Author of the article: Sudakov A.P.

Papers confirming that an individual has a solvent status may be needed when receiving benefits, loans, when visiting a foreign country or when registering an adopted child in a family. However, how to confirm the amount of previously received income if the enterprise where the person worked is closed? Who will issue a certificate if a person is in fact considered unemployed?

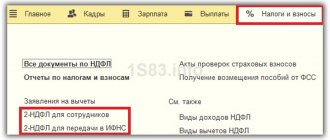

Help 2-NDFL

What to pay attention to when applying for 2nd personal income tax

The certificate must be stamped. It is important that the seal is placed in a specially designated place, at the MP mark. The signature of the head of the enterprise or another person authorized to sign such a certificate is written in blue pen with a clear imprint. It is not allowed to cover the signature with a seal.

Is it possible to be held accountable for forging 2 personal income taxes and what the consequences are for this?

Personal income tax certificate 2 is issued by the employer; if the company has already been liquidated, the employee will be issued a certificate by the tax office. Tax agents are required to report to the inspectorate. The time frame for obtaining a certificate is the same as for the standard procedure – 3 days.

general information

A certificate issued in form 2-NDFL is an official document confirming the level of income of a citizen.

On its basis, the solvency status is determined and a decision is made by the interested party to apply financial or organizational measures to the owner of the document. The certificate is submitted to the authorized bodies as a statement declaring the level of income received by the employee and confirming the correctness of the taxes accrued and paid on him. It can be issued personally to the person whose information is reflected in the document.

Why is it needed?

Every person of able-bodied status was faced with the need to obtain a document that would confirm his level of profitability. It is required to be presented to the lender when issuing a loan, since the person providing his funds for use prefers to make sure that the borrower will be able to pay off his obligations in the future. The applied interest rate and the term for which the loan is provided may depend on the information displayed in the document.

The certificate will be required when registering a pledge and surety, as well as when an individual applies for tax benefits, compensation payments and alimony. It must be issued when obtaining a visa, and in some situations when applying for a new job. The amount of your income will need to be confirmed during legal proceedings and when calculating pension payments.

Refusal to issue

The employer does not have the right to refuse to issue paper if the applicant is officially employed or was previously on the staff of the enterprise.

A problem with registration may arise if tax payments have not been made for a person. This is typical when the head of the company does not employ the people whose labor he uses, or in the case of an official payment of the minimum wage and additional payments of funds that in fact do not belong to the category of wages, and for this reason contributions are not withheld from them. Labor relations according to this scheme can result in troubles for both participants. The employee will not be able to obtain a truly solvent status, and the employer may be subject to administrative penalties with the imposition of considerable penalties.

If an employer refuses a person’s verbal request for a certificate, he must fill out a corresponding application. If the manager refuses to accept him, a request should be sent by mail with a notification option and a list of attachments. If a currently unemployed, but previously employed citizen needs a certificate for the period in which he officially worked, then the employer does not have the right to refuse to issue a document on his solvency status for the previous period.

If a person is denied his legal right to receive a document, then he has the right to contact the labor inspectorate. An individual can defend his interests only if there is documentary evidence of attempts to resolve the issue through negotiations. As a result of such actions, the person will receive a certificate, and the company will be fined. Additionally, the labor inspectorate will schedule an unscheduled inspection, during which other violations may be identified.

Illegal transactions

Situations often occur when official income is not high enough to take out a loan. In this case, illegal attempts are made to obtain a 2NDFL document. To what extent does this contradict current legislation and what are the chances of being caught providing a counterfeit?

In connection with the tightening of the requirements of financial institutions (banks, credit organizations, etc.) to the package of documents, a new segment of services has emerged.

Some companies offer to purchase various fake certificates and statements at fairly reasonable prices.

They may be needed in the following cases:

- To obtain a loan. Insufficient monthly income may be grounds for refusal by the bank. The fake certificate indicates the optimal income indicators according to the requirements of the financial organization.

- Lack of official work experience.

Confirmation of experience - entries in the work book. Find out how to fill out a work book correctly. An individual entrepreneur can enter into a civil contract with an employee. Do you know why?

It is not difficult to fill out the consignment note form TORG-12. There is an example in the article.

Buy a certificate

Before considering the option of purchasing a false certificate, you need to try all legal methods. If there are no other options other than purchasing a forged document, you can attempt to purchase it. The cost of such a certificate ranges from 3,000 to 6,500 rubles.

However, you should be prepared for certain risks:

- Fraud. An advance payment or the full amount for the service is taken without actually providing a package of documents.

- Registration of many similar certificates on behalf of one organization. Such information can be tracked in banking structures and will become a reason for refusing lending.

- Non-existent organization. To verify the fact of economic activity of the entity and registration with government agencies, you can use the available services. Even a non-specialist can detect such a fake.

Remember that by purchasing a forged document, you are violating the criminal code. This entails a certain responsibility.

Summary

- Where can I get a 2nd personal income tax certificate if the organization where I worked was liquidated?

- How and where can I get a 2nd personal income tax certificate if the organization has already been liquidated?

