How to use the calculator

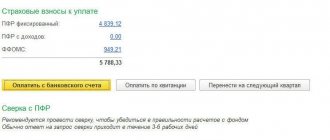

Select the period for which you want to calculate contributions. This can be a full year or part of it; the calculator will automatically recalculate the amount of fixed contributions in accordance with the term.

If you worked as an individual entrepreneur for less than a full year, indicate the start and end date of your activity:

- start of activity - date of registration in the Unified State Register of Individual Entrepreneurs;

- end of activity - date of exclusion from the Unified State Register of Individual Entrepreneurs.

In the “Income” field, enter the amount of income for the year. For amounts exceeding 300,000, 1% must be transferred to the Pension Fund. We will discuss how to determine income below.

After entering the data, the calculator will automatically calculate the amount of contributions to be paid and display it at the bottom.

Registration of ERSV for 2021

The report consists of 3 sections and 24 sheets, which display information about all insurance premiums, except for “accidental” ones. But you only need to fill out those that are mandatory and for which you have indicators.

Let's consider who should fill out which sheets when preparing reports for the 4th quarter of 2021.

| Sheet | Is it necessary to fill out | Who fills it out |

| Title | Yes | All policyholders |

| Sheet “Information about an individual who is not an individual entrepreneur” | No | Only individuals who are not registered as entrepreneurs |

| Section 1 | Yes | All |

| Annex 1 | Yes | Subsections 1.1 and 1.2 - filled out by all policyholders, Subsections 1.3, 1.3.1., 1.3.2, 1.4 are completed only if there are payments of contributions for additional tariffs |

| Appendix 2 | Yes | All employers indicate information about insurance premiums in case of temporary disability and maternity |

| Annexes 3 and 4 | No | Fill out only those employers who paid sick leave benefits in the reporting period |

| Appendix 5 | No | Filled out by IT firms that have the right to apply reduced tariffs |

| Appendix 6 | No | They are drawn up by simplifiers who have the right to apply reduced tariffs in accordance with paragraphs. 5 p. 1 art. 427 Tax Code of the Russian Federation |

| Appendix 7 | No | NPOs engaged in activities named in paragraphs. 7 clause 1 art. 427 of the Tax Code of the Russian Federation, which allows you to pay contributions at reduced rates |

| Appendix 8 | No | Businessmen apply for a patent, with the exception of those who work in catering, retail or rent out real estate |

| Appendix 9 | No | Designed for those employers who pay income to foreigners and/or persons temporarily staying in the Russian Federation |

| Appendix 10 | No | Issued only in relation to payments to students working in student teams under a GPC or labor agreement |

| Section 2 and Appendix 1 | No | Only heads of peasant farms in relation to contributions for themselves and members of the farm |

| Section 3 | Yes | Employers record pers. information on all hired persons |

FILLING SEQUENCE

Start with the title page. Then form Section. 3 for each employee who was registered with you in the 4th quarter. After this, fill out the Appendices to Section. 1. And last but not least, Section itself. 1.

Insurance premiums in 2021-2023

Federal Law No. 322-FZ of October 15, 2020 established the following amounts of fixed contributions for individual entrepreneurs for 2021 - 2023:

| 2021 | 2022 | 2023 | |

| Pension Fund | RUB 32,448 | RUB 34,445 | RUB 36,723 |

| FFOMS | RUB 8,426 | RUB 8,766 | RUR 9,119 |

| Total | RUB 40,874 | RUB 43,211 | RUB 45,842 |

Program for generating calculations for insurance premiums

There are many computer systems that allow you to generate calculations for insurance premiums 2021 (you can use the link above) automatically. The 1C program is rightfully considered the most popular, which includes many reports regulated by law, among which there is also a calculation of insurance premiums (form KND 1151111). However, it is not economically feasible for every employer to purchase an expensive license to use the software. At the same time, various Internet resources come to the rescue, providing the opportunity to generate calculations for insurance premiums 2021 (KND form 1151111) online.

Some of the online accounting services include Kontur and My Business.

You can download the insurance premium calculation form from the link provided above.

Insurance premiums from 2021

Starting from 2021, the amount of insurance premiums no longer depends on the minimum wage. Now these are the fixed values established by law for 2021, 2021 and 2021:

| 2018 | 2019 | 2020 | |

| Pension Fund | RUB 26,545 | RUB 29,354 | RUB 32,448 |

| FFOMS | 5840 rub. | 6884 rub. | 8426 rub. |

| Total | RUB 32,385 | RUB 36,238 | RUB 40,874 |

If your annual income exceeds 300,000 rubles, then you must pay another 1% of the excess amount to the Pension Fund, as before. Nothing has changed here. Contributions to the FFOMS do not depend on income.

