The smallest wage established by the state pursues one very important goal - to protect the citizens of the country, so that the employer cannot pay the employee for his work less than the established amount if he has worked a full month.

In the spring of this year, reports were provided on the work of the government over the past year in the State Duma, as well as on the need to bring the minimum wage to the subsistence level. As a result, the social protection of Russia and the Ministry of Labor were given instructions to develop a bill by May 20.

An increase in the minimum wage will affect insurance investments. Taking into account the current minimum wage indicators, pension accruals can be calculated. To do this you need to multiply 3 digits:

- The figure is 26%.

- The number of all months.

- Minimum wage.

The amount of insurance through medicine is calculated similarly, only the percentage will be 5.1. Entrepreneurs have the opportunity to make payments either in full or in parts. The procedure must be completed by the end of the year.

Minimum wage from January 1, 2021

In our country, an increase in the minimum wage affects the amount of insurance investment. Therefore, taking into account the current value of the minimum wage for employment, there is a chance to calculate pension accruals. To do this, we multiply just three numbers:

- Minimum wage.

- The number of all months in a year, that is, 12.

- The coefficient is 26%.

Through medicine, the amount of insurance is calculated almost the same way, only the number of percentages will be 5.1. Entrepreneurs are asked to make payments not only in full. But also distribute them into parts. However, this must be done before the end of the year. December 31, 2017 will be a Sunday, so the payment deadline is set on the 1st working day of 2021. It turns out that it is advisable for businessmen not to delay repayment of debts to employees, so that they do not subsequently have to pay more than usual.

Otherwise, the latest news about the minimum wage in the country in 2021 may announce an upcoming increase in the corresponding indicator. But representatives of the tax service can calmly oblige the businessman to make the same payments to employed citizens in accordance with the new minimum wage values. And the legislation itself talks about taking into account the minimum wage at the very end of the pension payment period.

Minimum wage 2021 and wages

When last year the businessman’s profit went beyond 300 thousand rubles upwards, then they added 1 percent to his deposits. Only the total value of funds transferred to the Pension Fund should not exceed eight minimum wages. Those involved in high-ranking business activities are in an advantageous position in this case. In other words, if we take into account the current size of the current minimum of 7.5 thousand rubles. accruals will not exceed 60 thousand rubles, which is equal to 8 minimum wages.

From raising the minimum wage in our country, ordinary residents will definitely benefit, since the amount of salary, payment for vacation and sick days will increase, but the female part of the population will have access to increased maternity benefits and for children. Of course, there remains the possibility of increasing services and goods, which was initiated by the same businessmen.

This contingent is very happy about short-term earnings as opposed to stable income generation. However, the management staff of the organization does not have the right to make accruals that do not reach the minimum wage. Because if they fail to comply with this condition, they face sanctions from the labor inspectorate.

Calculation features

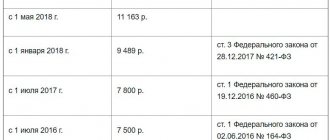

The employer will be held administratively liable if, from May 1 of the current year, the employee receives a salary of less than 11,163 rubles. The employer will be subject to a fine of 30,000-50,000 rubles if he does not comply with the legislator’s instructions. If repeated violations are detected, the specified amount will be increased to 50,000-70,000 rubles.

Will there be a raise?

From May 1 of this year, the minimum wage has been increased to 11,163 rubles, which will certainly affect the well-being of many Russian citizens. The amount of accrual of social payments depends on it, including certain types of benefits - for temporary disability, pregnancy and childbirth, child care up to 1.5 years, including subsidies, the amount of which is tied to the specified indicator.

How is the value calculated?

The size of the minimum wage is determined by the average wage, which is calculated for working hours worked minus income tax, insurance contributions and other types of holdings.

Initial data:

| Indicators | Description |

| Employee salary per month | is 17,200 rubles |

| Monthly bonus issued in accordance with the terms of the collective agreement | equal to 10% of salary |

| The employee has a standard tax deduction | equal to 1,200 rubles |

It is necessary to determine the compliance of the employee’s salary with the minimum wage.

An example of its calculation:

| Indicators | Calculation |

| Determination of wages | 17,200 + (17,200*10/100) = 18,920 rubles |

| Finding the personal income tax amount | (18,920 – 1,200) x 13% = 2,303.6 rubles |

| Calculation of the amount due for issuance | 18,920 – 2,303.6 = 16,616.4 rubles |

Wages are subject to indexation in accordance with the instructions of Article 34 of the Labor Code of the Russian Federation. It allows you to regulate the amount of income received by citizens. The indexation rate depends on the increase in prices for consumer goods and services.

When calculating it, in accordance with Article 129 of the Labor Code of the Russian Federation, the use of quantities is not allowed:

| Indicators | Description |

| Additional payments and allowances | provided for performing work in hazardous production conditions, in areas with special climatic conditions, in areas subject to radiation contamination |

| Various types of bonuses and rewards | provided for by local regulations of the enterprise |

| Social payments | provided by the state at the expense of budgetary funds |

Size by region

The size of the minimum wage is established by the legislator uniform throughout the entire territory of the Federation. At the same time, its subjects are allowed to set the minimum wage within the territory of the region, as noted in the instructions of Article 133 of the Labor Code of the Russian Federation. It should in no way be less than that established by the legislator at the federal level.

