“Consultant”, N 12, 2004

RESERVE FOR UPCOMING HOLIDAY COSTS

To evenly distribute the burden of paying vacations to employees throughout the year, both in accounting and tax accounting, the organization may provide for the creation of an appropriate reserve. At the same time, a clear procedure for its formation and use is not defined in either accounting. The author considers possible options for reserving, paying attention to the provisions that must be defined in the accounting policies of the organization.

In order to evenly include future expenses in production and circulation costs, organizations can create appropriate reserves for the types of these expenses. The list of reserves for future expenses provided for by law that organizations can create in the reporting year, the procedure for their formation and use must be reflected in the accounting policies of the organization. The amounts of reserves are subject to regular verification to ensure correct formation and use. It should be noted that before drawing up annual financial statements, an inventory of reserves for future expenses is carried out without fail on the last working day of the reporting year (commentary to account 96 “Reserves for future expenses” of the Instructions for the application of the Chart of Accounts for financial and economic activities of organizations, approved by Order of the Ministry of Finance of Russia dated 10.31.2000 N 94n; hereinafter - Instructions for using the Chart of Accounts).

Expenses for vacation pay for the organization's employees are made unevenly: the bulk of vacation pay payments, as a rule, falls on the summer months. To distribute expenses evenly during the reporting year, it is advisable to create an appropriate reserve. The possibility of creating such a reserve is provided both in accounting and for the purposes of calculating corporate income tax. At the same time, when creating a reserve, for example, in tax accounting, an organization is not obliged to automatically create a reserve for upcoming vacation payments in accounting, and vice versa.

Accounting for reserve

The possibility of creating a reserve for the upcoming payment of vacations to employees is provided for in clause 72 of the Regulations on maintaining accounting and financial reporting in the Russian Federation, approved by Order of the Ministry of Finance of Russia dated July 29, 1998 N 34n.

If a reserve is created for the upcoming payment of vacations, the organization’s accounting policies for the next financial year must reflect a calculation justifying the feasibility of creating a reserve, the procedure for its formation and use. As a rule, in accounting, the monthly amount of contributions to the reserve is determined by dividing the annual amount of the created reserve by 12.

The amount of the reserve for accounting purposes is calculated for the coming financial year based on the planned amount of expenses for vacation pay (including payments for social insurance and security). Such instructions are contained in the Instructions for using the Chart of Accounts. Information on the formation and use of reserve amounts is taken into account in account 96 “Reserves for future expenses”.

The accrual and use of the reserve for upcoming vacation pay is reflected in accounting by the following entries:

D 20 (26, 44, etc.) - By 96 reserve accrual (performed monthly);

D 96 - K 70, 69 include actual expenses for paying for vacation at the expense of reserved amounts.

If at the end of the reporting year the actual expenses for vacation pay exceed the reserve amount, an additional charge is made for the missing amount.

In the accounting records as of December 31, the following entry is made:

D 20 (26, 44, etc.) - To 96 the missing amount was added in case of overspending of reserve funds.

During the year, overexpenditure of reserve funds is reflected in account 96.

If at the end of the reporting year the reserve has not been fully used and the organization does not create a reserve for the next year, then the following adjustment options are possible:

1) reversal of the reserve balance:

D 20 (26, 44, etc.) - By 96, the overly reserved amount was reversed;

2) attributing the balance of the reserve to the financial results of the organization’s activities:

D 96 - K 91 the balance of the reserve is included in non-operating income.

Previously, in paragraph 58 of the Methodological Recommendations on the procedure for preparing financial statements of organizations approved by Order of the Ministry of Finance of Russia dated June 28, 2000 N 60n (repealed), it was established that if, when clarifying the accounting policy for the next reporting year, the organization considers it inappropriate to accrue the corresponding reserve, then the balances funds of the unused reserve as of January 1 following the reporting year are included in the financial result of the organization and are reflected in the accounting records of the organization for January.

At the end of the reporting year, adjustments to the reserve amounts are made depending on the results of its inventory. When conducting an inventory of the reserve and reflecting its results in accounting, it is necessary to be guided by the Methodological Guidelines for the Inventory of Property and Financial Liabilities, approved by Order of the Ministry of Finance of Russia dated June 13, 1995 N 49, to the extent that does not contradict subsequent changes in accounting legislation.

When creating a reserve next year, its size is subject to clarification in accounting. The updated calculation is based on the number of days of unused vacation, the average daily amount of labor costs and unified social tax deductions.

It should be noted that the possibility of transferring the balance of the reserve to the next financial year is controversial among experts. Proponents of the position in which the balance of the reserve at the end of the year should not exist proceed from the principle of temporary certainty of the facts of economic activity, which is enshrined in clause 6 of the Accounting Regulations “Accounting Policy of the Organization” PBU 1/98, approved by the Order of the Ministry of Finance of Russia dated 09.12. 1998 N 60n.

At the moment, the regulatory documents do not clearly establish the procedure for the formation and use of a reserve to pay for upcoming vacations, so the issue remains controversial until its legislative settlement.

Tax accounting of reserve

The accounting policy of the organization for tax purposes reflects the accepted method of reserving, the maximum amount of deductions and the monthly percentage of deductions to the specified reserve. The specified indicators of the organization's accounting policy are determined in the manner prescribed by Article 324.1 of the Tax Code of the Russian Federation. When making a decision on the formation of a reserve, it is necessary to proceed from the economic feasibility of its creation. The created reserve as an element of accounting policy can be used as a method for optimizing the tax burden.

