What is the SZV-M report?

In accordance with Art. 3 of the Federal Law of April 1, 1996 No. 27-FZ “On individual (personalized) accounting in the compulsory pension insurance system” the goals of individual (personalized) accounting are:

- creating conditions for the appointment of insurance and funded pensions in accordance with the labor results of each insured person;

- ensuring the reliability of information about length of service and earnings (income), which determine the size of insurance and funded pensions when they are assigned;

- creation of an information base for the implementation and improvement of the pension legislation of the Russian Federation, for the appointment of insurance and funded pensions based on the insurance length of the insured persons and their insurance contributions, as well as for the assessment of obligations to the insured persons for the payment of insurance and funded pensions, urgent pension payments, lump sum payments pension savings funds;

- developing the interest of insured persons in paying insurance contributions to the Pension Fund of the Russian Federation;

- creating conditions for monitoring the payment of insurance premiums by insured persons;

- information support for forecasting the costs of paying insurance and funded pensions, determining the tariff of insurance contributions to the Pension Fund of the Russian Federation, calculating macroeconomic indicators related to compulsory pension insurance;

- simplification of the procedure and acceleration of the procedure for assigning insurance and funded pensions to insured persons.

The SZV-M form was approved by Resolution of the Board of the Russian Pension Fund dated February 1, 2021 No. 83p “On approval of the form “Information about insured persons.” In the section “Information about insured persons”, information about insured persons is indicated - employees with whom employment contracts, civil law contracts, the subject of which is the performance of work, the provision of services, author's order contracts, contracts for alienation of the exclusive right to works of science, literature, art, publishing license agreements, license agreements granting the right to use works of science, literature, art

| № p/p | Last name, first name, patronymic (if any) of the insured person (filled out in the nominative case) | Insurance number of an individual personal account (required to be filled in) | TIN (filled in if the policyholder has data on the individual’s TIN) |

When SNILS asks the house management

As of January 1, 2018, liability came into force that comes with the disclosure of information about the activities of a homeowners’ association, management company, etc.

Fraudulent schemes using SNILS and how ordinary citizens are deceived

When SNILS is entered into the system, this allows you to link a personalized account with a specific person. In addition, there are more opportunities to collect debt from the property owner.

Thus, non-payment of utilities ceases to be a problem in the relationship between the management company and the owner of the apartment, but becomes a violation of an obligation, which is automatically recorded in the state system.

Who should fill out the SZV-M?

According to clause 2.2 of Art. 11 of the Federal Law of April 1, 1996 No. 27-FZ “On individual (personalized) accounting in the compulsory pension insurance system”, the policyholder, on a monthly basis, no later than the 15th day of the month following the reporting period - month, submits information about each person working for the person, (including persons who have entered into civil law agreements, the subject of which is the performance of work, the provision of services, copyright contracts, agreements on the alienation of the exclusive right to works of science, literature, art, publishing license agreements, license agreements on granting the right to use a work of science, literature, art, including agreements on the transfer of rights management powers concluded with a rights management organization on a collective basis) the following information:

- insurance number of an individual personal account;

- last name, first name and patronymic;

- taxpayer identification number (if the policyholder has data on the taxpayer identification number of the insured person).

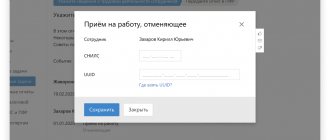

How to take SZV-TD if an individual does not have SNILS when applying for a job?

The organization enters into employment contracts with temporarily staying foreigners. They don't have SNILS. In this case, reporting in the SZV-TD form is submitted to the employee the next day after the order for employment is issued. In this case, what should I indicate in the SNILS field of the SZV-TD form?

You should wait until individuals receive SNILS, and then accept them into the workforce and submit the SZV-TD form.

The documents that an employee must provide upon employment are listed in Art. 65 Labor Code of the Russian Federation. Among them is a document confirming registration in the individual (personalized) accounting system. Currently this is the ADI-REG form, approved. Resolution of the Board of the Pension Fund of the Russian Federation dated June 13, 2019 No. 335p. It is there that the SNILS (individual personal account insurance number) assigned to the individual is indicated. Thus, the employer has the right to require SNILS from an employee during employment (with the exception of those who are hired first). And also refuse to hire if the employee does not introduce him.

From 04/09/2020, in case of hiring an individual, as well as in case of dismissal of an employee, reporting in the SZV-TD form is submitted to the Pension Fund of Russia the next day after the publication of the corresponding personnel document - order, instruction, etc. (Clause 1, Clause 2.5, Article 11 of the Federal Law dated April 1, 1996 No. 27-FZ, Decree of the Government of the Russian Federation dated April 8, 2020 No. 460).

