In the Russian Federation, every year before April 15, legal entities need to confirm their main type of activity. A simple procedure must be performed in order for the Social Insurance Fund (SIF) to set the correct percentage of the contribution “for injuries”. About the process of determining and confirming the main type of activity, about the accompanying documents required by the FSS, as well as about who does not have to annually record the type of activity and what the consequences of delay in submitting data are in more detail in the article below.

Where can I see the amount of contributions?

- Find in the table the type of economic activity for which you had the most income over the past year.

- Using the same table, determine the professional risk class of your business. The higher the class, the higher the fees.

- Look at the law for the contribution rate.

For example, for risk class 1 the minimum contribution rate is 0.2%. This means that from an employee’s salary of 20 thousand rubles you will pay 40 rubles in injury contributions per month.

Risk class 1 includes most businesses: cafes, clothing repair, hairdressers, almost all wholesale and retail trade, software development, consulting, photo services, passenger transportation, couriers, hotels, food delivery, education and other businesses.

Example of defining the main type of work

The main type of entrepreneurial activity is determined by the legal entity independently. It depends on the VD with the highest share for commercial entities or on the VD with the maximum number of employees for non-profit structures. If a company maintains several VCs, and the specific weight as a result of the calculation is the same, then the highest class of profrisk is selected. Let's look at the algorithm for choosing the main OKVED using an example.

Example

Assorti LLC carries out the following internal activities:

| Type of work | OKVED code | Sales volume for 2021 (RUB) | Income level (%) | Profrisk class |

| Production of alcoholic beverages | 11.01.1 | 7 550 000 | 40 | II |

| Wholesale trade of alcohol | 46.34.2 | 7 550 000 | 40 | I |

| Retail sale of alcohol in specialized stores | 47.25.1 | 3 740 000 | 20 | I |

| Total | 18 840 000 | 100 |

To determine the rate of “unfortunate” contributions, we select the indicator with the highest share of income. In the example conditions, this is the wholesale trade of alcohol and its production. Since the indicators are equal, we choose a higher profit class, which includes the production of alcoholic beverages, that is, II. The rate of “unfortunate” contributions corresponding to risk class II is 0.3%.

How to determine the main activity?

This is the one for which you received the most income last year.

For example, Katya has a beauty salon, an online cosmetics store and courses for hairdressers.

Her income for 2021 is 3.6 million rubles excluding expenses. Here's how income is distributed across different businesses:

- income from a beauty salon - 2.5 million rubles

- income from the online store - 800 thousand rubles

- income from courses for hairdressers - 300 thousand rubles.

Katya's main activity is a beauty salon. The share of income from this business is 69.4%.

If several types of business have the same shares of income, the main one will be the one with the higher risk class.

Source of information about assigned codes when contacting Rosstat authorities

Data on OKVED, despite the storage of accounting information in the registers of the Federal Tax Service, is distributed by statistical authorities. When contacted by a representative of the enterprise, the territorial body will provide a letter about the specified types of activities relevant at the time of application. The basis for issuing information is a written statement of the person.

The document is issued to the legal representative of a legal entity or individual entrepreneur with a power of attorney. The head of an organization or an individual entrepreneur can apply without a power of attorney. Until 2021, data was presented on paper in the form of a letter with the seal of an official body. Today, data obtained through the website of the statistical agency is available. A person who has registration data about an enterprise has the opportunity to obtain current OKVED data of the organization in electronic form.

How to confirm the main type of activity?

From January 1 to April 15, send to the FSS at the place of registration of the LLC:

- statement

- confirmation certificate

- a letter about the absence of an explanatory note to the balance sheet is not necessary, but it is better to be safe.

If April 15 falls on a holiday or day off, the deadline is moved back to the next working day.

If you register an LLC in 2021, you will first confirm the type of activity only in 2022. For the entire 2021, pay contributions for the main type of activity, which is indicated in the Unified State Register of Legal Entities.

Results

All policyholders who pay contributions to the Social Insurance Fund, with the exception of individual entrepreneurs, are required to confirm their main type of work every year by submitting the appropriate certificate to the social insurance department at the place of registration. The sample, form, as well as the algorithm for filling out the document are discussed in detail in the material.

