This is a sheet with summary information, which is filled out last, when all the necessary calculations have been made.

Line by line filling in the table:

Declaration line

| Instructions for filling | |

| 010 | The number 2 is entered, which corresponds to the need for a tax refund from the budget. |

| 020 | KBK code – 18210102010011000110 |

| 030 | OKTMO |

| 050 | Tax for refund - rewritten from section 2 p. 160. |

Filling example:

On this page of 3-NDFL, calculations are made to determine the amount to be returned. You do not need to fill in all the lines, but only those indicated in the table below.

Line by line filling:

| Declaration line | Instructions for filling |

| 001 | The tax rate is 13 percent. |

| 002 | Enter the number 3 – other income |

| 010 | The amount of annual income received from adj. 1 page 070. |

| 030 | Annual income subject to taxation - corresponds to field 010, if personal income tax is withheld from the entire amount of income received. |

| 040 | Total amount of deductions – filled in on the basis of adj. 7. |

| 060 | Tax base - the difference between income (line 030) and deductions (line 040). |

| 070 | Tax calculated for payment from the tax base - line 060 * rate from line 001. |

| 080 | Withheld and paid annual personal income tax - taken from adj. 1 page 080 |

| 160 | Tax that must be returned from the budget. |

Filling example:

The first appendix of the 3-NDFL declaration reflects the amount of income that was accrued for the year, the amount of tax that was withheld, as well as information about the person who paid this income to the individual.

If there were several sources, then each is shown separately with the corresponding amount of accruals and deductions.

To fill out this application, you must take a 2-NDFL income certificate from your place of work, which will reflect the employer’s details, the amount of accruals and deductions by month and for the year.

Line by line filling in the table:

| Declaration line | Instructions for filling |

| 010 | The tax rate is 13 percent. |

| 020 | Type of income – 07 for wages under an employment contract |

| 030 | TIN of the organization that paid the income |

| 040 | Checkpoint of the employer's organization |

| 050 | OKTMO organization |

| 060 | Employer company name |

| 070 | The annual amount of accrued income is taken from the 2-NDFL certificate |

| 080 | Personal income tax withheld for the year is also taken from the 2-NDFL certificate |

- Declaration forms 3-NDFL

- Application for tax deduction (form and sample)

- Application for distribution of property deduction

- Statement to employer - standard deduction for children

- Application for waiver of child deduction in favor of spouse

Title page

Despite the fact that the title page has visually changed, in general the same information is filled in. This is data characterizing the tax period and the taxpayer.

An individual, as before, indicates the Taxpayer Category Code. For ordinary citizens who do not act as entrepreneurs, this code is saved with the value “760” - another individual declaring their income in order to receive tax deductions. But for arbitration managers, a new code “750” has been introduced.

In the Title Page, the location of some data has been changed: about the identity document and the taxpayer’s address. Now all this is reflected on the first page.

note

The new declaration form now does not reflect some “tips”, for example, the same Taxpayer Category Code “760”, as well as the Country Code “643” - for citizens of the Russian Federation. All codes can be found in the Appendices to the Procedure for filling out the declaration, placed in the published Order.

Sheet E1 of the 3-NDFL declaration: example of filling

- Find out the deduction for previous years

- How to find out the inspection number

- How to find out OKTMO for the declaration

- Find out the cadastral number

- How to find out your TIN

- How to save the Declaration in PDF

- How to find out your account number

- How to find out postal code

- What is a tax deduction

- Who is eligible for deductions?

- Deadline for filing 3-NDFL for deduction

- How long to wait for tax deduction

- How to submit 3-NDFL to the tax office

- How to apply 3 years in advance

- Taxpayer attribute

- Purchase method

- Object cost (IV)

- How to submit via LC

- How to make an electronic signature

- How to get a 2-NDFL certificate

- How to add additional documents

The legislation states: all taxpayers of the country recognized as tax residents. The report should be kept not only on domestic income, but also on funds received by the family budget abroad.

