How to reflect the sale of a fixed asset in 1C: Accounting 8.3? This will be discussed in this article.

Why might organizations need to sell fixed assets, since they are purchased for a long period? Fixed assets as means of labor involved in the production process can quite often be updated at enterprises in connection with the development of new technologies, which means that it is most effective to sell unused fixed assets, and try to make a profit, or, in extreme cases, a zero financial result. Cases of a negative financial result cannot be excluded, but this is also a kind of income, because a retired fixed asset, albeit with a negative result, does not require costs for its further storage or disposal.

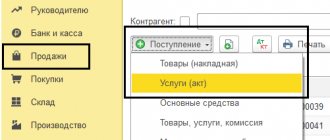

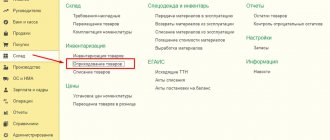

The transfer of fixed assets belongs to the section of operations for the disposal of objects, and documents for such operations are located in the corresponding configuration interface:

Fig. 1 Documents for disposal operations

Let's consider three options for transferring the OS:

- A fixed asset with zero residual value, i.e. depreciation on it has been accrued in full. The sale of such a fixed asset leads to the generation of income;

- An asset with a non-zero residual value and a sales price greater than its residual value. The sale of such a fixed asset leads to the emergence of both income and expense, as well as profit;

- An asset with a non-zero residual value and a selling price less than its residual value. The sale of such a fixed asset results in both income and expense, as well as loss.

It is important to understand that in all cases the procedure is the same - the document “Transfer of OS” is registered.

Differences will arise after the document has been processed. They consist in the principles of formation of accounting entries.

Sale of fixed assets without bonus depreciation

In this case, the document Transfer of fixed assets (Menu fixed assets and intangible assets - Disposal of fixed assets - Transfer of fixed assets ) (some mistakenly try to sell fixed assets with the document “Write-off of fixed assets,” but this is not true).

Example:

03/11/2016 – The organization registered fixed asset OS 1 with an initial cost of 105,000.00 rubles. The useful life of the fixed asset is 60 months:

04/30/2016 – Depreciation of OS 1 in the amount of 1,750.00 rubles began to accrue:

12/13/2016 – Due to the need that arose, fixed asset OS 1 was sold at a cost of 101,000.00 rubles:

Let's create a document OS Transfer :

In the header of the document Transferring the OS to 1C 8.3, fill in all the necessary details:

- Counterparty.

- Agreement.

- Location of the fixed asset (Division in which the fixed asset was registered).

- OS event (only one event option is available in this document, “OS Transfer”).

On the Fixed Assets tab of the document that opens, add a line in which we indicate the OS 1 object as a fixed asset, and the object’s inventory number will be filled in automatically:

- The price field indicates the selling price of the fixed asset item as agreed with the counterparty.

- The income and expense accounts are the accounts of other income and expenses - 91.01 and 91.02, since the sale of fixed assets does not relate to the main activity of the organization (VAT calculated on the sale of a fixed asset will also be taken into account in the other expenses account).

- Analytics for the accounts of other income and expenses is also filled in the field of the document Transfer of fixed assets. This is an item of other income and expenses with the type “Sales of fixed assets”:

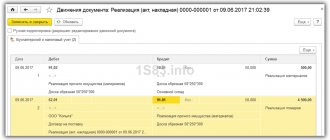

As a result of the transaction, document 1C 8.3 generates the following transactions for the sale of fixed assets:

- Accounts receivable have been generated in the amount of the sales value of the fixed asset (in accounting and accounting records).

- Depreciation was accrued for December (the month of sale of the fixed asset, in accounting and accounting records).

- The amount of depreciation calculated for the entire period of operation of OS 1 is included in the reduction of the residual value of the fixed asset (in accounting and accounting records).

- The initial cost of the fixed asset was transferred to the account of the residual value of the fixed asset, which will be reduced by the amount of depreciation (in accounting and accounting records).

- The residual value of the fixed asset is charged to other expenses (in accounting and accounting records).

- VAT accrued is charged to other expenses (in accounting).

