Author: Ivan Ivanov

Excise tax on tobacco products is an indirect tax that is included in the cost of goods. The full list of excisable products is specified in Article 193 of the Tax Code of the Russian Federation.

So, excisable tobacco products include tobacco:

- smoking;

- pipe (has the shape of a thin cigar);

- chewing;

- sucking;

- nasvay;

- snuff;

- for use in hookahs;

- for cigarettes with and without filter;

- cigarette

Tobacco, which is used as raw material for the direct manufacture of tobacco products, does not qualify as excisable products.

Smoke will become a luxury. How much and why will cigarette prices rise in 2021?

Let's look at cost calculation using an example. Let's assume that the Breeze tobacco factory sold about 4,000 cigars during the tax period. The rate that was in effect at the time of sale of goods in this category in 2021 is 233 rubles. for 1 piece

Let us determine the amount of excise tax to be paid:

233 * 4000 cigars = 932,000 rubles.

However, making calculations is not so simple when it comes to selling tobacco products at different rates. The cost can be determined taking into account the specific component, the ad valorem combined rate, as well as the total cost of the excise tax by adding all the indicators.

For example, a tobacco factory sold 5,000 cigarettes (250 packs) in 2021. The sales rate for these products at the time of sales was 1,718 rubles per 1,000 pieces + 14.5% calculated price.

Retail cost is 36 rubles.

Based on this information, we make the calculation:

- at a specific rate: 8590 rubles (1718 rubles * 5000 cigarettes);

- at an ad valorem rate: 9,000 rubles (36 rubles * 250 packs of cigarettes). Excise tax cost: 1305 rubles (9000 * 14.5% / 100%);

- total figure: 9895 rubles (8590 + 1305).

If you have the necessary information, calculating the cost of excise duty will not be difficult.

In 2021, you can sell tobacco products in an area that meets certain requirements, namely:

- Sale of cigarettes in a store. A store is considered to be a premises with a household and utility room, as well as the allocation of a separate space for the sale of tobacco products.

- Sale of tobacco products in the pavilion. A pavilion is considered to be a building in which there is a sales area and the opportunity to arrange workplaces.

Current legislation strictly prohibits the sale of tobacco products in other places, however, the possibility of sale by delivery is allowed.

In addition, the sale of tobacco products is strictly prohibited:

- at public stations (railway, air, car, etc.);

- at metro stations;

- in hotels.

^Back to top of page

When the applicant submits the Application and the above documents to the Department (Inspectorate), the official of the structural unit of the Department (Inspectorate) responsible for receiving documents registers the Application and documents in the manner prescribed by paragraph 35 of the Administrative Regulations. A copy of the Application with notes on its acceptance is transferred to the applicant immediately after registration of the Application. If the Application and documents are received by mail, a copy of the Application with notes on its acceptance is sent to the applicant by mail within one business day from the date of its registration. The submitted Application and documents are reviewed within three working days from the date of receipt by the Office (Inspectorate), after which the presence or absence of grounds for refusal to provide a public service is established.

When establishing the basis and in the absence of documents, the Department (Inspectorate) within one working day following the day of registration of the Application and documents, through the interdepartmental electronic interaction system, forms and sends an interdepartmental request for the applicant to pay a fee for the purchased special stamps.

^Back to top of page

Upon completion of the administrative procedure for consideration of the Application and documents, if, when considering the Application and documents, there are no grounds for refusal to provide public services specified in paragraph 28 of the Administrative Regulations, the Department (Inspectorate) within 4 (four) working days from the date of receipt by the Department ( Inspectorate) of the application and documents makes a decision on the issuance of special stamps and sends by mail or delivers to the applicant a written notice of the start of production of special stamps, signed by the head (deputy head) of the Department (Inspectorate). The notification about the start of production of special stamps must contain the name of the applicant, location, information about the date of sending the Application to the manufacturing organization.

If, during the consideration of the Application and documents, one of the grounds for refusal to provide a public service specified in paragraph 28 of the Administrative Regulations is identified, the Department (Inspectorate) issues a corresponding Certificate, the form of which is given in Appendix No. 6 to the Administrative Regulations. A certificate with attached documents submitted by the applicant is sent to the applicant by mail or delivered personally to the head of the applicant - legal entity (individual - individual entrepreneur) or his authorized representative against signature.

In case of return of the submitted documents, the amount paid by the applicant for special stamps, provided for in paragraph 32 of the Administrative Regulations, is returned by the Office (Inspectorate) to the applicant in full within 3 (three) banking days from the date of signing the Certificate.

