If not an exact definition, then an understanding of what a balance most of us have. An Italian word that carries the meaning of the words “difference”, “remainder”. The firmly established association with accounting allows us to consider the concept in its context as the difference between the amounts recorded as debits and credits. Final balance, initial balance - first of all, they are what we are talking about when the balance is mentioned. Now we will dwell in more detail on the final one.

Closing balance - what is it?

The ending balance is the residual value at the end of a certain period of time. Despite clarifications of the format “can the final balance be negative?”, it is known from the general accounting course that the balance cannot be negative. The meaning of debt may be implied. But in no case is it written as a negative value - only positive. Even in the case of an exotic score of 60 – active-passive. Its final balance can be debit and credit, which, however, in each case is written as a positive number.

How to find the ending balance?

There is a specificity in finding it based on the indicator of account passivity or activity. Therefore, we will consider two options.

Active accounts reflect changes in households. funds have a debit balance (beginning and ending). Their debit turnover is usually a display of incoming amounts, credit - outgoing amounts.

The formula for calculating the final balance looks like this.

End = First + Deb. Obor. - Cred. Obor.

Within the framework of this chapter, to simplify calculations, it is assumed that the company pays taxes (VAT and NPR) at the end of the reporting period. The change in the cash balance generally does not coincide with the net profit of the enterprise.

1. ODS out = ODS in + Revenue with VAT – Mat expenses with VAT – FZP with reporting. – VAT to the budget – NPR – OSF

2. ODS out = ODS in + PE + Depreciation – OSF

3. ODS out = ODS in + Revenue excluding VAT - Input costs excluding VAT - FZP with reporting. – NPR – OSF

ODS in and ODS out – incoming and outgoing cash balances, respectively;

Depreciation – depreciation expenses for the reporting period;

OSF is the cost of fixed assets acquired in the reporting period.

In order to always accurately calculate the cash balance, you need to have a good understanding of the financial flows of the enterprise and distinguish between its monetary and non-monetary income and expenses. Thus, in the second calculation method, the amount of net profit increases by the amount of depreciation accrued for the period, since depreciation is not a cash expense of the enterprise and does not involve the transfer of funds to anyone. When net profit is calculated, we subtract all the company’s expenses from revenue (cash income) in order to correctly calculate net profit and NPR. However, some of these expenses do not lead to an outflow of cash, and we must take this into account when determining the cash balance.

A more complete picture of the financial flows of an enterprise is given by studying Form No. 4 “Cash Flow Statement”, which is used in the official Russian reporting of enterprises [6]. In this report, the sources and directions of use of funds are broken down by three types of activity of the enterprise:

During the normal functioning of an enterprise, the following patterns take place:

— current production activities generate the bulk of cash at the disposal of the enterprise (revenue minus expenses);

- investment activity - involves the acquisition of fixed assets and long-term financial investments - therefore, it leads to a decrease in the enterprise’s funds;

- financial activity - search for additional financial resources, settlements on borrowed funds, placement of excess funds - both generates funds (issuing shares, obtaining loans) and leads to the consumption of funds (repayment of loans and interest, payment of dividends).

Analysis of the financial flows of an enterprise for the reporting period can be carried out by studying the influence of individual operations of the enterprise on changes in the amount of its cash in the context of the three above-mentioned types of activities (Table 13).

The influence of individual operations of the enterprise on changes in the cash balance

| Operations by type of activity of the enterprise | The influence of indicators on the amount of funds of the enterprise | |

| Cash inflow | Cash outflow | |

| A. Current activities | ||

| - financial results | net profit | lesion |

| – depreciation | accrual | – |

| - accounts payable | increase | decrease |

| - accounts receivable | decrease | increase |

| – reserves | decrease | increase |

| B. Investment activities | ||

| – fixed assets, intangible assets, long-term financial investments | sale or disposal | acquisition |

| – interest and dividends on funds invested by the enterprise | receiving | – |

| B. Financial activities | ||

| - equity | issue of shares or interests | repurchase of shares or interests |

| – interest and dividends on attracted funds | – | pay |

| – long-term loans and borrowings | receiving | extinction |

| – short-term loans and borrowings | receiving | extinction |

| – short-term financial investments | implementation (sale) | acquisition |

| D. Total net cash flow | A+B+C | |

| D. Cash at the beginning of the period | remainder | — |

| E. Cash at the beginning of the period | remainder = D+G | — |

We study accounting

Accounting is an obligatory part of accounting and control over the activities of an organization. The basic rules of accounting are timeliness, completeness and reliability of the information provided. The main principle of constructing this type of accounting is the principle of double entry, the meaning of which is that if something has gone somewhere, then something has arrived somewhere and vice versa. (example: an organization bought equipment for sowing: there was less money, but at the same time there was more available equipment. Or, for example, an organization took out a loan: there was more money, but there were also more debts.)

