Why do you need a VAT refund application?

If for a particular reporting period VAT deductions exceed the tax paid, then the taxpayer has the right to reimburse the difference from the budget (clause 1 of Article 176 of the Tax Code of the Russian Federation).

The amount legally recoverable may be:

- Credited against debts on VAT and other payments to the budget (penalties, VAT fines), as well as against future VAT payments. The Federal Tax Service carries out this offset independently, detecting overpayments and arrears.

- Offset against debts and future debts for other federal taxes, as well as for penalties and fines in relation to these taxes. From 10/01/2020, Law No. 325-FZ dated 09/29/2020 established that overpayments of taxes can be offset against the payment of any other taxes, regardless of their level.

- Returned to the VAT payer's account.

In all cases, the fact that the amount to be reimbursed has arisen is reflected in the tax return. But the implementation of scenarios under paragraph 2 or 3 requires sending an application for VAT refund to the Federal Tax Service.

We eliminate penalties, penalties and tax fines

The Federal Tax Service reimburses taxes only to those payers who do not have penalties, penalties and fines for taxes and fees. If there are any, then the amount of VAT refund will first be used to pay them off, and the rest will be transferred to you.

Important! If the VAT refund is not enough to pay off penalties, fines and penalties, you must cover the remaining debt.

Having made a decision on a tax refund, the inspectorate sends a refund order to the treasury within a day. The transfer is processed by the treasury within 5 working days.

We recommend the cloud service Kontur.Accounting. The program allows you to keep records of export transactions and check your VAT return before submitting it to the tax office. The system will make a preliminary calculation of VAT, give tips on legal reductions in the amount, missing documents and possible accounting errors. We give all newbies a free trial period of 14 days.

When to submit an application?

VAT reimbursement from the budget consists of several procedures (Articles 88, 176 of the Tax Code of the Russian Federation):

- verification of the declaration (takes 2 months, the period can be extended to 3 months);

- making a decision on approving a return or refusing a return - within 7 working days;

- filing an application for VAT refund;

- transfer of funds to the taxpayer - within another 5 days.

If you want to return funds from the budget, then if the tax authorities make a positive decision, the refund is carried out:

- when submitting an application for a refund before the tax authorities make a decision - within the period indicated above (3 months and 12 days);

- when submitting an application for VAT refund after a decision is made - within a month after submitting such an application.

If you are ready to provide the Federal Tax Service with a bank guarantee for payment of VAT, then you have the right to request a refund before completing the inspection (subclause 2, clause 2, article 176.1 of the Tax Code of the Russian Federation). To do this, within 5 days after submitting the declaration, you need to submit an application to the Federal Tax Service and supplement it with a bank guarantee. If everything is in order with the documents, the VAT will be returned to you within 11 days.

Articles on the topic (click to view)

- Criminal Lawyer

- How to pay your internet or TTK TV bill without commission?

- Conditions for bankruptcy of individuals

- Article 1484. Civil Code of the Russian Federation. Exclusive right to a trademark

- Sale of apartments at bankruptcy auctions in St. Petersburg

- Trademark cost calculator How much does it cost to register a trademark:

- Who can begin bankruptcy proceedings for a legal entity, what stages does bankruptcy include, and how long do such stages last?

The taxpayers named in paragraph 2 of Art. have the right to accelerated VAT reimbursement without guarantees. 176.1 Tax Code of the Russian Federation.

Procedure for refund of overpaid taxes

- Drawing up an application for a refund of overpaid tax. The taxpayer, immediately after paying off the previously unpaid balance (if it is necessary to pay money), should submit a written application for a refund of the overpaid tax.

- Submitting an application. If the taxpayer was notified during a certain time period that he must make payment as tax, then he has the opportunity to submit an application to the relevant authority on any day of the coming month. The same situation is appropriate in the case of a certain court decision that came into force on a specific day.

