On the income of hired personnel and personal income tax withheld from these amounts, tax agents, incl. employers submit Calculation 6-NDFL to the tax office. Filling out the form is carried out in accordance with the norms of the Order of the Federal Tax Service of Russia dated October 14, 2015 No. ММВ-7-11 / [email protected] (as amended on January 17, 2018). The calculation contains generalized data on the level of personnel income and personal income tax; it does not provide for a detailed breakdown of each amount and personalization of data. Let's look at how to fill out 6-NDFL based on the results of 9 months of 2018.

What does Form 6-NDFL show?

6 Personal income tax is a relatively new report, mandatory for all employers, applied from the 1st quarter of 2021.

It includes information about:

- employee remuneration (income);

- accrued, withheld and transferred personal income tax;

- terms of assignment, withholding and transfer of tax.

The document form and the algorithm for its execution were approved by order of the Federal Tax Service on October 14, 2015 No. ММВ-7-11/ [email protected] To calculate for 9 months, you should take the form as amended. Order of the Federal Tax Service dated January 17, 2018 No. ММВ-7-11/ [email protected]

You can download the current 6-NDFL form here .

Who submits 6-personal income tax and where for 9 months of 2018

The form is submitted to the Federal Tax Service at the place of registration of tax agents paying income under employment and civil law contracts to individuals. Personal income tax agents are considered organizations and individual entrepreneurs, as well as private notaries, lawyers and other self-employed persons who pay income to “physicists”.

6-NDFL includes all accrued income, regardless of whether they are paid or not. If you did not calculate or issue salaries to your employees, there is no need to create a calculation. However, it is advisable to notify the tax authorities that you are not submitting the report due to the lack of data to fill it out.

Branches are also required to submit Form 6 personal income tax to the tax office at the place of registration. At the same time, the checkpoint and OKTMO corresponding to the territorial location of this separation are indicated on the title page of the form. An exception is large taxpayers who have the right to submit the form at the place of registration of the parent organization. However, tax authorities do not consider this position to be legitimate and want to see a report to the Federal Tax Service at the place of registration of the unit (letter of the Ministry of Finance of the Russian Federation dated December 19, 2016 No. BS-4-11 / [email protected] ).

Also see “Deadline for submitting 6-NDFL for the 3rd quarter of 2021“.

Procedure for filing 6-NDFL for 9 months of 2018

The form is filled out based on tax registers for personal income tax. General filling requirements include:

- entering information into each individual cell from left to right;

- mandatory completion of sum and detail indicators; if any data is missing, 0 is entered;

- if during the registration process there are blank acquaintances left, a dash is placed in them;

- The pages are numbered consecutively.

In calculations submitted on paper, it is prohibited:

- making corrections using a bar-corrector;

- two-sided printing.

The form can be filled out in blue, purple or black ink.

Sample 6-NDFL can be downloaded here .

Why is CPPR necessary?

The 6-NDFL submission period code is an identifier used to automate information processing. Therefore, you should not only indicate the data as accurately as possible, but also use the correct form of their reflection:

- All 6-NDFL period codes consist of two digits; in the corresponding columns of the form, a certain number of places are allocated for this identifier. When preparing reports, it is forbidden to leave empty cells. If data is missing, a dash is added.

- If the report is completed by hand, only blue, purple, or black ink may be used on paper. The entered data must be reflected in rich color without distortion.

- It is not allowed to cross out or erase information, or use proofreaders. If any code is entered incorrectly, the entire report should be reissued with the correct information.

In most cases, special software is used when filling out the form; many operations are performed automatically, which eliminates the possibility of errors.

Title page

The title page of form 6-NDFL is filled out by both the tax agent and the tax authority employee in specially designated cells. It contains:

- TIN of the organization's checkpoint (or only TIN for entrepreneurs or self-employed people) in accordance with the tax registration certificate.

- In the line “Adjustment number” indicate the serial number of the clarification. For the primary report, the value 000 is fixed.

