General provisions

The EAEU today includes 5 countries: Russia, Armenia, Belarus, Kazakhstan and Kyrgyzstan. For all transactions that occur within this union, there is a special procedure for paying VAT, as well as a number of other taxes. The rules regarding the payment of taxes when making transactions between these 5 countries were established by the Protocol on the procedure for collecting indirect taxes and the mechanism for monitoring their payment when exporting and importing goods, performing work, providing services (Appendix No. 18 to the Treaty on the Eurasian Economic Union, which was signed in Astana on May 29, 2014).

VAT on imports from Kyrgyzstan: determining the tax base

When paying VAT on imported goods, it is paid not as part of its cost, but separately to the budget of the receiving state. The tax regime and other features of the importer’s tax payment do not in any way affect the rules for paying import VAT. Let's look at the procedure for determining the tax base. The tax is paid at customs in most cases along with customs duties.

- The tax base is determined at the time the product is accepted for accounting and is formed on the basis of their cost. The cost in this case is the amount indicated in the supply contract, or in any other basis for payment for the goods (for example, an invoice).

Attention: an exception when calculating the date of acceptance of a product for accounting is products that were received on the basis of a leasing agreement, moreover, one that provided for the transfer of the right to the product in full to the lessee. In this case, the tax base is determined as many times as lease payments are made.

- If the product was purchased not for rubles, but for another currency, then it is necessary to recalculate the cost of the product at the rate that was set by the Central Bank at the time the product was accepted for accounting.

- The tax base is multiplied by the tax rate, which, as we have already found out, can be either 10% or 18%.

Calculation example: for example, you purchased goods worth 18,650 US dollars from a Kyrgyz supplier, payment was made in dollars. Similar goods in Russia are taxed at a rate of 18%. The dollar to ruble exchange rate on the date the goods were accepted for accounting was 56.14 rubles. So, let's calculate VAT: 18,650 x 56.14 x 0.18 = 188,461.98 rubles.

Peculiarities of calculation and payment of tax when importing from the EAEU

What distinguishes the procedure for assessing VAT on goods imported from the EAEU countries? There are several features here:

- The tax is calculated and paid not at the time of import, but after the goods are received by the buyer or the next lease payment is due, if we are talking about the subject of the leasing transaction (clause 19 of Section III of Appendix No. 18 to the EAEU Agreement).

- You must pay VAT not at customs, but to the tax authority.

- The calculation of the amount of tax due is carried out by the importer, determining the tax base for him on the date of acceptance of the goods for accounting or on the payment date specified in the leasing agreement.

- The calculation process is reflected in reporting documents of special forms drawn up at the end of each of the months in which imports took place. If there were no import operations in some months, then there is no need to submit zero reporting. However, when imports are carried out every month, then reporting under the EAEU-VAT becomes monthly.

- There is a special deadline for paying tax and reporting on it, different from the deadline for regular VAT. It corresponds to the 20th day of the month following the month of import (clauses 19, 20 of Section III of Appendix No. 18 to the Treaty on the EAEU). However, in terms of interaction with the Federal Tax Service, a rule is applied to shift this period if it coincides with a weekend to a later date corresponding to the nearest weekday (Clause 7, Article 6.1 of the Tax Code of the Russian Federation).

The tax base for calculating the EAEU-VAT includes the cost of the goods themselves, indicated in the accompanying documents, as well as the excise tax (if the goods are excisable). If it is necessary to recalculate the value of a product into a value expressed in Russian rubles, the conversion rate is taken as of the date the product was accepted for accounting (clause 14 of Section III of Appendix No. 18 to the Treaty on the EAEU). If the price is not indicated in the accompanying documents, then the accounting value of the goods becomes the base.

The subject of the leasing agreement is subject to taxation in parts (as the deadline for making leasing payments stipulated by the leasing agreement arrives). Moreover, a payment made in foreign currency is also recalculated for tax purposes into Russian rubles at the rate, but this rate should be determined on the payment date specified in the leasing agreement, regardless of when and in what amount the payment was actually made ( clause 15 of Section III of Appendix No. 18 to the Treaty on the EAEU).

The rate used to calculate the tax depends on the type of imported goods (clause 15 of Section III of Appendix No. 18 to the Treaty on the EAEU). For 2021, its size in Russia will be, respectively, either 20% or 10% (Article 164 of the Tax Code of the Russian Federation).

