Material assistance income code

- Code 2710 - used to reflect any type of financial assistance, including that whose amount does not exceed 4,000 rubles, with the exception of:

- Code 2760 - used to reflect financial assistance to retired workers.

- Code 2761 - used to reflect financial assistance to disabled people, provided that it is provided by public organizations and not by the employer.

- Code 2762 - reflects financial assistance, which is paid at the birth of children or upon their adoption.

- financial assistance to retired employees (due to old age or disability);

- financial assistance for the birth or adoption of children;

- financial assistance provided to disabled people by public organizations.

So, we have looked at all types of income codes and deductions that are indicated in the 2-NDFL certificate when paying financial aid.

In fact, such an exemption is nothing more than a type of property tax deduction. Both income and deductions have special codes. The material assistance code in the 2-NDFL certificate and deduction codes are reflected by personnel employees or other responsible persons.

Next, we’ll figure out what the income codes are. assistance, and by what regulatory act they are established. Income code - material assistance up to 4,000 rubles Income codes for material assistance are reflected in the Order of the Federal Tax Service of Russia dated September 10, 2015 No. ММВ-7-11/ The income code for material assistance of 4,000 rubles or less is entered in the 2-NDFL certificate. The codes are indicated in Appendix No. 1 to the above Order of the Federal Tax Service.

Guided by the requirements of this order, specific income codes - financial assistance, as well as deduction codes for financial assistance of 4,000 rubles or less, entered in the 2-NDFL certificate, depend on the amount of payment and the purpose of such support (i.e., the type of financial assistance).

When the total support paid to an employee does not exceed 4,000 rubles (for any type of financial assistance), the deduction code is as follows: 503. When financial assistance is paid in connection with the birth (adoption) of a child, deduction code 508 is entered. No other deduction codes are currently established.

Material assistance: income code in the 2-NDFL certificate. Entering the income code on the material assistance received in the 2-NDFL certificate is carried out in accordance with the requirements of the already mentioned order No. MMV-7-11/387.

Rules for reflecting financial aid in 2-NDFL

The Tax Code establishes different procedures for taxing financial aid with personal income tax depending on the reason for which it is paid or what “type” this financial aid is. Conventionally, all financial assistance can be divided into 2 groups: limited by the amount not subject to personal income tax and unlimited.

So, any financial assistance that is not subject to personal income tax in a certain amount must be reflected in the 2-personal income tax certificate. It is necessary to show the entire amount of income in the form of financial assistance and the deduction applied to it (in the amount not subject to personal income tax).

For example, in 2-NDFL, financial assistance up to 4,000 rubles paid to an employee (clause 28 of Article 217 of the Tax Code of the Russian Federation) must be shown with income code 2760 and at the same time with deduction code 503. Similarly, the certificate indicates a lump sum payment accrued to the employee in connection with the birth of his child.

As you know, it is not subject to personal income tax up to 50 thousand rubles. for each child, but for both parents, and provided that it is paid within a year from the date of birth. For this financial assistance, income code 2762 and at the same time deduction code 504 are used (Appendices No. 1, No. 2 to the Order of the Federal Tax Service of September 10.

2015 No. ММВ-7-11/ [email protected] ).

But financial assistance, which is not subject to personal income tax regardless of its size, is not indicated at all in 2-personal income tax. For example, there is no need to reflect in the certificate the payment of one-time assistance to an employee whose apartment burned down for reasons beyond his control. After all, it was paid due to an emergency circumstance, which means it is completely not subject to personal income tax (clause 8.3 of Article 217 of the Tax Code of the Russian Federation).

Payment classification

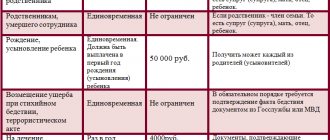

All required benefits are conditionally divided into mandatory and optional. Mandatory payments contain all types of assistance that are paid by the state. Optional - paid by the organization where the expectant mother works, in other words, this is financial assistance paid by the company to its employee on a voluntary basis.

https://www.youtube.com/watch?v=b8oAsN9sc8w

There is also a difference: one-time payments and benefits that are paid monthly.

