To calculate sick leave benefits for a highly paid employee, you need to know the maximum average daily earnings in 2021. It is no secret that current legislation sets a limit on the amount of sick leave benefits paid to employees. No matter how much an employee officially earns, temporary disability benefits are always limited to a maximum amount. We’ll talk about the maximum average daily earnings in 2021 for sick leave in the article.

Principle of calculation and amount of payment

In the event that a period of incapacity for work is associated with an employee’s illness or received as a result of a non-work injury, then during the first three days the payment is calculated by the employer, and the following periods will be repaid by transferring funds from the Social Insurance Fund. All other reasons are the basis for the issuance of funds from the first day of sick leave exclusively at the expense of the Social Insurance Fund. An important point is that only those employees who are officially employed through an employment or other contract, on the basis of which funds are transferred to the Social Insurance Fund in a certain amount from their income, can count on the transfer of funds. At the same time, not only employees who are citizens of the Russian Federation can count on receiving funds for the period of sick leave; money is transferred in favor of any employees if the employer makes payments to the Social Insurance Fund for them.

When determining the possibility of transferring funds for a period of incapacity, first of all, non-insurance periods that are not included in the period of illness are excluded, which include downtime, suspensions from work, other exemptions other than planned annual leave, stay in custody, as well as examinations of a judicial or medical nature. . In parallel with this, regarding restrictions on sick leave payment, there is an established limit on the number of days. So, in particular, when caring for a sick child, 30 to 60 days are allowed (in some cases - without limitation), if an employee is disabled - up to 5 months, sick leave for pregnancy (in standard situations) is 140 days.

For the current period, the benefit is calculated taking into account the total length of service of the employee - up to 5 years, 60% of the average earnings for the period of the last two years are due, from 5 to 8 - 80%, and over 8 years - in full amount of the calculated average wages. Moreover, provided that the illness or disability was related to the situation at the enterprise (occupational disease) or an accident (industrial injury), in such a situation the employee’s length of service is not taken into account, he is paid sick leave in the full amount of the salary, taking into account only what how many days he was absent from work for a valid reason. When paying sick leave for pregnancy, the duration of the employment relationship is also not taken into account and a woman can count on 100% of her average salary for the last two years.

The procedure by which sick leave is calculated

The basic formula by which sick leave benefits are calculated has not changed. As before, the amount of compensation due will be equal to the product of the average daily earnings, the number of days on sick leave and a coefficient depending on the length of service. Let us remind you how these indicators are calculated.

Average income per day

The average daily salary is calculated based on income for the last two years before the disease. The total amount includes any bonuses and material incentives, deductions from which went to the Social Insurance Fund. In this case, the resulting “dirty” amount is taken into account, that is, earnings before tax and insurance deductions.

The calculation is carried out by dividing the total earnings for 2 years by 730, so the work mode (standard “five-day week”, shift work, shift work) does not play a role.

Duration of sick leave

In order to avoid causing significant economic damage to the state, and also as an incentive for recovery, the legislation establishes a maximum duration of sick leave.

- no more than 15 days (issued by a therapist when visiting the clinic);

- up to 10 days (provided by the dentist);

- if treatment requires a longer period, sick leave is extended only by decision of the medical commission of the medical institution.

If it is necessary to care for a child, one of the parents is provided with sick leave:

- for an unlimited time until a child under 7 years of age recovers;

- no more than 15 days if the child is from 7 to 15;

- up to 3 days if the teenager is over 15.

The law sets a limit on the number of days that can be spent on sick leave and receiving appropriate compensation.

In 2021, this value will not change and will be 60 days. The period can be extended for another 30 days if there are grounds prescribed by law.

Experience coefficient

In case of illness, the amount of compensation depends on the employee’s length of service.

- If the employee’s length of service is from 6 months to 5 years, he will be entitled to only 60% of the calculated amount.

- With 5 to 8 years of experience, he will already receive 80% of the compensation.

- An employee of an enterprise who has worked there for more than 8 years has the right to claim full sick pay.

- Sick leave for pregnancy is always paid in full, but this requires six months of experience.

Thus, the longer the work experience, the more social guarantees the employee receives. In general, this system is fair, as it takes into account a person’s merits to the enterprise.

Maximum and minimum limit

When calculating the amount due for the period of incapacity of an employee, a concept such as the minimum accrual amount may be used. This concept is used in situations where the employee has not yet worked for a certain period of time - 2 years, and therefore, based on calculations, his average salary may be less than the established minimum wage. In such situations, the accounting department must accept for calculation the minimum wage established for the period of incapacity and then calculate the due amount from it. The minimum wage is divided by the number of days of the month and multiplied by the period that occurred during his illness.

According to Article 1 of Federal Law No. 41 of March 7, 2018 “On Amendments to Federal Law No. 82,” the minimum wage from May 1, 2021 is set at 11,163 rubles.

