How much will they return?

IMPORTANT!

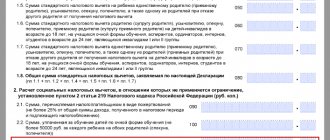

It should be taken into account that not the entire amount of expenses is claimed for refund, but only 13% of this amount. This 13% does not exceed the amount of personal income tax withheld from the employee’s income and paid to the budget. The maximum amount for deduction in 2021 is RUB 120,000.

For example, income for the year amounted to 540,000 rubles. The amount of calculated and withheld personal income tax is RUB 70,200. Treatment expenses for the year amounted to 100,000 rubles. RUR 13,000 is due for refund. (100,000*13%). This amount is indicated in the application for a tax deduction for treatment, which is submitted to the tax office simultaneously with the 3-NDFL declaration or within 3 months after its submission.

3 months is the period established for a desk audit. If you apply for a refund for medical services during this period, the decision on the return or refusal of personal income tax refund is made within 10 days after the end of the inspection.

If expenses were 130,000 rubles, then reimbursement would be 15,600 rubles. (120,000*13%).

ConsultantPlus experts have discussed how to take advantage of the social tax deduction for treatment. Use these instructions for free.

Refund application (for treatment)

For expenses incurred in a later period, it will not be possible to issue a refund of overpaid tax.

The main limitation is the cost of 120 thousand rubles.

But this limit applies to non-expensive treatment. If it’s expensive, you can return 13 percent of any amount of money spent, which is limited only by your earnings for the year.

Download for viewing and printing:

- his wife;

- other.

- pension deposits;

- treatment: taxpayer;

- his wife;

- his children and other minor relatives;

Reference! Taxes contributed to the budget are not eligible for refund:

- individual entrepreneurs using a different tariff rate (not 13% for personal income tax).

- unemployed;

- It is impossible to return more money than the taxes paid for the reporting period.

- refers to the total cost of: medical services;

- education;

- refers to the total cost of: medical services;

Download the personal income tax declaration file 3, it is available for filling out on your computer, or print it and fill out the necessary sheets.

and 3 personal income tax declarations for dental treatment To receive a deduction for dental treatment, you need to fill out only five sheets of the 3 personal income tax declaration: title page, section 1, section 2, sheet A, sheet E1. You should start filling out with the title page.

Information for filling out the 3rd personal income tax declaration can be obtained from the 2nd personal income tax certificate, which is issued by the accountant at the declarant’s place of work.

So, for example, from it you can take data for the TIN line, which is located at the very top of the title page. In the adjustment number field, if the declaration is submitted by a person for the first time, the value “0” is entered.

The year for which the declarant plans to receive reimbursement for dental services is entered in the “Tax period” line. It should be remembered that all deductions are made at the end of the year. This means that it will be possible to receive reimbursement for expenses incurred in connection with dental treatment in the current year only in the next year.

and 3-NDFL for earlier periods (2019 and 2021) you can on the page. Note: the 3-NDFL declaration form (for the report for 2019) was approved by Order of the Federal Tax Service of Russia dated October 3, 2019 N. Official instructions for filling out the 3-NDFL declaration are in Word format. You can read the step-by-step instructions for filling out a declaration when applying for a deduction for treatment in the “Taxpayer’s Personal Account” on the tax service website (online) with detailed comments and screenshots.

A sample of filling out 3-NDFL when applying for a deduction for treatment (ordinary and expensive) - in Excel format.

The list of medicines was approved by the government in 2001. You can find it in Resolution No. 21 of March 19.

According to the law, the maximum deduction amount is 120 thousand rubles, however, in addition to expenses for medicines and direct treatment, the amount consists of:

- expenses for voluntary non-state pension insurance or provision.

- payment for education;

- contributions to the funded part of the pension in the Pension Fund;

However, the situation is changing; paid treatment is recognized as expensive.

Then on medical documents confirming that you paid for honey. services, code K2 will be present.

In addition, to receive a deduction, the following conditions must be met:

- medications purchased for treatment must be included in the list compiled by the government;

- independent purchase of medicines due to the impossibility

I receive tax deductions for treatment and tests without leaving home

Payment for dental services can also be offset by a tax deduction, in accordance with current Tax legislation.

A tax deduction will be provided if one (or more) of the following cases occurred:

- payment for dental clinic services (the treatment was carried out in relation to the taxpayer himself or his relative);

- purchasing medications necessary for dental treatment (for yourself or a family member).

An application for a personal income tax refund is drawn up in exactly the same way as in the general case; there are no differences in the order of its writing and submission.