In addition, cash benefits are:

- federal (received by all citizens of the Russian Federation from the country’s budget);

- regional (the region has the right to issue additional benefits from its budget).

From the state

A lump sum payment upon the birth of a child is due once. It is possible for both the father and mother of a newborn to receive it. Every woman receives the payment, regardless of her employment before maternity leave. An unemployed woman can also receive this money.

The following documents are needed:

- statement;

- child's birth certificate;

- parents' passports;

- certificate from the other parent’s place of work;

- child's birth certificate and copy.

Documents for download (free)

- Sample application from an employee for financial assistance

The law allows 10 days for the calculation and issuance of money from the moment the package of documents is transferred to the accounting department at the address of work or study of a family member.

For child care

This subsidy is available to those who plan to take parental leave for up to 1.5 years. This could be any of the spouses. If an unemployed parent plans to provide care, you can do everything necessary to receive funds at the nearest branch of the Federal Social Insurance Fund of the Russian Federation.

For a working citizen, the benefit is calculated in the amount of 40% of the average monthly salary, 2 years before the birth of the child are taken into account, the amount is paid every month.

According to the law, the amount should not be less than 4,465.20 rubles if this is the first child, and 6,284.65 rubles for subsequent children.

A woman who has never worked before the birth of a child has the right to a minimum level payment, for which she needs to visit the Social Insurance Fund office at her place of residence. If a woman, while on leave to care for her first child, goes on leave to care for her next child, she becomes entitled to a subsidy, which will consist of the amount of benefits for caring for the first child and the second.

The maximum amount should not be more than 100% of the average salary for the last 2 years and be less than the minimum amount.

It is important that in this case the woman has the right to count on either payment of benefits or maternity benefits.

The following documents are required:

- parents' passports;

- child's birth certificate;

- parents' work records;

- a certificate from the employment service stating that no payment was made (for the mother);

- certificate from place of work (study);

- personal account number in the Security Council of the Russian Federation;

- certificate of family composition.

Maternal capital

Maternity capital is paid once in the event of the birth of a second and/or next child in the family. If there is more than one child in a family, and they did not use the capital, then when the next one appears, the family can issue a payment.

In addition to the child’s mother, the father can also receive state payments if he remains the sole adoptive parent of the second or subsequent children.

It is important to understand that current legislation allows the use of this capital exclusively for the following purposes:

- Elimination of housing problems (buying an apartment or a larger house).

- Children's education. Capital is allowed to pay for the education of any of the children in the family. You can pay with the amount of maternity capital to study at the desired accredited educational institution in the Russian Federation.

- Compensation for expenses for disabled children.

- To pay for the pension of the child’s mother, its funded part.

The use of capital for other needs is punishable by Russian law and is criminally punishable.

Maternity capital is registered at the Pension Fund branch. You are allowed to submit a package of documents at any convenient time. To receive capital, a personal certificate is required.

Basic documents for receiving funds:

- statement;

- parents' passports;

- children's birth certificate.

From the employer

An employer can pay financial assistance to employees upon the arrival of a child in the family; to do this, you need to write an application, to which you must attach the documents required by company regulations. But this payment is not mandatory and is paid solely at the request of the company. Therefore, the application will not necessarily receive a positive response.

The Labor Code does not provide for regulation of this payment. The conditions must be specified in the employment and collective agreement, and it must also indicate what documents must be attached to the application. As a rule, these should be:

- child's birth certificate;

- certificate of income of the second parent.

Taxation and contributions, deduction code

Tax deductions can also be considered one of the types of financial assistance. For example, the amount of financial assistance up to 50,000 rubles is not subject to personal income tax.

The employee has the right to independently decide whether to use this type of assistance or not. The employee must also provide documents independently. The limit on the standard deduction in 2018 was 391,454.79 rubles. If the total income from the beginning of the year is more than this amount, then the right to deduction disappears.