The maximum contribution amount is now also calculated in a new way. This is now also a fixed value and for 2021 it is equal to 259,584 rubles.

The deadline for paying fixed contributions has not changed - they must be paid before December 31 of the current year. However, the deadline for paying the additional 1% has changed. Now this part of the contributions must be paid before July 1, and not until April 1, as before.

ERSV deadline for 2021 and current form

Absolutely all employers are required to submit insurance premium calculations (ERSV):

- Companies, their branches and separate divisions (if these separate divisions independently calculate and pay contributions) “surrender” to the Federal Tax Service at the place of registration or business (clause 7 of Article 431 of the Tax Code of the Russian Federation).

- Individual entrepreneurs - to the inspectorate at the place of registration (registration).

If there were no accruals in the reporting period (from January to December 2021), you are required to submit a zero calculation by filling out the required sections and applications. This will allow tax authorities to distinguish those organizations that did not have accruals from those that forgot to submit calculations (for entrepreneurs, such an obligation is not established by law).

The deadline for submitting the DAM is set by the Tax Code of the Russian Federation on the 30th day of the month following the reporting quarter. The results of 2021 must be reported no later than January 30, 2021.

If the DAM for 2021 is submitted 10 days later than the deadline, tax authorities have the right to block the current account (clause 3.2 of Article 76 of the Tax Code of the Russian Federation). The same trouble threatens the policyholder who submitted the calculation on time, but with erroneous information: the tax authorities will not accept the report, and it will be considered not submitted.

The RSV form has not changed. The calculation for the 4th quarter of 2021 is still submitted in the form approved. By order of the Federal Tax Service of October 10, 2016 N ММВ-7/11/551.

The report for the 4th quarter of 2021 can be submitted on paper by policyholders whose payroll for 2021 does not exceed 24 employees inclusive. All employers with a large payroll are required to report electronically via telecommunications channels. For violation of this requirement, the policyholder will face a fine for the incorrect method of submitting the calculation - 200 rubles. (Article 119.1 of the Tax Code of the Russian Federation).

Calculation of insurance contributions to the Pension Fund and the Federal Compulsory Medical Insurance Fund until 2021

- Amount of contribution to the Pension Fund = minimum wage * 12 * 26%

- Amount of contribution to the Compulsory Medical Insurance Fund = minimum wage * 12 * 5.1%

where the minimum wage (Minimum Wage) from July 1, 2017 is set at 7,800 rubles.

Please note that when calculating the amount of insurance premiums, the minimum wage is used, which was set on January 1 of the current year, despite its changes during the year.

Thus, the amount of fixed insurance premiums in 2021 is equal to 27,990 rubles.

Also, starting from 2014, upon receipt of income in excess of 300,000 rubles per year, the individual entrepreneur is obliged to pay 1% to the Pension Fund of the Russian Federation on the amount exceeding 300,000 rubles. For example, when receiving an income of 400,000 rubles, 1% must be paid on the amount of 400,000 - 300,000 = 100,000 rubles, we get 1,000 rubles.

In this case, the amount of contributions to the pension fund will not exceed (8 * minimum wage * 12 * 26%). In 2021 it is 187,200 rubles, in 2021 – 154,851.84 rubles.

Calculation of contributions for compulsory health insurance and compulsory health insurance – subsections 1.1 – 1.2 of Appendix 1 to section. 1

Basic tariff codes (line 001):

- 01 – organization on a general regime, charging contributions according to basic tariffs;

- 02 – organization on the simplified tax system with basic tariffs;

- 08 – organization on the simplified tax system with reduced tariffs, conducting preferential activities;

- 03 – UTII payer with basic tariffs.

The number of insured persons (line 010) – all employees registered in your organization, as well as those who work under the GPA. Line 010 may be larger than line 020. After all, line 010 will take into account workers on maternity leave who do not have payments subject to contributions.

The data on payments and contributions in subsection 1.1 must correspond to the data in section. 3 for all employees (clause 7 of Article 431 of the Tax Code of the Russian Federation, Letter of the Federal Tax Service dated December 13, 2017 # GD-4-11/25417).