The SZV-TD form is filled out and submitted to all registered persons with whom labor relations have been concluded or terminated (clause 1.4 of the Procedure for filling out the SZV-TD, approved by Resolution of the Pension Fund Board of December 25, 2019 No. 730p). Registered individuals are individuals who have opened an individual personal account in the individual personalized accounting system (Article 1 of Law No. 27-FZ).

This account is opened for every foreign citizen, regardless of his migration status (Part 1, Article 6 of Law No. 27-FZ). Thus, foreigners temporarily staying in the territory of the Russian Federation are entitled to a document indicating SNILS.

At the same time, SNILS must be indicated in personalized reporting. Otherwise, the reporting will not be accepted.

An individual can obtain the ADI-REG form independently by contacting the Pension Fund of Russia at the place of residence (stay) or the MFC (Article 14 of Law No. 27-FZ).

In the situation under consideration, we believe that it is more expedient to first ask foreign citizens to issue a SNILS, and then hire them and present them with a SZV-TD. This will help avoid penalties for late submission of personalized reports. Currently, violation of the deadline for filing a SZV-TD entails a fine under Art. 5.27 Code of Administrative Offenses of the Russian Federation (Part 21, Article 17 of Law No. 27-FZ). It amounts to:

- for entrepreneurs and officials – from 1,000 rubles. up to 3,000 rubles;

- for organizations - from 30,000 rubles. up to 50,000 rub.

Is SNILS a mandatory document?

According to Art. 65 of the Labor Code of the Russian Federation, when concluding an employment contract, a person applying for work presents to the employer:

- passport or other identity document;

- work book, with the exception of cases when an employment contract is concluded for the first time or the employee starts working on a part-time basis;

- insurance certificate of compulsory pension insurance;

- military registration documents - for those liable for military service and persons subject to conscription for military service;

- a document on education and (or) qualifications or the presence of special knowledge - when applying for a job that requires special knowledge or special training;

- a certificate of the presence (absence) of a criminal record and (or) the fact of criminal prosecution or the termination of criminal prosecution on rehabilitative grounds;

- a certificate stating whether or not the person is subject to administrative punishment for the consumption of narcotic drugs or psychotropic substances without a doctor’s prescription or new potentially dangerous psychoactive substances.

The labor legislation of the Russian Federation prohibits requiring other documents from a potential employee during employment.

According to Art. 11 of the Labor Code of the Russian Federation, labor legislation and other acts containing labor law norms do not apply to persons working on the basis of civil law contracts.

Thus, the insurance certificate of compulsory pension insurance (SNILS) is a document required when concluding an employment contract or civil servants' agreement.

How to pass SZV-M if you don’t have SNILS?

In accordance with paragraph 3 of Art. 9 of the Federal Law of April 1, 1996 No. 27-FZ “On individual (personalized) accounting in the compulsory pension insurance system”, an insured person entering work or concluding a civil law contract, for which remuneration is in accordance with the legislation of the Russian Federation insurance premiums are charged, he is obliged, in turn, to provide the policyholder with his insurance certificate of compulsory pension insurance, and if it is not available, write a corresponding application for the issuance of an insurance certificate of compulsory pension insurance for the first time or for the issuance of a new one (to replace the lost one).

If SNILS is not available in SZV-M, the policyholder will be provided with a negative report, and therefore the report may not be accepted. Before the insured person receives an insurance certificate, the policyholder may not indicate his data in SZV-M, but after providing SNILS, it is necessary to submit a supplementary report to the Pension Fund of the Russian Federation, accompanied by a letter explaining the reasons. In this case, it is possible to avoid a fine.

What to do if an employee does not have SNILS

If there is no SNILS, information about the employee cannot be included in the SZV-M report. It turns out that the employer submits a SZV-M report to the Pension Fund with incomplete information.

For this violation, the fund will issue a fine of 500 rubles. for each individual whose information is not available in the SZV-M (Article 17 of Law No. 27-FZ).

There is only one way out - to arrange for the employee to receive SNILS as quickly as possible.

The figure below shows the nuances of obtaining SNILS:

Legislatively, the procedure for making a decision by the Pension Fund of Russia on opening a personal account (that is, issuing SNILS) takes 5 working days from the moment the fund specialists receive the necessary documents (clause 11 of the order of the Ministry of Labor of Russia dated December 21, 2016 No. 766n, letter of the Pension Fund dated June 28, 2019 No. 09 -19/13246).