Also, for the first and second child, you can receive a deduction in the amount of 1,400 rubles, for the third and subsequent children, a deduction of 3,000 rubles.

In addition, insurance premiums are not charged for financial assistance for the birth of a child; the non-taxable amount is 50,000 rubles.

The employer submits a 2-NDFL certificate to the inspectorate - the deduction for the child is indicated in it as a separate line for each employee. To fill out the certificate, tax deduction codes for children are used (they are detailed in the Order of the Federal Tax Service of the Russian Federation).

For example, the deduction code for the first child is 126, for the second - 127, for the third and next - 129, for a disabled child under 18 years old (provided that he is studying full-time, then from 18 to 24 years old, from I or II disability group) - code 129.

Sample payment order

Basic requirements when filling out a payment order:

- Payer status – the person making the payment (01 – legal entity; 02 – tax agent, etc.).

- When indicating tax payments in the fields provided, you should carefully fill in the account numbers and bank names.

- Priority of payment (for tax contributions - 5).

- BCC (104) must be indicated as valid at the time of payment.

- OKTMO code – indicated at the location of the legal entity.

- The period for which the insurance or tax contribution is paid.

The form of the payment order does not change; the only thing that differs when transferring insurance premiums in case of disability due to maternity is the KBC.

Insurance premiums in case of disability due to maternity are paid according to KBC 182 1 02 02090 07 1010 160 from January 2021.

Can both parents receive financial assistance?

According to current legislation, both parents can receive financial assistance from the employer, but it is important not to forget that the non-taxable amount of 50,000 rubles consists of total birth benefits.

What to do if management refuses to pay financial assistance?

The fact is that a financial payment from an employer is voluntary assistance from an organization. This payment is not regulated by the Labor Code, so the employer has every right not to pay it.

Is it possible to receive payment before the birth of the child?

No, the payment is made only after the birth of the child, and the basis is a document confirming the birth.

Accounting entries

When paying out financial assistance, the postings may differ; it depends only on the source of the payment.

In the case when these payments are made from retained earnings from previous years:

Dt 87 Kt 73 (76) It must be remembered that retained earnings can be transferred to provide financial assistance to employees only with the consent of the founders or shareholders of the company.

If the current year’s profit is used for financial assistance:

Dt 91.2 Kt 73 (76)

The founders' permission is not required. Such a decision can be made by the management of the organization.

Financial assistance issued:

Dt 73 (76) Kt 50 (51)

At the birth of a child, a woman has the right to financial assistance both from the organization in which she works and from the state. Even if a woman has never worked before having a child, she can count on financial support from the state.

Of course, these cash receipts will not solve the financial issue once and for all, but, nevertheless, they will serve as a good help. After all, right after birth it is necessary to purchase a lot of things necessary for the child. Therefore, it is important to know your rights and timely collect and submit the necessary documents for each payment location.

- Balance sheet JSC Accounting (financial) statements of enterprises 39,149.84 billion rubles — JSC VTB CAPITAL 4,892.93 billion…

- Tax planningTax planning in an organization Tax planning can significantly affect the formation of the financial results of an organization,…

- Exemption from VAT, notification of the use of the right to exemption from VAT, notification of the use of the right to exemption from VAT...

Source: https://ecoafisha.ru/kod-dohoda-materialnoj-pomoshhi/

Financial assistance 4,000 rubles in 2021: how to assess personal income tax and contributions

For various reasons, an employee may need some kind of financial support, for which he has the right to turn to the employer. The law allows you to support your employee in this way, but there are restrictions on the amount that will not be taxed. In the article we will consider issues related to financial assistance to an employee and its taxation in 2019.

Financial assistance is paid by the employer voluntarily at the request of the employee. Chapters 23 (NDFL) and 34 (Insurance contributions) of the Tax Code of the Russian Federation provide for some relaxations regarding the tax burden on the employee and employer associated with such financial support for an individual.