- In the “Representation period” field, enter the code designation of the reporting period:

| Reporting period | In general | Upon liquidation |

| 1st quarter | 21 | 51 |

| half year | 31 | 52 |

| 9 months | 33 | 53 |

| year | 34 | 90 |

Data coding in 6-NDFL

Most often you encounter information coding when filling out tax reports.

All encoded information in the 6-NDFL report is located on the first sheet in compressed form (data converted into numbers). Coded indicators include:

- TIN - a combination of numbers contains information about the tax agent (which Federal Tax Service Inspectorate is attached to, legal address, etc.);

- KPP is a nine-digit code that encrypts information about the tax office where the company is registered and the basis for tax registration;

- KPR - code of the period for submitting the calculation;

- KNO is a four-digit tax authority code: the first two digits mean the code of the region of the Russian Federation in accordance with the Constitution, the next two mean attachment to a specific Federal Tax Service Inspectorate (interregional, interdistrict, etc.);

- KMN - Federal Tax Service code at the location of the tax agent;

- other codes (OKTMO, form presentation method code).

The contents of the report regarding the reflection of the amount of income paid to individuals, personal income tax, dates and deadlines are displayed in the report without coding. Amount indicators are written in rubles, calendar information in the form HH.MM.YYYY.

Using Form 6-NDFL coding has the following advantages:

- The information is provided in a unified format, which makes it easier to process using computer programs.

- The number of form sheets is reduced - encrypted information takes up less space.

Section 1

Sec.

1 of Form 6-NDFL includes general information about income, as well as accrued and withheld tax from January to September 2018. The section is filled out separately for each tax rate, with the exception of lines 060-090. The total indicators for these lines are recorded only on the first page of the section. 1. This section contains:

| Line | Index |

| 010 | Tax rate |

| 020 | Amount of employee income |

| 025 | Amount of calculated dividends |

| 030 | The amount of standard, property and social deductions |

| 040 | Amount of calculated personal income tax |

| 045 | Amount of accrued tax on dividends |

| 050 | Amount of advances paid for a foreign worker |

| 060 | Total number of employees to whom income was accrued |

| 070 | Amount of personal income tax withheld |

| 080 | Amount of unwithheld personal income tax |

| 090 | Return of withheld personal income tax to the taxpayer (for example, if an employee’s salary was recalculated and the amount of withheld tax exceeded the calculated one) |

Let's look at an example of filling out section. 1 form 6-NDFL for 9 months of 2018.

Alliance LLC for 9 months of 2021 accrued income to its employees in the amount of 6,832,350 rubles. The amount of deductions amounted to 210,000 rubles. The amount of calculated personal income tax is RUB 860,906. The amount of unwithheld tax is RUB 102,700.

6-NDFL for the 3rd quarter: example of filling

Frank LLC has a staff of 7 people. Three employees use the standard deduction for one child (1,400 rubles), two more employees receive a deduction for two children (1,400 rubles x 2). Every month, the enterprise accrues wages in favor of hired personnel in the amount of 173,000 rubles, the estimated amount of monthly tax is 21,216 rubles. To simplify the example, let’s assume that for 9 months of 2021, not a single employee’s salary reached the threshold for termination of the tax deduction, and there were no vacation or sick pay payments. Salaries are paid on the 5th, advance payment on the 20th. The company calculates, withholds and pays personal income tax obligations on time and in full. Let's fill out the calculation form.

Title page:

- indicate the INN and KPP of the tax agent;

- “Adjustment number” is indicated by zeros, since the form is primary;

- The “tax period” of the current year is 2021, and the “presentation period” corresponds to 9 months (code “33”);

- Next, you must indicate the controlling tax authority (its code) and the name of the employer;

- the accuracy of the reflected data is confirmed by the tax agent, as evidenced by the code “1” in the field provided for this and the signature of the manager.