- Decision of the Federal Tax Service. After a particular citizen has submitted an application for a refund of the amount of overpaid tax collected, the tax authority should order the transfer of a certain amount of money to the taxpayer’s account within a period of one month. You can also simultaneously engage in tax restructuring, which will help in obtaining additional funds for circulation.

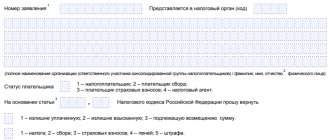

What does a sample application for VAT refund look like?

If the taxpayer returns VAT - as usual (without providing a guarantee from a financial institution and using other grounds specified in clause 2 of Art.

176.1 of the Tax Code of the Russian Federation), and with an accelerated procedure, an application for tax refund is sent to the Federal Tax Service using the form from Appendix 8 to the order of the Federal Tax Service of Russia dated February 14, 2017 No. ММВ-7-8 / [email protected]

The application for VAT refund shall indicate:

- On the first page:

- INN, KPP (if any) of the taxpayer;

serial number of the document (1 - if this is the first application for the year, 2 - if the second, etc.);

- Federal Tax Service code;

- name of the business entity;

- link to article 176 of the Tax Code of the Russian Federation (with the usual procedure for VAT refund);

- link to article 176.1 of the Tax Code of the Russian Federation (with an accelerated procedure for VAT refund);

- refund amount;

- billing period code (for example, for the 1st quarter of 2021 - KV.01.2020);

- OKTMO code of the territory controlled by the Federal Tax Service to which the application is submitted;

- KBK VAT.

- On the second page:

- account details where the refund should be transferred;

- name of the organization receiving the compensation.

- The third page is not filled in.

In addition, there are two cells above the field for indicating the amount of compensation. We fill them out like this: in the cell located directly below the line where the regulatory article of the Tax Code of the Russian Federation is indicated, code 3 is entered. In the cell below it is code 1. The applicant indicates his full name, telephone number, the date of filling out the document, and signature.

The document can be submitted to the Federal Tax Service both in paper form and electronically.

You can apply for VAT refund on our website.

The excess of VAT deductions over the amount paid in the reporting period provides grounds for tax reimbursement from the budget - in the usual mode (after completion of the audit) or in an accelerated manner (if there is a bank guarantee or other conditions provided by law are met). To refund VAT from the budget, an application is sent to the Federal Tax Service in the prescribed form.

Even more materials on the topic can be found in the “VAT” section.

If an overpayment of taxes is detected, a refund application will be required. Compiling it and submitting it to the tax service is half the battle. This article will tell you how to correctly reconcile with the budget and return the overpayment without errors.

Documents for refund of overpaid tax

In order to get a refund of overpaid tax, you must provide documents that would confirm the relevant fact. Such documents can be submitted:

- documents on the amount of tax transferred

- documents confirming tax benefits

- declaration 3-NDFL

- certificate 2-NDFL

- copies of medical documents (contracts, payment receipts) and tax certificates, if part of the personal income tax is returned

- copies of documents on training and payment for training, if personal income tax is returned on this basis

- a copy of real estate purchase and sale documents, transfer and acceptance certificates, a document confirming the registration of ownership rights

- other documents

The specific list of documents depends on the grounds for the tax refund. In addition, you must provide the return application itself, a copy of your passport and a copy of your TIN.

What cases require VAT refund to the company?

The most likely cases when an organization overpays taxes:

- Excessive payment of VAT;

- Operations with customs payments;

- Submitting a declaration with the amount of tax refund.

In accordance with the norms of tax law enshrined in paragraph 1 of Art.

Expert opinion

Kuzmin Ivan Timofeevich

Legal consultant with 6 years of experience. Specializes in the field of civil law. Member of the Bar Association.

173 of the Tax Code of the Russian Federation, the amount of VAT is calculated for payment at the end of each tax period. The amount represents the positive difference in tax accrued from sales transactions (goods, services), reduced by the total amount of input VAT deductions.

If, upon completion of the calculation, a negative result is revealed (the amount of input tax exceeds the tax accrued for all business sales transactions), this amount must be returned from the budget to the taxpayer’s account. Read about the features of import VAT refund.