Acceptance of assets for accounting with registration of a customs declaration in KA 2.4

To register the receipt of fixed assets indicating the customs declaration number, you need to register the Receipt of Goods and Services in the program with the “import” type. Receipts of goods and services with the type “import” are filled in like regular import receipts. In order for the goods to arrive at account 08.04.1, you need to indicate the item card with accounting account 08.04.1 (Fig. 1)

Figure 1 — Nomenclature card

After posting the document, postings are generated for Dt. 08.04.1 - Kt. 60.01 - receipt of goods at the warehouse (Fig. 2)

Figure 2 — Postings of the document Receipt of goods and services with the import type

After registering the Receipt of goods and services with the import type, you need to create an import declaration, where you will be able to indicate the customs declaration number, as well as the costs of customs duties and the amount of duty. Next, the organization has the goods listed on account 08.04.1, in order to accept the fixed asset for accounting, first you need to write off the goods as expenses, indicating the required fixed asset. In the section “warehouse and delivery” - “Internal documents”, a document “Write-off for expenses” is created with the business transaction “Write-off for expenses\assets”. (Fig. 3)

Figure 3 — Document Write-off for expenses

In this document, the warehouse to which the goods, organization and division were capitalized is filled in; on the goods tab, the goods that were purchased on 04/08/1 are added, and you also need to indicate the write-off item (Fig. 4). The write-off article must have the following setting (Fig. 5 and 6):

- Type of expenses - Formation of the value of non-current assets

- Cost allocation option - Attribute to non-current assets

- Analytics type - Fixed asset

- Accounting account 08.04.2

Figure 4 - Filling out the expense write-off document

Figure 5 - Creating an expense item

Figure 6 - Creating an expense item

After filling out an expense item in the “Write-off as expenses” document, it will be possible to specify an analytics; the analytics indicates the fixed asset that needs to be taken into account. In fact, the goods that arrived at the warehouse taking into account the customs declaration number are decommissioned from 04/08/1 to 04/08/2. (Fig. 7) and then the OS is accepted for accounting. After posting the “Write-off as expenses” document, the following transactions will occur: Dt. 08.04.2 - Kt.08.04.1 with analytics for fixed assets.

Figure 7 — Postings of the document Write-off as expenses

Next, a document is created for accepting fixed assets for accounting, in which the basic information on the fixed asset is filled in, the cost, period of use, reflection of expenses is indicated, on the “Fixed Assets” tab, the fixed assets that were indicated in the analytics when written off as expenses are indicated (Fig. 8.9)

Figure 8 — Filling out the document Acceptance for accounting of fixed assets”

Figure 9 — Filling out the document Acceptance for accounting of fixed assets

After posting the document “Acceptance for accounting of fixed assets” there will be the following transactions Dt. 01.01- Kt. 08.04.2 (Fig. 10). To calculate the cost and reflect this transaction, you need to close the month, and after closing the month, the cost of the fixed assets is calculated. Postings for SALT 08 and 01 accounts are generated with a total value that can be checked using SALT (Fig. 11)

Figure 10 — Postings of the document Acceptance for accounting of fixed assets

Figure 11 - OSV

The sale of fixed assets is the write-off of fixed assets or the transfer of fixed assets

Let's first figure out what documents are used when selling an OS in 1C 8.3 Accounting.

In 1C there are several documents on the disposal of fixed assets:

- Decommissioning of OS;

- Preparing for transfer;

- OS transfer.

The last two documents are used when implementing the OS. The document Write-off of fixed assets is used only for its disposal within the organization, for example, write-off of fixed assets due to physical wear and tear.

Selling OS in 1s 8.3 base

It is necessary to sell a plot of land with several buildings located on it. Since I have never carried out operations with the OS before, please tell me how to correctly carry out this disposal in 1C 8.3 base. What is the sequence of documents? Thank you very much in advance for your help.

It’s better to look for information on the 1C website, having received free access for several days. It’s unlikely that anyone will manually write instructions for you here; you won’t be able to get by with just two words.

The main thing for us is to sum up the results... So far the results have not let us down. ©

Posted by

ZZZhannaIt’s better to look for information on the 1C website, having received free access for several days. It’s unlikely that anyone will manually write instructions for you here; you won’t be able to get by with just two words.

