Compensation to an employee for the use of his personal property is discussed in Article 188 of the Labor Code of the Russian Federation. Moreover, the specialist must use the car with the consent (knowledge) of the employer and in the interests of the latter. The agreement must be formalized in writing, for example, in an additional agreement to the employment contract. Otherwise, the employee will not be able to claim compensation. It is useless to turn to the servants of Themis for help (appeal rulings of the St. Petersburg City Court dated April 5, 2018 No. 33-7704/2018, Perm Regional Court dated August 16, 2017 No. 33-8949/2017 and the Moscow City Court dated November 14, 2014 No. 33- 23925/2014).

Moreover, the employer has the right to prohibit employees from using personal transport when performing work duties. If an individual is provided with everything necessary for work, compensation can definitely be forgotten (Appeal ruling of the Moscow City Court dated 04/08/2015 No. 33-11579/2015).

It’s another matter if the necessary conditions were not created for the specialist, and therefore he had to spend money. In this case, the court may oblige the employer to pay compensation to the employee, even in the absence of a written agreement on it (Appeal ruling of the Volgograd Regional Court dated July 11, 2013 No. 33-7602/2013).

"Profitable" mockery

Article 188 of the Labor Code of the Russian Federation deals with the payment of compensation to an employee “for the use, wear and tear (depreciation)” of property. But what exactly lies behind this very “use” is unclear. Officials tried to fill the gap.

Thus, recently, in a letter dated March 23, 2018 No. 03-03-06/1/18366, the Ministry of Finance indicated: the compensation already takes into account the reimbursement of costs arising during the operation of machines (wear, fuels and lubricants, repairs). This position is well-established (see letters dated April 10, 2017 No. 03-03-06/1/21050 and letters dated September 23, 2013 No. 03-03-06/1/39239). Moreover, in earlier explanations, financiers emphasized: compensation generally includes any costs that arise when using transport, including the costs of its maintenance (letter dated May 16, 2005 No. 03-03-01-02/140, etc.). The capital's tax authorities echo them (letter from the Federal Tax Service of the Russian Federation for Moscow dated February 22, 2007 No. 20-12/016776).

This position is of decisive importance primarily for profit tax purposes. The fact is that the costs of compensation for the use of personal cars and motorcycles for business trips are taken into account only within the limits established by the ancient Government Decree No. 92 of 02/08/2002 (subclause 11, clause 1, article 264 of the Tax Code of the Russian Federation).

These limits are simply ridiculous: for cars with an engine capacity of up to 2000 cc. cm - 1200 rubles per month, over 2000 cubic meters. cm - 1500 rubles, and for motorcycles - 600 rubles.

If the compensation includes wear, fuel, and lubricants, repairs, and maintenance of the machine, then you can imagine how small a part of it the company will be able to write off as tax expenses. In this situation, 1200 (1500) rubles. per month – it’s just nothing. And regarding motorcycles – no comments at all...

Unfortunately, it will be difficult to argue with officials. The referees support them. Take, for example, the Determination of the Supreme Arbitration Court of the Russian Federation dated January 29, 2009 No. VAS-495/09 and the Decision dated September 14, 2009 No. VAS-10278/09. Senior arbitrators also believe that “personal” compensation includes all costs incurred by the employee when operating the machine, including fuel and lubricants.

It is unlawful to take into account the cost of gasoline separately, that is, in addition to compensation, in such a situation.

Plus, “profitable” standards are established based on the fact that the car is used to its fullest. If during a month, due to vacation, business trip, illness of an employee, etc., the car was idle for official needs, compensation for this time is not paid (letter of the Federal Tax Service of the Russian Federation for Moscow dated February 22, 2007 No. 20-12/016776). And if it was nevertheless issued for a given period, this amount cannot be written off as expenses - the Ministry of Finance is against it (letter dated December 3, 2009 No. 03-04-06-02/87).

Let's say there are 21 working days in a month. The employee used his car (the norm for which is 1,500 rubles) for business purposes for only 15 days. In this case, the amount of compensation that reduces the taxable profit of the enterprise will be 1071.43 rubles. (RUB 1,500 × 15 days / 21 days).

