Deadlines for payment of insurance premiums

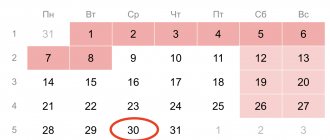

Insurance premiums are paid at the end of each month no later than the 15th day of the following month. Contributions for compulsory pension, medical insurance, in case of temporary disability and in connection with maternity (VNiM) must be transferred to the tax authorities, and “traumatic” contributions - to the Social Insurance Fund of the Russian Federation. If the payment deadline falls on a weekend or non-working holiday, it is postponed to the next working day. Companies must pay insurance premiums for July no later than August 15.

Deadlines for payment of insurance premiums in 2021:

- for January - 02/15/2018

- for February - 03/15/2018

- for March - 04/16/2018

- for April - 05/15/2018

- for May - 06/15/2018

- for June - 07/16/2018

- for July - 08/15/2018

- for August - 09/17/2018

- for September - 10/15/2018

- for October - 11/15/2018

- for November - 12/17/2018

- for December - 01/15/2019

Responsibility for late payments of insurance premiums

If the deadline for transferring insurance premiums in 2021 is violated, a fine is provided in accordance with Art. 75 of the Tax Code of the Russian Federation - 1/300 of the refinancing rate of the Central Bank of the Russian Federation for each day of delay (up to 30 days) and 1/150 of the rate for delay of more than 30 days.

If contributions are calculated incorrectly due to an understatement of the taxable base, the tax office will also impose a fine of 20% of the unpaid amount. In case of deliberate non-payment of insurance premiums, if the Federal Tax Service proves this fact, the organization faces a fine of 40% of the unpaid amount. These points are indicated in Art. 122 of the Tax Code of the Russian Federation.

The video provides information about insurance premiums:

How to fill out a payment order for payment of insurance premiums

When filling out payment slips for the transfer of insurance premiums to the tax authorities, in field 101, companies making payments to individuals must indicate payer status “01”.

Individual entrepreneurs indicate one of the following values in this field:

- 09 - taxpayer (payer of fees) - individual entrepreneur;

- 10 - taxpayer (payer of fees) - a notary engaged in private practice;

- 11 - taxpayer (payer of fees) - lawyer who established a law office;

- 12 - taxpayer (payer of fees) - head of a peasant (farm) enterprise.

These provisions are provided for by Order of the Ministry of Finance of the Russian Federation dated November 12, 2013 No. 107n.

When transferring contributions for accident insurance, “08” is entered in field 101.

The BCC is entered in field 104. In this field you need to indicate the value of the budget classification code of the Russian Federation established for the payment of the corresponding type of insurance premiums.

The purpose of payment and other necessary information are indicated in field 24. This field should reflect the type of insurance premiums and the period for which they are paid. When paying “traumatic” premiums, you can indicate the registration number of the policyholder in the Federal Social Insurance Fund of the Russian Federation.

In fields 106-109 of the payment order for the transfer of accident insurance contributions, “0” must be entered.

When transferring contributions to the tax authorities, you must reflect on the payment slip:

- “TIN” and “KPP” of the recipient of funds - the value of the “TIN” and “KPP” of the relevant tax authority that administers the payment;

- “Recipient” is the abbreviated name of the Federal Treasury authority and in brackets is the abbreviated name of the tax authority that administers the payment.

In field 106, when transferring the current payment, the TP is entered, in field 107 - the month for which contributions are paid (for example, MS.07.2018).

What payments are subject to compulsory medical insurance contributions?

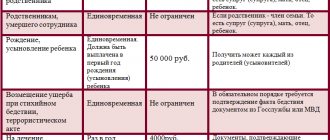

Insurance premiums for compulsory medical insurance are subject to almost all payments made in favor of employees and individuals with whom GPD agreements have been concluded for the performance of work/provision of services (clause 1 of Article 420 of the Tax Code of the Russian Federation). True, some payments are still not subject to compulsory medical insurance contributions. You will find their complete list in Art. 422 of the Tax Code of the Russian Federation. Non-taxable payments, for example, include:

- benefits paid in accordance with the law (for example, temporary disability benefits);

- daily allowance within the established limit (700 rubles for each day of a business trip in Russia, 2500 rubles for each day of a business trip abroad);

- the amount of financial assistance that the employer provides to its employees is within 4,000 rubles. per employee per year.