The taxpayer is required to draw up a special calculation (estimate), which reflects the calculation of the amount of monthly contributions to the specified reserve, based on information about the estimated annual amount of expenses for vacations, including the amount of the unified social tax on these expenses. It should be noted that Article 324.1 of the Tax Code of the Russian Federation does not specify what amount of unified social tax should be taken into account in calculating the reserve - with or without taking into account insurance contributions for compulsory pension insurance. In this regard, the taxpayer has the right to establish an appropriate calculation procedure in the accounting policy.

The percentage of contributions to the reserve for upcoming vacation expenses is determined as the ratio of the estimated annual amount of vacation expenses to the expected annual amount of labor expenses. It is not clear from the wording of the above article what is meant by the estimated amounts of expenses for wages and vacations. In the accounting policy for tax purposes, it is necessary to establish what amount is taken into account, for example, the planned amount of expenses for the next year or the actual amount of expenses for vacation pay for the previous year.

In accordance with paragraph 24 of Article 255 of the Tax Code of the Russian Federation, expenses in the form of deductions to the reserve for the upcoming payment of vacations to employees of the organization for profit tax purposes are included in labor costs.

In tax accounting, various algorithms for calculating monthly contributions to the reserve can be used. Thus, the determined monthly percentage of deductions can be calculated by dividing the estimated annual amount of vacation expenses by the estimated annual amount of labor expenses and 12 months, or the resulting percentage is not divided by 12 months. In the first case, the amount of monthly contributions to the reserve is determined by multiplying the annual amount of labor costs by the percentage of contributions and is a constant value. In the second case, the amount of monthly deductions is determined by multiplying the monthly estimated labor costs by the percentage of deductions. The amount of monthly contributions in this case is variable.

To this we can add that the first of these calculation methods is most consistent with the principle of uniform distribution of expenses in tax accounting.

The reserve amounts underutilized at the end of the tax period in tax accounting are subject to mandatory inclusion in non-operating income of the current tax period (clause 3 of Article 324.1, clause 7 of Article 250 of the Tax Code of the Russian Federation).

It should be noted that the need to recognize in tax accounting as part of income the amount of unused reserve for the amount of vacation “carrying over” from one tax period to another is a controversial issue. In order to avoid disagreements with the tax authorities, it is necessary to reflect the entire amount of the unused reserve as part of non-operating income at the end of the reporting period.

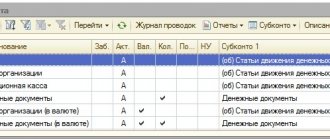

Synthetic and analytical accounting of account 69 by subaccounts

Search for Lectures ⇐ Previous1234 To manage an enterprise, you need not only generalized information, but also detailed information about the state and movement of funds and the sources of their formation.

Therefore, accounting uses classification of accounts according to the degree of generalization of information. This classification distinguishes three groups of accounts: - synthetic (generalizing) accounts,

— analytical accounts (detailing),

— subaccounts (intermediate between synthetic and analytical).

Synthetic accounts provide general indicators in monetary terms about economic assets and their sources and about the transactions performed.

Analytical accounts are used for detailed quantitative and summative characteristics of economic assets and their sources.

In analytical accounts, data from synthetic accounts is analyzed and specified. Analytical accounts reflect data not only in monetary terms, but also in natural, labor or conditionally natural terms. Analytical accounts are opened only for a specific synthetic account, so their structure must correspond to the synthetic account to which they are opened.

Accounting for accrued contributions and offset expenses is carried out on account 69 “Calculations for social insurance and security”. This account is intended to summarize information on contributions to state insurance, pensions, medical insurance of personnel and to the Employment Fund of the Russian Federation.

Analytical accounting for account 69 “Calculations for social insurance and security” is carried out in the context of each type of calculation.

The explanations to this account say that if the organization has payments for other types of social insurance and security, additional sub-accounts may be opened. An example of such a case could be a subaccount for compulsory social insurance against industrial accidents and occupational diseases.

Account 69 is intended for accounting for settlements of insurance contributions to extra-budgetary funds.

For account 69 you need to open sub-accounts:

69-1 “Calculations for social insurance” - to account for calculations for insurance premiums transferred to the Social Insurance Fund and contributions for social insurance against industrial accidents and occupational diseases;

69-2 “Calculations for pension provision” - to account for calculations for pension insurance contributions transferred to the Pension Fund;

69-3 “Calculations for compulsory health insurance” - to account for calculations for insurance premiums transferred to the Federal (until 2012) and territorial compulsory health insurance funds.

Open second-order subaccounts for these subaccounts.

To account for settlements with the Social Insurance Fund for insurance premiums and contributions for insurance against industrial accidents and occupational diseases, subaccount 69-1 is divided into subaccounts:

69-1-1 “Settlements with the Social Insurance Fund for insurance contributions”;

69-1-2 “Settlements with the Social Insurance Fund for contributions to social insurance against industrial accidents and occupational diseases.”

Until 2014, to account for contributions to the Pension Fund for the insurance and funded parts of the labor pension, it was necessary to split subaccount 69-2 into subaccounts:

69-2-1 “Calculations for the insurance part of the labor pension”;

69-2-2 “Calculations for the funded part of the labor pension.”

From January 1, 2014, the responsibility for determining and accounting for insurance premiums for the insurance and funded part of the labor pension passed to the Pension Fund (Federal Law of December 4, 2013 No. 351-FZ). Therefore, there is no longer a need to open and maintain additional subaccounts to subaccount 69-2.