Well, let me write and you check.) I make a document “Preparation for the transfer of fixed assets” (Disposal of fixed assets - Preparation for the transfer of fixed assets), adding there a list of the fixed assets being sold (and the land and buildings on it), and then I make a document for each fixed assets object “OS Transfer.” From which I print out the UPD (by the way, can I use the UPD if we have a simplified tax system?) and the OS-1 act for the land plot. For buildings, apparently you need to look for the act on the Internet? OS-1 says that it is used for OS EXCEPT buildings and structures. Or is there also an act for buildings in 1C??? Right? It seems that it turned out quite well in 2 words.))) But is this correct or did I miss something?

Message from

AnonymousI am making a document “Preparation for the transfer of fixed assets” (Disposal of fixed assets - Preparation for the transfer of fixed assets)

Yes

Message from

Anonymous

adding there a list of assets for sale (both land and buildings on it)

if the program allows a list

Message from

Anonymous

From which I print out the UPD (by the way, can I use the UPD if we have a simplified tax system?) and the OS-1 act for the land plot.

only the OS certificate, no UPD, no invoice is needed. For real estate there is an OS-1a form

The main thing for us is to sum up the results... So far the results have not let us down. ©

Posted by

ZZZhannaonly the OS certificate, no UPD, no invoice is needed.

When purchasing a used OS, I will receive only OS-1 as a buyer (legal entity on OSNO). And how can I make a purchase without UPD (bargaining-12+ invoice)? How to get a VAT deduction?

Message from

Alexander_ne_bukhAnd how can I make a purchase without UPD (bargaining-12+ invoice)

uh... how do received documents prevent you from pressing keys on the keyboard and selecting the desired documents in the program? Have you never bought a used OS?

Message from

Alexander_not_bukh

How to get a VAT deduction?

and no one canceled the invoice if there is VAT. And the author of the question has a simplified tax system, so I didn’t write about VAT.

Message from

Alexander_not_bukh

How to get a VAT deduction?

If you buy from TS, then no way))

The main thing for us is to sum up the results... So far the results have not let us down. ©

Still, I am for UPD - even from the tropic starter (sign 2)! Here is a special case (seller using the simplified tax system). But this is a general forum - many, having read that nothing is needed except OS-1, will take it as a guide to action. We bought a used OS from an individual entrepreneur - required Torg-12.

Message from

Alexander_ne_bukhBut this is a general forum - many, having read that nothing is needed except OS-1, will take it as a guide to action.

To transfer property that the seller had OS, nothing else is really needed. An invoice is needed exclusively for VAT. OS-1 is perfectly created for the act. And how do you imagine conducting TWO documents for the transfer of the same asset in the seller’s program?

The main thing for us is to sum up the results... So far the results have not let us down. ©

Message from

Alexander_ne_bukhmany, having read that nothing is needed except OS-1, will take it as a guide to action.

VAT payers are usually aware that they must issue an invoice. And the sale of OS is perfectly formalized by OS-1. UPD (TOGG-12 or something else) can be issued for those who have not read all the regulations

Posted by

JanuaryUPD (TOGG-12 or something else) can be issued for those who have not read all the regulations

It’s better to “be on the safe side” right away than to collect documents later...

Message from

Alexander_ne_bukhIt’s better to “be on the safe side” right away than to collect documents later...

Well, no, it’s better to force illiterate people to read the regulations than to do extra work.

The main thing for us is to sum up the results... So far the results have not let us down. ©

Posted by

ZZZhannaWell, no, it’s better to force illiterate people to read the regulations than to do extra work.

Is there an OS-1a form for real estate in 1s 8.3 Base? And one more thing - can a land plot for sale be registered with an OS-1 act? OS-1a is only for buildings and structures...

Message from

AnonymousIs there an OS-1a form for real estate in 1s 8.3 Base?

so look))

The main thing for us is to sum up the results... So far the results have not let us down. ©

Posted by

ZZZhannaso look))

I can’t find it))) Maybe I’m looking in the wrong place, that’s why I’m asking

Message from

AnonymousI can't find it)))

Look at the printed forms from the same form.