Error: The taxpayer did not declare his right to a tax deduction for payment for treatment within 3 years from the moment his right to a refund arose.

Comment: If you do not submit an application to the tax office requesting an income tax refund within the first three years from the date of payment for treatment or purchase of medicines, the right to deduction is lost.

Error: A pensioner who retired 2 years ago did not submit an application for a personal income tax refund for treatment.

Comment: Pensioners have the right to apply for a tax deduction within three years from the date of leaving work.

Question No. 1: How soon will the demands of a taxpayer who has submitted an application for a personal income tax refund for treatment be satisfied?

Answer: A desk audit at the tax office is scheduled every 3 months, so in some cases you have to wait up to 90 days, provided that no errors were found in the documents. After the verification is completed, the applicant will receive a letter with a positive or negative response, after which the Federal Tax Service will have 1 month to transfer the funds to the taxpayer. In practice, the procedure can take up to 6 months.

Question No. 2: I paid for expensive dental treatment for my mother, can I get a personal income tax refund?

Answer: Yes, paying for dental services and purchasing dental medications (for yourself or a family member) are considered legal grounds for claiming an income tax refund.

After you have collected the documents, you need to fill out the 3-NDFL declaration and an application for a tax deduction for treatment and medicines. Leave a request on our website - a tax expert will check your documents and correctly fill out the 3-NDFL declaration. Remember that even a minor mistake may be a reason for the Federal Tax Service to return documents for revision.

From us you received two files with the completed 3-NDFL declaration: PDF and XML. This is done specifically for your convenience: you can print the PDF file and submit it to the tax office in person or send it by mail.

A file in XML format is needed to send a declaration using the Russian Federal Tax Service website. How to do this, read the article “How to submit a 3-NDFL return through the taxpayer’s personal account.”

We can not only fill out the 3-NDFL declaration, but also send it to the tax authority using an electronic signature. In this case, all you have to do is wait for the deduction for treatment to be approved and the money to be transferred to your account.

Sample application for a deduction for treatment

In general, a tax deduction can be received at the end of the calendar year. To do this, you need to submit a 3-NDFL declaration for the past year to the Federal Tax Service at your place of residence. The declaration must reflect:

- income;

- expenses for which deductions are due;

- tax amount to be reduced.

You should also attach documents confirming that the expenses were actually incurred and belong to the category for which you are entitled to a deduction.

In the general situation, you can submit 3-personal income tax for deductions at any time within 3 years after the end of the year for which the deduction was due (i.e., there were income subject to personal income tax) .

Please note that when submitting documents for previous years, you should use the declaration form that corresponds to the year in which you received the right to deduction.

Personal income tax is refundable if 2 conditions are simultaneously met:

- The individual received income during the year, from which personal income tax was withheld at a rate of 13%.

- An individual has incurred expenses that qualify for a tax deduction.

Filing only a 3-personal income tax return from 2021 confirms the facts of tax reduction and the appearance of an amount that can be returned from the budget so that the tax office transfers personal income tax for refund to the individual’s account.

The application consists of three sheets. Only the first two (title page and bank details) must be filled out. The third sheet will be needed if you did not enter your TIN on the first two. The title page contains your details and other information about the tax being refunded (in your case, this is personal income tax). On the second sheet enter your bank details, according to which the money will be returned. The third sheet is devoted to individual information about you: passport details and place of registration (registration).

The application can be filled out by hand in capital letters, or on the computer. But the signature on the application must be “live” (that is, written by hand). It is placed only on the title page.

This sheet is needed for bank details for which the tax office will return the tax (overpayment). Get bank details for depositing money from the bank where you have your card or account. At your request, you will be given a printout where all the details will be indicated. You can also take them from the personal account of the bank in which the account is opened (if you have obtained access to your personal account). In Sberbank Online, you need to go to the details of your card or account by clicking on it, go to the “Deposit Information” tab and click the link “Transfer details to the deposit account”.

They do it like this.

1. Go to your card or account details by clicking on it.

2. Next, go to the “About Map” tab.

The employee has the right to contact the employer and reduce income subject to personal income tax by the amount of medical expenses. To do this you need:

- Receive a notification from the Federal Tax Service about the right to apply a deduction for treatment.

- Submit a written application in any form to the employer.

To receive notification of the right to deduction, you must contact the Federal Tax Service with an application and documents confirming the medical expenses incurred. The application form for a refund due to illness to receive notification of confirmation is established by letter of the Federal Tax Service No. BS-4-11/ dated January 16, 2017. When filling out the form, indicate the full name, tax identification number, passport details of the applicant and the amount of expenses. Be sure to include documents confirming the costs incurred.