By the way, Chapter 25 of the main tax document does not limit compensation to employees for freight transport. Therefore, it can be written off as expenses in full on the basis of subparagraph 49 of paragraph 1 of Article 264 of the Tax Code of the Russian Federation. Naturally, if the requirements of Article 252 of the Code are met (letter of the Ministry of Finance of Russia dated March 18, 2010 No. 03-03-06/1/150).

simplified tax system

The tax base of organizations that apply the simplification and pay a single tax on income does not reduce the cost of paying for travel tickets (clause 1 of Article 346.14, clause 1 of Article 346.18 of the Tax Code of the Russian Federation).

If an organization pays a single tax on the difference between income and expenses, accounting for expenses for travel tickets depends on:

- whether the employee whose travel is paid has a traveling nature of work;

- Is travel payment for the employee provided for in the employment (collective) agreement.

If an organization pays travel for employees whose work is not required to travel, the cost of travel tickets is:

- take into account when calculating the single tax as part of labor costs - if the organization’s obligation to pay for travel is provided for in the labor (collective) agreement (subclause 6, clause 1, clause 2, article 346.16, article 255 of the Tax Code of the Russian Federation). Please take into account the costs at the time of payment (clause 2 of Article 346.17 of the Tax Code of the Russian Federation);

- do not take into account when calculating the single tax - if the organization’s obligation to pay for travel is not provided for in the labor (collective) agreement (subclause 6, clause 1, clause 2, article 346.16, article 252 of the Tax Code of the Russian Federation).

Personal income tax and contributions: not without nuances

The picture regarding insurance premiums and personal income tax is more optimistic. In 2018, officials repeatedly noted: auto compensation is free from these payments in the amount determined by the agreement between the company and the employee. In this case, the use of the machine must be related to the employee’s performance of work duties.

This conclusion follows from paragraph 3 of Article 217 and paragraph 10 of subparagraph 2 of paragraph 1 of Article 422 of the Tax Code of the Russian Federation (letters of the Ministry of Finance of Russia dated September 12, 2018 No. 03-04-06/65168, No. 03-04-06/65170 and dated January 23, 2018 No. 03-04-05/3235, Federal Tax Service dated November 13, 2018 No. BS-3-11/ [email protected] ).

In our opinion, the intensity of transport use here also needs to be taken into account (by analogy with income tax). After all, auditors will most likely consider that the nature of payments for days when the machine was idle for official purposes is not compensatory. As a result, additional personal income tax and contributions, fines and penalties are charged.

note

Compensation for passenger cars and motorcycles is recognized in tax accounting on the date of its payment to the employee (subclause 4, clause 7, article 272 of the Tax Code of the Russian Federation). In our opinion, this rule also applies to compensation for trucks. Officials have repeatedly expressed a similar point of view in private explanations.

One more nuance. Previously, officials argued that “profitable” norms should also be taken for income tax purposes. That is, on compensation amounts exceeding these ridiculous limits, personal income tax must be paid (see letters from the Ministry of Finance of Russia dated 01.06.2007 No. 03-04-06-01/171, Federal Tax Service of the Russian Federation for Moscow dated 21.01.2008 No. 28-11/ 4115). However, the arbitrators did not agree with this strange position, pointing out quite logically: Government Resolution No. 92 dated 02/08/2002 was issued specifically for income tax purposes. And the norms he established have nothing to do with personal income tax (Resolution of the Presidium of the Supreme Arbitration Court of the Russian Federation dated January 30, 2007 No. 10627/06). As a result, officials changed their anger to mercy, indicating: compensation from income tax is free in the amount fixed by the parties (letter of the Ministry of Finance of Russia dated December 23, 2009 No. 03-04-07-01/387, sent for information and use in work by a letter from the Federal Tax Service dated 01/27/2010 No. МН-17-3/ [email protected] ). The departmental point of view, fortunately, is still the same, which is also confirmed by the clarifications we mentioned in 2021.

There are also some nuances regarding insurance premiums. For example, sometimes auditors insist that they tax the entire amount of auto compensation. However, according to the arbitrators, such compensation within the amount established by the agreement between the enterprise and the employee is not remuneration. It does not refer to remuneration for the performance of labor or other duties, nor to material benefits. This means that such payments are free of insurance premiums (Determination of the Armed Forces of the Russian Federation dated April 25, 2016 No. 302-KG16-3855).