Sources:

- Decree of the Government of the Russian Federation dated December 1, 2005 N 713

- Order of the Ministry of Health and Social Development dated January 31, 2006 No. 55

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

How to fill out a confirmation certificate?

Provide information about the organization: name, tax identification number, address, full name of the director and chief accountant. If the organization does not have a chief accountant, indicate the director instead. Calculate the average number of employees - read the article on how to do this.

Fill the table:

- Your OKVED codes according to the extract from the Unified State Register of Legal Entities.

- Decoding of OKVED codes is in the same wording as in the extract from the Unified State Register of Legal Entities.

- Income for each OKVED code excluding expenses. Important: indicate income in thousands of rubles. For example, write 1 million like this - 1,000 thousand rubles.

- Do not fill out the fourth column if there was no targeted income - for example, grants and subsidies.

- Calculate the share of income for each OKVED as a percentage.

- Do not fill out the sixth column, it is only for non-profit organizations.

In paragraph 10, write the type of economic activity for which the share of income is greater, indicate its OKVED code.

Sample confirmation certificate

What are the consequences of not confirming ATS?

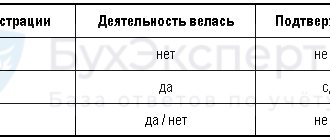

In case of failure to submit documents on time, the regulatory authority independently sets a tariff based on information from the Unified State Register of Legal Entities. The principle of choosing a tariff rate is fixed in paragraph thirteen of the Rules: the percentage of the rate is taken from the register of the foreign trade activity that has a higher class of professional risk. To make such a choice, the FSS does not need evidence of the reality of this type of activity, as established by the Supreme Court of the Russian Federation dated November 2, 2018 No. 308-KG18-17110.

The resolution of the Arbitration Court of the Volga-Vyatka District dated 02/04/19 No. F01-6889/2018 provides an exception. The FSS can approve the percentage of contribution according to the Unified State Register of Legal Entities only when it does not have data on the organization’s internal affairs bodies. If the Fund received such information in other reporting documents, then fixing the rate in the Unified State Register of Legal Entities is prohibited.

To top it all off, if a legal entity submitted documents late, the budget organization is obliged to change the tariff rate previously established in the Unified State Register of Legal Entities - to fix a percentage that coincides with the percentage of the current OVED. These conditions were determined by the Judicial Collegium for Economic Disputes of the Supreme Court of the Russian Federation dated September 11, 2018 No. 309-KG18-7926 and dated November 12, 2018 No. 304-KG18-9969.

What to do after sending confirmation?

Two weeks after the FSS receives a confirmation certificate from you, it will issue you a notification about the amount of insurance premiums for this year. Until you receive the notice, calculate your contributions at the previous year's rate.

If you have a new rate, recalculate contributions from the beginning of the year to the month in which you received the notice.

Submit reports without accounting knowledge

Elba - accounting that anyone can handle. The service will prepare payments for salaries, taxes and contributions - and then generate reports itself.

Try 30 days free Gift for new entrepreneurs A year on “Premium” for individual entrepreneurs under 3 months

Who applies for reduced rates?

| Type of organization | Conditions |

| Public organizations of disabled people | At least 80% of all payments to individuals go to disabled people or their legal representatives |

| Organizations whose authorized capital is formed from contributions from public organizations of disabled people (100%) | At least 50% of the average number of employees are disabled, and at least 25% of all payments go to disabled people |

| Institutions created to achieve socially significant areas (goals) for people with disabilities | For cultural, medical and recreational, physical education and sports, scientific, information and other social purposes, providing legal and other assistance to people with disabilities, disabled children and their parents. Additional condition: the only owners are public organizations of disabled people |

| All government organizations | Payments to disabled people (1, 2 or 3 groups) |

If the institution does not provide an application and confirmation certificate to the Social Insurance Fund, there will be no punishment. The law does not provide for administrative liability for this violation. The organization and officials will not be fined. But for such policyholders, FSS specialists will set maximum rates that cannot be reduced throughout the year.

Responsibility of the enterprise for the use of undeclared OKVED

In the process of conducting business, enterprises often do not monitor the relevance of OKVED data entered into the register. The enterprise must report changes in OKVED codes within three days (Clause 5, Article 5 of the Federal Law dated 08.08.2001 No. 129-FZ). In some cases, organizations or individual entrepreneurs do not attach importance to making changes to the registry.