The main thing for us is to sum up the results... So far the results have not let us down. ©

Posted by

ZZZhannaTo transfer property that the seller had OS, nothing else is really needed. An invoice is needed exclusively for VAT. OS-1 is perfectly created for the act. And how do you imagine conducting TWO documents for the transfer of the same asset in the seller’s program?

It’s not very clear, what document from the SELLER will reflect the implementation of the OS? The OS act indicates a lot of different information about the OS, and in monetary terms only the initial cost, accrued depreciation, residual value. But there is no SALE value in the OS act. If you do not generate a TORG-12 invoice on the basis of the act, then how will the Seller’s sales be reflected in accounting and on what basis will the Buyer reflect the cost of the fixed assets in his accounting?

Message from

AnonymousBut there is no SALE value in the OS act

Actually, that is. Section 1, column 8 And everything is perfectly reflected in the program according to the postings, both in the control unit and in the control unit. But I don’t see the printed form OS-1a...

Posted by

JanuaryBut I don’t see the printed form OS-1a...

I don’t work in 3.0 now, but in 2.0 when printing, depending on the type of OS: if real estate is transferred, OS-1a is printed, if there are several OS, then OS-1b, if everything else is just OS. The program itself knows. If, of course, the OS was taken into account correctly.

The main thing for us is to sum up the results... So far the results have not let us down. ©

Posted by

ZZZhannaThe program itself knows. If, of course, the OS was taken into account correctly.

Yes, that's probably true. I didn’t recklessly look at “real estate”

Posted by

JanuaryActually, that is. Section 1, column 8 And everything is perfectly reflected in the program according to the postings, both in the control unit and in the control unit. But I don’t see the printed form OS-1a...

So this Column 8 of Section 1 for the Seller is called “Acquisition cost (contractual value)”. As I understand it, the cost of PURCHASE and the cost of SALE are somewhat different concepts, no?) But in Section 2 there is “initial cost on the date of acceptance for use,” but this is a section for the Buyer.

Anonymous

, there will be a “purchase cost” for the recipientPosted by

JanuaryAnonymous

, for the recipient there will be “acquisition cost”

Didn't understand. We are a seller. And our part in the act is section 1, and for the Buyer section 2. With the buyer everything is clear, but we, as the seller, what amount should be entered in column 8 of Section 1? It says “acquisition cost”. So we enter our purchasing, not sales? The same part of the act is filled out by us – the Seller. The buyer “does not touch” it. And in the column for the Seller it is written - cost of acquisition....

Posted by

ZZZhannaWell, no, it’s better to force illiterate people to read the regulations than to do extra work.

This is advice and not just for me!

Message from

Alexander_ne_bukhThis is advice and not just for me!

Well, I look at examples of filling. To be written - filled out by the Seller. The examples are numbers, but they are numbers and numbers in Africa. How to understand in the example without explanation - the sale or purchase price. The name of the column reads “purchase price” and if it is filled in by the seller, then how to interpret this name?) So, do you need to put your sales price in this column 8, not your purchase price? So?

- You can create new topics

- You can reply to topics

- You cannot attach attachments

- You can not edit your posts

Topic information

Users viewing this topic

This topic is viewed by: 1 (users: 0, guests: 1)

Your rights

Forum Rules

Conditions for registration

A car purchased from the organization’s current account, and which will be used in the future in the activities of the enterprise, and the costs of its acquisition will go to reduce the tax base, must be shown on the organization’s balance sheet. If the cost of the property you are purchasing exceeds 40 thousand rubles. (clause 5 of PBU 6/01) without VAT, then it is accounted for as a non-current asset, and for a non-current asset, such a vehicle must exceed 100 thousand rubles. (Clause 1 of Article 257 of the Tax Code of the Russian Federation). However, for their capitalization, the cost criterion alone is not enough. According to clause 4 of PBU 6/01, such an asset must simultaneously meet the following criteria (in addition to cost):

- if such property will be used for the production of products, performance of work or provision of services, is intended for the management needs of the organization, or will be provided by it for temporary possession and use or for temporary use

- the period of use of the asset in the organization’s activities will be more than 12 months;

- the object was not purchased for subsequent resale;

- the asset has the potential to generate income in the future.

The car is recorded on the balance sheet at the cost for which it was purchased. If you have registered it with the State Traffic Safety Inspectorate and it meets all four criteria given above, then, according to accounting rules, the car can be capitalized as a non-current asset.