The measure is feasible on the basis of regional agreements, which provide for the economic situation and social conditions of the region, the features of its location and the size of the subsistence minimum.

A tripartite agreement in accordance with Article 45 of the Labor Code of the Russian Federation must be signed:

- executive authority of the subject of the Federation;

- a voluntary public association of workers bound by common interests in their line of work;

- association of employers.

The regional coefficient and the percentage bonus provided for the performance of work in the regions of the Far North and equivalent areas should be calculated above the established minimum wage.

Increase in the minimum wage from July 1, 2021

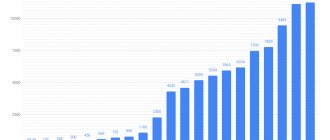

The minimum wage, according to the existing legislative framework, is required to be worked out every year and increased by the amount of inflation. If we observe how the rate of depreciation increases, allowances can be recalculated not only once a year, but also once a quarter. However, if we recall the current state of the treasury, the question of whether the minimum wage will increase in 2021 still remains open.

It should also be noted that the federal legislative framework does not regulate a very specific date for the development of the new minimum wage. And all because this innovation requires a separate decision from officials, which will clearly indicate the amount and timing of the adjustment in question. Allowances must be made in accordance with the current depreciation or a similar reliable indicator from last year. It also often happens that the official interpretation of inflation in numbers does not reach its real value.

Important nuances

The term “living wage” refers to an economic indicator of the well-being of the population, which allows one to assess the standard of living of the country’s population. Its indicator is calculated individually for working citizens, pensioners and minor children, depending on their needs.

It is set based on the cost of the consumer basket. The list of products included in it, essential goods and services is approved at the government level. Information about their prices is provided by the State Statistical Committee of the Russian Federation.

His responsibilities include:

- Collection of data on consumer prices throughout the Federation.

- Carrying out analysis and processing of collected data.

- Transfer of the results of the processed material to the relevant government authorities.

The cost of living indicator is determined for each quarter of the current year using a special method. It is approved by the legislator by the provisions of regulatory legal acts issued both at the federal and regional levels.

The minimum set of food products, consumer goods, and consumer services is determined once every 5 years for the entire country and separately for regions. They help ensure normal human functioning and maintain good health.

List of food products included in the consumer basket:

| Indicators | Weight |

| Bakery and pasta products, cereals | 126.5 kg |

| Potato | 100 kg |

| Eggs | 210 pieces |

| Meat products | 58.6 kg |

| Fish products | 18.5 kg |

The cost of services includes expenses for utility bills and electricity delivery, use of vehicles, telephone communications, and payment for cultural events.

For the country's unemployed population, the minimum wage is set according to the minimum wage. It is used to calculate the amount of social benefits and subsidies provided by the state to low-income citizens. Any fluctuations in it affect the financial situation of the country’s unemployed citizens and pensioners.

The employer's management, represented by the general director and chief accountant, will be subject to administrative sanctions if the employee is paid less than the established minimum wage. The norm was established in accordance with the instructions of Article 5.27 of the Code of Administrative Offences.

The amount of the penalty is:

| Sum | Description |

| 1,000-5,000 rubles | upon initial violation |

| 10,000-20,000 rubles | upon repeated violation |

In addition, the management team of a legal entity may be disqualified for a period of one to three years.

Video: promotion

Minimum wage 2021 and benefits

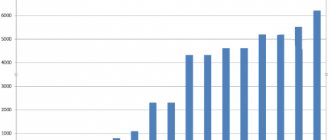

If we take into account practical experience, it can be noted that making extra payments does little to contribute to the minimum rate in achieving the established minimum subsistence level for the same period. For example, the indexation of the minimum wage, carried out twice last year, raised its value exclusively to 60 percent of the minimum, and such actions are considered non-compliance with the letter of the law in the field of labor relations. Today, the government only promises to improve the situation and raise the minimum wage to the subsistence level. But in reality everything remains in its place. Last year, the minimum wage was increased by only 4 percent, as opposed to the expected 17.1 percent.

Most of all, the constant precarious position of the economy affects socially vulnerable categories of Russian citizens. Statistics show that the poor stratum of our compatriots mainly includes single mothers and families with a considerable number of children. So, for the most part, it is these people who are concerned about how much the minimum wage will be in 2021 per child.

Want to know how to earn over 450% per annum in the stock market?

Get a free course on investing in high-yield instruments that brought in more than $1 million in 2021.

I, Andrey Abrechko, an investment expert with 12 years of experience and the founder of the Academy of High Profit Investments, invite you to take part in my free course, where you will learn:

— which instruments are the most profitable in 2021;

— what are IPOs and SPACs and how to start making money on them from 100% per annum;

I will analyze my real case, where I will show with a clear example how I managed to make more than 450% per annum for 2020.

The course consists of 5 small lessons that will be sent to you via Telegram and you can watch them at any convenient time.

Follow the link and start free training