As for contributions for injury, “personal” compensation is also exempt from them in the amount determined by the company and the employee (letter of the Federal Social Insurance Fund of the Russian Federation dated November 17, 2011 No. 14-03-11/08-13985, resolution of the AS of the West Siberian District dated August 24. 2015 No. F04-21805/2015). At the same time, the servants of Themis emphasize that regulations in the field of “traumatic” insurance do not establish compensation limits for the use of a personal car (Resolution of the Federal Antimonopoly Service of the Ural District dated 03.03.2011 No. F09-133/11-S2, upheld by the Determination of the Supreme Arbitration Court of the Russian Federation dated 05.08.2011 No. VAS-8118/11). However, there are also examples of verdicts with the conclusion that auto compensation paid in excess of the “profitable” norms is subject to contributions for injury (Resolution of the Federal Antimonopoly Service of the Ural District dated March 22, 2004 No. F09-1001/04-AK). So the possibility of a dispute with controllers on this issue cannot be completely ruled out. But in the event of a trial, the company's chances of success are very high. And now - the most important thing. To avoid troubles with taxes and contributions, the amount of compensation must be economically justified.

Issuance of travel cards

Situation: how to issue travel tickets to employees?

Travel tickets must be received at the box office. The cashier is responsible for their safety. As necessary, employees who have the right to use travel tickets receive them against signature, and upon returning from a trip (at the end of their validity period) they hand them back. The movement of travel tickets must be reflected in a special statement, which the organization develops independently (Part 1, 4, Article 9 of the Law of December 6, 2011 No. 402-FZ). It must be borne in mind that the primary document must contain the mandatory details established by Part 2 of Article 9 of the Law of December 6, 2011 No. 402-FZ.

The list of employees who have the right to use travel tickets must be approved by order of the manager (another local act of the organization, for example Labor Regulations) or established in an employment (collective) agreement. This procedure follows from Part 3 of Article 57 of the Labor Code of the Russian Federation.

Situation: should an organization assign a public transport ticket purchased by it to a specific employee?

Answer: no, you shouldn't.

An organization has the right to purchase one or more travel tickets without assigning them to specific employees. In this case, the ticket is issued to employees as needed and then returned. The order for the organization may not specify the positions and names of employees who have the right to use such a travel ticket. But you need to specify the rules for its storage and use. In addition, provide in the order the procedure for confirming the official nature of the trips.

How to secure compensation

The amount of compensation must be clearly justified. To do this, you need to make a detailed calculation, taking into account all the costs for each specific machine (wear, fuel costs, maintenance, etc.). The intensity of using a car for business purposes should also be taken into account (letter of the Ministry of Finance of Russia dated May 16, 2005 No. 03-03-01-02/140). Financiers have repeatedly mentioned that it is impossible to do without calculating compensation (see, for example, letters dated September 12, 2018 No. 03-04-06/65168, No. 03-04-06/65170).

If the amount of compensation is not properly justified, allegations of hidden wages will most likely not be avoided. With all the consequences regarding personal income tax and contributions. Problems may also arise with “profitable” expenses, since one of the requirements of Article 252 of the Tax Code of the Russian Federation will not be met.

note

You need to fill out your waybill as carefully as possible! Indeed, in the absence of data on a specific destination, it is impossible to judge the fact of using the car for business purposes (letter of the Ministry of Finance of Russia dated February 20, 2006 No. 03-03-04/1/129). As a result, the organization will face negative consequences, for example, additional assessment of income tax (Resolution of the Moscow District Administration of 04/08/2015 No. F05-3450/2015).

By the way, the very need to use an employee’s car should be justified (for example, his work involves constant travel, which is clear from the job description). And one more thing - the auditors will probably want to get acquainted with copies of documents confirming that the property used belongs to the employee (letters from the Ministry of Finance of Russia dated January 23, 2018 No. 03-04-05/3235, dated December 1, 2011 No. 03-04-06/6-328).