The provisions of Article 49 of the Civil Code of the Russian Federation establish the legal capacity of a legal entity. Organizations have the right to engage in all permitted types of business. Restrictions apply only in cases where the activity uses licensing, participation in an SRO or certain types of admission for types of work by a self-regulatory organization.

The legislation provides for administrative penalties for enterprises for violations consisting of failure to provide data or submission of unreliable or knowingly false information. Sanctions are provided for in Art. 14.25 Code of Administrative Offences.

| Characteristics of the violation | Article of the Administrative Code | Sanction form |

| Late submission by organizations or individual entrepreneurs of information required by law to the registration authority | clause 3 art. 14.25 Code of Administrative Offenses | The Code of Administrative Offenses provides for a warning or a fine of 5 thousand rubles. The fine is imposed on officials (director of the organization or individual entrepreneur) |

| Failure to provide information or submission of false data about an organization or individual entrepreneur to the registration authority | clause 4 art. 14.25 Code of Administrative Offenses | A fine of 5 to 10 thousand rubles imposed on officials |

| Repeated failure to provide data or submission of knowingly false information that does not fall under the provisions of the Criminal Code of the Russian Federation | clause 5 art. 14.25 Code of Administrative Offenses | Disqualification of officials for a period of 1 to 3 years |

The peculiarity of presenting a protocol on an administrative offense is the limited period for imposing a sanction. If an administrative penalty for which information on OKVED was not provided is imposed after 2 months, the sanctions are not eligible. The period is calculated from the date of the violation.

Using up-to-date activity code data

OKVED is important for partnerships when concluding contracts, for licensing, opening a bank account and using special taxation systems. Information is provided when conducting foreign economic activity and passing through customs.

Government agencies use codes to create complete institutional registry information. When participating in a tender for a government order, an enterprise must have an activity code corresponding to the request.

| The need to use OKVED | Description | Peculiarities |

| Obtaining a tax deduction for VAT by an enterprise | When checking the eligibility of a deduction, the Federal Tax Service pays attention to the presence of OKVED, which allows you to conduct activities subject to VAT | If a VAT deduction (refund) is refused, the actions of the tax authorities can be challenged by a court decision |

| Application of a special taxation regime for UTII | When using UTII it is necessary to declare the activities falling under the regime | The Federal Tax Service may refuse to register an enterprise as a UTII payer |

| Use of Unified Agricultural Tax | The use of Unified Agricultural Tax is possible if the appropriate codes are indicated in OKVED | Enterprises engaged in the production of agricultural products can apply the Unified Agricultural Tax |

Most of the problematic issues related to the refusal of the Federal Tax Service to provide professional deductions, VAT refunds, and the application of special regimes are resolved through judicial proceedings. There are positive court decisions on taxpayers' claims, based on the position of the absence of a requirement in the Tax Code of the Russian Federation on the need to comply with the activities and the specified codes.

Procedure for submitting documents

Within 14 days from the date of submitting a set of documents to the Fund, the policyholder must receive a response with the decision of the Social Insurance Fund on establishing the rate for contributions.

If the certificates and application were not sent on time, then this should be done immediately: the organization has a chance that their documents will be reviewed and the tariff will not be considered at the highest rates. The organization has the right to provide a completed application and certificates in person, using the help of a legal representative or the MFC. If it is impossible to use other methods, the policyholder retains the right to transfer documents by mail. In this case, you should take care to fill out all forms in advance.

Certificate of confirmation of the main type of economic activity, form

A sample of the documents required to be filled out can be found on the MFC website or the government services portal.

In the established form, all fields are filled in: name of the organization, INN, registration number according to the Unified State Register of Legal Entities.

It is necessary to correctly indicate the start date of the company and its legal address. Among the personal data, the full name is indicated. manager and chief accountant, the number of workers operating at the enterprise.

In addition to indicating the OKVED code, information is entered on the types of activities and income received from them. The area that brings the greatest profit fits into the column “name of the main activity.”

Read also: Signs of business fragmentation

The completed document is certified by the signature of the manager and chief accountant, stamped and dated.