The following goods are exempt from EAEU-VAT:

- not subject to VAT in accordance with Art. 150 of the Tax Code of the Russian Federation (subclause 1, clause 6, article 72 of the Treaty on the EAEU);

- being customer-supplied raw materials (clause 14 of section III of Appendix No. 18 to the Treaty on the EAEU);

- purchased from a Russian supplier, but delivered to the buyer through the territory of the EAEU country (letter of the Ministry of Finance of Russia dated February 26, 2016 No. 03-07-13/1/10895).

Application of a special regime (Unified agricultural tax, simplified tax system, UTII, PSN) or exemption provided for in Art. 145 of the Tax Code of the Russian Federation, does not relieve the importer from paying import VAT and filing reports on it (clause 13 of section III of Appendix No. 18 to the Treaty on the EAEU).

We declare and pay tax

Payment of import tax is very strictly regulated. Thus, VAT must be paid by the 20th day of the month following the day when the product was accepted for accounting. Also, before the 20th day of the next month, you must submit a declaration to the Federal Tax Service. The declaration is submitted in the old form and can be found in the appendix to Order No. 69 of the Ministry of Finance of the Russian Federation dated July 7, 2010.

You should be careful when filling out and submitting the declaration, because unlike the usual one, the import VAT declaration must be submitted not for the quarter, but for the month. If you receive goods regularly, you will have to submit a declaration every month.

Who is required to pay import VAT?

Based on legislative acts related to the EAEU, it is possible to distinguish categories of citizens and legal entities who are required to pay import VAT when working with counterparties from Kyrgyzstan.

| Pay tax | Don't pay tax |

| All companies and individual entrepreneurs that import products from the EAEU. This applies even to those persons who, according to the Tax Code of the Russian Federation, are exempt from paying regular VAT. | Persons who have imported the product for their own use and who do not intend to sell it or conduct any business activity involving it. |

Some products are not subject to tax:

- products that were imported under the customs zone regime under the “free” sign;

- companies that are exempt from paying fees in accordance with Art. 150 Tax Code of the Russian Federation;

- when transferring products from one department of the organization to another (for example, if one division is located in Kyrgyzstan and the second in Russia.

Important: if you are not sure whether you will need to pay VAT or not, you can consult Art. 150 of the Tax Code of the Russian Federation - other legislative acts are built around it.

There are different ways to pay VAT. The most common is payment through the Federal Tax Service. However, you can only pay through the inspection the VAT that was received only on goods that were manufactured in the EAEU member countries, as well as those that, although they were manufactured in other countries, were officially released into free trade in the territory of the entire so-called Customs union.

Local tax payments

Local tax payments include:

- Payment on property.

- Land.

- Hotel.

- Payment for a vehicle parking space.

Let's look at each of them in more detail.

Payment on property

This type of tax is direct. It is paid by owners of real and movable property, in particular real estate and various vehicles.

There is no single rate. It is progressive, that is, it directly depends on the estimated value of the property. The rate for vehicles is calculated based on the power of the vehicle.

If the assessed value of the property is below three million drams, then the owner is not subject to tax.

For real estate prices ranging from three to 10 million, the tax is 100 drams. An additional 0.1% is paid from the amount that exceeds three million drams.

If the property price is from 10 to 20 million drams, the rate increases to 7100 drams. An additional 0.2% of the amount that exceeds 10 million drams is paid.

If the property price is from 20 to 30 million, the rate increases to 27,100 drams. An additional 0.4% of the amount that exceeds 20 million drams is paid.

With a property value of 30 to 40 million drams, the rate is 67,100 drams. Additionally, the owner pays 0.6% of the amount that exceeds 30 million drams.

For real estate values of 40 million and above, the fee is 127,100 drams. Additionally, the owner pays 0.8% of the amount that exceeds 40 million drams.

Table. Rates for vehicles

| Criteria | Horsepower | Price for each horsepower (indicated in drams) |

| Facility for up to 10 people | up to 120 | 200 |

| Facility for up to 10 people | from 120 to 250 | 400 |

| Facility for up to 10 people | over 250 | 500 |

| Facility with a capacity of over 10 people | up to 200 | 100 |

| Facility with a capacity of over 10 people | over 200 | 200 |

Land tax

This type of tax payment is direct. It is paid by land owners. There is no flat rate. It depends on the cadastral price of the land plot and its location.