Enterprise funds and sources of their formation.

Before studying this topic, it is recommended that you familiarize yourself with the lecture materials on the topic and the classification given in them. An enterprise of any form of ownership is usually engaged in three types of activities: production of goods, provision of services, work. In order for the production process to be continuous and efficient, the company first needs what the final product will be made from. This type of means will be called an object of labor. What the enterprise will use to influence the object of labor to give it the appearance, form and properties of the final product will be called a means of labor. (for example, in the manufacture of desks, the subject of labor will be boards, iron structures, and the means of labor will be equipment for processing boards, equipment for fastening, etc.) Means of labor, objects of labor, and even the money available to the enterprise, regardless of the source of their appearance, are usually classified as to enterprise funds. We have already noticed that in order for an enterprise to have objects of labor, means of labor, money, we must first find the sources of their formation. This can be bank loans, loans, and profit remaining at the disposal of the enterprise. And even taxes not paid on time can be sources of funds in a particular situation. Think about what can be classified as objects of labor, means of labor or sources of their formation: Trademark Advertising poster Workshop building Hammer Contributions of founders Authorized capital Based on the above, in accounting it is customary to classify the funds of an enterprise as ASSETS, and the sources of formation of funds as LIABILITIES of the enterprise. Simply put, what is involved in the production process is the enterprise’s funds or Asset, and the sources of formation of our funds are Passive.

Accounts. Chart of accounts

One of the tasks of accounting is to record all the activities of enterprises. Now imagine this situation: to keep records, an accountant needs to make notes, or remember the following amount of information: Sidorov took money from the cash register to buy office supplies, Petrov went on a business trip with the accountable amount, the shop manager delivered the finished products to the warehouse, and Ivanov sold them today half and tomorrow one third, the caretaker also took from the cash register for household needs and... In general, it turns out that there can be no talk of any accuracy or reliability in these writings. Therefore, in accounting, the following system was invented: all funds of the enterprise and the sources of their formation were assigned numbers. For example, cash desk-50 account, fixed assets-01 account, bank loans-96, accountable amounts-71, etc. Such numbers were called abacus. And so that it is immediately clear whether we are talking about a means or a source, a note is made on the account - active account or passive. All these accounts are available in the chart of accounts, which consists of nine sections, according to the types and places of formation of funds and sources. There are 99 accounts in total (there are also off-balance sheet accounts in the last section of the chart of accounts, but we won’t talk about that for now)

Double entry. Correspondence of accounts.

It has already been said that the main principle of accounting is the principle of double entry, that is, if something has gone somewhere, then something has arrived somewhere and vice versa. And in fact, if we have more finished products (41 counts), then there are fewer raw materials (10 counts); if there is more money in the cash register or in the current account (50 or 51 accounts), it means that something was sold (41, 01 accounts, etc.) To simplify accounting for the availability of funds and their sources, accounting entries are used (or, in another way, correspondence of accounts is done). But, before we get to the accounting entries, let's take a closer look at the accounts themselves and their classification (since accounts are direct participants in accounting entries). It was noticed that our accounts are active (enterprise funds), passive (sources of their formation) and more! active-passive. Naturally, both the funds of the enterprise and the sources of education can increase and decrease at different periods of time. Such changes in accounts are reflected using Debit and Credit. Let's look at how this happens using the example of a 50-cash account. The account is active. Let's assume that at the beginning of the day there were 1000 rubles in the cash register. During the day, Ivanov was given 500 rubles in advance, and Sidorov was given 300 in advance. Trade proceeds in the amount of 400 rubles were handed over to the cash register. At the end of the day, there was a total of 600 rubles left in the cash register. All these operations are recorded in this form (Table 1):