General characteristics

If a company, for the purpose of producing an excisable tobacco product, purchased tobacco at cost without excise tax, but used it for other purposes (for example, resold it to another company), then it is obligated to reimburse the country’s budget in the amount of the cost of the excise tax.

This rule is provided for in paragraph 1 of Article 193 of the Tax Code of the Russian Federation. The production of cigarettes with or without a filter is carried out in accordance with the established standards of GOST 3935-2000 “Cigarettes. General specifications”, providing for the possibility of producing products of various brands.

According to the Decree of the Government of the Russian Federation No. 27 “On special brands for labeled tobacco products,” tobacco and its products that are manufactured on the territory of the Russian Federation (with the exception of export goods under signed contracts) are subject to mandatory labeling, which can confirm legal production on the territory of the Russian Federation.

Companies involved in the production of tobacco products are responsible for applying special markings. Payment for them is carried out based on the cost of purchasing raw materials. In addition, the Tax Code provides for the possibility of obtaining a refund of financial expenses.

All funds spent on the purchase of special stamps are transferred to the Gozznak association to cover production costs. Based on this, the mandatory payment made for special brands applies to all manufacturers of tobacco and related products and is not related to federal fees.

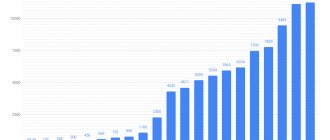

The excise tax rate on cigarettes in Russia increased by 20%

^Back to top of page

The period for consideration by the Office (Inspectorate) of an application for the issuance of special stamps (hereinafter referred to as the Application) and documents in accordance with the list provided for in paragraph 22 of the Administrative Regulations (hereinafter referred to as the documents) is no more than 3 (three) working days from the date of their submission to the Office (Inspectorate) .

The deadline for the Department (Inspectorate) to send the Application to the manufacturing organization is no more than 4 (four) working days from the date of its submission to the Department (Inspection). The production period for special stamps by the manufacturing organization is no more than 18 (eighteen) days from the date the applicant submits the Application and documents to the Department (Inspectorate).

The period for issuing special stamps to the applicant is no more than 25 (twenty-five) working days from the date the applicant submits the Application and documents to the Office, Inspectorate.

^Back to top of page

Manufacturers of tobacco products submit to the territorial tax authority that issued the special stamps (to the Department of the Federal Tax Service of Russia for the constituent entity of the Russian Federation (Department) or the interregional inspectorate of the Federal Tax Service of Russia for the largest taxpayers (Inspectorate)), monthly, no later than the 25th day, a report on the use of special stamps, the form of which is approved by the Ministry of Finance of the Russian Federation.

^Back to top of page

Manufacturers of tobacco products store special stamps in premises that are located in buildings at the location of manufacturers of tobacco products , are used for storing stamps and for carrying out operations related to the receipt and issuance of stamps, are isolated from other service and utility rooms by solid walls, and have durable floor coverings and ceiling (concrete), are closed on external and internal doors and comply with fire safety rules, including being equipped with a fire alarm and primary fire extinguishing equipment.

^Back to top of page

Special stamps received but not used by the manufacturer of tobacco products , as well as special stamps damaged during transportation from the territorial tax authority to the manufacturer of tobacco products, storage at the manufacturer of tobacco products or when applied to tobacco products, are subject to destruction by the manufacturer of tobacco products in the presence of an official persons of the territorial tax authority .

The destruction of special brands by the manufacturer of tobacco products is carried out on the basis of an act on the destruction of special brands. Attached to the act are sheets of paper to be destroyed with special stamps pasted on them in the following order:

- special stamps are pasted without folds or irregularities;

- special stamps are pasted so that the central part of the stamp is clearly visible;

- When a special brand breaks, its individual parts must be connected.

The act of destruction of special stamps is drawn up in 2 copies and signed by an official of the territorial tax authority and the financially responsible person of the tobacco product manufacturer.

The first copy of the act remains with the tobacco product manufacturer, the second is handed over to an official of the territorial tax authority.

There are several good reasons for this:

- According to the laws of marketing, small products are located at the cash register. These include chewing gum, candy, pills and cigarettes.

- Since advertising of tobacco products is prohibited, they must be located in a closed module, which is hung at the cash register.

- For control, the easiest way is to present documents confirming your age at the cash register.

- Reduce the risk of theft. Small goods are easy to steal, especially if they are located in the center or beginning of the back. If it is located at the cash register, the security guard and cashier will be able to detect the loss in a timely manner.