KBC for insurance premiums

TABLE: “Budget classification codes for payment of contributions in 2021”

| Payment | KBK for payments on contributions (at basic tariffs) from 2018 |

| Pension | |

| Contributions | 182 1 02 02010 06 1010 160 |

| Penalty | 182 1 02 02010 06 2110 160 |

| Fines | 182 1 02 02010 06 3010 160 |

| Social insurance (VNiM) | |

| Contributions | 182 1 02 02090 07 1010 160 |

| Penalty | 182 1 02 02090 07 2110 160 |

| Fines | 182 1 02 02090 07 3010 160 |

| Medical | |

| Contributions | 182 1 02 02101 08 1013 160 |

| Penalty | 182 1 02 02101 08 2013 160 |

| Fines | 182 1 02 02101 08 3013 160 |

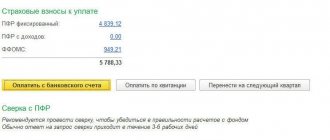

How to transfer

SV payments are sent monthly to the tax service. The accountant calculates the amount of contributions for the institution, draws up a payment order, checks the details and sends the payment to the Federal Tax Service.

Instructions on how to make a payment:

- “How to transfer insurance premiums to a budget organization”;

- “We fill out payments for insurance premiums.”

Who can apply the reduced tariff

An individual entrepreneur has the right to a benefit if the following conditions are met:

- application of the simplified tax system;

- annual income – no more than 79 million rubles;

- carry out the type of activity specified in the list given in clause 1, paragraph. 5 tbsp. 427 NK;

- the share of profit from it is 70% or more of the total income.

Under such conditions, the entrepreneur has the right to use coefficients: 20% should be deducted to the pension fund, to the Social Insurance Fund - only for injuries, and no fees are paid to the Federal Compulsory Medical Insurance Fund.

Who should pay how much?

Employees of the Social Insurance Fund are responsible for calculating contributions. Specific indicators depend on:

- main type of activity (specified in registration documents);

- rights to benefits;

- tariffs for fees.

Reference: the Fund’s activities in terms of accumulation and redistribution of payers’ funds are regulated by Law No. 125-FZ, adopted in 1998.

At the same time, the Foundation has the following powers:

- take into account receipts from each payer;

- control the correctness of deposits;

- present invoices for payment;

- require clarification from policyholders on topics related to transfers.

For information: the FSS has the right to conduct an on-site inspection of the enterprise or request documentation for inspection.

Download for viewing and printing: Federal Law dated July 24, 1998 N 125-FZ (as amended on July 29, 2017) “On compulsory social insurance against industrial accidents and occupational diseases”

How to find out the tariff

Law No. 179-FZ (2005) established 32 tariff plans, depending on the risk level of workers. The betting parameters in them are distributed in the range from 0.2% to 8.5%.

Note: since the Fund pays funds in connection with accidents at work, it is fair to distribute contributions according to the degree of risk for workers.

Table of tariffs corresponding to risk factors

| Class PR | Tariff (%) | Class PR | Tariff (%) | Class PR | Tariff (%) | Class PR | Tariff (%) |

| I | 0,2 | IX | 1 | XVII | 2,1 | XXV | 4,5 |

| II | 0,3 | X | 1,1 | XVIII | 2,3 | XXVI | 5 |

| III | 0,4 | XI | 1,2 | XIX | 2,5 | XXVII | 5,5 |

| IV | 0,5 | XII | 1,3 | XX | 2,8 | XXVIII | 6,1 |

| V | 0,6 | XIII | 1,4 | XXI | 3,1 | XXIX | 6,7 |

| VI | 0,7 | XIV | 1,5 | XXII | 3,4 | XXX | 7,4 |

| VII | 0,8 | XV | 1,7 | XXIII | 3,7 | XXXI | 8,1 |

| VIII | 0,9 | XVI | 1,9 | XXIV | 4,1 | XXXII | 8,5 |

Help: to use the table, you need to look at the registration documents of the enterprise regarding registration with the Fund.

The OKVED code is indicated there. And the class of profrisk is determined by it. Download for viewing and printing: Federal Law No. 179 of December 22, 2005 “On compulsory social insurance against accidents...”

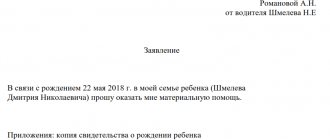

Example

Three enterprises decided to find out their tariff rates:

- Sirius LLC, engaged in freshwater fishing. OKVED - 03.22.4.

- LLC "Delta" The main activity is clay mining. OKVED 08.12.2.

- Alpha LLC grows grains. OKVED 01.11.1 17.