| 50A | ||

| Debit | Credit | |

| Beginning balance | 1000 | |

| +400 | -500 | |

| -300 | ||

| Balance | 600 | |

Such a record is simply called an “airplane”, due to its similarity in shape to an airplane. It is noticeable that we showed the balance at the beginning of the day, the balance at the end of the day and the receipt according to Dt, and the expense from the cash desk according to the Kt account. The balance at the beginning and at the end of the period is called the balance, and the expense and income during the period are called turnover according to CT or DT. The balance at the end of the day is calculated using the formula: End balance = DT balance + DT turnover - CT turnover In the active account, the balance can only be Dt. Why? Yes, because there is either money in the cash register, then the balance will be positive, or there is none, then the balance will be zero. But the balance can never be Kt, because we cannot give out more money from the cash register than is there, we are not magicians. The situation is different with passive accounts. Passive accounts can otherwise be called enterprise debts. Because no matter how generous the source of our funds is, sooner or later we must repay our debts. Let's start with an example. At the beginning of the month, the company had a debt to suppliers in the amount of 40,000, during the month the supplier delivered raw materials in the amount of 12,000, the company partially settled with the supplier in the amount of 20,000 rubles. Settlements with suppliers are carried out using account 60, passive (Table 2).

| 60P | ||

| Debit | Credit | |

| Beginning balance | 40000 | |

| -20000 | ||

| +12000 | ||

| Balance | 32000 | |

As we noticed, the initial and final balances in the passive account Kt. Because according to the CT passive account there is an increase in our debts (or, in other words, an increase in our sources, and, as a consequence, an increase in our funds.), and according to the DT, accordingly, a decrease in our debts, a decrease in our sources, a decrease in our funds (calculating with debts, the enterprise naturally loses some share of funds) Formula for the final balance in a passive account: Final balance Kt = beginning balance Kt. + Kt turnover-Dt turnover Why can the balance in a passive account only be a credit balance? Because a passive account implies that we either must - the balance is positive Kt, or we should not - the balance is zero. But it cannot be that they owe us. (And in fact, imagine - the bank owes us for the loan issued - there are no fairy tales in accounting). Situations where debt can arise both for the enterprise and for the enterprise are reflected in active-passive accounts. Example: Ivanov went on a business trip to sell goods. I received 2000 rubles for travel expenses. (travel, entertainment expenses, food, accommodation). In fact, Ivanov presented supporting documents in the amount of 1900 rubles. (tickets, accommodation receipts, checks). At the beginning of the period, the company had a debt to Ivanov for an earlier business trip in the amount of additional expenses incurred from personal funds, documented in the amount of 1,500 rubles. Settlements with accountable persons are carried out on account 71A-P (Table 3)

| 71A-P | ||

| Debit | Credit | |

| Beginning balance | 1500 | |

| -2000 | ||

| +1900 | ||

| Balance | 1400 | |

If we assume that at the beginning of the period the enterprise had a debt to Ivanov in the amount of 50 rubles, then (Table 4):

| 71A-P | ||

| Debit | Credit | |

| Beginning balance | 50 | |

| -2000 | ||

| +1900 | ||

| Balance | -50 | |

That is, we see that in one case the enterprise owes Ivanov 1400 rubles, in another case Ivanov owes the enterprise 50 rubles. Make up airplanes: At the beginning of the period, the enterprise had fixed assets worth 1,580,000; during the period, the vehicle fleet was supplemented with a combine worth 250,000, and a plow worth 5,600 rubles was sold. Now let's get back to the accounting entries. So how are they compiled? In airplanes, we showed changes only within the account, without indicating where everything goes and where it comes from. Postings record such changes. For example: Cashier Ivanov withdrew money in the amount of 15,000 from the current account (account 51) and put it in the cash register (account 50). Let's assume that at the beginning of the period there were 2,000 rubles in the cash register and 56,000 rubles in the current account. First, let's make airplanes (Table 5):

| 50A | 51A | ||

| Debit | Credit | Debit | Credit |

| 2000 | 56000 | ||

| 15000 | 15000 | ||

| 17000 | 41000 | ||

As we see, 15,000 rubles passes through the DT account 50 and the credit account 51 (That is, there is less money in the current account, and more in the cash register) Now we make the posting (Table 6):

| Debit | Credit | Sum |

| 50 | 51 | 15000 |

Make an entry: The company paid a debt to the supplier in the amount of 45,000 rubles from the current account, the debt to the supplier at the beginning of the period was 150,000, the money in the current account was 200,000 rubles.