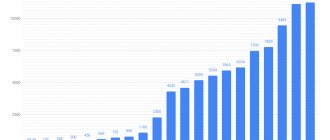

In parallel with the established minimum limit on the amount of payment for the sick leave period, the concept of the maximum amount of payment is also used. This concept refers more to the maximum possible amount of transfers of funds to the Social Insurance Fund and it is recalculated annually, after which a new limit on the amount of possible accrual is established. So, for 2015 its indicators were 670,000 rubles, for 2016 - 718,000 and for 2021 - 755,000. If we take 2021 with a maximum base of 815,000 rubles, then when calculating the average daily earnings in the calculations, amounts cannot be accepted greater than than 2021.81 rubles per day. Thus, if an employee’s daily salary exceeds this maximum, sick leave will be calculated based on the maximum limit.

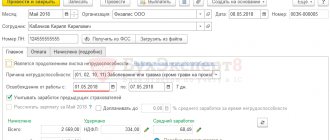

How to calculate sick leave in 2021: step-by-step guide

To calculate temporary disability benefits, you need to multiply the average daily earnings by the number of sick days and by a percentage depending on the insurance period

06/27/2018Russian tax portal

Every employer is faced with the fact that its employees get sick and go on sick leave. And after the employee returns to work, the accountant is obliged to calculate temporary disability benefits.

Formula for calculating sick leave

The most important thing is to know the formula for calculating sick leave: the average daily wage must be multiplied by the number of sick days, then we multiply the resulting value by%, which depends on the employee’s length of service.

Employee length of service

How does the amount of benefits depend on the employee’s length of service? We present a convenient table that reflects: the reason for going on sick leave, the length of service and the amount of benefits.

| Reason for going on sick leave | Work experience of the employee | Amount of benefit based on average earnings (in%) |

| “Normal” employee illness | 8 years or more | 100 |

| From 5 to 8 years | 80 | |

| Up to 5 years | 60 | |

| Occupational disease, work accident | Does not depend on experience | 100 |

| Care for a sick child (under 15 years of age) on an outpatient basis | 8 years or more | 100 (first 10 days) + 50 (for subsequent days of the child’s illness) |

| From 5 to 8 years | 80 (first 10 days) + 50 (for subsequent days of the child’s illness) | |

| Up to 5 years | 60 (first 10 days) + 50 (for subsequent days of the child’s illness) | |

| Care for a sick child (up to 15 years of age) in a hospital, care for an adult family member (including a sick child over 15 years of age) on an outpatient basis | 8 years or more | 100 |

| From 5 to 8 years | 80 | |

| Up to 5 years | 60 |

Number of sick days

We find out the number of days of illness from the sick leave; the dates of illness and return to work are noted by the doctor. But the average daily earnings need to be determined by an accountant.

Average daily earnings

Average daily earnings are calculated for the two calendar years preceding the year of disability, based on all payments and rewards that were accrued to the employee during this period and were subject to insurance contributions to the Social Insurance Fund.

So, to make the calculation, you need to pull up all the payslips and look at the employee’s wages for two years. If an employee has recently come to work for you, he has not worked for you for two years, then a certificate from his previous place of work in form 182n will help determine the average daily earnings.

When determining the average daily wage, it is important to remember that there is a limit. The amount of earnings taken into account in the calculation for a calendar year cannot be greater than the maximum base for calculating insurance contributions to the Social Insurance Fund:

– in 2021 no more than 718,000 rubles,

– in 2021 no more than 755,000 rubles.

Conclusion - the maximum amount of sick leave benefits for one day in 2018 is 2021.81 rubles ((718,000 +755,000) / 730).

Procedure for paying sick leave

1) Sick leave due to illness (injury) of the employee himself - the first three days of illness are paid at the expense of the enterprise, and the remaining days of illness are paid at the expense of the Social Insurance Fund;

2) Sick leave to care for a family member - paid entirely from the Social Insurance Fund.

How to calculate sick leave if the average earnings are less than the minimum wage?

In this case, sick leave is calculated based on the minimum wage.

Let us remind you that from May 1, 2021, the minimum wage is 11,163 rubles. The minimum amount of sick leave benefits for one day is 367 rubles (11,163 x 24/730).

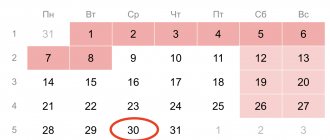

Paying sick leave on holidays

Payment of sick leave on holidays occurs as usual. The presence of non-working holidays does not in any way affect the amount of temporary disability benefits.

Payment for long-term sick leave

There are cases when an employee is sick for a long time (up to several months), who pays for sick leave in this case? The Social Insurance Fund reimburses amounts for long-term sick leave.

What documents does a company need to collect in order to reimburse the costs of sick leave?

Based on the order of the Ministry of Health and Social Development of the Russian Federation dated December 4, 2009 No. 951n, the policyholder is obliged to collect the following documents:

– a written statement from the policyholder; copies of supporting documents (sick leave certificates, certificates from medical institutions, etc.);

– certificate-calculation.