In addition, in order to accept the transport purchased by an individual entrepreneur on the balance sheet, it matters who the purchase and sale record is issued for, as well as what is the purpose of the further use of such a vehicle. Therefore, in order for the regulatory authorities to recognize the legality of the purchase and sale transaction, it must be registered in the name of an individual entrepreneur, and not in the name of an individual, just as all primary documents and payment must also be made on behalf of the individual entrepreneur. In addition, the acquisition and further use of vehicles must be aimed at business activities, which is confirmed by waybills indicating routes and destinations. In this case, further costs, such as fuel and spare parts, can be recognized as expenses of the entrepreneur and accepted as NU.

However, in the case of individual entrepreneurs, the moment of purchasing a passenger car remains controversial, since letters from the Ministry of Finance (letter dated March 26, 2008 No. 03-04-05-01/79) and conclusions of desk tax audits often recognize the illegality of taking into account and expenses of individual entrepreneurs the cost of passenger cars. Entrepreneurs have to prove the legality of such operations through the courts. Therefore, when purchasing a passenger car, an individual entrepreneur may encounter difficulties in accruing expenses in his activities.

“1C: Accounting 8” (rev. 3.0): how to reflect the transfer of the OS for free use (+ video)?

How to reflect the transfer of a fixed asset (Fixed Asset) for free use in 1C:Accounting 8 (rev. 3.0)?

The video was made in the program “1C: Accounting 8” version 3.0.75.93.

A fixed asset transferred for free use remains the property of the organization, therefore it continues to be accounted for in account 01 “Fixed assets” and continues to pay off its value through depreciation (PBU 6/01 “Accounting for fixed assets”, approved by order of the Ministry of Finance of Russia dated March 30 .2001 No. 26n, Guidelines for accounting of fixed assets, approved by order of the Ministry of Finance of Russia dated October 13, 2003 No. 91n).

For profit tax purposes, fixed assets transferred for free use are accounted for in a new way from 01/01/2020 (as amended by Federal Law No. 325-FZ of September 29, 2019, hereinafter referred to as Law No. 325-FZ).

Now fixed assets transferred (received) under contracts for free use are not excluded from depreciable property. This means that these fixed assets can be depreciated in tax accounting.

At the same time, accrued depreciation on fixed assets transferred for free use cannot be taken into account in expenses for profit tax purposes (clause 16.1 of Article 270 of the Tax Code of the Russian Federation, introduced into the Tax Code of the Russian Federation by Law No. 325-FZ). Exceptions include fixed assets transferred for free use to government agencies and government institutions, if such an obligation is established by the legislation of the Russian Federation (Clause 4 of Article 256 of the Tax Code of the Russian Federation).

After the fixed assets are returned to the organization, the accrued depreciation amounts are again included in expenses.

According to the Russian Ministry of Finance, transactions involving the transfer of property rights under an agreement for gratuitous use are recognized as subject to VAT taxation (letter dated September 18, 2019 No. 03-07-14/71592). Some courts support this point of view (see, for example, Resolution of the Arbitration Court of the Far Eastern District dated May 15, 2019 No. F03-896/2019 in case No. A51-16899/2018). At the same time, there are opposite court decisions (see Resolution of the Federal Antimonopoly Service of the West Siberian District dated July 13, 2011 in case No. A81-4401/2010).

The amount of VAT accrued in connection with the transfer of an asset for free use is not taken into account for profit tax purposes (clause 16 of Article 270 of the Tax Code of the Russian Federation, letter of the Ministry of Finance of Russia dated November 26, 2013 No. 03-03-06/1/51112).

To reflect the transfer of OS for free use in “1C: Accounting 8” edition 3.0, you should use the document Transfer of OS

(section

OS and intangible assets

). The document is intended to reflect:

- moving fixed assets to another division;

- changes in the financially responsible person;

- suspension or resumption of depreciation;

- changes in the way depreciation expenses are reflected.