Balance

Recommendation: before starting to study this topic, have a balance sheet as a visual aid. One of the main accounting methods is the balance sheet. From Latin the word “Balance” is translated as “Libra”. The balance sheet is the most important, final report of an enterprise. A competent specialist, having studied the balance sheet, can tell about the financial condition of the enterprise as of the date of drawing up the balance sheet. The balance sheet consists of two parts - Asset and Liability. The assets of the balance sheet keep records of the enterprise's funds, and the liabilities account for the sources of their formation. All funds of the enterprise and the sources of their formation are grouped into articles, the articles are combined into sections. The balance consists of two settlement columns - at the beginning of the year and at the end of the year. Recommendation: when drawing up a balance sheet, create an intermediate column reflecting the changes. The most important rule when calculating balance sheet totals: Currency (total) of an asset = Currency (total) of a liability Hence the name of the balance sheet: - scales During the year, the company carries out some activity, which affects the balance sheet currency at the end of the year.

There are 4 types of balance changes:

1. Two articles are changed: one in the asset, the other in the liability in the direction of increase (Example: they took a loan - more money (Asset increases), more debts (liability increases) 2. Two articles change: one in the asset, the other in liability in the direction decrease (Example: the company repaid the loan - less money (asset decreases), less debts (liability decreases) 3. Two items in the asset change - one item decreases, the other increases (example: money from the current account was deposited into the cash register: less money in the current account, more in the cash register, both items are in assets) 4. Two items in liabilities change, one downward, the other upward (example: retained earnings are aimed at increasing the authorized capital) Such changes can be depicted schematically as follows (Table 7):

| Assets | Passive |

| 1 | |

| 2 | |

| 3 | |

| 4 |

Draw up a balance sheet yourself: at the beginning of the year, the company had: a vehicle fleet worth 250,000, buildings and structures - 450,000, inventories - 40,000, finished products - 89,000, the company's authorized capital was 500,000, wage arrears - 329,000. During the year, a car was sold in the amount of 45,000, products were sold in the amount of 20,000, and debt to employees in the amount of 60,000 was partially repaid.

Text: Valentina Andreev Topics of material: accounting, coursework in accounting, theses Read other articles and materials

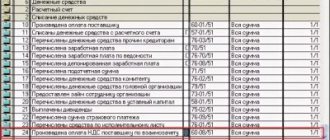

1) Let's consider an example of the procedure for calculating Balance and turnover on an active account.

To do this, we will draw up a journal of business transactions showing the movement in account 51 “Current account”

The data from Figure 1 (the transaction log) is entered into the account diagram (Scheme 1). We look at account 51 by debit or credit, for example, by operation 1 on debit, which means we take the figure 15,300 rubles. We debit account 51 (Scheme 1). The remaining numbers are also “scattered” by debit or credit

The areas highlighted in green are called Balance at the beginning and balance at the end, or simply in accounting language Balance at the beginning and balance at the end. (For example, if you took a month period, then there will be balances at the beginning and at the end of the month)

Those highlighted in yellow are called turnover; debit turnover is, in active accounts, the entire income for a certain period in total terms. And the loan turnover shows the total expenses for a certain period.

a) When calculating the End Balance (Remaining), the first thing you need to do is calculate the turnover. In our example, the debit turnover (total) will be 273,100 rubles. (15,300 rubles +257,800 rubles)., shows that the receipt to the current account was in the amount of 273,100 rubles. The turnover on the loan will be 63,000 rubles (35,000 rubles +25,300 rubles), the turnover on the loan 60,300 rubles shows that during the reporting period there were expenses in the amount of 60,300 rubles - money was written off from the current account.

b) The second step is to calculate the balance at the end of the period, using the formula End Balance (Snp) = Beginning Balance (remaining) + Income (Debit Turnover) - Expense (Loan Turnover).