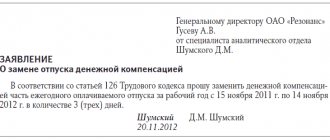

The basis for payment of compensation to workers is an order from the head of the organization, which stipulates its amount (letter from the Federal Tax Service of the Russian Federation for Moscow dated January 13, 2012 No. 20-15 / [email protected] ). The specialist will be required to submit a statement outlining both his consent to use his car for business purposes and a request for compensation for expenses incurred in this regard (Resolution of the Federal Antimonopoly Service of the Moscow District dated September 25, 2012 No. A40-104646/11-119-902) .

Of course, the expenses incurred by the employee in connection with the operation of the machine for the benefit of the company must be documented. For example, advance reports with attached checks, receipts for the purchase of fuels and lubricants, consumables, etc., acts of work performed (with a breakdown of their specific types) for maintenance, repairs, etc. This is emphasized, in particular, in letters from the Federal Tax Service dated November 13. 2018 No. BS-3-11/ [email protected] and the Ministry of Finance of Russia dated September 12, 2018 No. 03-04-06/65168, No. 03-04-06/65170.

Order to pay compensation for the use of a personal car

To calculate and pay compensation, it is not enough to receive an application from the employee. The head of the company must issue an appropriate order. Such a document is drawn up in any form, taking into account all the required details.

An integral part of the order is its number and date.

After this, it is written down on the basis of which the order was drawn up. Most often, Article 188 of the Labor Code of the Russian Federation and the details of the employment contract or additional agreement to it are prescribed here.

Next, point by point, you need to write down in detail the total amount of compensation per month. What kind of machine is used in the work and its main characteristics. For what expenses is compensation calculated? On what day is the payment made and under what conditions?

At the bottom is the signature of the director, the accounting employee and the employee himself.

On the road - with a waybill?

Do you need waybills when using a personal car for business purposes? As practice shows, this issue is one of the most controversial.

On the one hand, such sheets are intended to record the work of an enterprise’s transport, and not the personal cars of its employees. Therefore, you can do without them, especially if the specialist is not a company driver (resolutions of the Federal Antimonopoly Service of the Central District dated May 25, 2009 No. A62-5333/2008, dated April 10, 2006 No. A48-6436/05-8, Moscow District dated December 19. 2011 No. A40-152815/10-116-694).

Some officials in private consultations expressed the opinion that in order to write off auto compensation for tax expenses, an order from the manager with its amount, as well as a job description indicating the traveling nature of the employee’s work, is sufficient. But on the other hand, how exactly to confirm the actual use of an individual’s property in the interests of the company? Just with the help of a waybill containing the date, purpose of the trip, specific route, kilometers traveled, fuel consumption, etc. After all, for example, a gas station receipt indicates that the fuel was purchased, but for whose needs - the company or the employee himself - unclear. Therefore, there is no way without a waybill (see letters from the Federal Tax Service of Russia dated November 13, 2018 No. BS-3-11/ [email protected] , the Ministry of Finance of Russia dated June 27, 2013 No. 03-04-05/24421, etc.). It is separately noted that the memo does not confirm the use of a personal car for the benefit of the company (letter from the financial department dated April 20, 2015 No. 03-03-06/22368).

In the absence of a waybill, the auditors will probably consider that the employee received an economic benefit (to the extent that it can be assessed), and the expenses are not economically justified. As a result, additional personal income tax, insurance premiums and income taxes, fines and penalties are charged.

Many judges agree that the use of a personal car for the benefit of the company is confirmed by waybills (see decisions of the Arbitration Court of the Ural District dated October 18, 2018 No. A71-312/2018 and dated May 16, 2016 No. F09-4056/16, Arbitration Court of the North- Western District dated 03/16/2015 No. A05-6484/2008 and FAS of the same district dated 02/17/2006 No. A66-7112/2005).

Hence the conclusion - it is better not to ignore such documents, but to draw them up clearly and carefully. Of course, this is a certain hassle, but it's worth it. Otherwise, claims from auditors most likely cannot be avoided. In principle, the company has a chance to defend its position in court, but wasting time, energy and tempting fate is not an activity suitable for everyone.