In the left column of the document header, you should fill in the details related to the new OS state as follows:

- Location of fixed assets

- indicate the division of the organization to which fixed assets are moved. In the same field, you can indicate for reference the name of the organization to which the fixed asset is transferred; - Recipient

- indicate the financially responsible person (MRP), who becomes responsible for the safety of fixed assets; - Accrual of depreciation

– a sign of accrual of depreciation after the movement of fixed assets (select the

Accrue

); - Method of reflecting depreciation expenses

- indicate a new method of reflecting expenses. As an expense account, you should indicate account 91.02 “Other expenses”, and as an item of other income and expenses - an item that is not taken into account for profit tax purposes.

In the right column of the document header, you should fill in the details related to the previous state of the OS as follows:

- The location of the fixed assets

is the division of the organization from which fixed assets are moved; - Deliverer

– the person who was responsible for the safety of the transported fixed assets; - OS event

- the name of an event in the life of a fixed asset, which is reflected in this document (for example,

Transfer for free use

).

In the Fixed Assets

a list of fixed assets intended for movement is indicated.

Starting from the next month after registration of the movement of fixed assets (after transfer for free use), depreciation begins to be calculated using a new method (will not be included in expenses in tax accounting).

To reflect the accrual of VAT, you should use a document of the same name (section Operations

). The cost of the service for providing OS for free use is determined at market prices (for example, as the cost of renting a similar OS).

As a VAT account, you should select account 91.02 and the item of other income and expenses with the type Expenses for the transfer of goods (work, services) free of charge and for your own needs.

If an organization applies PBU 18/02 (approved by order of the Ministry of Finance of Russia dated November 19, 2002 No. 114n), then a constant tax expense (PTR) will be recognized monthly.

Agreement and other documents

IMPORTANT! A sample car purchase and sale agreement between a legal entity (seller) and an individual (buyer) from ConsultantPlus is available at the link

The main document confirming the sale of a car between a legal entity and an individual is the purchase and sale agreement. The agreement does not currently contain any special features or innovations compared to previous periods. At the same time, its content must comply with the norms of civil legislation of the Russian Federation.

A standard car purchase and sale agreement is drawn up according to the norms of the Civil Code of the Russian Federation, Art. 161, 454, 458, 130, 224, 223. It must include:

- date and place where it was concluded;

- details of the parties (personal passport details and details of the seller-legal entity);

- contents of the transaction and obligations of the parties;

- detailed description of the car;

- cost (in numbers and words);

- how the obligations under the contract will be fulfilled: the procedure for transferring goods, transferring funds, date of transfer;

- accessories, additions to the car (if available);

- package of transferred documents.

On a note! Despite the fact that a car is movable property and when selling, in general, registration of rights is not required (Article 130 of the Civil Code of the Russian Federation), it must be re-registered to the new owner in the traffic police. One copy of the contract must be left with the inspectorate.

The sale of fixed assets in an organization is carried out by order of the manager. When concluding a contract and re-registration, you will need documents for the car, primarily a title. The disposal of fixed assets is documented in a package of accounting documents. When depositing cash through an individual's cash register, the buyer is given a confirming cash document and second copies of accounting documents. We will talk about them in more detail later.

How to account for the sale of a car that is a fixed asset ?

Nuances: real estate sales

On January 29, the office premises were transferred to Digital LLC under the OS acceptance and transfer certificate.

For this purpose, on January 21, the office space was prepared for sale and was no longer in use.

On February 8, ownership of the office premises was transferred to the buyer.

Step-by-step instructions for selling real estate PDF

Let's create the document Transfer of fixed assets in the section fixed assets and intangible assets - Disposal of fixed assets - Transfer of fixed assets.

If real estate objects are sold, then registration of the transfer of ownership rights is required upon sale. If the transfer of real estate is carried out before the transfer of ownership rights, then check the box The ownership right is transferred after state registration on the Additional .

Postings

When carrying out a document for the transfer of fixed assets without transfer of ownership, VAT and income will be charged according to the Tax Code (Clause 3 of Article 271 of the Tax Code of the Russian Federation), and revenue according to the Accounting Code will not be recognized, since it is determined at the moment of transfer of ownership.

Transfer of ownership rights to the buyer

In the future, complete the transfer of ownership using the document Sales of shipped goods in the Sales - Sales of shipped goods section.