For plots located in populated areas, a rate of 1% applies.

For plots located outside the populated area, the rate is 0.5%.

You can find out about salaries in Armenia and available vacancies on our website.

Required documents

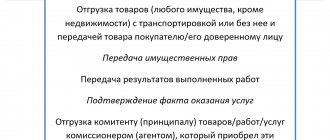

Along with the tax return, you also need to provide a number of documents:

- A statement that you have imported a certain product;

- Documents confirming the fact of tax payment (for example, a bank statement);

- Accompanying documents (waybill);

- If the product was purchased through the services of intermediaries, then you must provide an agreement between your organization and the intermediary;

- The basis for payment and import of goods into the territory of the Russian Federation (for example, an agreement or invoice).

Please note: you can submit your application either electronically or in printed form.

You can submit documents electronically through the State Services website, as well as through the Tax Service website. The document must be signed with an electronic signature. If you submitted an application electronically, there is no need to submit it again in paper form. Also, if you submit an application in printed form, there must be 4 copies, as well as 1 more copy in electronic form on removable media.

You may not provide a bank statement to confirm the fact of payment of VAT when your organization has overpaid taxes and fees that go to the federal budget, because in this case the Federal Tax Service may decide to offset import VAT against the invoice overpayments.

Accompanying documents (in particular, the waybill) may also not be able to be submitted to the Federal Tax Service due to the fact that, according to the legislation of Kyrgyzstan, suppliers have the right not to issue such a document. The same applies to other accounting documents, such as invoices.

The supplier may be required to send a letter on official letterhead stating where the product came from. Such a letter may not be provided to the Federal Tax Service when all this data is indicated in other documents provided, for example, in a contract.

Do not forget that if you work under a contract with intermediaries, then you must submit documents such as an agency agreement, or a commission or assignment agreement to the Federal Tax Service.

Results

Kyrgyzstan is one of the countries that have concluded the agreement on the EAEU. In accordance with this document, the calculation, payment of VAT and reporting on it are carried out according to special rules. Including this:

- the presence of nuances in determining the tax base;

- the existence of other mandatory reporting (import statements and tax declarations of a special form);

- another payee (tax authority, not customs);

- a separate deadline for making tax payments and filing reports on it;

- the emergence of additional conditions for accepting VAT for deduction.

Accounting for transactions with the EAEU-VAT is not complicated and is carried out using only three entries.

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Who takes into account import VAT and how?

There is a difference between including VAT on the cost of goods and accounting for VAT on expenses. Let's figure it out.

| Taken into account in the cost of goods | Taken into account in expenses |

| 1. Companies that operate under the general tax regime, or that use UTII; 2. Companies that, according to Art. 145 Tax Codes of the Russian Federation were exempt from taxation; 3. VAT payers if the products purchased from a member country of the EAEU were purchased in order to carry out activities to which payment of VAT does not apply, or for activities that cannot be carried out on the territory of the Russian Federation. | 1. Companies that use the “simplified” system of “income minus expenses”; 2. Companies that operate under the single agricultural tax system; |

When we take EAEU-VAT for deduction

The tax that arises when goods are imported into the Russian Federation from EAEU countries can be taken as a deduction. However, for this it is not enough to fulfill the conditions provided for in paragraph 2 of Art. 171 and paragraph 1 of Art. 172 of the Tax Code of the Russian Federation (i.e., acceptance of goods for registration, their intended use for operations subject to VAT, and payment of tax).

The necessary points for the possibility of carrying out this procedure, due to the mandatory registration, also become (letter of the Ministry of Finance of Russia dated 07/02/2015 No. 03-07-13/1/38180):

- presence of an import application signed by the tax authority;

- adoption by the Federal Tax Service of a declaration reflecting data on it.

That is, the procedure for accepting EAEU-VAT as deductions turns out to be more complicated than when importing goods from countries outside this union. Let us recall that in the latter situation, it is sufficient to have a customs declaration with the amount of tax paid reflected in it and confirmation of the fact of its payment.