1. Where can I get a personal income tax certificate 2 if the organization where I worked was liquidated?

1.1. You can obtain a certificate of taxes paid, in particular personal income tax, for the tax period from the tax office at your place of residence. The shape is different. But the information is the same. Article 32 of the Tax Code of the Russian Federation. Responsibilities of tax authorities 1. Tax authorities are obliged to: 10) provide to the taxpayer, fee payer or tax agent, at his request, certificates on the status of the specified person’s payments for taxes, fees, penalties, fines, interest and certificates of fulfillment of the obligation to pay taxes, fees, penalties , fines, interest based on data from the tax authority. A certificate on the status of settlements for taxes, fees, penalties, fines, interest is transferred (sent) to the specified person (his representative) within five days, a certificate on the fulfillment of the obligation to pay taxes, fees, penalties, fines, interest - within ten days from the day the tax authority received the relevant request; Order of the Federal Tax Service of Russia dated December 28, 2016 N ММВ-7-17/ [email protected] “On approval of forms of certificates on the status of settlements for taxes, fees, insurance premiums, penalties, fines, interest, the procedure for filling them out and formats for submitting certificates in electronic form "(Appendix 2).

1.2. Contact the tax office at your place of residence; the processing time for such a certificate is about 10 days.

2. How and where can I get a 2nd personal income tax certificate if the organization has already been liquidated?

2.1. A copy of the certificate must be at your tax office at your place of registration.

3. The organization was liquidated on January 10, 2021, but certificates for 2 personal income taxes and 6 personal income taxes for the 4th quarter have not been submitted, is it possible to submit them after liquidation, if not, what is the threat?

no, you can’t surrender, and if you’re liquidated, then there’s no threat, there’s no threat

Sincerely, Evgeniy Pavlovich Filatov.

4. I would like to receive a tax deduction from the purchased housing. But one of the organizations in which I worked in 2013 (the year I bought a home) has already been liquidated. I cannot receive personal income tax certificate 2 from this office. The Pension Fund said that they could only issue an extract from the personal account about the transfers. The question is: will the tax office accept such an extract? If not, where else can I go for help?

4.1. You can. A certificate to receive a deduction is not required at all. See art. 220 Tax Code of the Russian Federation.

4.2. Hello! A certificate of income in Form No. 2-NDFL is a required document to receive a deduction.

At the same time, the liquidated organization had to report on income (including employee income) during the liquidation period. Therefore, we advise you to submit a written request to provide you with a certificate in the form “2-NDFL” to the Federal Tax Service at the place of registration.

5. How to restore certificate 2 personal income tax for 2012 for submission to the Federal Tax Service when receiving a property deduction if the organization was liquidated in 2013.

5.1. Lyudmila, in this case - no way. Just confirm the information with the Pension Fund and the Federal Tax Service, collect it bit by bit, from the reports and deductions of the former employer.

6. What to do if you need a 2-NDFL certificate to return a tax deduction for the purchase of an apartment from an organization that has been liquidated?

6.1. At the tax office at the place of registration of the organization.

7. What is the algorithm of actions to obtain a 2-NDFL certificate for a tax deduction for the purchase of an apartment if the organization is liquidated.

7.1. Everything is available at the tax office at the place of registration of the organization, submit a request there.

8. Can I return the tax deduction for the purchase of an apartment for 2013, if it is impossible to request a 2-personal income tax certificate, because the organization was liquidated. Can the tax office help?

8.1. you have the right to receive a tax deduction, Article 220 of the Tax Code, contact the tax authority

9. I studied at the state in 2008-2010. Academy and worked officially. Can I get a deduction for training for these years, and where can I get a 2nd personal income tax certificate if the organization is liquidated? Thank you.

9.1. Hello! The statute of limitations for filing a tax deduction for education is 3 years.

Probably every working person has taken out a 2nd personal income tax certificate at least once in their life. This is a mandatory account for banks when applying for a loan, the tax office when receiving deductions, and social services when assigning benefits. The certificate reflects the citizen’s official income and taxes that he paid to the state. As a rule, obtaining a certificate is not a problem, but difficult cases also occur, for example, during the liquidation of an LLC.

For what period do organizations submit information upon liquidation or reorganization?

According to the rules, the tax period is a calendar year, what deadlines are provided for the completion of the enterprise. When a company is closed, the legal entity submits personal income tax reports before liquidation.

There are three options for determining the last tax period, and depend on when the company ceased operations:

- Until the end of the calendar year. In this case, the period is considered to be the time from January 1 to the closing date.

- The opening and closing of the company occurred within one year. In this case, the period is less than 12 months. The beginning is the date of opening of the company, the end is the liquidation.

- Legal entity opened in December of one year and closed at the end of the next year. The tax period in this case does not exceed 13 months and includes the work of the organization.

Where to get certificate 2 personal income tax for different categories of citizens

The requirement to provide reporting also applies to entrepreneurs closing an individual entrepreneur (if he is an employer). There are no separate deadlines for this procedure, so the entrepreneur submits 2 personal income taxes, as is customary, before April 1.

Important! You can close an individual entrepreneur only after submitting reports.

How to submit personal income tax during reorganization.

It is important to take into account the type of changes; the following options are possible:

- "Merge". A number of companies are transformed into one, while the previous legal entities cease to operate. Data must be provided before the date of registration of the new organization.

- "Joining". One company merges with another, but ceases to operate as a separate legal entity. In this situation, only the affiliated company must submit tax information before making the corresponding entry in the Unified State Register of Legal Entities.

- "Separation". A series is created from one organization. Certificates are provided before registering new legal entities.

Certificate 2 personal income tax from the previous place of work: who can require it and why

Information is submitted in the usual manner if the reorganization takes place in the form of a spin-off or transformation, since in this case the work of the enterprise does not stop.

Important! The assignee is not required to submit reports for the reorganized company.