When it is carried out, VAT will not be accrued, since it was calculated at the time of shipment, but revenue will be recognized according to accounting records. Revenue under NU is recognized on the date of signing the acceptance certificate (clause 3 of article 271 of the Tax Code of the Russian Federation).

Purchase of used fixed assets in 1C: Accounting ed. 3.0

Published 09/04/2020 08:16 Author: Administrator Business is like a car - it only goes down. Therefore, for its growth and development, renewal and replenishment of fixed assets is required. In order to save money, many businesses resort to purchasing equipment or vehicles that are not new. And here the first difficulties arise: at what cost to accept it, to which depreciation group to assign it to, how to find out the service life, and others. Let's look at a few examples of purchasing used equipment.

The cost of the fixed asset is less than 40,000 rubles

According to paragraph 5 of PBU 6/01, assets worth no more than 40,000 rubles can be reflected in accounting as part of inventories. Based on this, when purchasing a used fixed asset, its service life or whether it was depreciated by the former owner will not matter.

Please note that when we talk about the cost of 40,000 rubles, we mean the real redemption value under the contract without VAT, and not the residual value of this property from the previous owner, which he indicated in the act in form No. OS-1.

Reflection of such a purchase in the 1C software product: Accounting ed. 3.0 is completed in the section “Purchases” - “Receipts (acts, invoices)”.

In the window that opens, click on the “Receipt” button and select “Goods (invoice)” from the drop-down list. Let's fill in all the columns with the data from the invoice. To correctly reflect property on accounting accounts, an item should be created with the item type “Inventory and household supplies.”

The posted document will create transactions:

When putting equipment into operation, the document “Transfer of materials into operation” is entered in the “Warehouse” section. You should fill out the “Inventory and Household Supplies” tab.

When posting a document, the cost of a fixed asset is taken into account at a time in income tax expenses, in accordance with paragraph 1 of Article 256 and paragraph 1 of Article 254 of the Tax Code of the Russian Federation.

Also, inventory accounting continues to be maintained in the off-balance sheet account MTs.04.

The cost of the fixed asset is from 40,000 to 100,000 rubles

When purchasing property worth from 40 to 100 thousand rubles, the first step is to determine the useful life of this property.

If you decide that it is more than 12 months, then you must include this object in depreciable property according to accounting, since its cost is more than 40,000 rubles.

Tax accounting has slightly different assessment criteria. Thus, paragraph 1 of Article 256 of the Tax Code of the Russian Federation states that depreciable property is that which costs more than 100,000 rubles.

Based on this, such equipment at the time of its commissioning will be completely written off as expenses in tax accounting and will begin to be depreciated in accounting.

However, you do not have to be tied to the same depreciation bracket as the former owner, as required by the tax code.

For accounting purposes, an organization has the right to independently determine the useful life of a used fixed asset, guided by paragraph 20 of PBU 6/01.

To reflect such an operation, go to the “Fixed assets and intangible assets” section and select the “Receipt of fixed assets” item.

We will fill in the standard data for any purchase, such as the number and date of the invoice, counterparty, contract. Next, we need to indicate in which department this equipment will be located, who will be the financially responsible person, and on what account we plan to record depreciation costs.

Then, in the tabular part of the document, you should create a new fixed asset, indicating the asset accounting group, OKOF and depreciation group. After selecting the equipment we have created, we fill in the purchase cost, VAT rate and service life.

When posting a document, the program will create the following transactions:

Let's analyze them.

In the first line we see the receipt of a non-current asset from the supplier in the amount excluding VAT. VAT is allocated to account 19 in the fourth line.

The second line shows us the commissioning of a fixed asset, both for accounting and tax accounting.

And finally, in the third line, the cost of the fixed asset is attributed to expenses in tax accounting.

In the future, depreciation will be calculated only according to accounting records. Let's check. Let's go to the "Operations" section and select the "Month Closing" item.

Let’s select the month following the month of commissioning, click on the item “Depreciation and depreciation of fixed assets” and select the item “Perform operation” from the drop-down list. After this operation is written in green font, click on it again and select the “Show transactions” item.

Please note that depreciation is calculated only in accounting, based on our data: 60,000 rubles / 36 months = 1,666.67 rubles.