The number of residents includes not just citizens of the Russian Federation, but any subjects who stayed in the country for more than 183 days a year. Even the lucky ones who won the lottery, received a large inheritance or other gift in the amount of, say, more than 100,000 rubles must provide a report in the form of Form 3-NDFL. Recipients of social deductions for personal income tax for the treatment and education of a child also need to fill out this form.

After you have filled out the 3-NDFL for 2021, you choose the appropriate filing method:

- Personal presence - a visit to the territorial department of the Federal Tax Service at the place of your registration, be it temporary or permanent registration.

- Postal delivery - tax authorities require sending such things by registered mail with a list of documents. After all, in addition to the five sheets of the declaration, you also attach a copy of your passport and another document confirming your income-generating activities.

- Electronic filling - via a link on the Federal Tax Service website or the State Services portal. It doesn’t matter in what form you decide to fill out the form - you can download form 3 personal income tax for 2021 for filing in 2021 in the unified format KND 1151020 using the link below. It is very difficult to make a mistake when searching for a form and filling it out, but we will still give an example.

Calculation and results

Of the six previously existing sections, only two now remain:

- Section 1 - it reflects the amount of tax to be paid to the budget or refunded from the budget (previously it was Section 6);

- Section 2 - it reflects the calculation of the tax base and the amount of calculated tax at any of the possible personal income tax rates (previously, such a calculation was filled out in sections 1 to 5 depending on the tax rate).

Section 1, which states the final tax amount, has not changed. But in Section 2, innovations appeared in relation to calculations.

In the first part of Section 2 “Calculation of the tax base”, from now on it will be necessary to show tax deductions and expenses taken to reduce income received separately - in lines 4 and 5, respectively.

In the second part of Section 2 “Calculation of the amount of tax to be paid (surcharge)/refund”, new lines have been introduced:

- line 9 - it reflects the amount of tax withheld from income in the form of financial assistance;

- line 11 - it reflects the amount of tax paid by the taxpayer independently in accordance with Article 227.1 of the Tax Code of the Russian Federation (for foreign citizens working in the Russian Federation for hire).

Income information

As before, information about income is filled in on Sheet A.

Now the format of this sheet allows you to fill out information about income received at different tax rates on one sheet.

The new field is (020), which reflects the Income Type Code. This is a code that determines the basis for receiving income. For example:

- “01” - income from the sale of property and shares in it, owned for less than 3 years;

- “02” - income from the sale of other property, etc.

If income is indicated in the form of a regular salary, it is necessary to indicate code “06” - income received on the basis of an employment (civil) contract, the tax from which is withheld by the tax agent.

All code values are given in Appendix No. 4 to the Procedure for filling out the declaration.

Information on income received outside the Russian Federation, as before, is reflected in Sheet B. There are no changes to it.

But minor adjustments have been made to Sheet B, which is filled out by entrepreneurs, lawyers, notaries and other persons.

The perimeter of business entities that fill out Sheet B has been expanded, and now they include arbitration managers.

In addition, a new part has appeared in Sheet B, in which, in accordance with the rules

Clause 6 of Article 105.3 of the Tax Code of the Russian Federation, the taxpayer independently adjusts the tax base and recalculates the tax for the reporting year. This procedure applies to cases where prices that do not correspond to market prices are used in transactions with related parties.

Personal income tax declaration 3: how to fill out, sample 2021

You have already seen a sample of filling out the title page. Since this is the most important sheet, it would be useful to consider in detail the filling of all its subsections.

| Subsection | What to write |

| A cap | Taxpayer Identification Number, adjustment number*, period (year), Federal Tax Service code. |

| Code of the country | Country code (643 for the Russian Federation), 999 for those who do not have citizenship. |

| Payer category code | Code for individual entrepreneurs 720, for notaries 730, for individuals 760, for rentiers and farmers 770 |

| Taxpayer information | Full name, date and place of birth, passport information, contact phone number and taxpayer status (resident 1, non-resident 2). |

| List of attached documents | Depending on the type of income, a 2-NDFL certificate, a receipt for receiving money when selling a car, etc. |

| Number of pages | Indicate the number of pages to be completed in this declaration, along with attachments** |

| Signature | Manually or when submitted electronically, using a digital electronic signature. |

* - when submitting the declaration for the first time, you should enter the adjustment number 000, subsequently it will be assigned in ascending order (001, 002, etc.) ** - this declaration has only 19 sheets, not all of them need to be filled out. Only those that will reflect information about income received, taxes paid, and deductions.

