- home

- Reference

- Insurance premiums

When sending any employee on a business trip, the head of the company is obliged to pay daily allowance. They are intended to pay for food, accommodation and other mandatory expenses.

Their size is regulated by federal legislation and also depends on whether the work trip takes place in Russia or other countries. The director of the company has the right to increase this payment. Insurance premiums must be paid on excess daily allowance, and these payments are certainly recorded in the official documentation of the company.

note

In 2021, accountants need to be more attentive to excess daily allowances: insurance premiums will have to be charged on them. And the main thing here is not to get confused. After all, earlier, in 2016 and earlier, any amount of daily allowance was free from contributions. The main guarantee was that their maximum values were specified:

- in a collective agreement;

- regulations on business trips or other internal acts.

However, in 2021, insurance premiums from daily allowances in excess of the norm will have to be paid to the treasury. At the same time, the daily allowance standards remained at the same level (clause 2 of Article 422 of the Tax Code of the Russian Federation):

- for business trips in Russia – up to 700 rubles;

- for foreign business trips – up to 2.5 thousand rubles.

Thus, daily allowances in 2021 are subject to insurance premiums if they exceed these values.

As you can see, legislators have equated the daily allowance standards that have long been in effect in relation to income tax. Therefore, from the specified norm of the head of the Tax Code of the Russian Federation on insurance premiums, a direct reference is given to the third paragraph of Article 217 of the Tax Code of the Russian Federation.

Also see “Excess Per Diem Rules.”

In 2021, insurance premiums must continue to be accrued for payments under employment agreements and civil contracts. This is regulated by Article 420 of the Tax Code of the Russian Federation. But quite often the question arises: are daily allowances subject to insurance premiums?

Payments that are not subject to contributions have not changed in 2021. They are recorded in Article 422 of the Tax Code. At the same time, in 2021, daily allowances for the Social Insurance Fund for industrial injuries are not subject to insurance premiums. Any amount of such daily allowance is free from such contributions.

What it is

If an employee of an enterprise goes on a business trip, he receives a daily allowance. They are represented by a fixed amount of funds, which allows a citizen to provide optimal living conditions in another city or country.

The daily allowance covers the specialist’s expenses associated with his residence in the territory of another state or region of the Russian Federation. Money is paid not only for weekdays, but also for weekends or holidays. Additionally, days that a citizen spends traveling or during forced stops along the way are paid.

Attention! Daily allowances are not assigned only for one-day business trips carried out within the territory of Russia, but other rules may be recorded in the internal documentation of the company, so some specialists receive compensation for food costs even for one work trip.

According to Art. 168 of the Labor Code, organizations have the right to independently decide on the amount of daily allowance, which is enshrined in internal local acts. Typically, travel provisions are used for these purposes. Other features of the assignment of daily allowance include :

- The minimum payment amount is 700 rubles. when traveling around Russia and 2.5 thousand rubles. when traveling to other countries;

- personal income tax and insurance premiums are not paid on the minimum payments, and income tax will have to be paid on the excess;

- insurance premiums are paid in excess of the daily allowance established at the federal level;

- there are no maximum limits on these payments, so any company can increase them at its own discretion;

- The law does not contain information about the minimum duration of a business trip, but if it is a one-day trip, then company managers may not pay daily allowances, but only when traveling within the territory of the Russian Federation.

Although, according to the law, there is no need to compensate an employee’s expenses during a one-day work trip, many company managers prefer to pay specialists funds intended to pay for food, travel, etc.

It is also useful to read: What contributions is an individual entrepreneur required to make to the Pension Fund of Russia?

Are daily allowances subject to insurance contributions?

Insurance premiums are not charged on daily allowances if such daily allowances do not exceed the above limits (clause 2 of Article 422 of the Tax Code of the Russian Federation). Accordingly, daily allowances in excess of the norm are subject to insurance premiums in 2021.

In other words, when traveling within the Russian Federation for daily allowances over 700 rubles, insurance premiums will need to be calculated. And for business trips abroad, insurance premiums are calculated from daily allowances exceeding 2,500 rubles per day of business trip.

Please note that for one-day business trips, insurance premiums must be calculated from the entire amount. This is due to the fact that payments for one-day business trips cannot be recognized as daily allowances, and therefore they are not exempt from contributions (clause 11 of the Regulations, approved by Government Resolution No. 749 dated 13.10.2008, Letter of the Ministry of Finance dated 02.10.2017 No. 03- 15-06/63950).

Although, if such payments for one-day business trips are formalized not as daily allowances, but as reimbursement of expenses associated with the business trip, they will not be subject to contributions. But the expenses incurred will need to be confirmed with primary documents.

When talking about insurance premiums, we mean contributions for compulsory medical insurance, compulsory medical insurance and VNIM, paid in accordance with the requirements of the Tax Code of the Russian Federation.