In particular, financial assistance up to 4,000 rubles. for taxation in 2021 is not taken into account at all. More precisely, it is reflected in income and at the same time a tax deduction is provided for the same amount, thus, there is no tax base for personal income tax.

With insurance contributions it is even simpler - they are simply not included in taxable income.

More on this in the following sections.

Personal income tax with financial assistance in 2021

Subp. 28 Art. 217 of the Tax Code of the Russian Federation states that material assistance is not included in the taxable base for income tax, but only that which does not exceed 4,000 rubles. for one individual in one tax period. What does it mean?

The tax period for personal income tax is one year. And the limit is 4,000 rubles. established for the total amount of financial assistance received from one or more employers.

That is, if for a calendar year an employee has already received financial assistance in the amount of 4,000 rubles from one of the employers, then from another employer similar financial support for the employee should already be taxed.

True, if the employee did not notify the employer of such a fact, and the 2-NDFL certificate was not provided, no sanctions will follow against the employer. But the employee will receive a notification from the tax authorities about the need to pay additional personal income tax on the amount of “excess” financial assistance.

Not limited to the amount of 4,000 rubles.

personal income tax-free financial assistance for employees who have lost a family member, as well as for employees who have a baby in the family, regardless of whether it is the employee’s own child or adopted. Financial assistance in connection with the birth of a child is limited to 50,000 rubles. for each such child. Such standards are specified in subparagraph. 8 tbsp. 217 Tax Code of the Russian Federation.

Financial assistance not subject to personal income tax

As has already been announced, only material assistance up to 4,000 rubles is not taxed. and some targeted financial assistance in excess of 4,000 rubles.

This is reflected in reporting forms by providing a tax deduction.

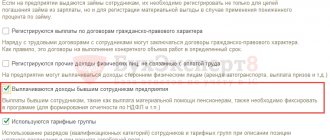

So in the 2-NDFL certificate, the provision of financial support will be reflected as follows:

- with income code 2760, financial assistance up to 4,000 rubles is reflected. inclusive;

- with code 503, the adjacent column reflects the deduction in the amount of financial assistance provided.

As a result, the tax base for personal income tax will be zero.

Similar codes are used for financial assistance associated with the death of a family member. And for financial assistance related to the birth or adoption of a child, the following pair of codes is used: 2762 for income and 508 for deductions.

Personal income tax assessment of material assistance in 2021

If financial assistance is provided by the employer in excess of 4,000 rubles. and for a reason other than the death of a family member or the birth of a child, then the entire excess amount must be taxed at a rate of 13%

In this case, when filling out the 2-NDFL certificate, the same codes as indicated above will be used, but the deduction amount will be less than the amount of income. For example:

- financial assistance was provided in the amount of 6,000 rubles. – code 2760;

- a deduction was provided in the amount of 4,000 rubles. – code 503;

- Personal income tax payable (6,000 – 4,000) * 13% = 260 rubles.

Deadline for payment of personal income tax on financial assistance

With regard to the deadline for paying tax on income in the form of material assistance in excess of the non-taxable amount, the norm from clause 6 of Art. 226 of the Tax Code of the Russian Federation - personal income tax must be transferred no later than the day following the payment of financial assistance.

Financial assistance not subject to insurance contributions

Subp. 11 clause 1 art. 422 of the Tax Code of the Russian Federation establishes a limit on the amount of financial assistance that is not subject to insurance contributions. It is similar - 4,000 rubles. per employee per calendar year.

True, there is no longer any connection with the amount of financial assistance received by an individual from all employers.

In the case of insurance contributions, even if the employee had previously received financial support from another employer, this fact does not affect the exemption of the new amount of financial assistance from insurance contributions from the current employer.

In addition, sometimes, for the purposes of determining the base for insurance premiums, there is no limit on the amount of financial assistance, but its intended purpose is important. According to sub. 3 p. 1 art. 422 of the Tax Code of the Russian Federation are not included in the amounts of financial assistance paid to insurance contributions:

- in connection with natural disasters and other circumstances, including acts of terrorism;

- in connection with the death of an employee’s family member;

- in connection with the appearance of a child in the family (however, for this case there is a limit of 50,000 rubles for each child, and the period for providing financial assistance is also limited - during the first year after birth, adoption, etc.).

