organization the right to apply the taxation system for agricultural producers.

Thus, if only its own products are sold through retail outlets opened by the LLC and these retail outlets do not have the characteristics of a branch (representative office) as defined in Art. 55 of the Civil Code of the Russian Federation

, then the organization is considered to have switched from January 1, 2004 to a taxation system for agricultural producers.

If through the above-mentioned retail outlets not only the sale of products of own production is carried out, but also the retail trade of purchased goods, then such activities of the organization are considered as activities subject to transfer to the payment of a single tax on imputed income.

In this case, the organization does not have the right to switch to a taxation system for agricultural producers, and therefore, in relation to other types of business activities carried out by the organization that are not subject to transfer to the payment of a single tax on imputed income, the general tax regime should be applied in 2004.

What are the advantages of switching to the Unified Agricultural Tax?

The transition to the Unified Agricultural Tax provides merchants with the opportunity to:

- reduce the tax burden by replacing with a single tax taxes on profits - for organizations (with some exceptions), personal income tax - for individual entrepreneurs (also with certain exceptions), on property (except for tax on cadastral value), as well as by obtaining exemption from VAT on more favorable conditions than under OSN;

We wrote about the size of the tax rate under the unified agricultural tax in the material “What is the tax rate of the unified agricultural tax?”

Details about the payment of property tax under the Unified Agricultural Tax are written in the ready-made solution ConsultantPlus. Sign up for a free trial access to K+ and get acquainted with the material

- write off the cost of fixed assets faster (compared to OSN);

- reduce costs for maintaining tax registers;

- report once a year and pay tax twice a year, etc.

At the same time, this taxation regime should not be idealized - the advantages of the unified agricultural tax must be assessed together with the disadvantages: a limited list of expenses compared to the special tax system, strict conditions for the transition to a special regime and further work on it, etc.

For the nuances of using unified agricultural tax, see the materials on our website:

- “What is the deadline for paying the Unified Agricultural Tax for the year and what to do in case of a loss?”;

- “KBK for payment of unified agricultural taxes in 2021 - 2021”.

Main responsibilities of the Unified Agricultural Tax payer

Here are some responsibilities when paying the unified agricultural tax and compare them with the simplified tax system and UTII:

| Mode | Unified agricultural tax | simplified tax system | UTII |

| Submitting a declaration | Once a year (at the end of the year) | 4 times a year (based on the results of each quarter) | |

| Payment of taxes and advances | 2 times per year | 4 times a year | |

| Additional reporting | Book of income and expenses - for individual entrepreneurs | Book of income and expenses | No |

The Ministry of Finance, by Order No. 169n dated December 11, 2006, introduces the form of a book of income and expenses for individual entrepreneurs paying the Unified Agricultural Tax. For organizations, maintaining such a register is not established, but the obligation to maintain accounting records is retained (clause 8 of Article 346.5 of the Tax Code of the Russian Federation).

Results

Any agricultural producer who has fulfilled all the conditions stipulated by the Tax Code and notified the tax authorities in a timely manner of their desire to apply this special regime can switch to the Unified Agricultural Tax.

When switching to the unified agricultural tax, an entrepreneur needs to evaluate all its advantages and disadvantages.

Sources:

- Tax Code of the Russian Federation

- Order of the Ministry of Finance of Russia dated January 28, 2013 No. ММВ-7-3/ [email protected]

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.