The law allows an individual entrepreneur to receive a discount on the insurance rate for premiums for injuries.

Dear readers! The article talks about typical ways to resolve legal issues, but each case is individual. If you want to find out how to solve your particular problem , contact a consultant:

+7 (499) 938-81-90 (Moscow)

+7 (812) 467-32-77 (Saint Petersburg)

8 (800) 301-79-36 (Regions)

APPLICATIONS AND CALLS ARE ACCEPTED 24/7 and 7 days a week.

It's fast and FREE !

However, it must be taken into account that the indicators that allow one to count on a reduction in contributions have been changed. The discount is not available to everyone.

In order for a citizen to count on paying contributions on preferential terms, you need to study the rules for submitting an application to the Social Insurance Fund before November 1, 2020.

FSS latest edition, download report form

This table shows the costs of injury contributions . On lines 1-8, fill in columns 3 (number of days) and 4 (amount). Payment information must be provided:

- on line 1 - in connection with accidents;

- on line 4 - in connection with occupational diseases;

- on line 7 - for vacation for sanatorium treatment.

Data on these payments is detailed. The number of days and amount are indicated in relation to persons who:

- suffered while working outside (lines 2 and 5);

- suffered while working for another organization (lines 3, 6 and 8).

For the rest of the line, the following information is indicated:

- line 9 - amount spent on measures to prevent injuries and occupational diseases;

- line 10 - total cost (sum of lines 1, 4, 7 and 9);

- line 11 - the amount of benefits that were accrued but not paid.

Information about the number of affected persons is reflected here . There are only 5 lines in the table, which indicates:

- in line 1 - the number of persons injured due to accidents, based on reports of industrial accidents in form N-1;

- in line 2 - the number of people injured in fatal accidents (included in the indicator from line 1);

- in line 3 - the number of persons affected by occupational diseases, based on acts on cases of occupational diseases;

- in line 4 - the total number of victims (line 1 + line 3);

- in line 5 - the number of persons who lost their ability to work only temporarily, based on data from sick leave.

Lines 1-3 indicate insured events for the reporting period according to the date of the examination .

Usually, before the start of the next reporting season, the accounting community is concerned with the question: whether they were “pleased” with an unexpected update of reporting forms, including whether a new form 4-FSS appeared with the reporting for the 2nd quarter.

There is no reason to worry yet. It is difficult to call the current 4-FSS form new - its last adjustments took place in the summer of 2021 (Order of the FSS of the Russian Federation dated 06/07/2017 No. 275).

A few words about the changes made to 4-FSS by Order No. 275:

- A new field “Budgetary organization” has appeared on the title page, in which budgetary organizations indicate the source of funding.

- Two new lines were added to Table 2 - 1.1 (to reflect the amount of debt owed by the reorganized policyholder) and 14.1 (reflecting the debt of the Social Insurance Fund).

No adjustments that could affect the rules for filling out 4-FSS for the 2nd quarter of 2021 have been made recently. This applies not only to the rules for filling out, but also to the form (form) of this report. For this reason, we do not call Form 4-FSS for the 2nd quarter of 2020 new.

You can download the current 4-FSS form for the 2nd quarter of 2021 here.

As before, the procedure for filling out 4-FSS is regulated by Order of the Social Insurance Fund dated September 26, 2016 No. 381 (Appendix No. 2).

Let's look at an example of how to fill out the calculation based on the results of the six months. Please note that the indicators for the calculation are collected on an accrual basis - for the 1st quarter, half a year, 9 months and a year, so the calculation, although it contains data including for the 2nd quarter, generally combines semi-annual indicators (clause 5.4 of the Procedure approved by the order No. 381).

Example

Krasny Bor LLC employs 38 people. Before registering 4-FSS for the first half of the year, specialists from Krasny Bor LLC collected the necessary information:

1. We decided on the composition of the calculation, taking into account the fact that there were no accidents in the company, benefits for personal and labor protection were not paid in the reporting period, and employees were not transferred to other companies under an outsourcing agreement. As a result, there are no indicators for filling out tables 1.1, 3 and 4 - these tables are not filled out and not submitted (clause 2 of the Procedure approved by Order No. 381). You must complete the title page and mandatory sections 1, 2 and 5.