The excise tax on cigarettes will begin to increase in 2021

Photo 19101

Photo 17161

Photo Video 16584

- Tax

- Accounting

- Balance sheet

- Current assets

- Entity

- Accounting statements (financial statements)

- Civil contract (CLA)

- What imports have the excise tax been abolished and how will this affect prices?

- How prices for imported passenger cars will change from August 1

- All imported nicotine-containing products will become excisable

- What will excise taxes be raised on October 1?

- Imported refrigeration equipment was exempted from excise duty

- Excise taxes on compressed gas, alcohol and tobacco will be raised

How to calculate

To calculate the cost of excise duty on cigarettes, you must use the formula provided for in Article 194 of the Tax Code of the Russian Federation:

Ca = Ats + Apns, where

Sa is the cost of excise tax, Ats is excise tax, which is determined at a fixed rate, Apns is excise tax, which is determined at the ad valorem tax rate (percent).

In turn, the ATS is calculated by multiplying the volume of cigarettes sold (Ops) by a fixed tax rate (FSN):

ATS = Ops * Fsn

Apns implies an ad valorem rate (Ac) of the share of the maximum retail cost of cigarettes (Spc), multiplied by the volume of tobacco products (Vtp):

Apns = Sps * Otp * Ac

In the process of determining the cost of excise duty, you must be more than careful, which will allow you to avoid problems with the tax and other regulatory authorities in the event of errors.

The State Duma adopted a law on new excise tax rates on excisable goods until 2023

A special barcode is applied to the product (fur, medicine, alcohol), where the item of trade is assigned its own identification number. This is necessary to track its movement from the beginning of production to the final point of consumption. This is done to ensure that the population does not use low-quality goods that are either counterfeited or illegally imported from other republics. Counterfeit manufacturers are not officially registered anywhere and do not buy licenses. Therefore, inspection bodies are not able to control the production process and determine the quality of raw materials.

A successful experiment in the circulation of alcohol-containing products prompted the Duma to amend the law and write down new rules for the sale and mandatory labeling of cigarettes in 2021. This is done so that the state can control the production process, the movement of each pack from the wholesaler to the store, and then to the consumer. Ultimately, the government is interested in ensuring that the product arrives of appropriate quality and original content. Counterfeits without a barcode will not reach store shelves.

From 2021, labeling was optional. At this time, an experiment was carried out, during which a deadline was given for restructuring the business, where it was possible to understand the technological process without haste, and prepare staff to work under the new rules. The mechanisms by which the task was determined whether it was necessary to chip cigarettes with excise stamps or introduce new formats were also assessed. Businessmen asked an important question: how much investment will have to be made into the project?

This year showed that no additional capital investments were needed and the regulations did not harm companies. Therefore, from March 1, all manufacturers and sellers were required to connect to the system and register with the tax office. Labeling will become a prerequisite. Remaining undesignated products can be sold until July 1, 1919. From now on, implementation will be punishable by penalties.

Since March, the government has issued and approved three fundamental standards, according to which manufacturers were required to install equipment, and retail chains were required to provide information about the movement of each pack to the MOTP IS:

- federal for No. 272 and No. 487;

- order number 792.

The introduction of a chipping structure will ensure the whitewashing of commercial activities, spur competition and significantly reduce the level of smuggled products on the territory of the Russian Federation. Experience has shown that after this procedure and the transition to online cash registers, the turnover of fur goods and 30% of alcohol-containing goods increased by 50 percent.

For private entrepreneurs, code reading equipment helps in large supermarkets to reduce the number of employees and optimize working hours.

For small stores selling food, vodka and tobacco, it is not very profitable to have three systems:

- EGAIS for the sale of alcohol-containing goods.

- FSIS "Mercury" for food with animal-containing composition.

- IC MOTP for cigarettes.

They don't contact each other. You have to purchase different equipment and install three programs. In addition, you need to acquire an online cash register to transmit information to the FMS (tax office) about all purchase and sale transactions. To combine all regulations into one platform, the legislative authorities decided to introduce a single labeling mechanism for all types from 2024.

Excise taxes on cigarettes and tobacco products 2019-2020

Since the beginning of the year, all participants in the production and sales process have been able to take part in debugging technologies that ensure circulation with individual ciphers.

Factories installed new equipment, retail chains purchased scanners and devices for transmitting information. Since the fall, importers have been involved in this process.

In order to be ready for total chipping, you must:

- Have a 2D scanner capable of reading the DataMatrix.