We are writing an application for a personal income tax refund for treatment

When compiling, follow the following rules:

- If you are applying for a tax refund for the first time this year, enter the number 1 in the “Application Number” field.

- In the “Payer status” line, “1” is indicated.

- KBK for personal income tax 182 1 0100 110.

- The OKTMO code is taken from the 2-NDFL income certificate.

- The tax period is a year, so in the “Tax period code” field you should indicate “YY.00.2020” if you are returning tax for 2020.

- The amount to be refunded is equal to the value on page 050 of section 1 and page 160 of section 2 of the declaration.

- On page 2, where bank details are indicated, in the “Account type (code)” field, the value “02” is indicated if the funds are credited to a card, or a “Demand” account, or “07” if the funds are credited to a bank account.

- The account number is taken from the details for crediting salaries, which you will find in your online banking account. If you do not use such an application, contact the bank branch in person. Do not enter your bank card number in this field.

The total deduction amount (120,000 rubles for yourself and 50,000 rubles for a relative) includes not only payment for medical treatment services, but also the cost of purchasing medications.

You can return 13 percent of drug costs if the following conditions are simultaneously met:

- a prescription has been issued for the medicine by a doctor;

- The recipe and receipt have been preserved.

The previously existing restriction on the list of medications for tax reimbursement is no longer in effect; you can receive a deduction for expenses on any type of medications prescribed by a doctor.

To return personal income tax on treatment costs, you need to:

- Wait until the end of the year in which the expenses were incurred - you can get a tax refund for 2020 for 2021;

- During the reporting year, collect payment documents confirming expenses, contracts for the provision of medical services, and doctor’s prescriptions.

- At the end of the reporting year, fill out 3-NDFL, indicating the actual expenses within the social deduction and the amount of tax to be refunded.

- Submit the 3-NDFL declaration with supporting documents to the Federal Tax Service in paper form in person, through a representative, by mail, or electronically through the taxpayer’s account.

- The deadline for submitting documentation for deductions for 2021 is any time during 2021 without restrictions.

In one declaration, you can indicate both the amount to be refunded for the costs of treatment and medicines for yourself and relatives, and the amount for expensive medical services.

This is the second page of the 3-NDFL tax return; data is reflected here on how much tax the taxpayer is entitled to return for the reporting year.

The amount to be refunded is shown in line 050.

In this case, in line 010 you need to indicate the number 2, which will correspond to the need to return personal income tax from the budget.

The codes KBK and OKTMO are entered in lines 020 and 030.

This section is filled out last, when all the necessary calculations have been made, based on data from other pages of 3-NDFL.

The declaration page where the tax base and refundable tax are calculated. Filling out is carried out on the basis of data on income and withheld tax for the year specified in Appendix 1, and data on social deductions for treatment specified in Appendix 5.

You need to fill in the following lines:

- 001 — tax rate of 13 percent;

- 002 — in order to return personal income tax for treatment, you must indicate 3;

- 010 — total annual income of the taxpayer;

- 030 — annual income from which personal income tax had to be withheld (in most cases corresponds to line 010);

- 040 — the total amount of deductions from page 200 of Appendix 5;

- 060 - personal income tax base - the difference between taxable income and deductions (line 030 - line 040);

- 070 — personal income tax from the tax base that had to be paid for the reporting year, taking into account all deductions (rate from 001 multiplied by base from 060);

- 080 - the tax that is actually withheld and paid for the year is taken from page 080 of Appendix 1;

- 160 — Personal income tax, which must be returned from the budget in connection with expenses for treatment and medicines, is defined as the difference between the tax paid and the one that had to be paid, taking into account deductions (line 080 minus line 070). This indicator is the final value, which is transferred to the summary section 1.

How to return personal income tax through a tax deduction: sample application for a refund 2021

Necessary documents for tax deduction for treatment

- Completed tax return in form 3-NDFL (original).

- Application with details of the bank account to which the money will be transferred to you (original).

- Certificate 2-NDFL about income for the year, issued by the employer (original).

- Documents confirming payment (cash receipts, or receipts, or payment orders, or bank statements, etc.) (copies are allowed).

- In the case of payment for medical services, a certificate of payment for medical services for submission to the tax authorities, issued by a medical institution. Such a certificate is needed in addition to the document confirming payment (point above). That is, you need both that document and this one (the original).

- In case of purchasing medicines, prescriptions in form N 107-1/u (a copy is allowed).