We determine the profrisk class using the table:

| Name | Kind of activity | OKVED | Class PR | Rate |

| Sirius LLC, | Freshwater fishing | 03.22.4 | I | 0,2 |

| LLC "Delta" | Clay mining | 08.12.2 | XIV | 1,5 |

| Alpha LLC | Growing grains | 01.11.1 | XVII | 2,1 |

Reference

The Fund calculates fee amounts for 2021 based on data submitted by the payer. Information should be provided by April 15. The package includes:

- a statement confirming the main type of activity;

- explanatory balance sheet (for LLC);

- copy of the registration document.

Important: if the payer did not transfer the package of documents within the required time frame, then the Fund’s employees are guided by the information at their disposal.

In addition, the Government, by resolution No. 551, prohibited challenging the tariffs established by the Social Insurance Fund for fees for injuries from 01/01/2017.

Download for viewing and printing:

Decree of the Government of the Russian Federation of June 17, 2016 N 551 “On amendments to the Rules for classifying types of economic activities as professional risk”

Calculation formula

Responsibilities are distributed as of 2021 as follows:

- The Fund sets a tariff plan for the payer and informs about it;

- the accountant of the latter is obliged to calculate the amount of the contribution and transfer funds;

- The government agency retains the right to verify the correctness of operations.

A simple formula is used for calculations:

Svz = Bn x T, where:

- Svz - the required amount to be transferred;

- Bn - taxable;

- T - tariff.

What is included in the contribution base

Deductions are made from the wage fund. It includes accruals in favor of persons with whom agreements are drawn up:

- labor;

- civil law (there are exceptions).

The contribution base includes:

- earnings;

- amounts of bonuses and allowances;

- compensation payments for unused vacation days.

The following payments in favor of workers are excluded from the base:

- state capacity;

- accruals for staff reductions;

- targeted financial assistance;

- allowance for work in especially dangerous conditions;

- payment for attending advanced training courses.

Information: payers of injury fees are individuals and legal entities using hired labor.

Example

Gorny LLC is engaged in horse breeding. OKVED - 01.43.1:

- Profrisk class - 25.

- In April, the accounting department accrued earnings to workers in the amount of 1,230,000 rubles, including: financial assistance - 35,000 rubles.

- for completing courses - 10,000 rubles.

About benefits

For diligent taxpayers, the Fund may provide a preferential rate on personal injury fees. Its size is limited to 40% discount. In addition, if the company employs disabled people, then their contributions may be subject to a 60% discount.

Help: to establish a preferential tariff for the next year, you must submit an application before the end of November of the current period. That is, in 2021 it will no longer be possible to obtain it.

The size of the discount depends on the following indicators:

- number of injuries per 1000 workers;

- number of days of incapacity;

- presence of violations: the reporting procedure;

- deadlines for making mandatory payments;

Example

Garant-Stroy LLC is engaged in design (OKVED - 74.20). The company received a 20% discount from the Social Insurance Fund for 2021. The following accruals were made for April:

- salary 400,000 rub.,

- including disabled people 85 thousand rubles.

Determination of the contribution amount:

- According to the OKVED classifier it belongs to class 1. The “traumatic” rate is 0.2%.

- taking into account the discount: general: 0.2 - 0.2×20% = 0.16%.

- for disabled people: 0.2 - 0.2×60% = 0.08%.

- The calculation of contributions is carried out in two stages:

- total: (400,000 rub. - 85,000 rub.) x 0.16% = 504 rub.

- for disabled people: RUB 85,000. x 0.08% = 68 rub.

- Total to be transferred: 504 rub. + 68 rub. = 572 rub.

How does an individual entrepreneur pay a “traumatic” fee?

The legislation establishes that individual entrepreneurs pay the following amounts to the Social Insurance Fund:

- for yourself voluntarily on the basis of an agreement with the Fund;

- for hired workers, obligatory at the rate: general;

- preferential.

Tariff plans are set as follows:

| Category | Tariff (%) |

| Policyholders who did not receive preferential rights | 2,9 |

| The same after reaching the maximum base | 0 |

| Individual entrepreneurs operating in special economic zones | 2 |

Individual entrepreneurs operating in the following economic zones:

| 1,5 |

Do individual entrepreneurs pay contributions to the Social Insurance Fund?

According to the Tax Code, an individual entrepreneur contributes to social insurance:

- If acting as an employer on the basis of an employment contract. Then the businessman pays fees for all employees and submits reports in Form 4-FSS, according to the general rules.

- The individual entrepreneur may not make contributions to himself, but in this case you should not rely on disability benefits or in connection with childbirth and maternity.

- If desired, social contributions are also deducted for hired personnel hired under a civil agreement.