A similar situation arises when taking into account contributions to the Federal and territorial compulsory health insurance funds. So, until 2012, subaccount 69-3 was required to be divided into subaccounts:

69-3-1 “Settlements with the Federal Compulsory Health Insurance Fund”;

69-3-2 “Settlements with the territorial compulsory health insurance fund.”

From January 1, 2012, policyholders (firms and entrepreneurs) remained obligated to pay insurance premiums only to the FFOMS. There is no longer a need to pay contributions to the TFOMS - the tariff for them is not established (Article 12 of the Federal Law of November 29, 2010 No. 313-FZ). This means that there is no need to open and maintain additional subaccounts to subaccount 69-3.

The amounts of accrued insurance premiums should be reflected in the debit of the same accounting accounts that reflect the payroll of your organization's employees.

After accruing wages, immediately reflect the accrual of insurance premiums on the credit of subaccounts of account 69:

DEBIT 20 (23, 25, 26, 29, 44, ...) CREDIT 69-1-1

– insurance premiums are calculated from employees’ wages in the part to be transferred to the Social Insurance Fund;

DEBIT 20 (23, 25, 26, 29, 44, ...) CREDIT 69-3-1

– insurance premiums are calculated from employees’ wages in the part subject to transfer to the Federal Compulsory Medical Insurance Fund;

DEBIT 20 (23, 25, 26, 29, 44, ...) CREDIT 69-2 SUBACCOUNT “PENSION SECURITY CALCULATIONS”

– insurance premiums are calculated from employees’ wages in the part subject to transfer to the Pension Fund.

From July 1, 2013, “special regime” insurers (USN, UTII and Unified Agricultural Tax) must keep records of settlements with the Federal Social Insurance Fund of the Russian Federation according to accounting rules, namely reflect:

amounts of accrued and paid insurance premiums, penalties and fines;

the amount of expenses incurred for the payment of insurance coverage;

amounts of compulsory social insurance funds payable to the Social Insurance Fund (received from the Social Insurance Fund) in case of temporary disability and in connection with maternity.

Thus, those who combine the general taxation system and UTII no longer need to keep separate records of expenses based on the amounts of insurance premiums (Order of the Russian Ministry of Labor dated June 13, 2013 No. 256n).

For most firms, the total premium is 30%. The following tariffs are provided for each extra-budgetary fund:

| Base for calculating insurance premiums | Pension Fund of the Russian Federation | Social Insurance Fund of the Russian Federation | Federal Compulsory Medical Insurance Fund |

| Within the established limit of the base for calculating insurance premiums | 22% | 2,9% | 5,1% |

| Above the established limit of the base for calculating insurance premiums | 10% | 0% | 5,1% |

Some policyholders must pay premiums at an additional rate. The rate of additional insurance premiums is established by parts 1 and 2 of Article 58.3 of the Federal Law of July 24, 2009 No. 212-FZ: for payments in favor of persons engaged in underground work, work with hazardous working conditions and in hot shops (clause 1 of Part. 1 Article 30 of the Federal Law of December 28, 2013 No. 400-FZ “On Insurance Pensions”), an additional tariff of 9% is applied; for the work listed in paragraphs 2 - 18 of part 1 of Article 30 of the Federal Law of December 28, 2013 No. 400-FZ “On Insurance Pensions” - in the amount of 6%.

The amounts of additional tariffs until January 1, 2014 were determined based on the results of certification of workplaces for working conditions. Its results are valid until December 31, 2021 (clause 4 of article 27 of the Law of December 28, 2013 No. 426-FZ “On special assessment of working conditions”).

From January 1, 2014, the organization is obliged to charge insurance premiums at additional rates on the basis of Part 2.1 of Article 58.3 of Law No. 212-FZ based on the results of a special assessment of working conditions, as well as on the basis of certification of workplaces for working conditions carried out before December 31, 2013 year, according to which working conditions are recognized as harmful and (or) dangerous (letter of the Ministry of Labor of Russia dated March 13, 2014 No. 17-3/B-113). Therefore, within five years from the date of completion of certification, a special assessment of working conditions for certified workplaces can be do not produce. But if the special assessment covers all jobs, including those that have passed certification, then the amount of additional pension contributions can be adjusted.

Based on the results of a special assessment of working conditions, the following tariffs are established:

| Class of working conditions | Subclass of working conditions | Additional tariff (%) |

| Dangerous | ||

| Harmful | 3.4 | |

| 3.3 | ||

| 3.2 | ||

| 3.1 | ||

| Acceptable | ||

| Optimal |

The entire additional tariff must be transferred to finance the insurance part of the labor pension. The maximum amount of the base for calculating insurance premiums to the Pension Fund of the Russian Federation at an additional tariff has not been established (Article 58.3 of the Federal Law of July 24, 2009 No. 212-FZ). It will have to be paid regardless of how much you have paid on an accrual basis to the early retiree employee from the beginning of the billing period.

In 2014, the maximum base for calculating insurance premiums for each employee is 624,000 rubles per year. In 2015, the maximum base for calculating insurance contributions to the Pension Fund of the Russian Federation was set at 711,000 rubles. Separately, for 2015, a maximum base for calculating insurance contributions to the Social Insurance Fund was established - 670,000 rubles. Insurance contributions to the Compulsory Medical Insurance Fund must be paid from the entire amount of wages (Resolution of the Government of Russia dated December 4, 2014 No. 1316).