How to document tax-free financial assistance

To issue financial assistance to an employee, you will need two documents:

- a statement from the employee indicating the intended purpose of material support;

- order from the manager to allocate funds for the provision of financial assistance, indicating the amount.

If the purpose of financial assistance corresponds to the purposes specified in subparagraph. 3 p. 1 art. 422 of the Tax Code of the Russian Federation or in sub. 8 tbsp. 217 of the Tax Code of the Russian Federation, this must be indicated.

Two gifts when you subscribe to Simplified!

Today there is a double benefit when subscribing to Simplified:

- 20% discount

- Four months free

Read "Simplified" at a favorable price for 16 months instead of 12!

Source: https://www.26-2.ru/art/351698-materialnaya-pomoshch-4000-2019

Deduction code mat help in certificate 2 personal income tax 2021

This section presents a significant number of codes, of which 3 are suitable: Type of financial assistance Income code Any financial assistance, except for that paid by the employer in favor of employees and former employees, as well as except for the amount of financial assistance paid at the birth of children. An example is financial assistance provided to any persons who are not on the staff of the organization. 2710 Any financial assistance provided to employees or former employees from the employer 2760 Financial assistance for workers who had children, or who adopted them, or took custody of them 2762 Next, we will consider what deduction codes are provided by law. Deduction code - material assistance up to 4,000 rubles in the 2-NDFL certificate. Codes for deducting amounts of material assistance, as well as income codes, are reflected in Order No. ММВ-7-11/ Like the income code, the deduction code for material assistance of 4,000 rubles or less is entered in the certificate 2-NDFL.

We recommend reading: List of Emergency Houses That Must Be Demolished in 2021 2021 City of Yoshkaor Ola

Material assistance and 2-NDFL certificate codes - what is it? Material assistance in the labor practice of enterprises of the Russian Federation means specific payments made by employers to their employees, as well as to third parties in connection with the occurrence of any unfavorable circumstances in their lives, as well as others forms of security other than cash. At the same time, financial assistance is considered a payment that is not directly tied to the results of work and is not of an incentive, but a compensatory nature, designed in one way or another to correct and compensate for the damage received by a person. Accordingly, the special nature of such payments presupposes the use of other tax standards reflected in individual articles of the Tax Code of the Russian Federation, namely:

Codes of deduction and income of material assistance and their reflection in the 2-NDFL certificate

— Business organization — Personnel — Codes of income for material assistance and deductions in the 2-NDFL certificate

Any funds received by an employee or non-working person must be reflected in the 2-NDFL certificate sent to the Federal Tax Service, including these requirements for financial assistance. However, the special specific nature of these payments requires the use of additional standards in matters of their taxation, which should be taken into account both by the recipients of assistance themselves and by the persons sending it. Accountants, employers, and ordinary people should know what income codes for financial assistance up to 4,000 rubles and above this amount should be entered in 2-NDFL, what are the deduction codes to reflect the special nature of financial assistance, and how the relevant documentation is generally prepared. employees.

Financial assistance and 2-NDFL certificate codes - what is it?

In the labor practice of enterprises of the Russian Federation, material assistance refers to specific payments made by employers to their employees, as well as to third parties in connection with the occurrence of any unfavorable circumstances in their lives, as well as other forms of support in addition to monetary support. At the same time, financial assistance is considered a payment that is not directly tied to the results of work and is not of an incentive, but a compensatory nature, designed in one way or another to correct and compensate for the damage received by a person.

Accordingly, the special nature of such payments presupposes the use of other tax standards reflected in individual articles of the Tax Code of the Russian Federation, namely:

- Article 217 of the Tax Code of the Russian Federation. Its regulations establish the possibility of specific taxation of material assistance, including complete exemption of the entire amount or part of the amount from personal income tax.