Section 1:

- tax rate – 13%;

- then fill out 6-personal income tax for 9 months on a cumulative basis (sample at the end of the article). In column 020, the total value of accrued income, taking into account the salary for September, is 1,557,000 rubles. (173,000 x 9 months);

- The total value of tax deductions is entered in field 030 - 88,200 rubles. ((1400 x 3 people x 9 months) + (2800 x 2 people x 9 months));

- column 040 – total amount of accrued tax for 9 months ((1557000 – 88200) x 13%);

- column 070 - tax withheld in January-September - 169,728 rubles, it does not include the amount of salary tax for September (21,216 rubles), which will be withheld in October.

Section 2:

- in 6-NDFL for the 3rd quarter of 2021, section 2 will reflect information on salary accruals (indicated without taking into account deductions) and tax for the period from June to August, September income is not included in section 2, since their payment falls on the next reporting period — they will be reflected in the calculations for 2021.

This year, for 6-NDFL, the deadline for submission (Q3) is October 31, 2021.

6-NDFL for the 3rd quarter of 2021: sample filling

Section 2

This section is prepared for 3 reporting months, i.e. when preparing calculations for 9 months, information for July, August, and September is transferred here.

In Sect. 2 the following information is recorded:

| Line | Intelligence |

| 100 | Date of receipt of income, the amount of which is reflected on page 130 |

| 110 | Date of personal income tax withholding from the amount recorded on page 130 |

| 120 | Deadline for transferring taxes to the budget |

| 130 | The amount of personal income tax income actually received on the day specified in page 100 |

| 140 | The amount of personal income tax withheld on the date reflected on page 100 |

If for at least one type of income received on the date specified on page 100, the day of tax withholding or transfer is different, a separate block on pages 100-140 is formed for this income.

Next, we will consider the procedure for filling out section. 2, continuing the previous example.

Question to the auditor

Salaries for March 2021 were paid on March 31. In calculating 6-personal income tax, for what period should personal income tax be reflected from it - for the first quarter or for the first half of the year?

If wages for March 2021 were paid on March 31, the tax on it must be included in Section 1 of the new form 6-NDFL for the first quarter. If the payment of wages for March occurred on April 1 or later, personal income tax on this payment should be reflected in Section 1 of the new form 6-NDFL for the six months.

Let's justify the answer.

Starting with reporting for the first quarter of 2021, a new calculation of 6-NDFL is in effect, the form and procedure for filling it out was approved by Order of the Federal Tax Service of Russia dated October 15, 2020 No. ED-7-11 / [email protected] (hereinafter referred to as the Order).

The main difference between the new form of calculation of 6-NDFL and the old one is the absence of two indicators - the date of receipt of income and the date of tax withholding. This is explained by the fact that section 1 of the 6-NDFL calculation indicates the date of payment of exclusively withheld tax and its amount (clause 3.1 of Appendix No. 2 to the Order). This means that while personal income tax is not withheld from income, it does not need to be indicated in section 1 of the 6-NDFL calculation. And if it is withheld in the current period, then it must be reflected in section 1 of the 6-NDFL calculation for this period, even if it is paid in the next period. The tax agent is obliged to withhold personal income tax upon actual payment of income (issuance from the cash register or transfer of money to an account). This rule is established in paragraph 4 of Art. 226 Tax Code of the Russian Federation.

Therefore, Section 1 of Form 6-NDFL for the current (reporting or tax) period from reporting for the 1st quarter of 2021 includes only personal income tax amounts on paid amounts of income (money). At the same time, the date of payment of tax to the budget on this income no longer matters for the purposes of choosing the period for reflecting it in the calculation of 6-NDFL.

In accordance with clause 3.2, Section 1 of the 6-NDFL calculation indicates:

- in field 021 – the date no later than which the withheld tax amount must be transferred to the budget;

- in field 022 - the withheld amount of personal income tax, which must be paid on the day indicated on line 021.