In 2021, the maximum base for calculating insurance premiums in the Pension Fund of the Russian Federation is 796,000 rubles, in the Social Insurance Fund - 718,000 rubles (Resolution of the Government of Russia dated November 26, 2015 No. 1265).

As soon as an employee’s income in a calendar year exceeds the limit, then contributions from the excess amount must be paid at reduced rates only to the Pension Fund. This rule applies to companies that are not among the “beneficiaries”. If the company has a preference for paying contributions, then contributions are not paid on amounts exceeding the maximum base.

Conclusion

The study of the insurance premium system in the context of the formation of a market economy is one of the most important problems that influences the development of relations between enterprises, organizations and the state.

The process of forming social insurance funds is carried out in accordance with the requirements of the objective laws of expanded reproduction. Relations regarding the formation and use of social insurance funds mediate the distribution of national income and the accumulation of its parts in specialized funds. The subjects of relations are the state, enterprises and organizations of various forms of ownership, and the population.

In order to improve the current pension system, from January 1, 2010, a transition from the tax principle to the insurance principle of forming the pension system is envisaged. The same principle is provided for the formation of social insurance funds and compulsory health insurance.

These changes are provided for by the draft Federal Law “On Insurance Contributions to the Pension Fund of the Russian Federation, the Social Insurance Fund of the Russian Federation and Compulsory Medical Insurance Funds.”

For accounting of insurance contributions to the Pension Fund of the Russian Federation, the Social Insurance Fund of the Russian Federation and compulsory medical insurance funds, as before for the unified social tax, account 69 “Calculations for social insurance and security” should be used.

The following subaccounts can be opened to this account to record the above insurance premiums:

69–1 “Calculations for insurance premiums credited to the Federal Social Insurance Fund of the Russian Federation”;

69–2 “Calculations for insurance premiums credited to the Pension Fund”;

69–3 “Calculations for insurance premiums credited to the FFOMS”;

69–4 “Calculations for insurance premiums credited to the TFOMS”

The accrual of insurance premiums is reflected in the credit of account 69 “Calculations for social insurance and security” (corresponding sub-accounts) in correspondence with the accounts for recording production costs (selling expenses).

In this case, the amounts of accrued insurance premiums are debited from those accounts to which the accrued wages of employees were allocated

The transfer of insurance premiums is reflected in the debit of account 69 “Calculations for social insurance and security” and the credit of account 51 “Current accounts”.

Account 69 of accounting is an active-passive account “Calculations for social insurance and security” in section Ⅵ “Calculations” of the chart of accounts. Let's look at typical transactions and examples of transactions on this account.

Accounting for reserves

The minimum size of the management company of an AOOT is no less than 1000 minimum wages, and for OSTs no less than 100 minimum wages. The shares of the company upon its establishment must be paid within the period defined by the charter, and at least 50% of the capital must be paid for. payment by the time of registration (for members of the company at least 10%, UV unit enterprise is paid in full), and the rest - within a year from the date of registration, additional shares must also be paid within a period of no more than one year, if payment non-monetary means, then d.b. payment in full immediately. Monetary valuation of property produced by agreement between the institutions in the presence of a document independent of the appraiser. The fact of not making or making incomplete contributions to the Criminal Code is the basis for the relevant bodies to recognize the organization as unincorporated and subject to liquidation. Funds were established, contributed to the management company not regional VAT, not regional VAT and funds received in the form of a share during the liquidation or reorganization of the enterprise in an amount not exceeding the management capital. The value of the Criminal Code in the founding document, in the accounting and reporting data must be identical, that is, in the entry Dt75.1 Kt80, which is produced after the state register.

Analyzes accounting according to Account 80 “Ust cap” of the organization to ensure the formation of information on the establishment of the organization. The fact of receipt of deposits via Kt75 in correspondence with account 50.51 52.55, price material 01.08.10.20.21., NMA 04, securities price 58 account. When providing quality incl. rights to use buildings, construction record Dt04 Kt75, at the same time on off-balance account 001 we will accept the balance sheet value of the decree of buildings, coor. Receipt of property in kind, production in the assessment, determined by agreement established. The accounting rules do not provide for the entry by an organization into the charter capital of other organizations of those rights (intangible assets) that are not listed on the balance sheet of the founder. Only by drawing up the appropriate document for the creation of intangible assets can you reflect its transfer as a contribution to the capital company.

The auditor should keep in mind that the institution may decide to increase its capital. These decisions are registered in the founding document, and the management company can be withdrawn only after full payment of the previously announced capital has been made. The decision to increase can only be made by the general meeting. It should be kept in mind that if the capital has been increased at the expense of the company’s property (DC, profits), then the formation of fractional shares is not allowed. The auditor must make sure that when increasing the capital capital, the condition must be met that the capital asset + RF. An increase in the authorized capital is possible through an additional issue, subject to payment for shares of the first issue, by increasing the par value of shares, by exchanging bonds for shares. A decrease in the authorized capital occurs when the par value of shares is reduced, and shares are not fully sold due to the repurchase of own shares. If, as a result of a decrease in the capital, the value of net assets becomes less than the established minimum, the company is subject to liquidation.

In a similar manner, I checked the settlements on deposits in the management company with the founders. In the event that shares of a company are sold at a price greater than their par value, the difference is taken into account in the DC.

