The most important document of an employee is his work book.

The document is so important that even the preparation of records is strictly regulated by the legislator. In this regard, the accounting of work records at the enterprise must be carried out with special care. The employee responsible for operations with books and their inserts must always clearly know how many of them have arrived, how many have been transferred to employees and what their cost is. The receipt and expenditure ledger helps with this. Let's take a closer look at it.

Where can I get it?

The magazine is purchased from distributors registered as individual entrepreneurs and legal entities related to the work of the Association of State-Owned Enterprises and Organizations "GOZNAK". The procedure for purchasing forms is carried out in accordance with clause 3 of Decree of the Government of the Russian Federation dated April 16, 2003 No. 225.

The frequency and volume of receipts of new forms and inserts occurs in accordance with the service agreement concluded between the organization and the distributor/manufacturer of these products.

Citizens' independent acquisition of work record forms and insert sheets is not encouraged. A book can be considered suitable if it is made according to the existing standard and has the necessary degrees of protection:

- the sheets have a watermark “TK”,

- the printed characters in the form are made using “iris printing”;

- when a source of ultraviolet radiation is brought to the sheets of the form, the inscription “WORK BOOK” should appear,

- in the production of document paper, special microfiber was used,

- the connection between the sheets of the work book and the crust cannot be faked.

An independently purchased document (labor document), accepted by the organization’s accounting department as meeting the requirements and having due protection, may subsequently be recognized as invalid by the Pension Fund.

Sample of filling out the receipt and expenditure book for accounting of work books:

To fill out the form according to the example given, download the blank form: Receipt and expense book form for accounting for work book forms.

Who is responsible?

The person responsible for timely entering information into the journal and submitting reports on the movement of documents is determined by the head of the organization. Most often, this work is carried out by the organization's accountant.

It is not forbidden to oblige a representative of the personnel department or another employee of the institution/company, whose professional duties do not interfere with the timely completion of the book and control over access to it by third parties, to perform such activities.

When appointing someone responsible for the accounting book, this employee must familiarize himself with a written statement of the assigned obligations, and then leave a signature in the document indicating that he has read the job description.

Who's leading?

In accordance with paragraph 41 of the “Rules...”, this documentation is stored in the accounting department .

If the position of cashier is provided, then usually filling out the book is assigned to him.

The person in charge is appointed by the head of the company by issuing an order or order. The text of this document is written in free form.

How to seal and stitch

The purchased accounting book of receipts and expenditures of work book forms must have a numbered indicator seal without signs of damage, corresponding to GOST 31282–2004.

The lacing of the journal is performed by the person designated as responsible for making entries.

Sequence of the firmware procedure:

- Using a sharp needle or awl, make a hole in the left blank margin of the magazine, piercing all the sheets through. When determining the location of the punctures, you should take into account the ease of use of the book after flashing.

- Thread a harsh or otherwise strong thread through the resulting holes so that upon completion of the work, two ends of 7–8 in length remain.

- The threads are tied in a knot on the back of the book.

- A sheet of paper is glued over the knot and the remaining ends of the lacing.

- The surface of the pasted sheet is intended for a certification inscription about the number of pages in the book, the date of the firmware, information about the person who performed the procedure (full name in abbreviated and full format, signature).

Algorithm for the accounting ledger verification procedure:

- Number all pages in the journal (information about the number of pages must be presented in words and in the form of numbers).

- A certification inscription must be made (it is performed by the head of the organization, who confirms with his signature that the specified number of pages corresponds to reality).

- Before putting the Book into operation, fill out its title page.

- Enter the digital code found on the production seal in the line provided for this (without fixing the number from the seal on paper, even the magazine will not be considered sealed).

- They are stitching the book.

- Seal the lacing.

Rules and requirements

Rules:

- Each organization must have a sufficient number of work book forms and inserts for them (if the employee responsible for issuing forms assumes that there may not be enough unfilled forms, he must notify his manager about this by writing a corresponding statement).

- The presence of a Journal of accounting forms of work books and inserts is mandatory for every institution and company.

- A logbook of forms, the forms themselves are strictly accountable documents (must be stored in a room/safe with appropriate access restrictions).

- The factory seal secures one of the ends of the cord from the magazine firmware. Untying it, removing the pages of the account book, or replacing them is strictly prohibited.

- Only the person responsible for it has the right to fill out the log.

- Only the head of the institution can put a certification signature (it is an offense for the procedure to be carried out by an authorized person, an employee who will subsequently keep the journal).

- Third parties should not have access to the journal unless the employee responsible for making entries is absent.

- The funds for receiving a new work form and insert are paid by the citizen receiving the documents (collection of funds for the issued document is carried out in accordance with clause 47 of Rules No. 225).

On a monthly basis, the person responsible for keeping records of work book forms and loose sheets for them is required to document the following:

- number of available unfilled forms,

- number of issued,

- amounts received for issuing completed documents to citizens.

The issuance of forms is carried out at the expense of the enterprise if:

- the document in storage was lost by the organization’s employees who were responsible for the safety of these papers;

- the document was lost or destroyed due to emergency circumstances (industrial accident, theft of documents from the institution’s safe, fire, natural disaster).