2. There are no workplaces with harmful and/or dangerous working conditions at Krasny Bor LLC.

3. According to a special assessment conducted in 2021, 12 out of 25 workplaces subject to this procedure were examined. These data will be reflected in the semi-annual calculation.

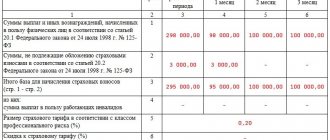

4. Information on the amounts of contributions subject to contributions and accrued injury contributions is presented in the table:

Sample of filling out form 4-FSS (2nd quarter 2021)

4-FSS is represented by everyone who uses the labor of individuals and pays “injury” contributions for them. This category includes organizations and entrepreneurs, as well as citizens without individual entrepreneur status who hire personnel, for example, a personal driver.

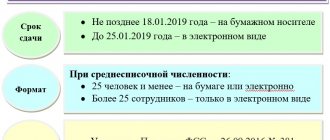

4-FSS is submitted quarterly. Its type - paper or electronic - is selected depending on the number of insured people. If there are more than 25 people, then it is necessary to send the calculation to the Social Insurance Fund in electronic form. With fewer employees, you can choose the submission form yourself.

Currently, Form 4-FSS is in force, approved by order of the fund dated September 26, 2016 No. 381. The same document also provides instructions for filling out the calculation. In accordance with it, it is mandatory to fill out the following sections: title page, Table 1, Table 2 and Table 5. Data in the remaining tables are indicated if there are relevant transactions in the reporting period:

- Table 1.1 – if personnel are temporarily sent to another employer (contributions are calculated according to its tariffs);

- Tables 3 and 4 - if there were cases of occupational diseases or injuries.

Let's take a closer look at the current Form 4-FSS and instructions for filling it out in 2021.

The deadline for submitting 4-FSS depends on the form of submission. There are two deadlines for submitting calculations: the 20th and 25th of the month following the reporting month. If the form is submitted on paper, then it must be submitted to the Social Insurance Fund by the 20th, if electronically - by the 25th. If the reporting deadline falls on a weekend or holiday, the period is extended to the next working day.

However, in 2021, coronavirus made its own adjustments to the reporting periods. In this regard, 4-FSS for the 1st quarter had to be submitted before May 15. The remaining deadlines for submitting the form are as follows: for half a year – July 20/27, for 9 months – October 20/26, for 2021 – January 20/25, 2021.

Relevant for submitting calculations for 2021 is Form 4-FSS, the latest edition of which was approved by order of the Federal Social Insurance Fund of the Russian Federation dated June 7, 2017 No. 275 “On amendments to appendices No. 1 and No. 2 to the order of the Social Insurance Fund of the Russian Federation dated September 26, 2016 No. 381 “On approval of the form of calculation for accrued and paid insurance contributions for compulsory social insurance against accidents at work and occupational diseases, as well as for the costs of paying insurance coverage and the Procedure for filling it out.” This is not the first time a report has been submitted to this form, so the “new” form can be called very conditionally.

To fill out the calculation, you must follow the procedure given in Appendix No. 2 of Order No. 381 of the FSS of the Russian Federation with clarifications of Order No. 275 of the FSS of the Russian Federation dated June 7, 2021. When filling out a paper version of the calculation, you must use a blue or black pen, using block letters. You can fill out the form on your computer.

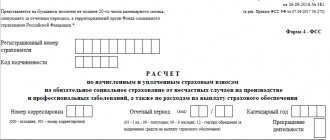

On each page, the policyholder must indicate his registration number and subordination code. These data are indicated in the notice issued when registering the policyholder with the social insurance fund. The policyholder's signature and the date of signing the document are indicated at the bottom of the page.

The adjustment number “000” is indicated on the title page if the quarterly form is submitted for the first time. In the future, if a revised calculation is submitted, then “001” is entered, subsequent clarifications of the same report are given “002”, etc. The updated calculation must be submitted according to the reporting form that was in effect during the period for which errors were identified.

Reporting periods are the first quarter, half-year, and nine months of the calendar year, which are respectively designated “03,” “06,” and “09.” The billing period is the calendar year, which is designated by the number “12”.

The pages of the form must be numbered and their number, as well as the number of pages of attachments (if any), are indicated on the title page.