The accrual of income from participation in the enterprise is reflected by entry Dt84 Kt75.2. In the absence of profit or its insufficiency for payment of dividends, but in the presence of obligations, stipulated by law or the establishment of a document, to pay income at the expense of the Russian Federation, accrued income tax Dt82 Kt75.2. Payment of income amounts reflected in correspondence with money or other relevant values. The amount of tax on income from participation in an enterprise is taught by zap Dt75.2 Kt 68 is maintained for each founder. Serious attention must be paid to auditing the organization of accounting and payment of dividends. The company is obliged to pay declared dividends. The amount of dividend payments is from the net profit for the current year. Dividends on privileged shares can be paid from funds allocated for this purpose. Unpaid dividends from shareholders cannot be used to increase the capital stock. The procedure for paying divs is determined by the Federal Law “On Joint Stock Companies”. The JSC can also pay intermediate payments for 3.6.9 months, that is, a minimum of . The period for the cat is 3 months.

Conditions that an enterprise must fulfill before paying dividends:

— Condition for full payment of the management company;

- if at the time of payment of the dividend there are signs of insolvency or bankruptcy;

— the organization must have enough funds to repay the debt to all creditors;

— the value of net assets must exceed the sum of its authorized and reserve capital, and this ratio must be maintained even after the payment of dividends;

— it is necessary to declare the amount paid for each type of shares;

— it is necessary to pay dividends on preferred shares.

Dividends on preferred shares can also be issued at the expense of funds that were specially created for these purposes.

In joint stock companies, the decision on the payment of dividends is made by the general meeting of shareholders, which takes into account the opinion of the board of directors and does not assign a larger amount of annual dividends than that recommended by the board of directors. In an LLC, income is issued to the owners of the company if the general meeting of company participants decides.

If the auditor finds violations in the formal document that do not affect the legality of the operation, do not cause damage to the state, institutions or shareholders, then the auditor records this in the analytical part, and the auditor has the right to issue a positive conclusion.

Typical accounting errors and shortcomings that arose during the audit of this section:

· Loan 80 sch does not correspond to what was stated in the establishment documents;

· Unreasonable increase in the capital as a result of inflated prices;

· Failure to deposit or incomplete payment of shares within the established deadlines;

· Late entry into the register of shareholders;

· Late payment or registration of retirement of shareholders;

· The difference between the actual costs of repurchasing shares and their nominal value should be attributed to 91 accounts;

· Incorrect calculation of capital income and taxes;

· Failure to pay for privileged shares;

· Wrong registration of shares in the management company;

· Absence of originals or certified in accordance with legislative documents;

· Incomplete or expired documents;

· Activities without a license.

Subaccount 75.1 - reflects the debt of the founders for the formation of the authorized capital.

When an organization is created, an initial entry is made

⇐ Previous12

Date added: 2014-01-04; ; Copyright infringement?;

Recommended pages:

Accounting and Auditing

Examples of operations on account 69 for dummies

Example 1. Calculation of insurance premiums

Renas LLC built the warehouse with its own resources. The total salary of workers involved in construction is 21,000 rubles. Insurance premiums of Renas LLC amount to 30%, including pension (22%), social (2.9%) and medical (5.1%).

Posting table – Reflection of insurance premiums from employees’ salaries (construction of fixed assets) in account 69:

| Account Dt | Kt account | Transaction amount, rub. | Wiring Description | A document base |

| 08.03 | 70 | 21 000 | Calculation of wages for construction workers. | Payroll |

| 08.03 | 69.01.01 | 609 | Calculation of contributions to the Social Insurance Fund | Payroll |

| 08.03 | 69.03 | 1 071 | Calculation of contributions for compulsory medical insurance | Payroll |

| 08.03 | 69.02 | 4 620 | Accrual for compulsory pension insurance | Payroll |

Example 2. Calculation of insurance contributions for social insurance from NS and PZ

For (11th class of professional risk) the rate of insurance contributions for social insurance against accidents at work and occupational diseases is 1.2%.

The plant employees received:

- Salary in the amount of 610,000 rubles, including main production – 250,000 rubles; auxiliary production – 360,000 rubles;

- Benefits for employees who suffered from accidents during production - 4,000 rubles.

The accountant of AsbestN LLC generated the following entries for account 69:

| Account Dt | Kt account | Transaction amount, rub. | Wiring Description | A document base |

| 20 | 70 | 250 000 | Calculation of wages for employees of main production | Payroll |

| 20 | 69.01.02 | 3 000 | Calculation of contributions for insurance against work-related accidents and occupational diseases | Payroll |

| 23 | 70 | 360 000 | Calculation of wages for employees of auxiliary production | Payroll |

| 23 | 69.01.02 | 4 320 | Calculation of contributions for insurance against work-related accidents and occupational diseases | Payroll |

| 69.01.02 | 70 | 4 000 | The amount of benefits for those injured at work is reflected | Payroll |

| 70 | 50.01 | 4 000 | Benefits were issued from the company's cash desk | KO-2 (expendable) |

How does the posting Debit 91 Credit 91 correspond with other accounts

When generating other income or expenses of the organization, the sources of their occurrence are taken into account:

- Dt 91 Kt 51 - if expenses arise in connection with banking services (commissions associated with account transactions).

- Dt 91 Kt 60 - attributing the shortage to other expenses after acceptance of goods from the supplier, charging penalties in favor of the supplier.

- Dt 91 Kt 01 - loss from the sale of fixed assets.

- Dt 60 Kt 91 - recognition of accounts payable (including unclaimed or expired) as income of the organization.

- Dt 76 Kt 91 - reflection of unclaimed amounts deposited for wages as income.