As for insurance premiums for injuries, daily allowances are not fully subject to them. In this case, it does not matter whether the daily allowance threshold established by the employer exceeds 700 rubles or 2,500 rubles (Clause 2 of Article 20.2 of the Federal Law of July 24, 1998 No. 125-FZ, Letter of the Social Insurance Fund of November 17, 2011 No. 14-03-11/ 08-13985).

Business trip Travel payment is reflected in RSV 2021

⭐ ⭐ ⭐ ⭐ ⭐ Legal topics are very complex, but in this article, we will try to answer the question “Business trip Travel Payment is reflected in the RSV 2020”. Of course, if you still have questions, you can consult with lawyers online for free directly on the website.

Field pay is a compensation payment that is associated with the traveling nature of the work or work in the field. The amount of this payment is determined by the employer and reflected in its local acts, for example in a collective agreement.

How to fill out calculations for insurance premiums to the Federal Tax Service

If, as a result of an error, the amount of insurance premiums was underestimated, then an updated document is required. Otherwise, if the underpayment is revealed by fund employees during an audit, the organization cannot avoid fines.

For contributions for periods before January 1, 2021, this rule is established by Part 1 of Article 17 of Law No. 212-FZ of July 24, 2009. For contributions for periods from January 1, 2021, the rules are the same (clause 1 of article 81 of the Tax Code of the Russian Federation, clause 1.1 of art.

24 of the Law of July 24, 1998 No. 125-FZ).

Question

Payment for travel to the place of business trip and accommodation of a posted employee are payments in favor of the employee within the framework of the employment relationship. Such payments are not subject to insurance premiums, provided that the expenses are documented. This is provided for in paragraph 2 of Article 422 of the Tax Code of the Russian Federation.

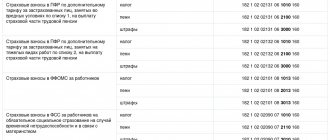

- according to lines 030 of subsection 1.1 (for “pension” contributions) and subsection 1.2 (for “medical” contributions) of Appendix 1 to Section 1;

- on line 020 of Appendix 2 (for contributions to compulsory social insurance in case of temporary disability and in connection with maternity) to section 1;

- according to line 210 of subsection 3.2.1 of section 3.

We recommend reading: Kbk 340 IN 2021

It follows from this rule that amounts reimbursed by the employer for employee expenses related to business trips (reimbursement for gasoline costs, rental housing) are not subject to insurance premiums only if such expenses are documented, note the authors of the letter. Otherwise, payments to the employee that are not confirmed by documents for reimbursement of expenses on a business trip are subject to contributions in accordance with the general procedure.

Calculation of insurance premiums

- daily allowance in the amount of 700 rubles for each day of a business trip within the country and 2,500 rubles - when abroad;

- actually incurred and documented target expenses for travel to the destination and back, expenses for renting residential premises, etc.

When filling out information about the length of service of a posted worker in subsection 6.8 of Section 6, keep in mind that there is no special code entered in column 7 for the period of being on a business trip. This is a normal working period.

Travel expenses and RSV-1

In individual information for each employee, the amount of travel expenses reimbursed to him (daily allowance, travel costs, accommodation, etc.) is shown in subsection 6.4 of section 6 of the calculation in the total amount of payments that are subject to contributions to compulsory pension insurance.

Section 6. Information on the amount of payments and other remuneration and the insurance period of the insured person

“The object of taxation with insurance premiums is, in particular, payments and rewards accrued in favor of individuals within the framework of labor relations. If an organization transferred money from the current account directly to the hotel to pay for the accommodation of posted workers, the object of taxation with insurance premiums does not arise. And the living expenses of the posted worker paid in this way do not need to be reflected either in his individual information or in lines 200 (210) and 201 (211) of subsection 2.1 of section 2 of the calculation

Article 422 of the Tax Code of the Russian Federation exempts travel expenses from insurance premiums (daily allowance within the limit and actually incurred and documented targeted expenses for travel to the destination and back, expenses for renting residential premises, etc.). The contribution base is calculated as the difference between all payments in favor of the employee and the amounts prescribed in Art. 422 Code.

We recommend reading: Frequency of Medical Examinations of Higher School Teachers

How to include travel expenses in the calculation of insurance premiums

- according to lines 030 of subsection 1.1 (for insurance contributions for compulsory pension insurance) and subsection 1.2 (for insurance contributions for compulsory health insurance) of Appendix 1 to Section 1 of the calculation;

- on line 020 of Appendix 2 (for insurance contributions for compulsory social insurance in case of temporary disability and in connection with maternity) to section 1 of the calculation;

- according to line 210 of subsection 3.2.1 of section 3 of the calculation.

Question:

In addition, the department reminds that violation of the procedure for filling out the DAM may lead to incorrect control ratios between report indicators. In this regard, tax authorities will send a request for explanations or corrections.