Cash amounts in calculations are not subject to rounding, i.e. are indicated in rubles and kopecks. If the indicator is zero, then a dash is placed in the corresponding column.

Table 1 - it reflects the calculation of the base for calculating contributions for “injuries”. Indicators are indicated on a cumulative basis from the beginning of the year, and are broken down by month of the last quarter of the reporting period.

Table 1.1 is filled out by policyholders if their employees, on the basis of a contract, were sent to work for other employers. (clause 2.1 of article 22 of the law of July 24, 1998 No. 125-FZ).

Table 2 - the calculation is filled out according to the policyholder’s accounting data on the status of settlements for contributions and expenses.

Table 3 - is filled in when there are expenses for “injuries”, that is, payments for temporary disability certificates for industrial accidents or injuries, payment for leave for the treatment of occupational diseases at resorts and sanatoriums.

Table 4 - it indicates the number of people affected by occupational diseases and industrial accidents. The data is indicated on the basis of the relevant acts. This table is located on the same page as Table 3.

Table 5 - information on the results of a special assessment of working conditions and medical examinations of workers performed. The table reflects the number of jobs subject to assessment, the number of workers in hazardous production conditions and, accordingly, the number of jobs assessed and the number of workers who underwent medical examinations at the beginning of the year.

The FSS of Russia has developed a draft order approving the new reporting form 4-FSS. The new document will come into force with reporting for the 1st quarter of 2021. The changes are related to the transition to direct payments to employees from the fund.

What will change in the calculation:

- The column “Subordination Code” will appear on the title page - the code of the FSS body where the policyholder is registered.

- Table 1 will change its name to “Calculation of premium amounts”; a new line “Calculated insurance premiums” has been added to it.

- Table 1.1 will be supplemented with a breakdown of information about the base and contributions for organizations with designated independent classification units (SCU). It is formed by type of activity: in the first line of the “Main Foreign Economic Activity” it is necessary to indicate data related to that part of production (activity) that is not allocated in the SKE.

- Table 2 is intended for policyholders who temporarily send their employees under an outsourcing agreement.

- Tables 2 and 3 will be removed from the current calculation form.

- Current tables 3, 4 and 5 will be renumbered.

The deadline for submitting a report to Social Insurance in Form 4-FSS for the 4th quarter of 2021 depends on the method of submission. For policyholders who generate reports on paper, the report is submitted no later than 01/20/2021. There is a deadline of January 25 for injury contribution payers reporting electronically.

A single memo to the accountant, the deadline for submitting the new Form 4-FSS for 2020 in one table:

| Electronic | On paper |

|

|

IMPORTANT! There are special rules for choosing the type of submission of 4-FSS reports: for policyholders with an average number of up to 25 people, they are provided on paper, for payers with 25 or more employees - exclusively in electronic form.

The policyholder independently determines how to submit 4-FSS electronically: use the free state FSS portal or purchase a license to send electronic reports through an electronic document management operator.

Companies suspend operations infrequently. In most cases, this situation occurs in non-profit organizations; public sector employees are “frozen” much less often.

If the activity of the entity is suspended, there are no taxable charges in favor of employees, it is necessary to submit a zero 4-FSS. Even if there were no accruals in favor of full-time employees in the billing period, for example, if a non-profit organization did not make payments throughout 2021, then still submit the report on time.

Officials did not provide any exceptions; a zero 4-FSS report is required to be submitted to inspectors. A fine will be issued for failure to pass zero marks. To prevent the application of sanctions, you will have to fill out the title page of the 4-FSS form and tables numbered 1, 2 and 5.

Initial data

If an individual entrepreneur has employees, he must make contributions for injuries.

They are calculated based on the current tariff plan, as well as taking into account existing discounts or surcharges.

As a general rule, the tariff depends on the type of activity the individual entrepreneur or organization is engaged in. At the same time, the Social Insurance Fund has the right to establish additional discounts or allowances.

In order for a company to receive the right to make contributions on preferential terms, its labor safety indicators are compared with industry averages.

When deciding whether to grant a discount, Social Insurance Fund employees take into account the following indicators:

- number of insurance cases per 1000 working people;

- the total costs that the Social Insurance Fund had to incur to pay for insured events with the employer, as well as the total amount of accrued contributions;

- the number of days of incapacity for work that occurred per insured event.