- Dt 10 Kt 91 - free receipt of materials.

Postings Kt 91 Dt 91 also record the results of other income and expenses:

- Dt 91 Kt 99 - profit on other income and expenses is reflected;

- Dt 99 Kt 91 - a loss was received on other income and expenses.

Organization of accounting for account 69

An enterprise that makes payments to employees in accordance with concluded employment contracts is obliged to record the accrual of insurance premiums for their subsequent transfer to an extra-budgetary fund. The law provides for compulsory medical, social and pension insurance for employees. The employer must also ensure payment of insurance premiums in case of occupational diseases and accidents at work.

To reflect the amounts of accrued and paid contributions to extra-budgetary funds, account 69 is used. To analyze and control the amounts of contributions, the organization can open sub-accounts in accordance with the types of transfers made.

Regulatory documents provide that account 69 can be used to reflect the following transactions:

- calculation of the amount of contributions (including fines, penalties);

- payment of the amount of contributions (fines, penalties);

- reflection of expenses for contributions to extra-budgetary funds.

It should be noted that on account 69 not only the amounts of obligations to the funds are recorded, but also credits coming from the Social Insurance Fund are made.

Subaccounts 69 accounts

- 69.01 – Social insurance payments

- 69.02.1 — Insurance part of the labor pension

- 69.02.2 — Cumulative part of the labor pension

- 69.02.3 — Contributions to supplement pensions for flight crew members

- 69.02.4 — Contributions to supplement pensions for employees of coal industry organizations

- 69.02.5 - Additional contributions to the insurance part of the pension for employees engaged in work with hazardous working conditions

- 69.02.6 - Additional contributions to the insurance part of the pension for employees employed in jobs with difficult working conditions

- 69.02.7 - Compulsory pension insurance

- 69.03.1 — Federal Compulsory Medical Insurance Fund

- 69.03.2 — Territorial Compulsory Medical Insurance Fund

- 69.04 - Unified Tax in the part transferred to the Federal Budget

- 69.05.1 - Contributions at the expense of the employer

- 69.05.2 - Contributions withheld from employee income

- 69.06.1 — Contributions to the Pension Fund (insurance part)

- 69.06.2 — Contributions to the Pension Fund (funded part)

- 69.06.3 — Contributions to the Compulsory Medical Insurance Fund

- 69.06.4 — Contributions to the Social Insurance Fund

- 69.06.5 - Compulsory pension insurance for entrepreneurs

- 69.11 — Calculations for compulsory social insurance against accidents at work and occupational diseases

- 69.12 — Calculations for voluntary contributions to the Social Insurance Fund for employee insurance in case of temporary disability

- 69.13.1 — Settlements using Social Insurance Fund funds for policyholders paying UTII

- 69.13.2 — Settlements using Social Insurance Fund funds for policyholders using the simplified tax system

Using targeted funding for an organization

CASH |Cash |5|1 . Cashier | | |0|organizations | | | |2. | | | |Operating | | | | cash desk | | | |3. Cash | | | |documents | |Calculated |5| | |accounts |1| | | | | | |Forex |5| | |accounts |2| | | | | | |Financial |5|1. Pies and | |investments |8|shares | | | |2. Debt | | | |securities| | | | | | | |3. | | | |Provided by| | | |loans | | | |4. Contributions by | | | | agreement | | | |simple | | | | partnership | SECTION VI. CALCULATIONS |Calculations with |6| | |suppliers |0| | |and | | | |contractors | | | |Calculations with |6| | |buyers |2| | |and customers| | | | | | | |Calculations by |6|By type | |short-term|6|loans and | | loans and | |loans | |loans | | | |Calculations by |6|By type | |long-term |7|loans and | | loans and | |loans | |loans | | | |Calculations by |6|By type | | taxes and | 8 | taxes and | | fees | |fees | |Calculations for |6|1. Calculations | |social |9|by | |insurance and| |social | |providing | | insurance | | | |2. Calculations by| | | | pension | | | |providing | | | |3. Calculations by| | | |mandatory| | | |medical | | | | insurance | |Calculations with |7| | |staff by|0| | | wages | | | |Calculations with |7| | |accountable |1| | |faces | | | |Calculations with |7|1. Calculations | |staff by|3|by | |other | |provided| |operations | | loans 2. | | | |Calculations by | | | |reimbursement | | | |material| | | |damage | |Calculations with |7|1. Calculations | |founders |5|by contributions to | | | |statutory | | | |(fold) | | | | capital | | | |2. Calculations by| | | |payment | | | |income | |Calculations with |7|1. Calculations | |different |6|by | | debtors and | |property| |creditors | |y and personal | | | | insurance | | | |2. Calculations by| | | | claims | | | |3. Calculations by| | | |due| | | | dividends and | | | |to others | | | |income | | | |4. Calculations by| | | |deposited| | | |m amounts | SECTION VII. CAPITAL |Authorised |8| | |capital |0| | | | | | |Reserve |8| | |capital |2| | | | | | |Additional |8| | |capital |3| | | | | | |Unallocated|8| | |new profit |4| | |(uncovered | | | |loss) | | | SECTION VIII. FINANCIAL RESULTS |Sales |9|1. Revenue | | |0|2. | | | |Cost| | | |sales | | | |3. Tax on | | | | added | | | |cost | | | |4. Excise taxes | | | |9. | | | |Profit/loss| | | |k from sales | |Other income|9|1 . Other | | and expenses | 1 | income | | | |2. Other | | | | expenses | | | |9. Balance | | | |other | | | | income and | | | | expenses | |Shortages and |9| | |losses from |4| | |damage | | | |values | | | |Reserves |9|By type | |upcoming |6|reserves | | expenses | | | |Expenses |9|By type | |future |7|expenses | |periods | | | |Income |9|1. Income, | |future |8|received in | |periods | | future account | | | |periods | | | |2. | | | |Free| | | |receipts | | | |3. | | | |Upcoming | | | |receipts | | | |debt| | | |by | | | |shortages, | | | |identified for| | | |past years | | | | | | | |4. Difference | | | |between the amount,| | | | subject | | | |collection from | | | |perpetrators,| | | | and balance | | | |cost by| | | |shortages | | | |values | |Profits and |9| | |losses |9| | | | | |