The organization in the general mode charges contributions at the basic tariffs. It employs 10 people, one of whom is on maternity leave. The amounts of payments and contributions for 2021 are shown in the table.

| Index | 9 months | October | november | December | year |

| Payments | 1 153 000 | 303 837 | 304 018,45 | 328 696 | 2 089 551,45 |

| Non-taxable payments | 18 300 | 7 179 | 11 781,90 | 7 179 | 44 439,90 |

| Contribution base | 1 134 700 | 296 658 | 292 236,55 | 321 517 | 2 045 111,55 |

| Contributions: – to OPS | 249 634 | 65 264,76 | 64 292,04 | 70 733,74 | 449 924,54 |

| – on compulsory medical insurance | 57 869,70 | 15 129,56 | 14 904,06 | 16 397,37 | 104 300,69 |

History of insurance premiums

| Year | Amount, rub. |

| 2020 | 40,874.00 (+1% of income from amounts over RUB 300,000) |

| 2019 | 36,238.00 (+1% of income from amounts over RUB 300,000) |

| 2018 | 32,385.00 (+1% of income from amounts over RUB 300,000) |

| 2017 | 27,990.00 (+1% of income from amounts over RUB 300,000) |

| 2016 | 23,153.33 (+1% of income from amounts over RUB 300,000) |

| 2015 | 22,261.38 (+1% of income from amounts over RUB 300,000) |

| 2014 | 20,727.53 (+1% of income from amounts over RUB 300,000) |

| 2013 | 35 664,66 |

| 2012 | 17 208,25 |

| 2011 | 16 159,56 |

| 2010 | 12 002,76 |

| 2009 | 7 274,4 |

| 2008 | 3 864 |

Who submits the ERSV and when?

Unified calculation of insurance premiums (ERSV or abbreviated RSV) is a report containing data on:

- accrued insurance premiums for compulsory pension, medical and social insurance;

- individual information of employees;

- accrued earnings and insurance contributions for each employee.

Thus, the report combined information that, until 2017, was submitted to the Pension Fund and the Social Insurance Fund in the following forms:

- RSV-1 (in terms of contributions to pension and health insurance);

- RSV-2 (rented by heads of peasant farms),

- RSV-3 (in terms of insurance contributions for additional social security);

- 4-FSS (in terms of maternity contributions).

All employers who paid income to “physicists” working under civil law and labor contracts are required to submit calculations. If there were no payments to the insured persons or the employer did not operate in 2021, the report must be submitted with zero figures.

The deadline for submitting the ERSV is set at the 30th day of the month following the reporting quarter. This means that you should report for 2021 no later than January 30, 2019. This is Tuesday, a working day, so there will be no rescheduling.

Insurance premiums and reduction of tax simplified tax system

An individual entrepreneur who has chosen the simplified tax system (simplified tax system) and the “income” tax regime can reduce the amount of income tax by the amount of insurance premiums paid. Individual entrepreneurs without employees can reduce tax by 100%, with employees - by 50%.

Both annual tax and quarterly advance payments can be reduced. To reduce advance payments, it is necessary to pay insurance premiums in quarterly installments.

If the object of taxation is “income reduced by the amount of expenses”, then paid insurance premiums can be included in expenses.

How to determine income received

Revenue is determined by all types of activities carried out by the payer.

Depending on the taxation system, income is determined as follows:

- OSNO - sales revenue minus VAT;

- STS - the amount of revenue reflected in KUDiR;

- Unified agricultural tax - the sum of proceeds from sales and the indicator of non-operating income;

- patent - there are two indicators: actual revenue received (the amount is reflected in the KUDiR) and the income tax calculated according to Article 346.51 of the Tax Code.

If an individual entrepreneur combines several modes, the revenue received is summed up.

Section 1

In section 1, the accountant transferred all amounts of contributions for the year, for the 4th quarter and broken down for October, November, December 2021. I also indicated the current BCC for each type of contribution.

We recommend checking the budget classification codes before sending the report to the Federal Tax Service, as the program may pick up incorrect codes. If this happens, then the accrued and paid contributions will end up on different cards, and an arrears will form on the front card with the incorrect BCC, on which the tax authorities will charge penalties. To correct the error, you will have to submit a clarification.

Sample RSV 2018

Section 3

For each employee, the accountant prepared a separate section 3. In each, he displayed:

- billing period code, which corresponds to a similar code indicated in the title page: “34”;

- reporting year;

- date of settlement;

- employee information:

- TIN;

- SNILS;

- FULL NAME;

- date of birth;

- passport information.

You should be very careful when filling out the personal information of employees: if there is an error in the last name, first name or patronymic, as well as in the TIN or SNILS, the tax authorities will not accept the calculation (letter of the Federal Tax Service of Russia dated January 19, 2017 No. BS-4-11 / [email protected] ).

In the fields “Identification of an insured person in the system,” the accountant recorded code 1, which means that the employee is insured in the system of compulsory pension, medical and social insurance.

In section 3.2.1, the accountant indicated the month of accrual of earnings: 10 (October), 11 (November) and 12 (December). In the line “Category code of the insured person” - code “НР”, which means that the employee is an employee.

A complete list of codes is given in Appendix No. 8 to the procedure for filling out the calculation. You can download it here.

In lines 210, 220, 230, 240, the accountant recorded the amount of income accrued for each month and the amount of contributions to pension insurance.