Today, individual entrepreneurs can count on receiving a discount for 2021. To do this, they need to submit an application to the Social Insurance Fund before November 1, 2021.

The application will be considered. If it is satisfied, the entrepreneur will have to pay smaller contributions in the coming period.

In this case, it is allowed to submit an application directly on November 1, 2020. Completion of the action will not constitute a violation of the deadline.

Who is eligible to apply

Any organization or individual entrepreneur can count on a discount, but only if the following conditions are met:

- at the time of submitting the application, the policyholder does not have any debt on contributions for injuries;

- the entrepreneur pays the contribution without delay;

- the company has been registered and has actually been operating for three or more years;

- There are no fatalities in the organization.

If, while working, an employee dies as a result of an insured event, and the incident is not the fault of third parties, you should not count on receiving a discount.

The possibility of making contributions on preferential terms is a right of an entrepreneur, not an obligation.

If for some reason he does not want to reduce the amount of contributions, the law does not force him to contact the Social Insurance Fund with an application.

There will be no automatic reduction in the amount of contributions even if you have the right to a discount.

Deadline for submitting the completed form

An application must be submitted to the Social Insurance Fund no later than November 1 of the year preceding the contribution period. So, if a person wants to receive a discount in 2021, he must apply in 2020.

If the action is not carried out, the privilege will not be granted during the next period. The law allows you to submit an application until November 1 inclusive.

So, if a person applies to the FSS on this day, this will not constitute a violation. Employees of the institution do not have the right to refuse to provide a discount. If the application is submitted on November 2, 2021, you will not be able to receive the discount in 2021.

Legal basis

The provision of discounts is carried out strictly in accordance with the norms of current legislation.

If a person wants to make payments on preferential terms, he should first familiarize himself with:

| Federal Law No. 125 “On compulsory social insurance against accidents” dated July 24, 1998 | Contains the entire list of standards in accordance with which social insurance of employees is carried out and payments are provided. It also stipulates who is obliged to make contributions to the Social Insurance Fund, and also records the specifics of the implementation of the action. The regulatory legal act determines the size of the lump sum and monthly insurance payment. The employer has no right to deviate from the established deadlines. Violation of the law may result in prosecution |

| Decree of the Government of the Russian Federation No. 524 “On approval of the rules for establishing discounts for policyholders” dated December 10, 2016 | Fixes the rules according to which a person can count on a reduction in the amount of money that he is obliged to pay to the Social Insurance Fund for employees |

| Order of the Ministry of Labor of the Russian Federation No. 177-“On approval of the administrative regulations for the provision of services to the Social Insurance Fund for establishing a discount on the insurance tariff” dated September 6, 2012 | Determines the circle of persons who can act as an applicant, and also approves the standard for the provision of public services. Attached to the order is an application form that must be filled out in order to receive a discount. |

4-FSS for 2021: form and sample

Let's look at a clear example of filling out form 4-FSS: GBOU DOD SDUSSHOR "ALLUR" receives funding from the regional budget. OKVED 93.1 corresponds to group 1 - tariff 0.2%. The average number of employees for the reporting period was 28 people. Employment contracts have been concluded with all employees.

Total accruals for the four quarters of 2021 are 9,000,000 rubles, including in the 4th quarter of 2021:

- October - 1,000,000 rubles;

- November - 1,000,000 rubles;

- December - 1,000,000 rubles.

| Name of section of form 4-FSS | How to fill out |

| Title page | We enter information about the organization in the following order:

|

| Table 1 | In the tabular section we indicate information about accruals made to employees, amounts not included in the calculation of insurance premiums, and the taxable base. We indicate the information by month, and the total amount - on an accrual basis. We obtain information for filling out the reporting form by generating a turnover sheet for account 302.10 “Calculations for wages and accruals for wage payments.” We determine the contribution rate in accordance with the professional risk class. |

| table 2 | We fill in information about accrued insurance premiums for injuries and information about the transfer of payments to the budget. We obtain the data for the table by generating a turnover sheet for account 303.06 “Calculations for insurance contributions for compulsory social insurance against industrial accidents and occupational diseases.” |

| Table 3 | To be completed if available:

|

| Table 4 | Information about employees injured on the territory of a budgetary institution or while performing their official duties. If there are none, put dashes. |

| Table 5 | Information about the special assessment of working conditions. If a special assessment was not carried out, put dashes in the cells. |