Section 2 of the 6-NDFL calculation indicates the amounts of accrued income, calculated and withheld tax, aggregated for all individuals, on an accrual basis from the beginning of the tax period (clause 4.1 of Appendix No. 2 to the Order).

Section 2 of the 6-NDFL calculations indicates ( clause 4.3 of Appendix No. 2 to the Order):

- in field 100 – the rate used to calculate the tax amount;

- in field 110 – the amount of accrued income on an accrual basis from the beginning of the tax period;

- in field 112 – the amount of accrued income under employment contracts;

- in field 140 – the amount of calculated tax on an accrual basis from the beginning of the tax period;

- in field 160 – the amount of tax withheld on an accrual basis from the beginning of the tax period.

Thus, if wages for March 2021 were paid on March 31, it is reflected in Section 1 of the 6-NDFL calculation for the first quarter of 2021 as follows:

- in field 021 – 04/01/2021;

- in field 022 – the amount of personal income tax on wages for March 2021.

At the same time, in Section 2 of Form 6-NDFL for the first quarter of 2021, wages for March and personal income tax on it are reflected as follows (at the selected personal income tax rate):

- in field 110 – the total amount of accrued income from January to March (including wages for March);

- in field 112 – the amount of accrued income from January to March under employment contracts (including wages for March);

- in field 140 – the amount of calculated personal income tax from January to March (including wages for March);

- in field 160 – the amount of personal income tax withheld from January to March (including wages for March).

If wages for March 2021 were paid on April 1, then you must fill out the 6-NDFL calculation as follows.

- calculation of 6-personal income tax for the first quarter of 2021:

- The salary for March and personal income tax do not fall into Section 1

- Section 2 indicates:

- in field 110 – the total amount of accrued income from January to March (including wages for March);

- in field 112 – the amount of accrued income from January to March under employment contracts (including wages for March);

- in field 140 – the amount of calculated personal income tax from January to March (including personal income tax on wages for March);

- in field 160 – the amount of personal income tax withheld from January to March (personal income tax from wages for March is not included).

- Section 1 indicates:

- in field 021 – 04/02/2021;

- in field 022 – the amount of personal income tax on wages for March 2021.

- in field 110 – the total amount of accrued income from January to June (including wages for March);

- in field 112 – the amount of accrued income from January to June under employment contracts (including wages for March);

- in field 140 – the amount of calculated personal income tax from January to June (including personal income tax on wages for March);

- in field 160 - the amount of personal income tax withheld from January to June (including personal income tax from wages for March).

Similar rules will apply when paying wages on any day after the end (that is, later than the last calendar day) of the reporting period for personal income tax (first quarter, half-year, 9 months, year).

Source: information system 1C:ITS

Algorithm for preparing a report when paying bonuses, vacation pay and sick leave

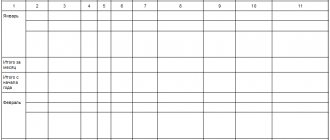

accrued to 30 employees:

| Month | July | August | September |

| Salary | 750 000 | 710 000 | 780 000 |

| Monthly bonus | 15 000 | 10 000 | |

| Leave compensation upon dismissal | 17 000 | ||

| Vacation pay | 32 000 | ||

| Hospital benefits | 12 000 | ||

| Remuneration under the GPC agreement | 20 000 |

Leave compensation upon dismissal was paid to the employee on September 10, 2018, vacation pay on August 20, 2018, and sick leave benefits on July 16, 2018.

On August 15, remuneration was paid to the individual who carried out the installation of equipment under a civil contract in the amount of 20,000 rubles. (Personal income tax - 2,600 rubles). The advance payment date is the 20th of each month, the salary date is the 5th of the month following the month of income accrual.

The date of receipt of income in the form of salary, including bonuses based on the results of the month (letter of the Ministry of Finance of Russia dated April 4, 2017 No. 03-04-07/19708), is considered to be the last day of the month, and not the day of actual payment of funds to the employee (clause 2 of Article 223 Tax Code of the Russian Federation). Therefore, the monthly salary can be included in one block of lines 100-140. The tax withholding period is the date of actual payment of funds to employees, the deadline for transferring personal income tax to the budget is the day following the payment.