Persons enjoying VAT exemption under Art. 145 of the Tax Code of the Russian Federation, and special regimes for whom the fact of import leads to the obligation to pay import tax cannot take advantage of deductions, since they are not payers of the usual VAT for the Russian Federation. They will have to include such a tax in the cost of the purchased goods (subclause 3, clause 2, article 170 of the Tax Code of the Russian Federation).

We subtract import VAT

You can deduct VAT if you apply the normal tax regime and are not exempt from paying VAT. Deduction of import VAT is possible only after you have paid it and you have all the documents to confirm this. There are no other official conditions for tax deduction; however, tax authorities often also require you to provide a statement that you imported the goods and paid tax on them. However, this is not a mandatory condition, and you have every right to refuse to comply with it.

An organization can submit documents for deduction only when several conditions are met. Product was purchased:

- In order to use it only on the territory of the Russian Federation, either for temporary transport, or for its processing;

- The product was purchased for an activity that is subject to value added tax;

- The product has been accepted for accounting.

Attention: if at least one condition is not met, then you do not have the right to apply for a deduction.

Kyrgyzstan

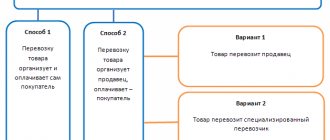

Suppose a client from Kyrgyzstan contacts you and intends to purchase your products. To make such a delivery, you need to prepare all shipping documents, the ST-1 certificate, and prepare a package of documents to confirm the zero VAT rate. Depending on your experience in foreign economic activity, you can choose several options for shipment to Kyrgyzstan: independent export registration and VAT refund from the budget, or outsourcing the export issue.

Features of export from the Russian Federation to Kyrgyzstan

At the moment, there are no distinctive features for the Russian supplier - the export operation is processed in the same way as to other EAEU countries.

Export to Kyrgyzstan from

IFC Titan74 LLC offers to take on the burden of the contract holder and relieve the Russian supplier from the burdens of foreign economic activity if it is necessary to export only non-food products and products that do not fall under dual use. works in accordance with Russian and international legislation and does not recommend resorting to “gray” schemes. Our company has been solving problems of Russian suppliers in foreign economic activity for more than 15 years and already has positive experience in supplying Russian products to the Republic of Kyrgyzstan.

Customs clearance is part of the complex of foreign economic activities. We carry out customs clearance in Moscow, St. Petersburg, Nizhny Novgorod, Yekaterinburg, Chelyabinsk, Vladivostok, Kaliningrad and other cities of Russia. The cost of customs clearance of goods starts from 7,000 rubles and is included in the buyer’s invoice.

By delegating exports to our company, you will no longer need to understand HS codes, determine and pay the amount of customs duties, or prepare documents for customs clearance.

Thus, by working with IFC Titan74 LLC, you will avoid a number of possible risks associated not only with customs clearance, but also with the bank and the tax office.

Independent export registration by a Russian company

To do this, you will need professional knowledge and experience at each stage:

- registration of a foreign trade contract;

- checking goods for licensing and inclusion in dual-use lists;

- registration of a certificate of raw materials, certificate ST-1;

- customs clearance of goods;

- searching for a transport company and organizing delivery to the LPR/DPR;

- implementation of currency control in the servicing bank;

- preparing a package of documents and submitting an application to the tax service.

Depending on which HS code the product falls under, additional documents may also be required for export:

- Export license from the Ministry of Economic Development and Trade;

- Export permits from the Ministry of Defense, FSB, FAPRID, Ministry of Health, Ministry of Culture, Ministry of Natural Resources and other special departments;

- Export certificates: veterinary, phytosanitary;

- Expert opinions (documents confirming that the goods are not subject to export control, issued by the competent authorities).

The list of documents for shipment to Kyrgyzstan is similar to the list for other CIS countries.

Providing export documents to the Federal Tax Service

Organizations carrying out export operations and not applying for a waiver are required to confirm the 0% VAT rate - submit a declaration and have the right to a refund of incoming VAT amounts.

Please note that it is not possible to submit a separate declaration for export activities; you must provide data on the entire volume of business transactions in the organization.

To confirm, you must provide the following documents:

- Contract with a foreign buyer.

- Customs declaration on shipment of goods. Now the tax office does not require a customs resolution on the release of exports. A copy of the declaration can be downloaded from the personal account of a foreign trade participant or through the Unified Automated Information System of customs authorities.