- Make sure that your cash register allows updating to meet the new requirement.

- Check the readiness of your accounting system to work with EDI.

From March 1 to July 1, equipment should be installed, software configured, and personnel trained in new operations. From July 1, all retail outlets must connect to the IS. By this time, all unmarked products are sold. Their production stops completely.

From 2021, identification marks will be applied not only to the pack, but also to the entire range of cigarettes. Accounting should abandon paper media and switch to working with UPD with the help of electronic document management operators. From July 1, 2021, tobacco cannot be sold without a radio frequency tag.

To calculate the excise tax on cigarettes (Ac), you must apply the following formula (Article 194 of the Tax Code of the Russian Federation):

Ac = ATNS + AANS,

Where:

ATNS - excise tax calculated at a fixed rate;

AANS is an excise tax calculated at an ad valorem (percentage) tax rate.

ATTS is determined by multiplying the volume of cigarettes sold (Ors) with a fixed tax rate (TNS):

ATHC = Ors × THC.

AANS is the proportion of the maximum retail price of cigarettes (MRP) corresponding to the ad valorem rate (ANS) multiplied by the number of tobacco products (Kp):

AANS = MCr × Kp × ANS.

Who installs the MCR and whether it can be changed - find out from the diagram below.

Tabak LLC sold 50,000,000 filter cigarettes in January 2021. (the number of packs of cigarettes is 2.5 million, 20 cigarettes each).

To calculate the excise tax for the specified period, the following initial data were used:

- maximum retail price of 1 pack of cigarettes (MCR) - 74 rubles;

- tax rate - 1,562 rubles. for 1,000 pcs. + 14.5% of the estimated cost determined from the MCR (but not less than 2,123 rubles per 1,000 pieces).

The calculations are shown in the table:

Index

| Formula (calculation) | |

| Excise tax amount at a fixed tax rate (ATNS) | ATNS = Ors × TNS RUB 1,562 × 50,000,000 pcs./1,000 pcs. = 78,100,000 rub. |

| Excise tax amount at ad valorem tax rate (AANS) | AANS = MCR × Kp × ANS 74 rub. × 2,500,000 pack. × 14.5% = 26,825,000 rub. |

| Excise tax amount (Ac) | Ac = ATNS + AANS RUB 78,100,000 + 26,825,000 rub. = 104,925,000 rub. |

| Calculation of the amount of excise tax at the minimum rate | RUB 2,123/1,000 pcs. × 50,000,000 = 106,150,000 rub. |

| Comparison of Ac with the amount of excise tax calculated at the minimum rate | RUB 106,150,000 > RUB 104,925,000 |

| Amount of excise duty payable (highest of the compared values) | RUB 106,150,000 |

In early February, the Public Chamber proposed setting a minimum price for cigarettes similar to a bottle of vodka, fixing it at 62–65 rubles. According to estimates by the World Health Organization, the excise tax should be about 70 percent of the structure of the retail price of tobacco products; in 2015 in the Russian Federation this share was only 38%. No other highly developed country in the world has such low excise taxes on tobacco. According to WHO estimates, increasing the tax rate to achieve a 10% increase in tobacco prices leads to a reduction in tobacco consumption by 4-6 percent. WHO has calculated that, on average, every eight seconds around the world, one person dies from diseases associated with smoking tobacco, and five million people die from this cause every year.

Terms and rates

Excise tax rates on tobacco products are increased annually by the Government of the Russian Federation and are fixed by the Tax Code. In 2021 the rate is:

- cigars – 233 rub. for 1 piece;

- tobacco or tobacco products intended for smoking by heating - 6040 rubles per 1 kg;

- cigarillos – 3055 per 1000 pcs.;

- electronic nicotine systems – 20 rubles per 1 piece;

- liquid for electronic systems – 13 rubles. for 1 ml.;

- cigarettes and cigarettes - 1966 rubles per 1000 pieces and an additional 14.5% of the calculated price, based on the maximum retail cost, but not less than 2671 rubles per 1000 pieces;

- other types of tobacco and tobacco products (chewing, tubular, etc.) – 3172 rubles per 1 kg.

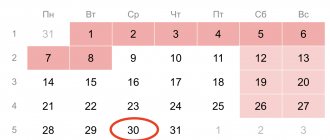

Excise tax must be paid to the government authority during the following periods:

- the goods were sold before the 15th day of the month - no later than the 30th day of the month following the reporting month;

- the goods are sold after the 15th day of the current month - no later than the 15th day of the second month following the end of the reporting month.