When, during the tax period, an operation is carried out to import imported goods into the territory of the country or other places that are under the control of the Russian Federation, the amount of VAT is paid in full without any deductions in accordance with clause 5 of Art. 166 Tax Code of the Russian Federation.

In a situation where an organization that applies a special tax regime has a benefit/exemption from the calculation and payment of VAT (clause 5 of Article 173 of the Tax Code of the Russian Federation) issues an invoice to the counterparty, then the amount of tax will need to be transferred to the budget.

Possible errors when processing a return

The most likely grounds for refusal of VAT refund from the budget:

- A desk audit revealed gross violations;

- The application was generated using an invalid form;

- The tax refund period, which is limited to three years, has expired.

Episodes that influenced the decision to refuse a VAT refund by Federal Tax Service employees are identified during a desk audit. Many nuances are taken into account.

These may be dubious invoices from unreliable counterparties; absence of mandatory details in invoices or errors were found in the preparation of documents; availability of the total number of clarifying VAT declarations. In the convinced opinion of the tax service, these facts represent an attempt to obtain an unjustified benefit from the payer (in this case, an unscrupulous one).

If an application is drawn up using an invalid form, then the tax authorities will most likely refuse (or not accept the application at all) and there is a chance to promptly correct the applicant’s mistake. You should also avoid errors and inaccuracies when filling out company details: TIN, KPP, recipient's name, bank name, company current account.

The moment when the condition for a tax refund to a company arises is considered to be a declaration, or rather the day when it is transferred to the Federal Tax Service and accepted for accounting. From the moment/date of its submission to the Federal Tax Service, a three-year period is counted, after which the budget debt to the taxpayer is leveled.

Expedited procedure

A guarantee from a financial institution ensures that the amount is returned to the budget if the audit result is negative.

In this case, the guarantee must be more than 8 months from the date of reporting, and its amount must exceed the amount of the deduction claimed for return.

Important: the accelerated process involves the return of the declared amount before the end of the desk audit.

The application must indicate the bank account details for the transfer of funds, and indicate the security obligations in case of possible refusal. The application must be submitted within 5 days after the declaration.

The application is reviewed within 5 days from the date of receipt, as well as a check for the absence of fines and errors in the past.

After verification and if the deadlines are not met, actions occur in the same way as the standard procedure.

Mandatory and additional conditions for VAT refund from the budget are discussed in this video:

Common Questions

Situation 1: The company, in the process of selling products, has formed the right to a VAT refund. At what stage is the tax base formed in case of VAT refund?

The tax base from the sale of products in relation to the tax refund will be formed and confirmed after collecting and submitting a comprehensive package of documentation to the inspectorate for a desk audit. During the verification process, the right to a tax refund will be confirmed or canceled.

Situation 2: During a desk audit, Federal Tax Service employees refused a VAT refund, justifying the decision by saying that the company had missed the established time threshold of 3 years. Is it permissible to recognize the amount of unrefunded tax in relation to the company’s non-operating expenses?

Based on tax law, all VAT amounts that were presented when purchasing goods/services are accepted on the basis of clause 2 of Art.

171 of the Tax Code of the Russian Federation for deduction. The norm specified in paragraph.

1 tbsp. 170 of the Tax Code does not allow VAT amounts to be written off against profits or expenses, except in certain cases.

This list is closed. Such cases include purchases/imports of goods that are used in production or work for the company’s own needs, but there is no indication that expired VAT amounts are also included in expenses.

If the amount of tax deductions (“input” VAT) exceeds the amount of VAT on sales, the difference is subject to reimbursement from the budget.

note

, only payers of this tax can recover VAT. Organizations and individual entrepreneurs using special tax regimes (USN, UTII, Unified Agricultural Tax, PSN), in the case of issuing an invoice with the allocated amount of VAT, are required to pay tax to the budget, but do not have the right to a refund.