Requirements for filling:

- The forms are filled out with a pen and paste.

- Entries are made one by one, legibly, without erasures.

- A new entry is made on the day the forms and inserts for work books are received/accepted for registration or at the time the document is issued to the person in need of it.

- A damaged work form (a mark was made during the filling process or incorrect information was entered by mistake) is subject to mandatory disposal.

The fact of document destruction must be documented (an act is drawn up). For reliability, identification information of the destroyed form is pasted into the act (cut out fields with the number and series of the destroyed form). - The citizen who has received the work book in hand, under the control of the person responsible for the Journal, signs in the receipt and expenditure book, confirming the fact that the form/insert has been issued to him.

Algorithm for entering information:

- The serial number of the entry is indicated in a special column.

- In separate columns enter the day, month, and year of completion of the accounting information.

- The fifth column indicates information about the person who issued the forms/received the form (full name of the citizen or name of the organization).

- In the sixth, the basis for issuance, the identification number of the document and the date of its issue to the bearer are prescribed.

- In the receipt column, first indicate the number of work books received, their series, number, then write down information about the inserts.

- Enter information about the amount spent on purchasing forms.

- In the receipt column indicate the number of work books issued, the number of inserts for them with the obligatory indication of the series and document numbers.

- The final column contains information about the amount of funds to be received for the issued forms.

Do not confuse the firmware of the book for recording TC forms with the firmware of the book for recording the movement of TC. These are different things! We wrote in detail about keeping a book of labor movements in this article.

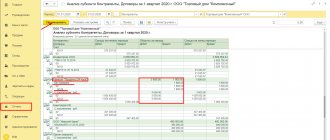

Accounting entries for work records

Work books are accepted as a strict reporting form:

| Debit | Credit | Explanation |

| 006 | Work books are accepted as strict reporting forms | |

| 91 | 60 | The cost of work books is accepted as expenses |

| 19 | 60 | VAT reflected |

| 006 | Writing off work books issued to newly hired employees | |

| 73 | 91 | Reimbursement of the cost of the work book by employees upon dismissal and receipt of the work book in their hands |

| 91 | 68 | VAT accrual on the cost of issued work record forms |

| 50 | 73 | The debt for the issued work record forms has been repaid |

Work books are accepted as assets:

| Debit | Credit | Explanation |

| 10(41) | 60 | Work books are accepted as inventories |

| 19 | 60 | VAT reflected |

| 006 | Work books are accepted as strict reporting forms | |

| 91(90) | 10(41) | The cost of issued work books is accepted as expenses |

| 91(90) | 68 | VAT accrual on the cost of issued work record forms |

| 006 | Writing off work books issued to newly hired employees | |

| 73 | 91(90) | Reimbursement of the cost of work books issued to employees upon dismissal is included in income |

| 50 | 73 | The debt for the issued work record forms has been repaid |

Misconduct and responsibility

The absence in the organization of the Register of documents allowing to determine the work experience of citizens, places of work and duration of activity gives the regulatory authority the right to impose a punitive administrative penalty in the form of a fine:

- from 500 to 5 thousand rubles (for officials);

- 30–50 thousand rubles (for an organization).

Filling out the Accounting Book is carried out only by an authorized person. If a violation of this rule is detected, a fine is imposed: from 3–5 thousand rubles (for citizens), from 10–20 thousand rubles (for officials).

Author of the document

| Contract-Yurist.Ru offline Status: Legal company rating460 84 / 6 Private message Order a consultation | number of consultations: |

| noted as the best: | 5 |

| answers to documents: | |

| documents posted: | 927 |

| positive feedback: | |

| negative reviews: |

| Appendix No. 2 to Resolution of the Ministry of Labor of Russia dated 10.10.2003 No. 69 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Is it possible and how to make changes to it?

Any corrections to information without accompanying written explanations on behalf of the person responsible for the Journal are unacceptable. Which is another type of protection against falsification of documentary information.

A notification that information in a line in a certain column has been corrected is recorded:

- in a special field for notes, if there is one in the Journal table (incorrect information is crossed out with one neat line, and in the note, the entry about the error is certified by a personal signature of the person responsible for the accounting book, a transcript of the signature, and the date of the procedure);

- line below, but in the same column where the inaccuracy was made (incorrect information is not crossed out, they only indicate in words that the entry with such and such a number is unreliable). The following is accurate information.

Maintaining a receipt and expenditure book to keep track of purchased and issued new work record forms is ignored by some heads of organizations. However, if it is discovered that such a document is missing, as well as being found to have violated the rules for filling it out, it is punishable by an administrative penalty.

What is it used for?

The receipt and expenditure book is a registration document where records are made about the new forms of work books received by the enterprise from their manufacturers/sellers and about their subsequent issuance to employees.

There they record information about:

- company costs for purchasing blank workbook forms;

- expenditure of purchased documents due to the issuance/registration of personal labor documentation to employees.

Sample book of accounting and movement of work books