- Transport documents (CMR). When sending by railway, sea or air transport, a railway or air waybill or bill of lading is required. From 2021, innovations will be introduced when transporting goods from Russia to the EAEU countries.

- Shipping documents.

- Declaration.

Each document must clearly indicate the details, all names and signatures of the counterparties.

A package of documents for each shipment must be submitted no later than 180 calendar days, counting from the date of placing the goods under the customs export procedure.

From the date the documentation is received by the tax authorities, a desk audit begins. The period of the desk audit was reduced from 3 months to 2 from 09/04/2018. If during the inspection the inspector has grounds to suspect a violation or errors are discovered, the period can be extended to 3 months. If an updated declaration is provided, a new check begins.

The Federal Tax Service will check:

- whether due diligence was exercised in selecting the supplier,

- presence and reality of signatures of authorized persons on shipping documents,

- compliance of data in invoices and contracts,

- witnesses to transactions,

- production and warehouses,

- no debt to the budget,

- availability of translation into Russian of all documentation,

- And so on.

In practice, the tax inspector may request additional documents, so it is necessary to ensure that all documents accompanying the transaction are correctly completed and stored securely.

The Federal Tax Service may issue a verdict of refusal or partial compensation. If you disagree with this decision, you should appeal to a higher authority.

In case of correctly completed documents and a positive decision from the tax authorities after a desk audit, 6-8 months after shipment, you will be reimbursed from the budget for the VAT previously paid for the product, or the components and raw materials used in its manufacture.

You can omit the stage of confirming the zero VAT rate and refuse to apply it.

Difficulties in independently processing exports

- Currency control - for a contract amount of more than 6 million rubles, you will need to comply with currency legislation, because in case of violation of the deadlines for the provision of documents, significant fines for legal entities are possible. The bank has the right to request copies of contracts worth more than 200 thousand rubles.

- Confirmation of the zero VAT rate for the Federal Tax Service - if it cannot be confirmed for any reason, you will have to pay the entire amount of VAT to the budget at the full rate plus penalties from the date of shipment. In addition, a desk audit of the entire activity of the enterprise will be carried out - only “white” companies with experienced accountants and lawyers can pass it.

- Passing customs control - it is very important to choose the correct HS code, otherwise an additional amount may be charged that you will have to pay at your own expense, and not at the expense of the buyer. Correctly filling out the declaration and complying with the letter of the law is the key to successful passage through the customs post.

- Registration of a phytosanitary certificate - if the goods or pallets are regulated products. To obtain a conclusion, you need to agree with the inspector on the date and time of his visit before loading directly onto the declared vehicle, indicating its license plate number. Unfortunately, some people learn about the existence of the Office of the Federal Service for Veterinary and Phytosanitary Surveillance only after the cargo arrives at customs.

- Selecting the optimal solution for cargo delivery – in case the buyer did not choose self-pickup. A mistake in choosing a transport company can lead to many troubles: violation of cargo transportation deadlines, loss of goods, refusal to reimburse the cost of cargo, etc.

- Other completely unexpected nuances.

Accounting entries

Let's look at the accounting entries when working with import VAT:

| Operation | Debit | Credit |

| We reflect the price of the product | 60 | 51 |

| We pay for the goods | 60 | 51 |

| We charge VAT for payment to the Federal Tax Service | 19 | 68 (sub-account “VAT calculations”) |

| Paid VAT | 68 | 51 |

In order to consider in more detail the process of accounting entries, as well as everything related to the import of VAT from Kyrgyzstan, one of the EAEU member countries, you can use the Treaty on the EAEU and Appendix %18 to it. Also on the official website of the tax service there is a section “Customs Union”, where other application documentation is located.

Accounting EAEU-VAT

Accounting for VAT generated when importing from EAEU countries is quite simple. There are only three wires involved here:

- Dt 19 Kt 68 - accrued the amount reflected for the corresponding month in the application and declaration;

- Dt 68 Kt 51 - tax paid;

- Dt 68 Kt 19 - import VAT is taken as a reduction from ordinary Russian VAT.

The last of them becomes possible only if all the conditions necessary for applying the EAEU-VAT deduction are met. The amount accompanying this posting will appear in line 160 of section 3 in a regular quarterly VAT return, specifically designed to reflect the tax arising on imports from the EAEU countries.