- Article 270 of the Tax Code of the Russian Federation. This article regulates the procedure for accounting for material assistance in the expenditure portion of the tax base of an enterprise.

- Article 422 of the Tax Code of the Russian Federation. The standards of this article regulate the procedure for calculating insurance premiums accrued for financial assistance.

Financial assistance is regulated only by the provisions of tax legislation. The Labor Code does not contain this definition and does not provide for any specific regimes for its settlement. Based on this, the nature of the payment of financial assistance is initially purely voluntary for employers - it is they who decide whether the possibility of receiving the said compensation should be reflected in the regulations of the enterprise. However, if such standards are present in the organization, compliance with them is the responsibility of the employer.

Considering that material assistance refers to special funds that cannot be directly attributed to the income of the person receiving it, and also taking into account the specific taxation regime for material assistance, it must be appropriately reflected in tax reporting.

Certificate 2-NDFL is currently the main document submitted to the Federal Tax Service regarding the payment of taxes on personal income, and material assistance income codes, as well as tax deduction codes, must be entered in it in relation to these funds in a separate manner.

Income codes for financial assistance up to 4,000 rubles and above

First of all, most accountants are interested in what codes of income for financial assistance up to 4,000 rubles must be indicated.

This is due to the fact that this amount, from the point of view of legislation, in most cases is the limit for receiving tax-free material assistance for one calendar year.

Moreover, this restriction is established for all types of financial assistance except those that have separate specific regulation and other restrictions on the amount.

Material assistance income codes include the following designations reflected in the 2-NDFL certificate:

- Code 2710. This income code displays any financial assistance, both up to 4,000 rubles and above it, paid regardless of the circumstances and not included in certain categories of types of financial assistance established by law.

- Code 2760. This financial assistance code is used to display the income of former employees who retired but received some support from the employer.

- Code 2761. This code is used for financial assistance provided to disabled people by charitable organizations, and not by employers.

- Code 2762. This code indicates financial assistance issued by the employer on the occasion of the birth of a child.

The employer is considered the actual tax agent of the recipient of financial assistance, even if he provides it to a person who is not in an employment relationship with him at the time of receiving assistance, for example, former employees, relatives of deceased employees and other persons. If assistance is provided by government agencies or other third parties, the obligation to submit a 2-NDFL certificate may also be assigned to the recipient of financial assistance.

Codes for deducting material assistance in the 2-NDFL certificate

Since material assistance in certain situations is not subject to collection of personal income tax, this should be reflected when filling out 2-NDFL using the appropriate deduction codes. Situations in which financial assistance is not subject to recovery of tax deductions and insurance contributions may be as follows:

- Death of an employee or his relatives . In this case, financial assistance is not subject to taxes, regardless of its total size.

- Emergency circumstances or terrorist attacks. In this situation, financial assistance can be paid by both employers and the state. At the same time, it is also not subject to collection of any deductions and payments from it and can have an unlimited amount. Employers have the right to provide such assistance not only to their direct employees but also to third parties who need it.

- Birth of a child . In such a situation, no more than 50 thousand rubles can be paid per child without deductions. It should be taken into account that this limit applies to the immediate child - that is, if one of the parents has already received financial assistance in the amount of 50 thousand rubles, then the support received by the second parent will be taxed in full.

- Other types of assistance. Financial assistance, regardless of its purpose, paid in the amount of up to 4 thousand rubles during the year, is not subject to recovery of any deductions from it.

For different categories of financial assistance, different tax deduction codes are provided, reflected in the 2-NDFL certificate. They may be as follows:

- Deduction code 503. This code applies only to amounts of financial assistance up to 4 thousand rubles.

- Deduction code 504. This code indicates the receipt of financial assistance for the birth of a child.

Financial assistance that has no limits and restrictions, for example, in connection with the death of an employee, emergency events or terrorist attacks, is not displayed in the 2-NDFL certificate. ( 34 votes, 4.60 out of 5) Loading...