But no one prohibits the fund’s specialists from issuing SNILS faster. To speed up the process, send the employee himself to the fund branch. There, a specialist will register the application within half an hour and issue a sheet with the SNILS number.

As soon as the employer has information about SNILS, you need to fill out and submit to the Pension Fund the supplementary form SZV-M, if the original report has already been sent. It is better to accompany the submission of the adjustment with a letter, indicating in it the reason for the late submission of data (the employee does not have SNILS). In this case, the chances that the employer will not be fined increase.

Are there deadlines for submitting supplementary and canceling SZV-M forms without sanctions? The answer to this question can be found in ConsultantPlus. If you do not already have access to this legal system, trial access is available for free.

How can I pass the SZV-M?

According to Art. 8 of the Federal Law of April 1, 1996 No. 27-FZ, information for individual (personalized) accounting submitted in accordance with this Federal Law to the bodies of the Pension Fund of the Russian Federation is presented in accordance with the procedure and instructions established by the Pension Fund of the Russian Federation.

This information may be presented as follows:

| Method of reporting | Conditions |

| In the form of written documents | Provided that the number of insured persons (including those who have entered into civil contracts for which insurance premiums are calculated in accordance with the legislation of the Russian Federation) does not exceed 25 people |

| In electronic form (on magnetic media or using public information and telecommunication networks, including the Internet, including a single portal of state and municipal services) with guarantees of their accuracy and protection from unauthorized access and distortion | The policyholder provides information on 25 or more insured persons working for him (including persons who have entered into civil contracts) for the previous reporting period in the form of an electronic document signed with an enhanced qualified electronic signature in the manner established by the Pension Fund of the Russian Federation. |

When submitting information in electronic form, the relevant body of the Pension Fund of the Russian Federation sends to the policyholder confirmation of receipt of the specified information in the form of an electronic document.

Responsibility for failure to provide SZV-M

For violation of the submission of the SZV-M form, the insurer is held liable:

| Offense | Penalties | Normative act |

| SZV-M is not represented for individual contractors | Fine 500 rubles for each insured contractor | Art. 17 Federal Law dated April 1, 1996 No. 27-FZ |

| Failure of the policyholder to comply with the procedure for submitting information in the form of electronic documents | Fine 1000 rubles | Art. 17 Federal Law dated April 1, 1996 No. 27-FZ |

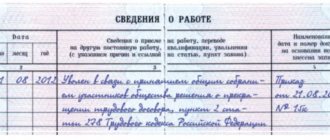

Case from practice

The employer encountered difficulties submitting the DAM to the tax authority, although he had previously submitted a similar calculation to the Pension Fund without any problems. The Federal Tax Service does not see the SNILS of one of the employees. The situation is complicated by the fact that it is registered in another region.

As a result, the DAM was not accepted, and the company faces a fine and account blocking. Neither the Federal Tax Service nor the Pension Fund are in a hurry to figure it out. They also do not explain the reason for their inaction.

The employee has been working for the company for several days, and previously reports to the Pension Fund of the Russian Federation with his SNILS number did not raise any questions. The reason for refusal to accept payment for insurance premiums is: “SNILS not found.” This suggests that the error lies on the side of the Federal Tax Service. We all remember well that in the recent past the transfer of administration of pension contributions from the Pension Fund to the Tax Service took place . In this case, apparently, an error occurred. Most likely, incorrect data about the employee’s SNILS entered the Federal Tax Service database.

It turns out that it is not his fault that the policyholder cannot report. Moreover, if the SZV-M forms were submitted and the mentioned error did not occur, it means that the employer provided the correct information about the SNILS of its employees to the Federal Tax Service. And since it is correct, then the tax service has no reason to refuse to accept the report.

This is an example of the fact that failure to submit reports on time can be the fault of the tax authority. If this is followed by sanctions, their imposition will be unlawful.

Questions and answers

- Why can you submit a SZV-M report without an INN, but not without SNILS?

Answer: The section where SNILS is indicated is mandatory for filling out in SZV-M. When concluding an employment contract or a GPC agreement, SNILS is a mandatory document.

- Do I have the right to hire an employee without SNILS?

Answer: According to Art. 65 of the Labor Code of the Russian Federation, when concluding an employment contract, a person entering work presents the employer with an insurance certificate of compulsory pension insurance. Thus, you need to obtain SNILS from the new employee.