look at abstracts similar to “Accounting (postings, cheat sheet)”

Table of typical transactions for account 69

The basis for calculating the amount of insurance premiums is the amount of remuneration that is paid to the employee according to the employment contract. The amount of accrual of contributions is carried out according to Kt 69, transfers to extra-budgetary funds are reflected in Dt 69. Also, according to Kt 69 the amount of receipts of contributions credited from extra-budgetary funds in favor of the organization can be carried out.

Basic transactions on account 69 are reflected in accounting with the following entries:

| Dt | CT | Description | Document |

| 69 | 51 | Insurance premiums are transferred to an extra-budgetary fund | Payment order |

| 20 | 69 | Insurance premiums accrued to an employee of the main production | Payroll |

| 44 | 69 | Insurance premiums have been accrued to the employee who ensures the process of selling goods | Payroll |

| 99 | 69 | Accrual of fines and penalties for insurance premium payments | Accounting certificate-calculation |

| 51 | 69 | Refund of funds overpaid to extra-budgetary funds | Bank statement |

Example of postings for account 69

On January 31, 2016, Start LLC made a payment to K.R. Sazonov, an employee of the economic department:

- salary - 41,300 rubles;

- sickness benefit - 7,500 rubles. (including for the first 2 days at the expense of the organization - 2,350 rubles).

When paying Sazonov’s salary, the accountant at Start LLC calculated the amount of insurance premiums:

- Pension Fund for the insurance part of the labor pension: 41,300 rubles. x 14.0% = RUB 5,782;

- Pension Fund for the funded part of the labor pension: 41,300 rubles. x 6.0% = 2478 rub.;

- FSS for insurance premiums: 41,300 rubles. x 2.9% = 1198 rub.;

- Social Insurance Fund for contributions to insurance against accidents and occupational diseases: 41,300 rubles. x 0.2% = 83 rub.;

- FFOMS: 41,300 rub. x 1.1% = 454 rubles;

- TFOMS: 41,300 rub. x 2.0% = 826 rub.

The accountant at Start LLC reflected the payment of wages to Sazonov and the accrual of insurance premiums with the following entries:

| Dt | CT | Description | Sum | Document |

| 91.2 | 70 | The salary of K.R. Sazonov has been accrued. | RUB 41,300 | Payroll |

| 91.2 | 70 | Sickness benefits accrued (at the expense of Start LLC) | RUB 2,350 | Payroll |

| 69.01 | 70 | Sickness benefit accrued (at the expense of the state) | RUB 5,150 | Payroll |

| 91.2 | 69.01 | The amount of insurance contributions to the Social Insurance Fund has been calculated | 1198 RUR | Payroll |

| 91.2 | 69.01 | The amount of insurance premiums accrued (accidents and occupational diseases) | 83 rub. | Payroll |

| 91.2 | 69.02.1 | The amount of insurance premiums has been calculated (the insurance part of the pension) | 5782 rub. | Payroll |

| 91.2 | 69.02.2 | The amount of insurance contributions has been accrued (the funded part of the pension) | 2478 rub. | Payroll |

| 91.2 | 69.03.1 | The amount of insurance premiums accrued (FFOMS) | 454 rub. | Payroll |

| 91.2 | 69.03.2 | The amount of insurance premiums accrued (TFIF) | 826 rub. | Payroll |

| 69.01 | 51 | The amount of insurance contributions (accidents and occupational diseases) was transferred to the extra-budgetary fund. | 83 rub. | Payment order |

| 69.02.1 | 51 | The amount of insurance contributions (the insurance part of the pension) was transferred to the extra-budgetary fund | 5782 rub. | Payment order |

| 69.02.2 | 51 | The amount of insurance contributions (the funded part of the pension) was transferred to the extra-budgetary fund. | 2478 rub. | Payment order |

| 69.03.1 | 51 | The amount of insurance contributions was transferred to the extra-budgetary fund (FFOMS) | 454 rub. | Payment order |

| 69.03.2 | 51 | The amount of insurance contributions was transferred to the extra-budgetary fund (TFIF) | 826 rub. | Payment order |

What is account 69 used for in accounting?

The law obliges every employer to pay contributions to social funds on almost all remunerations (salaries) of its employees. Let's look at what it is.

Contributions to the funds are mandatory payments that guarantee each employee medical care, pensions, and insurance compensation in case of disability.

There are currently four types of such contributions:

- To the Pension Fund;

- To the social insurance fund - divided into two, payment of disability and compensation for injuries;

- To the health insurance fund.

Attention! Since 2021, the Federal Tax Service has been managing these contributions (except for injuries). They are transferred by the 15th of each month in separate payment orders.