Source: https://delatdelo.com/organizaciya-biznesa/kadry/materialnaya-pomoshh/kody-dohoda-materialnoj-pomoshhi-i-vycheta-v-spravke-2-ndfl.html

Deduction code 503 in personal income tax certificate 2

On the website you can fill out the 3-NDFL declaration online; we have fully automated all deduction codes from the 2-NDFL certificate (including code 503). You indicate them, they are automatically reflected in the declaration along the required lines. Our specialist will check the finished declaration.

When filling out a 3-personal income tax declaration in order to receive tax deductions (that is, a tax refund, for example, for expenses on education, treatment, or when buying an apartment), entering data from the 2-personal income tax certificate into the declaration, if there is a deduction code 503, it is also necessary reflected in the completed declaration.

We recommend reading: Kosgu Installation of a Local Area Network with Equipment 2021

Financial Assistance 2019 Personal Income Tax Codes

To receive payment to an employee or former employee, you must write an application in any form. In the text part of the application, describe the circumstances in as much detail as possible.

Attach documents confirming your life situation (certificate from the Ministry of Emergency Situations about a natural disaster, death certificate of a relative, birth or adoption certificate of a child, extract from the medical history, doctor’s report).

The employer, along with payment for work, has the right to provide financial assistance to the employee.

Financial assistance is a one-time cash payment to an individual due to a difficult life situation or special circumstances.

The employee is required to document the circumstances if they are related to private life, otherwise the money received is recognized as incentive, that is, remuneration for work.

Financial assistance in connection with the death of a close relative 2019 personal income tax code

A company that values its employees tries to satisfy their requests to the best of its ability. The reason for applying may be the death of a family member, the birth of a child, health problems, a wedding, or an unforeseen natural disaster.

Such payment is not related to professional skills and the nature of the work performed.

It is very important that the wording of additional assistance be extremely clear, since vague definitions may arouse suspicion among the tax inspectorate, and the company’s management will be suspected of understating the tax base.

217 Tax Code of the Russian Federation. In other words, personal income tax must be withheld from wages, bonuses and other accruals.

Peculiarities of taxation of personal income tax on material assistance In 2021, personal income tax on material assistance is not withheld if its amount does not exceed 4,000 rubles per year for any reason, with the exception of special cases. 1.

Completely non-taxable, these include: the death of a close relative of an employee, the death of a former employee; emergency circumstances, incl.

2-NDFL and financial assistance

Information on the income of employees, as well as calculated, withheld and transferred personal income tax from this income is indicated in a certificate in form 2-NDFL (Appendix No. 1 to the Order of the Federal Tax Service dated October 30.

2015 No. ММВ-7-11/ [email protected] ). It should also reflect the financial assistance paid to the employee. But not every one.

By the way, in the list of income codes noted in the 2-NDFL certificate, not every financial aid has its own code.

For example, in 2-NDFL, financial assistance up to 4,000 rubles paid to an employee (clause 28 of Article 217 of the Tax Code of the Russian Federation) must be shown with income code 2760 and at the same time with deduction code 503. Similarly, the certificate indicates a lump sum payment accrued to the employee in connection with the birth of his child.

As you know, it is not subject to personal income tax up to 50 thousand rubles. for each child, but for both parents, and provided that it is paid within a year from the date of birth. For this financial assistance, income code 2762 and at the same time deduction code 504 are used (Appendices No. 1, No. 2 to the Order of the Federal Tax Service of September 10.

2015 No. ММВ-7-11/ [email protected] ).

What is the income code for financial assistance up to 4000 rubles?

- A precise list of events when an employee may receive this type of support from his employer.

- The exact amount of financial assistance, payment procedure.

- Documents that must be submitted to receive such support.

In accordance with the requirements of paragraph 28 of Art. 217 of the Tax Code of the Russian Federation, financial support paid to a company employee for one year, provided that it does not exceed 4,000 rubles, should not be subject to taxes. In this case, the corresponding tax deduction is used.

We recommend reading: Transfer of residential premises to non-residential premises in the Russian Federation