In addition, some will likely escape with little blood. According to financiers, waybills should be drawn up at a frequency that allows one to judge the reasonableness of expenses. Let’s say this can be done once a month, if the accounting of time worked and fuel consumption does not suffer (letter dated February 20, 2006 No. 03-03-04/1/129). This means that in some cases the additional burden on employees and accounting can be reduced to a minimum.

And further. Keep in mind that the waybill is not recognized as a primary document, which in itself certifies a business operation (Resolution of the Federal Antimonopoly Service of the Ural District dated March 12, 2014 No. A07-11574/2013). So you can’t do without checks, receipts, acts and other papers indicating expenses incurred.

To complete the picture, we recommend keeping a log of business trips.

Features of accounting, or “Favorite” PBU 18

As for accounting, according to PBU 10/99 (approved by order of the Ministry of Finance of Russia dated May 6, 1999 No. 33n), compensation is included in expenses in full as of the date of accrual. In tax accounting, it is included as expenses (within the limits of “profitable” norms) on the date of payment. It is not uncommon for companies to accrue compensation in one month and pay it out the next. This leads to the emergence of a deductible temporary difference (DTD) and, as a consequence, a deferred tax asset (DTA). These VVR and ONA are repaid at the time of payment of compensation (clause 17 of PBU 18/02, approved by order of the Ministry of Finance of Russia dated November 19, 2002 No. 114n).

In addition, if the compensation exceeds the “profitable” limit (which happens to almost everyone), a permanent difference is formed and, accordingly, a permanent tax liability (PNO).

Let us remind you that by order of the Ministry of Finance of Russia dated November 20, 2018 No. 236n, significant changes were made to PBU 18/02. The amendments apply starting with reporting for 2021. However, the company has the right to start doing this earlier, disclosing its decision in the accounting (financial) statements.

When calculating compensation, it is better to use the same cost accounts where the employee’s salary is reflected (20 “Main production”, 26 “General expenses”, 44 “Sales expenses”, etc.).

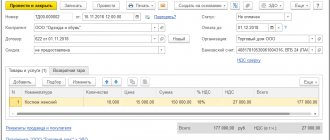

Example.

Car compensation: calculation, taxes, accounting An employee uses his passenger car with an engine capacity of over 2000 cubic meters for business purposes.

see. For this, the individual is entitled to compensation (the company calculates it at the end of the month and pays it at the beginning of the next month). Its size consists of the monthly wear and tear of the car (RUB 8,300), as well as the cost of fuel and lubricants and other costs that arise during the operation of the car. All costs for compensation purposes are taken in the part that falls on the time the machine is used in the interests of the employer. Data on fuel consumption and mileage for the month are taken from travel reports. For the current month, the cost of fuel and lubricants was 29,700 rubles, the total mileage of the car for the month was 3,300 km, including 2,400 km for business needs. There were no other costs associated with operating the car this month. The machine was used for the benefit of the company during all working days of the month. Thus, the amount of compensation was 27,636.36 rubles. ((RUB 8,300 + RUB 29,700) / 3,300 km × 2,400 km). This entire amount is not subject to personal income tax, insurance and injury contributions. It was possible to include only 1,500 rubles in “profitable” expenses, that is, the maximum amount of compensation in accordance with Decree of the Government of the Russian Federation dated 02/08/2002 No. 92. The excess amount is 26,136.36 rubles. (27,636.36 – 1500) – not reflected in tax accounting. The company's accountant made the following entries. As of the date of accrual of compensation: Debit 26 Credit 73

-27,636.36 rubles.

– the amount of compensation is included in expenses; Debit 99 sub-account “PNO” Credit 68 sub-account “Income Tax”

- 5227.27 rubles.

(RUB 26,136.36 20%) – a permanent tax liability is reflected; Debit 09 Credit 68 subaccount “Income Tax”

-300 rub.

(RUB 1,500 20%) – a deferred tax asset is reflected. On the date of payment of compensation: Debit 73 Credit 51

-27,636.36 rubles.

– compensation is transferred to the employee; Debit 68 subaccount “Income Tax” Credit 09

-300 rub. – the deferred tax asset is repaid.