Let's take one of the previously mentioned sheets and see how data was entered into it:

Example. Citizen Kirchanova A.S. sold the apartment in 2021, and in 2021 filed a declaration for the past period. The apartment was inherited by her in 2014, which means that she was in possession for less than 3 years allotted by law, and the transaction is subject to Kirchanova’s income tax. She must attach to the declaration a purchase and sale agreement, a payment document, confirmation of the period of ownership of the living space and a certificate of entry into inheritance rights. Declaration sheet A of citizen Kirchanova will contain information about the buyer (Kiselev A.V.), his TIN (7705888888), the amount of the transaction (2,500,000 rubles), the taxable amount without deduction (1,500,000 rubles), the exact amount of tax (195 000r).

Sheet A, filling out information about the sale of an apartment:

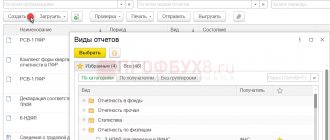

There are many options, but the official one is one. It’s called “Declaration”, you can download this software directly on the Federal Tax Service website. Downloading is absolutely free, the software is distributed in the public domain to all registered taxpayers. This program automatically saves information about the taxpayer and enters it when filling it out - you only need to indicate the income and its type. Next, depending on the rate at which you pay (resident or non-resident), the program calculates the amount of tax. Naturally, deductions are also taken into account.

After reading the examples, you must have noticed that filling out the 3-NDFL declaration for 2021 is not such a difficult task. Even those who are doing this for the first time will be able to cope with it by reading the line number clues. For this purpose, a simple Federal Tax Service form was thought up, which will allow citizens to quickly familiarize themselves with it and learn how to fill it out.

Please be sure to read all 19 sections carefully to provide information relevant to your income. You can always get advice by calling the Federal Tax Service hotline.

As a last resort, submit your return in person for the first time and ask a tax officer to check your form on the spot. An even simpler way would be to download and install a program for filling out the 3-NDFL declaration, which will automatically enter the amount of income, calculate deductions and the amount of tax by filling out an electronic form. All you have to do is check it, sign it digitally and send it to the tax office using your personal account.

Read also: Who and how can take advantage of professional deductions for personal income tax

Let's look at an example.

The taxpayer paid for the child's education in 2021. The amount spent was 100,000.00 rubles. As confirmation, the taxpayer provides with the Declaration a payment certificate issued by the educational institution.

The taxpayer's income in 2021 amounted to 600,000.00 rubles. They were taxed at a rate of 13%. The taxpayer also received a tax deduction for a child under 24 years of age (1,400 rubles). It was provided for 7 months (until income in the reporting period exceeded 350,000.00 rubles).

Example of filling.

The tax return should be submitted to the territorial office of the Federal Tax Service at the place of registration, permanent or temporary. The income statement is submitted to the Federal Tax Service in person, by mail, or by filling out the document online.

For example, if you need help filling out the 3-NDFL declaration, then contact the Federal Tax Service or prepare a report online using special tips. Step-by-step instructions on how to fill out 3-NDFL online yourself and for free are given below.

Before you start preparing your tax return, please read the basic requirements and instructions for filling out 3-NDFL:

- Fill in the cells from left to right with blue or black ink, or using printing or computer technology.

- Place dashes in empty fields on your tax return. If the indicator value is missing, dashes should be placed in each cell of the indicator field.

- Indicate the amounts of income and expenses in rubles and kopecks, with the exception of personal income tax amounts.