The cost of fixed assets is over 100,000 rubles

Let's move on to the most complex example of our article, when equipment that was previously in use is taken into account as depreciable property in both accounting and tax accounting.

First of all, let's determine the useful life. Here I would like to note that used fixed assets are included in the depreciation group in which they were included by the previous owner. This position is set out in paragraph 12 of Article 258 of the Tax Code of the Russian Federation. You can find out the depreciation group by looking at the Act in Form No. OS-1.

There is one more nuance: if, according to the accounting policy of the enterprise, you use the linear depreciation method, then you have the right to reduce the useful life of not new equipment by the number of months of their operation by the previous owner. This right is enshrined in paragraph 7 of Article 258 of the Tax Code of the Russian Federation.

If you use a non-linear method, then the useful life of fixed assets does not matter. The main thing is to include the object in the depreciation group in which it was taken into account by the former owner.

To reflect the receipt of fixed assets, we will use the document “Receipt of equipment” in the section “Fixed assets and intangible assets”.

Following our example, we purchase a used car, after which we register it with the traffic police and include the state duty paid for registration in the cost of the fixed asset.

In accordance with paragraph 8 of PBU 6/01, the state duty may be included in the initial cost of the car if registration with the traffic police was made after commissioning. The Tax Code adheres to the same criteria; this is stated in paragraph 1 of Article 257 of the Tax Code of the Russian Federation.

Let's move on to filling out the document. We will indicate when, from whom and under what contract the fixed asset was acquired. In the tabular section, you need to create a new directory element “Items” with the item type “Equipment (fixed assets)”, and then indicate the quantity and amount of the purchase.

The posted document will create transactions:

Now let’s enter the document “Receipt of additional. expenses."

The most convenient way to do this is by clicking on the “Create based on” button in the fixed asset purchase document. Or call this document from the “OS and intangible assets” section.

In the window that opens, we will indicate the counterparty, the amount of additional expenses and the method of distributing these expenses among the purchased objects. In our example, the method of distribution does not matter, since only one object is acquired. The “Products” tab will be filled in automatically due to the fact that we used the base-based input mechanism.

The posted document will create transactions:

After all additional expenses have been entered, go to the document “Acceptance for accounting of fixed assets” in the section “Fixed assets and intangible assets”.

We will indicate the date of commissioning, the method of receipt of fixed assets in the organization, useful life and methods of calculating depreciation.

You can read more about filling out this document in our articles Acquisition and registration of a vehicle in 1C: Accounting ed. 3.0. – Part 1 and Purchase and registration of a motor vehicle in 1C: Accounting ed. 3.0. – part 2. The completed and posted document will create the following transactions:

Please note the amount: we purchased the car for 500,000 rubles excluding VAT and paid another 2,000 for state registration. Thus, the initial cost of the fixed asset was 502,000 rubles.

Let’s check the depreciation calculation; to do this, go to the “Operations” section and select the “Month Closing” item. We indicate the next month, after the month of commissioning, click on the item “Depreciation and depreciation of fixed assets” and select “Perform operation” from the drop-down menu. After this line turns green, click on it again and select “Show transactions”.

According to our example, the car was initially taken into account with a useful life of 48 months, and a year later it was sold to us. Accordingly, when we accepted it for accounting, we also assigned it to the third depreciation group, and in connection with the use of the linear method of calculating depreciation, we credited the years of accrued depreciation from the former owner. The resulting period was 36 months.

Let's calculate depreciation: 502,000 rubles / 36 months = 13,944.44 rubles, which is what we see as a result of the routine operation.

Author of the article: Alina Kalendzhan

Did you like the article? Subscribe to the newsletter for new materials

Add a comment

Comments

0 Alina Kalendzhan 11/27/2020 03:43 I quote Alena Vostrilova:

Good afternoon Tell me what to do in a situation where the OS has been completely depreciated by the previous owner? How to set up SPI for a new buyer?

Good afternoon.

In this case, taxpayers have the right to independently determine the SPI of this fixed asset, taking into account safety requirements and other factors. Quote 0 Alena Vostrilova 11.20.2020 18:44 Good afternoon! Tell me what to do in a situation where the OS has been completely depreciated by the previous owner? How to set up SPI for a new buyer?

Quote

Update list of comments

JComments