The obligation to provide Form 4-FSS does not depend on what legal form the employer has and what taxation regime it applies. Let's look more specifically:

- An individual entrepreneur without employees is on the simplified tax system, so he does not need to submit form 4-FSS to the FSS;

- Individual entrepreneurs with employees on UTII must pass 4-FSS;

- Individual entrepreneurs with employees with whom GPC agreements are concluded, which do not provide for the payment of contributions for injuries, do not need to submit 4-FSS;

- An LLC with hired employees on OSNO is required to pass 4-FSS;

- LLCs without employees are required to submit 4-FSS.

Thus, if the company does not have employees, then only entrepreneurs do not need to submit Form 4-FSS. In this case, organizations will have to submit a zero form 4-FSS.

The 4-FSS report is submitted in electronic form if the average headcount in the company for the previous year (in our case for 2017) is more than 25 people. Other companies have the right to independently decide whether to submit a report on paper or through an operator in electronic form.

Form 4-FSS for the 2nd quarter of 2021

For the 2nd quarter, the report is submitted according to Form 4-FSS, approved by FSS Order No. 381 dated September 26, 2016. There is no new form provided for submitting reports for the 1st half of 2021.

Please remember the following when filling out the form:

- Form 4-FSS includes a title page and 6 sections. However, you do not need to fill out absolutely all the tables in the form.

- Companies and individual entrepreneurs using the simplified tax system must fill out the title page and tables 1, 2 and 5 of the form;

- Table 1.1 is filled out by employers who transfer their employees to other organizations or individual entrepreneurs;

- Table 3 is filled out by employers paying expenses for injuries at the expense of the Social Insurance Fund;

- Table 4 is filled out by employers who have had accidents at work.

Important! You can fill out the form by hand or on a computer. If the form is filled out manually, you can use a fountain or ballpoint pen with blue or black ink.

Only one indicator can be entered in each line, and if they are missing, then dashes are added. Page numbers are entered in the “page” field, in continuous order. On each page of the form you must indicate the registration number and subordination code. These indicators are indicated at the top of the sheet. A signature must be placed on each sheet of the form, including the title page. This can be done by the policyholder or his representative.

If an error is discovered in a manually completed form, you can correct it like this:

- first, the incorrect value is crossed out;

- then the correct data is entered;

- the correction is signed and dated, as well as a seal, if the company uses one.

It should be remembered that you cannot use a corrector or other analogues of this product.

| Line 1 | Payments and rewards calculated from the beginning of the year and for the last 3 months |

| Line 2 | Amounts that are not subject to insurance premiums (Article 20.2 No. 125-FZ) |

| Line 3 | Base for calculating contributions (line 1 – line 2) |

| Line 4 | Payments to disabled people |

| Line 5 | Insurance rate depending on risk class |

| Line 6 | % discount on tariff |

| Line 7 | % surcharge to tariff |

| Line 9 | Tariff including discount or surcharge |

| Line 1, 4 and 7 | Expenses incurred under OSS from NS and occupational diseases |

| Substrings 2 and 5 | Expenses for external part-time workers |

| Substrings 3, 6 and 8 | Expenses to another organization |

| Line 9 | Expenditures on preventive measures to reduce injuries at work |

| Line 11 | The amount of benefits accrued but not paid, except for benefits accrued in the last month |

| Column 3 | Paid days of incapacity for work due to national emergency and occupational diseases |

| Column 4 | Expenses since the beginning of the year, offset against contributions to OSS from the National Social Security and occupational diseases |

| Line 1 | Information from acts in form N-1 |

| Line 3 | Information from reports on occupational diseases |

| Line 4 | Line 1 + Line 3 |

| Line 5 | Information about victims (temporarily disabled) |

When filling out lines 1 and 3, insured events of the reporting period are taken into account according to the date of examination (verification of the occurrence of the event).