In our example, 25,000 rubles. +273100 rub. -60300 rub. =237,800 rubles This amount shows how much money we have left in our current account (if this is an account of 10, then the cost of materials at the end of the period).

This procedure for calculating the closing balance is suitable for the following active accounts: 01,04,08,10,20,41,43,44,45,50,51,55,52,58.

The concept of net indicators

The cleared turnover of the current account is:

An indicator of the organization's performance, as well as an index of financial well-being.

A concept used in accounting slang. That is, it is not used in legislation and does not appear in contracts.

If you don’t delve too deeply into financial and accounting terminology, you can take it as a rule that current account turnover represents an index of activity, and net turnover is an index of the organization’s success. That is why the second category is used quite often:

- auditors when analyzing the organization’s activities;

- tax authorities in order to exercise control over the timely payment of taxes;

- representatives of banks in order to establish the solvency of a potential loan recipient.

2). Let's consider an example of the procedure for calculating Balance and turnover on passive accounts.

Basically, passive accounts are divided into capital and settlement accounts. Let's consider the calculations of account 60 “Settlements with suppliers and contractors”, this account is active-passive but mostly passive. (Account credit balance). Let's compose

Journal of business transactions for account No. 60.

Let’s “scatter” the debit and credit amounts from Figure 2 into diagram 2 (account diagram).

To begin with, let’s calculate the debit and credit turnover for the reporting period. The turnover on debit 60 of the account for the period amounted to 28,300 rubles (12,300 rubles + 16,000 rubles), in this case shows the repayment of accounts payable, how much was repaid (since before entering the entry debit 60 credit 51 there was a debt on the loan Balance ). The loan turnover amounted to 51,000 rubles (25,000 rubles +26,000 rubles), showing an increase in accounts payable by 51,000 rubles over a certain period.

The ending balance (Balance) is calculated using the formula Closing balance on a passive account = Beginning credit balance + loan turnover (increase in debt) - debit turnover (debt repayment). In our example, 77,700 rubles (55,000 rubles + 51,000 rubles - 28,300 rubles). This figure shows that we owe 77,700 rubles to suppliers, since the balance is on the loan, i.e. accounts payable.

This formula, the calculation procedure, is only suitable for purely passive accounts (accounts for settlements), sub-accounts. such as 60,66,70(mostly),68,69(mostly).

Management

It is necessary to determine the period for which the calculation will be carried out (for example, for a month, half a year). Most often, calculations are made per year.

You will need to collect data on all sales made during the selected period. To do this, the cost of goods sold (P) is summed up.

It is necessary to calculate costs (C), taking into account costs, liabilities and expenses for all goods sold during the selected period.

The value obtained as a result of calculating sales (P) must be divided by the amount of costs (C).

The obtained result allows you to analyze the success of business activities. The larger it is, the more efficiently assets are used and the higher the profitability of production. Increasing turnover will increase profits.

To assess how effectively working capital is used, their turnover is calculated. To do this, determine the time required for a complete turnover of funds from the acquisition of materials (cash stage) to the sale of products (commodity stage). By comparing planned and actual turnover, a conclusion is drawn about its slowdown or acceleration.

4) Calculation of the expanded balance.

The expanded balance is called a balance where there are 2 balances for debit and credit. Let’s take account 76 “settlements with other debtors and creditors”; this account is actively passive; it reflects information about our and our debts. That is, it turns out that at the same time someone owes us and at the same time we owe it. To calculate such expanded balances, you need to open analytical accounts for the synthetic account, i.e., calculate the schemes of accounts for Debtors and Creditors in each balance and turnover, then add one account. Let's look at the example of 71 accounts (Settlements with reporting entities).

The synthetic (general) account consists of analytical accounts, for example Ivanov and Kirin:

As we see in diagram No. 5, Ivanov owes us 150,000 rubles (accounts receivable). And in diagram No. 6 Kirin, we owe 20,000 rubles (accounts payable) These are analytical accounts, they need to be combined to make a synthetic account, for this all the numbers from both schemes are in one table:

From Diagram 7 it is clear that according to the debit balance of 150,000 rubles, this indicates that we are owed (accounts receivable), and at the same time we owe 2,000 rubles. Such balances are called expanded. The balance of the settlement account is reflected in detail. (In 1c you can make the filter expanded or not)