How to correctly reflect carryover payments

Studying the above example of filling out form 6-NDFL, you may wonder whether the accountant of Alliance LLC made a mistake by reflecting the salary for June in the document for 9 months and not recording the data for September. How to correctly display the rolling salary on the form? The answer to this question was given by the Federal Tax Service in its letter dated February 25, 2016 No. BS-4-11/3058: in section. 2, only indicators are recorded on those incomes on which tax was calculated, withheld and transferred during the last 3 months for which the report is generated.

That is, in the example conditions, income for September is considered received, but the deadline for tax withholding and transfer will occur only in October (on the day of salary payment), i.e. already in the 4th quarter of 2018. Therefore, this information should be recorded in the report for 2021 (Letter of the Federal Tax Service dated January 25, 2017 No. BS-4-11/1249). At the same time, on page 020 section. 1 reflects the generalized amount of employee income from January to September.

Salary for June 2021 is displayed in the same way. Since the tax was withheld and transferred to the budget already in July 2018, information about the June earnings of employees is recorded in the report for 9 months.

Question to the auditor

Salaries for March 2021 were paid on March 31.

In calculating 6-personal income tax, for what period should personal income tax be reflected from it - for the first quarter or for the first half of the year? If wages for March 2021 were paid on March 31, the tax on it must be included in Section 1 of the new form 6-NDFL for the first quarter. If the payment of wages for March occurred on April 1 or later, personal income tax on this payment should be reflected in Section 1 of the new form 6-NDFL for the six months.

Let's justify the answer.

Starting with reporting for the first quarter of 2021, a new calculation of 6-NDFL is in effect, the form and procedure for filling it out was approved by Order of the Federal Tax Service of Russia dated October 15, 2020 No. ED-7-11 / [email protected] (hereinafter referred to as the Order).

The main difference between the new form of calculation of 6-NDFL and the old one is the absence of two indicators - the date of receipt of income and the date of tax withholding. This is explained by the fact that section 1 of the 6-NDFL calculation indicates the date of payment of exclusively withheld tax and its amount (clause 3.1 of Appendix No. 2 to the Order). This means that while personal income tax is not withheld from income, it does not need to be indicated in section 1 of the 6-NDFL calculation. And if it is withheld in the current period, then it must be reflected in section 1 of the 6-NDFL calculation for this period, even if it is paid in the next period. The tax agent is obliged to withhold personal income tax upon actual payment of income (issuance from the cash register or transfer of money to an account). This rule is established in paragraph 4 of Art. 226 Tax Code of the Russian Federation.

Therefore, Section 1 of Form 6-NDFL for the current (reporting or tax) period from reporting for the 1st quarter of 2021 includes only personal income tax amounts on paid amounts of income (money). At the same time, the date of payment of tax to the budget on this income no longer matters for the purposes of choosing the period for reflecting it in the calculation of 6-NDFL.

In accordance with clause 3.2, Section 1 of the 6-NDFL calculation indicates:

- in field 021 – the date no later than which the withheld tax amount must be transferred to the budget;

- in field 022 - the withheld amount of personal income tax, which must be paid on the day indicated on line 021.

Section 2 of the 6-NDFL calculation indicates the amounts of accrued income, calculated and withheld tax, aggregated for all individuals, on an accrual basis from the beginning of the tax period (clause 4.1 of Appendix No. 2 to the Order).

Section 2 of the 6-NDFL calculations indicates ( clause 4.3 of Appendix No. 2 to the Order):

- in field 100 – the rate used to calculate the tax amount;

- in field 110 – the amount of accrued income on an accrual basis from the beginning of the tax period;

- in field 112 – the amount of accrued income under employment contracts;

- in field 140 – the amount of calculated tax on an accrual basis from the beginning of the tax period;

- in field 160 – the amount of tax withheld on an accrual basis from the beginning of the tax period.