Here data is provided on the total number of jobs that are subject to assessment, as well as the number of workers who are employed in hazardous or hazardous work.

| 3 columns lines 1-6, 7 | Number of recipients of benefits in excess of mandatory Number of workers who used their days off to care for disabled children |

| 3, 4, 7, 10, 13, 16, 19 columns | Line 1-2 – number of days paid Line 3-5 – payments Line 6 – number of benefits paid in excess of mandatory ones |

Please note that in the 4-FSS calculation, the title page, as well as tables 1, 2 and 5, are required to be completed by all insurance premium payers! The remaining tables are filled in if there is appropriate data for reflection.

Table 5 indicates data on conducting a special assessment of working conditions (SOUT) and conducting preliminary and (or) periodic medical examinations of the insurer's employees (hereinafter referred to as PMO) as of January 1 of the reporting year.

Table 5 is filled out by the policyholder in the first quarter of each reporting year, and subsequently the data is duplicated in each subsequent quarter without changes.

Data on SOUT are calculated in total for 5 years preceding the reporting year, and data on conducting PMO are indicated for 1 year preceding the reporting year.

We also remind you that the Calculation in Form 4-FSS is submitted quarterly and is compiled on an accrual basis from the beginning of the year .

If you need to submit an updated Calculation for periods before 2021 , use the form of the forms that were valid in the relevant periods.

If the sample report does not load, please refresh this page.

In a situation where the company did not conduct any activities during the reporting period, and, accordingly, no deductions were made to employees, the calculation in Form 4-FSS will still have to be submitted, but it will be zero. After all, information that the business is not being conducted should also be in the Social Insurance Fund. In this case, it is necessary to include in the report only mandatory data (title page, tables 1, 2 and 5) with dashes .

You can attach an explanation to the zero report that no activity was carried out, no salaries were accrued, and, accordingly, no deductions were made to the fund. However, this is not necessary. If necessary, FSS specialists will request the necessary information themselves.

The procedure for filing an application with the authority

In order for an entrepreneur to be granted a discount, he must fill out an application. Documents are submitted to the Social Insurance Fund branch at the place of registration of the organization.

Photo: application to the FSS

The form of the paper is fixed by law. For a document to be considered valid, it must reflect the following data:

- the name of the territorial unit of the Social Insurance Fund to which the application is made;

- name of the insured and information about him;

- OKVED code;

- TIN of the applicant;

- date of commencement of financial and economic activities;

- registration number in the Social Insurance Fund;

- Full name of the policyholder and signature;

- date of application;

- Full name and signature of the person who accepted the application, as well as the date the action was carried out.

The application is reviewed within 1 month. Another 5 days are given to inform the applicant about the decision. The application form to the FSS is available.

Package of necessary documents

If an entrepreneur wants to receive a discount, he must fulfill a number of conditions, the list of which includes:

- it is necessary to contact the local branch of the Social Insurance Fund with an application for a discount no later than November 1 of the year that follows the period during which the entrepreneur wants to make contributions to the fund on preferential terms;

- a company wishing to reduce the amount of deductions must carry out financial and economic activities for at least 3 years. Thus, in 2021, only those organizations that began operating before 2016 can count on receiving a discount;

- there should be no fatalities during the above period. Temporary disability of employees during this period will not be a reason for rejecting the application;

- The organization must not have any debt on insurance premiums. Contributions to the Pension Fund and the tax authorities are not taken into account.

From the above conditions it follows that it is not necessary to provide supporting documents. The only paper required to receive a discount is an application.

It must be filled out on the form prescribed by law and contain a complete set of necessary information.

Submission methods

Today there are 2 ways to apply. An entrepreneur can fill out a classic paper form and personally submit it to the organization or use an electronic form of the document.

In the first case, the standard application rules must be followed. The law does not specify exactly how the form must be filled out.

This allows the entrepreneur to enter data into it on a computer or by hand. If the second method is chosen, the paper should not contain corrections.

If an error is made, you must fill out the documents again. It is better to enter data in black or blue pen. Information must be legible.

Experts recommend filling out the paper in block letters. In the columns intended to indicate the TIN, registration number of the policyholder, as well as the OKVED code, only one digit must be entered in each square.

If a citizen decides to provide a document electronically, the paper must be signed with an enhanced qualified electronic signature. Documents that do not meet the above requirements will not be considered.