- Specify tax amounts strictly in rubles, apply the rounding rule: up to 50 kopecks - discard, more - round up to the full ruble.

- Cash received in foreign currency and expenses incurred should be reflected in rubles. Recalculate amounts in foreign currency at the exchange rate of the Central Bank of the Russian Federation on the date of receiving the currency or making expenses.

Here are detailed step-by-step instructions for filling out the 3-NDFL declaration in 2021 for 2021 (2019 - last year).

Let's start with the header. Here we register the Taxpayer Identification Number, indicate the adjustment number, tax period, and Federal Tax Service code. If the ND is submitted to the inspection for the first time, then in the “Adjustment number” field we enter 000; if it is submitted again, then the adjustment number is indicated, taking into account the chronological order.

Information about the taxpayer - an individual. Fill in the country code. According to the all-Russian classifier of countries of the world, Russia is assigned code 643. If a person does not have citizenship, enter 999.

Fill out the payer category code taking into account Appendix No. 1 to the procedure for filling out ND (Order of the Federal Tax Service of Russia dated October 3, 2018 No. ММВ-7-11/ as amended in 2021). Please enter the following values:

- For individual entrepreneurs - 720.

- For a person engaged in private practice, for example, notaries, code 730.

- For lawyers, put 740.

- For individuals, enter 760.

- For farmers - 770.

Next, fill in the fields: Full name, date and place of birth.

Provide information about your identity document. Fill out the document type code taking into account Appendix No. 2 to the order of how to fill out 3-NDFL for 2021 (the same order of the Federal Tax Service).

Let’s look at a specific situation to sample how to fill out the new 3-NDFL certificate form. As an example, let’s file a declaration to receive a professional tax deduction for 2021.

Morskaya Natalya Aleksandrovna worked at PPT LLC in 2021 under an author’s contract. According to paragraph 3 of Art. 221 of the Tax Code of the Russian Federation, the employee is entitled to a professional tax deduction. The amount of the deduction cannot be documented, so the amount is calculated according to the standard - 20% of the amount of taxable income.

Non-taxable income

Information on income not taxed in accordance with the norms of the code was previously reflected in Sheets G1, G2 and G3. Now everything is consolidated into one Sheet G.

It reflects data on material assistance and the cost of gifts, the amount of reimbursement for the cost of medicines and other similar non-taxable income of individuals.

All information from sheets G1 and G2 has been completely transferred to Sheet D of the new declaration. But Sheet G3 has been abolished. And now information about income in the form of material benefits received from savings on interest for the use of borrowed funds is not indicated, but the directly withheld tax on this amount is reflected in line “090” of Section 2 of the declaration.

Reference

Line 090 of Section 2 is filled in only when calculating the amount of personal income tax taxed at a rate of 35 percent; in other cases, a zero is entered in it.

Sheet D now also reflects the amount of additional insurance contributions for the funded part of the labor pension paid by the employer (see clause 8 of Sheet D). Previously, they were not reflected in the declaration.

The calculation of the non-taxable amount of income in relation to income in the form of payment in kind from agricultural producers has been significantly reduced (see paragraph 9 of Sheet D). Now it is enough to indicate the number of full months actually worked, the total amount of income in kind and the amount of income itself that is not subject to taxation.

Property deductions

Previously, information and calculations for property deductions were filled out in Sheet E - for income from the sale of property, and Sheet I - for income from construction or acquisition of real estate. Now there are also two sheets:

- Sheet D1 - Calculation of property tax deductions for expenses on new construction or acquisition of real estate (instead of Sheet I);

- Sheet D2 - Calculation of property tax deductions for income from the sale of property (instead of Sheet E).

Let's start with Sheet D1, it is filled out only by tax residents for deductions provided for in Article 220 of the Tax Code of the Russian Federation.