Post:

Comments

Special cases you need to know to correctly calculate compensation

Most of the burden of payments falls on the state social insurance fund. The employer pays its employee benefits only for the first three days of sick leave. And in case of sick leave to care for a minor, the FSS makes the necessary deductions from the very first day of its validity.

If an employee gets sick while on vacation, his sick leave will be added to the days of rest, so he can go to work later for the number of days indicated on the sick leave. Vacation does not deprive the right to sickness compensation, but only if the employee himself falls ill. If you need to care for a minor, you will have to take sick leave without compensation.

There are grounds for which benefits are not paid:

- if a person is injured or becomes ill while committing an illegal act;

- when the employee was removed from his duties;

- if the employee takes sick leave after recovery;

- it will be proven that the person violated the doctors’ requirements, thereby prolonging the period of illness;

- when working under a contract.

For part-time work, the procedure for calculating compensation does not change, however, a coefficient is taken into account depending on the length of the working week. If the average daily earnings is less than the minimum wage, the calculation is also carried out based on the minimum wage. Only in this case the compensation is reduced depending on the length of the working day. For example, if a person works for 3 hours instead of 8, his average daily earnings when calculating sick leave will be 311 rubles 96 kopecks: 8 x 3.

However, part-time work is taken into account only when this regime is established no later than the day of the onset of the disease. This measure protects the rights of workers who are transferred to part-time work retroactively.

Thus, the new year 2021 will not bring significant changes to the scheme for calculating sickness benefits. However, detailed innovations should be known to the employer in order to prevent violations of labor laws, or to the employee to protect their rights.

Changes for 2021 that play a role in calculating sickness benefits

The procedure for calculating sick leave based on three criteria will not change in 2021. However, details that play a significant role in determining the specific amount that the patient will receive will undergo changes.

Maximum countable earnings per day

Compensation is calculated based on the employee’s salary. However, the state sets a maximum amount of earnings, from which the average daily income is calculated.

In 2021, the figure will change, since the calculation will be based on average earnings for 2021 and 2021. For this period, the maximum amounts of income taken into account were established - 718 and 755 thousand rubles, respectively.

Thus, the maximum accountable earnings per day in 2018 will be 2021 rubles 80 kopecks.

Minimum wage size

Calculation of compensation for sick leave based on the minimum wage is carried out in the following cases:

- 2 years before the disease the person did not receive wages;

- his average earnings, taking into account tax deductions, did not reach the minimum wage threshold;

- The person's work experience is less than 6 months.

The minimum wage has been changed. In 2021 it will be 9,489 rubles.

Thus, when calculating the average daily income according to the minimum wage in the coming year, the result will be 311 rubles 96 kopecks.

Features of calculating sick leave in 2021, taking into account the maximum benefit amounts

When calculating benefits, it is necessary to compare income for each base year: if in total they do not exceed the established limit for 2 calculation years, and when considering the employee’s income for each year, an excess of the base is established for one of them, the Social Insurance Fund will refuse compensation, citing its refusal as an overstatement of the amount benefits.

Payments under the BC (minus personal income tax) should be transferred to the employee on the next salary day. Benefits are not included in the calculation base for insurance premiums; when calculating income tax, the base includes only the costs of paying the employer for the first 3 days of illness.

Example 1: procedure for calculating BL for the period established by the medical advisory commission

A company employee (5 years 2 months of experience) was sick for 28 calendar days - from April 16 to May 13, 2021 (according to the VKK) - 15 days in April, 13 days in May. His income subject to FSS contributions amounted to:

- for 2021 – 715,000 rubles,

- for 2021 – RUB 736,000.

When comparing income amounts, it was not established that the base year limit was exceeded:

RUB 715,000 ‹ 718,000 rub. (2016);

736,000 rub. ‹ 755,000 rub. (2017).

Calculation:

- (715,000 + 736,000) / 730 = 1987.67 rubles. in a day

- The benefit amount is RUB 55,654.76. (1987.67 x 28 days),

incl. for April – 29,815.05 rubles. (1987.67 x 15 days),

for May – 25,839.71 rubles. (1987.67 x 13 days).

- Taking into account the length of service, the benefit will be 44,523.81 rubles. (55,654.76 x 80%),

incl. for April 23,852.04 rubles. (29,815.05 x 80%),

for May – 20,671.77 rubles. (25,839.71 x 80%).

- Personal income tax: 5788 rub. (44,523.81 x 13%), including for April - 3101 rubles, for May 2687 rubles.

- Amount to be issued: RUB 38,735.81,

incl. for April – 20,751.04 rubles. (23,852.04 – 3101),

for May 17,984.77 rubles. (20,671.77 – 2687)

When calculating the amounts, the amount of the benefit is distributed and reflected in the accounts on a monthly basis.