- In case of payment for treatment for a relative, documents confirming the relationship of the taxpayer with the persons for whom payment was made (birth certificate, marriage certificate, etc.) (copy).

- An agreement with a medical institution, if one was concluded, or a document confirming treatment, for example, there must be an extract from a medical record (a copy is allowed).

- License of a medical institution to carry out medical activities, if the documents do not contain information about the details of the license. If information about the license is in an agreement or other document, then the tax authorities should not require a copy of the license. However, in order to avoid possible disputes with the tax authority, we recommend attaching this document in any case (a copy).

- To receive a deduction under a voluntary medical insurance agreement, copies of: a voluntary medical insurance agreement or a voluntary medical insurance policy are required; cash receipts or receipts for insurance premiums (contributions).

- To receive a deduction for the purchase of medicines, copies are required: the original prescription form with the prescription of medicines in the prescribed form with a copy of the payment documents confirming the fact of payment for the prescribed medicines.

By law, all copies of documents for tax deductions must be certified by a notary or independently by the taxpayer.

In order to independently certify, you must sign each page (not each document) of the copy as follows: “Copy is correct” Your signature / Signature transcript / Date. Notarization is not required in this case.

You need to prepare the following package of documents for tax deduction for treatment:

- At the Federal Tax Service (FTS) at your place of residence, you must fill out an application to receive a document confirming your right to receive a deduction.

- The application must be accompanied by documents that confirm the costs of training or treatment (contracts, doctor’s prescriptions, payment receipts, etc.). The period for consideration of the application by the Federal Tax Service is 30 calendar days, after which the corresponding document will be issued.

- It is also necessary to write an application to the tax agent (employer), to which should be attached a copy of the document confirming the right to a tax deduction from the Federal Tax Service.

After this, the employer is obliged to reduce the tax base by the appropriate amount.

The package of documents for a tax refund for treatment is somewhat different from what is required for a tax deduction for the purchase of medicines, but some of them must be submitted in both cases:

- Declaration 3-NDFL . Formed at the end of the year when treatment was carried out. It is important to reliably indicate information about all income received during the designated period.

- Help 2-NDFL . Issued by the taxpayer’s employer and contains information about accrued and withheld income for the year. If several jobs have changed during the specified time, you must obtain certificates from each of them.

- Copy of the passport . The Federal Tax Service provides certified copies of pages containing general information and registration information.

- Application for tax refund . In the text of the application, be sure to indicate the bank account details for transferring the deduction.

- Documents confirming guardianship, trusteeship or relationship . Provided if treatment was carried out or medications were purchased for a close relative or a minor child.

What documents to attach to the application

Attached are copies:

- Agreements with medical institutions.

- Documents confirming payment for medications and medical services (receipts, cash register checks).

- Marriage (birth) certificates, if you paid for the treatment of your spouse or relatives.

Originals:

- Certificates of payment for medical services for submission to the Federal Tax Service, issued by the medical institution in the form approved. by joint order of the Ministry of Health and the Federal Tax Service No. 289/BG-3-04/256 dated July 25, 2001.

- Prescription forms with the stamp “For tax authorities” issued by the medical institution.

Application for personal income tax refund in 2021

- Declaration forms 3-NDFL

- Application for tax deduction (form and sample)

- Application for distribution of property deduction

- Statement to employer - standard deduction for children

- Application for waiver of child deduction in favor of spouse

- Find out the deduction for previous years

- How to find out the inspection number

- How to find out OKTMO for the declaration

- Find out the cadastral number

- How to find out your TIN

- How to save the Declaration in PDF

- How to find out your account number

- How to find out postal code

- What is a tax deduction

- Who is eligible for deductions?

- Deadline for filing 3-NDFL for deduction

- How long to wait for tax deduction

- How to submit 3-NDFL to the tax office

- How to apply 3 years in advance

- Taxpayer attribute

- Purchase method

- Object cost (IV)

- How to submit via LC

- How to make an electronic signature

- How to get a 2-NDFL certificate

- How to add additional documents

It is presented in pdf and excel formats, which you can open on a computer and fill out yourself, or print the form and fill in the missing data with a ballpoint pen (in block letters).

There should be no problems filling out an application for a tax deduction. You can find all the necessary data in your own documents and on our website. The main thing is accuracy and attentiveness.

The state exempts from tax the part of a citizen’s income that he used for his socially significant expenses: buying a home, maintaining health, studying, etc. Income or a part thereof that a person received in the process of a major transaction may also be exempt from personal income tax. For example, when selling an apartment or car.

In all these cases, the right to a so-called personal income tax deduction arises.