To carry out accounting of accrued and paid amounts for each type of contribution in the chart of accounts, account 69 “Calculations for social insurance and security” is used. Since this information is widely used to fill out various reports, it is necessary to organize accounting in the context of each fund, as well as the type of transfer to it (contribution, fine, penalty, etc.).

Typical wiring

Account 69 can correspond with the following accounts.

From the debit of account 69 to the credit of accounts:

- Account 50 - used in certain cases when social benefits are issued from the cash register. Moreover, such an entry can only be made in situations where the benefit is not combined with salary payments and is calculated bypassing account 70. In addition, they should not be subject to taxes and other deductions.

- Account 51 - when transferring contributions from a current account;

- Account 52 - when transferring contributions from a foreign currency account. Despite the fact that such correspondence is directly indicated in the chart of accounts adopted by Order 94-N, it is unlikely in real life, since payments to the budget must be made in rubles.

- Account 55 - when transferring contributions to social funds from open special accounts;

- Account 70 - when calculating benefits to employees at the expense of social funds.

According to the credit of the account, it corresponds with the debit of the following accounts:

- Account 08 - when calculating contributions to employees involved in preparing capital investment objects for operation;

- Account 20 - when calculating contributions to employees engaged in the main production;

- Account 23 - when calculating contributions to employees engaged in auxiliary production;

- Account 25 - when calculating contributions to general production employees;

- Account 26 – when calculating contributions to administrative employees;

- Account 28 - when calculating contributions to employees involved in correcting a previously committed defect;

- Account 29 – when calculating contributions to employees employed in service industries and farms;

- Account 44 - when calculating contributions to employees involved in the sale of finished products or services;

- Account 51 - when crediting excess funds transferred to funds, compensation, etc. to the current account.

- Account 52 - When crediting money, compensations, etc., excessively transferred to funds to a foreign currency account. Despite the fact that such correspondence is directly indicated in the chart of accounts adopted by Order 94-N, it is unlikely in life, since budget payments must be made in rubles.

- Account 70 - When deducting from the employee part of the cost of sanatorium treatment allocated by the social insurance fund;

- Account 73 - when withholding penalties and fines issued by social funds from the guilty person;

- Account 91 - when calculating contributions to employees not directly involved in the production of products or provision of services;

- Account 96 - when accruing contributions for the amount of vacations, employees undergoing warranty repairs, at the expense of previously formed reserves;

- Account 97 - when accruing to amounts of wages that are paid in one period, but are recognized in accounting in the subsequent period.

- Account 99 - when reflecting contributions for wages paid in connection with the liquidation of the consequences of natural disasters. The same entry is drawn up when reflecting accrued fines and penalties for payments to social funds.

What does the entry Debit 91 Credit 94 mean?

In cases where losses of valuables that have occurred in an organization or shortages identified as a result of an inventory cannot be compensated at the expense of the guilty parties, the resulting expenses are charged to account 91: Dt 91 Kt 94 - writing off shortages and losses as other expenses.

And when transferring property and materials free of charge to third parties, the following entries are made: Debit 91 Credit 10 or Dt 91 Kt 41.

For additional information on establishing the facts of shortages, see the article “Accounting for losses from theft if the culprit is not identified.”

Posting examples

When calculating insurance premiums, they must be charged to the same cost account where the salary of the same employee is taken into account. The transfer of contributions to the budget is carried out by various payment orders indicating the BCC of the corresponding fund. Let's consider further examples of drawing up postings for dummies.

Calculation of insurance premiums

| Debit | Credit | Operation designation |

| 08, 20, 23, 25, 26, 29, 44, 91/2, 96, 97 | 69 subaccount “Pension insurance” | Contributions for employee pension insurance have been calculated |

| 08, 20, 23, 25, 26, 29, 44, 91/2, 96, 97 | 69 subaccount "Medstrakh" | Contributions to the health insurance fund have been calculated |

| 08, 20, 23, 25, 26, 29, 44, 91/2, 96, 97 | 69 subaccount "Social Insurance" | Contributions to the social insurance fund for temporary disability and maternity have been calculated |

| 08, 20, 23, 25, 26, 29, 44, 91/2, 96, 97 | 69 subaccount “Injuries” | Contributions for insurance against accidents and injuries have been calculated |

Transfer of insurance premiums

| Debit | Credit | Operation designation |

| 69 subaccount “Pension insurance” | 51 | Employee pension insurance contributions transferred non-cash |

| 69 subaccount "Medstrakh" | 51 | Contributions to the health insurance fund were transferred non-cash |

| 69 subaccount "Social Insurance" | 51 | Contributions to the social insurance fund for temporary disability and maternity were transferred non-cash |

| 69 subaccount “Injuries” | 51 | Payments for insurance against accidents and injuries are transferred non-cash |

Other transactions with insurance premium funds

| Debit | Credit | Operation name |

| 69 subaccount “Injuries” | 70 | A payment was made from the fund due to a work-related injury. |

| 69 subaccount "Social Insurance" | 70 | Sick leave payments have been accrued |

| 99 | 69 subaccount “Pension insurance” | Reflects the accrual of penalties for late payment of employee pension insurance contributions |

| 99 | 69 subaccount "Medstrakh" | Reflects the accrual of penalties for late payment of contributions to the health insurance fund |

| 99 | 69 subaccount "Social Insurance" | Reflects the accrual of penalties for late payment of contributions to the social insurance fund for temporary disability and maternity |

| 99 | 69 subaccount “Injuries” | Reflects the accrual of penalties for late payment of accident and injury insurance premiums |