In clause 1.3 “Taxpayer Identification” the code of the person declaring a property deduction is entered, which can take the following values in accordance with Appendix No. 6 to the Procedure for filling out the declaration:

- 01 - owner of the object;

- 02 - spouse of the owner of the property;

- 03 - parent of a minor child - owner of the property;

- 13 - a taxpayer claiming, according to the Declaration, a property deduction for expenses associated with the acquisition of an object in the common shared ownership of himself and his minor child (children);

- 23 - a taxpayer claiming a property deduction on the Declaration for expenses associated with the acquisition of an object in the common shared ownership of the spouse and his minor child (children).

By the way, previously there were only the first two categories of persons.

And there were also fewer “Types of ownership of an object” (see paragraph 1.2 of Sheet D1), now it has been added with code “4” - property of a minor child.

A new field has also appeared (see paragraph 1.4 of Sheet D1), which indicates whether the taxpayer in respect of whose income the declaration is being submitted (at the time of its submission) is a person receiving pensions and using his right to transfer the balance of the property deduction to previous tax periods. There are only two values: is - “1”, is not - “0”.

Otherwise the calculation has not changed. Sheet D2 (formerly Sheet E) also has not undergone any changes.

What are the standard tax deductions for individuals who are tax residents of the Russian Federation?

Deductions that are due to the entire certain category of individuals - residents of the Russian Federation (regardless of the individual actions of a particular person in the tax period, as, for example, in the case of a deduction for the purchase of real estate) are classified as standard.

The list of standard deductions is given in Art. 218 Tax Code of the Russian Federation. The most common examples include deductions due to:

- persons affected by man-made disasters (at the Mayak production association, at the Chernobyl nuclear power plant);

- persons who suffered harm to their health as a result of work to eliminate man-made disasters, as well as those related to radioactive, nuclear components and the field of space technology;

- participants in military operations to protect both the Russian Federation and the former USSR;

- persons who have been awarded state titles and awards;

- Leningrad siege survivors;

- bone marrow donors;

- parents of minor children and disabled children and persons equal to parents.

NOTE! If the same individual has the right to several types of deductions at once (except for deductions for children), then in fact only one, the largest possible, is provided.

According to the procedure provided for by the Tax Code of the Russian Federation, all standard deductions are provided monthly during the tax period (year). All of these deductions must be carried out by tax agents who pay income to the individual entitled to the deduction and withhold personal income tax from this individual at the source.

Social and standard deductions

Social and standard deductions were previously reflected in Sheets G1 (for standard deductions), G2 (for social deductions) and G3 (for social deductions in terms of pension contributions).

Now one common Sheet E1 is intended for social and standard deductions.

But to decipher the calculations for pension contributions, a separate Sheet E2 was left, from which the final deduction (see clause 4 of Sheet E2) is transferred to line 160 (clause 3.4) of Sheet E1.

note

The calculation of social deductions in Sheet E2 is combined, i.e. different data can be filled in on the same lines, regardless of the type of insurance.

In addition, in addition to deductions for pension contributions under non-state pension agreements and voluntary pension insurance agreements, Sheet E2 can now indicate additional insurance contributions for the funded part of the labor pension. For “new” contributions, lines 090, 100, 110 are provided.

Professional deductions, previously reflected in Sheet D, will now be filled out in Sheet J.

There are no changes to this part of the declaration. As before, confirmed expenses are reflected separately on various grounds: under civil contracts, under copyright agreements, as well as expenses accepted for deduction when selling a share in the authorized capital of an organization.

As a rule, when filling out this sheet, the rule applies: a negative financial result obtained from one source of income payment does not reduce the financial result obtained from another source of income payment.

Let us remind you that if the taxpayer cannot document professional expenses, they can be deducted to a limited extent. The amounts of standard costs (as a percentage of the amount of accrued income) are set out in paragraph 3 of Article 221 of the Tax Code of the Russian Federation and are, for example, the following values:

- creation of literary works - 20 percent;

- creation of artistic and graphic works - 30 percent;

- performance of works of literature and art - 20 percent;

- creation of scientific works and developments - 20 percent;

- discoveries, inventions, utility models and the creation of industrial designs - 30 percent.