How to show daily allowances in a single calculation of insurance premiums

Reflect the entire amount of daily allowance in the calculation of insurance premiums on line 030 of subsection 1.1 of Appendix 1 to Section 1. The amount of daily allowance within the limits of the standard is not subject to insurance premiums. Therefore, reflect it on line 040 of subsection 1.1 of Appendix 1 to Section 1. Similarly, reflect it on lines 030 and 040 of subsection 1.

In subsection 3.2.1 of section 3, reflect the amount of daily allowance:

- on line 210, indicate the entire amount of daily allowance (within the norms and above the norms);

- In line 220, include only the taxable amount, that is, in excess of the norms.

Daily costs in travel expenses in Russia in 2021

If a company sends an engineer to another city to install its machines, this is a business trip. And if he goes to another city to visit relatives, and along the way he arbitrarily decides to go to the production site to see how the machine works. The expenses for such a trip cannot be classified as travel expenses.

Which employee trips can be considered business trips?

- Such supporting documents include:

- tickets (air, train, bus, train);

- checks and receipts;

- hotel registration voucher;

- other documents documenting the employee’s residence in a particular place;

- contracts, invoices;

- waybill;

- office notes;

- marks in the passport about border crossing.

How to take into account compensation during the period of parental leave for a child up to three years, personal income tax and insurance contributions. Compensation for caring for a child up to three years old refers to compensation payments established by law. The organization pays it without fail, regardless of the presence of such a condition in collective labor agreements. That is, the employee receives it outside the framework of employment agreements concluded with the organization. The procedure for calculating other taxes depends on what taxation system the organization uses. In subsection 3. Do not include A in line. Travel expenses 2. How to calculate contributions from daily allowances Object of taxation. Non-taxable daily allowance. Contributions under the Tax Code are not subject to daily allowances that you paid according to the law and within the limits of tax norms.

Business trips in RSV 2020

As always, we will try to answer the question “Travel allowances in RSV 2020”. You can also consult with lawyers for free online directly on the website without leaving your home.

Tax Code of the Russian Federation (taking into account the provisions of paragraph 7 of Article 81 of the Tax Code of the Russian Federation as amended by Federal Law dated July 3, 2016 N 243-F).

At the same time, however, we note that in the circumstances we are considering, we are not talking about errors or distortions in the accrued insurance premiums. Federal Tax Service in a letter dated November 2020.

Now, if the daily allowance, say 100 rubles, was not reflected in the calculation of contributions, you will have to submit updated calculations for insurance premiums.

How to prepare and submit a calculation of insurance premiums to the Federal Tax Service

Namely, documented travel expenses (cost of train, plane, bus tickets, etc.), expenses for renting living quarters (cost of hotel accommodation), etc. Usually, the posted worker is given money on account and he pays the expenses himself. Should these amounts be reflected in the calculation of contributions?

Answer

In the situation under consideration, daily allowances, reimbursement of expenses for fuel and lubricants and rental of residential premises are not reflected in the certificate in form 2-NDFL and in the calculation in form 6-NDFL. Calculation of insurance premiums to the Federal Tax Service. Reflection of travel expenses in the DAM.

Read the article about the consequences of violations when submitting payments. It can be assumed that this is due to the fact that in terms of personalized accounting in subsection 3.2.

1 of Section 3 of the Calculation must indicate not only the base for calculating contributions (columns 220/230/240), but also payments made in favor of the employee (column 210, line 250). Please note that from January 1, 2021, any error made when filling out subsections 3.2.1 and 3.2.

2 Section 3 Calculation of insurance premiums will entail refusal to accept it. Corresponding additions have been made to paragraph 7 of Art. 431 of the Tax Code of the Russian Federation by Federal Law of November 27, 2020 N 335-FZ.

This applies to the following expenses: travel for a business trip, accommodation on a business trip, any daily allowance of 100, 500, 2,500, 5,000 rubles.

Although, if such payments for one-day business trips are formalized not as daily allowances, but as reimbursement of expenses associated with the business trip, they will not be subject to contributions. But the expenses incurred will need to be confirmed with primary documents.

10 subp. 2 p. 1 art. 422 of the Tax Code of the Russian Federation). Therefore, in your calculations, reflect this amount as follows. Include the entire amount of compensation in line 030 of subsection 1.1 of appendix 1 to section 1 and in line 040 of subsection 1.1 of appendix 1 to section 1.

How to calculate and process daily allowance for a business trip

Employees refuel company cars and pay for their accommodation on their own, and the organization reimburses expenses. In the letter from the Ministry of Finance of Russia from the Explanations contained in this letter apply to all organizations? If they apply to all organizations, then what expenses must be reflected in the calculation of insurance premiums?

10 subp. 2 p. 1 art. 422 of the Tax Code of the Russian Federation). Therefore, in your calculations, reflect this amount as follows. Include the entire amount of compensation in line 030 of subsection 1.1 of appendix 1 to section 1 and in line 040 of subsection 1.1 of appendix 1 to section 1.