Thus, if wages for March 2021 were paid on March 31, it is reflected in Section 1 of the 6-NDFL calculation for the first quarter of 2021 as follows:

- in field 021 – 04/01/2021;

- in field 022 – the amount of personal income tax on wages for March 2021.

At the same time, in Section 2 of Form 6-NDFL for the first quarter of 2021, wages for March and personal income tax on it are reflected as follows (at the selected personal income tax rate):

- in field 110 – the total amount of accrued income from January to March (including wages for March);

- in field 112 – the amount of accrued income from January to March under employment contracts (including wages for March);

- in field 140 – the amount of calculated personal income tax from January to March (including wages for March);

- in field 160 – the amount of personal income tax withheld from January to March (including wages for March).

If wages for March 2021 were paid on April 1, then you must fill out the 6-NDFL calculation as follows.

- calculation of 6-personal income tax for the first quarter of 2021:

- The salary for March and personal income tax do not fall into Section 1

- Section 2 indicates:

- in field 110 – the total amount of accrued income from January to March (including wages for March);

- in field 112 – the amount of accrued income from January to March under employment contracts (including wages for March);

- in field 140 – the amount of calculated personal income tax from January to March (including personal income tax on wages for March);

- in field 160 – the amount of personal income tax withheld from January to March (personal income tax from wages for March is not included).

- calculation of 6-personal income tax for the first half of 2021:

- Section 1 indicates:

- in field 021 – 04/02/2021;

- in field 022 – the amount of personal income tax on wages for March 2021.

- in field 110 – the total amount of accrued income from January to June (including wages for March);

- in field 112 – the amount of accrued income from January to June under employment contracts (including wages for March);

- in field 140 – the amount of calculated personal income tax from January to June (including personal income tax on wages for March);

- in field 160 - the amount of personal income tax withheld from January to June (including personal income tax from wages for March).

Similar rules will apply when paying wages on any day after the end (that is, later than the last calendar day) of the reporting period for personal income tax (first quarter, half-year, 9 months, year).

Source: information system 1C:ITS

Hot questions about filling out form 6-NDFL

Since the calculation of 6-NDFL appeared only in 2021, tax authorities often provide explanations and recommendations on the procedure for drawing up a document in a given case.

Let's look at some of them:

- How to reflect daily or other non-taxable income in form 6-NDFL?

Daily allowances in the amount of the limits established in the Tax Code (700 rubles / day - in Russia and 2,500 rubles / day - for foreign business trips) are not reflected in the calculation of 6-NDFL, since they are not taxed. And non-taxable amounts are not included in form 6-NDFL (see question 4 of the Federal Tax Service letter dated 06/01/2016 No. BS-4-11 / [email protected] ). Over-limit daily allowances (as well as other payments in excess of the norms established in the Tax Code, for example, the cost of gifts exceeding 4 thousand rubles) are recognized as income of the taxpayer, and tax is withheld from them on the salary payment day closest to the date of approval of the advance report.

- Should I submit an updated calculation for the 1st quarter and half of the year if an error was discovered in August for February 2021, which led to an understatement of the taxable base?

What are the deadlines for submitting a report to the Federal Tax Service and the penalties for late submission of Form 6 Personal Income Tax

Form 6-NDFL is generated once a quarter and sent to the Federal Tax Service no later than the last day of the month following the reporting period. That is, based on the results of 9 months, the form should be submitted to the tax authorities by October 31, 2018.

If the tax agent is late for any reason and the payment reaches the tax authorities later than the deadline, the Federal Tax Service will issue sanctions for each month of delay (full or partial) in the amount of 1 thousand rubles. (clause 1.2 of article 126 of the Tax Code of the Russian Federation), and will also block the current account if the delay exceeds 10 days (clause 3.2 of article 76 of the Tax Code of the Russian Federation).